After tens of millions of dollars in CRV's long-short duel, Aave lay down?

Recently, the mysterious giant whale whose address starts with "0x57e" continues to short CRV. At the peak, he mortgaged more than 63.6 million USDC, lent 92 million CRV and continued to short. With the price of CRV falling all the way, the founder of Curve had to take it personally. Although "0x57e" failed to reproduce the legend of the big short like the Mongo attack, and the outcome of the long and short is to be determined, it has an impact on the DeFi lending platform Aave.

secondary title

Oolong news kicks off CRV drop

In the middle of this month, Convex, which is the same as Curve, updated the keeper incentives, but this new mechanism was misunderstood, which led to Oolong news. The security audit company Blocksec interpreted vlCVX's keeper incentive as an attack, which caused panic in the market.

Some investors believe that, dragged down by Convex, the price of CRV has also plummeted.

On November 17, Blocksec deleted their previous tweet and posted a post acknowledging their mistake. But then CRV prices did not recover. Investors found that it seems that all this is not as simple as a wrong news.

As early as November 14th, the mysterious giant whale 0x57e04786e231af3343562c062e0d058f25dace9e had fired the first shot of this multi-air battle.

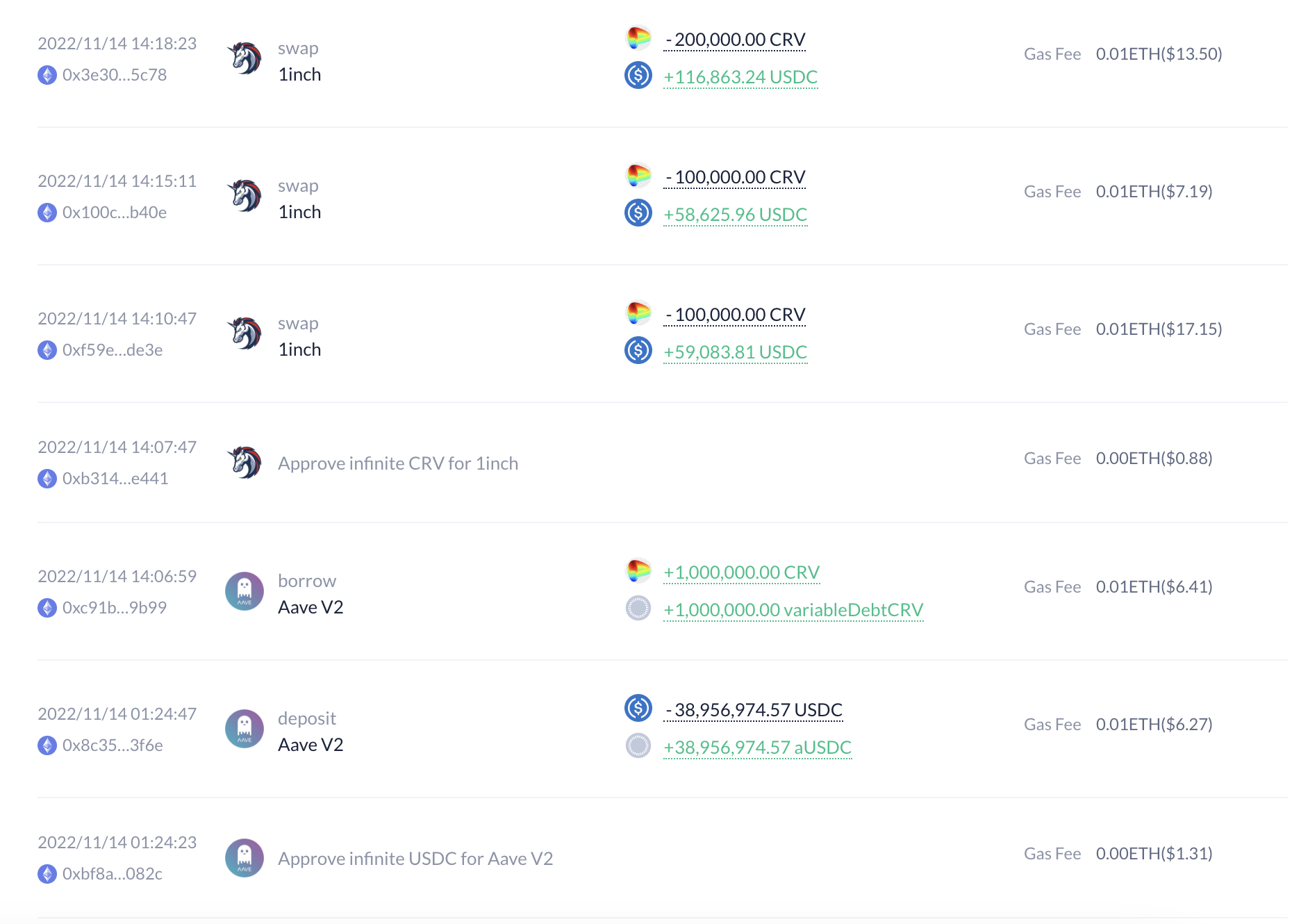

The data on the chain shows that on November 14, the mysterious giant whale 0x57e deposited about 39 million USDC in Aave, and continued to lend CRV to smash the market, or this action was interpreted as "market panic" and led to the following market All the way down.

Since then, in just two hours, 0x57e has conducted dozens of CRV sell-off transactions through different channels such as 1inch and SushiSwap. For the market, most investors are still ignorant of the matter. For CRV, a multi-short war of tens of millions of dollars has officially started.

How much selling pressure did the "mysterious giant whale" cause?

Odaily sorted out the on-chain data and found that on the first day of short selling (14th), 0x57e initiated 51 CRV sell transactions, selling a total of 3.7 million CRV. At that time, the CRV price was still around $0.62, although this amount was not large. However, it still has a slight impact on the CRV panel.

