The breaking point of the NFT-Fi track: AMM or fragmentation?

Since August, the rapid growth of Sudoswap's trading volume and number of users has attracted the attention of the market. This so-called "Uniswap V3 in NFT" has brought NFT AMM into the spotlight, and the topic of NFT liquidity solutions has also been heatedly discussed again. Once upon a time, fragmentation was also considered a solution to the NFT liquidity dilemma. When Sudoswap was on fire in August, don’t forget that Fractional, an NFT fragmentation protocol, also completed a $20 million Series A round led by Paradigm.

Also starting from DeFi, which solution can really solve the problem of NFT liquidity?

Table of contents

Table of contents

1. What is NFT Fragmentation/NFT AMM

2. Product Features and Applicable Scenarios

3. Track Status and Community Survey

4. Analysis of key projects

5. What problems did the two methods solve and bring about

6. Viewpoint/future

1. What is NFT Fragmentation/NFT AMM

In essence, NFT fragmentation is to generate multiple ERC-20 tokens associated with an indivisible ERC-721/1155 NFT by deploying a contract. This way, anyone holding these ERC-20 tokens can have partial ownership of the associated NFT.

Fragmentation in a broad sense aims to allow NFT to become a liquid, profitable and productive FT asset.

a. Fragments can make markets on DEX and earn handling fees;

b. Can be used as collateral to participate in DeFi Lego building;

c. Lower the entry and exit threshold of NFT;

Fragmentation methods can be divided into two types:

Collection method: Multiple different types of NFTs can exist in the same fund pool (ERC1155 & 721)

Indexation: Only NFTs of the same type can exist in a fund pool (ERC1155 or 721)

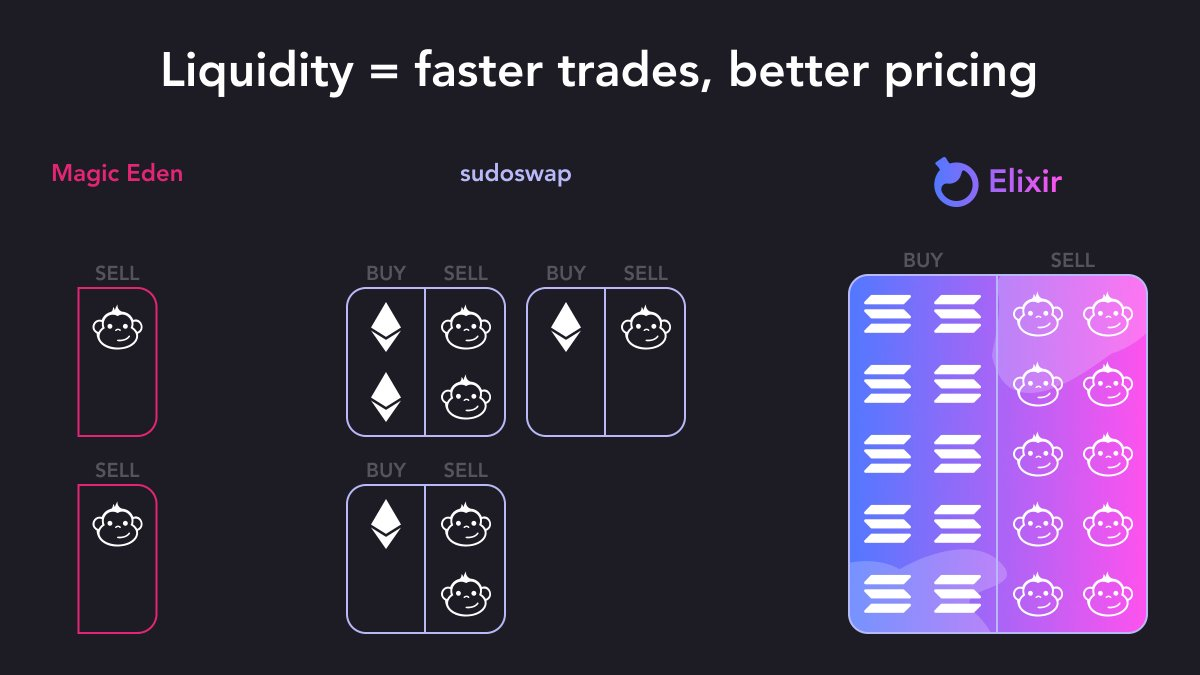

NFT AMMs are a decentralized alternative to off-chain order book centralized NFT marketplaces like Opensea, X2Y2, or Magic Eden, which primarily leverage liquidity pools to enable frictionless and low-cost transactions.

Due to the low accessibility of NFTs, sometimes even blue-chip NFTs don't have much liquidity in the current centralized market. Through NFT AMM, anyone can add liquidity to it on the chain and earn certain transaction fees.

For example, SudoAMM is an NFT AMM protocol created by Sudoswap. It consists of many separate NFT liquidity pools. Each liquidity pool is managed by an LP. LP can adjust the pricing function curve, initial fee, incremental threshold and transaction The cost ratio is controlled.

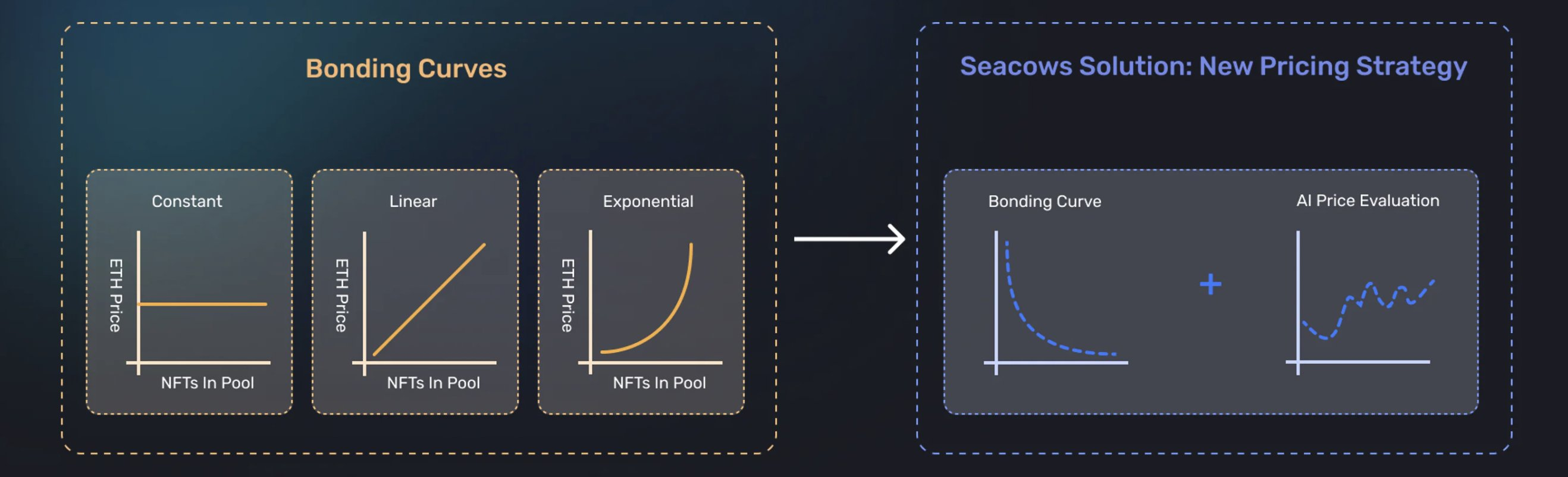

Different from the constant product algorithm (XYK) curve of traditional AMM, SudoAMM adopts a joint pricing curve (allowing to choose any curve) and builds a liquidity pool to facilitate NFT transactions, mainly including Linear Curve and Exponential Curve. Recently, the pricing curve of Concentrated XYK Curve has been added, which allows users to control the depth and slippage of their liquidity pool by setting concentration parameters, thereby controlling the price range of the liquidity pool.

In layman's terms,first level title

secondary title

NFT Fragmentation

feature:

Split NFT through smart contracts, and multiple people share the ownership of the NFT: holding NFT fragments means obtaining partial ownership. After NFT is fragmented, it can still be reorganized into a complete NFT. For example, the fragment holder can buy all the fragments to unlock and obtain the original complete NFT.

Security depends on smart contracts.

Scenes:

High-value NFT (eg blue-chip category) split ownership, such as popular but high-priced collectibles;

Asset fragmentation, such as real estate/art in real assets, improves the liquidity of NFT assets;

Lower the purchase threshold, with the function of price discovery, so that more people can participate in the transaction;

secondary title

NFT AMM

feature:

Use the mechanism of AMM to try to solve the NFT liquidity problem: for buyers and sellers, the purpose of instant buying and selling can be achieved through the pool, and selling can also be done similar to OpenSea pending order transactions. For LP, you can choose to earn transaction fees through bilateral NFT-ETH market making similar to V3, or you can only do unilateral market making of NFT or ETH to obtain ETH or NFT;

Allows to provide unilateral liquidity pools of NFT or ETH, each pool is managed by a liquidity provider, NFT and ETH are paired, liquidity pool parameters can be adjusted at any time, bilateral pool creators can set their own fees, pricing curves are optional Each pool is managed by a liquidity provider;

The rarity and attributes of NFTs are highly ignored.

Scenes:

CC0/Meme: long-tail assets, most suitable for the target, and conducive to resisting centralized powers such as Opensea;

Game props: demand matching, but in the initial stage, the platform does not rely on third-party markets;

NFT project party: provide liquidity for official NFT, earn LP fees from it, and no longer rely on royalties to obtain secondary income;

NFT market maker: It can be used to quantify trading strategies, arbitrage, volatility, long and short, etc.;

