14 indicators to see the changes in the blue-chip DeFi market in the past 90 days

Original compilation: PANews

Original compilation: PANews

In the crypto bear market, although many things seem to be calm, there are actually some places with dark tides, such as the DeFi ecosystem. The status of the blue-chip DeFi market may surprise you.

Next, let us understand the changes that have taken place in the blue-chip DeFi market in the past 90 days from the following 14 indicators.

1. Price

For most of the leading DeFi projects, the past year has been difficult. In terms of US dollars, the prices of many DeFi projects have dropped to varying degrees, such as:

Compound: -82%

Yearn Finance: -77%

Balancer: -76%

Aave: -74%

Uniswap: -74%

Curve: -69%

Convex: -65%

Lido:- 64%

Maker: -61%

2. Total lock-up amount

As of October 14, the total lock-up volume of DeFi is about 51.35 billion US dollars. The top ten Dapps with lock-up volume in the past 90 days are as follows:

Maker: $8.1 billion

Lido: $6.8 billion

Aave: $6.2 billion

Curve: $5.8 billion

Uniswap: $5.7 billion

Convex: $4.1 billion

PancakeSwap: $3 billion

Compound: $2.6 billion

Balancer: $1.5 billion

3. Reserve treasury

Treasury is the total dollar value of funds held on the protocol chain (including unallocated governance tokens). Currently, the largest reserve is UniSwap, and its average reserve size in the past 90 days is about 30 One hundred million U.S. dollars. This is followed by ENS with USD 1.1 billion, LidoFinance with USD 330 million, Compound and Aave with USD 160 million.

4. Dapp income

Revenue is defined as the share of fee revenue going to the protocol reserve or directly to token holders, over the last 90 days:

OpenSea ranks first with $34 million in revenue

DYDX: $22 million

PancakeSwap: $17 million

SNX: $14 million

ENS: $12 million

5. DApp fees

In the past 3 months, the amount of fees paid by the following DApp users are:

