What is the impact of FTX aftershocks on Bitcoin whales and long-term holders?

This article comes from GlassnodeThis article comes from

, compiled by Odaily translator Katie Koo.

The impact of the FTX turmoil on mainstream currencies and the overall encryption market is still continuing. We want to discuss the development trend of on-chain data and assess whether the recent market weakness has shaken the confidence of Bitcoin holders. The market continued to consolidate this week, but retreated from a high of $17,036 at the start of the week to $16,248, one of the lowest closes of the cycle.

This article will focus on three themes with the aim of assessing the extent to which Bitcoin investor confidence has been hit following the FTX crash:

Exodus from exchanges continues to break records;

Long-term holders are spending tokens at an extraordinary rate.

secondary title

A large number of tokens flowed out of the exchange

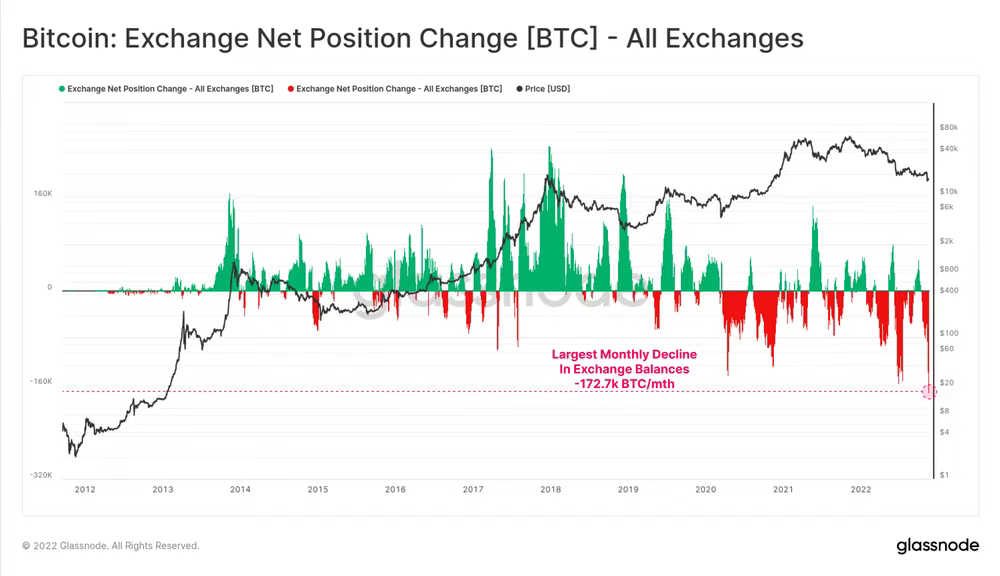

The amount of money flowing out of exchanges and into investors' wallets has almost broken records as bitcoin holders seek the "security" of self-custody. The 30-day net position change across all exchange balances reached a new all-time high.

Bitcoin is currently flowing out of exchanges at a rate of -1.727 million per month, surpassing the previous peak set after the June 2022 sell-off.

