Will 2023 be the first year of the Move ecological nuggets?

The public chain is an enduring mainstream narrative in the encryption world. Even though there are currently 30+ mainstream Layer 1s running millions of DApps such as DeFi, NFT, GameFi, and SociaFi, this track is still very early.

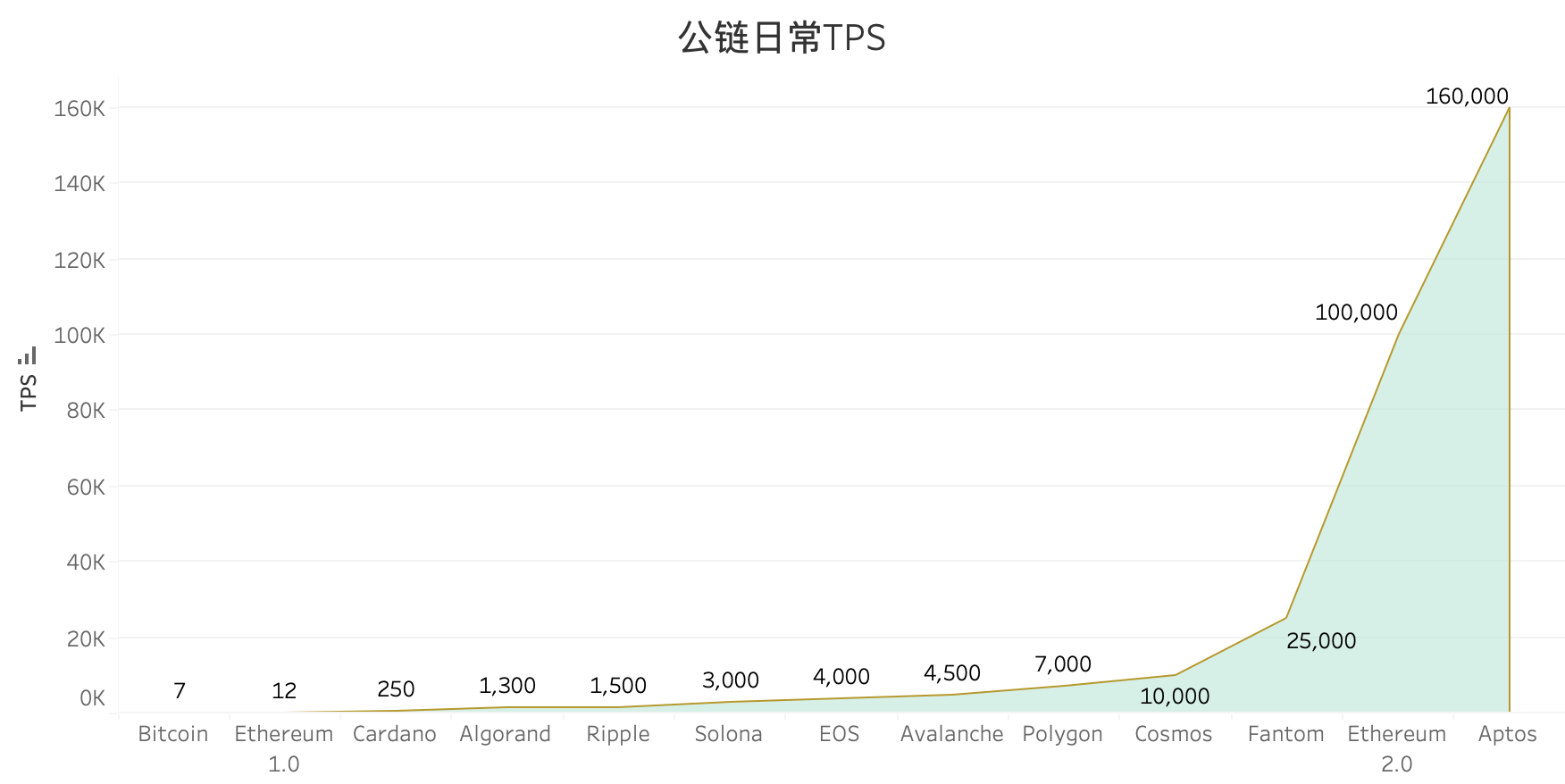

The "early stage" lies in the fact that the current public chain can only carry millions of users, which is at least two orders of magnitude away from the 1 billion+ users of Web 2.0 such as WeChat and Facebook, and the new public chains that bridge the gap will do a lot.