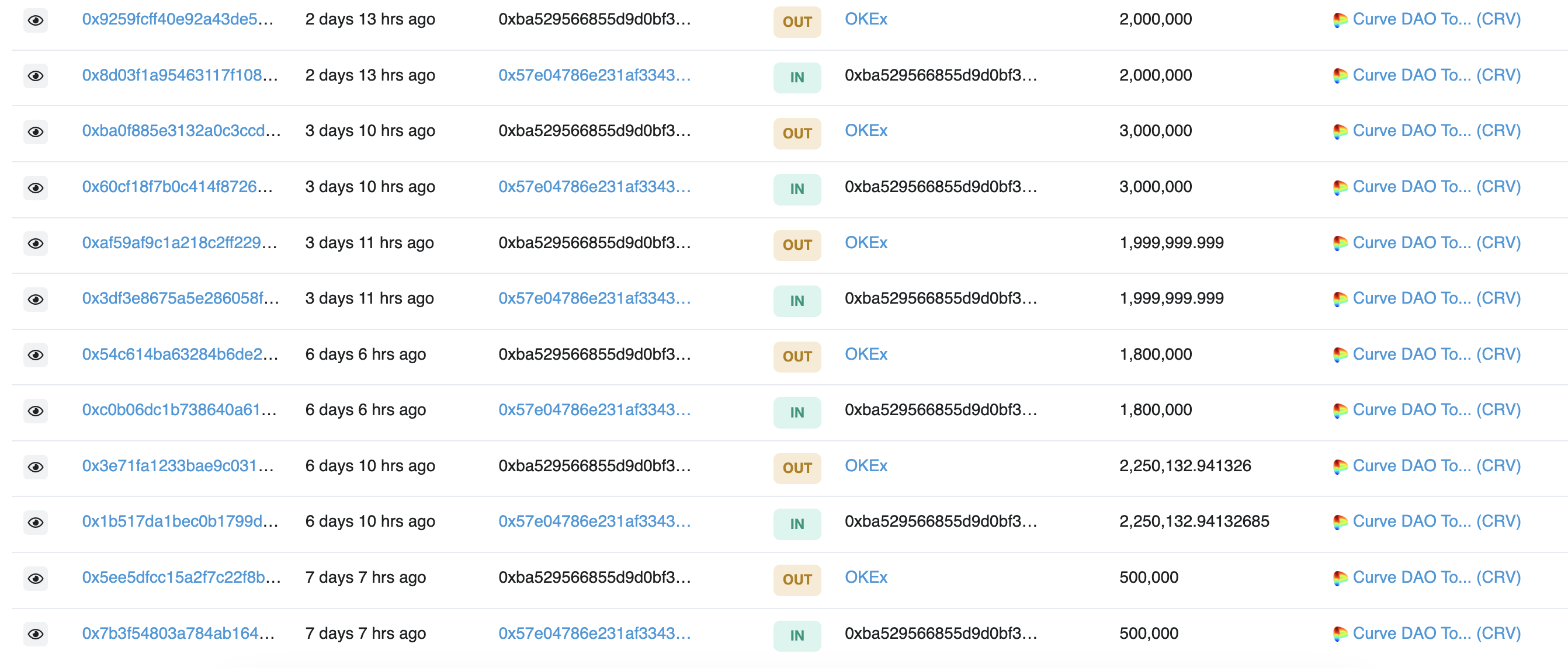

Since then, 0x57e has continued to increase its exposure to CRV's short positions. After two days of small sales on the 15th and 16th, on the 17th, 0x57e transferred 2.25 million and 1.8 million CRVs to its other address in two transactions, and transferred them to OKX to sell them all.

image description

(Millions of CRV are all transferred to OKX)

secondary title

The founder enters the market to protect the market

On November 22, the CRV price approached $0.4. While the price was still above $0.62 just a week ago, the market value has fallen by about one-third.

According to Odaily's statistics, since the short sale started on the 14th, as of the 22nd, 17 million CRVs have flowed out in 65 transactions from the 0x57e address. Its selling pressure hit the market directly and caused CRV to fall for several days. However, the 17 million CRVs are far from satisfying the appetite of this big short seller. 0x57e has not shown signs of stopping, and is still continuing to borrow and carry out short operations.

In the DeFi world, a chain reaction begins to happen. Since CRV can be used as collateral for lending agreements, the rapid price decline also triggered a large number of CRV liquidations. If it falls further, more CRV liquidations may cause a death spiral.

The self-help of the community has begun.

A large number of users appealed to lend CRV on social platforms, taking away Aave's CRV liquidity, leaving short sellers with no currency to borrow. There are also CRV diamond hands who are buying in large quantities, trying to raise the currency price.

