Vitalik Buterin: Which applications in the Ethereum ecosystem do I like?

Original Author: Vitalik Buterin

Compilation of the original text: MaryLiu, Bitui BitpushNews

Ten, five, or even two years ago, my vision of what Ethereum and blockchain could do for the world was very abstract. I'd say, "It's a general technology, like C++," and sure, it has specific properties like decentralization, openness, and censorship resistance, but beyond that, it's a question of which specific applications make the most sense. premature.

The world today is no longer that world. Enough time has passed that few ideas are completely unexplored: if something works, it's probably some version of something that has been discussed many times in blogs, forums, and conferences . We're also closer to identifying the limitations of the industry. For example, despite the inconvenience and cost, many DAOs have a fair chance, enthusiastic audiences willing to participate, many DAOs are underperforming, industrial supply chain applications are not widely adopted, decentralized Amazon on the blockchain hasn't shown up yet. But in this world, we're also seeing real and growing adoption of key applications that serve real needs of people -- and those are the ones we need to focus on.

So my perspective has changed: my excitement about Ethereum is now not based on the potential of undiscovered unknowns, but on some specific class of applications that have proven themselves and will only get better. stronger and stronger. What are these apps, and which ones are I no longer bullish on? That's what this article is about.

1. Money: The first and most important application

One of the experiences I remember very well when I visited Argentina for the first time last December was wandering the streets at Christmas when almost all the shops were closed, we were looking for a coffee shop, we searched for 5 and finally found one. In business. When we walked in, the boss recognized me and immediately showed me the ETH and other crypto assets on his Binance account. We ordered tea and refreshments, then asked if we could pay in ETH, the boss agreed and showed me the QR code of his Binance deposit address, I paid about $20 from my Status wallet on my phone ETH.

This is far from the most meaningful use of encryption happening in the country. Others use it to save money, transfer money internationally, pay for big important transactions, and more. But even so, the fact that I randomly found a coffee shop and it happened to accept cryptocurrency shows the breadth of adoption. Unlike developed countries such as the United States, where financial transactions are easily conducted, 8% inflation is considered extreme, in Argentina and many other countries around the world, with more limited connections to the global financial system, extreme inflation is a daily occurrence In reality, cryptocurrencies often step in as a lifeline.

Besides Binance, there are also a growing number of local exchanges, and you can see them advertised everywhere including airports

One of the problems with my coffee trade is that it has no real utility. The handling fee is high, about one-third of the transaction amount. Transactions take minutes to confirm: I recall that at the time Status did not yet support sending correct EIP-1559 transactions which were more reliable and confirmed faster. If, like many other Argentinian cryptocurrency users, I only had a Binance wallet, transfers would be free and instant.

However, things changed a year later. As a result of merging, transactions are included more quickly and the chain becomes more stable, making it safer to accept transactions after fewer confirmation times. Scaling techniques such as Optimistic and ZK rollups are advancing rapidly. Social recovery and multi-signature wallets are becoming more and more practical. As technology develops, these trends will take years to play out, but progress is being made.

At the same time, there was one major "nudge" driving interest in on-chain transactions: the FTX debacle, which reminded everyone, including Latin America, that even the most seemingly trustworthy centralized services can be fundamentally impossible. Not trustworthy.

Cryptocurrencies in developed countries

The more extreme use cases around surviving high inflation and conducting basic financial activities generally do not apply in wealthy developed countries. But cryptocurrencies still hold significant value. As someone who uses it to make donations (to legitimate organizations in many countries), I can personally confirm that it is much more convenient than traditional banking. It is also valuable for industries and activities that are at risk of being deplatformed by payment processors - a category that includes many industries that are perfectly legal under the laws of most countries.