Launchpad

first level title

secondary title

NFT Fragmentation

The market is turning cold, and fragmented products are even worse

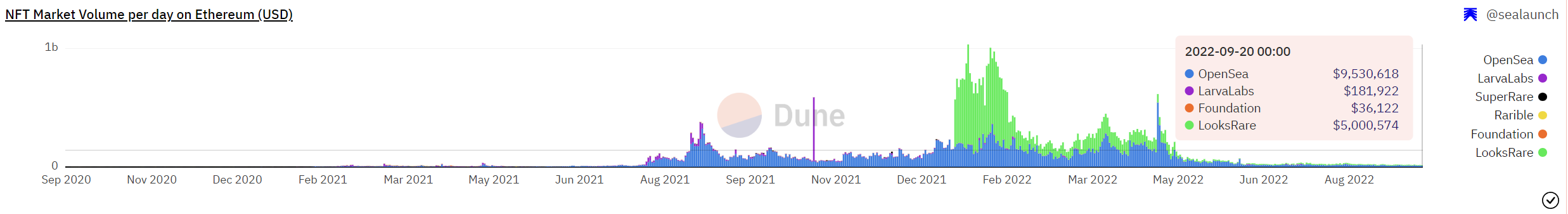

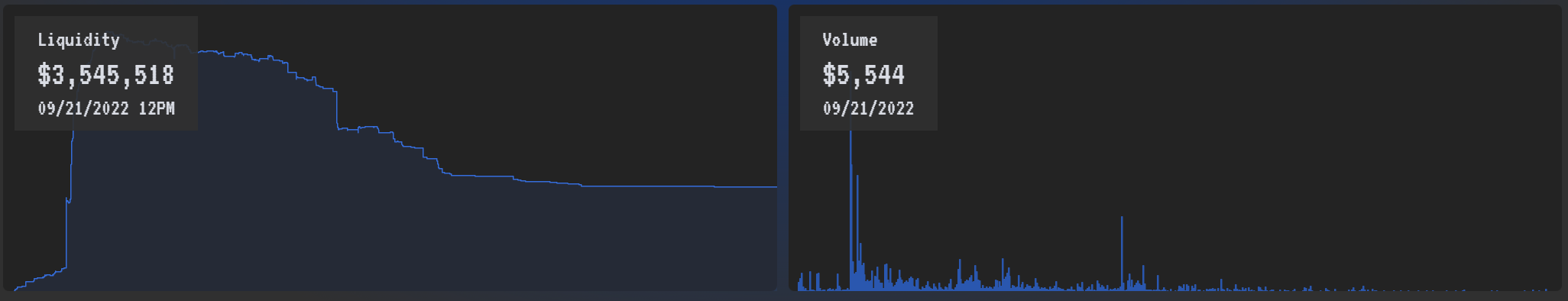

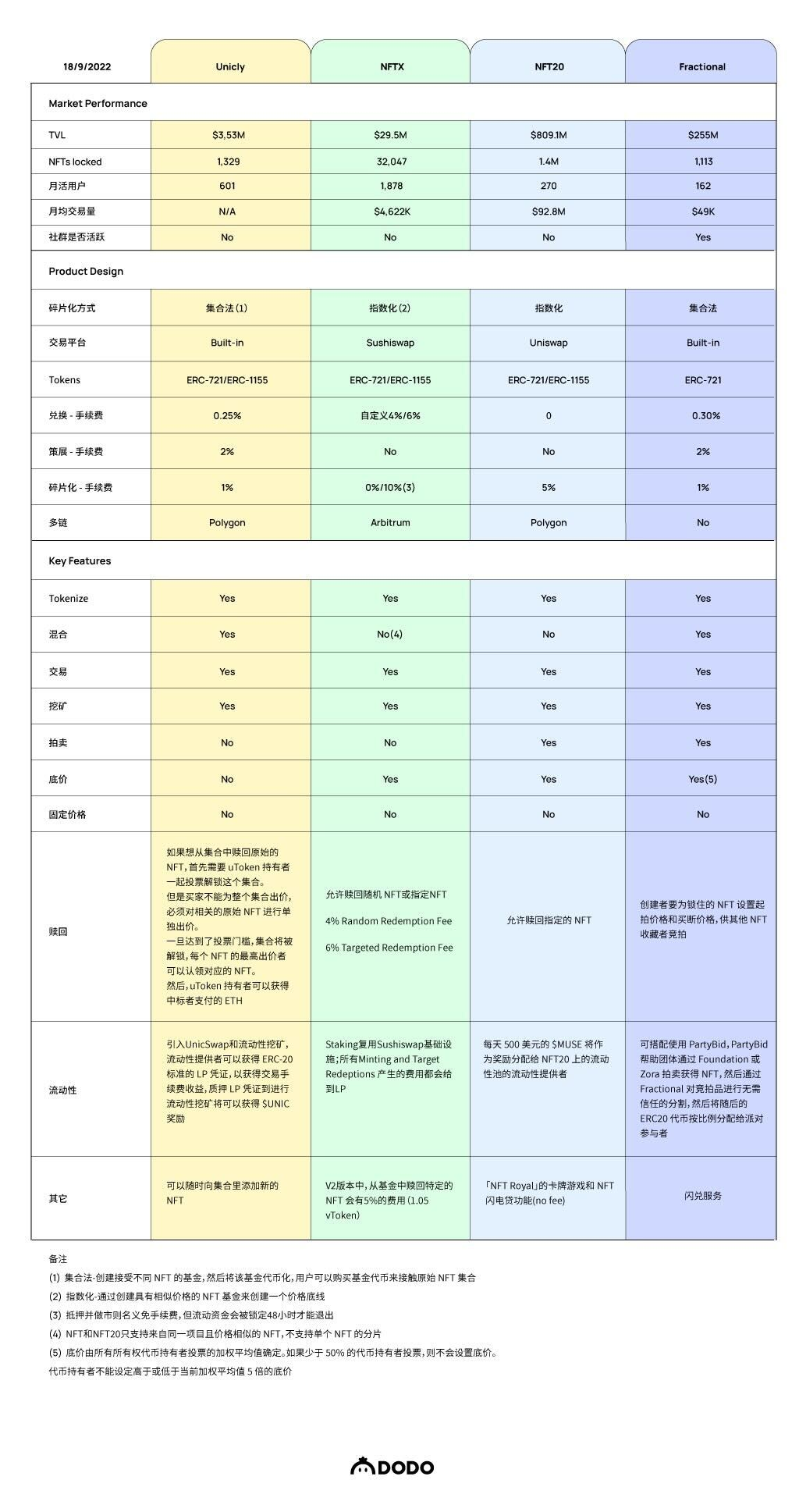

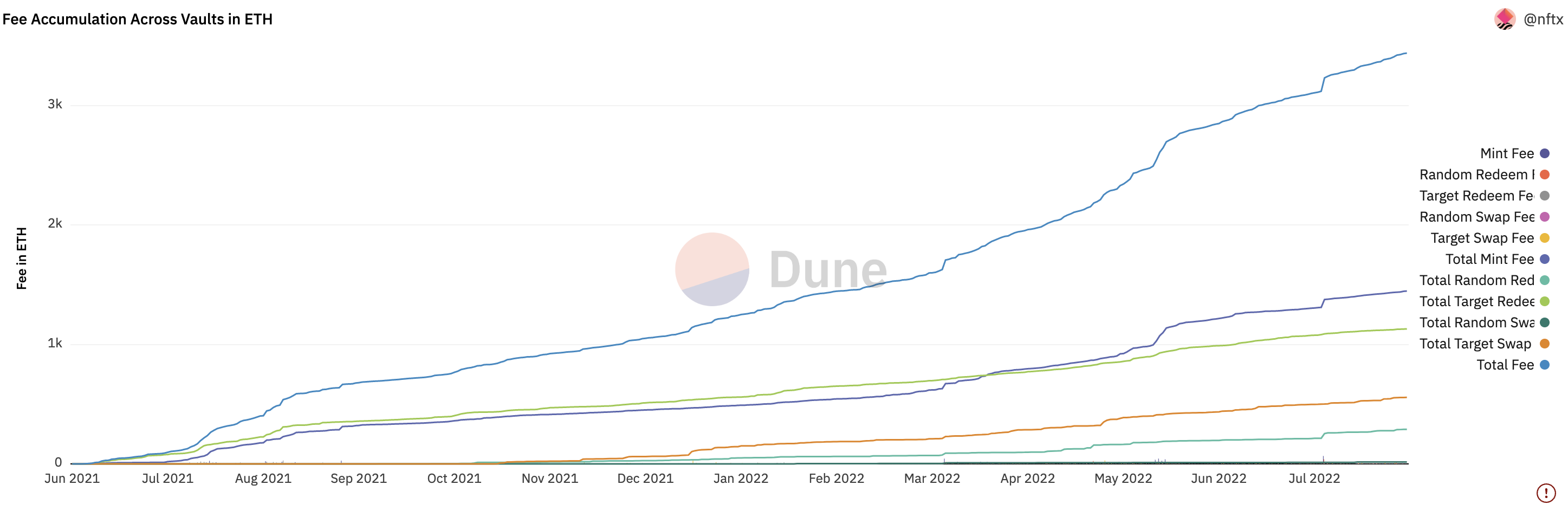

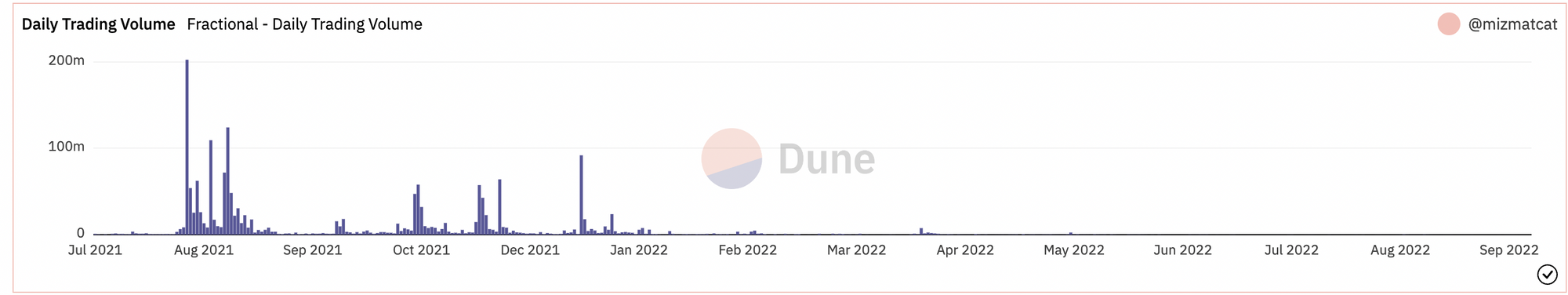

The trading volume of the NFT market has declined sharply since the beginning of the year, and the current trading volume is less than one-tenth of the peak value. The market has turned into a deep bearish market. In this market environment, many small and medium-sized NFT exchanges have been integrated and acquired by leading exchanges. The market ushered in the first reshuffle. In stark contrast to last year's fragmented products and the high market discussion, the current NFT fragmented products can be said to be in a cooling state.The transaction volume has declined severely, and user activity has declinedimage description

Data source: Dune Analytics

Product iteration trend

The emergence of fragmented NFT products last year has determined the basic model of NFT fragmented products, that is, aggregated fragmentation that packages a variety of different NFTs for fragmentation, and index fund fragmentation that anchors the same type of NFT. The fragmented form has been initially accepted by users.

Compared with last year, most NFT fragmentation products have carried out multiple product iterations on this basis, such as more flexible rate design, more wallet support, richer NFT support and data display, and more friendly interactions interface and a variety of ways to exit.The user experience of the overall fragmented product has been improved to a certain extent, and subsequent product iterations will continue to focus on rates, supported NFT itself and the interactive interface.

