One month after the merger of Ethereum, what is the computing power of each POW public chain?

Original Author: Wesely

A month ago, the successful merger of Ethereum opened its new era, and Ethereum miners have also become a historical term, accompanied by the disappearance of its $5 billion mining machine market and 850TH/S huge computing power . Fortunately, the merger is a deterministic event, which allows Ethereum miners enough time to make their own choices. Some are actively looking for the next target, some are waiting and watching in the bear market, and some choose at the end of the ETH POW era. After a complete exit, one month after the merger, we can use the changes in the computing power of each public chain to see where the miners migrated, and see who is the largest Ethereum computing power. Which projects have the greatest impact? What changes has the computing power experienced after moving in?

In the past, Ethereum mining used the Ethash algorithm. Since Ethash has a certain degree of ASIC resistance, the Ethereum mining machine did not form a large-scale professional ASIC mining machine like the Bitcoin mining machine. In terms of computing power, the Ethereum graphics card mine It is also two orders of magnitude worse than the ASIC mining machine, and it is this difference that makes the Ethereum graphics card mining machine unable to compete with ASIC professional mining machines on public chains such as BTC and BCH.

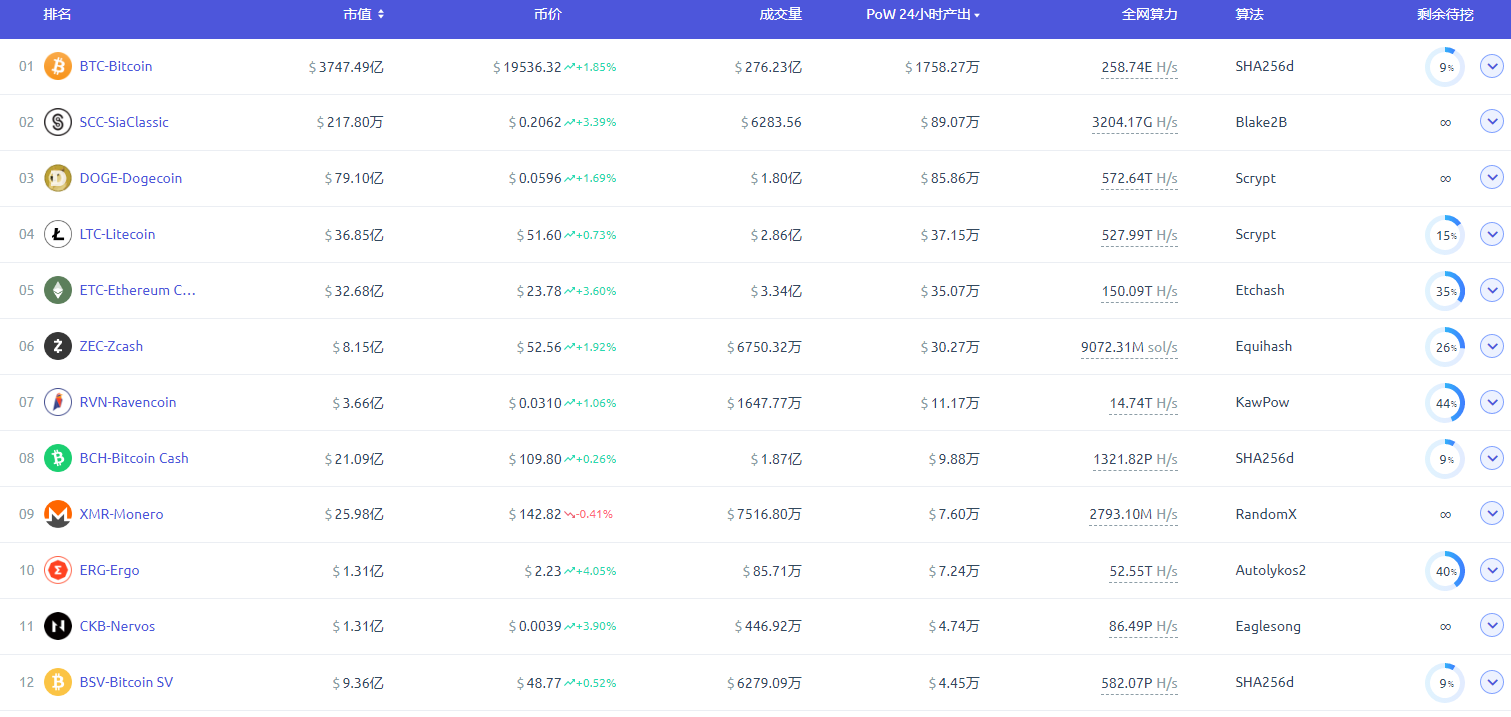

image description

The main data source of POW public chain in the current market: f2pool

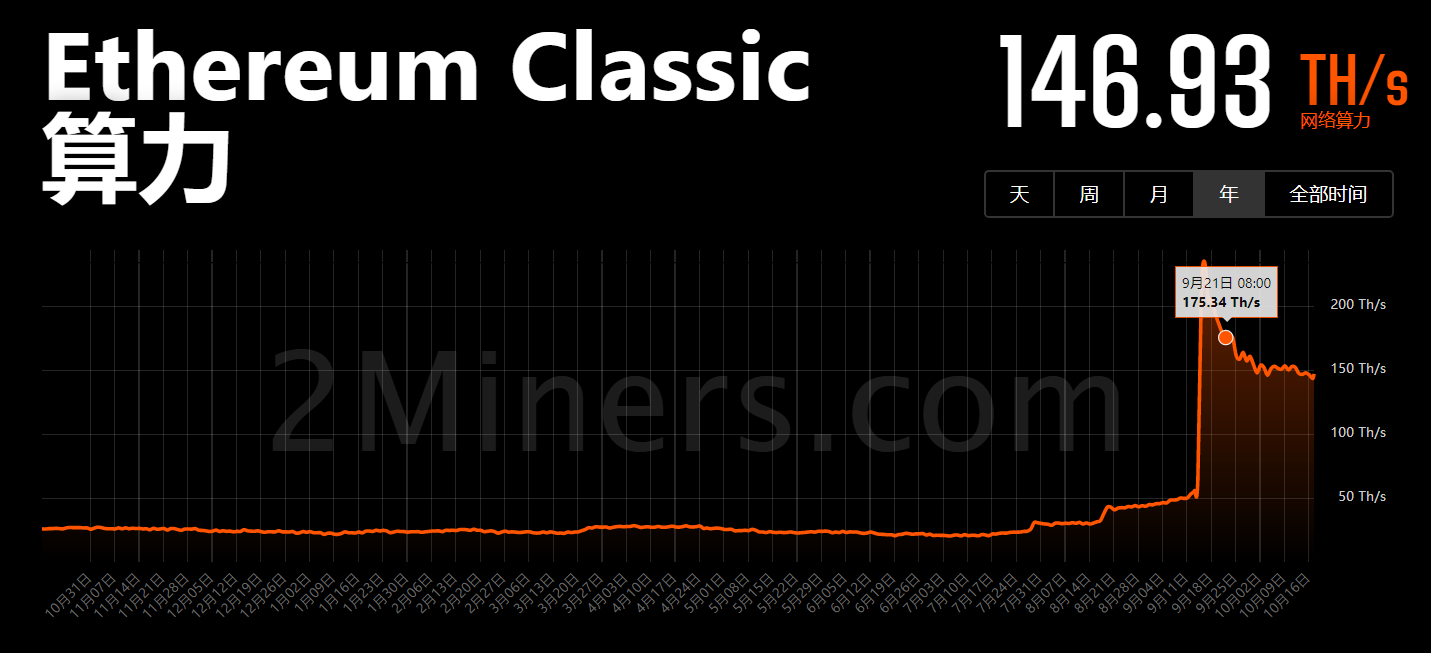

Ethereum Classic

Introduction: Ethereum Classic, the public chain that was forked because of The DAO hacking incident, is also the biggest split in the Ethereum community. Although ETC inherits the original geek spirit of Ethereum, it gradually falls behind in the subsequent development, and the ecological development It also cannot compete with the current ETH and other L1s. As can be seen from the growth of computing power in the figure below, three days before the merger of Ethereum, a huge amount of computing power began to pour in.From the initial 55.67TH/S to 234.35TH/S, an increase of nearly four times, is the most important destination for Ethereum computing power migration.

