Looking at the investment landscape of Binance Labs, which projects with low market capitalization are worthy of attention?

After several personnel adjustments, He Yi officially took charge of Binance Labs, a venture capital department that manages $7.5 billion, since August. As the co-founder of Binance, He Yi personally took charge of the investment department, which shows how much Binance attaches importance to the investment layout of Binance Labs in the future.

first level title

Binance Labs' Investment Landscape

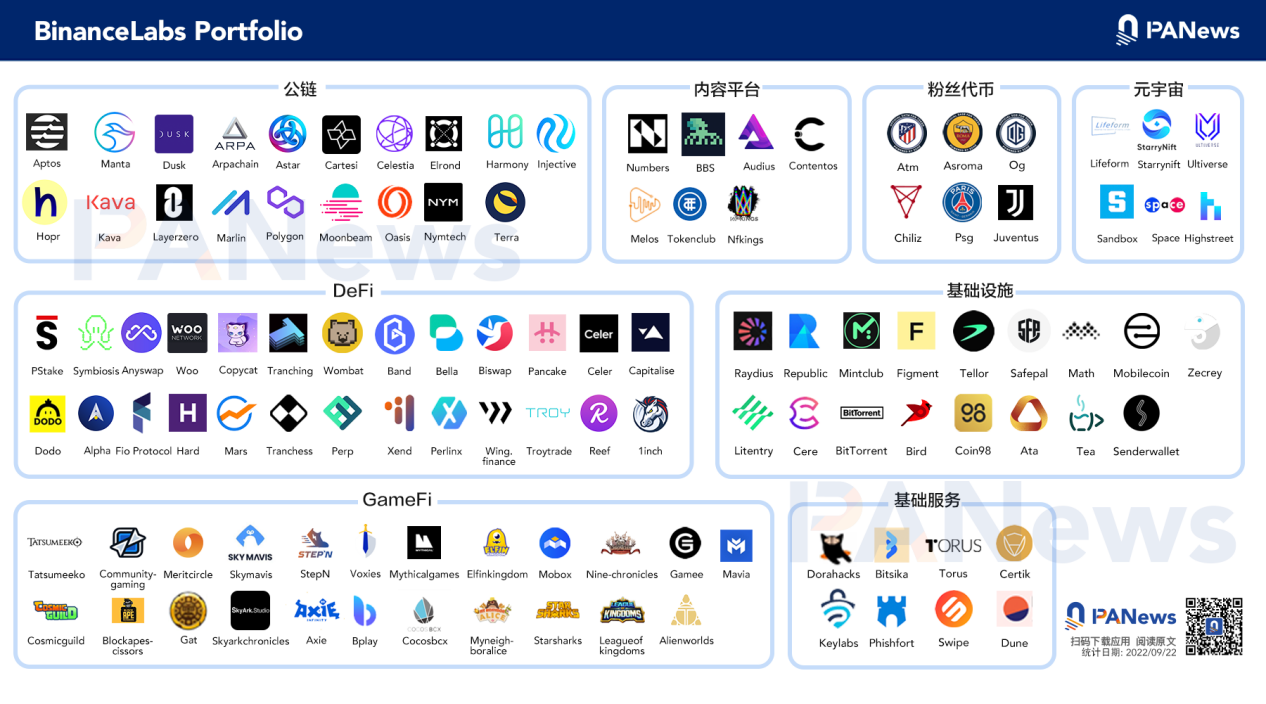

According to the official website of Binance Labs, since 2018, Binance Labs has invested in 121 projects from more than 25 countries through three stages of incubation, early venture capital and late growth. The investment sector involves infrastructure, DeFi , NFT, games, Metaverse, social and encrypted asset trading platforms. Its portfolio includes many Binance investments that have grown into industry-leading projects such as 1inch, Audius, Axie Infinity, Dune Analytics, Polygon, The Sandbox, and StepN.

In addition to direct investments in Binance Labs, Binance also invests indirectly in projects through the BSC’s Ecological Funding Program.