Product status comparison

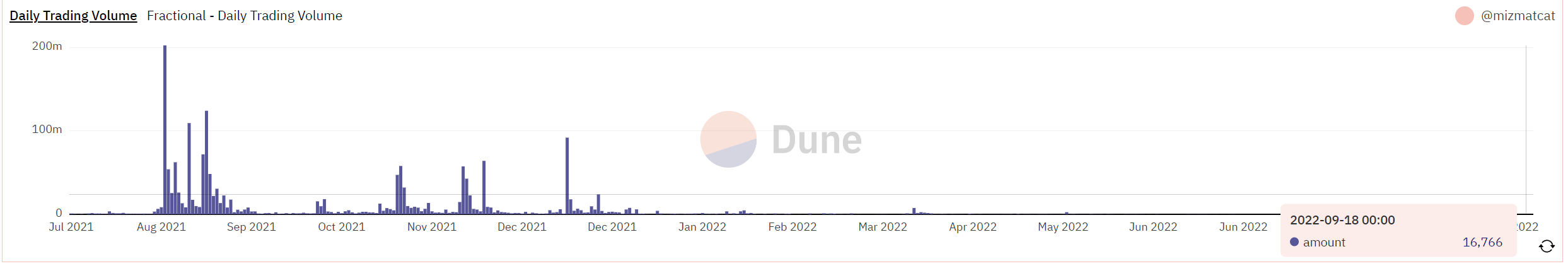

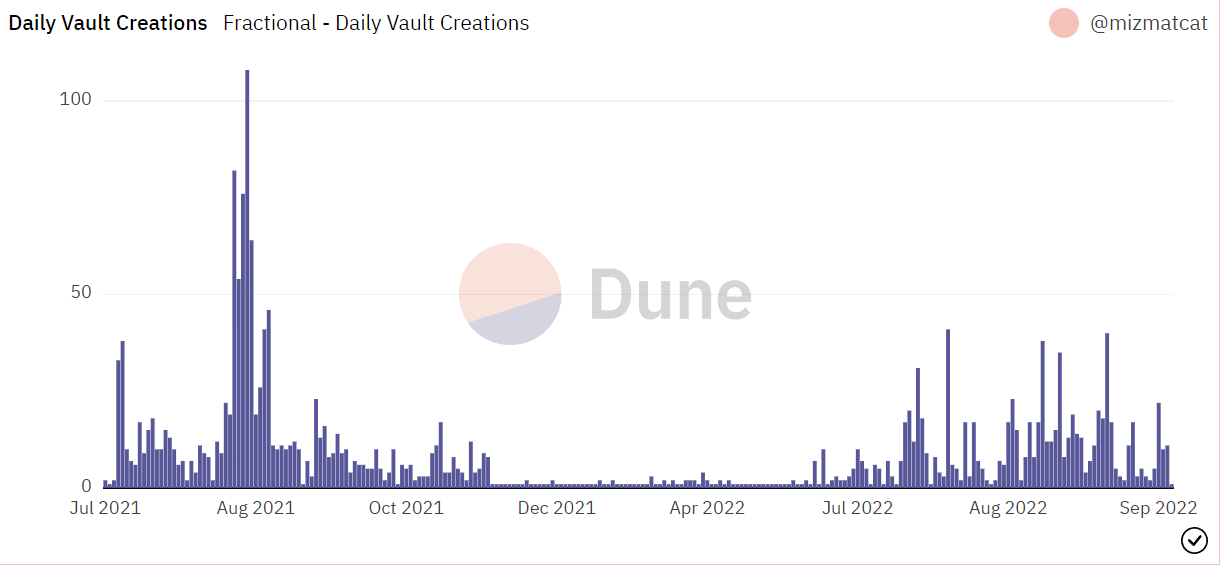

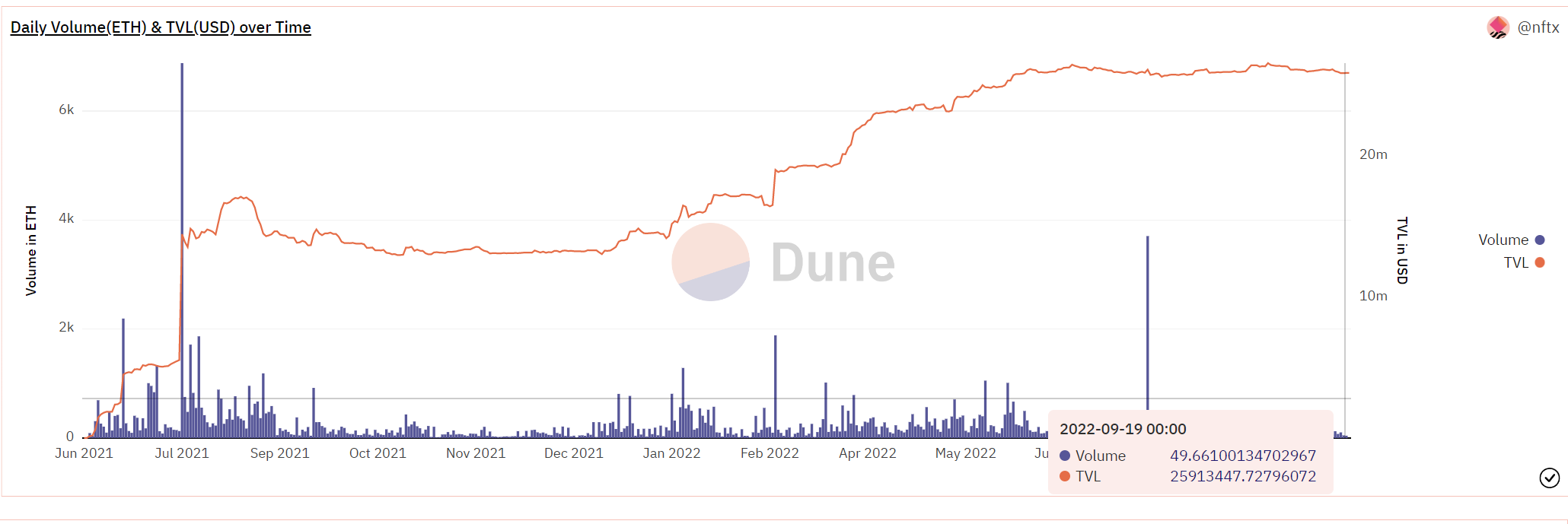

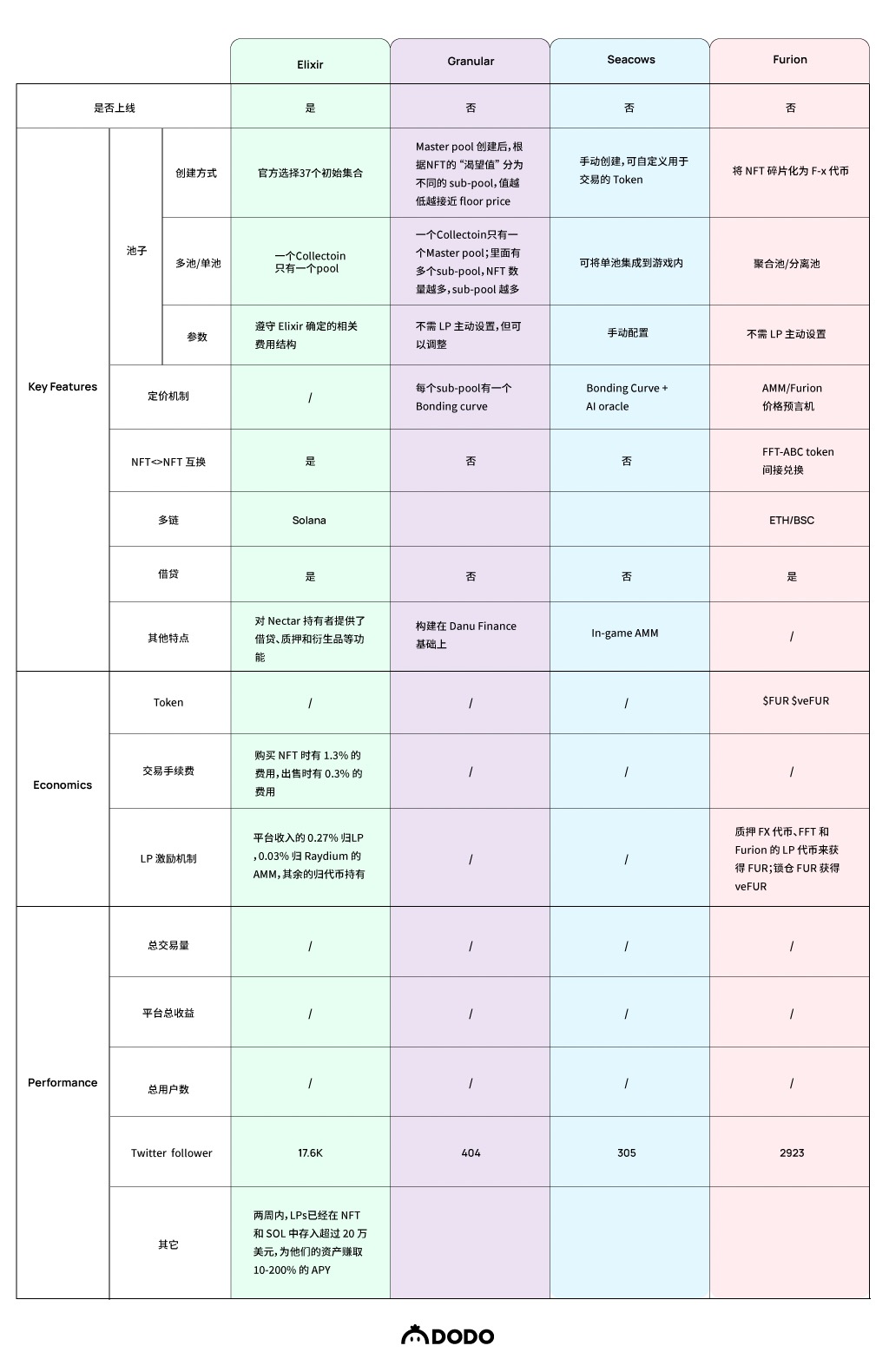

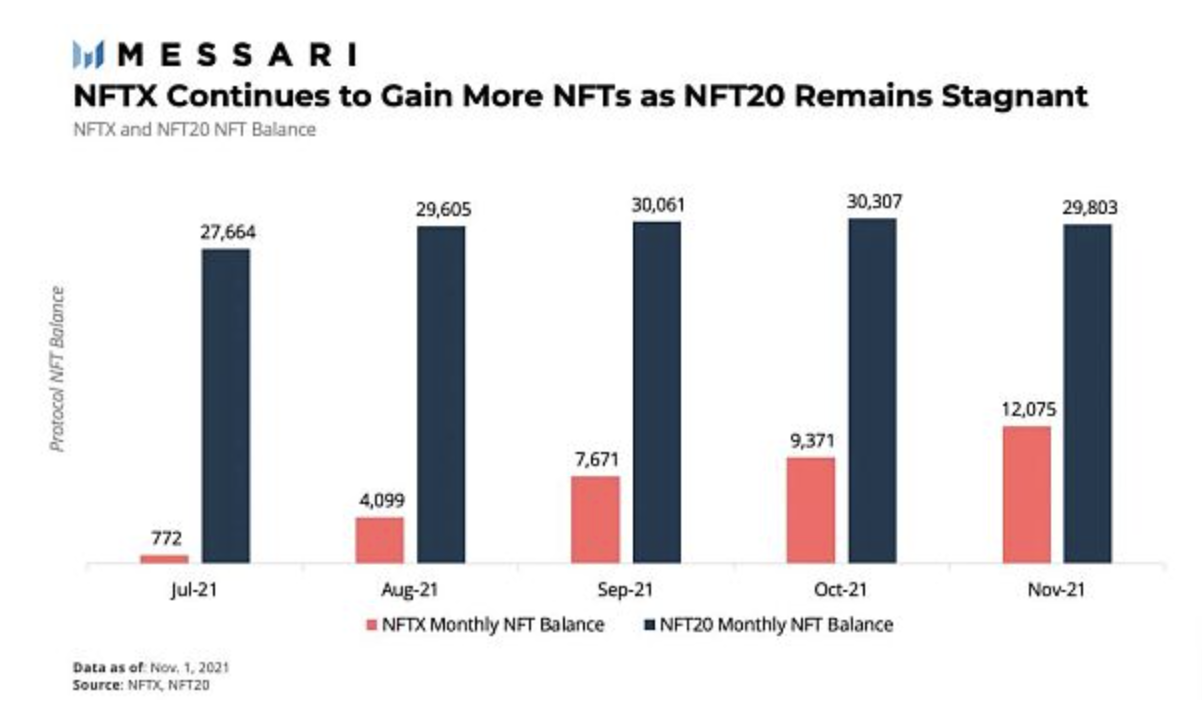

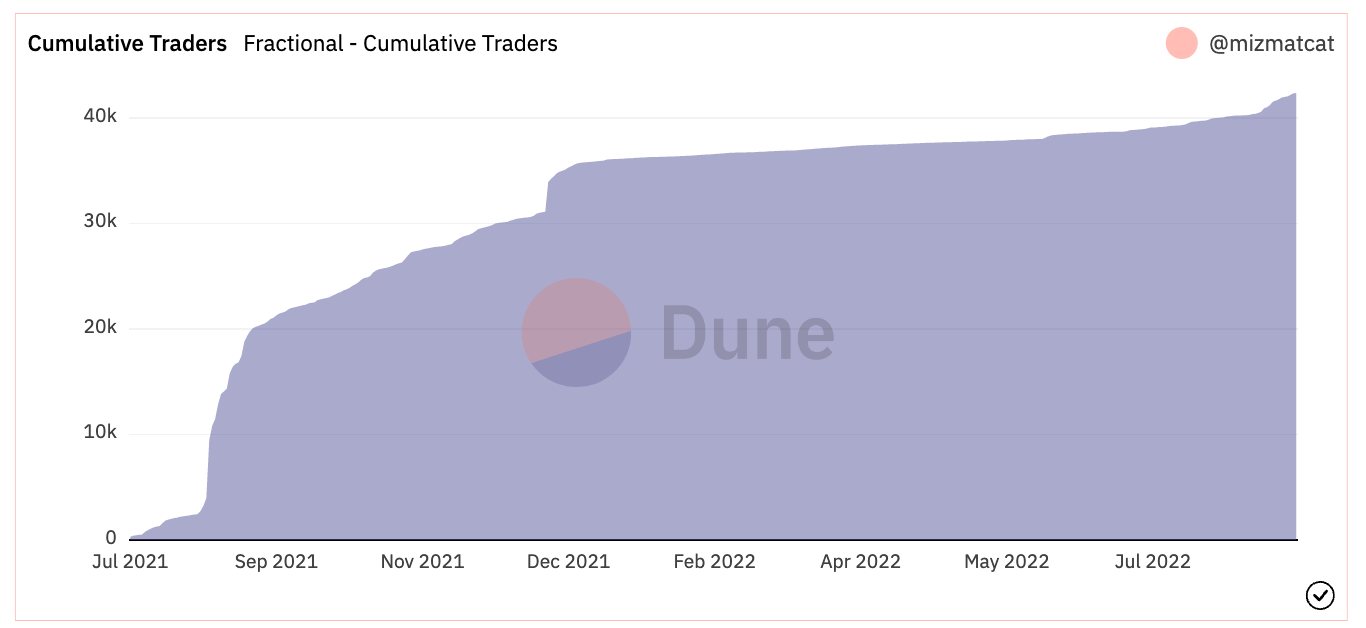

Fractional, NFTX, Unicly, and NFT20 are the top NFT fragmentation products. From the data point of view, the transaction volume is showing a downward trend, which has dropped sharply compared to before. Since most fragmented NFTs will not be bought back or Redeem, the growth rate of TVL will only slow down or decline slightly.

Fractional’s trading volume in August and September last year was amazing, once reaching $200 million. However, under the current bear market, the average daily trading volume is less than a fraction of last year. Although the transaction volume has declined, the number of new fragmented pools has increased back to the level close to the same period last year.

