MicroStrategy plans to sell $500 million in stock, or consider buying more bitcoin

This article comes fromThe BlockOdaily Translator |

Odaily Translator |

![]()

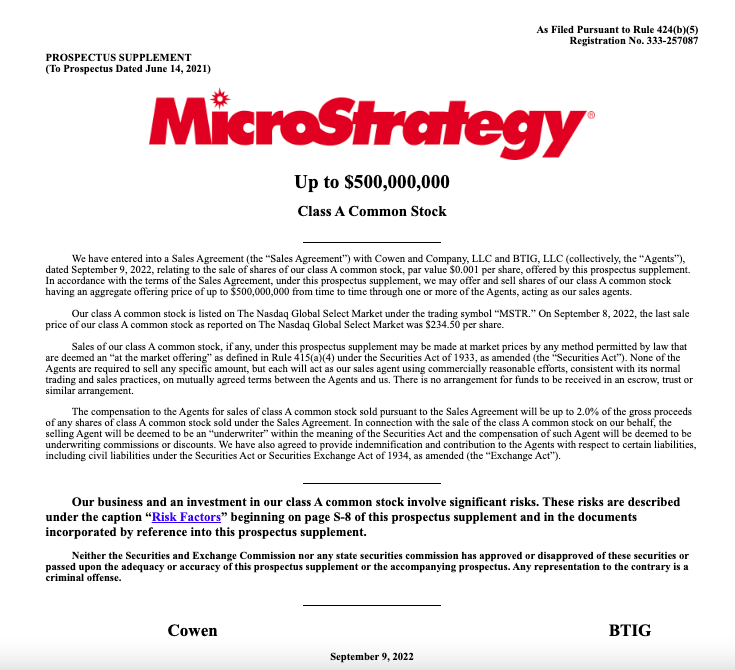

Business software developer MicroStrategy plans to sell up to $500 million in Class A common stock, with the possibility of buying more bitcoin.

textAccording to its filing with the U.S. Securities and Exchange Commission (SEC) on Friday,new prospectus

, the company has entered into sales agreements with agents Cowen and Company, LLC and BTIG, LLC, planning to sell up to $500 million in Class A common stock, and the funds may be used to purchase more bitcoins.

The filing states, “We intend to use the net proceeds from this offering for general corporate purposes, including the purchase of bitcoin, unless otherwise stated in the applicable prospectus supplement. We have not identified the net proceeds that will be earmarked for any particular purpose amount."Under the leadership of former CEO and bitcoin bull Michael Saylor, MicroStrategy has included bitcoin on its balance sheet since 2020. Billionaire Michael Saylor stepped down as CEO in August, but continues to serve as executive chairman and focus on his bitcoin strategy. New CEO Phong Le said in early August that MicroStrategy still plans to hold bitcoin for the long term. His remarks came amidst volatility in the overall crypto market and a slump in bitcoin prices,。

MicroStrategy Discloses $917.8 Million in Digital Asset Impairment Losses in Q2 2022

MicroStrategy said in the business strategy section of the document, "We have not set any specific target for the amount of Bitcoin we seek to hold, and we will continue to monitor market conditions to determine whether to conduct additional financing to purchase additional Bitcoin."

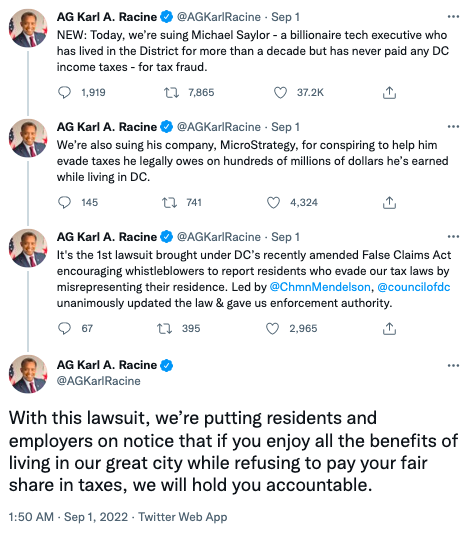

As of press time, the price of Bitcoin has returned to above $21,000.Separately, Michael Saylor is facing tax fraud charges from the Washington attorney general. September 1,Washington DC Attorney General Karl Racine tweeted:

, will prosecute Michael Saylor for tax evasion. Karl Racine said Michael Saylor never paid any Washington, D.C. income taxes, accusing the latter of committing fraud.