Authors: Henry Ang, Mustafa Yilham, Allen Zhao & Jermaine Wong, Bixin Ventures

Authors: Henry Ang, Mustafa Yilham, Allen Zhao & Jermaine Wong, Bixin Ventures

Original compilation: Evan Gu, Wayne Zhang, Bixin Ventures

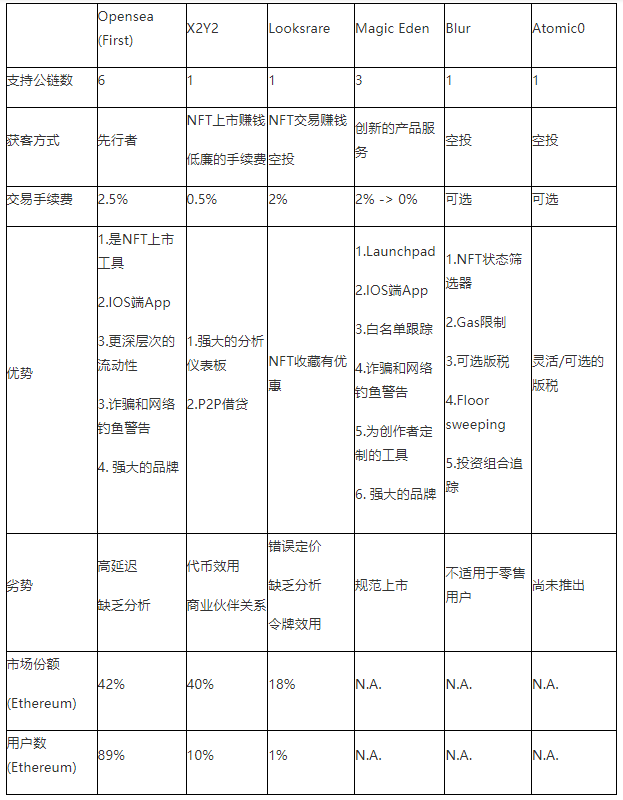

Opensea's position as the number one player in the NFT market is constantly being challenged as more and more new NFT marketplaces emerge. Increasing competition has led to more changes and innovations in the field, with projects such as X2Y2 and Magic Eden directly waiving royalties. Opensea used to be royalty-based and blacklisted NFTs that did not pay royalties. The emergence of X2Y2 made Opensen change the original rules. Amid this wave of industry-wide innovation, changes around royalties are just one of many strategies to stay price-competitive in the NFT market space. Other strategies include reducing transaction fees and incentivizing NFT trading and listings through token airdrops.

first level title

secondary title

direct market

Opensea, X2Y2, Looksrare, and Magic Eden can be considered direct marketplaces as the initial listing and trading of NFTs takes place here. The goal of direct marketplaces is to attract as many creators and users as possible to achieve high transaction volume, since their main income comes from transaction fees. The main problems that direct marketplaces aim to solve are:

1. There needs to be a balance between creators and users when implementing royalties. Direct marketplaces need to maintain royalties to attract NFT creators, but there is a risk that small but active users could be alienated.

2. Protect users from malicious NFT items and phishing websites. A lot of scammers could come in and steal user assets, so direct marketplaces need safeguards in place to help users.

secondary title

AMM NFT market

Similar to how Uniswap helped solve DeFi’s liquidity problems, new marketplaces like Sudoswap enable users to buy and sell NFTs from a liquidity pool rather than with other users. The AMM model has several advantages over the traditional order book model, for example, it unlocks instant liquidity for users as trades are executed automatically rather than waiting for matching orders on Opensea.

secondary title

NFT Market Aggregator

This articleThis articleAs pointed out in: "Users are encouraged to list NFTs at reasonable prices, which results in smaller spreads. Smaller spreads mean that traders and collectors experience the best prices, and best prices create sticky users and positive NFTs." Feedback". One way to avoid market manipulation and false transactions is to use an aggregator. When using an aggregator, users will have the following concerns:

1. User Interface: Displays all the best prices from various markets.

2. User interaction: optimize latency, gas fees and API connections with relevant markets to display the latest price updates

first level title

secondary title

Top 3 NFT market overview and emerging new markets

As a pioneer in the industry, Opensea has accumulated a considerable user base from the beginning by virtue of factors such as ease of creation, a wide variety of NFT projects, and easy navigation of the directory system. Opensea has also capitalized on its initial user base by onboarding notable NFT projects and implementing popular features like a multi-chain marketplace.