Uniswap: $144 million

OpenSea: $140 million

Lido: $76 million

Convex: $56 million

PancakeSwap: $52 million

Aave: $33 million

GMX: $29 million

DYDX: $22 million

Synthetix: $14 million

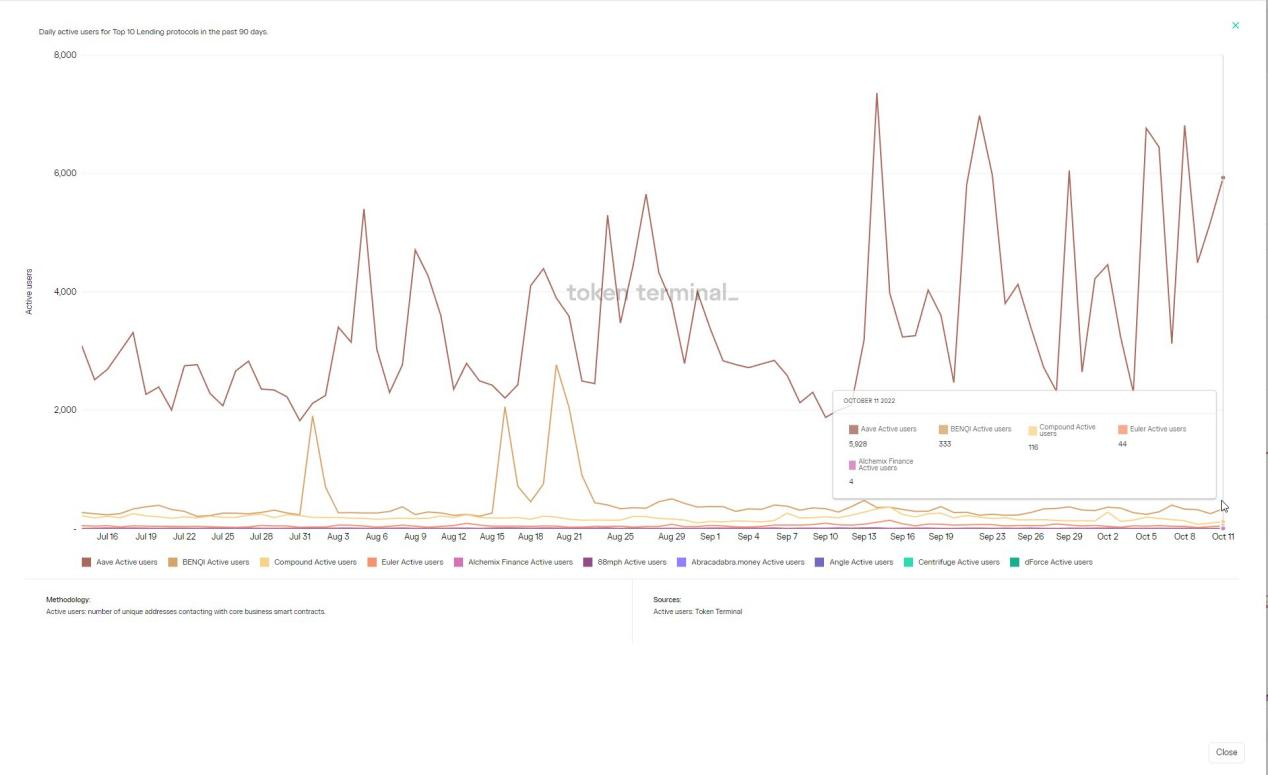

6. Active users of the lending agreement (the past 90 days)

Over the past 3 months, the number of unique addresses interacting with the lending protocol has grown by 77%, from 3,626 users to 6,425.

