ETH Weekly | The Ethereum Ropsten test network will be fully closed in December this year; the number of Ethereum nodes in the United States ranks first (11.28-12.4)

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

According to the official blog, the Ethereum Foundation stated that the Ropsten test network has begun to gradually shut down, and is expected to be fully shut down between December 15th and 31st. Over the past few months, developers have gradually stopped participating in the testnet, and the participation rate has declined. At the same time, Ethereum will also shut down its Rinkeby testnet sometime in mid-2023, giving developers enough time to move the applications they run to the Goerli or Sepolia testnets. All of these testnets have played an important role in the development and testing of Ethereum before the massive merger upgrade.

Second, the secondary market

1. Spot market

Second, the secondary market

(ETH daily chart, picture from OKX)

According to OKX market data, the price of ETH once rebounded to $1,315 last week, and closed at $1,254 during the week, a month-on-month increase of 3%.

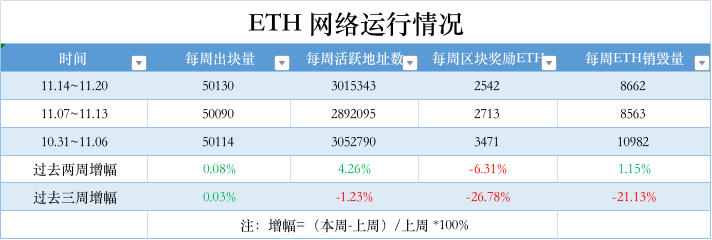

2. Network operation

etherchain.orgThe daily chart shows that the price is currently consolidating between US$1,250 and US$1,300, and may continue to test US$1,300 in the short term. The upper resistance level is the upper Bollinger Band at US$1,300, and the lower support levels are US$1,250 and US$1,200.

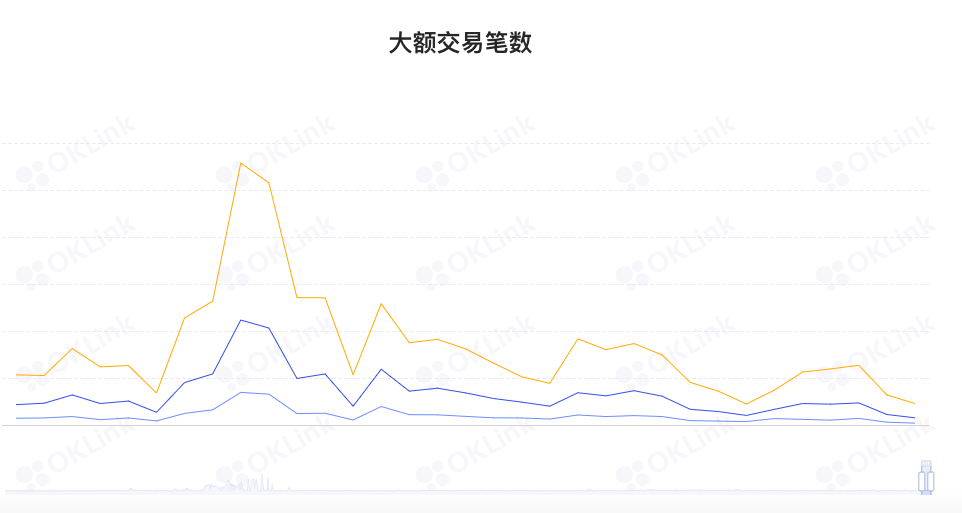

3. Large transaction

OKlink data3. Large transaction

4. Rich list address

OKlink data4. Rich list address

3. Ecology and technology

1. Technological progress

It shows that the total amount of pledged ETH in the entire network is currently 15,523,976 ETH, and the pledge rate is 12.98%, an increase of 132,352 compared with last week; from the perspective of the distribution of holding addresses, exchanges accounted for 11.16%, a month-on-month increase of 5.83%; DeFi projects accounted for 17.81 %, up 0.33% month-on-month; large addresses (top 1000 addresses and excluding exchanges and DeFi projects) accounted for 36.53%, down 5.73% month-on-month; other addresses accounted for 34.52%, up 0.44% month-on-month.

3. Ecology and technology

1. Technological progress

(1) The Ethereum Ropsten test network will be fully closed in December this year

At the same time, Ethereum will also shut down its Rinkeby testnet sometime in mid-2023, giving developers enough time to move the applications they run to the Goerli or Sepolia testnets. All of these testnets have played an important role in the development and testing of Ethereum before the massive merger upgrade.

2. Project trends

(2) Ethereum Developers: Devnet 3 release of expansion solution EIP-4844 postponed

2. Project trends

(1) StarkNet minted 10 billion STRK tokens

On November 30, Etherscan data showed that StarkNet minted 10 billion STRK tokens. Earlier news on November 16, StarkWare tweeted that StarkNet's ERC-20 token STRK contract has been deployed to the Ethereum mainnet, but the StarkNet Foundation still needs time to determine the token distribution mechanism. Tokens will remain untradeable until further notice from the StarkNet Foundation.

(2) Aave founder: Aave community is preparing to deploy Aave V3 in the Ethereum market

Aave founder Stani Kulechov tweeted, "Now, the Aave community is preparing to deploy Aave V3 on the Ethereum market."

(3) Torah Finance will airdrop TRH to UNI and CRV holders

Torah Finance, a DEX that provides transaction rewards on Ethereum, announced that it will airdrop TRH to UNI and CRV holders. The snapshot will be taken at 13:00 on December 11. This airdrop will release 2% of the total amount of tokens. The initial ratio is 0.017 TRH for holding 1 UNI, and 0.01 TRH for holding 1 CRV. After obtaining TRH, users can obtain veTRH and participate in governance by staking TRH.

(4) MetaMask has been integrated into the blockchain platform of Russia's largest bank Sber

Russia's largest bank, Sber (formerly known as Sberbank), announced that it has added and integrated the cryptocurrency wallet MetaMask, designed to interact with the Ethereum blockchain. The bank announced that this integration allows users to use Tokens and smart contracts to operate. Alexander Nam, head of Sber Bank's blockchain laboratory, revealed that the bank's blockchain laboratory is working closely with external developers and partner companies and will run DeFi applications on its infrastructure. (Cointelegraph)

(5) Tranchess has been launched on Ethereum and launched qETH, an ETH liquid pledge product

(6) A new proposal from the Uniswap community suggests deploying Uniswap V3 on the Scroll testnet

Dozens of projects including Lens, The Graph, Covalent, Empiric, Blockwallet, Ledger, Safe, Orbiter, etc. have committed to deploying to the Scroll testnet. The team expects to deploy more than 100 projects on the permissionless testnet.

(7) ETHGasStation will cease service on December 12

(8) ENS has reached a cooperation with Alchemy Pay, and ENS domain name users can use legal currency to purchase digital currency

3. Borrowing

DeFiLlama (9) BitDAO launches Mantle, a modular Ethereum L2 solution

4. News

3. Borrowing

4. News

Investment giant Fidelity has now announced that it will officially allow customers to open retail crypto trading accounts. In an email sent to customers, Fidelity stated that investors need to hold a brokerage account to fund crypto accounts. There are no commissions, but users are required to read and accept a number of disclosures, including a risk statement stating that "digital assets can fluctuate rapidly and significantly."