"Proof of Reserves" has sparked heated discussions and is regarded as a powerful measure to prevent FTX incidents

author:

author: Frederick Munawa

Several centralized exchanges, including Binance, have announced their digital asset audit plans to appease user sentiment.

Due to the inability to redeem digital assets worth billions of dollars, the industry's leading encryption exchange recentlyFTX Bankruptcy. Affected by this incident, criticism of centralized exchanges has intensified. Numerous criticisms have pointed out that centralized exchanges do not provide safe custody of user assets.

This has also sparked discussions on one of the potential solutions - Proof of Reserves (POR). It is a technology that can show the number of tokens held by the exchange with high confidence. As far as FTX is concerned, if it uses POR to demonstrate asset reserves, then in theory it cannot misappropriate user assets where they should not (such as Alameda Research) in full view.

Binance, the world's largest crypto exchange by trading volume, hasDisclosed its wallet asset balanceandGate.io, KuCoin, Poloniex, Bitget, Huobi, OKX,DeribitandBybitNot to be outdone, they made promises one after another.

related news:Indian crypto exchange Giottus says it will offer proof of reserves, yet its competitors remain silent.

POR is a technique for auditing assets held. Issuers of stablecoins, such asPaxosAn anchor reserve that can be used to prove itself issuing assets. crypto exchanges such asBitMEXOracle

decentralizedOraclenetworkChainlinkfirst level title

How does POR work?

There are various ways for an entity to demonstrate its asset reserves. The traditional way can be to find a third-party audit company such asArmanino, generating a Merkle tree proof.Merkle treeIt is a data structure that can be cryptographically verified.

Related Reading:Proof-of-Reserves: Could It Help Avoid FTX's Crash?

There are also blockchain analysis companies taking other approaches. For example, Chainlink splits proof-of-reserve into offline and online.

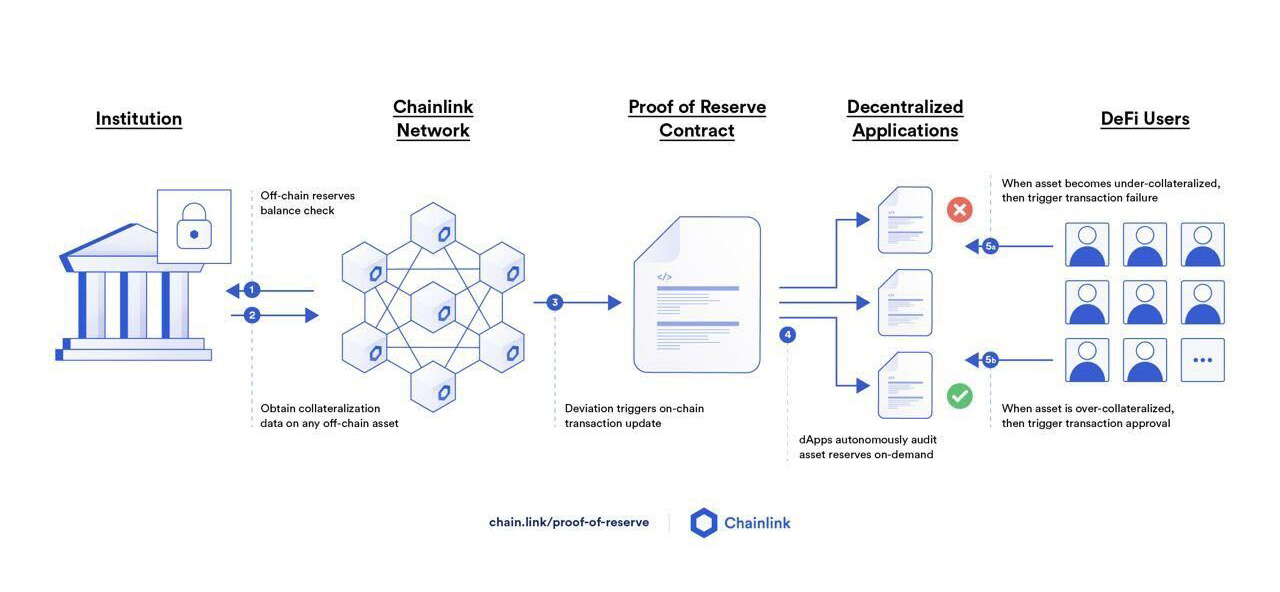

The offline part involves third-party data providers. Chainlink viaAPIimage description

Off-chain proof of reserves (Chainlink)