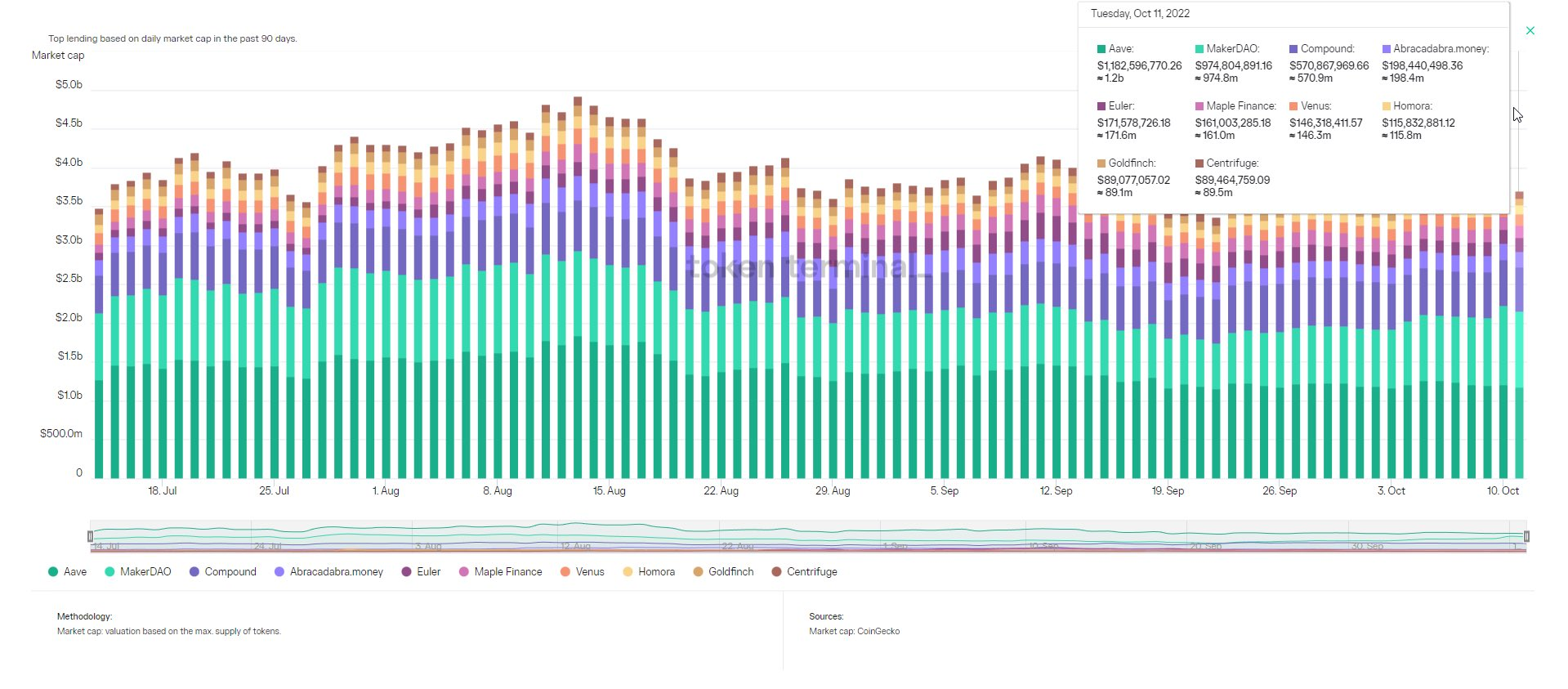

7. Market value of lending agreement

The total market value of the current cross-lending agreements is about 3.75 billion US dollars, and the market value of each agreement is as follows:

Aave: $1.2 billion

Maker: $974 million

Compound: $570 million

Abracadabra money: $200 million

Euler: $171 million

Maple: $161 million

Venus: $146 million

Homora: $115 million

Goldfinch: $89 million

Centrifuge: $89 million

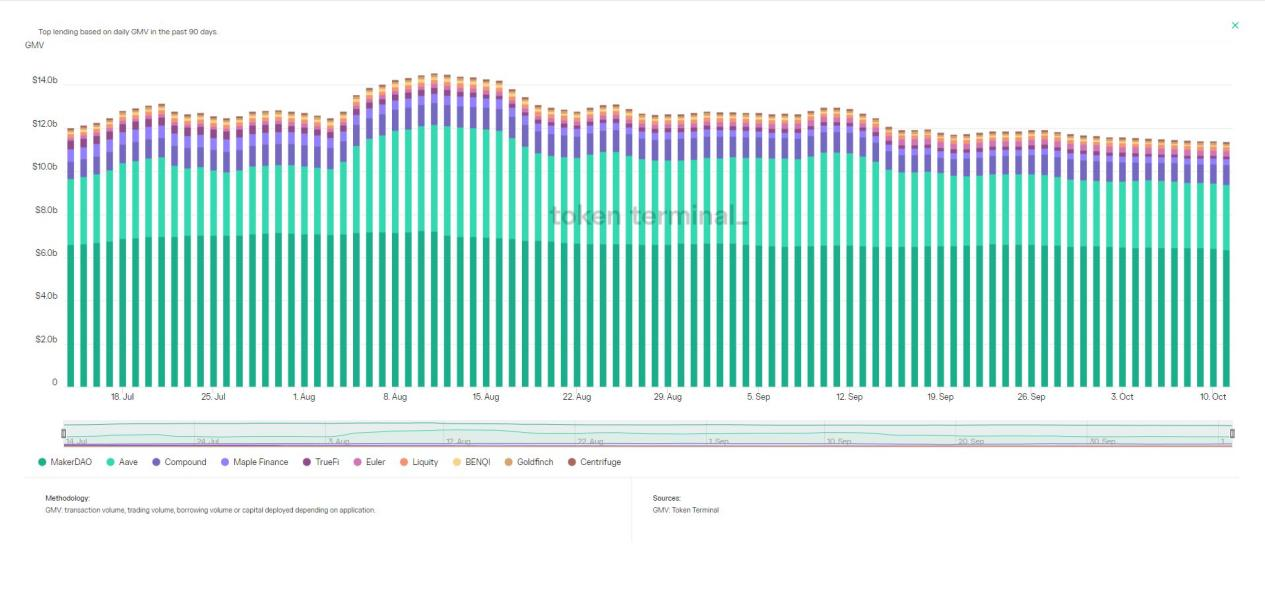

8. Loan amount of head lending agreement

The outstanding borrowing amounts of the current cross-loan agreements are as follows:

