JZL Capital Industry Weekly Report No. 50: Stablecoins continue to flow out and the market continues to slump

1. Summary of Industry Dynamics

first level title

1. Summary of Industry Dynamics

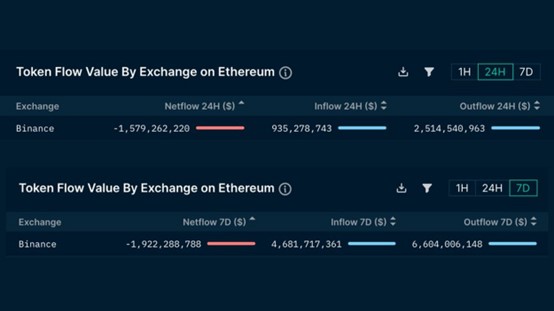

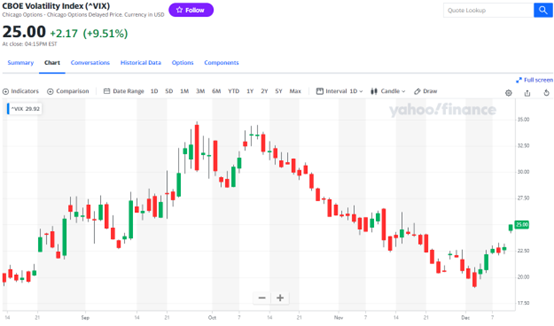

On the other hand, the U.S. stock market gapped and opened lower last Friday due to PPI exceeding expectations, and fell rapidly in late trading. The main reason is that there are two major uncertain events this week. One is the CPI released on Tuesday, US time, which is also the first day of the Fed’s interest rate meeting. The interest rate meeting will end on the 14th and a resolution will be announced, and Powell will also appear speak. Therefore, how much the interest rate will increase should be a definite number at this moment, but what kind of rhetoric Powell will adopt in his speech after the meeting will be affected by the CPI data (the CPI annual rate in November was 7.1%, expected 7.3%, and the previous value was 7.7%) , At the same time, this week's interest rate meeting will also release a dot plot, which will clarify the peak and time distribution of interest rate hikes. The panic index VIX also rose by 9.51% this Monday, accompanied by a rise in the market. The panic index is an index used by CME Group to measure the volatility of S&P 500 index options. It is usually used to assess the volatility risk in the future. Before a major event occurs, funds are deployed in advance, and more people participate in the future direction bets that result in higher option prices and greater volatility. The spike in the fear gauge also points to greater volatility in the days ahead. It just so happens that the Nasdaq Composite Index has been trading sideways for 3 months from September this year to now, and is currently on the upper track of a rectangular arrangement. It may re-choose its direction today and tomorrow. The broader market is down, and it is not easy to fall directly through the rectangle. The S&P was also suppressed by the annual line on the upward channel last week. Whether it can break through at the end of the year depends on this week's market.

2. Macro and technical analysis

first level title

2. Macro and technical analysis

From a macro perspective, the market will not experience more fluctuations before raising interest rates. We will wait for the announcement of the minutes of the meeting before deciding on the direction of the market.

At present, BTC and ETH have broken through the 17000/1200 mark, and they are trading sideways above the mark. The key to the current market lies in the path of future interest rate hikes, and the short-term market may take a look.

Two-Year Treasuries Change to 4.36

Nasdaq retreats to around 11,000

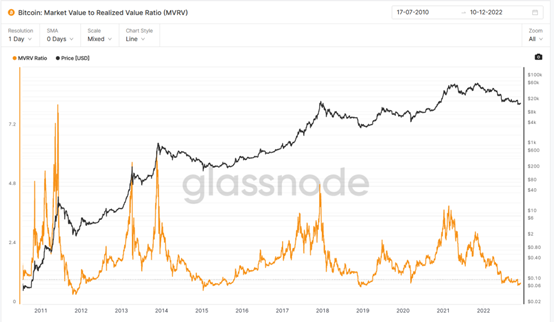

1. Ahr 999: 0.319, fixed investment can be made

first level title

3. Summary of investment and financing

Investment and financing review

3. Summary of investment and financing

Investment and financing review

During the reporting period, the number of financing and projects were relatively sluggish, and 12 investment and financing events were disclosed, with a cumulative financing amount of approximately US$63.7 million;