In the conception of Web 3.0, the most important point is that the existing Internet infrastructure and upper-layer applications will be reconstructed, from the bottom communication protocol to the middle layer of SaaS, and various upper-layer applications will be active Based on a new generation of high-performance public chain, the overall market is expected to be in the trillions of dollars. As Peter Smith, the co-founder of Blockchain.com, said, “We have witnessed the success of Solana, Avalanche and Near Protocol in this bull market, and have achieved super high returns in the short term. The next wave of Layer 1 will be the home of Aptos and Sui. "

The market has basically reached a consensus on the fact that the future belongs to the Move ecological public chain, but the reality is that the world has been suffering for a long time.

first level title

secondary title

Performance bottleneck: the contradiction has reached a critical point

When the time comes to 2022, the contradictions of the blockchain are concentrated in one point,The contradiction between users' increasing demand for high-speed network and the high delay, high price and slow confirmation of today's public chain.

In the DeFi Summer wave that started in 2020, the number of users on the chain exceeded one million for the first time, followed by the high Gas Fee problem of Ethereum. During the peak period, an interaction on the chain would cost hundreds of dollars. It has created the crowding out effect of giant whales on retail investors, and the crisis of centralization lingers in the encrypted world.

The throne of Ethereum is unstable, and careerists see their own opportunities. New public chains such as Solona and Avalanche that focus on "high performance" have entered the stage of history. Objectively speaking, the TPS of these two public chains has increased by two orders of magnitude compared with Ethereum, and is basically close to the transaction settlement capabilities of Web 2 giants such as Visa. However, Solona's successive downtimes prove that this is not the final destination.

Ethereum’s response is to promote the EIP-1559 proposal to carry out the London hard fork, to promote the growth of various L2 Rollups, and in the 2.0 era after the complete Merge next year, the TPS is expected to increase to 100,000.

However, the departure of dYdX from the Ethereum ecology declares that Ethereum has a bad start in stages. Ten thousand years is too long, and the encrypted world needs high performance now.

Time waits for no one. In the Web 3.0 era, more external users will pour into the encrypted rabbit hole. We need to provide a user experience beyond the Web 2.0 era to prove the superiority of DeFi, NFT, and GameFi.

It's time to discuss the possibility of a new generation of public chains replacing Ethereum, a high-performance public chain that is truly suitable for the next decade of blockchain, and this is a historical mission that Ethereum supported by Solidity cannot accomplish.

Solidity: the Achilles heel of smart contracts

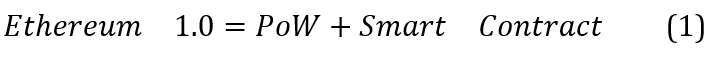

The success of Ethereum is built on the shoulders of Solidity and Bitcoin, both of which are indispensable. We can summarize it as the following formula:

The mining mechanism under the PoW principle allows miners to compete for bookkeeping rights through hash collisions and sequence transactions, which is the physical basis for individuals to participate fairly in Ethereum.

Smart contracts are the basis of complex logical operations such as DeFi, NFT, and GameFi, and it is the first time to realize the Crypto Native ecology built by assets on the chain.

Cheng Ye Xiao He. There is no problem with Solidity itself. It has successfully contributed to EVM, the largest moat in the Ethereum ecosystem. The rest of the public chains basically need to be compatible with EVM to stimulate the migration of applications. It can be considered that before 2022,The competition on the public chain track is the competition between Ethereum and other Ethereum.