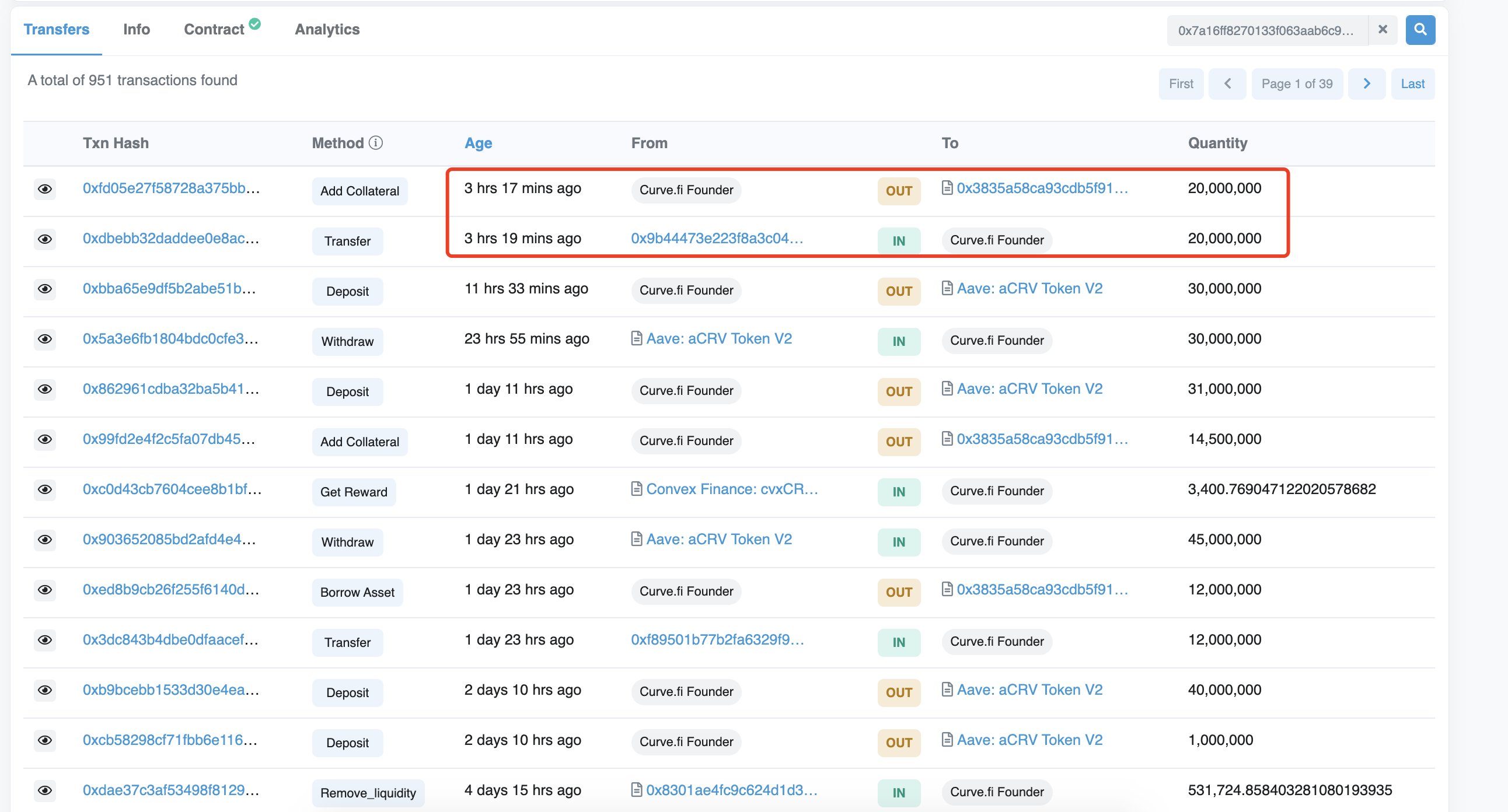

After the founder of Curve entered the field, the balance of victory turned even more towards the military side.

On the evening of the 22nd, the founder of Curve added 20 million CRV as collateral assets to Aave to ensure that his CRV collateral will not be liquidated.

In addition to personally coming out to rescue the market, the release of Curve's white paper may also have a certain impact on boosting the market. On the evening of the 22nd, the official code and white paper of the upcoming decentralized stablecoin crvUSD were announced. A repository published by the official GitHub account shows that the project is ready to finalize work on its stablecoin. The timely release of the white paper further boosted investors' confidence in CRV.

From the evening of the 22nd until the early morning, the price of CRV began to rebound strongly.