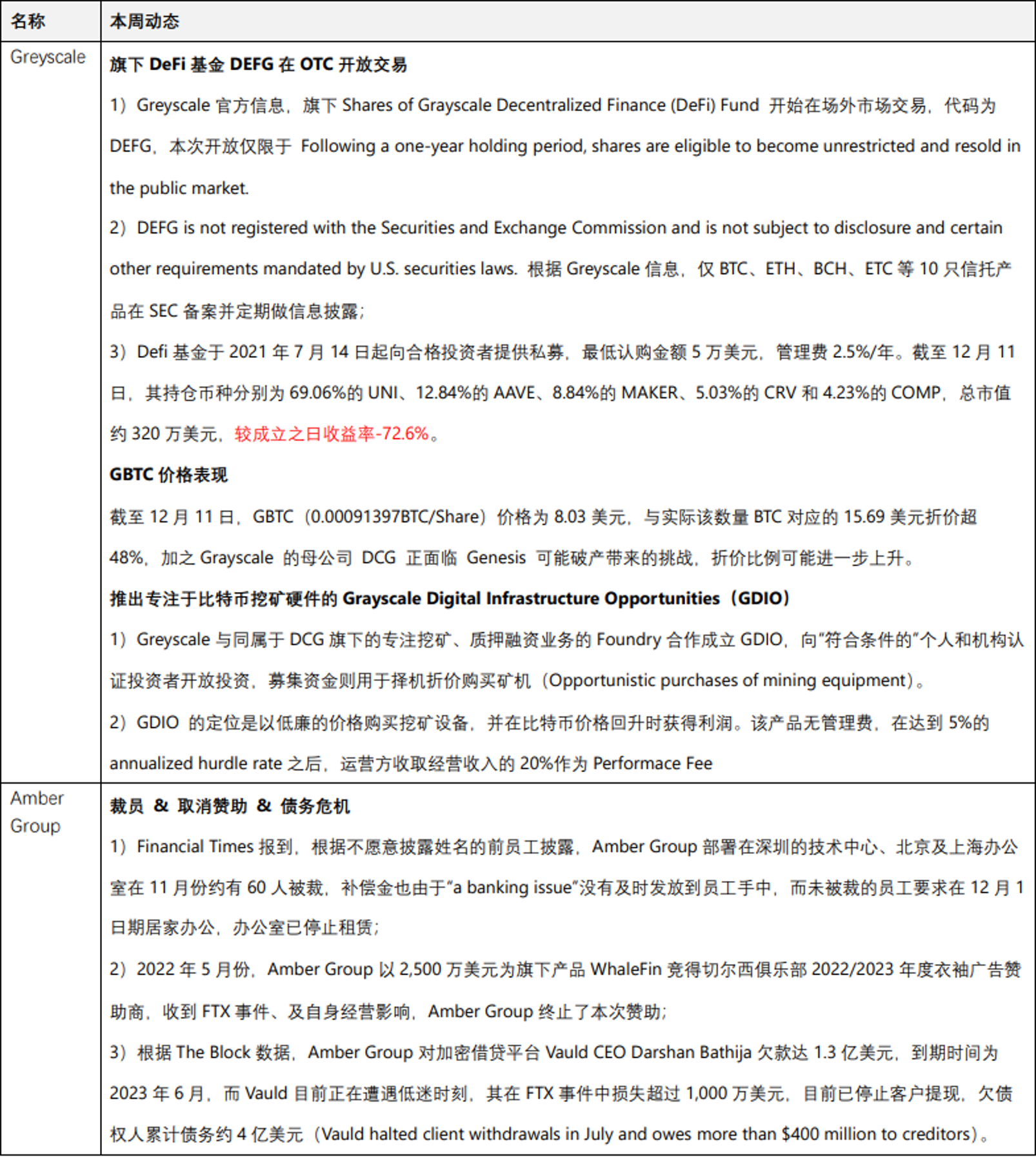

4. Encrypted ecological tracking

Institutional dynamics

4. Encrypted ecological tracking

1.NFTs

(1) NFT market this week

secondary title

(1) NFT market this week

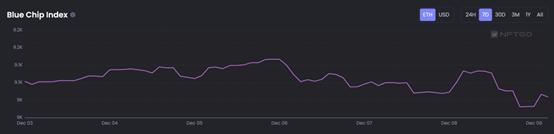

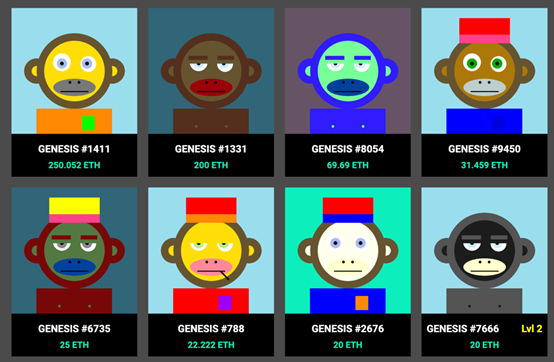

Market overview: Compared with the NFT blue chip index this week, there is not much significant improvement. As of December 9, the NFT blue chip market is still at the freezing point of a bear market. The blue chip index has dropped slightly compared with last week, but there has been no significant change. The market The mood is still low. The floor price of BAYC is currently maintained at around 68 ETH.

This week, the total market capitalization of the NFT market basically remained unchanged from last week, only up 0.03%, and the total transaction volume increased by 4.5% year-on-year. The fluctuations in the market in the past two weeks have been very small, and there have been no new blue-chip projects or platforms in the market.

The holders of the NFT market have not changed much this week. The activity of traders has declined to a certain extent compared with last week. Buyers have decreased by 1.27% compared to last week, and sellers have decreased by 6.5% year-on-year. Overall, the market is currently not There is not much sign that it will bottom out, and it is still fluctuating at a low level overall.

The top three NFTs with the highest trading volume in the market this week are BAYC, MAYC, and The Legend of CØCKPUNCH. It is worth mentioning that after The legend of cockpunch was released as a blind box at the end of November, the transaction volume has increased significantly this week, and it has jumped to the third place. The total cockpunch offer is 5,555. The floor price is currently 0.97 eth.

The Legend of COCKPUNCH is a fantasy kingdom tale from the bizarre universe of the mind of Tim Ferriss. Related characters, maps, novels, podcast episodes are released over time.

