Coinbase and Gemini's "reserve pull" battle, MakerDAO is expected to turn losses into profits?

Centralized institutions have gained huge benefits from DeFi. For example, Circle, the issuer of the stablecoin USDC, uses the reserves minted by users to mint USDC to purchase treasury bonds, and it has gained a lot of profits from it. The one holding the most USDC isMaker: PSM-USDC-Acontracts, but MakerDAO is in the red. According to the estimate on the maker burn page, as of November 3, according to current data, MakerDAO is expected to lose $5.6 million a year.

This contradiction was further intensified after Circle cooperated with the U.S. Department of the Treasury to sanction Tornado Cash-related addresses. USDC accounted for more than half of MakerDAO’s collateral, which brought centralization risks to MakerDAO. Gradually reducing the risk of exposure to USDC has become an inevitable choice for MakerDAO.

Facing the double pressure of losses, it seems to be a good way to actively adopt the stable currency in the collateral to obtain profits. Recently, Coinbase and Gemini competed for the stablecoin market share in MakerDAO PSM, allowing MakerDAO and other DeFi protocols to find new ways to make money.

Coinbase Offers to Earn Yield with Coinbase Prime

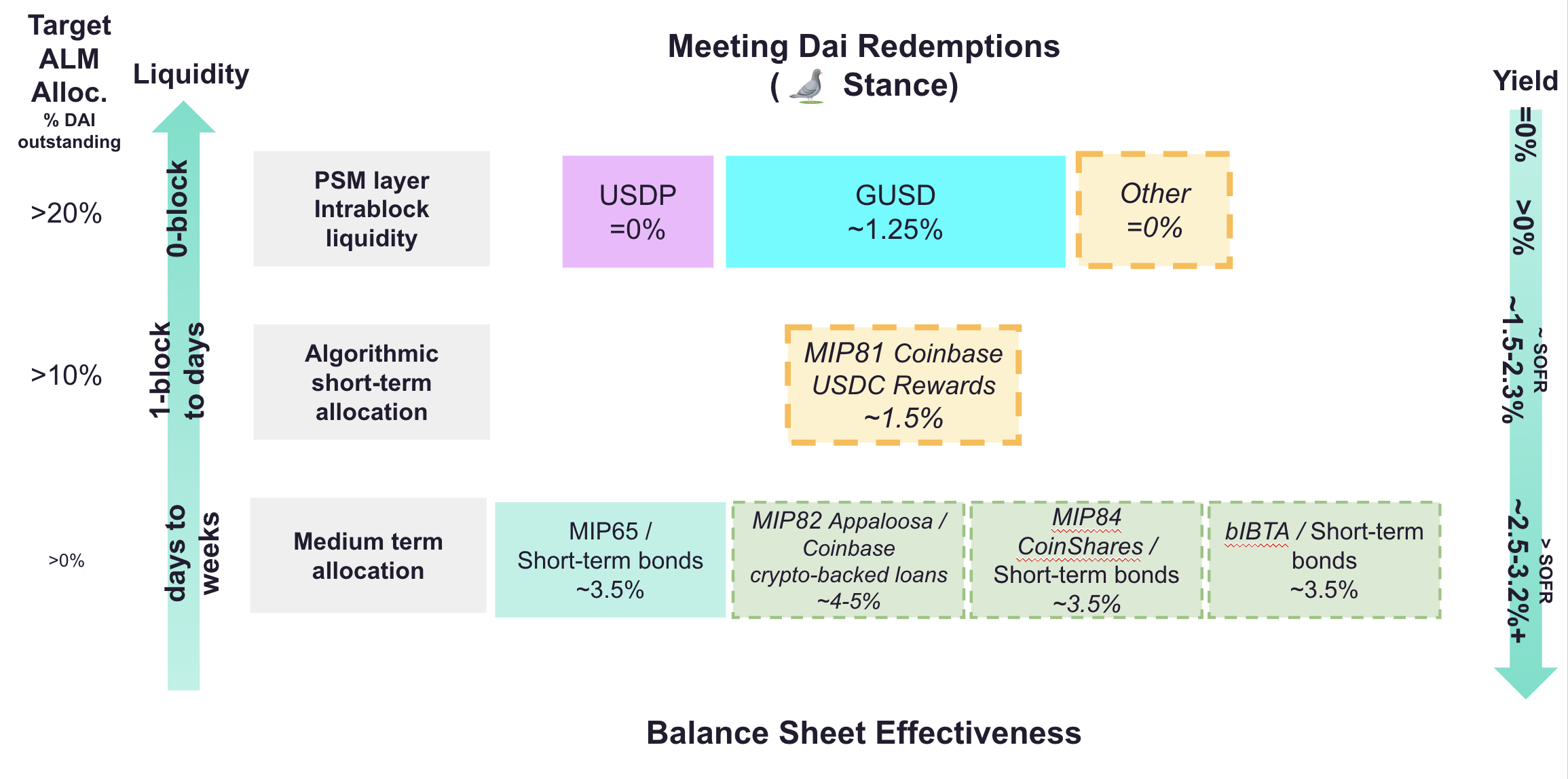

At the beginning of this year, MakerDAO passedMIP13c3-SP12Expressed an intention to invest in short-term bonds through stablecoins on the balance sheet. In June, MakerDAO passedAllocate 500 million DAI to purchase treasury bonds and bonds vote, these DAI will be converted into USDC through PSM first, and then used for investment.