image description

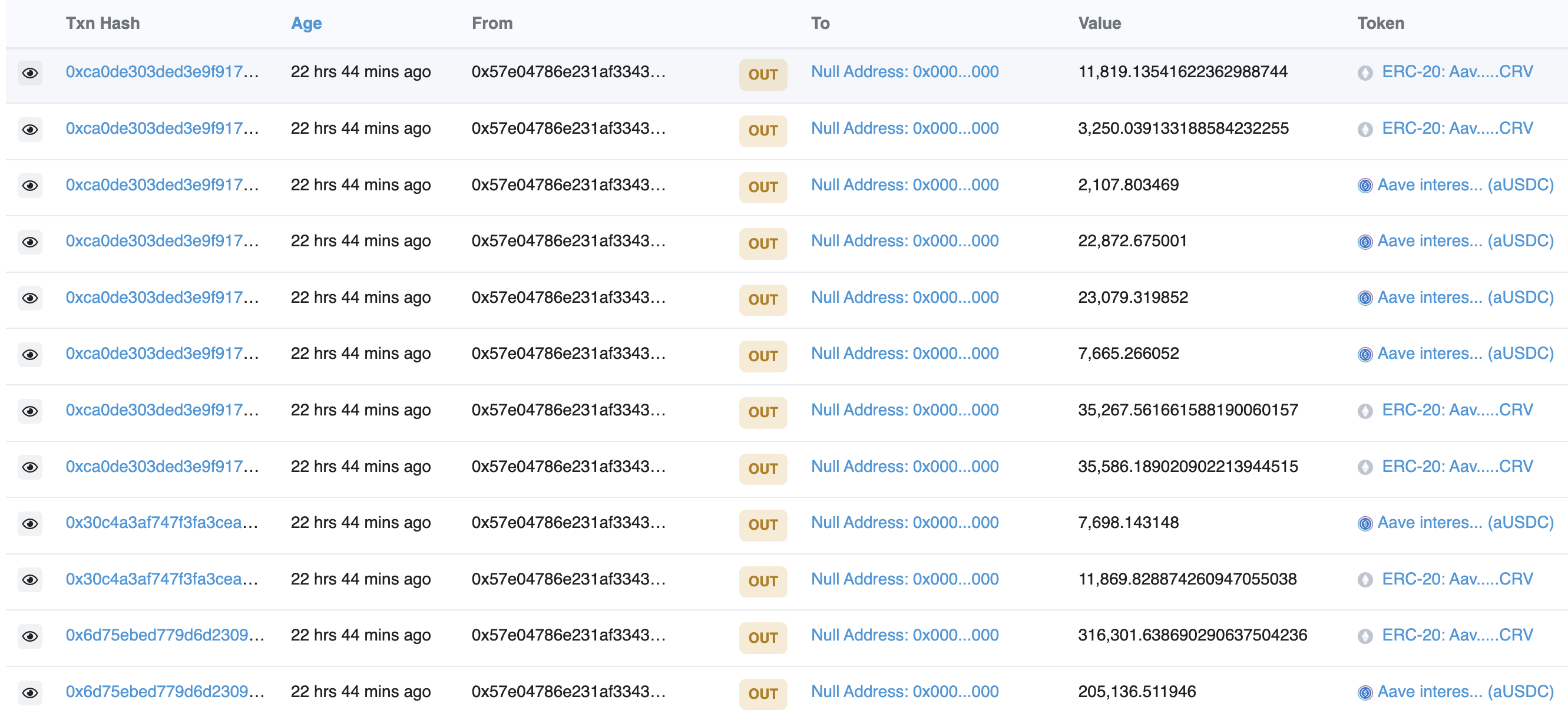

(Its certificate of deposit and debt position are both transferred to the black hole by the contract and destroyed)

From the on-chain browser, we can intuitively experience this massive liquidation behavior. The liquidation took over 5 hours with approximately 770 transactions executed on-chain. The USDC in Aave of 0x57e is almost all zeroed.

secondary title

Why did Aave "lay down the gun"?

Although the long-short showdown came to an end, the incident did not end there.