image description

image description

image description

image description

image description

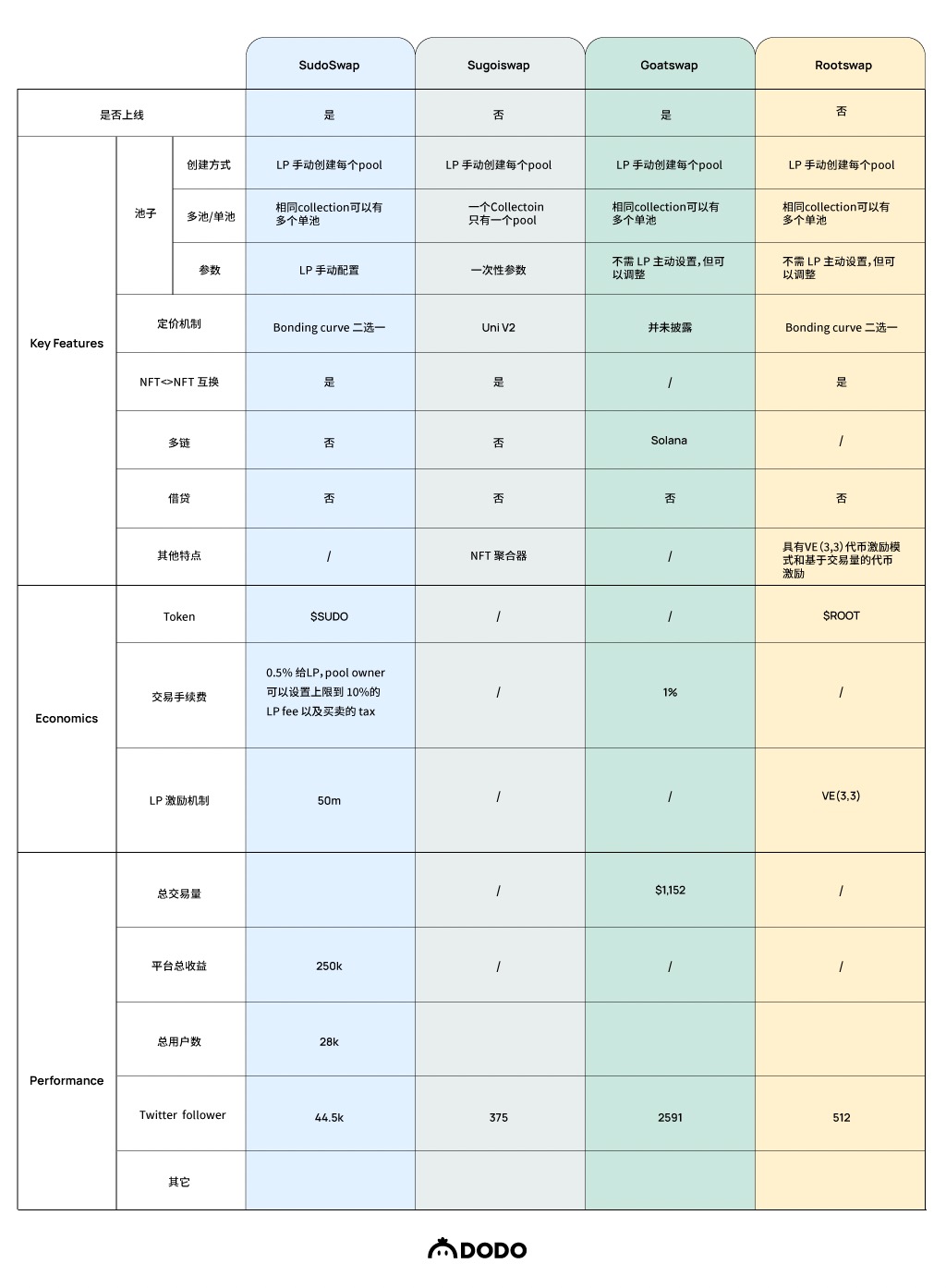

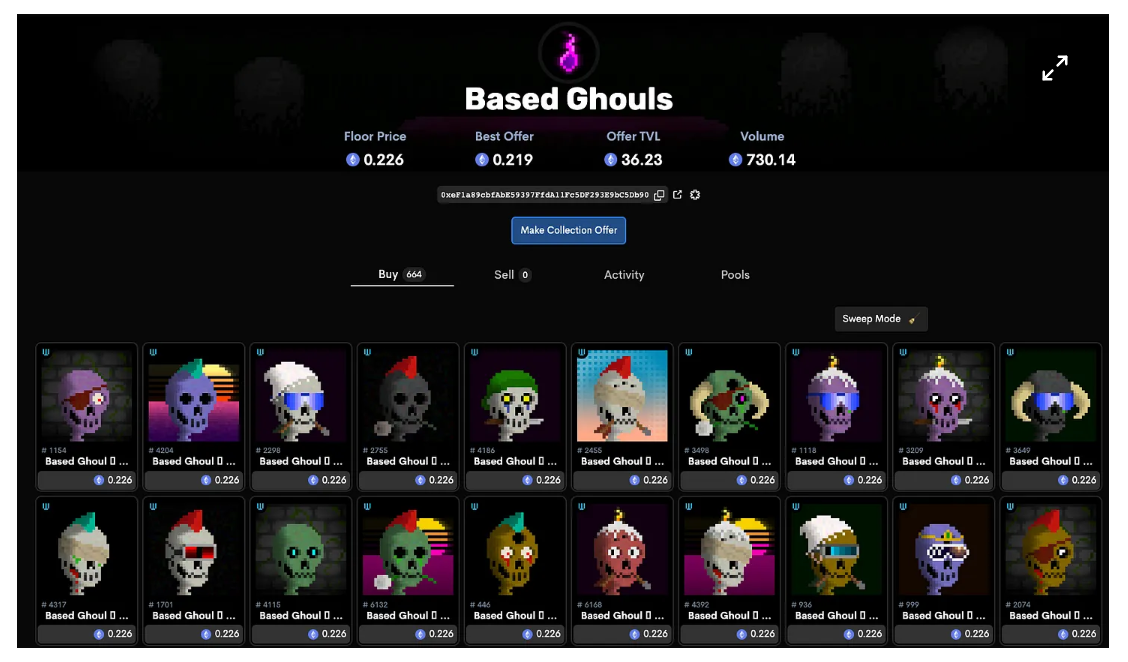

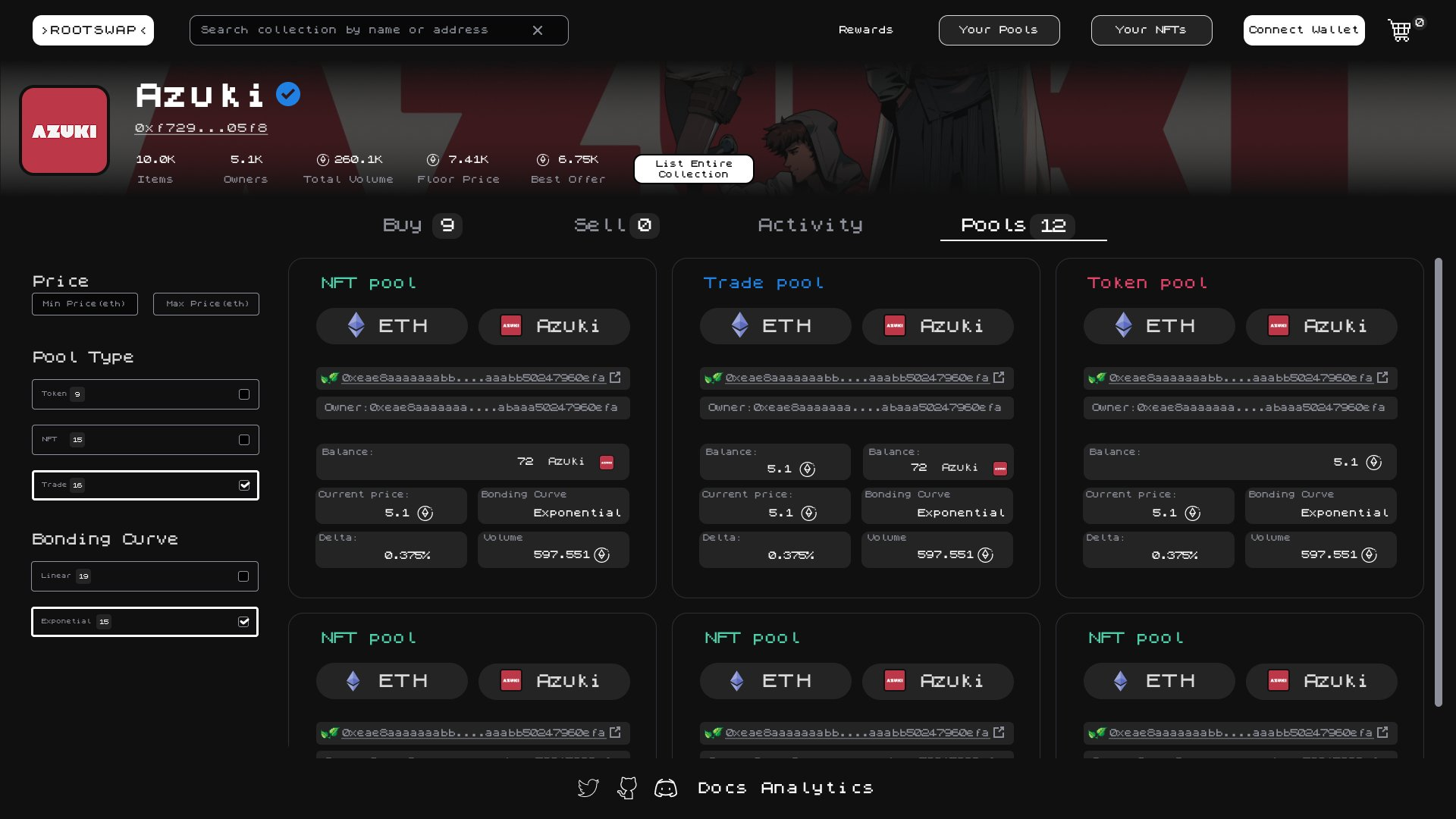

NFT AMM

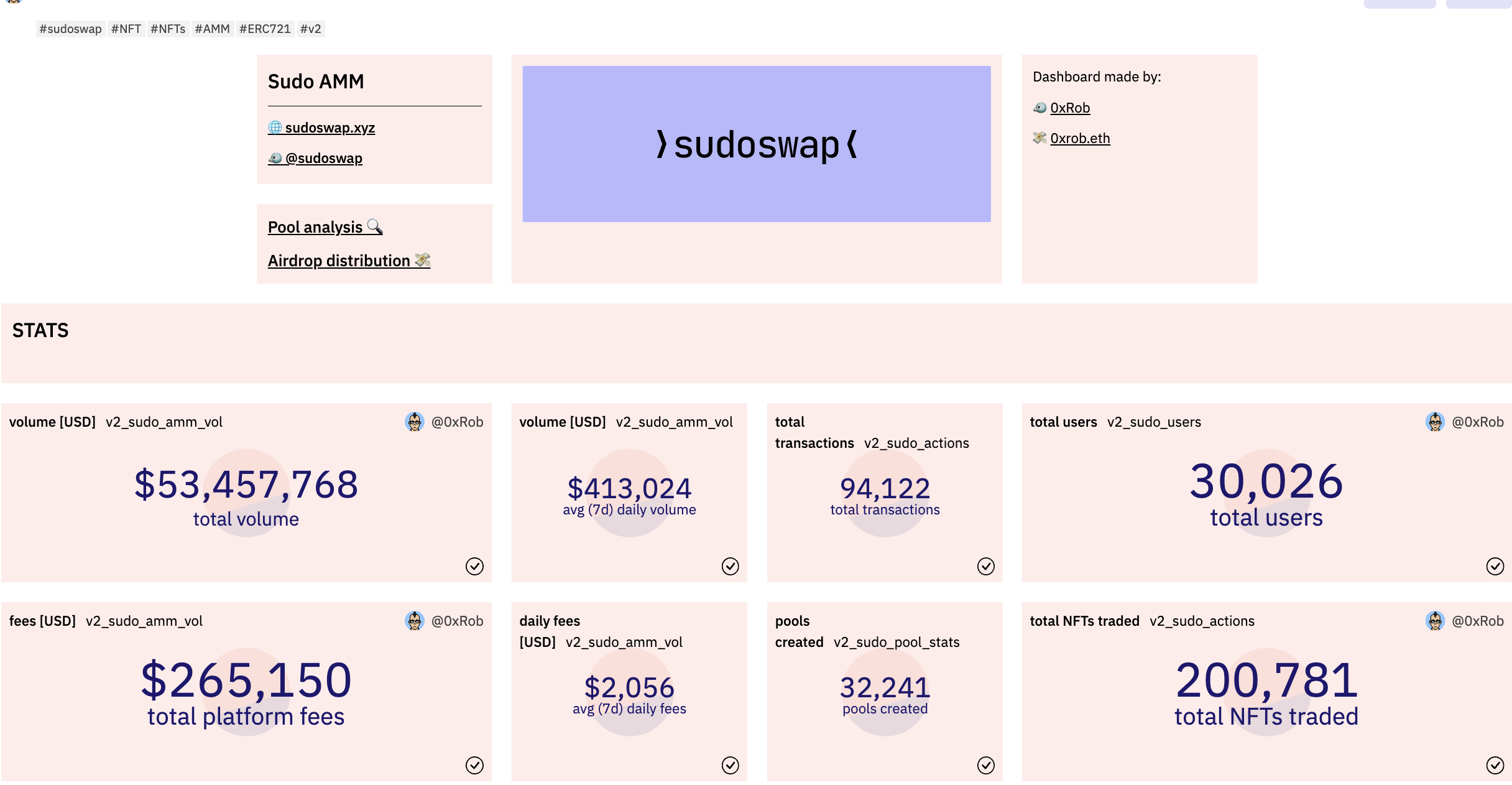

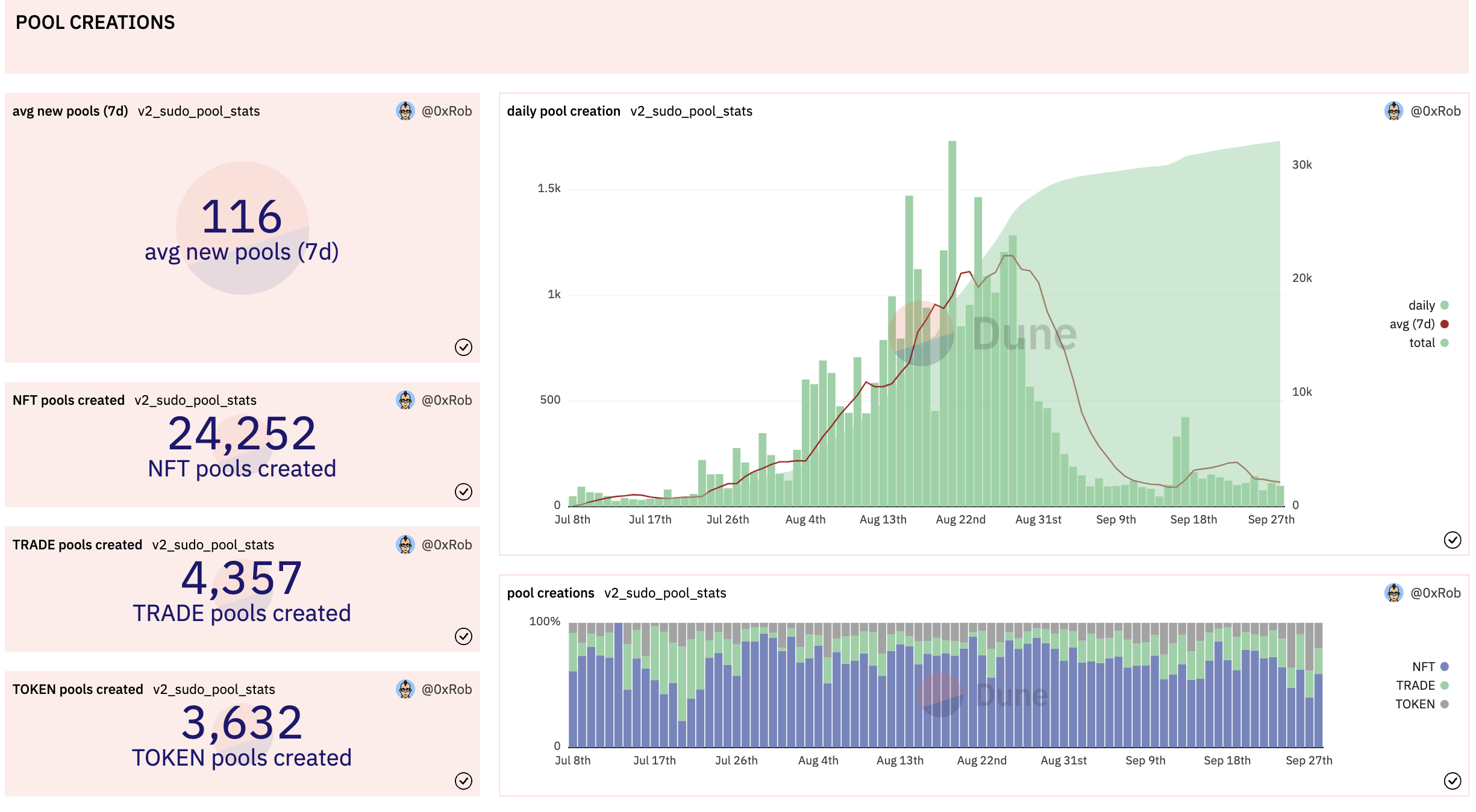

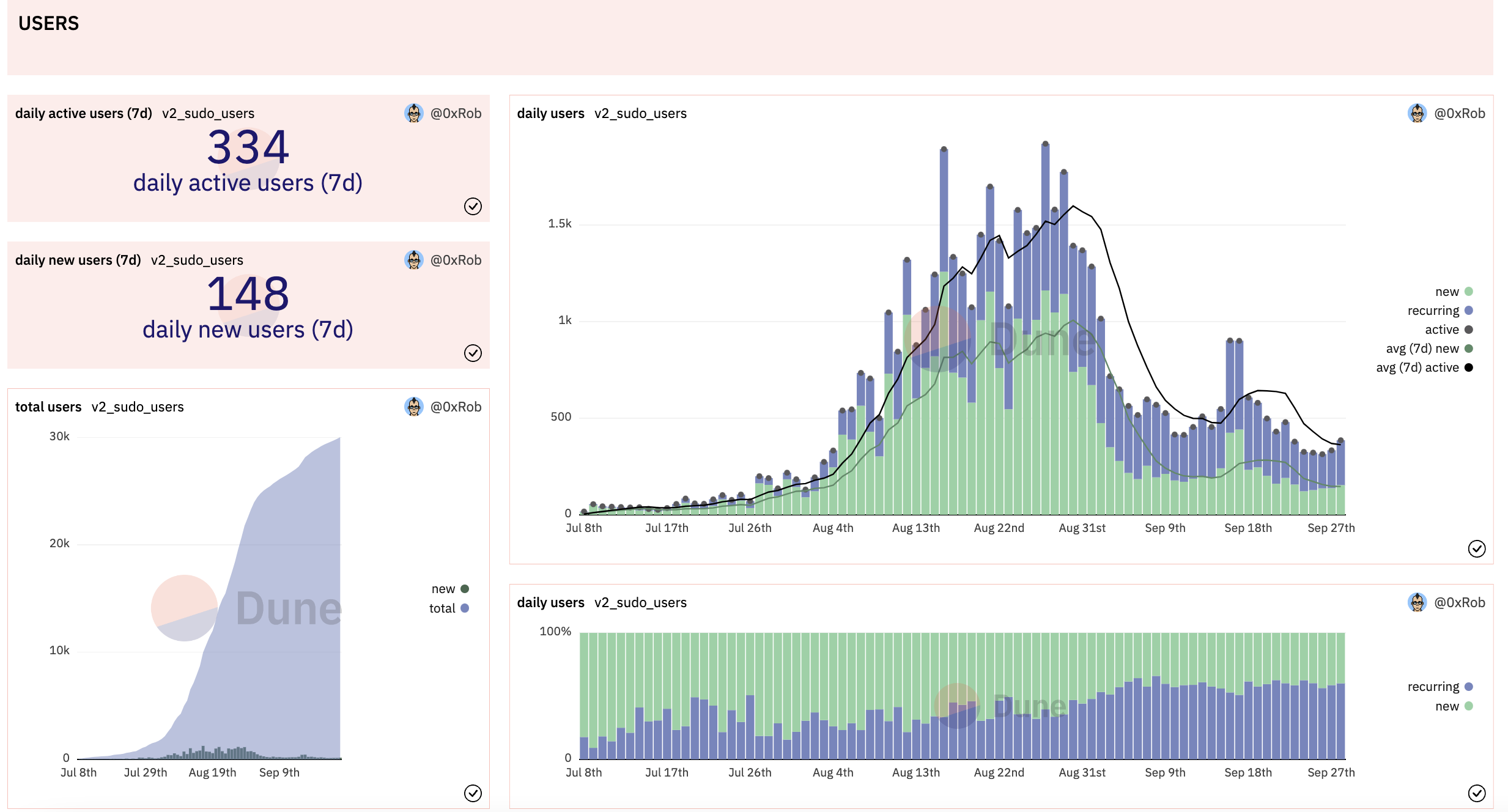

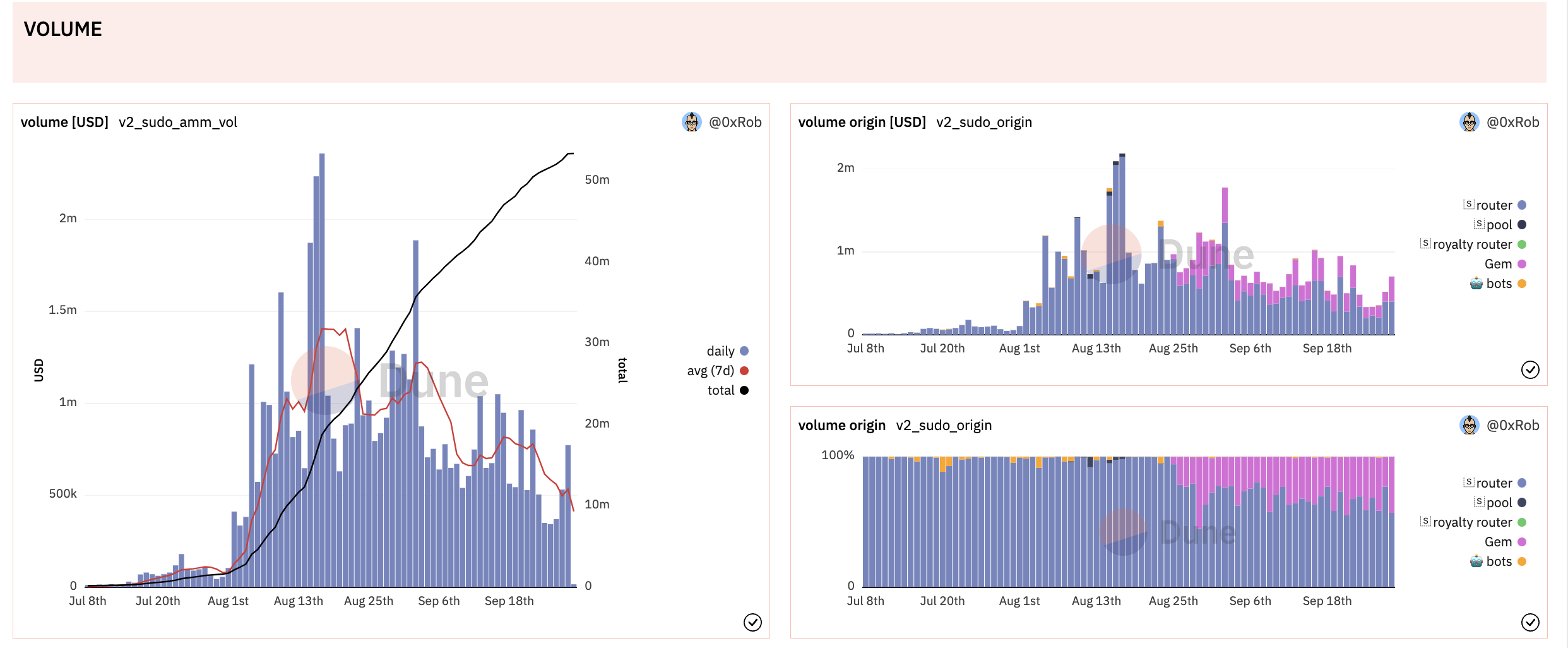

After Sudoswap took the lead in launching the NFT AMM mechanism, the NFT automated market maker track has flourished. There is Goatswap, which goes online directly across chains without adding any new mechanisms; there are also other protocols that try to improve the AMM mechanism.image description

image description

Sudoswap user data (data source: Dune)

