After the speculative frenzy, where should the PFP NFT project go?

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

PFP NFTs are in a bad place right now. While once the darling of the NFT space, they have taken a huge hit in recent months. A Boring Ape was once worth $400,000 at its peak; today, it's worth $100,000. There are good reasons for getting where we are today. The dopamine-fueled speculative enthusiasm has faded, so PFPs have struggled to find their proper place in the world.

No one expected them to explode like they did last year. PFP (Profile Picture) is our digital identity tied to us via NFT. They are more than just a picture, they are tokenized representations of community, cultural and social membership. At least, we think so.

Now that our rose-colored glasses are put away, we have to figure out: what's next for PFPs in the NFT space? What do we do with these ugly monkey photos?

All PFP projects need to think hard about the following three things in order to survive.

1. How to transition from Web3 to the real world?

Today, most PFPs resemble exclusive country clubs. Entrance fee? 7 ETH or whatever the floor price is today. These country clubs bring like-minded individuals together in a socially friendly environment. Country club membership entitles you to certain privileges such as free access to facilities, invitations to exclusive events, and votes on major decisions.

That's cool. As a "country club," PFP can do a lot of fun things for their members. Free hoodies, fanny packs, bomber jackets, and limited-edition merchandise—everyone loves free stuff. In the web3 world, geeks and degenerates are now the cool breed to shape the club however they like.

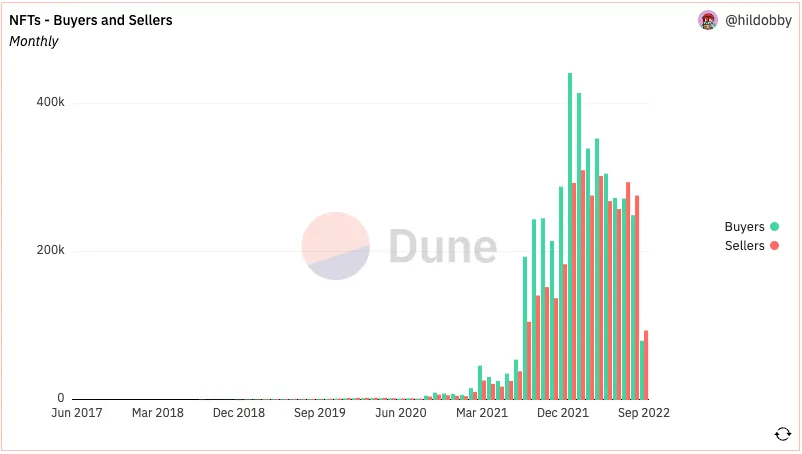

But as an exclusive "country club," you're always stuck in the echo chamber of your own significant. The hard truth is that the web3-native audience is small and niche. Ask your casual friends if they've heard of Doodles, Azuki, or Clone X. The answer is no, almost every time. Depending on the number of purchasing wallets, the entire NFT space may have fewer than 300,000 people active today. Even less, as many people use multiple wallets.

Today, PFP has little cultural significance in this world. They could be gone entirely tomorrow without the rest of the world shedding tears for their loss.

If PFPs are going to be culturally significant, they have to go out and create the culture that the world wants to embrace. Getting into people's minds, they can focus on:

television

Movie

Pop music

game

game

Entertainment/YouTube/TikTok

Each of these verticals is extremely competitive and littered with the dead bodies of failed companies. Building a strong and defensible IP is no easy task. Success requires a magical blend of luck, timing, money, deep expertise and hard work. I hesitate when I see teams launching NFT collections with the vision of making movies, anime, or games, but none of the team members have deep expertise and experience in the industry.

PFP has something that non-web3 companies don't: tools (NFTs) to cultivate a highly engaged, loyal fan base who will co-create and co-advertise with you. They can harness this superpower and use their community to bridge the divide and make it a sustained mainstream consciousness.