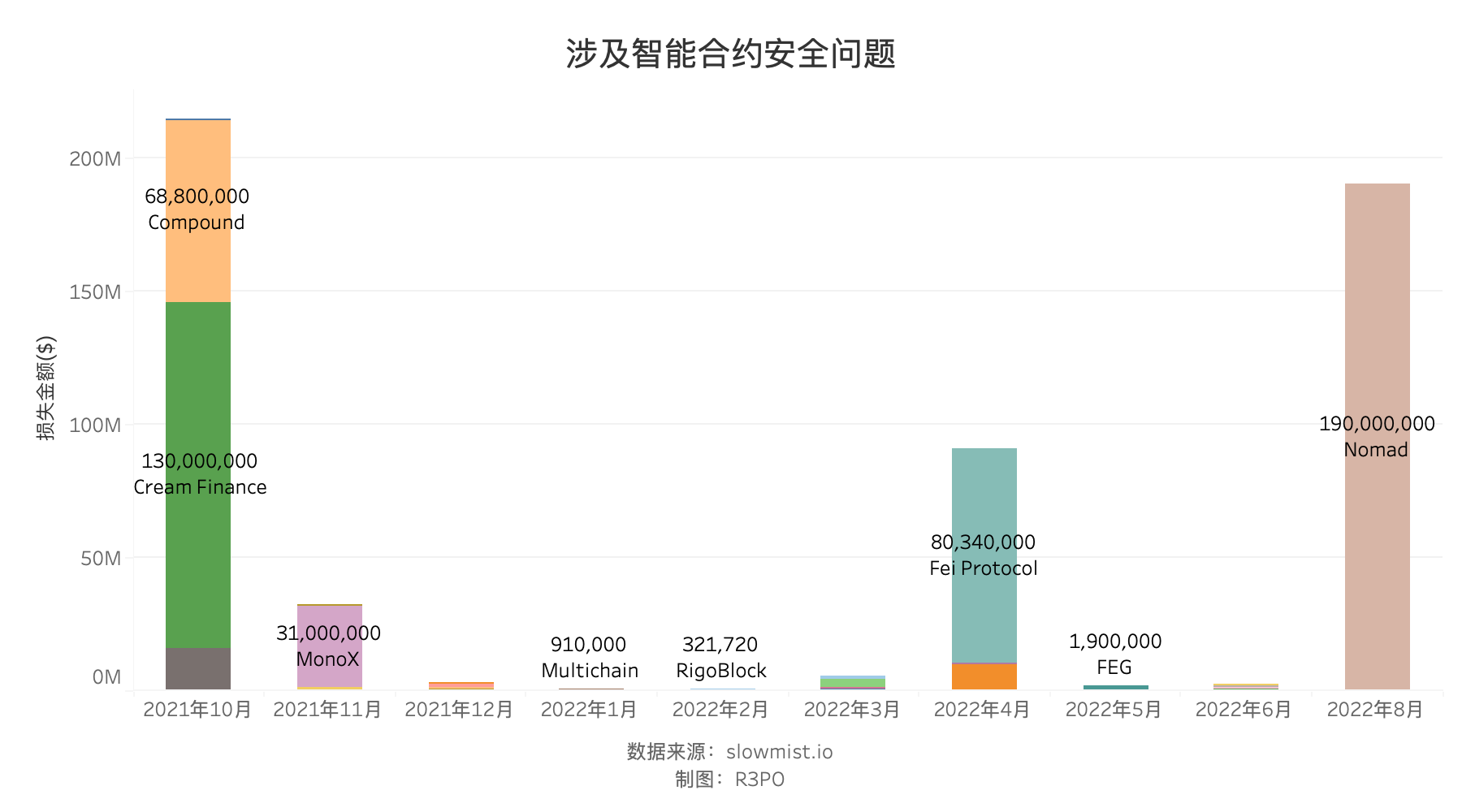

Xiao He also lost. Smart contracts written by Solidity often have problems. At its root, Solidity is not a programming language completely prepared for on-chain assets, but more of a writing tool for smart contracts. In smart contracts, assets are composed of time, integer All traditional attack methods can be applied to conventional numerical types combined with , floating-point numbers, Boolean values, etc., but it is precisely that Solidity supports a huge amount of assets on the chain, so security has become the giant's ankle, a lingering shadow.

To sum up, the red and black features of the Solidity language:

dynamic language. Easy to develop and debug VS is difficult to find problems in the compilation stage;

The syntax is flexible. Support dynamic calling VS endangering asset security;

Asset properties are supported. Smart contract basic VS requires developers to have complete logic.

Centralized storage of resources. Easy asset management VS contract loopholes will affect all user assets.