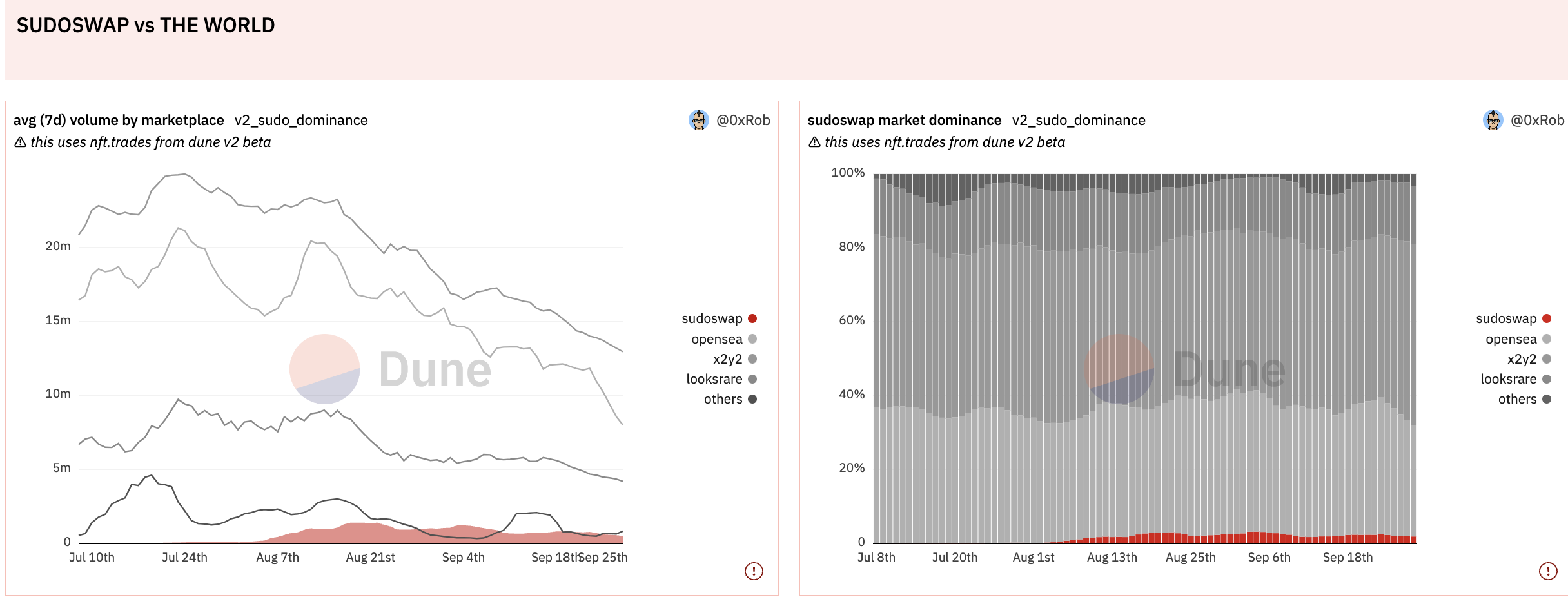

Judging from the existing data, due to the early launch of fragmentation, the mechanism is relatively mature, and it can be judged from the market performance that its demand is small. The AMM based on Sudoswap has only been launched for less than 3 months. Although the absolute value of the transaction volume has dropped significantly, the ratio of Sudo’s transaction volume to the overall Ethereum NFT transaction volume has increased slightly, and the current market share is 2.3%.

community survey

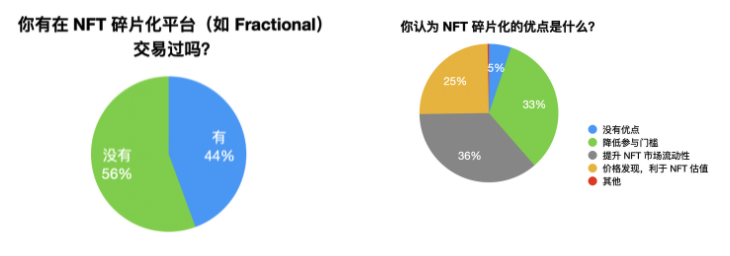

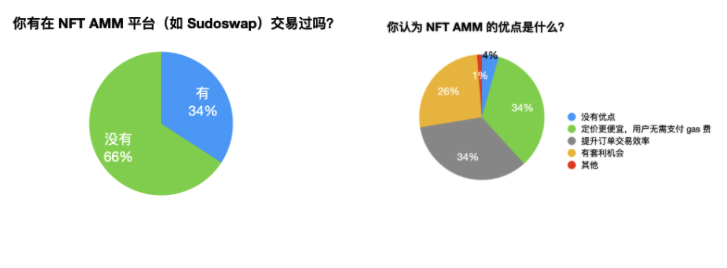

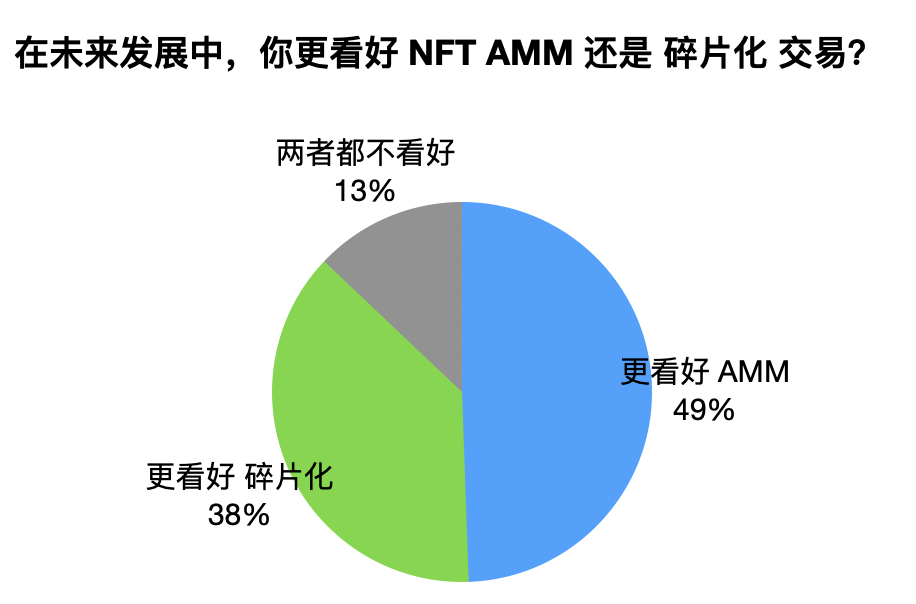

We conducted a community questionnaire survey on the two development directions of NFT fragmentation and AMM (the complete survey report can be viewed at:https://twitter.com/DodoResearch/status/158257484495650816). A total of 164 responses were received in this survey, covering both Chinese and English communities. 60% of the participants in the questionnaire survey have experience in NFT transactions, and 19% are engaged in NFT-related work, such as investors and project parties.

Among those who participated in this survey,56% of users have experienced fragmented transactions in NFT. Users believe that the top three advantages of NFT fragmentation are: improving market liquidity, lowering the threshold for participation, and price discovery, which is conducive to NFT valuation.

About 66% of users have participated in NFT AMM transactions.The main advantages of AMM in the eyes of users are: 1) improved transaction efficiency; 2) cheaper pricing, and users do not need to pay Gas fees. also,26% of users agree that the advantage of AMM is the existence of arbitrage opportunities.

In summary, regarding the future development of NFT AMM or fragmented transactions,49% of users are more optimistic about the future development of AMM, 38% of users are more supportive of fragmentation,13% of users expressed that they are not optimistic about the future development of the two in the NFT track.

text

image description

image description

image description

secondary title

NFT Fragmentation

1. NFTX

a. Mechanism, vision

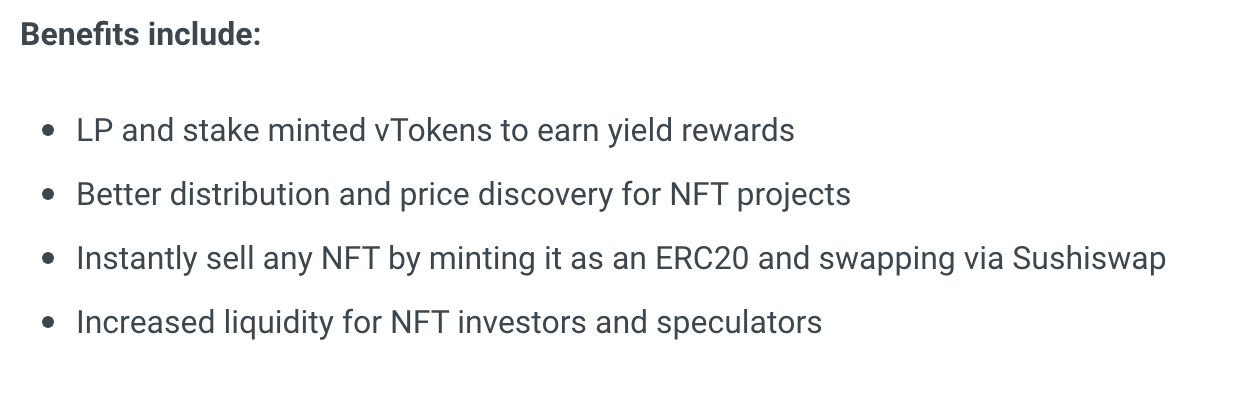

NFTX does not support fragmentation of a single NFT. NFTX focuses on providingNFT Creation Fund, thereby helping to create a reserve price for a specific NFT type.

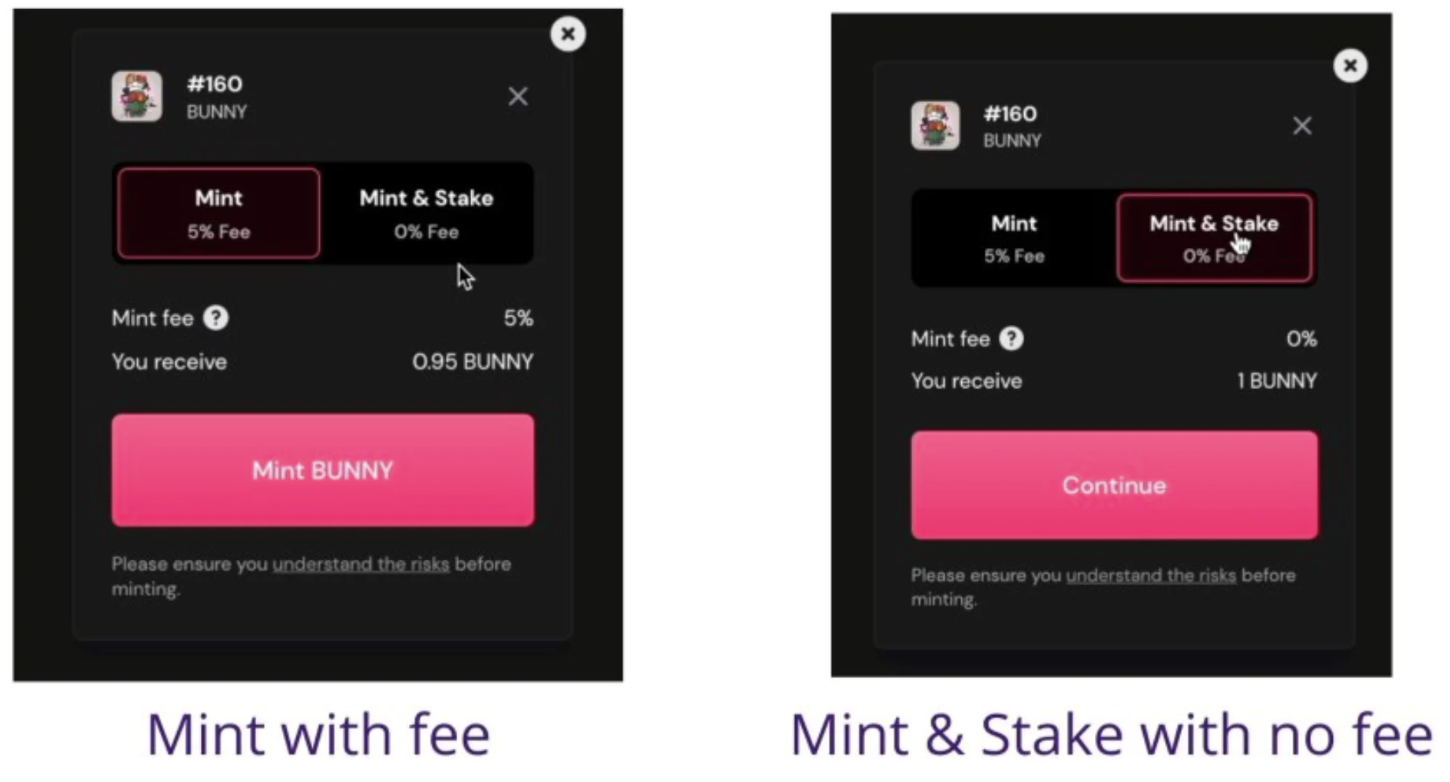

Minting: In the case of minting, for example a user deposits a CryptoPunk into a vault and he will receive 0.95 PUNK tokens in return. 0.05 PUNK tokens will be paid to vault liquidity providers. You can avoid paying minting fees if you stake your tokens for at least 48 hours.

Users can choose to provide liquidity on decentralized exchanges such as Sushiswap, and the default token pair is ETH.

Redemption: Customizable fees, random redemption (4%), or specified redemption (6%)

Transaction: Customizable fee, random transaction (4%), specified transaction (10%)

Pledge: Pledge NFT on NFTX in exchange for xToken (currently xToken does not have any application scenarios); 100% of the platform fee is returned to LP. There are currently two pledge methods:

Token + NFT pledge (Liquidity staking) - get 80% of the handling fee

NFT staking only (Inventory staking) - 20% commission

The governance token $NFTX is only used for governance, with a maximum circulation of 650,000 NFTX tokens

b. Highlights, Value and Risks

Highlights: The upgraded NFTX V2 allows users to customize the various fees (mint, swap, redeem) charged by the NFT vault, and use the fees to give back to LP

text

text

c. Opinion:

NFTX focuses on NFTs near the floor price (because they observed during product design that users generally create vaults for NFTs near the floor price.

NFTX also supported the combined fund in the v1 version, but they pointed out that because the underlying assets also need liquidity, the liquidity is not concentrated enough. This function still exists, but users do not build combined fund vaults very much.

Compared with NFT20, NFTX has NFT staking application scenarios, and you can choose liquidity or inventory staking.

The green line represents the specified redemption fee, which basically coincides with the minting fee in the early stage, representing the user's demand for specified redemption.

2. NFT20

a. Mechanism, vision

NFT20 is a decentralized exchange and exchange protocol for NFTs. NFT items can be converted into ERC20Token so that they can be traded on DEXs such as UniSwap or Sushiswap, thereby improving the liquidity of NFT.