(2) This week's dynamic focus

(2) This week's dynamic focus

Coca-Cola and Crypto.com have teamed up to launch a 10,000-piece NFT collection inspired by the 2022 FIFA World Cup in Qatar. Created in collaboration with digital artist GMUNK, the series is based on "heat maps" that visually present the movements and highlights of the players in the game.

In order to obtain NFT collectibles, fans need to create an account on crpyto.com’s NFT platform and visit Coca-Cola’s Fan Zone page to mint tokens. Coca-Cola has also opened a fan zone for this purpose, which is also the digital center of the 2022 FIFA World Cup in Qatar, providing fans with the opportunity to interact in real time during the game. In addition to the NFT collection, the fan zone also includes real-time team leaderboards, score predictions, and real-time interaction with the game.

However, it can currently be confirmed that even though the announcement is for a global audience, the current nft registration website "Coca-Cola Middle East" or the official link to the fan area only provides options for residents living in Qatar, Saudi Arabia or the UAE.

National Basketball Association Hall of Famer Scottie Pippen is forming a new partnership with Web3-based entertainment company Orange Comet, which will launch 1,000 limited-run Pippen Kicks NFT sneakers, scheduled to debut on NFT marketplace OpenSea on December 20 release. Orange Comet CEO Dave Broome also said that 33 NFT holders will be randomly selected to receive authentic prototype shoes signed by Scottie Pippen that the platform is building. Benefits also include tickets to hometour for 1 holder and a chance to play golf with Pippen for 2 holders.(3) Key projects

NFT startup Metagood completes $5 million in pre-seed funding

, the funds will be used to build OnChainMonkey's community and tools. Metagood launched the NFT series OnChainMonkey to give community members the opportunity to develop and fund social welfare projects through DAO. The organization raised 2,000 ETH within a year.