There is also an even more important broader philosophical case for cryptocurrencies as private money: many governments are using the transition to a "cashless society" as an opportunity to introduce levels of financial regulation unimaginable 100 years ago. Cryptocurrency is the only thing currently in development that can actually combine the benefits of digitization with a cash-like respect for personal privacy.

stable currency

stable currency

The Ethereum community has long understood the value of stablecoins. To quote a blog post from 2014:

Bitcoin holders have lost around 67% of their wealth over the past 11 months, and prices have often risen or fallen by as much as 25% in a single week. Seeing this concern, there is growing interest in a simple question: Can we have the best of both worlds? Can we have the full decentralization that crypto payment networks offer, but at the same time have a higher level of price stability without this extreme up and down volatility?

In fact, stablecoins are very popular among users who actually use cryptocurrencies today. That said, there is a reality that doesn’t align with today’s cypherpunk values: the most successful stablecoins today are centralized, primarily USDC, USDT, and BUSD.

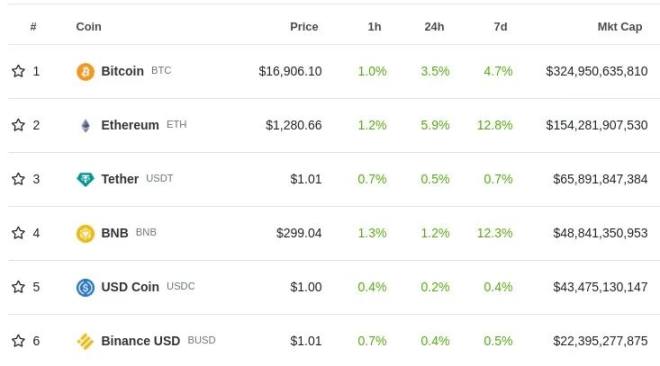

Top cryptocurrencies market capitalization, data from CoinGecko, 2022-11-30. Three of the top six are centralized stablecoins

Stablecoins issued on-chain have many convenient properties: they are open for anyone to use, they are resistant to the largest and opaque forms of censorship (the issuer can blacklist and freeze addresses, but such blacklisting is transparent , there are actual transaction fee costs associated with freezing each address), and they interact well with on-chain infrastructure (accounts, DEX, etc.). But it's unclear how long this will last, so research on other alternatives will need to continue.

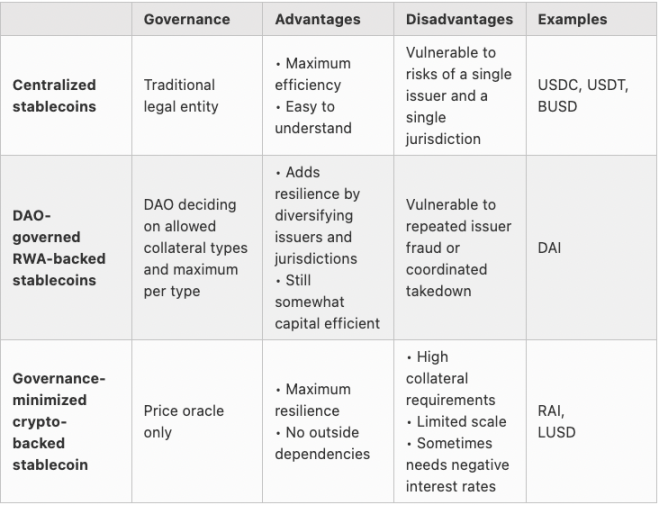

I think the stablecoin market basically falls into three distinct categories: centralized stablecoins, DAO-managed real-world asset-backed stablecoins, and governance-minimized crypto-backed stablecoins.

From a user perspective, all three types have to strike a balance between efficiency and resilience. USDC that works today will almost certainly work tomorrow. But in the long run, its continued stability depends on the macroeconomic and political stability of the United States, the continued US regulatory environment that supports making USDC available to all, and the credibility of the issuing organization.