2. How do you build a sustainable income stream?

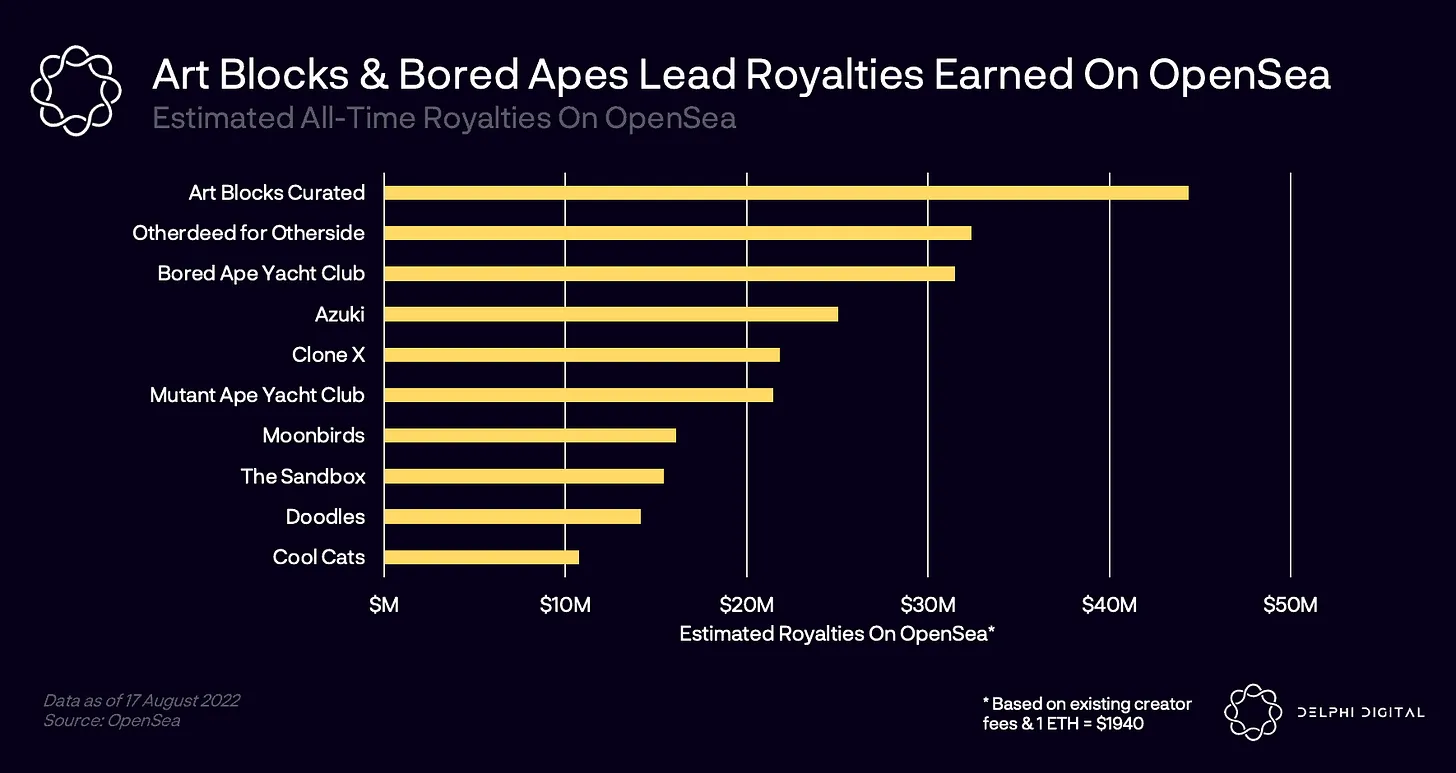

image description

Source: Delphi Digital's NFT Insights

However, since the second quarter of this year, the volume of NFT transactions has dropped sharply. It also means that royalties have slowed to a trickle, as they are a direct function of deal volume. Given the macro headwinds in global markets, it's also unlikely that we'll return to the good old days of super-high royalties anytime soon.

For the 2021/early 2022 PFP team, I would prefer to think of their past royalty income as their financial fundraising efforts rather than representing a true source of future recurring revenue. Worse: Creator royalties are trending toward 0, and markets like X2 Y2 already make royalties optional to increase purchase demand.

The PFP team had to go out and try to find new sustainable revenue streams like any other startup. They can no longer wait for royalties. Some possible business models I've been considering include:

Licensing IP/artwork to brands big and small. eg uniqlo hoodie

Create a new product line. For example, commodities and consumables (Bored Apes coffee, anyone?)

Sells digital collectibles with some utility, similar to Fornite/League of Legends skins.

Content & Media Production Company

subscription service

But really, the sky is the limit. We'll soon see which teams have the business acumen and the desire to grow from a humble JPEG collection into a true technology + culture business.

3. How do you bring value back to your community?

Venture capital is stepping up its NFT game. Moonbirds raised $50 million in August, while Doodles raised $54 million this week alone (at a whopping $704 million valuation). Apparently some VCs like JPEG. This is great news for these PFPs. It gives them an incentive to go out and expand their brand. Consumer goods companies need to burn a lot of marketing dollars to grow, or they'll be left behind.

This begs the question: are NFT holders really partial owners of the brand, or is everyone we embrace about community ownership just a facade?

When will we see VC fundraising for NFT teams where at least some of the investment involves buying NFTs?

It is now clear where the value accretion priority is (equity holders > NFT holders)

When VCs come in, the company's priority for value addition will naturally shift to equity owners rather than NFT holders. After all, investors pay huge sums of money for equity and don't own any NFTs. They need to get a 10x ROI.

In extreme cases some PFPs become like traditional firms:

NFTs are being used to raise seed funding and use that success to raise more venture capital funding.

The idea of community ownership became a meme. NFT buyers are considered "customers" rather than "co-creators".

More NFTs were sold to the community as they feverishly bought into the company's next much-hyped NFT airdrop. The community becomes a source of income.

Community-driven initiatives—fan art, lore creation, IRL meetups—become akin to user-generated social media content. Creators spend hours producing great content on Instagram: but at the end of the day, all financial value goes back to the company and creators get nothing.

NFTs end up being digital collectibles in the created universe, like the limited-edition Luke Skywalker action figure (only 10,000 pieces)

Twitter user @4156 summed it up succinctly in his tweet:

The founders are definitely throwing bait and hanging around here. Selling you on the meme of protocol ownership, then using the hype to keep it at a high valuation while claiming that NFTs are always the product.

I may be getting too cynical here. Most importantly, PFPs must recognize that their community brought them to where they are in the first place. More and more people today are starting to understand that NFT owners have far fewer (legal) rights than they previously thought — and we're still in the early stages of figuring this out. Today's regulations make it difficult for NFT owners to also become shareholders and share profits. But at some point, I believe the gap will be closed, at least to some extent.

At the same time, there is a social contract between the founders and the community. This means that teams need to constantly find ways to give value back to the community in authentic ways. Otherwise, trust is lost. It's a slippery slope.

Original link