Introduction to OnChain Monkey (OCM)

Investors include: Litecoin inventor-Charlie Lee, Etherscan CEO-Matthew Tan, Axie Infinity co-founder-Jeffrey and The Sandbox co-founder Sebastien Borge, etc.

The first series of OCM, OCM-Genesis, was released in September last year, using the Free Mint approach, with no whitelist and no public sale price. Moreover, it adopts the concept of "full chain", claiming to be the first fully chained NFT project.

The difference between full on-chain and partial on-chain: Due to the high cost of storing data on the chain, most NFTs on the market are only partially on-chain. In the form of video/music, etc., and then save it to IPFS. OCM produces SVG images through smart contracts, and deploys every part of the image attributes to the chain, so many people intuitively feel that the pfp images of these monkeys are ugly or strange, and there is actually a reason behind them. Because the cost of storing data on the chain is indeed very expensive. At present, OCM can be purchased in opensea, nifty gateway and origin. The floor price of opensea is around 0.8-1 eth, and the total circulation is 12,721 eth.

First Generation OCM-GENESISOCM product features: 1. There are many online and offline activities. In addition to the chat room on Discord, there are also many physical activities of OCM, such as offline forums, but currently they will mainly focus on overseas markets. 2. OCM-DAO, recently OCM-DAO launched a charitable donation to Ukraine on the platform. 3. There is an exclusive channel for OCM - NFT holders in Discord. By entering the specified code !RISE, you can receive a banana coin, or if you send a friend a banana coin, the system will give you an extra banana coin . This banana coin is currently off-chain and is expected to be on-chain this year. 4. The most important thing is that they are currently building monkeyverse, monkey universe, and every user who owns the first or second generation can join, forming a powerful community.

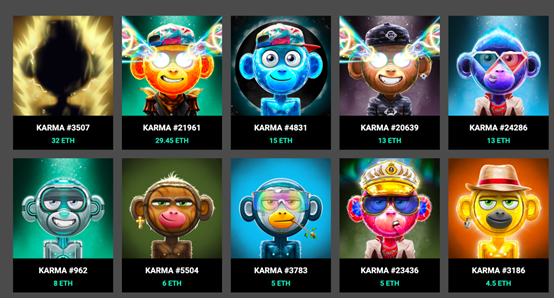

The second generation of OCM-KARMA

, a total of 20,000 pieces are issued, and there are two ways to obtain them.

At the beginning of February this year, three kinds of desserts were airdropped to 10,000 ancestral monkeys (Genesis). The three desserts were D 1 (Incredible Ice Pop), D 2 (Divine donut), and D 3 (Celestial Cake). At the end of March this year, monkeys holding Genesis can receive a second-generation KARMA monkey by eating desserts (desserts will disappear, Genesis will still be there).

Rules: Genesis will receive K 1 after eating D 1, and K 1 will have the characteristics of Genesis. In the same way, if you eat D 2, you will get K 2 , but in addition to the characteristics of Genesis, K 2 also has some extended rare features. Eating D 3 will become very unique, get a karma beyond recognition. If you have Genesis, it is highly recommended to eat D 2, especially if your Genesis rare rank is very low, eat D 2 and you can get K 2-divine karma, which accounts for 30% of the total, and it also guarantees that you can synthesize after eating desserts The rarity of the second-generation monkeys is the top 30%.