Current computing power: 146.93TH/S

Hashrate increase (decrease): After the merger with the company, the hashrate increased by a maximum of 178.68TH/S (based on September 1st, the same below), an increase of 320.9%, and then the hashrate gradually decreased and stabilized at 150TH /S or so.

Undertake the original Ethereum computing power ratio: about21.0%image description

ETC computing power change data source: 2miners

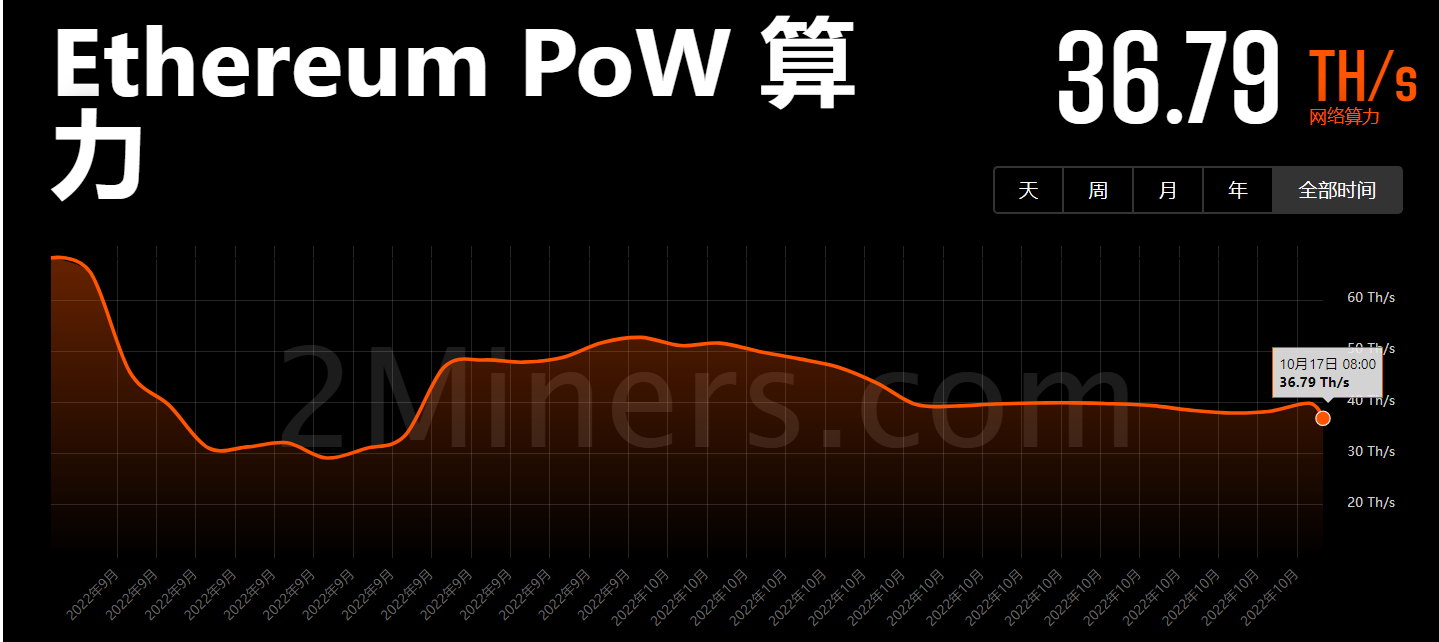

ETH POW

Introduction: As a fork chain of the original Ethereum, ETH POW inherits the consensus mechanism of POW and modifies the setting of the difficulty bomb, so that the original Ethereum miners can directly migrate over for mining. As a public chain, ETH POW lacks With stable coins such as USDT/USDC and the support of DEX, lending and other project parties, neither ecological development nor the number of developers can pose a threat to ETH POS, but it also undertakes part of the original Ethereum’s computing power (about 4.32 %).

Current computing power: 36.79TH/S

The increase (decrease) of computing power: Compared with the initial computing power of 68.17TH/S,At present, the computing power of the entire network has decreased by 31.38TH/S, a drop of 46%.

image description

ETHW computing power change data source: 2miners

Ravencoin

Introduction: Ravencoin is a blockchain platform mainly for token asset transactions, which was forked from Bitcoin in September 2017. Since the merger of Ethereum in early September, the price of Ravencoin has risen by nearly 2 times, and then with the decline of the token price, the computing power has also declined accordingly, and the current computing power is floating around 15TH/S.