Minting: The user deposits NFT into the NFT project pool, and the NFT20 factory will create an ERC20 token representation of the NFT project, generating 100 tokens for each NFT deposited. The handling fee is 5%.

Low-value NFTs are collectively deposited into corresponding pools, creating an average price of one NFT per item.

If the value of the NFT assets held is higher, then he can choose to create a Dutch auction in the NFT20 asset page to obtain a higher amount of ERC20 tokens for the NFT project

Transaction: 0 fee

Redemption: The NFT in the corresponding pool can be exchanged for 100 corresponding tokens, and the user can make a designated redemption of a specific NFT.

Governance token $MUSE

Daily liquidity reward 500 MUSE. Currently, liquidity providers of the ETH-MUSE trading pair receive 250 MUSE rewards per day. The Chonker, Doki Doki Finance, and NodeRunner pools earn 83 $MUSE per day.

Initially $MUSE was used to reward liquidity pools with over 10k

The NFT20 protocol will convert 5% of the minting fee into ETH, and then use ETH to purchase MUSE, and finally 50% of the purchased MUSE will be distributed to the pledgers of MUSE tokens.

b. Highlights, Value and Risks

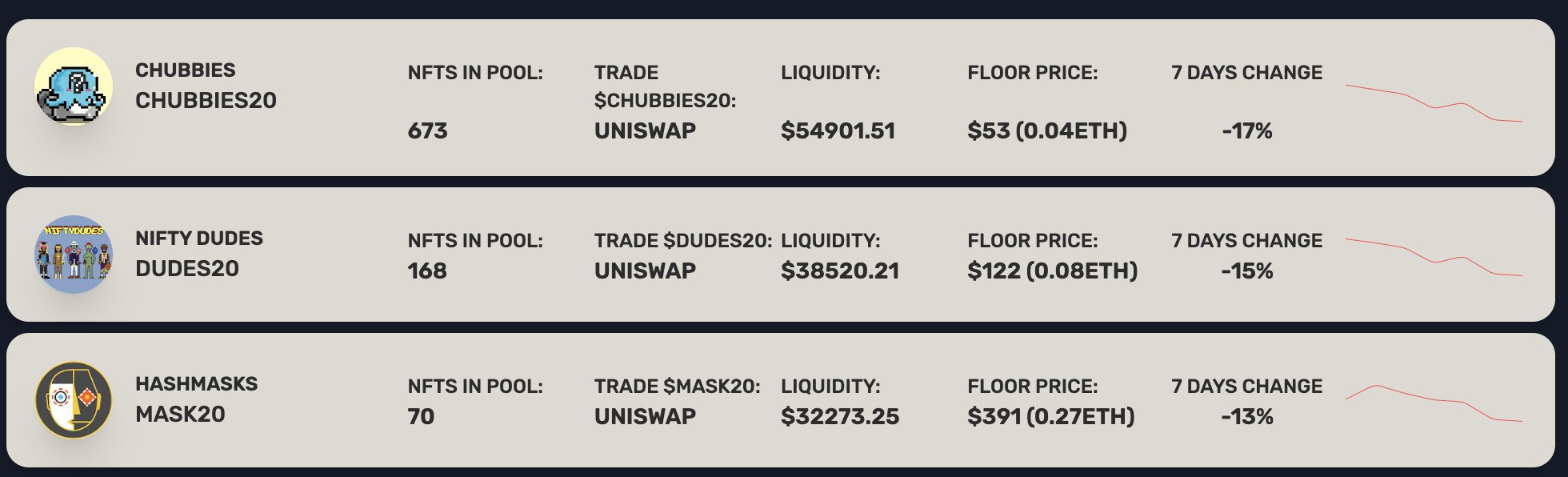

Currently the three pools with the most liquidity are: Chubbies, Nifty Dudes, Hashmasks

Supports flash loans; can initiate Dutch auctions

Compared with NFTX, the UI is simple; the transaction volume on Uniswap has surged but is generally not high.

3. Unicly

a. Mechanism, Vision

Unicly is liveV2 versionThere are two token mechanisms:

$UNIC: Governance token with a total supply of 1M. UNIC holders can lock UNIC for xUNIC, which is eligible for a 0.05% fee on the protocol.

uToken: The structure is similar to NFT funds. Users can lock and split the ownership of an NFT collection into uTokens (ERC 20), and there can be different types of NFTs (ERC-721&ERC-1155) in a collection.

Collectors can bid on specific NFTs, not an entire collection of NFTs

Introduced DeFi business:

UnicSwap: LP increases liquidity through whitelisted uToken and ETH, and pledges LP tokens to earn UNIC.

pledge: Deposit xUNIC regularly: 7, 30, 60 or 90 days, get UNIC/ uToken as income.

The project has reached cooperation with Polygon and releasedUnicly V2 ;

b. Highlights, Value and Risks

Highlight 1: Increase the holding power of uToken: governance and mining.

Highlight 2: Fragmentation method of collection method. In terms of transactions, users can add new NFTs to the collection at any time, and a collection has a maximum of 50. Under such a mechanism, institutional Curators can purchase and add new NFT collections in a timely manner after NFTs are sold.

Compared with Fractional, although the uToken on Unicly has a low transaction volume when the popularity is low, the liquidity mining rewards keep the mainstream uToken TVL sufficient. Most of the traffic is mainly attracted by DeFi mining revenue, and it is difficult to confirm the actual demand for fragmented transactions.

The DC group is not very active, and it is difficult to get timely feedback on questions.

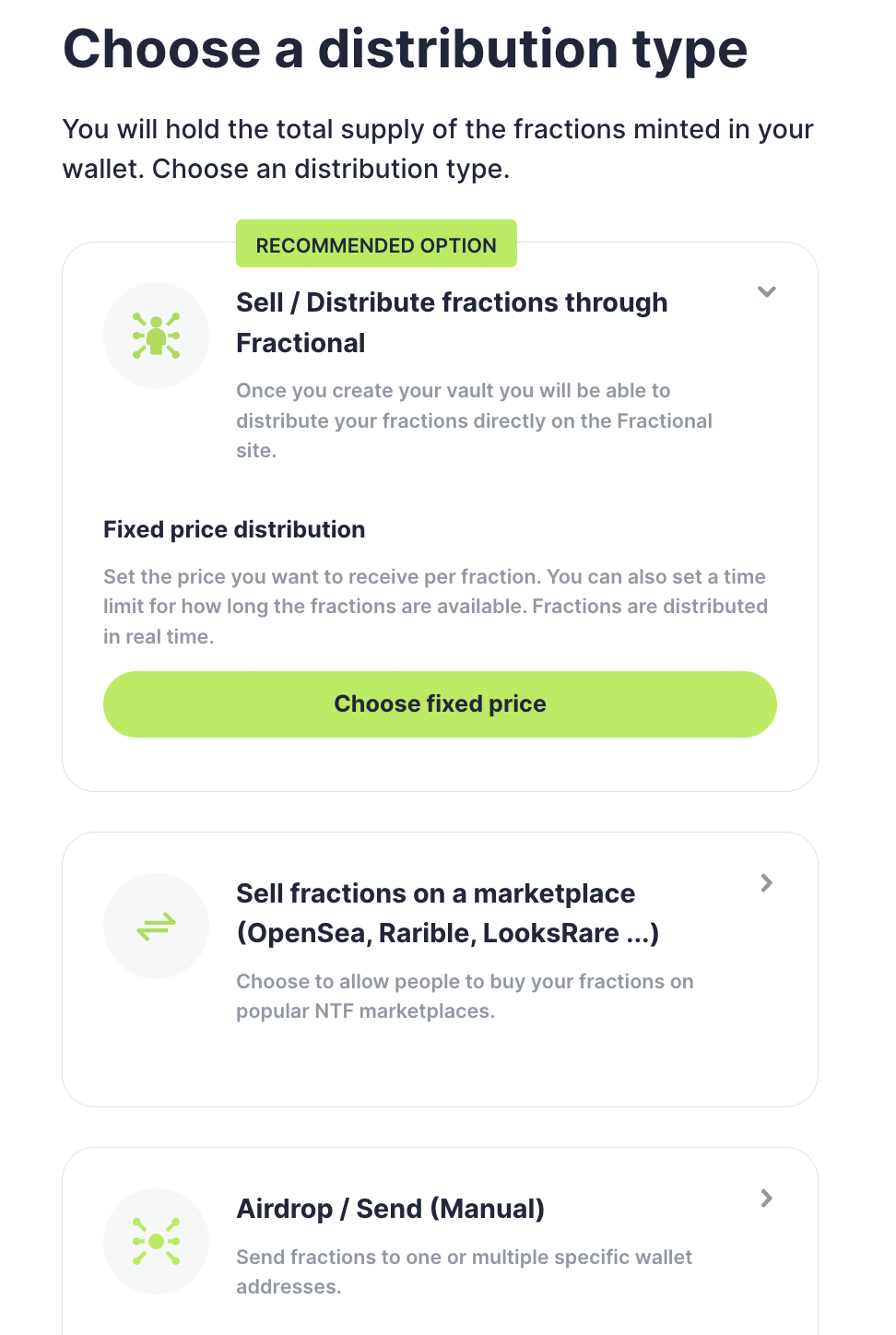

4. Fractional

a. Mechanism, vision

Fractional is built on the Ethereum network. Users can lock one or more NFTs into smart contracts to create their own vaults, and customize the starting price and buyout price for other collectors to bid. And owners of vaults can add liquidity to NFT shards.

At present, Matcha has been integrated to support ERC20 spot and NFT fragment transactions; users can also trade NFT fragments in the wallet.

In a buyout vault, the price is determined by a time-weighted algorithm and shard holders. The low price setting in the Vault requires the support of more than 50% of the shard holders; if the ETH exceeding the reserve price is directly deposited, the user can start the auction of the Vault.

b. Highlights, Value and Risks

image description

Image: Fractional's Distribution Types

Highlight 2: In the current fragmented NFT vaults, NFT series include BAYC, DogeNFT, etc.

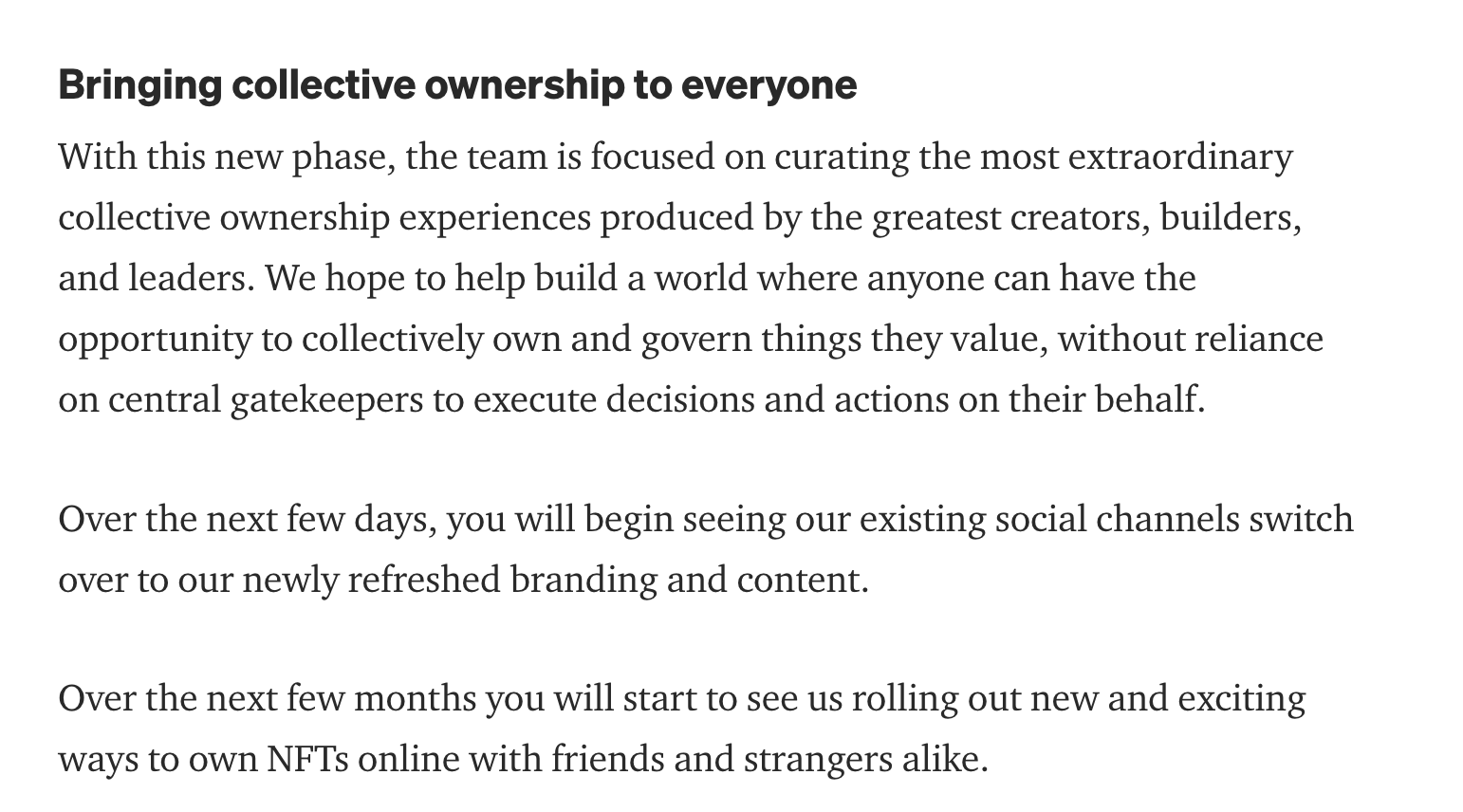

Highlight 3: After Rebrand, Fractional gives new value. An announcement was made in August this year that Fractional will be rebranded and renamed Tessera. Tessera atAugust FinancingAmong them, it received a $20 million investment led by Paradigm. But Tessera is not yet online, and one of its planned goals is to launch acollective ownership。

Dune dataDune dataData Sources:

Data Sources:https://dune.com/mizmatcat/Fractional.Art

c. Opinion:

Although the trading volume has dropped significantly and the development prospects of the fragmented track are not clear; but refer toFractional V2 Design DocumentFinally, it can be found that Tessera after rebrand has the following development potential:

1) Technology upgrade:

The conceptual design of Hyperstructures is equivalent to a perpetual machine contract that never needs maintenance or intermediaries;

"RICKS" NFT Fragmentation Solution: Ensures that fragments are always convertible back to their underlying NFT while avoiding the liquidity and coordination issues of all-or-nothing buyout auctions.

2) Business aspects:

Fragmentation for high-value art collections such as Doge meme photos, CryptoPunk, Bored Ape Yacht Club, Cool Cats, etc.;

secondary title

NFT AMM

1. Sudoswap

In July 21, the founder 0xmons released an NFT liquidity provision agreement called LSSVM, and released the initial white paper "LSSVM: A Liquidity Provisioning Protocol for NFTs", briefly introduced the basic idea of NFT AMM.

LSSVM literally means least squares support vector machine ( Least Square SVM ), which is a theoretical method in machine learning. This is a random name given by 0xmons, and he wants to express his joking attitude towards the phenomenon that many DeFi protocols use mathematical principles as names.

After SudoAMM is officially launched, the main support functions are:

buy and sell NFTs;

Add liquidity to NFT: buy wall, sell wall, bilateral LP;

The pool creator can adjust the pool parameters: LP fee, any Token withdrawal/deposit, custom payment address.