In order to acquire users from Opensea, Looksrare not only used the strategy of trading and earning coins, but also allocated token airdrops specifically for Opensea traders. In the short term, they end up gaining 1% of the market volume 0.7% User.

In the same way, X2Y2 initially adopted the List-to-earn (NFT listing to make money) strategy to attract new users and provide lower transaction fees than Opensea and Looksrare. This brings up another set of problems, including the inclusion of many low-quality NFTs just to earn rewards. X2Y2 eventually moved to a trade-to-earn rewards system, which again led to a surge in transactions just to transfer transaction fees. Similar to the case of Looksrare, although X2Y2 redistributes 100% of its revenue to users, the low transaction volume and subsequent low fees earned are not enough incentives for users to stay long term. As of this writing, X2Y2 only holds the entire industry2.2% User.

text

Case Study: Why Rarible Falls Behind Opensea Competition

At the end of 2020, Rarible tied with Opensea with over 4 million monthly transactions.

Subsequently, the gap between Opensea and Rarible widened, with the latter losing 75% of its transaction volume by the end of the first quarter of 2021. with the Opensea proposedIPO routeCaused an uproar in the community Rarible chose instead to make themselves more decentralized by issuing their $RARI token. Following a strategy similar to X2Y2, etc., Rarible's token rewards not only incentivize the growth of transaction volume, but also allow itself to have many wash transactions in the initial stage. There are other reasons why Rarible is at a disadvantage compared to Opensea, especially Rarible's lack of cooperation with well-known IPs, resulting in lower liquidity deployed in the market, and their inability to handle fake IP type NFTs. Opensea, on the other hand, fought fraud more quickly, launched limited-time orders, and partnered with multiple IPs to position itself as a trusted NFT marketplace. The difference in popularity between the two markets can be seen in the data below, which shows that from December 2020 to November 2022, the blue-chip NFT BAYC traded 27, 442 and 72 times on Opensea and Rarible respectively Second-rate.

The newest marketplaces, Blur and Atomic0, attract new users with 0 transaction fees, optional royalties, and airdrops. It’s worth noting that Blur isn’t just a direct local marketplace, it’s also an aggregator, which we’ll dig deeper into in the next sections. Blur also tries to motivate users by using a list-to-earn strategy. BlurredRegulationThose trying to cheat the system by charging unrealistic prices or having certain "dead NFTs" relisted will not be entitled to airdrops. Other ways to earn $BLUR airdrops include paying royalties and listing blue chip collections. The actual airdrop will take place in January 2023, and only time will tell if their strategy will suffer the same fate as the previous market. From a product standpoint, the main differentiator of a marketplace like Blur is a great user experience — NFT data such as offers, sales, and metadata appear in real time, scrolling and loading lists is much faster, and users can move across multiple NFT Marketplace View collections of NFTs and make informed decisions with advanced portfolio analysis and more. Unlike previous competitors, Blur didn't follow Opensea's model in terms of UI/UX.

Nonetheless, as of this writing, Opensea remains the leading platform, accounting for about72%, 82.7% and 75.7%secondary title

How can Opensea retain users when new competitors emerge?

Although Opensea's market share has declined, it still holds the lion's share of the market with more than two-thirds of transactions. Over the years, Opensea has undoubtedly built a strong brand moat in the NFT space. For example, we noticed that most NFT projects will always be officially listed on Opensea for legal reasons, just because people recognize and trust the brand. Whether on Twitter or Discord, most projects choose to direct their users to Opensea to purchase their NFTs. This leads to more items being indexed by it, and more items being indexed by more users, who then get more items listed there, igniting a flywheel effect.

Ultimately the competition is for liquidity - meaning the market with the most projects wins. Even with the poor user experience and lack of token incentives, people still choose to post and buy on Opensea because that's where you can find the most projects and traders. We do not think token incentives are a long-term solution as it is a strategy that will only attract opportunistic traders and will not build brand loyalty and product stickiness. Since users trade on these markets solely because of the incentives rather than the belief that it's a good trading platform, they leave once those incentives inevitably dry up. Token incentives can be a great way to gain an initial head start, but in the end only a good product and user experience can really motivate users to stay in the long run. Historically, this statement has been repeated many times before, as not only the NFT market has opted for a liquidity mining strategy, butcryptocurrency exchangetext