In January 2021, Binance Smart Chain (BSC) launched a quadratic funding program, BSC grants, on the DoraHacks blockchain developer platform HackerLink. The plan supports developers and ecological projects. Developers from all over the world can submit new projects based on BSC through HackerLink. The community uses BNB for quadratic voting, and the voting results will ultimately determine the distribution of the bonus pool.

There are currently 216 submitted projects, involving sectors such as DAO, NFT, Metaverse, GameFi, innovative infrastructure, and education. Pancake, an indispensable decentralized trading platform in the Binance Smart Chain ecosystem, is one of the previous projects.

In February 2021, Binance launched the Most Valuable Developer (MVB) Accelerator Program with a US$100 million fund. The main purpose of the program is to connect the two fields of DeFi and CeFi, help high-quality entrepreneurial projects on the Binance Smart Chain to carry out more innovative changes, gain mature industry experience and financial support, and accelerate the collaborative development of communities and projects. Participating projects have access to funding (ranging from $10,000-2 million) and expert support, as well as access to resources from the growing Binance Smart Chain ecosystem.

The current MVB program has been carried out for 27 seasons, and thousands of projects have been submitted. Among the projects incubated, many high-quality projects have also obtained the qualifications for listing on Binance, bringing super high returns to early users. Such as cross-chain infrastructure Biconomy, MOBA game Mobox, MMORPG game BinaryX with DeFi elements, etc.

first level title

Projects with low current market capitalization after Binance investment

secondary title

pSTAKE Finance

Launched in August 2021, pSTAKE Finance, built by Persistence, is a protocol that solves liquidity for pledged assets, unlocking the true potential of PoS tokens by releasing the liquidity of pledged assets. pSTAKE allows its users to exit staking positions immediately without having to wait for the entire unlock period.

Token holders of pSTAKE-backed PoS networks can deposit their assets into pSTAKE to initially mint 1:1-pegged ERC-20 derivative tokens and use them within the existing Ethereum DeFi ecosystem for maximum profit. Minted derivatives can scale to multiple chains depending on factors such as liquidity, usage, etc. Assets stored on pSTAKE are multi-signatured by a group of whitelist verifiers.

pSTAKE currently supports the liquid staking of ATOM and XPRT, and launched a liquid staking for ETH2.0, which currently supports BNB chain and Ethereum, and will support Solana and Avalanche networks in the future. The official Twitter followers are 39K, and the number of Discord users is 11K. According to defillama data, the value of assets pledged through the platform is currently about 21 million US dollars.

On November 17, 2021, pSTAKE completed a strategic financing of US$10 million, led by Three Arrows Capital, Sequoia India, Galaxy Digital and Defiance Capital, with participation from Coinbase Ventures and Tendermint Ventures. On May 10, 2022, Binance Labs announced a strategic investment in pSTAKE.

PSTAKE tokens are pSTAKE protocol governance and incentive tokens. Users can pledge PSTAKE to obtain incentives, while ensuring network security and preventing stakeholders from doing evil. pSTAKE was publicly offered on Coinlist at a price of US$0.4, and the current price in the secondary market is US$0.16 recently. According to CoinmarketCap data, its circulating market value is 7 million US dollars, and its full circulation market value is 79 million US dollars.

secondary title

Official website:https://pstake.finance/

Voxies

Voxies is a free 3D turn-based tactical RPG game built on the Polygon blockchain. The main gameplay of Voxies is similar to traditional RPG and tactical games, players can control multiple characters in the game, explore the virtual world of Voxtopia through NFT or challenge other users in the PVP arena. Upon winning, players receive VOXEL tokens and in-game NFT rewards.

Voxies was launched by AlwaysGeeky Games in the fourth quarter of 2021. The AlwaysGeeky Games team members have more than 15 years of experience in the game development industry. Members come from EA, Warner Bros. and Ubisoft, and participated in the construction of the "Assassin's Creed" series, "Farcry" series, Mortal Kombat 11 and the Harry Potter games. At present, the official Twitter followers are 60K, and the number of Discord users is 10K.

