How to identify NFT "washing transactions"?

This article comes from ForkastThis article comes from

, the original author: ANNDY LIAN, compiled by Odaily translator Katie Ku.For financiers, "wash trading" (wash trading) is not a new term. Cryptocurrencies are also "shuffled" back and forth with the same buying and selling techniques, and the same is true for the NFT market.

So how to use the data on the chain to identify "washing transactions" and detect suspicious activities?

secondary title

What is a "wash trade"?

In NFT transactions, "wash trading" occurs when the same user acts as the buyer and seller of the NFT transaction. Unlike traditional securities, the NFT market is not subject to government supervision, and it is difficult to determine the real identity behind the address. Therefore, wash trading is very common in the NFT market.

secondary title

Why is someone washing NFTs?

There are two main motivations behind the "washing" in the NFT field.

Get platform rewards

Some NFT marketplaces, like X2Y2, reward active users by rewarding them (in the form of protocol tokens) based on their trading volume. Wash traders take advantage of this to maximize their returns by generating large amounts of fake volume. In turn, this can easily deceive users who want to quantitatively analyze NFT collections or markets in terms of liquidity.

In order to create an illusion of liquidity and the inflated value of specific NFT collections, some unscrupulous creators turned to wash trading to deceive buyers. Genuine buyers profit when they are tricked into buying NFTs from them at inflated prices. This type of wash trader hides their activity with new wallet addresses that are self-funded by centralized exchange wallets. This type of wash trade generates relatively small volumes and is less disruptive to the market than Type 1 wash trades.

secondary title

How is the "washing transaction" carried out?

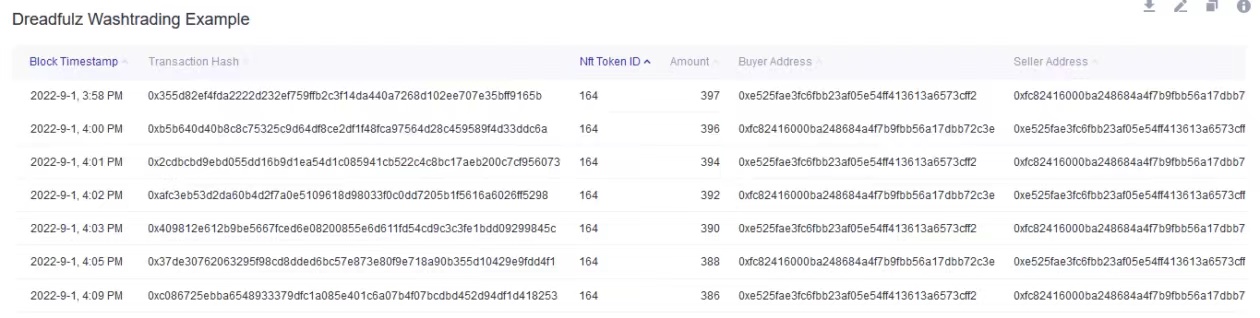

Figure 1 shows an example of wash trading activity on the X2Y2 market.

image description

From the picture above, we can see that the same NFT (ID 164) was purchased back and forth between the same two wallets many times in a day, and the sales price of each transaction exceeded 300 ETH. On September 1, 2022, these two addresses traded 19 times, resulting in a transaction volume of 7228 ETH, and paid the X2Y2 platform fee of 36.14 ETH. And Dreadfulz's royalty rates aren't set on X2Y2. Therefore, no creator fees are paid. Wash traders will choose series with zero royalty fees to minimize their trading costs.

secondary title

How to identify "washing trading"?

I researched how some analytics platforms detect it. Based on my own knowledge and analysis, the following is a list of suspicious data and activities:

A particular NFT is traded more than X times per day at the same address, while other collectibles remain unchanged;

The same address is conducting the same NFT transaction in a high-frequency manner;

NFT collections self-sell at high frequency without marketing or promotional support;

The average historical transaction price of market A is X times that of market B;

The sale price of the NFT is X times higher than the lowest priced NFT available for sale;

The same wallet funds all dubious wallets buying and selling NFTs;

The above assumptions are not perfect, and I hope to collaborate with researchers to develop a more comprehensive "scorecard" that can more effectively determine NFT trends and behavior. The ability to track multiple wallets over time to identify different levels of relationships is also critical.

secondary title

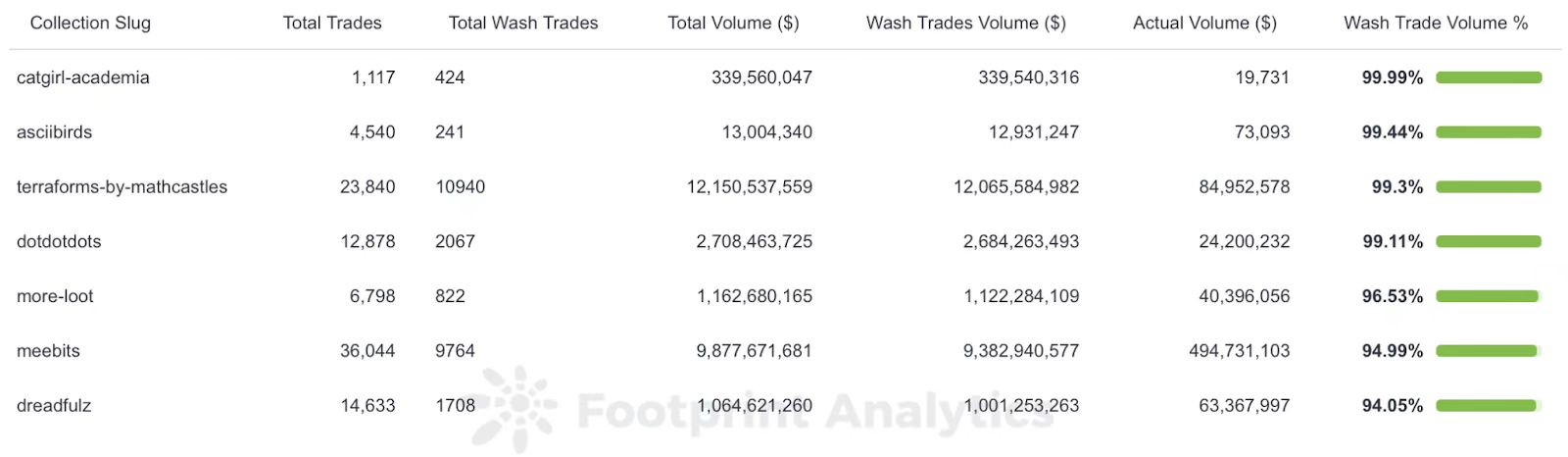

In Figure 2, Footprint Analytics applied their identification rules to the most traded NFT series on X2Y2 and LooksRare.

image description

By their rules, they have detected that 95% or more of the volume in these series is wash trading. Wash trades account for an extremely high percentage of the volume of these collectibles, which is misleading about the historical volume and sales activity of the collectibles.

Figure 3 - Wash trade statistics for blue-chip NFT series (Source: Footprint Analytics)

Figure 4 - Wash trade data from LooksRare and X2Y2 (Source: Footprint Analytics)

image description

Summarize

Summarize

image description

Figure 6 - Monthly NFT sales data from OpenSea, LooksRare and X2Y2 (Source: Footprint Analytics)