We must admit the excellence and shortcomings of Solidity, look at the future programming language development on the basis of it, and develop a high-performance public chain in the next era.

first level title

The origin and history of Move

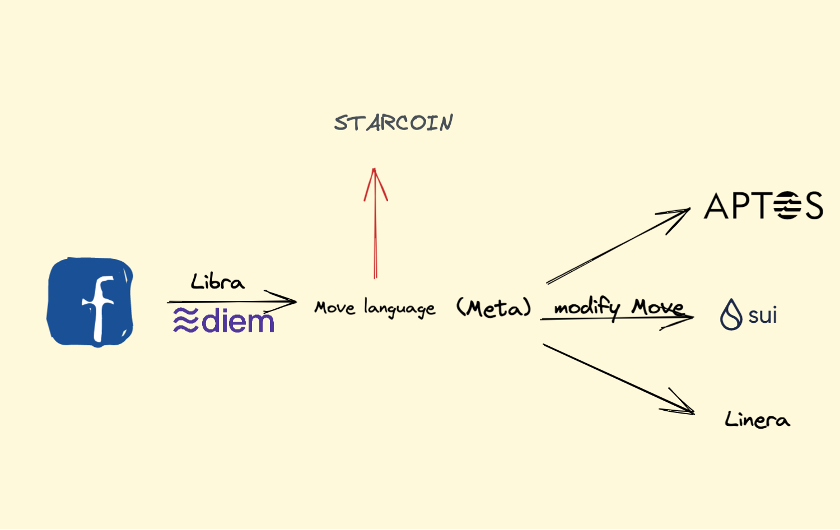

Before the Move language entered the public eye, it had already staged a story of the prince's revenge with ups and downs.

He was originally the son of a big factory born with a golden spoon in his mouth. Later, he was sold by his family. Fortunately, he was supported by a16z, FTX, Coinbase and other capital, and finally built the Move ecology. This is also the first time named by a programming language. The public chain ecology shows its excellence.

In fact, Move is not a new language. It has been developed for more than a few years. It was originally a language specially developed by Facebook for its Diem project. After Facebook sold the Diem team under regulatory pressure, the Move language has gone through a long period of time. The slump of time.

During the trough of Move, the Starcoin technical team chose to persevere for a long time, wrote a series of tutorials to encourage developers to participate, and took the lead in using the Move language to build a public chain and ecology, proving the power of the Move language to developers and the market.

The long-term persistence finally sees the light. From March 2022, the Move public chain began to reflect the mainstream perspective. Sui, Aptos and Linera completed financing successively. Because the three are too similar and highly homogeneous, they quickly attracted the market. attention.

The main development force of the three is composed of the original Diem team, and the Meta system is formally formed;

Both use Move as the development language, and Sui has modified the native Move;

All are invested by a16z. Since none of the three mainnets are online yet, it can be considered that they are more optimistic about the future of the Move language;

All three received large-scale financing, Sui completed US$236 million in financing, Aptos completed US$350 million in financing, and Linera completed US$6 million in financing;

Move itself is a programming language modified from the Rust language. Its grammatical features emphasize beyond Solidity. We can summarize the features of the Move language as follows:

Generic + static programming. Abandon the dynamic calls of Solidity, and use generic tools to achieve efficient development, and at the same time ensure that contract loopholes are intercepted during the compilation phase, preventing crises before the crisis, and avoiding asset losses after chaining.

Language-level formal verification capabilities. Formal verification refers to the verification method that mathematicalizes the contract logic. This is currently the safest verification mechanism. In the development of Solidity, professional security agencies, such as SlowMist and Paidun, conduct verification after the contract is completed. And Move implements this tool at the language level, which is convenient for developers to call.

Resource-oriented programming. In the Move language, resources are defined as a special type. Under the same timestamp, resources can only have one "owner" and can only exist in one state (exist or destroy), which fundamentally avoids wireless additional issuance, unknown ownership, etc. The possibility of attack methods ensures the security status of the whole process from development to delivery and end-to-end.

Distributed storage of resources. In the smart contract implemented by Solidity, resources are stored in "serial connection". If a hacker breaks one point, the assets involved in the entire contract will be included in the bag; while in the implementation of Move language, resources are stored in "parallel connection", and any data has For its specific owner, hacker attacks cannot cause the contract to fail as a whole.