The main demand for its token Voxel comes from the Voxies in-game equipment trading market, equipment production, and PvP battles. Voxel will be listed on Binance Launchpad on December 6, 2021, with a total fundraising of US$6 million. The public sale price is 0.2U, and the current price in the secondary market is 0.28U.

secondary title

Official website:https://www.voxies.io/

Symbiosis Finance

Symbiosis is a decentralized multi-chain liquidity protocol that aggregates the liquidity of decentralized exchanges in all EVM and some non-EVM networks. It aims to solve two problems: liquidity fragmentation between different chains, and poor user experience when using DeFi and Web3 ecology.

Symbiosis helps users find the most suitable cross-chain bridge, and users can perform any encrypted token exchange across multiple blockchains with just one click. Currently, the protocol supports 7 networks including BNB Chain, Ethereum, Polygon, Avalanche, Aurorr, Telos, and Boba, and more networks will be expanded in the future. According to defillama data, the value of assets pledged through the platform is about 4.77 million US dollars, the number of official Twitter followers is 77K, and the number of Discord users is 24K.

Its founder, Will, was a partner of SDT group. CTO Alexey has five years of experience in encryption technology development and was an engineer of SDT group. CMO Nick was in charge of early marketing at the encryption bank Axinetria.

On October 22, 2021, Symbiosis Finance completed $2 million in financing, led by Blockchain.com Ventures and Spartan Group, with participation from KuCoin Labs, Injective Labs, and DAO Maker. On February 18, 2022, Binance Labs made a strategic investment in Symbiosis Finance.

Its token SIS is the governance token of Symbiosis DAO and treasury. At the same time, relay network nodes must hold SIS to participate in consensus and process transactions. Symbiosis will be sold on DaoMaker on November 25, 2021 at a price of $0.8. In addition, $0.2 for the seed round, $0.5 for the private placement round, $0.75 for the strategic round, $1 for the public sale on other platforms, and $0.21 for the SIS secondary market.

secondary title

Official website:https://symbiosis.finance/

Astar Network

Astar Network is a smart contract platform on the Polkadot ecosystem, supporting Wasm, EVM and two-layer solutions at the same time. Polkadot Relay Chain does not support smart contracts. In order to allow all developers who want to build in the Polkadot ecosystem to do what they want, Astar supports EVM and creates a parachain where EVM and WASM smart contracts can coexist and communicate with each other , to provide the best solution for all developers.

Astar's development company is Stake Technologies, which has many resources in the Internet industry. Microsoft Japan provides Astar with services such as Azure, infrastructure support such as Microsoft's global network, and human resources such as entrepreneurs and blockchain engineers.

In February 2021, Astar Network received a $10 million seed round investment led by Binance Labs. In June 2021, Astar Network received a US$10 million strategic round investment led by Fenbushi Capital. In January 2022, Astar Network completed a US$22 million strategic round of financing. Participants include institutions such as Polychain Capital, Alameda, Research, Alchemy Ventures and industry-leading protocol founders.

According to the official announcement of Astar Network, on January 29, 2022, the value of its total locked assets will reach 400 million US dollars. According to defillama data, the current total lock-up value is 36.6 million US dollars. The current official Twitter followers are 360K, and Discord users are 140K.

According to the information on Astar’s official website, 50% of the current total tokens have been pledged, and the number of holders is 450,000. The utility of its token ASTR is on-chain transaction fees, on-chain voting governance, rewards for staking, Layer 2 application developers make deposits and create applications, with an annual inflation rate of 10%.

secondary title

Official website:https://astar.network/

Numbers Protocol

Numbers Protocol is a decentralized image network designed to create community, value and trust for digital media, enabling users to claim and retain ownership of their data. Specifically, use IPFS to store data, so that each registered picture or video has the creator's signature, ownership certificate, space-time information, and complete transaction records, so that the picture or video can be traced and verified, and protect the copyright of the creator. Monetization of digital image assets becomes possible.