2. Goatswap

a. Mechanism, Vision

A Solana-based NFT AMM marketplace founded by the co-founder of Jupiter Aggregator, an on-chain transaction aggregator on Solana.

Users can now create pools to automatically buy, sell, or trade NFTs, or sell NFTs to any pool with an offer.

The most common liquidity pool in GOAT Swap is NFT< >SOL pool, any user who holds the corresponding NFT in the liquidity pool can exchange it for SOL.

The Beta version of the main network has been launched, and the transaction fee is 1%

b. Highlights, Value and Risks

The mechanism has no special highlights,Overall lockuplower

Twitter follower3037; lower

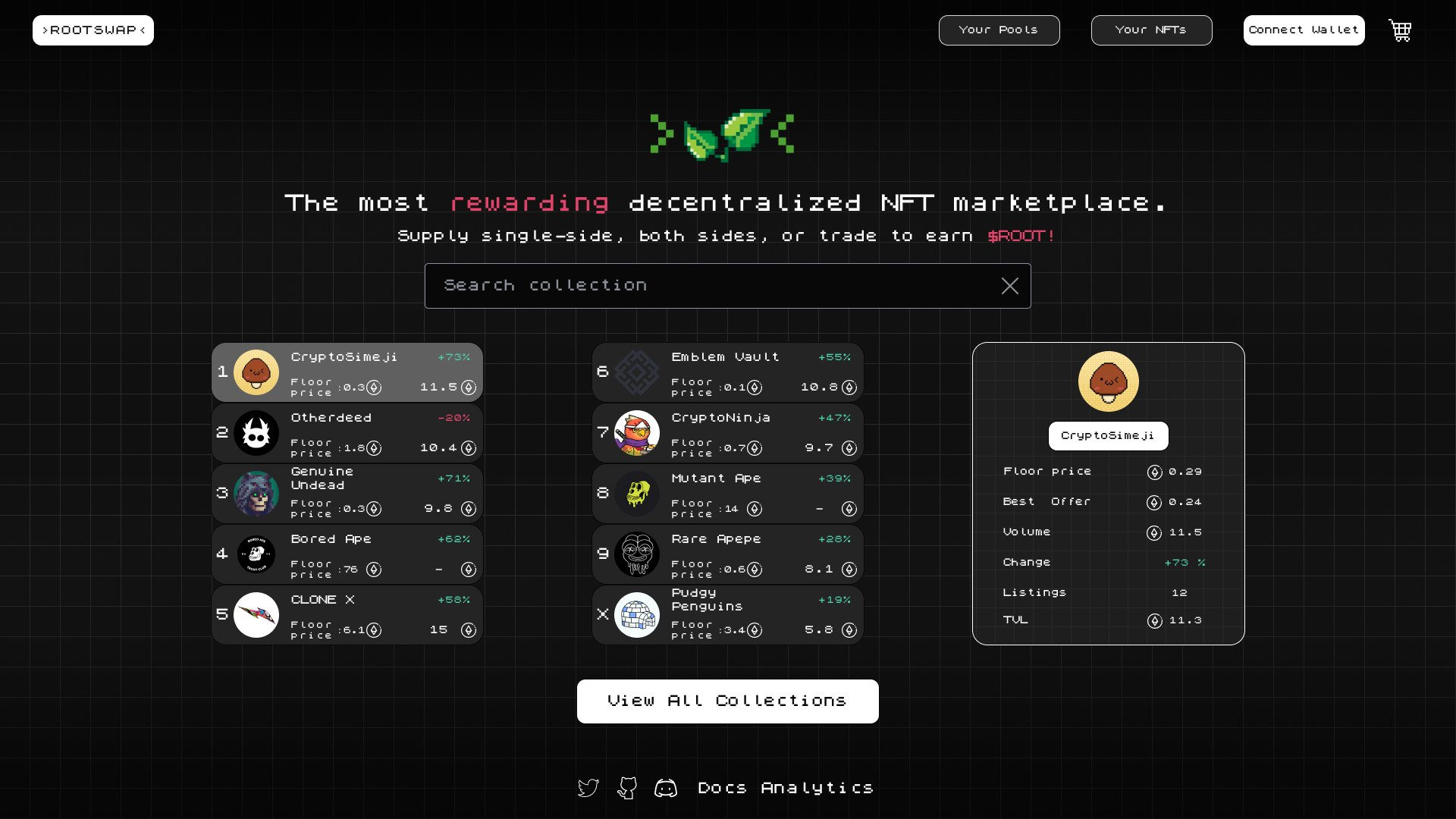

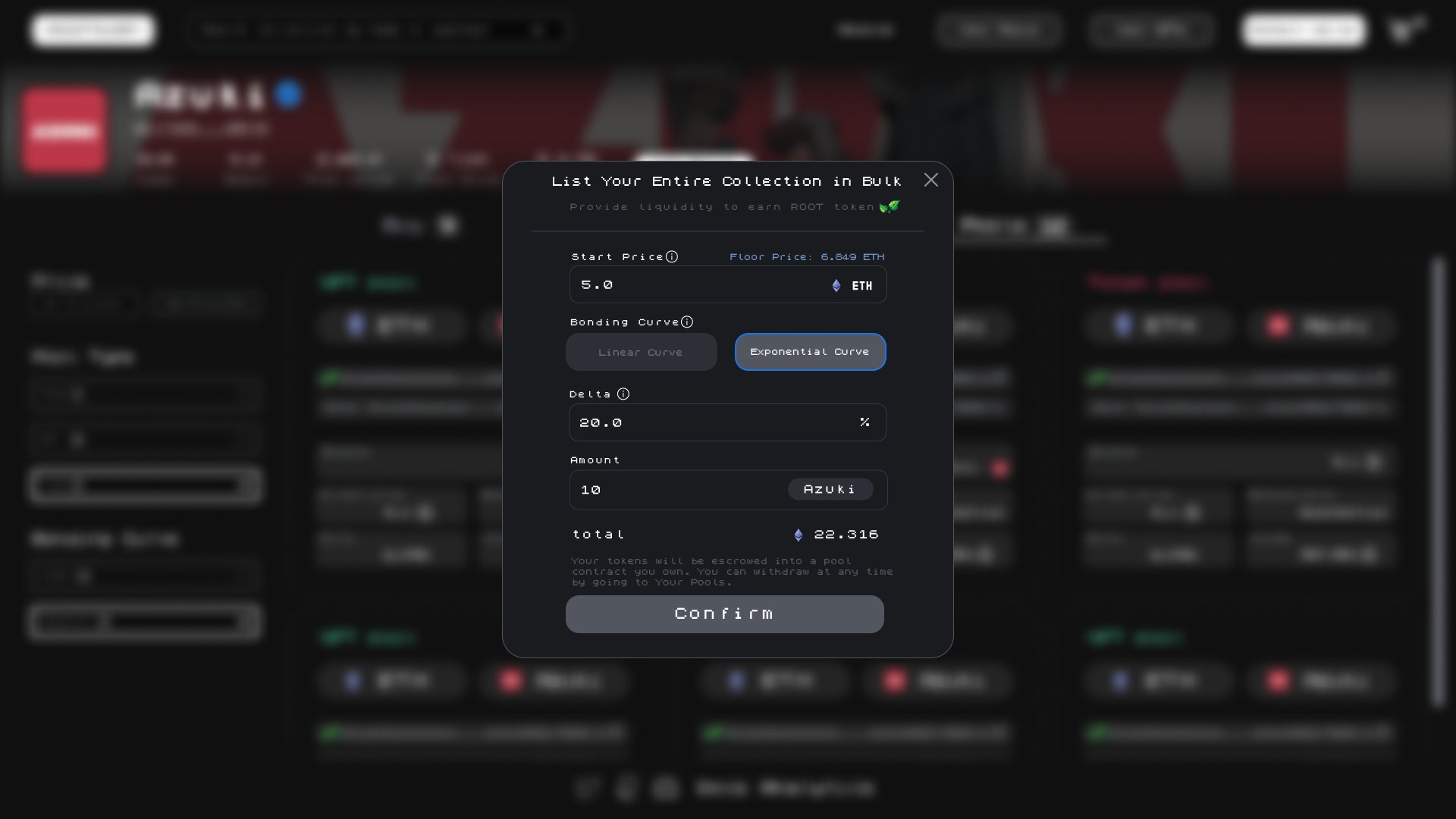

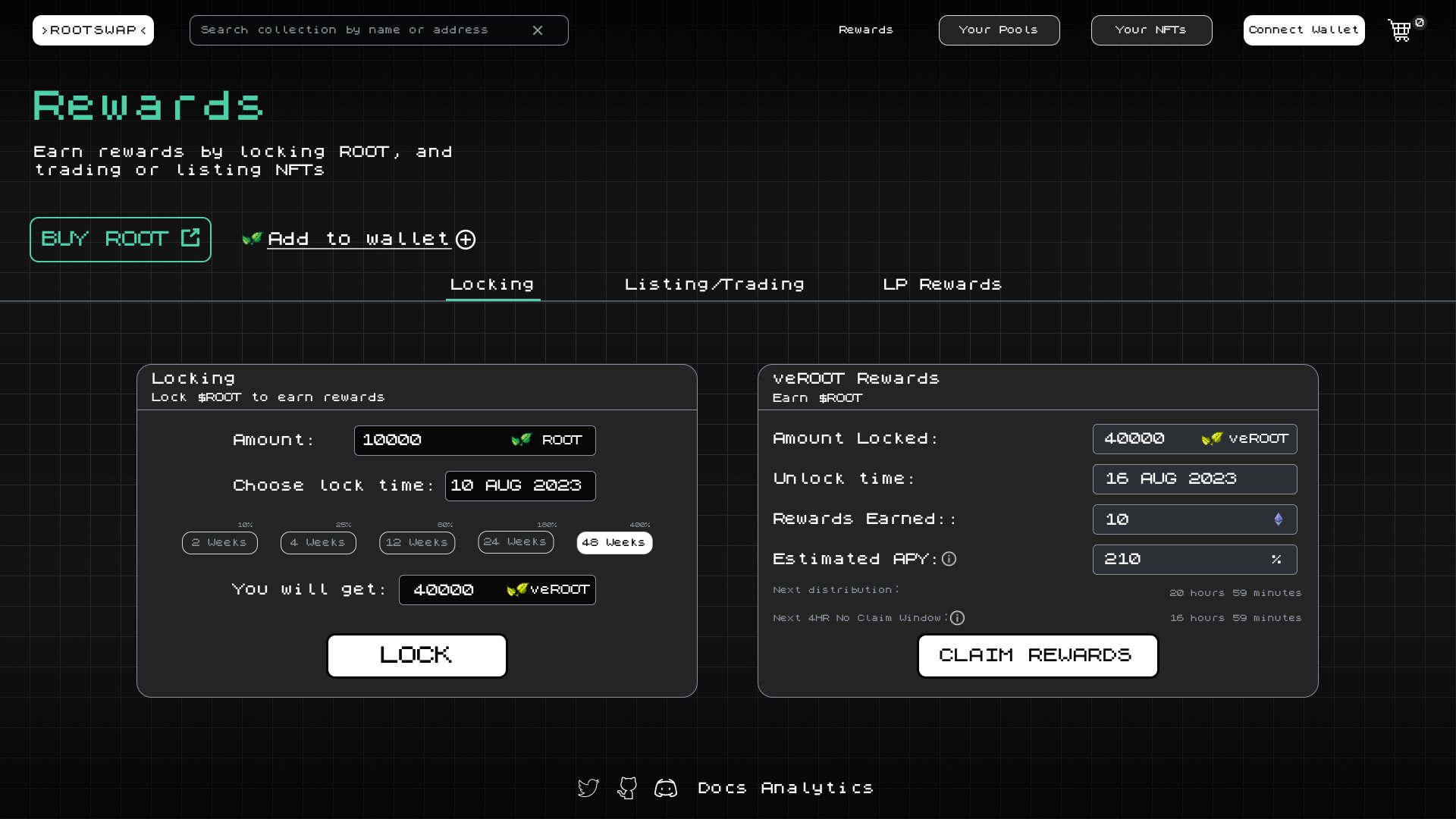

3. Rootswap

a. Mechanism, vision

RootswapIt is a decentralized exchange based on automatic market maker (AMM) for exchanging NFT, with VE (3,3) token incentive model and token incentive based on trading volume.

The product is not online yet

b. Highlights, Value and Risks

Mechanism Highlight 1: Rootners NFTs

Rootners NFTs are issued by Rootswap, the total supply has not been announced, but ideally between 1000 and 9999. Has the following effects: NFT minting cashback/early access benefits/boost token rewards/VIP community passes/governance powers.

image description

A preview of the VeROOT dashboard, listing and trading rewards, and LP rewards

Mechanism highlight 3: $ROOT token incentive model, price asking, bidding and liquidity funding will all be motivated by $ROOT.

4. Elixir

a. Mechanism, vision

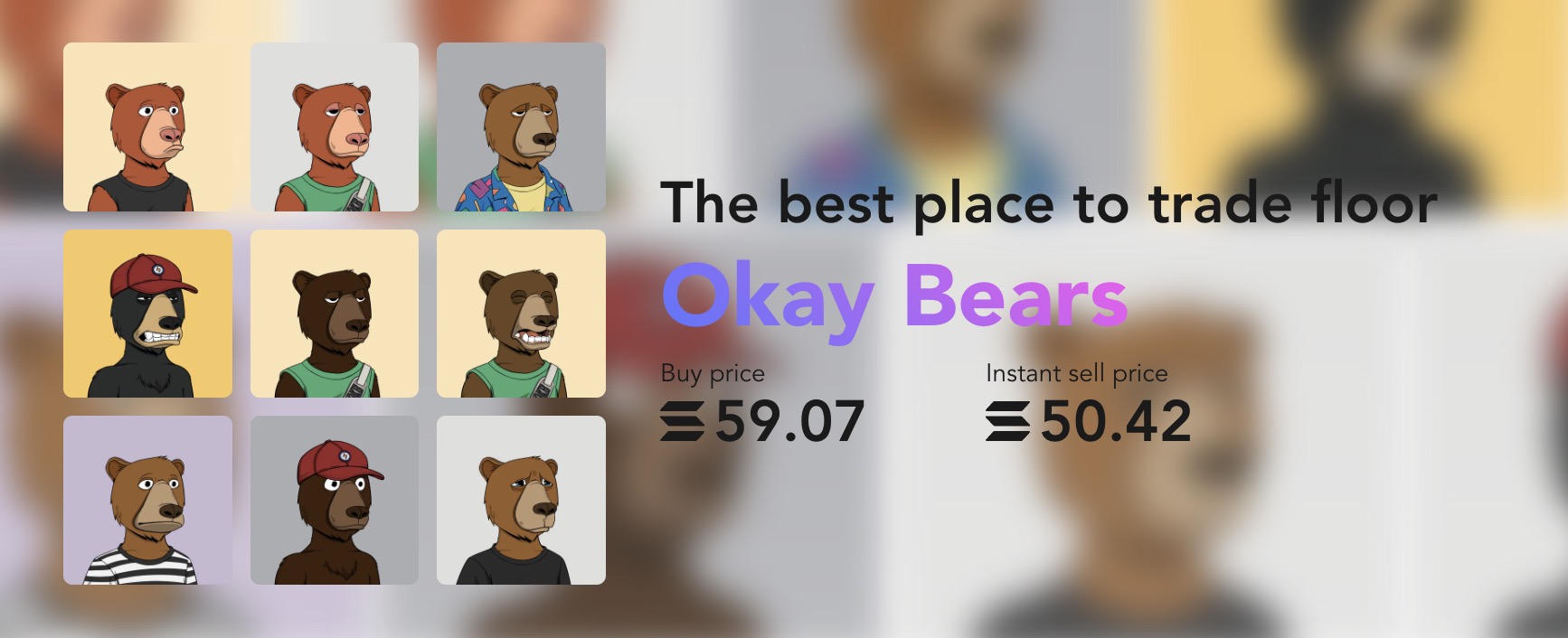

ElixirIt is another NFT AMM on Solana, which mainly provides buying, selling and trading NFTs near the floor price of collectibles. In order to adjust the incentive mechanism in the ecosystem, Elixir will become the first community-owned market, offering collectibles, communities and creations directly distribute ownership tokens

The first stage: Elixir's fAMM powers the NFT lending market, long and short collective reserve prices, and earn passive income on your NFT. These features are in alpha stage and currently only available to Nectar holders.