Current computing power: 14.9TH/S

The increase (decrease) of computing power: During the merger period, the computing power rose from 2.6TH/S in early September to the highest 20.16TH/S, with a maximum increase of 675.3%.

image description

Ravencoin computing power change data source: 2miners

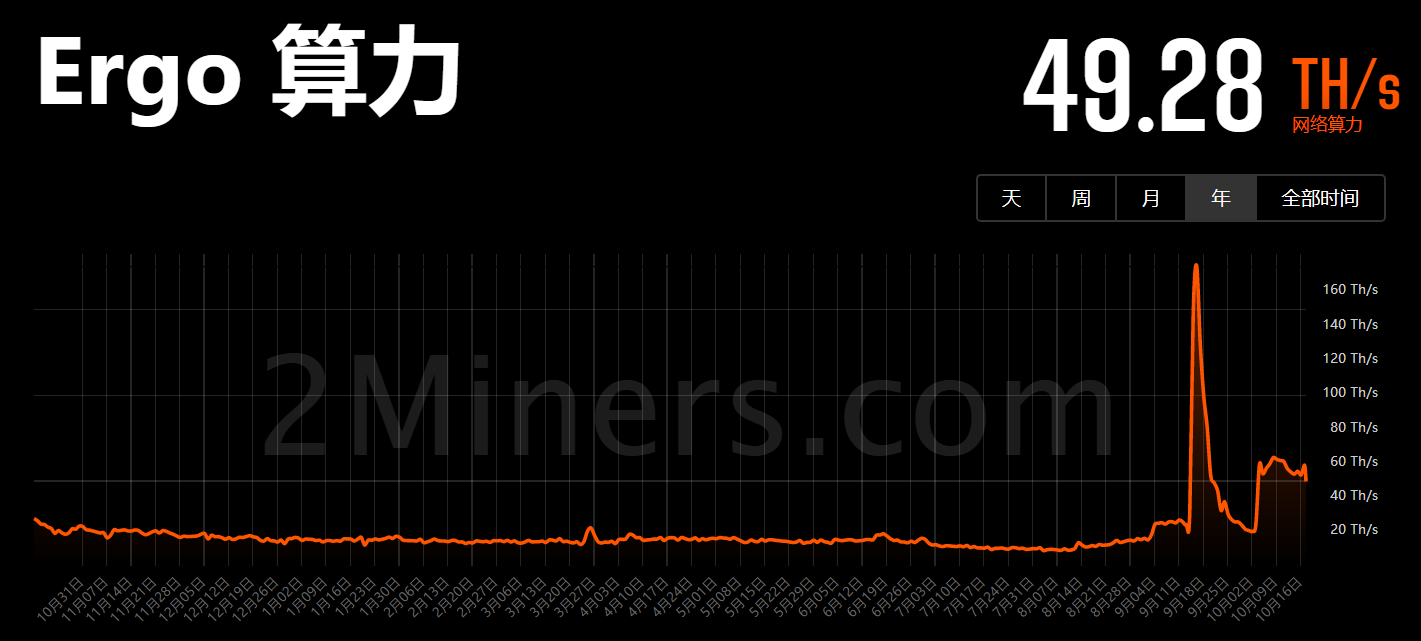

Ergo

Introduction: Ergo is an Autolykos-based consensus mechanism (a type of POW) smart contract platform, with various scripting languages and zero-knowledge proofs as the core, supporting various new financial interaction models.

Current computing power: 58.8TH/S

The increase (decrease) of computing power: During the merger period, the computing power rose from the initial 15.23TH/S to 175.11TH/S, an increase of 10 times. In the next half month, the computing power moved out on a large scale, and once dropped to 20.23TH/S, which almost wiped out the previous increase. The current computing power is stable at around 50TH/S.