RAI, on the other hand, bears all these risks, but it has a negative interest rate: -6.7% at the time of writing. In order for the system to be stable (and thus, not prone to crashes like LUNA), every holder of RAI must be matched with holders of negative RAI (aka "borrowers" or "CDP holders"), and then Those who use ETH as collateral. As more people participate in arbitrage, hold negative RAI and balance it with positive USDC or even interest-bearing bank account deposits, this rate may increase, but the interest rate of RAI will always be lower than the normal operation of the banking system, and there may be negative interest rates, users The question of experience will always exist.

The RAI model is entirely ideal for the more pessimistic LUNA punk world: it avoids all connections to non-crypto financial systems, making it harder to attack. Negative interest rates prevent it from being a convenient replacement for the dollar, but one way to adapt is to accept this disconnect: stablecoins with minimal governance can track some non-monetary assets, such as the global average CPI index, and advertise themselves as representing the abstract "best effort". price stability". It would also have lower inherent regulatory risk, as such assets would not be trying to provide a "digital dollar" (or euro, etc.).

A DAO-managed RWA-backed stablecoin could be a delightful medium if it works well. Such a stablecoin could combine sufficient robustness, censorship resistance, scale, and economic utility to meet the needs of a large number of real-world crypto users. But making this work will require both real-world legal work to develop a strong issuer and a lot of resilience-oriented DAO governance engineering.

In either case, any stablecoin that works well will benefit multiple currency and savings apps that already provide tangible help to millions of people today.

2. DeFi: Keep it simple

In my opinion, decentralized finance, a category that started out gloriously but limited, has somehow turned into an overcapitalized monster dependent on unsustainable forms of yield formation, is now in the early stages of a stable medium, raising Security and renewed focus on some particularly valuable applications. Decentralized stablecoins are, and likely will always be, the most important DeFi product, but there are a few others with important niches:

Prediction markets: Since Augur launched in 2015, they have been a niche but stable mainstay of decentralized finance. Since then, their adoption has been quietly growing. Prediction markets showed their value and limitations in the 2020 US election, and this year 2022, cryptocurrency prediction markets like Polymarket and virtual currency marketplaces like Metaculus are increasingly used. Prediction markets are valuable as a cognitive tool, and there are real benefits to using cryptocurrencies to make these markets more trustworthy and more accessible globally. Instead of a multi-billion dollar wave, I expect the forecasting market to continue to grow steadily and become more useful over time.

Other synthetic assets: In principle, the formula behind stablecoins could be replicated in other real-world assets. Interesting potential stocks include major stock indexes and real estate. The latter will take longer to get right due to the inherent heterogeneity and complexity of space, but it can be valuable for exactly the same reasons. The main question is whether someone can create the right balance between decentralization and efficiency so that users can access these assets at a reasonable rate of return.

Glue layer for efficient transactions between other assets: If there is an asset on-chain that people want to use, be it ETH, centralized or decentralized stablecoins, fancier synthetic assets, or anything else, then the layer The value in will make it easy for users to transact between them. Some users may wish to hold USDC and pay transaction fees in USDC. Others may hold some assets but want to be able to convert them instantly to pay someone who wants to pay in another asset. Another use case is that one asset can be used as collateral to obtain a loan against another asset, although these projects are most profitable if they keep leverage to a very limited level (e.g. no more than 2x) likely to succeed and avoid incurring losses.

3. Identity ecosystem: ENS, SIWE, PoH, POAPs, SBTs

"Identity" is a complex concept that means many things. Some examples include:

Basic authentication: simply prove that action A (such as sending a transaction or logging into a website) was authorized by an agent with some identifier (such as an ETH address or public key), without trying to say who or what its agent is .

Proof: Proof of statements made by other agents to the agent ("A proves that he knows B", "the Government of Canada certifies that C is a citizen")

Name: Establish a consensus that a specific human-readable name can be used to refer to a specific agent.