With the rapid maturity of capital, the market fell into madness for the first time because of the public chains that did not have any of the three mainnets. The move language developer's $1,200 hourly salary meme has quickly gone out of the circle, and it has obviously gotten out of the dilemma when Starcoin was struggling .

The Move language is not just a legend. Starcoin has already laid out its ecology on it, and the Aptos test network has also entered the third stage. Sui and Linera are also following. Will the Move ecology completely replace the Solidity ecology?

Let’s just talk and not practice fake tricks. Next, we will actually experience various high-performance public chain ecology based on Move.

Move’s Ecological Status

Moreover, the main slogan this time has quietly leapt forward to Web 3.0, occupying the leading position in the just-released Aptos. This is not a public chain prepared for DeFi or NFT, but a foundation for the migration of the next generation of the Internet to Web 3.0. 7 billion people need high performance, privacy protection requires a new public chain, and frictionless (Seamless) experience requires ecology.

Among the four public chains, Starcoin takes the lead and already has a relatively complete application ecosystem, including supporting measures such as DeFi, NFT, Metaverse, and hardware wallets. Sui is the first to obtain financing, but the current ecological construction is weak, and only a few applications are deployed. Further development is needed. observe.

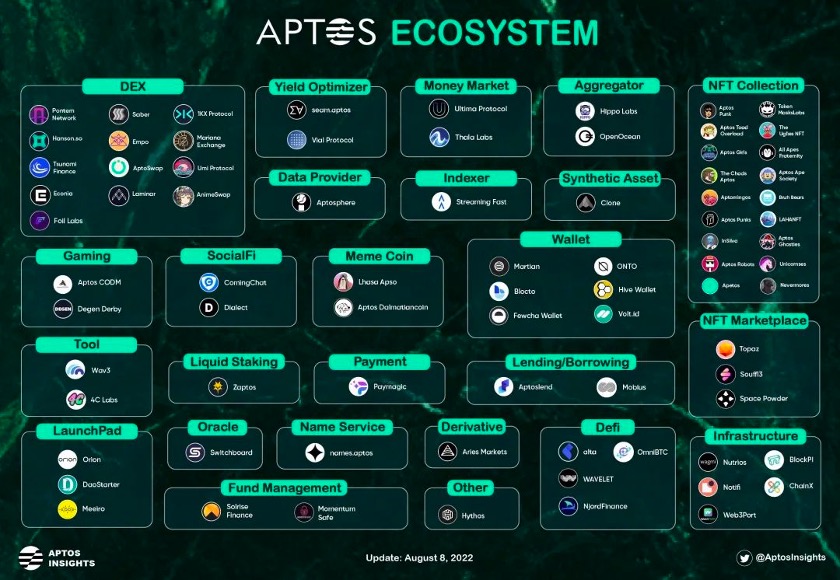

And Aptos has staged a good show of latecomers. It only had 30 applications in July, but by mid-to-early August, more than 80 ecological applications have been lined up to go online, which can be described as the current top stream.

And Linera is still under development, this article does not cover it.

These teams who are deeply involved in the MOVE ecosystem and are committed to promoting Web3.0 deserve attention.

Aptos four-step strategy

The rise of Aptos cannot forget the contribution of Solona developers. A large number of developers have migrated to the Aptos testnet, hoping to replicate Solona’s success in this bull-bear cycle.

According to the information on the official website, Aptos has already held a hackathon, and launched a Grant plan in June to fund ecological development. Its testnet incentives have a total of 4 rounds, including:

AIT 1: Launched, 119 nodes including 43 countries participated

AIT 2 : Staking, 226 nodes including 44 countries participated

AIT 3: Governance and upgrades, currently in progress

AIT 4: Dynamic validator topology

The 3rd phase of AIT has promoted the activeness of the Aptos ecology like the Cambrian explosion. It has basically covered a series of supporting infrastructure such as DEX, GameFi, NFT, oracle machines. The Aptos team has not attracted existing mature applications like other public chains. Instead, it is hoped that the application will grow along with the public chain, and then seamlessly switch to the main network to directly retain existing users and developers.

The highlights are as follows:

AMM-based DEX Liquidswap. Developed jointly by the Aptos official and the Pontem Network team, the Move VM built by it can perform cross-chain operations, and is the first batch of Polkadot to support the Rust language series. Liquid is designed based on Uniswap and is expected to become the mainstream native DEX on the Aptos chain.

