ConsenSys: Institutional DeFi and the Future of Ethereum

Authors: Clemens Wan, Nicole Adarme, Ryan Ho, Simran Jagdev, Yan Lin Fu

Compilation of the original text: Wu Zhuocheng

This week is a very important one in the history of Ethereum. The most anticipated upgrade since launch, the move to a proof-of-stake (PoS) consensus mechanism, was completed on September 15th. The upgrade, known as the merger, is the first step in ethereum's roadmap that will future-proof the network's infrastructure and prepare it for improved security, sustainability and scalability.

In our recent"Institutional Impact of the Merger"In the report, we discuss in detail the opportunities that the merger will create for institutions in a Web3 world. Authored by the MetaMask agency and the ConsenSys cryptoeconomic research team, the report also explores factors such as network activity, security, and valuation that underpin Ethereum's long-term growth and success. You can find the full report here:

https://pages.consensys.net/impact-of-the-merge-on-institutions-insight-report-sept-2022

first level title

Merge Unresolved Threats

The PoS mechanism may increase the risk of centralization, censorship and fraud in Ethereum. After the merger, ETH whales could theoretically interfere with the performance of the network. While this won't extend to catastrophic events like rolling back a transaction, it can hamper the accuracy of the results. An example of this threat is Lido Finance, Rocket Pool and similar protocols. Lido, for example, now controls nearly one-third of all staked ETH. Despite the decentralization within Lido (e.g. 21 validators on Lido responsible for staking), potential attack vectors still exist.

Improvements in interoperability pose an existential threat to Ethereum. This includes the emergence of cross-chain messaging protocols such as Axelar, the proliferation of protocols with built-in interoperability such as Cosmos and Polkadot, and improvements in bridging technology. All of these factors enable developers to build chain-agnostic applications while allowing users to move smoothly between chains in a more secure manner.

secondary title

Ethereum Roadmap

The Surge

The first update after the merger will be Surge, which will allow the Ethereum network to massively scale through sharding. As an overall concept, sharding divides the data processing responsibility of a database (decentralized or otherwise) among many nodes, allowing parallel transactions, storage and processing of information. As we mentioned in the previous chapters, sharding will split the Ethereum network into shards which will work as independent blockchains. Currently, Ethereum processes an average of 15 transactions per second (TPS). Ethereum co-founder Vitalik Buterin said that once its roadmap is completed, Ethereum can reach 100,000 TPS processing capacity.

Sharding will also address the existential threat to Ethereum posed by Layer 2 (L2) layers like Arbitrum and Polygon. Ethereum is currently significantly more expensive to use than most L2s.

Mature OP rollups like Optimism and developing ZK rollups like Starkware will use a base layer away from Ethereum, on which settlement is still resolved.

secondary title

The Verge

secondary title

The Purge

secondary title

The Splurge

The final stage of the Ethereum roadmap is a minor upgrade, which is just a fine-tuning of the network. Buterin called these upgrades"interesting stuff"。

first level title

The Future of Institutional DeFi

The Ethereum ecosystem is being built for long-term growth. Despite current geopolitical, macroeconomic factors, and market volatility, communities are still working on building innovative products and systems, and institutions still have a strong appetite to be a part of these innovations. Financial institutions — investment banks like Goldman Sachs and Barclays, hedge funds like Citadel Securities and Point72 Ventures, and commercial banks like Banco Santander and Itau Unibanco — are all putting money into crypto assets, or further planning to offer their clients crypto investments option.

As we continue to build through the bear market, we believe the future of institutional DeFi is bright.

For a long time, the debate around institutional investing in crypto assets was a debate about traditional finance (TradFi) vs. DeFi. The growing popularity of DeFi is often considered the death knell for TradFi. However, the digital asset management strategies of some TradFi firms during the downturn suggest that TradFi and DeFi are now coming together to complement each other. This trend is likely to increase post-merger as agencies acknowledge that this is all a long game.

As the merger improves the security of the Ethereum network and prepares it for future scalability, we expect institutions to become more enthusiastic about participating in the Web3 ecosystem.

Over the past two years, innovation in DeFi has created the infrastructure and tools needed for institutional adoption of DeFi. From permissioned loan pools that ensure only KYC participants, to on-chain asset management, MEV-resistant best execution protocols, and decentralized identities, more and more institution-focused projects have entered the market.

We have also seen L2 projects such as Optimism, Polygon, and Arbitrum increase DeFi transaction volume through high yield. We expect more institutional-focused projects to enter the market as the combined L2 scale accelerates.

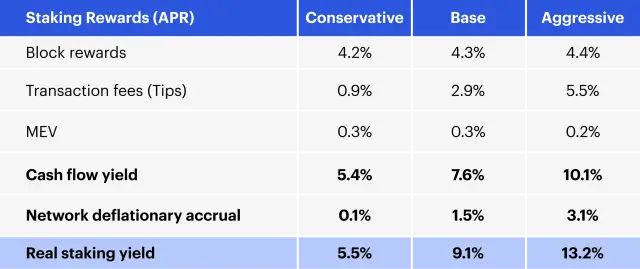

The transition to PoS creates compelling reward opportunities for institutions. As ETH whales — including crypto exchanges, funds, and custodians — have recognized the powerful position holding ETH has in the DeFi world, they have been able to earn 4.06% annualized returns on their ETH positions. Combined, we expect the actual return on ETH staking to be between 5.5% and 13.2%, depending on several factors such as block rewards, transaction fees, and the maximum extractable value (MEV) accumulated by validators.

The opportunity for institutional DeFi is huge, and Merge will help the market mature, creating opportunities for investors to chase yield in high-risk areas. Institutional investors who may have previously been skeptical of the investment opportunities in DeFi have now recognized that the growth of Web3 and its associated financial instruments is inevitable. They may not yet fully understand the drivers behind DeFi or Web3, but already know that the asset class cannot be ignored.

The next phase of Ethereum on the roadmap will address the challenges of scaling, thereby building confidence in the ecosystem, especially in investments where crypto assets may be considered too risky. We expect progress and innovation to come quickly, whether from crypto funds and DAOs, or traditional Web2 institutions.

Original link