Proof of personhood: to prove that the agent is a person, through the personality proof system (Proof of personhood) to ensure that each person can only obtain one identity (this is usually done with a proof, so it is not a completely separate category, but it is a very important one. special case of )

I've been bullish on blockchain identity for a long time, bearish on blockchain identity platforms, the use cases mentioned above are important for many blockchain use cases, and blockchains are valuable for identity applications because they have independent depending on the nature of the institutions and the interoperability advantages they provide. However, trying to create a centralized platform to do all of these tasks from scratch is not going to work. What's more likely to work is an organic approach, with many projects tackling specific tasks that are individually valuable, adding more and more interoperability over time.

That's exactly what's happened since then. The Sign In With Ethereum (SIWE) standard allows users to log into (traditional) websites in much the same way you log into websites with your Google or Facebook account today. This is actually useful: it allows you to interact with websites without giving Google or Facebook access to your private information or taking over or locking your account. Technologies such as social recovery can provide users with account recovery options in case they forget their passwords, much better than what centralized companies offer today. SIWE is supported by many applications today, including Blockscan chat, the end-to-end encrypted email and notes service Skiff, and various alternative blockchain-based social media projects.

NS lets users have usernames: I have vitalik.eth. Proof-of-personality and other proof-of-personality systems let users prove that they are uniquely human, which is useful in many applications including airdrops and governance. POAP ("Proof of Attendance Protocol", pronounced "pope" or "poe-app", depending on whether you're a brave contrarian or a sheep) is a general-purpose protocol for issuing tokens that represent proof: you're done Is it an educational program? Have you been to an event? Have you met a particular person? POAP can be used both as part of an identity proof protocol and as a way to try to determine if someone is a member of a particular community (valuable for governance or airdrops).

NFC card that contains my ENS name and allows you to receive POAPs to verify you have seen me

Each of these applications can be used individually. But what really makes them strong is their synergy. When I log into the Blockscan chat, I use Ethereum to log in. This means anyone I chat with can instantly see my vitalik.eth (my ENS name). In the future, to combat spam, Blockscan chat can "verify" accounts by looking at on-chain activity or POAP. The lowest layer will simply verify that the account has sent or been a receiver in at least one on-chain transaction (since this requires a fee). A higher level of verification might involve checking the balance of a particular token, ownership of a particular POAP, identity credentials, or a meta-aggregator like Gitcoin Passport.

The network effects of these different services combine to create an ecosystem that provides some very powerful options for users and applications. Ethereum-based Twitter alternatives such as Farcaster could use POAP and other proof-of-chain activity to create a "verification" feature that does not require traditional KYC, allowing anonymous participation. Such platforms could create rooms that are only open to specific community members — or a hybrid approach where only community members can speak but anyone can listen, the equivalent of a Twitter poll that might be restricted to a specific community.

Just as importantly, there are more pedestrian applications related to simply helping people make a living: verification by proof can make it easier for people to prove they are trustworthy to get rent, employment or loans.

The biggest future challenge for this ecosystem is privacy. The status quo involves putting massive amounts of information on-chain, which is too good to be true, and ultimately unacceptable if not downright risky for a growing number of people. There are ways to get around this by combining on-chain and off-chain information and making heavy use of ZK-SNARKs, but it's actually a lot of work. Scaling is also a challenge, but scaling can usually be solved with rollups and validation, while privacy issues cannot and must be analyzed on a case-by-case basis.

4. DAO

"DAO" is a powerful term that encompasses many of the hopes and dreams people have for the crypto space to build more democratic, resilient and efficient forms of governance. It's also a very broad term, and its meaning has changed a lot over the years. Most commonly, a DAO is a type of smart contract designed to represent an ownership structure or control over certain assets or processes. But this structure could be anything from low-level multi-signatures to highly complex multi-space governance mechanisms like the one proposed for the Optimism Collective. Many of these structures work, while many others don't, or at least are a bad match for what they're trying to achieve.

There are two questions to answer:

What governance structure makes sense and for which use cases?

Does it make sense to implement these structures as DAOs or via regular registries and legal contracts?

