"Stablecoin World War II" started, and the reshaping of the territory was in progress

Author |

Editor | Hao Fangzhou

Produced | Odaily

"The Second Great Stablecoin War has begun."

This is a comment made by FTX founder Sam Bankman-Fried (SBF) a few days ago when he talked about the recent competition and share changes in the stablecoin market.

Time goes back to around 2018. At that time, a number of over-collateralized stablecoins with fiat currencies as backing assets had launched a round of fierce fighting. finally,USDT, which took the first-mover advantage, and USDC, which has excellent compliance endorsement and liquidity scenarios, defeated competitors such as TUSD, GUSD, USDP, and HUSD, and won the "Stablecoin War".

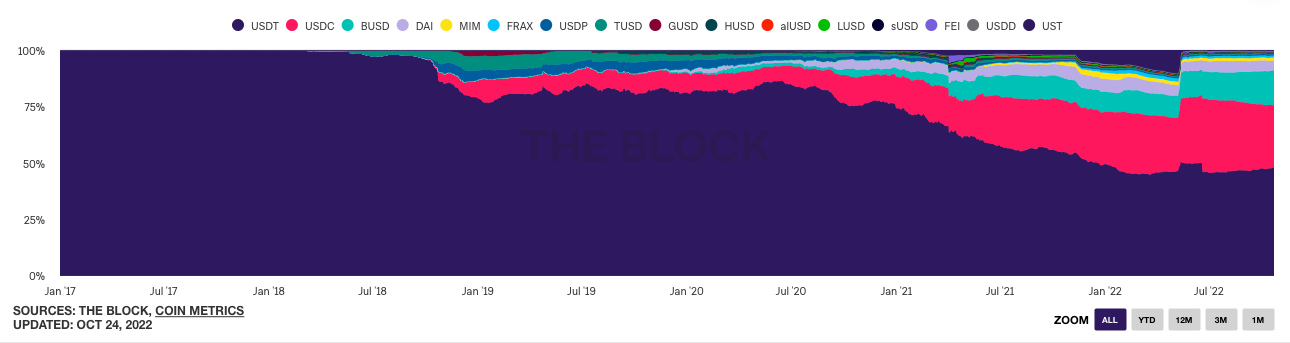

Since then, the competition in the stablecoin market has never stopped, and contestants with new concepts such as decentralization and algorithm support have emerged in an endless stream, but the dominance of USDT and USDC has never been shaken (the two rare "accidents" during this period "One is UST, but the latter's once strong momentum has been proven unsustainable by reality). In the king-level competition, the contest between USDT and USDC is generally in a relatively moderate situation. Although USDC took advantage of the momentum of DeFi to steal a lot of cakes from USDT, as DeFi became cold, the two In fact, the share ratio of China's market will not change much after entering 2022.

Odaily Note: The block's stable currency share change chart, the purple part is USDT, and the red part is USDC.

first level title

Main battlefield: BUSD vs USDC

The change occurred in September this year, and the attacking party was another big "accident" BUSD mentioned above and the Binance ecology behind it.

BUSD is a 1:1 USD-backed stablecoin issued by Binance in partnership with Paxos and approved by the New York State Department of Financial Services (NYDFS). Similar to USDC, BUSD is also following the compliance route and is backed by the top exchanges in the market. However, due to its late birth, its market volume is always weaker than the former. However, as time goes by,While USDC and USDT are directly competing on the bright side, BUSD has gradually accumulated an issuance scale of tens of billions of dollars by virtue of the traffic advantages of Binance and the ecological support of BNB Chain, and its market share has gradually expanded to more than 10%. He has the qualifications to wrestle with the two overlords.

On September 5, an announcement from Binance ignited the flames. In the announcement, Binance stated that it will automatically convert the existing USDC, USDP, TUSD stablecoin balances and new recharges of platform users to BUSD at a ratio of 1:1 on September 29, and will delist multiple transactions involving the above three. A spot trading pair of a stablecoin. Since then, WazirX and other Binance-owned exchanges have followed suit.

in short,Binance is intervening in the usage scenarios within the radiating range of its own power, thereby affecting the supply and demand situation between BUSD and USDC and other stable coins.Although the deposit and withdrawal of stablecoins such as USDC will not be affected, since these stablecoins will be automatically converted to BUSD within Binance, user inertia will gradually form over time—except for some relatively low-frequency necessary scenarios ( For example, you need to withdraw USDC to mine a certain mine), in higher frequency scenarios (mainly transactions and financial management on the platform), users only need to hold BUSD.

Facts have proved that Binance’s move has achieved excellent results. According to CoinGecko data,From September 5th to October 27th, the issuance size of BUSD has increased from approximately US$19.427 billion to US$21.42 billion, while that of USDC has decreased from US$51.903 billion to US$43.904 billion.

Of course, the sharp drop in USDC issuance is not just due to Binance’s move, but the combined influence of multiple factors.

First of all, the overall downturn in the encryption market has suppressed the demand for stablecoin transactions, and the reduction in market activity has led to a continued decline in the yield of stablecoin deposits.On the DeFi side, it is normal for USDC, as the most widely used stablecoin in DeFi, to be affected the most; on the CeFi side, since Circle itself is not as profitable as Binance, it cannot give USDC the same continuous support as Binance supports BUSD. This is embarrassingly reflected in Circle Yield's current 0% long-term financial management yield.