secondary title

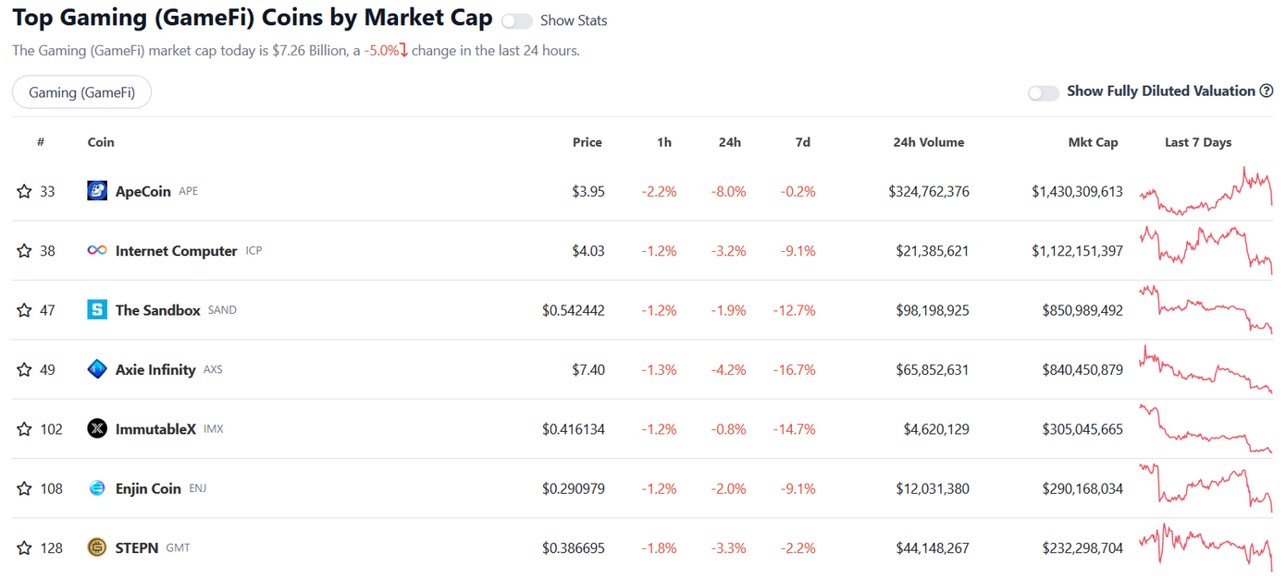

2. GameFi blockchain games

overall review

2. GameFi blockchain games

The token MAGIC will be listed on Binance Innovation Zone on the 12th, including three trading pairs: MAGIC/BTC, MAGIC/BUSD and MAGIC/USDT. At the beginning of MAGIC's launch, it was as high as 1.08, and then fell back to around 0.7. Benefiting from a series of favorable stimuli such as the popularity of the newly hatched game The Beacon, the launch of Coinbase and the launch of Binance, MAGIC has increased by more than 120% so far this month.

3. Infrastructure & Web3 infrastructure

secondary title

3. Infrastructure & Web3 infrastructure

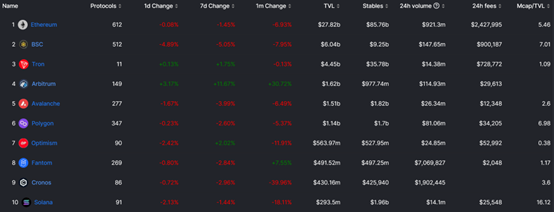

(1) Market Overview - Public Chain & TVL

As of December 13, the overall lock-up volume (including staking) of each public chain denominated in US dollars fell slightly following the market, falling to 48.46 B from 49.19 B last week.

The TVL rankings of the major public chains have not changed much. Only Arbitrum has maintained a strong growth momentum, surpassing Avalanche to rank fourth. Arbitrum’s growth sources are still GMX and TreasureDAO, of which GMX has maintained a rise for 5 consecutive weeks; TreasureDAO token MAGIC benefited from the listing on Binance, with a single-day increase of 45% on the 12th.

Among the remaining public chains, BSC saw a significant decline, mainly due to Reuters' report that some executives of Binance may be prosecuted for violating anti-money laundering and other matters, and BNB fell significantly.

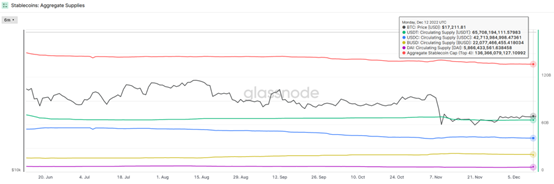

(2) Market Overview - Stablecoin Supply

As of December 12, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was about 136.366 billion, a slight decrease of about 157 million (-0.12%) from 136.523 billion a week ago. The supply of stablecoins has fallen for four consecutive weeks, and funds have continued to flow out, but the decline has stabilized this week.