Tammy Yang is the co-founder and CEO of Numbers Protocol, a Ph.D. in particle physics from the University of Manchester, and was the CEO and founder of DT42. Bofu Chen is the co-founder and CTO, one of the top five open source developers in Taiwan, with many years of experience in data engineering, embedded systems, artificial intelligence, and the Internet of Things. The current official Twitter followers are 116K.

On October 21, 2021, Numbers Protocol completed a US$6 million private equity seed round of financing, of which the private equity investors were Protocol Labs and DAO Maker, and the seed round investors were Binance, YouTube co-founder Steve Chen, and Twitch co-founder Kevin Lin wait.

secondary title

Official website:https://www.numbersprotocol.io/

BBS Network

BBS Network is a blockchain-based forum, all key data is stored on the chain, and each post is an NFT, which is anti-censorship and keeps the network open. Its founder is the co-founder of Bancor. The official Twitter follower count is 34K.

BBS tokens can be used to purchase advertising space across the network and can also be used for network governance. Users can mine by generating verifiable participation on the BBS network. Rewards are issued based on the user's contribution and weighted according to the influence of the user on traditional social media to motivate more people to migrate. Advertising revenue is automatically distributed among post publishers, content curators and forum moderators.

BBS token holders have full control over the project through the BBS DAO, such as resource allocation (rewards), product roadmap (features), and BBS token economics (issue and burn).

secondary title

Official website:https://www.bbsnetwork.io/

1inch Network

1inch Network is a one-stop access to decentralized financial protocol, launched in May 2019, which brings together the liquidity of various decentralized exchanges to help users trade at a more favorable price. According to the information on the official website, the total transaction volume so far is 245 billion U.S. dollars, the total value of protocol liquidity provision is 53 million U.S. dollars, and the official Twitter followers are 1043K.

In August 2020, 1inch Network completed a $2.8 million seed round of financing led by Binance Labs with participation from other institutions such as FTX, Galaxy Digital, and Dragonfly Capital. In December 2020, 1inch Network received US$12 million in investment from institutions such as Pantera Capital, ParaFi Capital, and Nima Capital. On December 1, 2021, 1inch Network completed its Series B round of financing of US$175 million. Amber Group led the investment, and Jane Street, VanEck, Fenbushi Capital, Alameda Research and others participated in the investment. The post-money valuation reached US$2.25 billion.

Its token 1INCH governance and utility tokens are mainly used in the 1inch liquidity protocol to achieve efficient routing connectors.

According to the 1inch economic model, 2.3% is used for initial financing, 18.5% is used for the first round of financing, and 12.2% is used for the second round of financing. According to the disclosed financing amount, it can be estimated that the seed round financing price is 280/(150000*2.3%)=0.08 USD, the A round financing price is 1200/(150000*18.5%)=0.04 USD, and the B round financing price is disclosed as 1.5 US dollars, the current price of the secondary market is 0.61 US dollars.

secondary title

Official website:https://1inch.io/token/

Cere Network

Cere Network is a decentralized data cloud platform, founded in 2018, to provide all businesses and consumers with a trustless, scalable global decentralized ecosystem. It provides the world's first customer relationship management (CRM) blockchain ecosystem in the Distributed Data Cloud (DDC), which is optimized for service data integration and data collaboration, and built on the Polkadot ecosystem.

Cere's approach to enterprise data has similarities to the successful cloud data platform Snowflake in providing direct access to first-party customer data. Cere optimizes existing models by anonymizing and encrypting (individual-level) customer data via blockchain, enhances its data value flow via DDC, and enables enterprise-favored GDPR and CCPA compliance. It serves content creators, game developers, consumer brands, and more. Its official Twitter currently has 109K followers.

Cere Network completed its first financing of US$3.5 million in August 2019, led by Binance Labs. On March 11, 2021, a US$5 million private equity round of financing led by Republic Labs was completed. On April 21, 2021, $1 million will be raised through a public sale on DAO Maker. On September 9, 2021, $31 million in financing was obtained, led by Republic and Polygon.