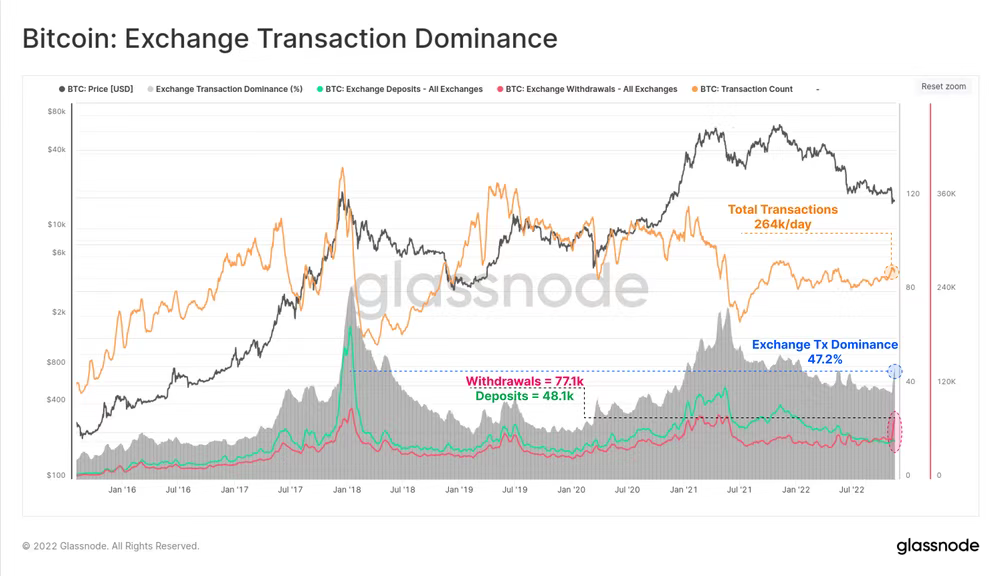

The total number of confirmed transactions has also risen over the past two weeks, hitting a multi-month high of 246,000 per day. Among them, about 29.2% were related exchange withdrawal transfers (771,000 withdrawals), and 18.2% were exchange deposit transfers (481,000 deposits).

The surge in exchange-related activity pushed the dominance of exchange deposits and withdrawals to 47.4 percent, the highest level so far this year. Historically, higher exchange dominance may have been associated with bull markets (continued trends) and high volatility sell-off events (short-term peaks).

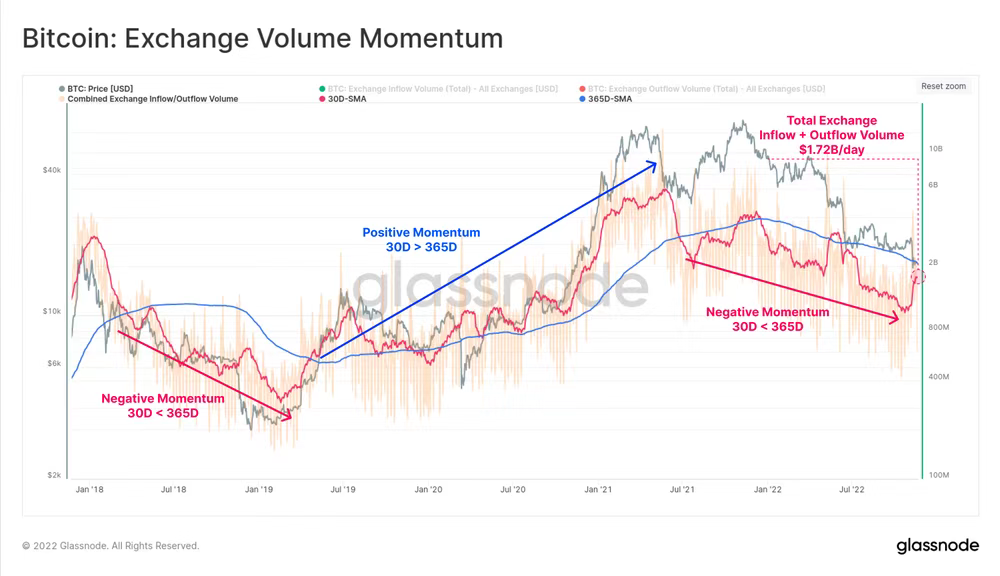

Historically, when the average monthly transaction volume exceeds the annual transaction volume, it indicates good market momentum as more tokens change hands. In the current market, total exchange inflows and outflows must reach and sustain levels above $2.15 billion to show positive momentum in this regard.