image description

Ergo computing power change data source: 2miners

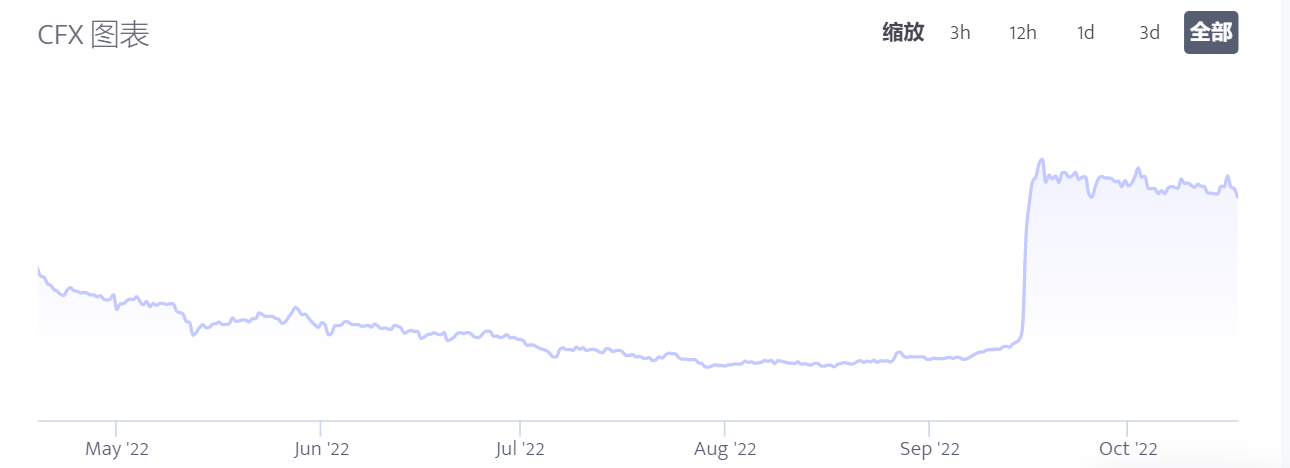

Conflux

Introduction: Treemap (Conflux) is a domestic public chain, which realizes the further development of the public chain in terms of transaction throughput (TPS) and confirmation time through the treemap structure consensus algorithm. As early as August 10, Conflux initiated a community proposal, hoping to change its own PoW mining algorithm to Ethash, so that Ethereum miners can switch to Conflux more easily.

Current computing power: 2.97TH/S

The increase (decrease) of computing power: from 1.03TH/S before the merger to 3.29TH/S after the merger,329% increase, the current computing power is stable around 2.8TH/S, and there is no obvious phenomenon of computing power fleeing after the merger, which is also different from other projects.

image description

Data source of conflux computing power change: minerstat

Summarize:

Summarize:

Through the changes in the above public chain computing power diagram, we can summarize the following conclusions:

1-3 days before the merger of Ethereum, the computing power on Ethereum fled on a large scale, and began to look for new targets that could be mined, and created the peak computing power of the above-mentioned public chains on the day of the merger.

After the computing power moved in, the degree of retention of computing power varies. Basically, within 3-5 days after the merger, the computing power of the above-mentioned public chains began to flee again, which also shows that the mining sustainability of these small coins It is not friendly, neither ETC nor ETHW can achieve the continuous mining income of the original Ethereum.

Within 3-5 days after the merger, the market began to decline, and the currency prices of the above-mentioned projects showed a trend similar to that of computing power, which further demonstrated that currency prices will determine changes in computing power.

If the computing power increased by the above-mentioned public chains from September 1st to October 15th is calculated, it can be roughly estimated that the computing power flowing out of Ethereum is about 250TH/S, accounting for the original computing power of Ethereum. 29%, that is to say, about 60% of Ethereum’s computing power has withdrawn from the mining market or is still in the wait-and-see stage. As a representative of graphics card mining, the withdrawal of such a large computing power of Ethereum will naturally affect the graphics card market. According to Northeast Securities estimates, in the past, 17 million 3060-level cards or 42 million 1060-level cards were used for mining (mainly used for Ethereum), which means that 60% of the withdrawal of Ethereum’s computing power will bring about more There are tens of millions of graphics card selling pressure, superimposed bear market and lower environmental demand, the downward cycle of this round of graphics card market may be very long.

At present, with the large-scale application of POS, there are fewer and fewer mining targets that support physical mining machines. In addition to the increase in DAPP application scenarios, the public chain under the POW mechanism is limited by insufficient performance. The competition is more difficult. If BTC is excluded, the future mining machine market may shrink further.