Its token, CERE, is a utility token that facilitates payments for businesses in the Cere decentralized data marketplace and SaaS-DeFi ecosystem. At the same time, it is also used for proof of stake and on-chain governance.

secondary title

Official website:https://cere.network/

Melos Studio

Melos Studio is a blockchain-based music creation platform serving musicians and music creators, established in Taiwan in 2020. It supports secondary creation, and has stronger DeFi and community autonomy attributes. All music on Melos Studio can be listened to for free. NFT holders have no special rights such as intellectual property rights, only the right of personal use and transfer. The team is from Taiwan, and the co-founders Yalu and Jim have work experience in music, blockchain industry and many other fields.

Melos Studio's NFT trading market currently has a total transaction volume of 18 million US dollars, with 150K official Twitter followers and 82K Discord users.

On October 22, 2021, Binance Labs announced its investment in Melos Studio. Previously, Dapper Labs, Innovion, NGC Ventures and Multichain Capital participated in the financing of Melos Studio, and the specific financing was not disclosed. On January 21, 2022, Binance Labs and Genblock Capital led a financing of US$5.5 million, and participating investors included Animoca Brands, Delphi Digital, etc. On March 1, 2022, the public sale will be held on Tokensoft, raising 500,000 US dollars.

50% of the income generated by its official market is used to burn Melos tokens, and 50% is used for charity, selected and executed by Melos DAO. 30% of its tokens are mined by users and distributed in 10 years.

secondary title

MobileCoin

MobileCoin is an encrypted currency system dedicated to mobile payment. It has features such as private payment and instant transactions, and is integrated into IM tools and social platforms. Founded in 2017, the test network was launched in April 2020, and the main network was launched in December. It is designed to be used for daily transactions on the mobile terminal, and is currently connected to two major communication software, Signal and Mixin Messenger. The number of official Twitter followers is 18K.

Joshua Goldbard is its CEO and co-founder, and previously served as a managing director at an encryption hedge fund. Sarah Novotny worked at Google, led and formed the Open JS Foundation, and is a leader in open source culture. Dr. David Bray worked in the U.S. government as a senior director of the National Intelligence Agency, won the National Intelligence Medal for Excellence in Achievement, and was named one of the "24 Americans who changed the world" under the age of 40 by "Business Insider". Renée DiResta is a technology research manager at the Stanford Internet Observatory and a fellow in the Truman National Security Project. Moxie Marlinspike, founder of the well-known encrypted communication application Signal, is the technical advisor of the project.

In April 2018, MobileCoin received USD 30 million in financing led by Binance labs, with Zhen Fund, Danhua Capital and other institutions participating in the investment. On March 10, 2021, MobileCoin raised a new round of financing of US$11.35 million, with participation from Future Ventures, General Catalyst and other institutions. On August 18, 2021, MobileCoin completed a US$66 million Series B financing at a valuation of US$1.066 billion, which will be used to develop stable coins, a new encrypted chatbot business payment system, and the application promotion of MobileCoin. Alameda Research and Coinbase Ventures participated in the round.

secondary title

Official website:https://mobilecoin.com/

Nymtech

Nym is a"full stack"With the privacy system, developers can hook their existing applications to the Nym system, protect their users at the network level through the Nym mixnet, and protect them at the application layer through Nym's private credentials. Nym mixnet provides privacy at layer 0, adding metadata protection to other blockchain and crypto projects at layer 1 (such as Bitcoin and Ethereum) and layer 2 (including most DeFi projects).

Nym was designed by research scientists and developers at MIT, KU Leuven, and University College London. Its CEO is Harry Halpin, who received a doctorate in artificial intelligence from the University of Edinburgh and was a member of Tim Berners-Lee's W3C team; Claudia Diaz, chief scientist and professor of privacy technology, pioneered how to measure anonymity and design anonymous communication networks method. At present, Nym's official Twitter followers are 50K.