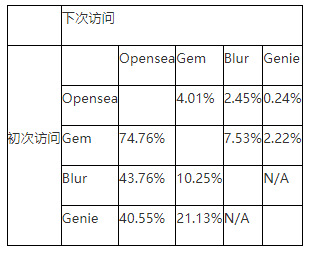

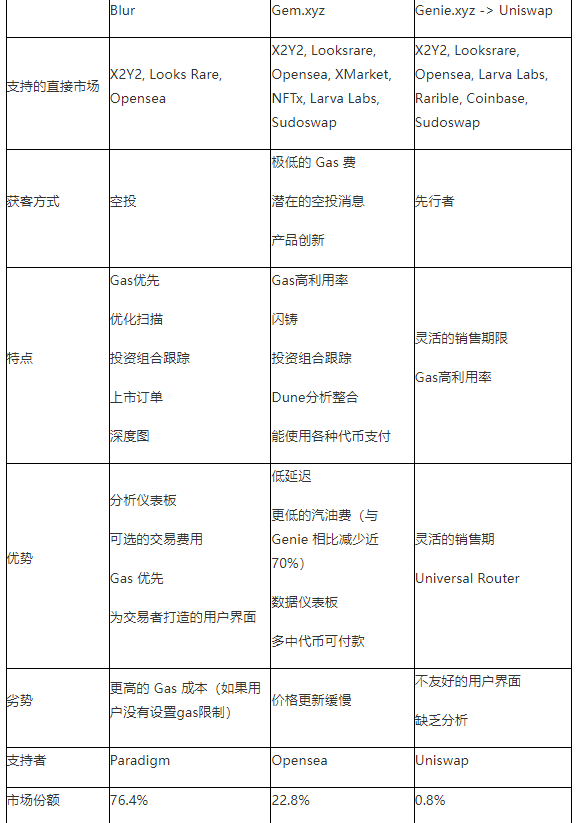

Case Study: First Mover Advantage Isn't Everything - Magic Eden

Given that Opensea is the first NFT marketplace, this begs the question of whether they are market leaders primarily because of their first-mover advantage. We can examine Solana's NFT market ecology from a historical perspective, and further appreciate the value of the first-mover advantage. Magic Eden is currently the leading NFT marketplace on Solana, but contrary to popular belief, it is actually the third marketplace to launch on Solana. The first two markets are Solanart and Digital Eyes in 2021, which initially accounted for most of the volume at that time. Ultimately, Solanart lost the trust of the community following incidents such as false listings and theft of digital assets, prompting users to switch to Digital Eyes. Magic Eden can replace Digital Eyes because the former has a better UI/UX and user experience. Magic Eden continues to grow on its moat by releasing features such as launchpad, which incubates a new collection of NFTs, and integrates with all wallets on Solana. This is why Magic Eden has been able to overtake its competitors to become the dominant player in the Solana ecosystem, having nearlyProduct Innovation Leads Growth Drawing insights from the above case studies, we realized that product-led growth is a sustainable way to gain long-term market share. Common complaints about the Opensea user experience include high gas and transaction fees, high latency, slow interface loading, and more. We believe that unless these issues are corrected and a better user experience is provided, Opensea's brand equity will continue to dilute as other platforms such as Blur innovate. As mentioned before - in addition to their own market liquidity, Blur also aggregates liquidity from other markets, which makes it more convenient for users. On the other hand, while competitors such as X2Y2 and Looksrare offer lower transaction fees, the general user experience is actually not that different from what Opensea offers. For example, the following snapshots of the BAYC family in each market clearly show which market has a differentiated user interface. In the end, the market that can provide the best user experience will attract the most listings and traders, and then form a brand moat. first level title With multiple direct markets, the development of an aggregator makes sense as it provides consolidated information across all markets. Rather than manually combining Opensea, Looksrare and X2Y2 to get the best price, it's easier to use an aggregator. But from the data below we can see that most of the deals are still done on Opensea. The data also showed that while aggregators such as Gem and Genie saw an initial spike in transaction volumes, they have since declined compared to Opensea. In our opinion, there may be several reasons for this. Before diving in, it's helpful to identify two big demand-side profiles (1) NFT community users who know exactly what NFT collectible they want, and their buying journey usually starts by clicking the official link on Twitter or discord, (2) Speculators looking for good deals. Such as buying a premium collectible with a low reserve price or a mispriced NFT First of all, considering that most NFT projects currently use Opensea links to gain legitimacy, we believe that the first stop for NFT community users in more cases is Opensea. Second, we believe that aggregators are more likely to be used by opportunistic traders, as they typically don’t consider NFT collectibles and instead look for deals with good value. While volumes on Gem and Genie have declined, volumes on another aggregator - Blur - have picked up. Of course it's too early to tell whether Blur has created a successful aggregator model. Case Study: How Gem Displaced Genie as the New Leader Genie was the first mover in the aggregator market, but it did not solve some product optimization issues, such as UI/UX layout and high gas cost. And Gem helps users save up to 40% of gas costs. secondary title The data below shows that around 33% of NFTs were purchased through aggregators, and Gem transactions accounted for around 90% of all previous aggregators’ market share before Blur launched70-80% 。 While 33% of NFTs are traded through aggregators, the data below interestingly shows that 90% of traded value is through direct marketplaces. This means that most high-value transactions happen on direct markets rather than aggregators. This may reflect users' trading preferences for trading blue-chip high-value NFTs on the direct market and low-value NFTs on aggregators. image description secondary title Genie was acquired by Uniswap in June 2022 and officially joined the Uniswap ecosystem recently. Users can now use it to trade NFTs on various markets, including Opensea, X2Y2, Sudoswap, and more. Uniswap’s NFT interface is completely open source and claims that their aggregator can help users save up to 15% on gas costs compared to other NFT aggregators. Visually, their