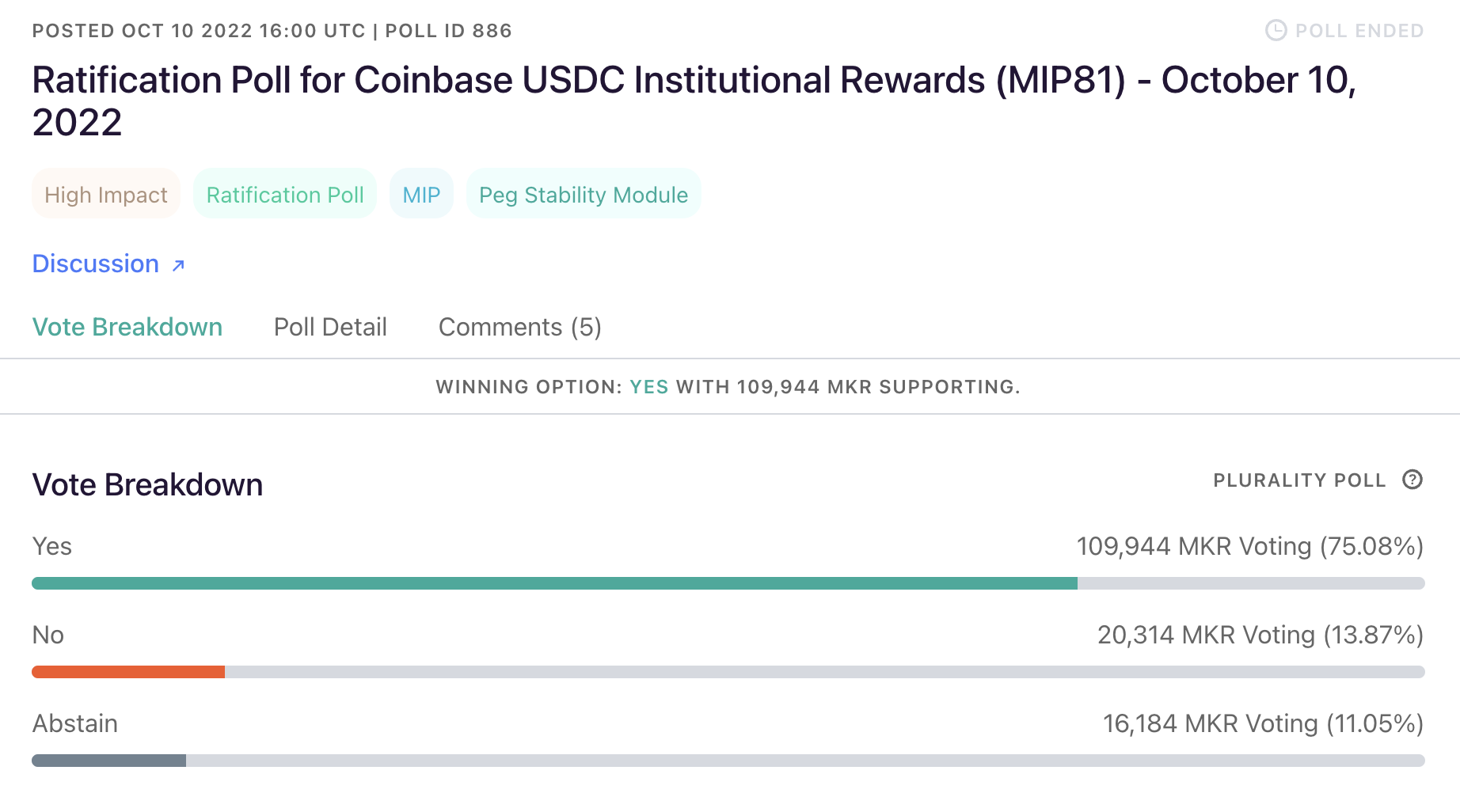

On September 7, Coinbase proposed at the MakerDAO ForumMIP81: Coinbase USDC Institutional RewardsThe proposal hopes that MakerDAO will register a Coinbase Prime account and transfer about 33% (about 1.6 billion) of USDC in PSM to Coinbase Prime custody, so as to earn income through Coinbase. The income depends on the amount of USDC deposited, at an annualized rate of 1%. Between 1.5% and no custody fees.

In fact, USDC was launched by the Center Consortium jointly established by Coinbase and Circle. Therefore, as a stakeholder, Coinbase is also constantly promoting the adoption of USDC, such as developing USDC product suites, attracting retailers, institutions and developers to develop the USDC ecosystem. Prior to this, Coinbase was already issuing rewards to users who held USDC in their accounts.

This proposal is also the first time that Coinbase has extended the USDC reward program to institutional users. Starting from MakerDAO, more institutions or DeFi applications may receive USDC rewards in the future. Therefore, this move is seen as an action to maintain the market value of USDC in a bear market.

The MIP81 proposal finally passed the nominal survey vote on October 24. MakerDAO will use these funds to participate in Coinbase’s USDC institutional reward program, and Maker Governance will be able to complete withdrawals on Coinbase Prime almost instantaneously. Coinbase calculates rewards based on the weighted average of the assets on the platform every month, and MakerDAO claims that the implementation of the proposal will bring about $15 million in annual revenue for itself. This will turn MakerDAO into a profit.