Maker: $6.4 billion

Aave: $3 billion

Compound: $900 million

Maple: $275 million

TrueFi: $122 million

Euler: $255 million

Liquidity: $174 million

BENQI: $68 million

Goldfinch: $99 million

Centrifuge: $79 million

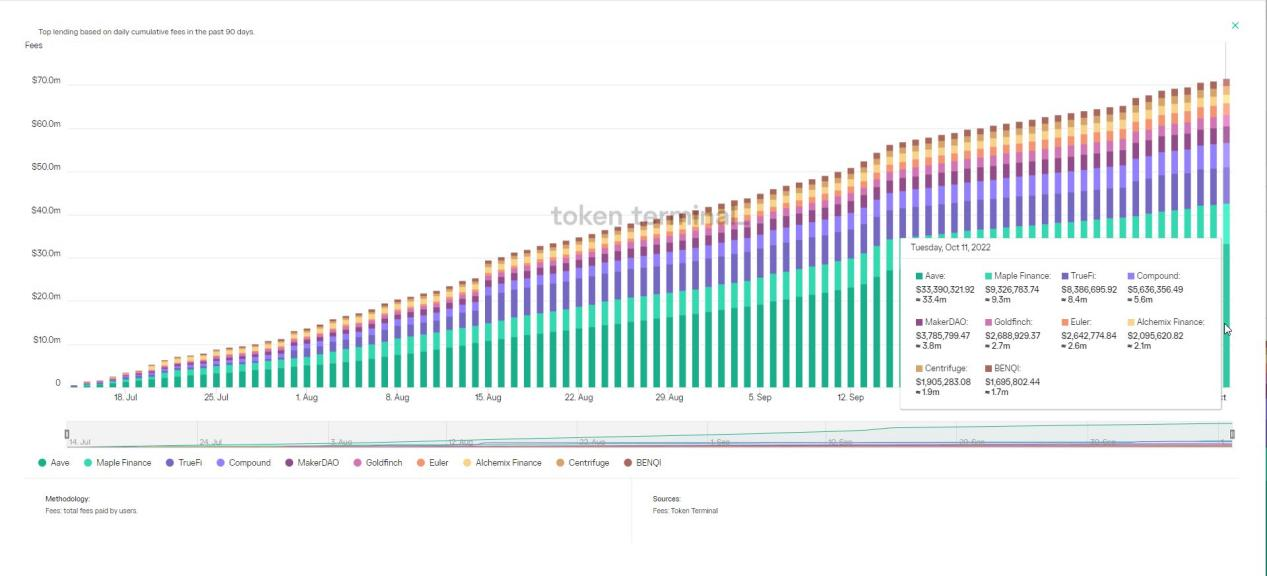

9. The total amount of fees paid by the user on the lending agreement (in the past 90 days)

The total amount of fees paid for each agreement is as follows:

