The funds are only enough for another year and a half. How can Sushi save itself?

On December 6, Jared Gray, Sushi's new "chef" after just two months in the job, launched anew proposal. In the proposal, Jared disclosed to the outside world for the first time Sushi's current dire financial situation and proposed a temporary self-help plan.

Jared pointed out that the current financial deficit of Sushi has affected the sustainability of the project,Although the annual expenditure budget has been reduced from 9 million US dollars to 5 million US dollars since he took office, even so the treasury funds can only last about another year and a half。

Jared also mentioned that since the SUSHI tokens are close to full circulation, and the Sushi treasury had only received a small amount of transaction fee commission income through Kanpai in addition to the token unlocking income, it has not been able to realize the asset diversification of the treasury reserves (It can be understood that there is basically only SUSHI in the hands of the treasury), which further weakens Sushi's ability to resist risks.

In this case,Jared suggested that Kanpai's current parameter ratio be increased from 10% to 100%, which means that xSUSHI holders (that is, SUSHI pledged users) will receive a share of the transaction fee from 90% to 0%. This part of the funds will be fully transferred to the treasury as an operational reservesecondary title

Proposal implementation logic

Jared's proposal involves some unique concepts in the Sushi system, such as xSUSHI, Kanpai, etc. To understand the implementation logic of the proposal, it is necessary to understand the specific meaning of these concepts.

Like most other DEXs, the sustainable income in the Sushi system comes from the commissions drawn from user transactions. current,Sushi charges 0.3% for transactions on Sushiswap, of which 0.25% is owned by liquidity providers (LPs), and the other 0.05% will be distributed to xSUSHI holders as system income.

The so-called xSUSHI is the governance token of the Sushi protocol. SUSHI holders can exchange xSUSHI by pledging SUSHI for a long time, binding their own interests with the development of the protocol, and thus obtaining the voting qualification to participate in future upgrades and changes of Sushi. As an incentive, xSUSHI holders can receive a 0.05% commission on transaction fees.

The concept of Kanpai was born in June 2021 from agovernance proposal,Its role is to take another part of xSUSHI's 0.05% income to supplement Sushi's treasury income and enrich treasury asset classes to cope with the coming bear market at any time. To put it simply, Kanpai is a parameter that represents the allocation ratio between the treasury and xSUSHI holders. Currently, the parameter is 10%, which means that the treasury allocates 10% (0.005%), and xSUSHI holders allocate 90% (0.045%) % ).

So it's clear what Jared's proposal is.secondary title

What does the community think?

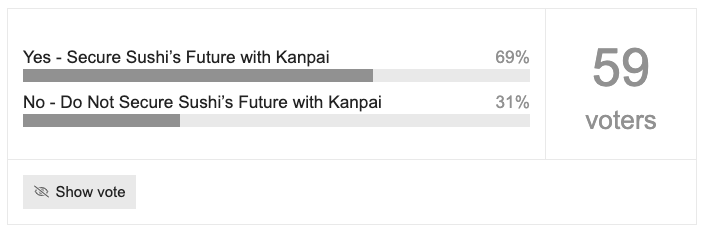

As of the publication of this article, although 69% of the community members in the preliminary poll below the proposal post chose to support it, judging from the discussion below, a large number of community members still have doubts about the proposal.

Looking through the comments of community members, it can be seen that the doubts mainly focus on the following points:

One is whether other alternatives can be found? Because "stripping" xSUSHI would obviously diminish the value of investing in SUSHI, this could lead to a massive sell-off leading to a more negative outcome.

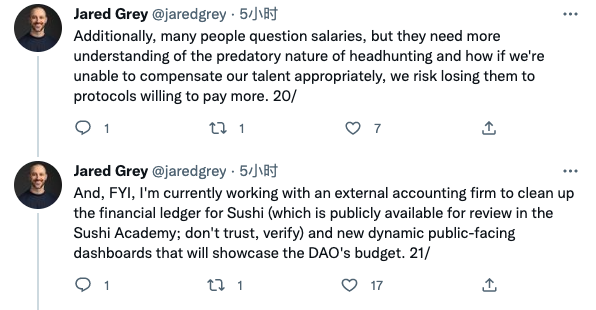

The second is whether Sushi really needs to spend $5 million? Are there detailed accounts for financial expenditures? Is Jared just trying to keep his paycheck?

The third is that Jared's wording on the voting option (the opposing option is "I will not use Kanpai to save the future of Sushi") is suspected of inciting the community?

Regarding these doubts, Jared responded to multiple messages, and even sent dozens of tweets on Twitter to respond positively to the doubts.

Regarding question one,Jared's response was that the measure was the only way for Sushi to replenish the coffers immediately, and without more money, it was questionable whether Sushi would be able to survive.

Regarding the second question, Jared responded that Sushi has always been the target of headhunting. If Sushi cannot pay workers a reasonable salary, it is easy to be poached by competitors. also,Sushi is working with an external accounting firm to organize and publish financial accounts. As for making personal profit, Jared said that he waived the severance clause in the contract when he took the post of Sushi "chef", and donated all the original 250,000 US dollars resignation budget to the treasury.

secondary title

Is it possible to save yourself like this?

As it stands, Jared's proposal is facing considerable resistance.

Considering that the holders of xSUSHI whose book interests are damaged are the ones who decide whether to vote or not, it is expected that a large number of community members will vote against the proposal after it officially enters the governance circulation.Whether the proposal can continue to advance will largely depend on how Jared can combine long-term and short-term interests to convince xSUSHI holders.

It should be noted that Jared himself mentioned that the proposal is only a stopgap measure,In the future, the important task for Sushi to get out of the quagmire is to come up with a more sustainable new economic model and explore more development paths to capture more value.

Regarding the new token economic model, Jared revealed last week that the first draft has been basically completed, but has not yet released any details to the outside world. Given that Sushi's financial situation is currently showing signs of depletion, it is still unknown whether the new model can sufficiently refine the details and convince the community to agree under such hasty conditions.

In addition, since SUSHI tokens are close to being fully released, there is not much room for the new token economic model to operate, so it is not ruled out that Jared and his team will consider expanding the total supply of tokens (it is entirely a personal guess, no FUD ), if so, will this cause panic and doubt on a larger scale? These are all unanswered questions.

Bear market is not easy, not everyone can be like ACCan go, facing Jared is an unimaginable challenge for ordinary people.