The order book DEX Econia based on the Block-STM mechanism. The key point is to use Aptos' parallel processing mechanism to batch-process orders, reduce impermanent losses, and promote matching efficiency.

After the fermentation of AIT 3, the market popularity of Aptos has further increased, and we are expected to witness the large-scale progress of the real Aptos high-performance public chain this year.

Sui's long work

Different from Aptos in the market, Mysten Labs behind Sui is more low-key and forbearing. Unlike Aptos, the Move language used by Sui has a certain color of modification. The highlight is that the network fee will be divided into calculations The two parts are settlement and storage, which are settled separately. The user pays for the current storage, and can also cancel the authorization to delete the data after it is not needed, and more emphasis is placed on protecting user privacy.

Mysten Labs has launched the test network DevNet for the Sui network. The mainstream application is the Sui wallet plug-in wallet developed by itself, including token and NFT management functions. The progress of other ecological construction is relatively slow.

It released the development guide on games and NFTs in March this year, and it can be clearly observed that Sui is more interested in commercial applications such as NFTs and games.

It released the development guide on games and NFTs in March this year, and it can be clearly observed that Sui is more interested in commercial applications such as NFTs and games.

The layout and future of Starcoin

Unlike Aptos and Sui, which are still struggling on the testnet, Starcoin is already developing real products for users. The total number of transactions has reached more than 8 million times, and the average transaction fee is only $0.000016. The ecology on it is more vibrant, and everything The state of the race.

The ecology includes wallets, DEX, NFT trading platforms, mining pools and stable coins, etc., which is enough for us to have a glimpse of the whole picture of the public chain built by the Move ecology.

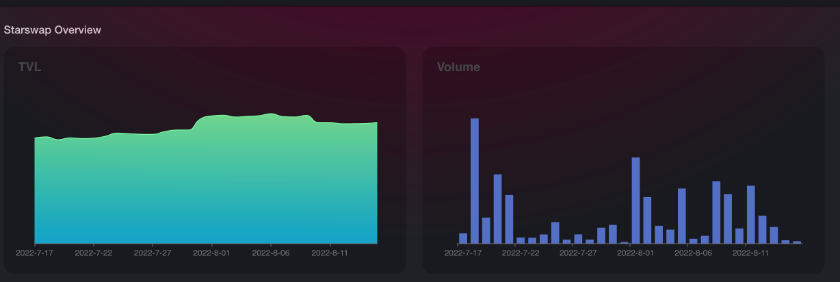

Take the above DEX Starswap as an example, the native Move application based on the AMM mechanism, currently has a TVL of 800,000 US dollars, supports transactions between five assets including WEN, FAI, XUSDT, STAR and STC, and supports cross-chain bridge exchange for more Multi-asset is also the starting point for future construction of Move financial ecology.

Within DeFi, native assets on the chain will be seamlessly supported by the over-collateralized stablecoin FAI. FAI can be obtained by STC or ETH mortgages, building a stablecoin experience belonging to Starcoin, getting rid of the threat of increasingly centralized stablecoins such as USDC, and more Good promotion of Move ecological construction.

Within DeFi, native assets on the chain will be seamlessly supported by the over-collateralized stablecoin FAI. FAI can be obtained by STC or ETH mortgages, building a stablecoin experience belonging to Starcoin, getting rid of the threat of increasingly centralized stablecoins such as USDC, and more Good promotion of Move ecological construction.

Off-chain, Starcoin is in-depth cooperation with the hardware wallet OneKey, and currently supports Starcoin Dapp, from soft to hard, the Move language is responsible for the security of assets on the chain, and the hardware wallet will ensure the security of physical assets.

In addition to DeFi, Starcoin also carries out the layout and construction including NFT and Metaverse. Unlike the high fees and high latency of the Ethereum ecology, Kiko Verse developed based on Move is a network that includes NFT, token mechanism and meme culture. The Trendy Metaverse platform within.

Different from the low-latency requirements of DeFi applications, the Metaverse platform needs high-load support. Thanks to the support of the Move language ecology and Starcoin, Kiko verse can solve the needs of Game/NFT/DeFi in one stop, and become the platform for our future life. entrance.

Conclusion and Outlook

text

text

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.