Aave: $33 million

Maple: $9.3 million

TrueFi: $8.4 million

Compound: $5.6 million

Maker: $3.8 million

Goldfinch: $2.7 million

Euler: $2.6 million

Alchemix: $2.1 million

Centrifuge: $1.9 million

BENQI: $1.7 million

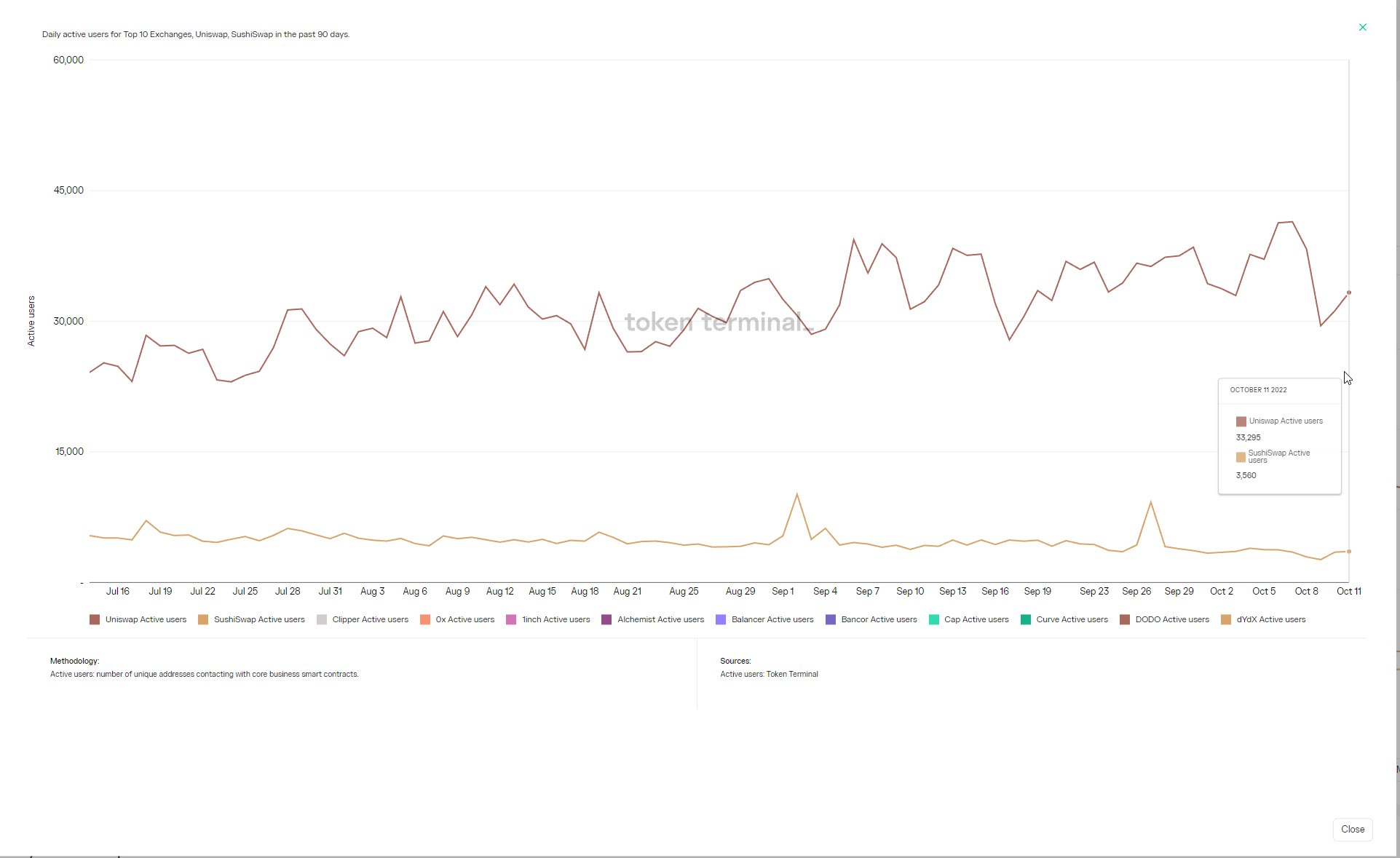

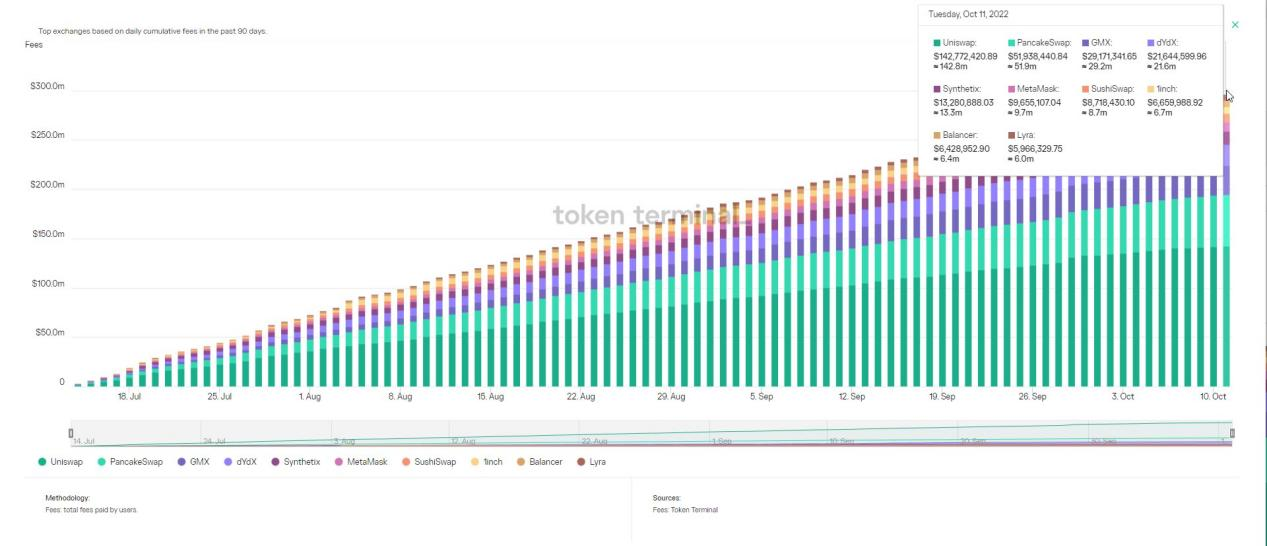

10. Active user blocks of SushiSwap and Uniswap (last 90 days)

SushiSwap, like Uniswap, is struggling to retain users. Currently, Uniswap has 33,295 active users. This is a 38% increase from 3 months ago. The situation is different for SushiSwap, which currently has 3,560 active users, a drop of 34% from 3 months ago.