secondary title

The current market valuation of the whale asset is lower than the original value

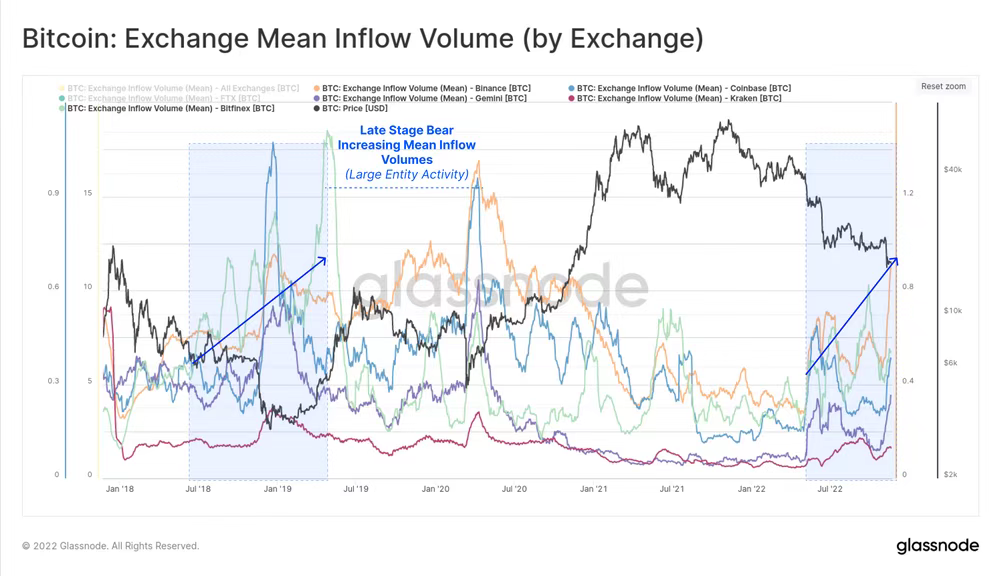

One trend that could be observed late in the 2018-19 bear market was an overall increase in average inflow volume to exchanges. In other words, the average deposit size across all major exchanges is increasing in USD terms as the market forms a cycle bottom. This exists on all major exchanges including Binance, Bitfinex, Coinbase, Gemini, Kraken.

A similar trend has begun to show since the thunderstorm of the LUNA-UST project at the end of May. This suggests that there has been a net increase in large deposits overall over the past six months. This suggests a greater dominance of exchange deposits by entities such as whales, institutions, and trading firms.

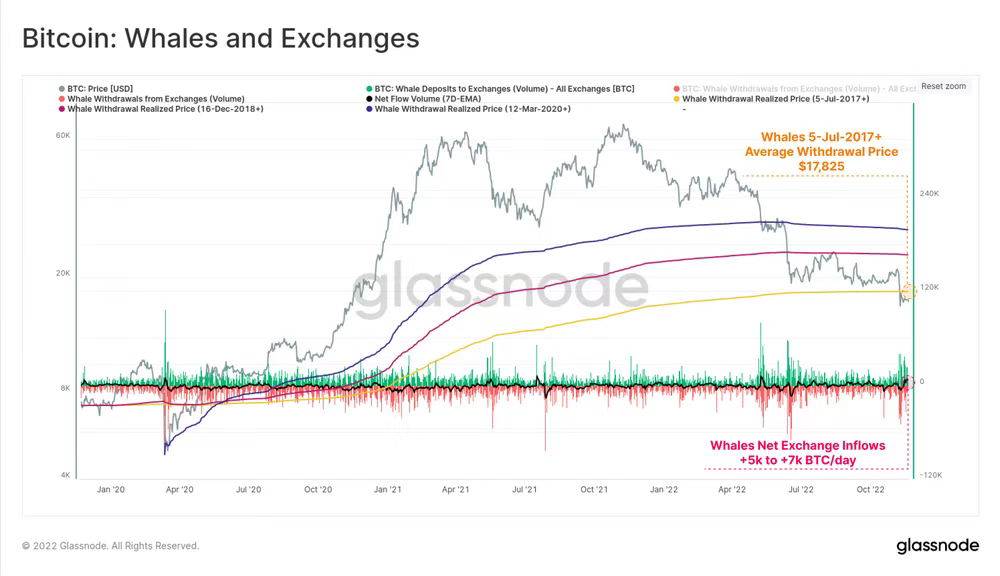

One of the driving factors may be the financial situation of large whales (entities > 1000 BTC). The yellow trace below shows the average withdrawal price for whale groups since July 5, 2017 (Binance launch), which currently trades at $17,825.

The spot price is currently at $16.2 million. It was the first unrealized loss for this group of whales since March 2020. In response to this, whales have actually been depositing BTC into exchanges, with net inflows exceeding 50,000 to 70,000 BTC per day over the past week.