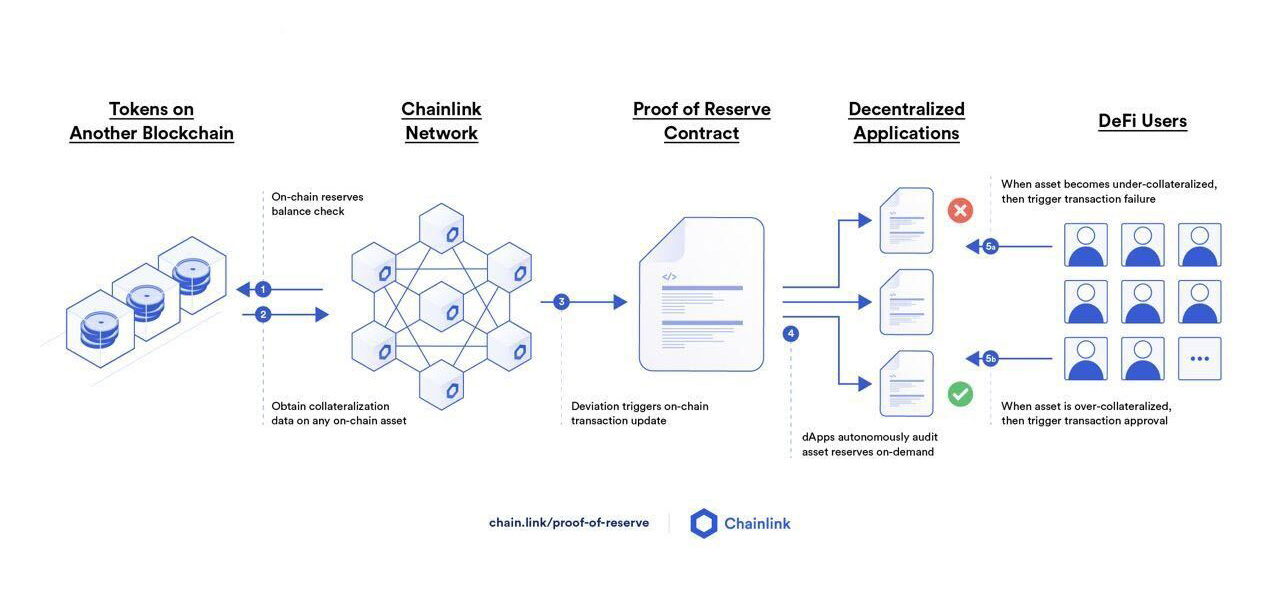

image description

On-chain proof of reserves (Chainlink)

first level title

Industry Experts Discuss

Eric Richmond was a corporate and securities lawyer before starting a business in the crypto industry. In 2019, he founded Tetra Trust, Canada's first licensed digital asset custody company. Now he is one of the largest exchanges in CanadaCoinsquarechief operating officer.

Related Reading:Canadian digital asset brokers Coinsquare and CoinSmartsoon to be merged

Coinsquare is a registered investment dealer regulated by the Investment Industry Regulatory Organization of Canada (IIROC), a voluntary regulatory organization of more than 170 dealers, similar to the Financial Industry Regulatory Authority of the United States (Financial Industry Regulatory Authority). Industry Regulatory Authority, FINRA). Richmond argues that while reserves have proven to be the right step, embracing regulation may be a better solution.

Richmond explained: "We are obliged to do daily reports to check our customers' account balances and assets held in cold storage. Every day we will ensure that the assets in the cold storage are one-to-one correspondence, which is IIROC requirements."

Cold storage means keeping assets offline rather than connected to the internet. Other experts, such as Nic Carter, agree that proof of reserves is "the industry's last hope for effective self-regulation". Carter is a general partner at Castle Island Ventures, a firm that invests in crypto-financial infrastructure.

Carter told CoinDesk: "We need to prove to the regulators that we are capable of self-regulation, especially after the heavy blow of FTX. PoR will avoid disasters such as Quadriga, FTX or MT. Gox. If any exchange refuses to do so now Do, people will be very suspicious of them."

In 2019, the largest cryptocurrency exchange in Canada at the timeQuadrigaCX collapsesLater, its late founder and CEO Gerald Cotten was revealed to have misappropriated client funds, leaving only a small portion of assets available for creditors to recover. And in 2014 the Tokyo-based bitcoin exchangeMt. Gox's Internal AccidentAmong them, its poor security measures and questionable funding activities led to massive hacks. Creditors are still trying to recover some of the lost funds. The collapse of these exchanges, like that of FTX this time, has forced the industry to consider major improvements to fund and custody management.

Peter Eberle, president and chief investment officer of cryptocurrency investment firm Castle Funds, responded to Carter's comments above: "I believe this event will force exchanges to be more transparent. They need to prove that they are not commingling user funds, and they are not lending out funds." Client assets. They have to earn the trust of their clients by proving that they actually own the assets they claim,” Eberle told CoinDesk. “Audited financial statements and proof of reserves will be the industry standard going forward. This should be the case, although previously It didn't happen."

One of the world's largest cryptocurrency exchangesKuCoinJohnny Lyu, CEO of , agrees — the industry needs more transparency. He saidKuCoinProof of reserves has already begun: "This is a self-regulatory issue for the entire industry. Next we will examine the internal data and try to find out what kind of data can really reassure users. After that, we will also work with third parties to disclose as needed data,” Lyu told CoinDesk in an interview. "Currently, we have disclosed more information on the balance of mainstream tokens, including Ethereum and Bitcoin."

Related Reading:Let’s actually do proof of reserves this time, shall we?