DAI, which is the leverage of ETH, has seen a rare rise. This week, the supply has increased by about 176 million pieces. The market sentiment has eased, and bottom-hunting behavior has begun to appear.

4. Social & DAO & DID

On the whole, market liquidity is still in short supply, lacking incremental funds to promote it, and it is too early to reverse the bull market.

secondary title

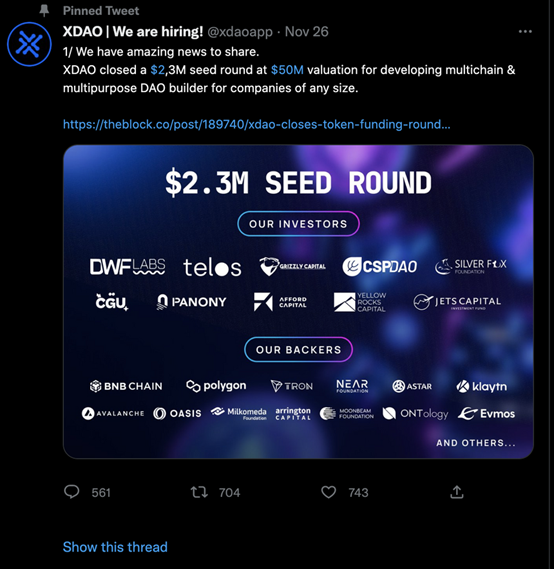

With a valuation of $50 M, XDAO completed a $2.3 M seed round of financing at the end of November this year. It was established on April 23, 2021 and is currently mainly located in Singapore. After more than a year of product development, the current Beta version has been launched and can be used on its official website.

Problems in the existing market:

In the traditional financial market, companies or organizations can skillfully invest assets in their targets under the existing legal framework. This is because, in traditional investment transactions, the country's legal framework provides security and convenience for companies or organizations, reduces risks for investors, and promotes the liquidity of funds in the market.

But this kind of web3 is difficult to realize, because it is a specific wallet that interacts with Defi products, and when it is necessary to invest in the form of an organization, it will encounter difficult management and execution.

What problem does XDAO solve?

In the previous DEFI Market, there was no effective and convenient tool for companies and organizations to invest in some decentralized protocols.

When users use XDAO, they can easily create a DAO on the platform, customize their own investment portfolio through the DAO asset management solution, and interact directly with Defi protocols.

What support can XDAO provide to DAO?

XDAO provides DAO with a complex Multi-signature Wallet, making DAO's fund management more secure and reliable

Full-process IDO assistance, including Launchpad, accelerator, promotion, etc.

Proposal full-process management, including initiation, voting (GT & LP), execution, etc.

Summarize

The asset transfer tool allows members to easily transfer assets to DAO's treasury, or transfer assets in Treasury to personal wallets, and also supports cross-chain transactions (ETH, polygon, BNB, etc.).

Summarize

XDAO has created an easy-to-use modular DAO management tool, allowing groups in the real world to participate in the Defi Market more safely and easily.The main difference between XDAO and other DAO Tooling tools is that it is a full-process DAO modular management platform. DAO can not only complete proposal initiation and voting on XDAO, but also can access different modules to complete investment, Dividends and other functions. The most distinctive function is that DAO can directly interact with Defi protocols on XDAO, making it easy to conduct Defi financing in the form of DAO.How to make real companies or organizations believe that their tools do not have loopholes.

If XDAO cannot give this sense of security, then the market he faces competition is still the traditional Dao tooling track, and he cannot achieve the effect of breaking the circle.

first level title

5. About us

team news

In the past week, JZL Garden has launched the Garden project's first NFT series "Dandelion" to the Upstairs platform, and it was completely sold out within one hour of the public sale. This is an important milestone moment for JZL Garden, thank you for your witness.

team introduction