Elixir provides functions such as lending, staking and derivatives for Nectar holders, and Nectar will distribute 777 for free. At present, the official Discord is closed, and the specific acquisition rules are still unknown.

There is a 1.3% fee when buying NFTs and a 0.3% fee when selling them. 0.27% of this fee goes to liquidity providers, 0.03% goes to Raydium's AMM, and the rest goes to token holders. There are no fees for the exchange. The community ownership model enables revenue sharing with the community. Details on how royalties will be addressed through tokenomics will be released in the coming weeks.

In addition, when creators publish NFT series on Elixir, they also need to set a certain percentage of mint income to be locked in the liquidity pool to provide initial liquidity, and users also need to abide by the relevant fee structure determined by Elixir when creating a liquidity pool .

b. Highlights, Value and Risks

Mechanism Highlight 1: Instant sale of NFTs; purchase of NFTs at the lowest price; free exchange of NFTs in the series

V0: Aggregate sellers, forcing each seller to wait for buyers.

V1: Collect buying and selling needs, but still separate liquidity and pricing, each series has many single LP pools Elixir fAMM: Concentrate the buying and selling needs of the entire collection in one market

Mechanism highlight 2: Incentive model, all tokens are distributed to the community, and the income from buying and selling is also distributed to the community;

Mechanism highlight 3: Nectar NFT holders (free distribution) enjoy functions such as lending, pledge and derivatives;

Less than two weeks after Elixir’s fAMM marketplace went live, LPs have already deposited over $200,000 in NFTs and SOL, earning 10-200% APY on their assets. In addition, the official only accepts 10 applications per week;

Reached a cooperation with Solswipe (The Solana Debit Card), Twitter followers reached 17.6k.

5. Granular

a. Mechanism, vision

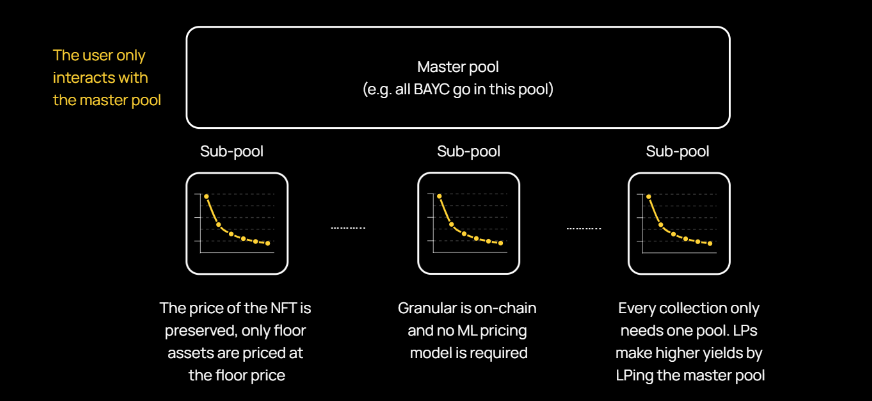

GranularIt is a decentralized trading platform that supports NFT automated market makers. The Sudoswap bonding curve only supports integer adjustments, and the slippage is large. Granular hopes to solve this problem through the Master Pool & Sub-pool mechanism.

Master Pool & Sub-pool mechanism: Each NFT Collection consists of a Master Pool and multiple sub-pools; both LP and Trader interact directly with the Master Pool.

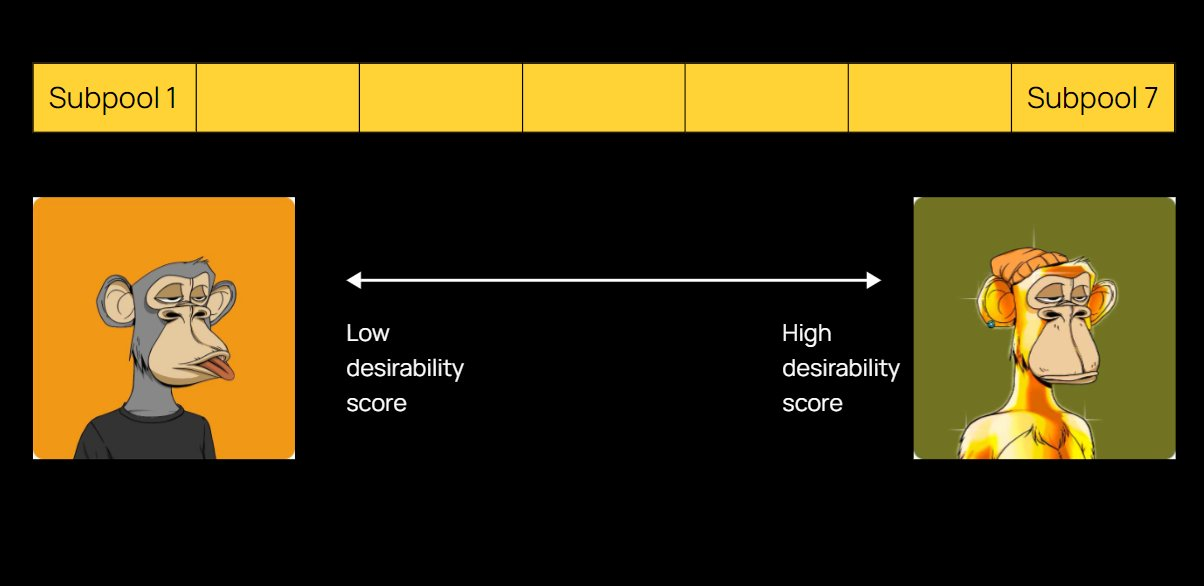

NFT is divided into different sub-pools according to the "desire value", the lower the value, the closer to the floor price. Each sub-pool has its own Bonding Curve. The number of sub-pools varies with the type of NFT and can be adjusted. The higher the liquidity of the NFT, the greater the number of sub-pools.

b. Highlights, Value and Risks

Based on DanuFinance's calculation of the "Desirability Score" for each NFT, the price of the NFT is determined to achieve differentiated pricing for similar NFTs.

LP does not need to manually set parameters, which simplifies the pledge process.

Each type of NFT only needs one pool, and the centralized liquidity improves the income of LP.

c. Opinion

The calculation mechanism of "Desire Value" has not yet been announced, and the feasibility of its pricing is yet to be confirmed.

6. Seacows

a. Mechanism, Vision

SeaCows is an AI-driven NFT AMM protocol that allows any web3 project to build its own decentralized NFT AMM market locally, providing instant NFT liquidity and increasing transaction volume.

Usage scenarios: Built-in GameFi, PFP

b. Highlights, Value and Risks

Price oracles collect aggregated NFT metadata and on-chain transaction history. The data will be captured, cleaned and processed, and ultimately used to train AI algorithms.

Using the mechanism of Bonding Curve + AI Oracle to comprehensively evaluate the value of NFT

Provide SDK for integrating different frontends, such as GameFi built-in market

c. Opinion

The details of the AI mechanism have not yet been announced, and the feasibility of its pricing is yet to be confirmed.

7. Furion

a. Mechanism, vision

The first NFT platform integrating trading, lending, liquidity aggregation and pledge mining.

The one-stop platform aims to solve the triangular dilemma of NFT financialization: NFT pricing, capital utilization and risk management.

By converting NFTs into fragmented ERC20 FX tokens, FX tokens can then be traded via AMM trading pairs or Furion pools. The price of the FX Furion pool is determined by the Furion oracle.

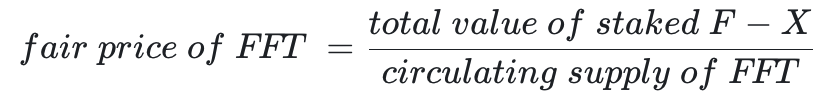

image description

When Circulating supply is 0, Fair price of FFT = 0.01 eth.

b. Highlights, Value and Risks

NFT fragmentation is divided into two methods: storage and lock-up:

Storage: release 100% liquidity of the underlying assets;

Lock-up: Release part of the liquidity of the underlying assets while retaining ownership of the assets.

The separation pool and the aggregation pool are suitable for different needs. Segregated pools can be used for individual NFT varieties, while aggregated pools can be used to create NFT index tokens.

c. Opinion

Aggregated index tokens aggregate the liquidity of different NFTs, which improves the liquidity of NFTs to a certain extent. However, its pricing process is relatively complicated, and fluctuations in NFT prices and oracle risks may cause large fluctuations in FTT tokens.

So far, there are no new projects in the fragmented track, and there are only 5 projects with transaction volume tracked. And the AMM track has just begun,first level title

5. What problems did the two methods solve and bring about?

Problems solved by NFT fragmentation

Empowering value discovery;

NFTs are poorly liquid/do not make good collateral;

Democratize investment

Problems caused by NFT fragmentation

Ownership issue: Forced to sell the fragments in hand after buying out;

Bypassing the problem of pricing NFT, it cannot solve the liquidity problem of NFT itself (it cannot capture the price difference of NFT with different rarities);

Friendly to rare and blue-chip NFTs, not to long-tailed NFTs;

Inefficient and incurs additional costs;

Purely fragmented Ponzi schemes, value bubbles.

Copyright issue

Problems NFT AMMs Solve

Lowering the threshold: Compared with NFTX, fractional and other solutions, Sudoswap really lowers the user's usage threshold (buying and selling), and the education cost is extremely low.

Instant liquidity: exit NFT positions at any time;

Completely on the chain, without permission: Publish, bid, and trade completely on the chain without permission, and the price is better than xyk after NFTX homogenization.

Efficient and flexible: NFT - FT LP directly participates in market making with a higher sales rate, and can customize pool parameters (LP fee, buying and selling tax, price discovery methods, etc.);

New NFTfi building blocks: Taking advantage of composability, it can be used as the underlying infrastructure of NFTfi, the marketplace of gamefi projects, and LP mining of eg Sudo Inu.

Another form of incentive: The business model of the simple and rude, non-sustained NFT issuance in the past may be changed. As an LP, the NFT project party can be deeply bound as a Stakeholder, and transaction fees can be used as a new type of "royalty" to motivate LP/project parties .

New NFT trading and market-making model: It has changed the trading habits of NFT order books to a certain extent, and provided new ideas and paths for NFT market-making (DCA strategy, etc. can be used).

Problems posed by NFT AMMs

Bonding curve has a single pricing curve: Linear Exponential; (theoretically, any type of curve such as linear, S-shaped curve, sinusoidal curve, etc. can be used); why not use the XYK model? The team believes that the use of the XYK model for NFT pricing will cause price changes to be too drastic (the liquidity distribution is too discrete and the NFTX model will generate more fees for no reason). Therefore, Sudoswap adopts a centralized liquidity method similar to Uni V3, which reduces the problem of excessive price fluctuations caused by the XYK model (this may also be a double-edged sword);

The rarity of NFT is eliminated during use: it cannot meet all NFT market needs, but it can be realized through a simple buy/sell wall;

Friction cost: NFT will be stored (hosted) in the pool as an LP, and there will be a fee for each withdrawal and pending order, which cannot be recorded in the off-chain order book and cannot be placed in multiple marketplaces;

Great authority to create LP: super administrator authority, can control the pricing function, incremental threshold, initial fee, and global handling fee.

Under the background of the bear market, LP risks are infinitely enlarged: due to the poor liquidity of NFT itself, the Exit liq provided by the Pool model itself makes NFT LP bear unlimited risks. If there is no corresponding incentive, no one will do LP.

first level title

6. Viewpoint/future

NFT Fragmentation

NFT fragmentation is mainly aimed at high-value investment NFTs, such as blue chips and real asset anchors. The fragmentation of NFT lowers the participation threshold of these assets, allowing users to participate in asset transactions and speculation at reduced prices.

NFT fragmentation itself does not solve the liquidity and pricing problems of NFT, resulting in the separation between the NFT spot market and the fragmented market. From the perspective of market performance, after the fragmentation of NFT, token liquidity is very low, transactions are not active, and the expected effect has not been achieved.

From the perspective of the asset itself, the NFT asset itself has equity attached to it, and the equity is indivisible. As a non-homogeneous asset, NFT brings non-homogeneous experience to users. It is precisely the fragmentation of NFT that is difficult to effectively divide the rights and interests, and is not suitable for equity NFT assets.

The development of the NFT fragmentation market ultimately depends on the development of the overall NFT market. In the case of insufficient liquidity of the underlying assets, fragmentation of assets will not improve liquidity.

The structure of NFT fragmentation products will not change much in the future, and product iterations will be launched from several aspects, such as more flexible rate design, more wallet support, richer NFT support and data display , a more friendly interface and a variety of exit methods.

NFT AMM

The AMM model will increase a lot of friction in trading/market making, and is not friendly to low-priced NFTs, so this group of users is not the target user for the time being.

The largest usage scenario of AMM, that is, Utility NFT, is an important category of game assets, and a standardized market is the foundation for the future development of the game ecosystem.

AMM provides a new idea for creator incentives, that is, binding is called stakeholders to motivate creators to continue output.

The form of AMM also lowers the entry threshold for NFT market making, and the deployment of strategies is more flexible.

Reference

https://mirror.xyz/0xfD541c8A6710006a63C83eC32B9F2D7b3291eFa3/kv1YOjjzbOC_FVruhkIUjidgkisQV0FkPV7n5vevnLM

https://fortune.com/2022/08/17/nfts-fractional-tessera-paradigm-20-million-funding-round/

https://medium.com/tessera-nft/announcing-tessera-6cc66d92a6a6

disclaimer

More information

Copyright Notice

Without the authorization of DODO Research Institute, no one may use without authorization (including but not limited to copy, disseminate, display, mirror, upload, download, reprint, excerpt, etc.) or allow others to use the above intellectual property rights. If the work has been authorized to be used, it shall be used within the scope of authorization, and the source of the author shall be indicated. Otherwise, its legal responsibility will be investigated according to law.

about Us

"DODO Research Institute" led by the dean "Dr.DODO" led a group of DODO researchers to dive into the Web 3.0 world, doing reliable and in-depth research, aiming at decoding the encrypted world, outputting clear opinions, and discovering the future value of the encrypted world. "DODO" is a decentralized trading platform driven by the Proactive Market Maker (PMM) algorithm, which aims to provide efficient on-chain liquidity for Web3 assets, allowing everyone to issue and trade easily.

More information

Official Website: https://dodoex.io/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Discord: https://discord.gg/tyKReUK

Twitter: https://twitter.com/DodoResearch

Notion: https://dodotopia.notion.site/Dr-DODO-is-Researching-6c18bbca8ea0465ab94a61ff5d2d7682

Mirror:https://mirror.xyz/0x70562F91075eea0f87728733b4bbe00F7e779788