The CRV borrowed by 0x57e once accounted for 63% of the total supply of Aave. According to DeBank, the address once borrowed more than 92 million CRV and mortgaged more than 63.6 million USDC. As a result, the CRV loan interest rate on Aave soared to 251.59%.

What will happen if such a huge short liquidation occurs?

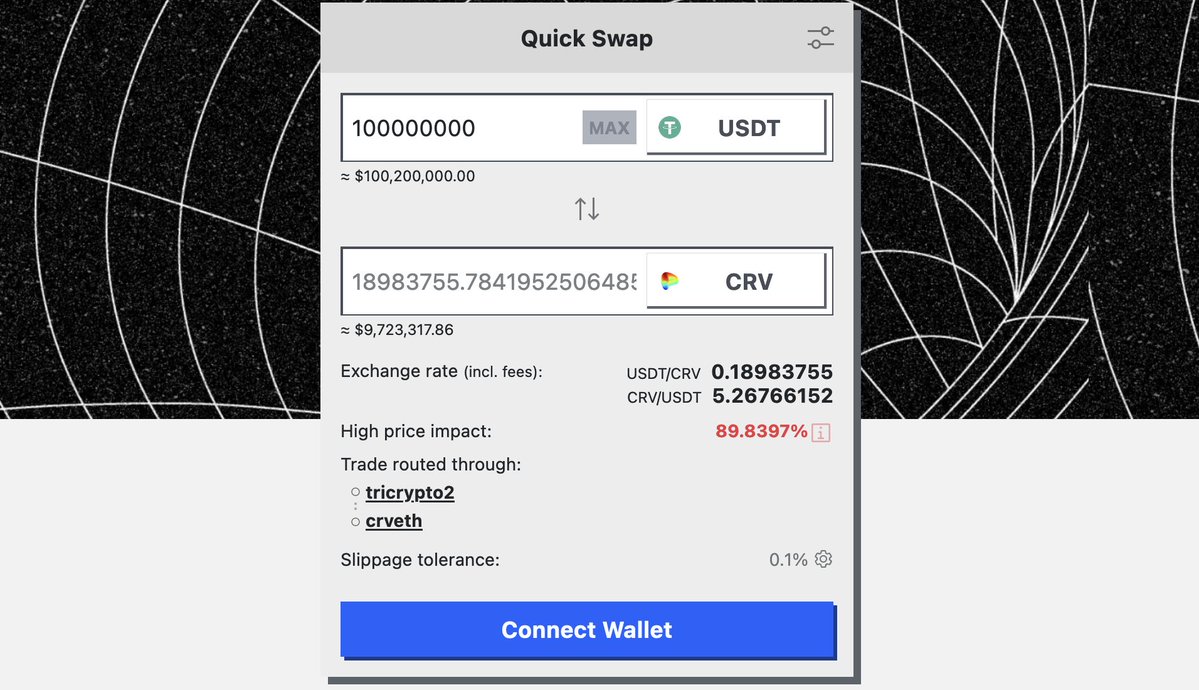

image description

(Only 18.98 million CRVs are enough to exhaust Curve's liquidity, far from repaying 0x57e's debt)