Another key factor is the tightening of regional regulation,Especially after the U.S. Department of the Treasury sanctioned Tornado Cash, Circle in the U.S. will inevitably come under greater regulatory and public pressure no matter what it does.

Under heavy pressure, USDC will naturally not "sit and wait for death". There are three points in its recent actions that are worth noting. One is that Coinbase, one of the strongholds of USDC, waived the fee for purchasing USDC with fiat currency; the other is that Circle will launch a new cross-chain transmission protocol to improve the interoperability of USDC; the third is that Circle has reached an agreement with Robinhood, a large stock brokerage and trading platform. A payment infrastructure cooperation agreement has been signed, and Robinhood has also launched USDC.

These three measures,The first trick is to make a fuss within the power radiation range of USDC,Like Binance's strong support for BUSD, it is a "guardian" operation;The second measure is to consolidate advantages in the public domain that you have set foot in but cannot control, and the third measure is to try to open up some new areas,All belong to the "wild" operation.

On the whole, the current battle between BUSD and USDC is still in the early stage, so it is too early to talk about the outcome, but considering that both sides have basically cleared each other's positions within the scope of their own power radiation (Binance, Coinbase platform) power,Therefore, in the future, who can grab more market share outside the scope of power radiation will become a key factor in determining the direction of the battle.

The external scope here includes not only FTX and other large companies in the circle that temporarily hold a neutral attitude (SBF said today that FTX has not yet confirmed the details of the stablecoin development, but it does not rule out that there will be actions in the future), as well as Robinhood and others. Potential traditional financial platforms include DeFi, a huge market that is completely open and completely free (this may be the reason why CZ said a few days ago that he would invest heavily in DeFi).

All in all, no matter who can have the last laugh in the next competition, this head-to-head confrontation between BUSD and USDC is bound to stir up the entire stablecoin market and reshape the pattern of the entire track.

first level title

Local Battlefield: DAI vs Challengers

In addition to USDT, USDC, BUSD and other stablecoins issued by centralized entities, decentralized stablecoins run through smart contracts are also a force that cannot be ignored in the track.

After the U.S. Department of the Treasury announced the sanctions against Tornado Cash in August this year, Circle immediately froze the USDC assets in the relevant addresses, which also aroused market concerns about the "arbitrary" centralized stablecoin. In contrast,Decentralized stablecoins have become the long-term development direction of the stablecoin track in many people's minds because they do not require permission and are not controlled by a single point.

Looking at the existing structure of the decentralized stablecoin market, DAI is still the dominant player. Except for UST, which has already collapsed, no challenger can threaten its status. FRAX, which is taking a somewhat stable route, currently seems to be Not bad, but there is still a gap of four or five times the market size of DAI. However, the variables that are expected to stir up this local battlefield are gradually approaching.

In mid-October, Aave released the development progress of its decentralized over-collateralized stablecoin GHO, and stated that it plans to start deploying GHO on the test network in the next few weeks. Earlier, Curve developers also uploaded the code of its native stablecoin crvUSD to Github.

The entry of two leading players such as Aave and Curve means that for the first time, DAI and MakerDAO have ushered in their own rivals in the decentralized stablecoin market, especially Curve, as the stablecoin DEX with the largest business volume, the platform used to be The battlefield of various stablecoin battles may change the competition mode of decentralized stablecoins after personally ending the battle.

first level title

Marginal Battlefield: The Battle for "Sovereignty" of Small Ecological Stablecoins

In some small and medium-sized ecosystems with weak market attention, there have also been some incentive competitions around stablecoins. The two sides of the battle are generally the native stablecoins supported by the ecology, such as Kava’s USDX and WAVES’ USDN, and the other side is the leader of the track such as USDT and USDC.

However, except for the fact that UST was able to overwhelm the crowd on its own Terra chain (it was mentioned for the nth time, the data that year was really good), such small ecological stablecoins have not yet shown enough competitiveness, and may even It is difficult to maintain anchoring due to mechanism design flaws or past bad debt gaps.

Some small ecological stablecoins have come to an end. On October 25, the NEAR Foundation officially proposed to gradually close USN. At the same time, in order to fill the bad debt gap of USN, the NEAR Foundation also allocated 40 million US dollars to ensure full redemption. Although this is just an extreme case, to a certain extent it also reflects the difficulty of small ecological stablecoins.

first level title

Written at the beginning of "Stablecoin World War II"

As the most commonly used medium of exchange in the cryptocurrency world, stablecoins carry a massive demand for transactions and transfers. With the support of astronomical business volume, the minimalist business model of "issuance, circulation, and redemption" has become one of the most "stable profits without loss" businesses in the market. Whether it is for a commercial entity like Circle or a DeFi protocol like MakerDAO, the strong value capture capability of the stablecoin business cannot be ignored, which is the main reason why this track has become a "battlefield".

Standing at the beginning of the "Stablecoin World War II", we can predict that this is destined to be a long and variable competition. In addition to the overlords who sit on the throne and the new fighters who challenge with swords, more new contestants will gradually join the battle, and their respective positions and roles may change unconsciously. The big show is opening, and you and I are all witnesses.