user interface is simple and clean, adopting a similar look and feel to most marketplaces. One notable difference is the ability for users to switch between ETH and USD pricing, which may be more friendly to non-crypto native users. As an aggregator, Uniswap’s NFT marketplace has fewer features than some of its competitors. Most notably, Uniswap lacks advanced analytics such as underlying depth, transaction and price history. It has also been argued that lower gas fees may not be enough to attract users in today's low gas fee environment. On the other hand, we think Uniswap's moat lies in theirUniversal Router, which allows fusion between FT and NFT. With Universal Router, users can perform multiple token swaps on Uniswap V2 and V3 and buy NFTs from multiple markets in one transaction. For example - users have to convert their USDC, ETH and DAI to WETH through multiple transactions themselves before they can complete the NFT purchase. However, Uniswap can realize the following functions through a single transaction, as shown in the figure below: This is critical as Uniswap has the deepest FT liquidity on a decentralized exchange, as well as significant crypto user traffic. This natural conversion of FT and NFT can provide users with more convenience in the purchase process. This is truly a game changer as it greatly reduces friction for users, especially in a multi-crypto asset environment. The inability to buy NFTs with ERC-20 tokens remains a huge pain point for other users of NFT aggregators. secondary title text Transaction Fees and Royalty From the perspective of NFT projects, the 0.5-2% cut of the market does not actually add any value to them. On top of that, NFT projects have been governed by the market lately because these markets are what determine whether or not to charge royalties. The lack of decision-making autonomy in royalties is a long-standing problem for NFT projects. For transaction fees, NFT projects ideally want to keep so they have more resources to add value to the community. Additionally, users may be more willing to give fees back to NFT projects in order to accumulate more value for their NFTs. NFT Market Token Economics Needs a Reconfiguration As discussed many times above - we believe that while there is a need for a decentralized community owned market, there is not yet one that has effectively implemented a token model to stimulate organic growth. Most of the existing token economics are only used to encourage behavior that is not beneficial to the community, such as fake transactions or the listing of low-quality collectibles. As detailed by Jhackworth here - 85% of $LOOKS airdrop holders no longer hold these tokens. The market needs to implement a model that goes beyond "free money" governance, and users find more utility in holding them for the long term. The market is too general While most of the NFT industry is currently focused on PFPs, we believe the market should continue to expand to include other categories such as gaming, art, fashion, utility, and brand-focused NFTs. If all these NFTs were traded on a general marketplace like Opensea, that would create other issues as well. For example, brands such as Starbucks and Nike want to provide a customized experience for their customers, and purchasing a game NFT should not be the same as a PFP. The experience of buying an NFT should not feel like a homogenous consumer product that can be traded on a common platform. The recently popular Blur is a marketplace for traders, and some of its services follow the trend of financialization of the NFT industry: NFT loans, derivatives, indices, grading. This confirms that there is a demand for a market that treats NFTs as commodities or financial assets. For a multi-faceted product like an NFT, the current market lineup may be too broad, thus risking isolating different types of users/NFT projects. lack of social function If you look back at the user journey: from discovering new NFT items on Twitter, to engaging and learning more about the community on Discord, to finally making a purchase on Opensea, you realize that the entire journey is highly social . However, if a user is trying to buy or sell an NFT, there is currently no easy way to communicate with a counterparty in the marketplace. There are understandably reasons why marketplaces choose not to enable chats, as this makes them redundant, as buyers and sellers can transact directly with each other. But this is still a feature that can greatly enhance the user experience, and the industry has not yet found a balanced solution. NFT infrastructure needs further development secondary title Vertical Markets and Infrastructure Vertical markets are not a new concept. Axie Infinity is the most well-known vertical that gets huge volume from sales of axies. In fact, the industry has slowly seen the emergence of community-owned marketplaces such as the one built specifically for the BAYC and Otherside communitiesApecoin DAO Market. Not only does Apecoin's marketplace charge lower fees than existing markets (0.5% for ETH transactions, 0.25% for ApeCoin transactions) - but also holds 0.25% of each transaction in a multisig wallet to fund future DAO initiatives ) and also create a profit cycle for ApeCoin holders. The infrastructure and tools that allow projects to easily launch their own niche markets are also slowly emerging. An example is Reservoir. Reservoir is a developer platform that aggregates NFT order books from across the Ethereum ecosystem and provides and fills this liquidity through APIs and SDKs. Similar to Blur’s strategy of gaining early traction, tools like Reservoir help address their own project’s cold start problem by being able to showcase wares not only in their local marketplace but in other marketplaces as well. articlearticleAs pointed out: "The market should map to the unique characteristics of the community, not the other way around". As more and more NFT categories start to gain attention. We expect specialized markets to emerge that will slowly gain market share at the expense of general purpose markets like Opensea. Additionally, there could be a long list of community-owned markets following in Apecoin's footsteps. The next related question is: what will help tie all of this together in the future NFT market ecosystem? We believe that the next iteration of NFT aggregators will be one that can effectively provide a unified experience without compromising user experience. membership exchange Mooar is a new membership-based NFT exchange developed by the STEPN team that sits between community-focused vertical marketplaces and direct marketplaces like Opensea. Mooar adopts a membership system, with a transaction fee of 0% and a copyright fee of 2% (creators can adjust it themselves), allowing members to enjoy lower transaction costs while giving back to creators. Mooar generates revenue by charging subscription fees. Members can vote for their favorite launchpad projects and gain access to an exclusive NFT listing. For example, if members have a preference for high-value generative art projects, the marketplace will list more similar projects accordingly. Despite skepticism about its viability and scalability, this market category certainly offers more autonomy to users and creators on the platform. Trader-Centric Exchange As discussed with the increasing financialization of the NFT space, there is also a need to cater to these users. The next generation of trader-focused exchanges must prioritize liquidity, speed, and analytical tools. Examples of features could be instant buying and selling (AMM model or better liquidity), better pricing, enhanced collection sweeping and more granular analytics. Features that match or even exceed the current e-commerce shopping experience In the next wave, we expect an influx of ordinary consumers who are used to how web2 e-commerce works, such as Amazon and eBay. Outside of the NFT market, user-side infrastructure such as wallets should be safer, easier, and more intuitive to use. Possible features include social and customer support chat boxes, multiple payments, P2P transactions, live streaming, push notifications, mobile apps, fraud detection, and more. We also expect further integration with existing web 2 apps and commerce, such as being able to seamlessly connect your wallet to apps like Instagram, TikTok, Twitch, to buy NFTs directly from brands or creators. first level title We are still in the early stages of the overall development cycle of NFT and the market, after all, the first wave of NFT craze actually started in 2021. As analyzed in this article, we discussed the various reasons why Opensea is still the dominant player in the market, as well as the drawbacks it has. Regardless of whether Opensea is able to maintain its moat or not, it is certain that there are certain gaps in the NFT user experience and further improvements are needed to attract the next wave of user adoption. Winners in the future market will be driven by product-led growth, innovation in user experience, and the need to adapt to different categories of NFTs. At the end of the day, our main goal should be to build an NFT ecosystem that achieves a perfect product-market fit. Whether it’s NFTs, marketplaces, wallets, communities, or projects, the overall user experience should be seamlessly integrated to attract and grow the next million users. If you found this discussion interesting and would like to participate, please feel free to chat with us. If you are an NFT infrastructure project looking to optimize for the next wave of users, please also contact us. Original link:https://bixinventures.medium.com/the-road-ahead-for-the-nft-marketplaces-1 2b139 a 545 a 6 Note: This article is not intended to nor constitute financial advice, investment advice, trading advice or any other advice or offer

Aggregator Analysis: Why Did the Aggregator Model Never Really Rise?

Why haven't gems captured a larger market share?

Can Uniswap's new marketplace compete with other aggregators?

The gap between different models in the current NFT market

text

Summary and reflection