In May 2019, it received US$2.5 million in seed round investment from well-known institutions such as Binance Labs, NGC, and 1kx. On July 16, 2021, $6 million in Series A financing was completed, led by Polychain Capital. On November 17, 2021, a US$13 million Series B financing was completed at a valuation of US$270 million, led by a16z, and DCG, HashKey, Fenbushi Capital and other institutions participated in the investment. On February 25, 2022, Nym raised $30 million through the Coinlist token sale. On May 2, 2022, Nym received a USD 300 million ecological fund commitment, with supporters including Polychain, a16z and many other institutions. The fund will be used to attract developers to its ecosystem, with individual grants ranging from $50,000 to several million dollars.

Its token, NYM, is a utility token that rewards mixing nodes for providing privacy to users of the Nym network. Users will use NYM tokens to access the mixnet and send data through it. Mixing nodes are rewarded based on their performance and the amount of NYM bound to their nodes. According to its economic model, by February 2024, its circulation will reach more than 80%.

secondary title

Official website:https://nymtech.net/

Xend Finance

The Xend Finance decentralized credit union agreement aims to optimize, improve and add value to the core business of the global credit union, remove the obstacles of traditional finance, and provide decentralized storage, lending and investment services of the credit union.

Xend Finance automates behaviors such as credit unions and personal storage through smart contracts, which regularly invest user deposits in DeFi lending protocols, such as Compound, AAVE, etc. The system charges a small fee to the credit union to create the union, and in each full storage cycle, the fee is paid in XEND, and a certain percentage of the fee is burned. The protocol currently supports the Ethereum network, Binance Smart Chain and Polygon Chain.

Aronu Ugochukwu is the CEO and co-founder of Xend Finance. He also founded Wicrypt and Ugarsoft, and co-founded Ogwugo. Abafor Chima is the CTO and co-founder of Xend. Before that, he worked at Ogwugo, Ugarsoft, ByteWorks Technology Solutions, and Chevron.

Xend Finance participated in the Google Launchpad Africa accelerator and the Binance incubation program in 2019, and subsequently received US$2 million in financing from NGC Ventures, Hashkey and other institutions. Its official Twitter followers are 68K.

Its token XEND provides incentives for decentralized storage and cross-chain aggregator agreements, and is also used to purchase insurance and protect assets within the agreement. Its seed round pre-sale is $0.005, seed round is $0.025, strategic first round is $0.045, private placement is $0.06, public offering is $0.075, strategic second round is $0.075, and the current price in the secondary market is $0.028. According to the information on the official website, the tokens sold for financing have been fully circulated.

first level title

Official website:https://xend.finance/

Binance Labs Future Investment Direction

In June 2022, Binance Labs completed the fundraising of a US$500 million investment fund, and received participation from global investment institutions including DST Global Partners and Breyer Capital.

According to Changpeng Zhao, founder and CEO of Binance, the goal of the investment fund is to discover and support projects and founders who have the potential to build and lead Web3 in DeFi, NFT, games, Metaverse, social and other fields.

He Yi, the new head of Binance Labs, also mentioned that his vision is to promote the popularization of Web3 and blockchain technology by "establishing blockchain industry standards". There will be a focus on investing in founders who are more capable, long-term thinking and have a role in shaping the future of the industry. Its goal is to help define industry standards by identifying sustainable projects and providing support, and to create a high-quality blockchain solution ecosystem that can empower the entire industry. Projects for real life problems.

In a recent interview, He Yi mentioned that he will focus on the early Web3 projects in the Indian market. With the rapid development of the ecosystem of entrepreneurs and development talents, India will be a key market for Web3.

In addition, three types of projects are also the focus of its attention: The first category is those projects that build infrastructure, whether you are the first layer or a cross-chain protocol. The second category of projects are those running various blockchain applications and are paying close attention to those with innovative use cases. The third category is those projects that provide blockchain-related services to support better development of the industry, such as data security.