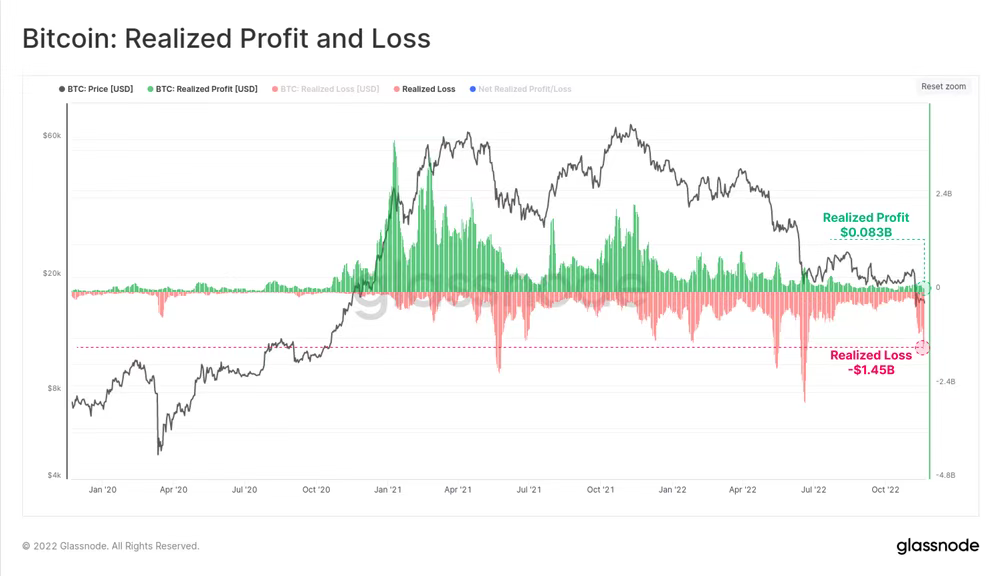

Realized profits were relatively small at $83 million, suggesting that the vast majority of payouts now came from investors in the current cycle, with previous cycles seeing very little token trading.

secondary title

Bitcoin long-term holders wake upIncreased Bitcoin spending by long-term Bitcoin holders.