One particularly subtle point is that the word "decentralized" is sometimes used to refer to both: a governance structure is decentralized if its decisions depend on the decisions of a large group of participants; a governance structure is decentralized if its implementation is Decentralized, then it is built on a decentralized structure like the blockchain and does not depend on any single nation-state legal system.

Decentralization for robustness

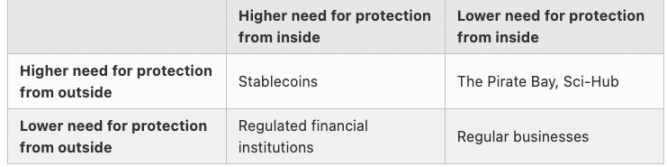

One way to think about the difference is that a decentralized governance structure protects against internal attackers, while a decentralized implementation protects against powerful external attackers (“censorship resistance”).

First, a few examples:

The Pirate Bay and Sci-Hub are great case studies in censorship resistance without decentralization. Sci-Hub is primarily run by one person, and if parts of the Sci-Hub infrastructure are torn down, she can simply move it elsewhere. The Sci-Hub URL has changed several times over the years. The Pirate Bay is a hybrid: it relies on decentralized BitTorrent, but is itself a centralized convenience layer.

The difference between these two examples and blockchain projects is that they do not attempt to protect users from the platform itself. If Sci-Hub or The Pirate Bay want to hurt their users, the worst they can do is provide poor results or shut down - both of which are only minor inconveniences until their users switch to other alternatives, and those alternatives would inevitably arise in their absence.

They could also publish user IP addresses, but even if they did, the total harm done to users would still be much lower than stealing all users' funds.

Stablecoins are not like that. Stablecoins are trying to create a stable, credible, and neutral global business infrastructure, which requires not relying on external single centralized actors, but also prevents attackers from within. If the governance of stablecoins is poorly designed, attacks on governance could steal billions of dollars from users.

At the time of writing, MakerDAO has $7.8 billion in collateral, more than 17 times the market cap of MKR. So, if governance rests with MKR holders, without any safeguards, someone could buy half of all MKR, use it to manipulate price oracles, and steal most of the collateral for themselves. In fact, this has already happened to a stable (Beanstalk) with a smaller market cap! This has not happened with MKR, mainly because MKR holdings are still fairly concentrated, with the majority of MKR being held by a fairly small group who are unwilling to sell because they believe in the project. This is a great model for launching a stablecoin, but not a great model in the long run. Therefore, for decentralized stablecoins to work in the long run, innovations in decentralized governance that do not suffer from these drawbacks are required.

Two possible directions include:

Some kind of non-financialized governance, or possibly a hybrid of "bicameralism", where decisions require approval not only from token holders, but also from other classes of users (e.g., Optimism Citizen or stETH holders)

Deliberate friction so that certain types of decisions only take effect after a delay long enough that users can see that something is wrong and flee the system.

There are many subtleties in crafting governance that effectively optimizes robustness. If the system's robustness depends on activating in extreme cases, the system might even want to intentionally test these extreme cases occasionally to make sure they work -- like rebuilding Ise Jingu every 20 years. This aspect of decentralization for robustness continues to require more careful thought and development.

Decentralization for greater efficiency

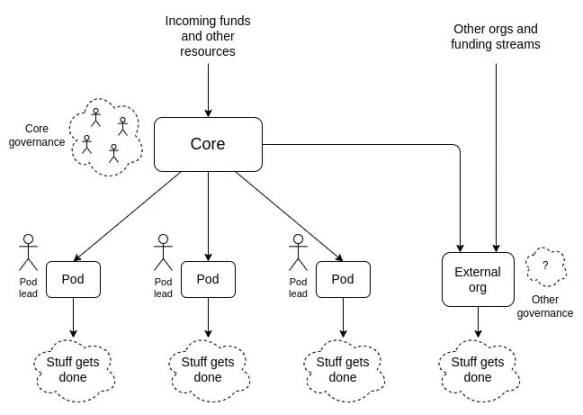

Decentralized efficiency is a different school of thought: a decentralized governance structure is valuable because it can incorporate more diverse voices at different scales, and a decentralized implementation is valuable because it is sometimes more diverse than The traditional legal system-based approach is more efficient and less costly.