first level title

Gemini joins the fray, GUSD circulation recently increased by 101%

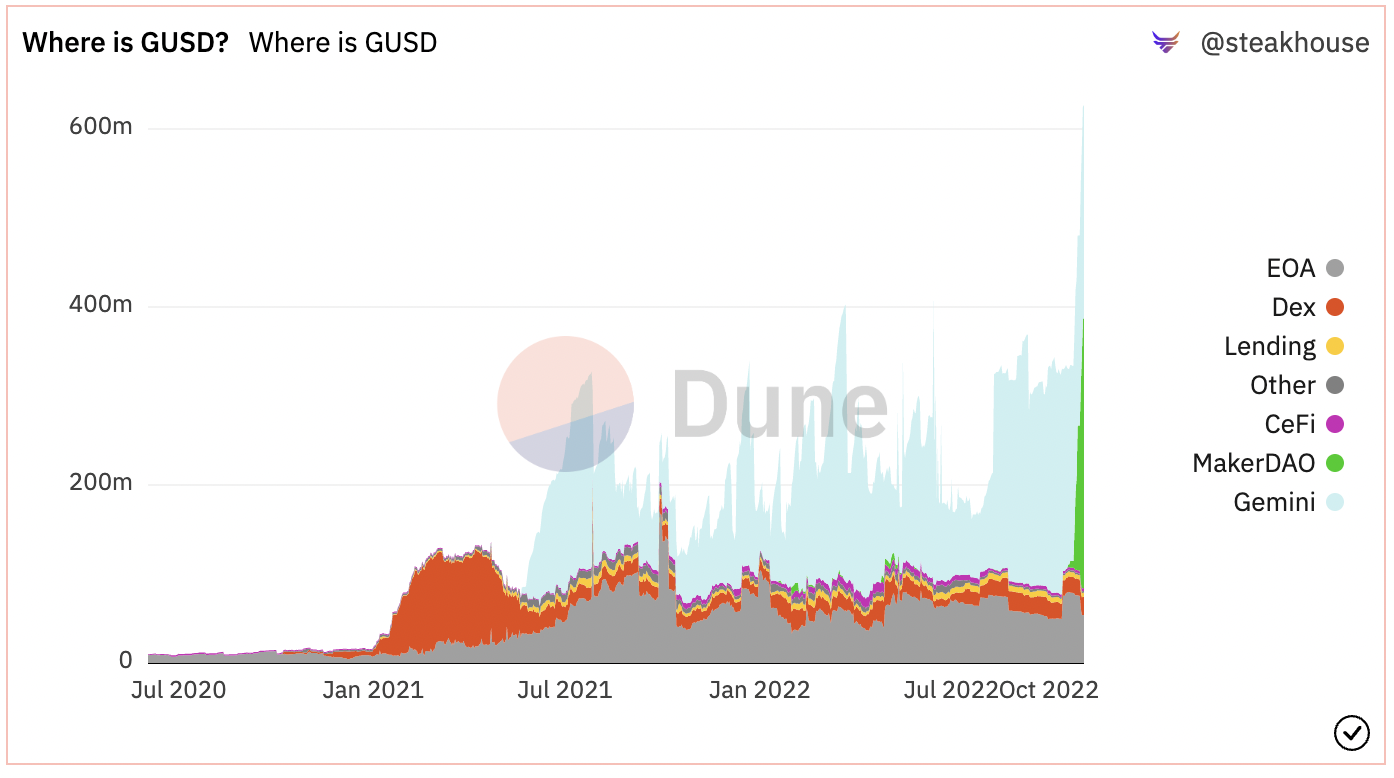

GUSD and MakerDAO Cooperation AnnouncementGUSD and MakerDAO Cooperation Announcementposts, the most important of which is Gemini's marketing incentives for MakerDAO, hoping to use GUSD more in the MakerDAO ecosystem.