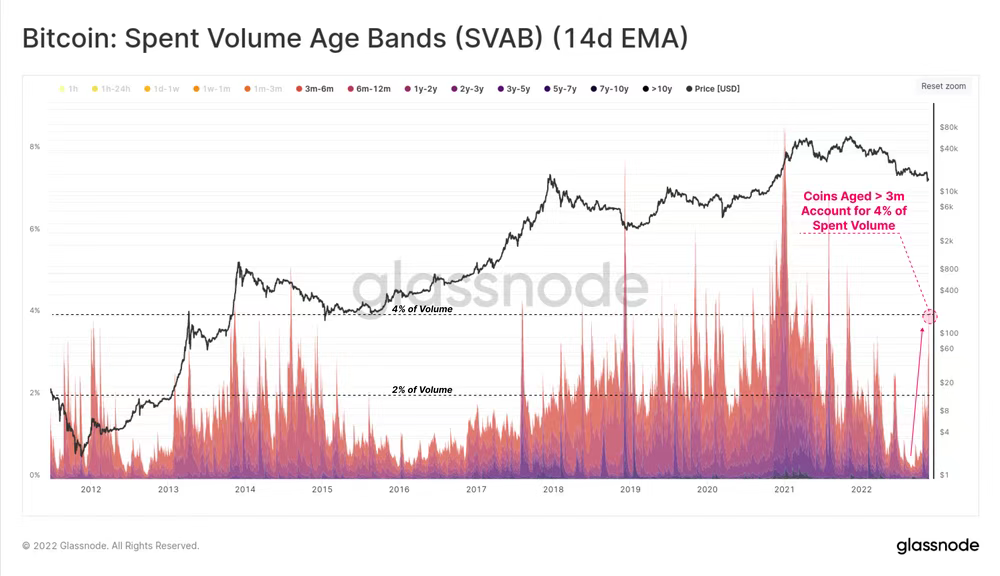

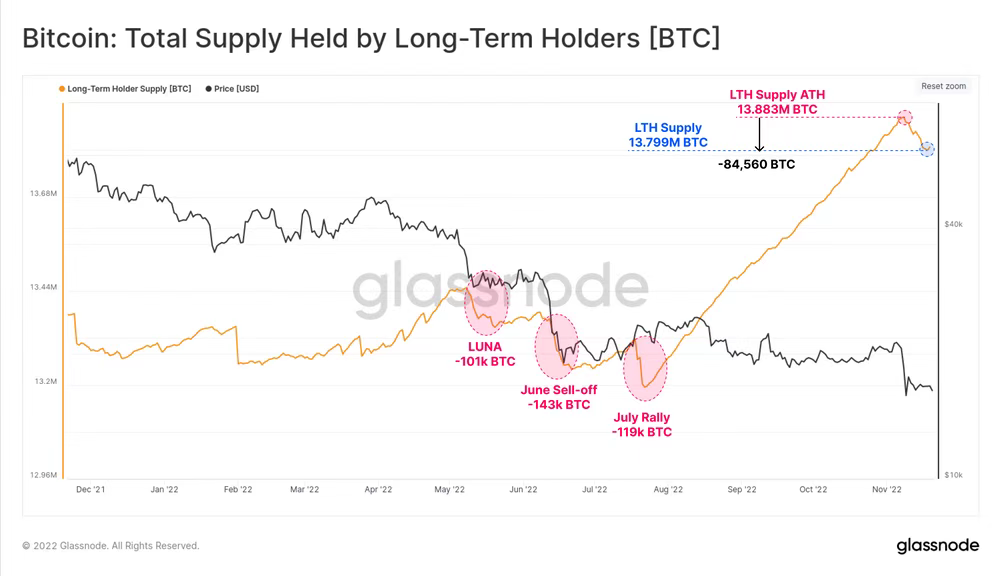

During a bear market, a large and sustained rise in older token spending is usually a signal of reduced belief, fear, and capitulation by this more experienced group.

The Spend Volume Time Period (SVAB) metric shows that over 4% of all spend this week came from tokens older than 3 months, which is the highest level in 2022. This is consistent with some of the largest sizes in history, often seen in funding “capitulation” events and mass panic events.

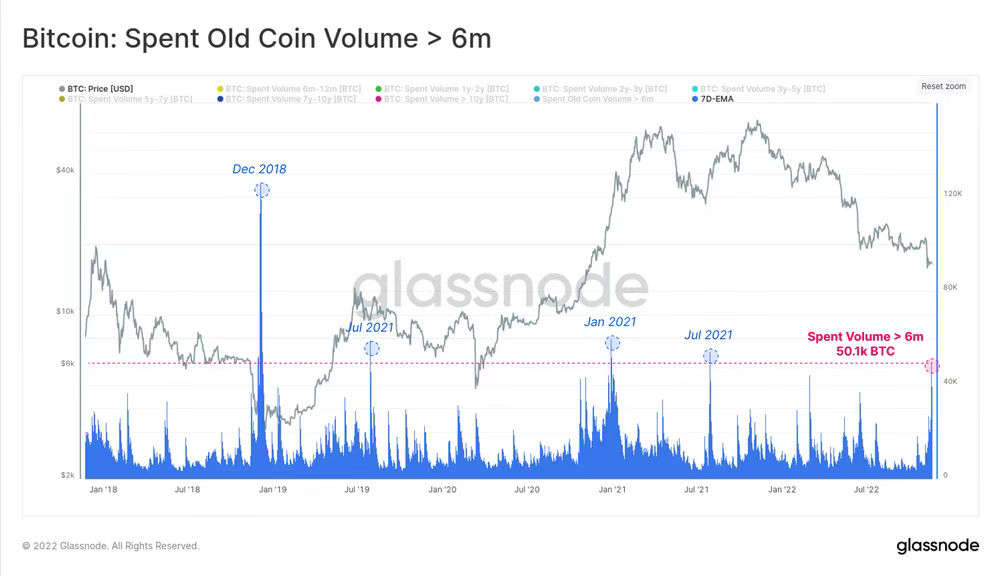

Bitcoin spending over 6 months also reached the fifth highest value in the past 5 years. On November 17 alone, 1.306 million bitcoins that had been dormant for 6 months or more were spent, and the current 7-day average is 501,000 per day.