And this approach is unavoidably reminiscent of the previous Mango attacks. If Aave cannot successfully complete this large amount of liquidation, there will eventually be a rare phenomenon where 0x57e's debt is higher than its collateral. And this difference will undoubtedly become a bad debt for Aave. If a bad debt occurs, all depositors of Aave will be affected by this event.

According to the design of the Aave security module, when bad debts occur, the AAVE tokens owned by the agreement will be sold to make up for the funding gap. Due to this mechanism, the sound of FUD AAVE even appeared on the market for a time.

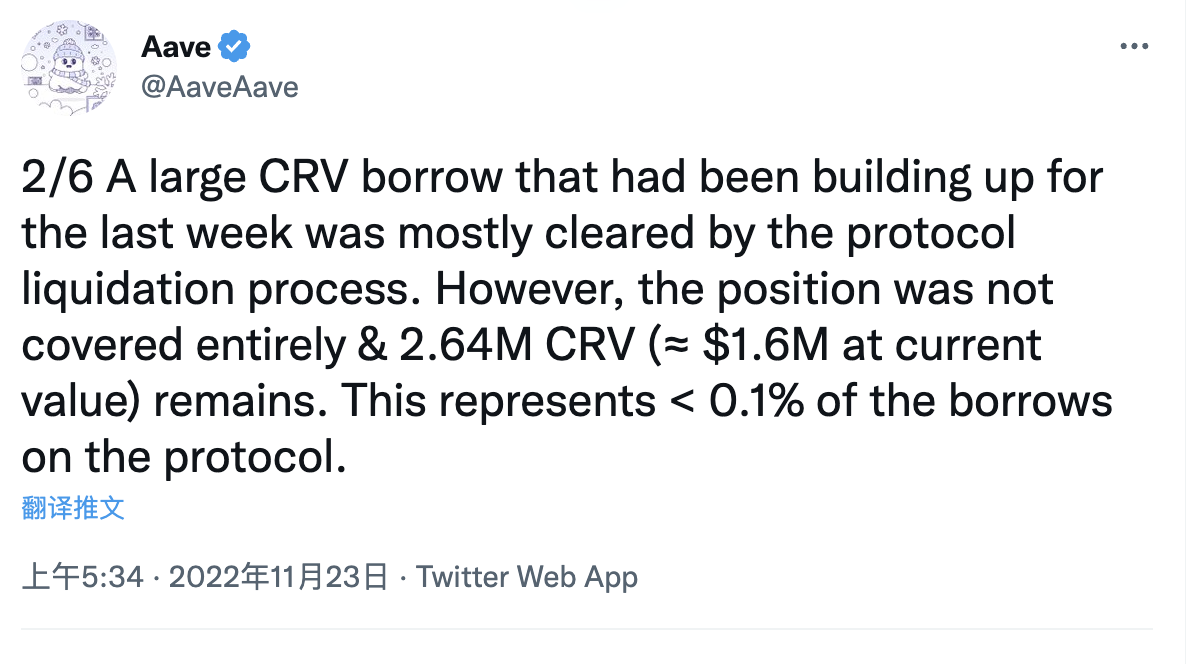

This morning, Aave's official Twitter said that although the liquidation was successful, bad debts still occurred. Fortunately, bad debts did not create a huge gap as previously expected by the market. There are only 2.64 million CRV bad debts, which is about 1.6 million US dollars.

Aave officials stated that the Aave community and contributors will discuss this event. In addition, discussions on the review of long-term asset risks took place in governance forums.

But so far, Aave has not explained how to deal with bad debts. How to make up for this bad debt gap remains to be dealt with by Aave.

In a bear market, liquidity gradually becomes scarce. Around the phenomenon of insufficient liquidity, non-mainstream asset prices have insufficient depth and greater volatility. And this will have a wider and unpredictable impact on both CeFi and DeFi.

In the current era of frequent attacks and bankruptcies in the encrypted world, is CeFi's custody platform safe and is DeFi's liquidation smooth? The plight of insufficient liquidity has gradually emerged.