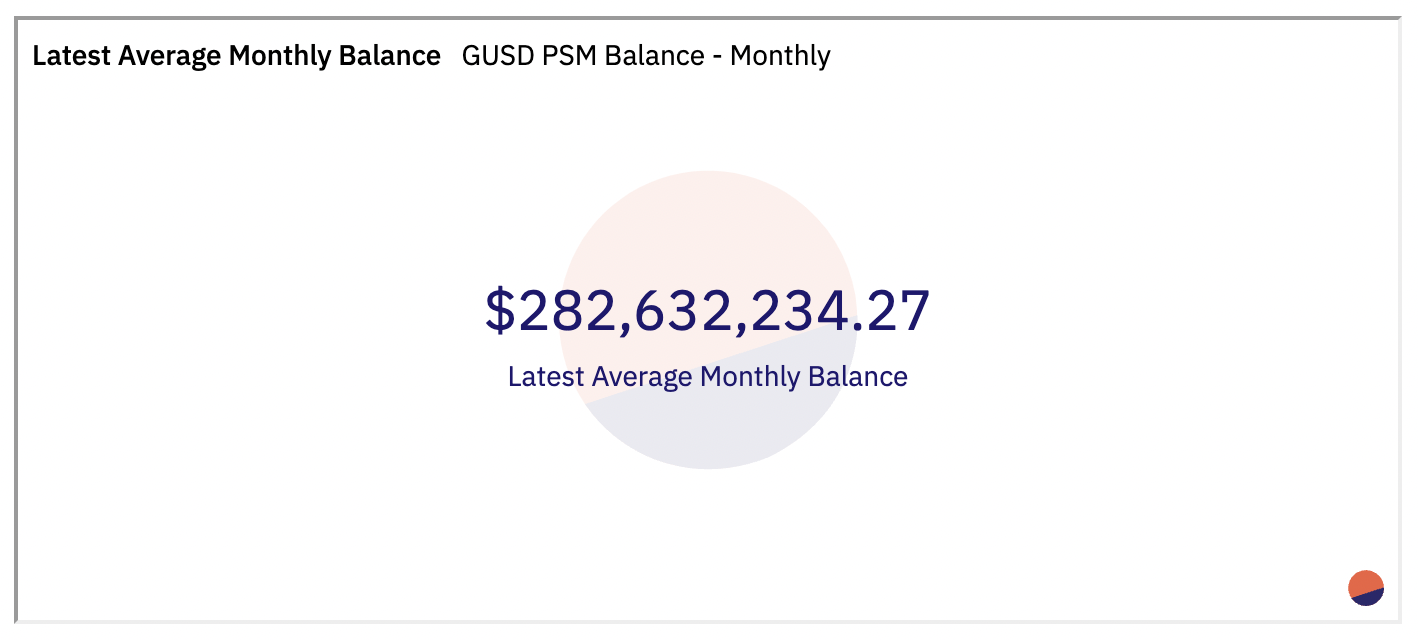

According to the plan proposed by Gemini, starting from October 1, 2022, within the next three months, as long as the average monthly balance of GUSD in PSM exceeds 100 million each month, Gemini will provide these GUSD with an annualized 1.25% Fixed rate income.

It can be seen from CoinGecko that the circulation of GUSD at that time was only 311 million, while the amount in MakerDAO PSM was almost zero.

However, Gemini’s solution is more secure and convenient than Coinbase’s. It does not require MakerDAO to transfer the tokens in PSM. It only needs to ensure that there is a sufficient amount of GUSD in PSM, and the data can also be tracked directly through Dune Analytics. After the expiration of three months, the plan can be extended or renewed according to the same plan according to the results. The only thing MakerDAO needs to do is to receive Gemini’s rewards as a KYC entity, and then transfer the rewards according to Maker Governance’s instructions.

This move will give MakerDAO more opportunities to obtain funds, and compared with before, it will not increase additional credit risk and custody risk.

Encryption entrepreneur Eric Kryski said in the MakerDAO forum that from the perspective of regulators and most lawyers and scholars, the deposit trust structure of Paxos and Gemini's stablecoins is better than Circle. Depository trusts are regulated financial institutions that are closer in structure and regulatory requirements to banks and credit unions. GUSD is more akin to a deposit receipt than Circle's money transmitter. In the event of a financial institution going bankrupt, the two have different claims rights.

This approach has achieved a significant increase in the market share of Gemini's GUSD. As shown in the figure above, in October, the average GUSD balance in PSM was about 283 million, which has reached Gemini’s reward standard.

According to data from CoinGecko, as of Nov. 3, GUSD’s circulating supply hit an all-time high of 625 million, up 101 percent from 311 million on Sept. 29. From Etherscan, it is known that currently exists inMaker: GUSD PSMThe GUSD in Gemini is 303 million, accounting for 47.3% of the total GUSD, even exceeding the number in Gemini. The chart on Dune Analytics also shows that the total amount of GUSD and the amount of GUSD in MakerDAO have risen sharply recently, while the amount in DEX has decreased.