This implies a different approach to decentralization. Governance that is decentralized for robustness emphasizes having a large number of decision makers to ensure alignment with preset goals and intentionally makes adjustments more difficult. Governance that is decentralized for efficiency retains the ability to move quickly and adjust when needed, but seeks to move decision-making away from the top to keep the organization from becoming a rigid bureaucracy.

Decentralized implementations designed for robustness and decentralized implementations designed for efficiency are similar in one respect: they both simply put assets into smart contracts. But decentralized implementations designed for efficiency will be much simpler: often just a basic multisig will suffice.

It’s worth noting that “decentralization for efficiency” is a weak argument for doing large projects in the same developed country. But it is a stronger argument for very small projects, highly international projects and those located in countries with inefficient institutions and weak rule of law. Many applications of "decentralized efficiency" can probably also be done on a chain run by a central bank run by a large stable country; I suspect that both decentralized and centralized approaches are good enough, and it is the path that will determine which approach dominates It's a matter of dependence which approach becomes feasible first.

Decentralization of Interoperability

This is a much-maligned argument for decentralization, but it's still important: it's easier and easier for on-chain things to interact with other on-chain things than to interact with off-chain systems that inevitably require a (vulnerable) bridging layer. safer.

If a large organization running as a direct democracy held 10,000 ETH in its reserves, that would be a decentralized governance decision, but it would not be a decentralized implementation: in practice, that country would Several people manage the keys, and the storage system can be attacked.

There is also a governance angle to this: if a system provides services to other DAOs that cannot change quickly, it is better for the system itself not to change quickly, to avoid a "rigidity mismatch" of the system. ”, the rigidity of the system makes it unable to adapt to interruptions.

These three "decentralization theories" can be summarized into a chart:

Decentralization and fancy new governance mechanisms

Over the past few decades, we have seen the development of many exotic new governance mechanisms:

quadratic voting

liberalism

liquid democracy

Decentralized conversation tools like Pol.is

These ideas are an important part of the DAO story, and they are valuable for both robustness and efficiency. These ideas, in addition to the more "traditional" century-old ideas around multi-space architectures and intentional indirection and delay, will be an important part of the story of making DAOs more effective, and they will also find value in improving the efficiency of traditional organizations.

Case Study: Gitcoin Grants

We can analyze different approaches to decentralization through an interesting edge case: Gitcoin Grants. Should Gitcoin Grants be an on-chain DAO, or just a centralized organization?

Here are some possible arguments for Gitcoin Grants to become a DAO:

It holds and handles cryptocurrencies as most of its users and funders are Ethereum users

Secure quadratic funding is best done on-chain (see next section on blockchain voting and on-chain QF implementation), so you can reduce security risk if voting results are fed directly into the system

It deals with communities around the world, and thus benefits from a credible neutrality rather than a single country focus.

It has the benefit of being able to convince users that it will still exist five years from now, so that public goods funders can start projects now and hope to be rewarded later.

These arguments favor decentralization for superstructure robustness and interoperability, although individual quadratic funding rounds fall more into the "efficiency decentralization" school of thought (the theory behind Gitcoin Grants is that quadratic funding is a more efficient funding method).

If the robustness and interoperability arguments don't apply, it may be better to simply operate Gitcoin Grants as a regular company. But they do apply, so it makes sense for Gitcoin Grants to be a DAO.

stable currency

Proof of humanity

Kleros

Chainlink

stable currency

Blockchain Layer 2 Protocol Governance

I don't know enough about these systems to justify that they are all optimized for decentralization robustness to meet my criteria, but hopefully by now they should be obvious.