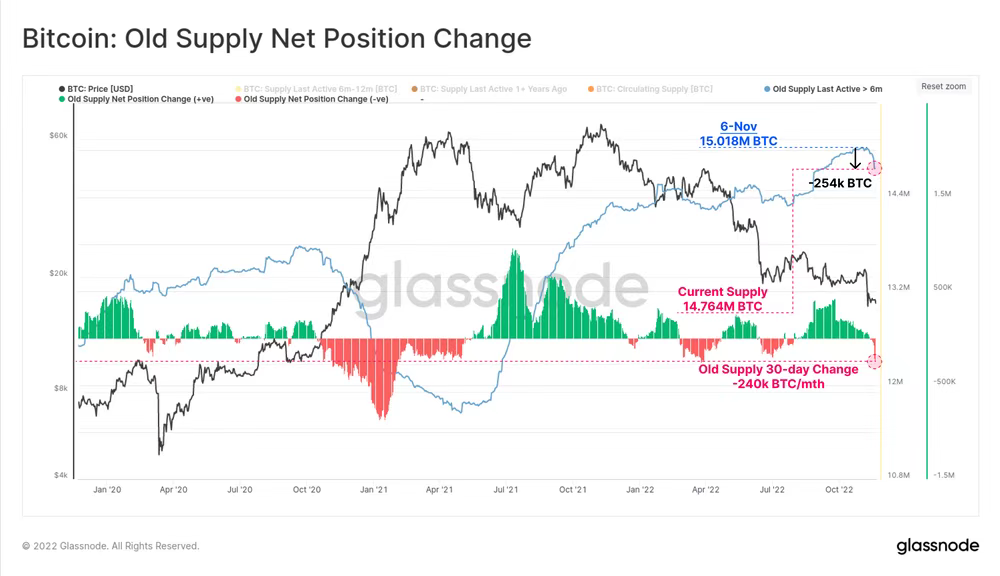

This shows that there is a lot of uncertainty, which is driving longer-term investors to change hands or shuffle tokens.A total of 254,000 BTC have been spent over 6 months since the FTX crash, equivalent to 1.3% of the circulating supply.

On a 30-day change basis, this is the fastest decline in old coin supply since the January 2021 bull market, when long-term investors took profits in the bull market.

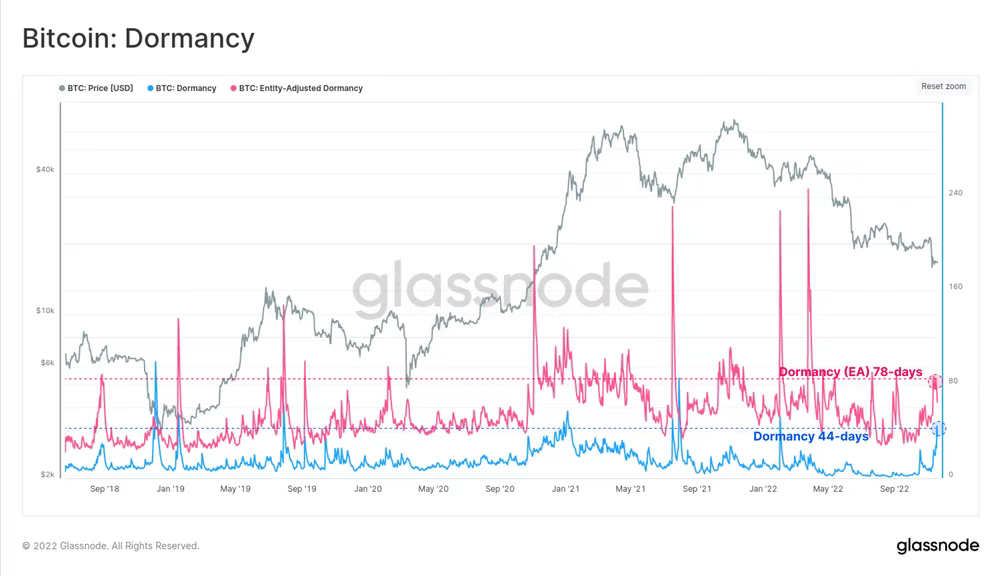

The average age per spent token can be measured by the dormancy metric, which has also seen a notable uptick in recent weeks. For different hibernate variables, as shown in the following figure:

Dormant period: has rebounded to 44 days, showing the average usage age of each token in the entire market;

Entity adjusted dormant period: also rebounded to 78 days. This reflects filtered data, removing instances of self-spending and internal wallet token reorganization.

secondary title

Summarize

SummarizeIndicators of long-term investor behavior in Bitcoin suggest that massive withdrawals and withdrawals are underway.As pointed out last week,

A slowdown and pullback in these indicators would mean that this is likely to be a short-term event, however a broader decline in confidence is increasingly likely as these trends continue.The group of whales is currently in a net distribution mode, sending more than 50,000 to 70,000 BTC into exchanges. at the same time,The amount of outflows from exchanges is at an all-time high for almost all categories of tokens.