first level title

$500 million mortgage loan to Coinbase

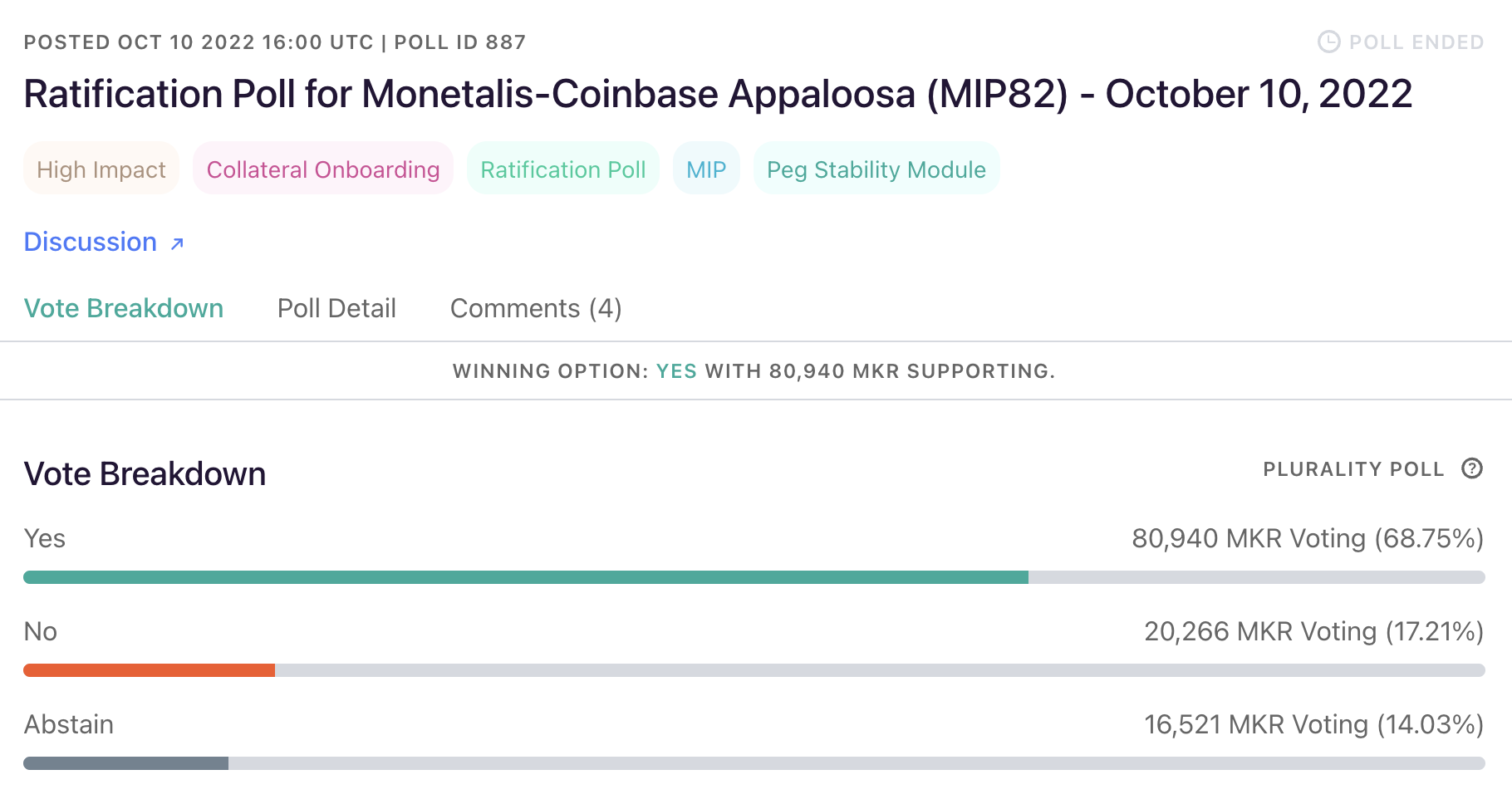

The MIP82 proposal voted at the same time as MIP81 was passed, although the support rate was not as high as that of MIP81. According to the proposal, MakerDAO would transfer $500 million in USDC to a consortium of hedge fund Appaloosa and crypto broker Monetalis, lending those USDC to Coinbase. This loan will be collateralized by BTC and ETH, and the expected annualized rate of return is between 4.5% and 6%.

summary

summary

With competition from Gemini and Coinbase, MakerDAO will hopefully turn a profit. The circulation of GUSD has increased by 101% in the past month or so, which may allow more stablecoin issuers to see the opportunity and join the battle.

And DeFi protocols such as MakerDAO with a large number of stablecoins are also expected to change the situation of "working workers" in the past, and can share the revenue of stablecoin issuers. The success of MakerDAO also allows other DeFi protocols to see the hope of making profits. The practice of issuing loans directly to Coinbase is more radical, and the combination of DeFi and CeFi may bring greater room for profit growth.