The main problem with poor functioning is that DAOs require pivot capabilities that conflict with robustness, and there aren't enough cases for "decentralization for efficiency". An example would be a large company that primarily deals with US users. When building a DAO, first determine whether it is worthwhile to build the project as a DAO, and second, determine whether its goal is robustness or efficiency: if it is the former, it also needs to think deeply about the governance design, and if it is the latter, then it must either pass Mechanisms such as quadratic funding innovate in terms of governance, or they should just be a multisig.

5. Hybrid apps

Many applications are not entirely on-chain, but leverage blockchain and other systems to improve their trust models.

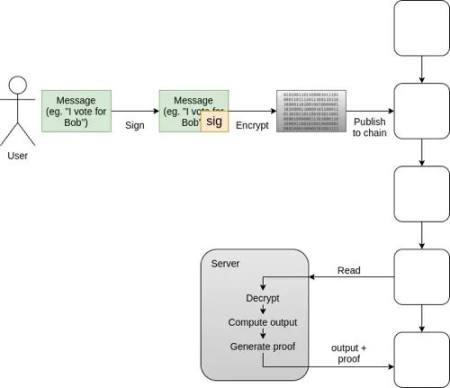

Voting is a good example. High levels of assurance against censorship, auditability, and privacy are all required, and systems like MACI effectively combine blockchains, ZK-SNARKs, and limited centralized (or M-of-N) layers to achieve Scalability and anti-coercion to achieve all these guarantees. Votes are posted to the blockchain so users can ensure their votes are included independently of the voting system. But votes are encrypted to preserve privacy and use a ZK-SNARK based solution to ensure the final result is a correct calculation of the vote.

Voting in existing national elections is already a high-assurance process, and it will be a long time before the country and citizens are satisfied with the security assurances of any electronic voting method, blockchain or otherwise. But techniques like this quickly become valuable in two other places:

Increase the credibility of voting processes that already take place electronically (e.g. social media voting, opinion polls, petitions)

Create new forms of voting that allow citizens or group members to provide quick feedback and give them high assurance from the start

Beyond voting, there is a potential area of "auditable centralized services" that could be well served by some form of hybrid off-chain verification architecture. The simplest example is a proof of solvency for an exchange, but there are many other possible examples:

government registry

Business Accounting

Games (see, for example, The Dark Forest)

Supply Chain Application

Track access authorization, and more...

As we go down the list, we see use cases of lower and lower value, but it's important to remember that these use cases are also low cost and validation doesn't require publishing everything on-chain. Instead, they can be simple wrappers around existing software that maintains a Merkle root (or other commitment) of the database and occasionally publishes the root on-chain along with a SNARK to prove it was updated correctly. This is a serious improvement over existing systems, as it opens the door to cross-institutional attestation and public auditing.

So how do we achieve it?

Many of these applications are being built today, although many of them are of limited use due to the constraints of today's technology. Blockchains are not scalable, transactions have until recently taken a considerable amount of time to be reliably included in the chain, and today's wallets leave users with an uncomfortable choice between low convenience and low security. In the long run, many of these apps will need to overcome privacy concerns.

These are all solvable problems, and there is a strong incentive to do so. The FTX debacle showed many people the importance of truly decentralized solutions for holding funds, and the rise of ERC-4337 and account abstraction wallets gives us the opportunity to create such alternatives. Rollup technology is rapidly evolving to address scalability issues, and transactions are already being included on-chain faster than they were three years ago.

But it's also important to pay conscious attention to the app ecosystem itself. Many of the more stable and boring apps aren't being built because there's less excitement and short-term profit surrounding them: LUNA has a market cap of over $30 billion, and stablecoins that strive for robustness and simplicity have tended to be largely ignored for years , non-financial apps often have no hope of making $30 billion because they simply don't have tokens. But in the long run, it is these applications that are most valuable to the ecosystem and will bring the most lasting value to their users and to the people who build and support them.