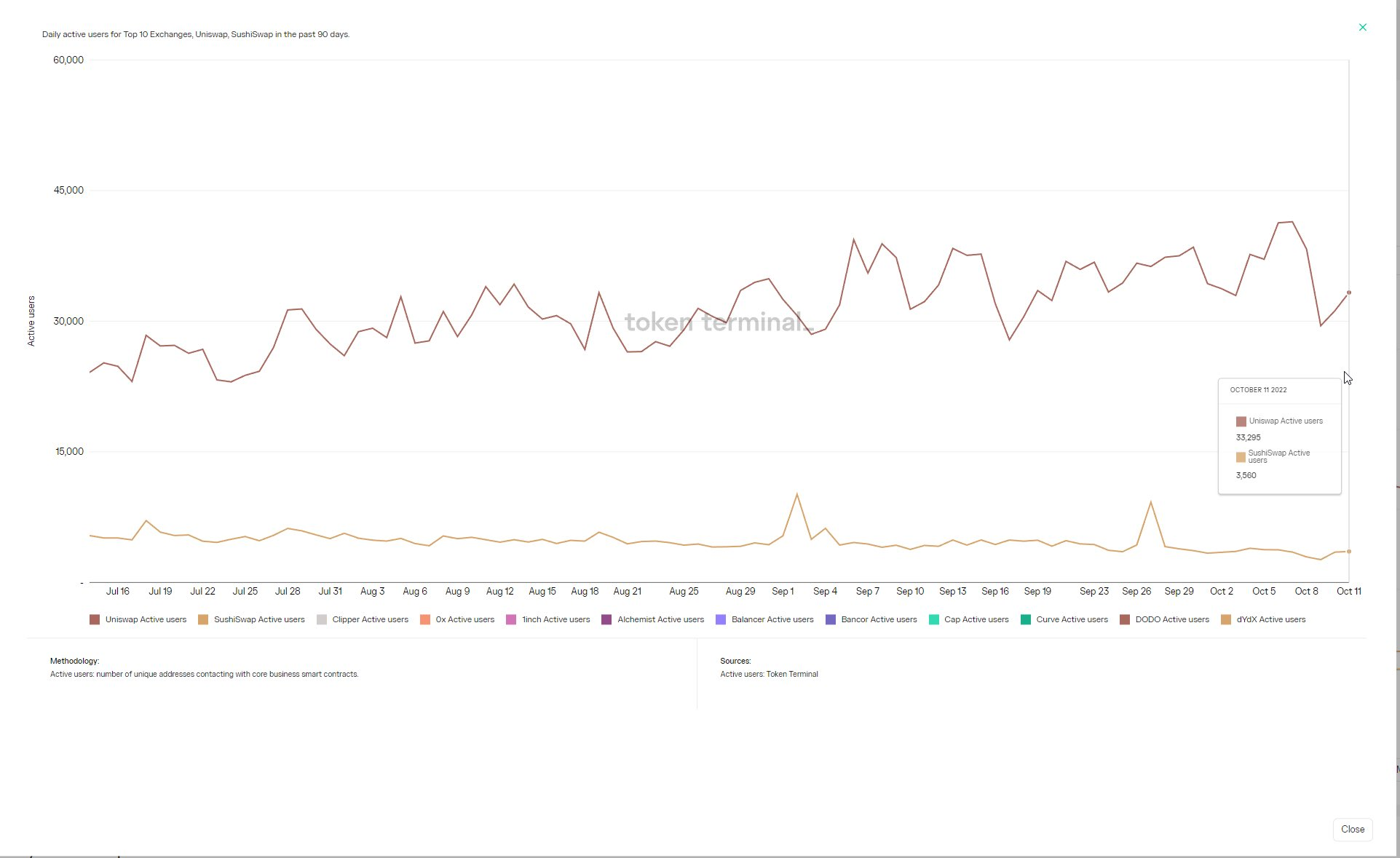

11. Cumulative trading volume of top DEXs (in the past 90 days)

Uniswap: $115 billion

dYdX: $86 billion

PancakeSwap: $21 billion

GMX: $19 billion

Curve: $8.5 billion

Balancer: $6 billion

Synthetix: $4.1 billion

SushiSwap: $2.9 billion

0x: $2.1 billion

Perpetual Protocol: $1.9 billion

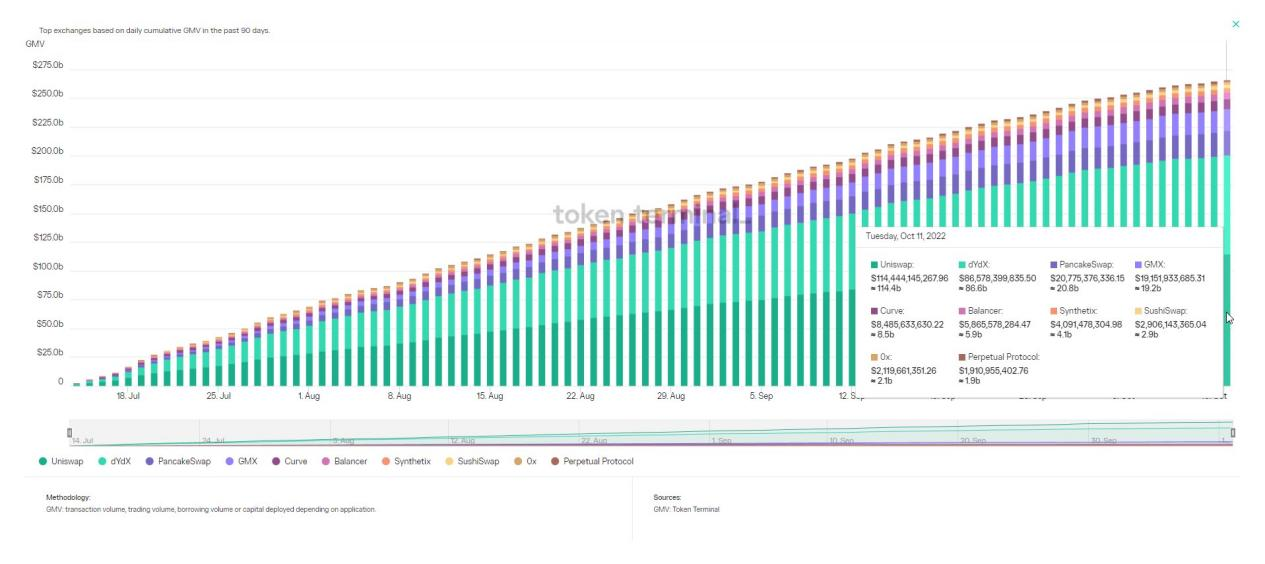

12. Cumulative fees paid by users on DEX (in the past 90 days)

Uniswap: $142 million

PancakeSwap: $52 million

GMX: $29 million

dYdX: $22 million

Synthetix: $13 million

MetaMask: $9.7 million

SushiSwap: $9 million

1inch: $6.7 million

Balancer: $6.4 million

Lyra: $6 million

13. Total transaction amount (last 90 days)

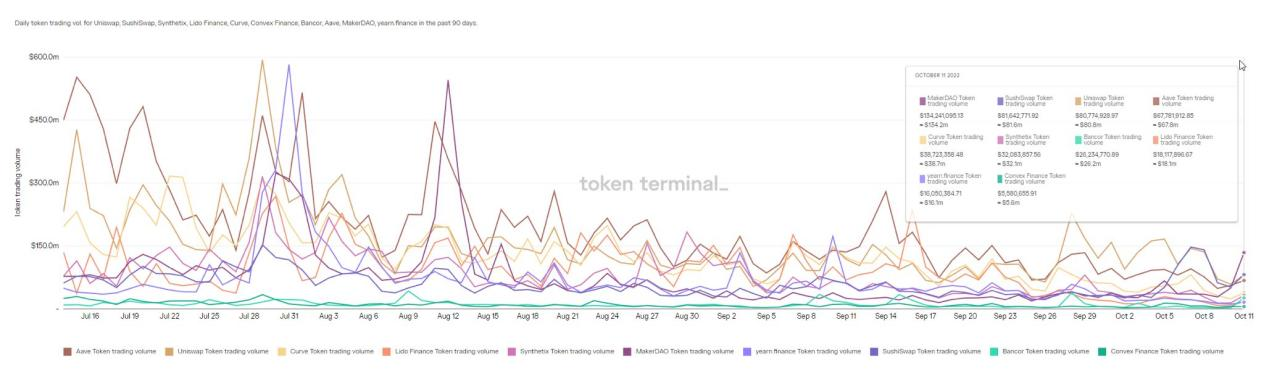

As expected, with the increasing volatility of the crypto market, the trading volume of DeFi tokens has also declined significantly. In the past 90 days, the trading volume of top DeFi tokens has plummeted from $1.3 billion to $500 million, a drop of as much as 62%.

14. Number of token holders (last 90 days)

Despite the decline in token prices and volatility over the past 3 months, the number of token holders in popular DeFi projects has maintained a steady upward trend, as shown in the chart below: