Inventory of 12 protocols that may illuminate the future of DeFi

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

While 2022 has been a year of bear carnage so far, there is some pretty intense building going on within DeFi, with many interesting implications…

So I wanted to do a long post about 12 protocols that I think shed light on the future of DeFi...

NOTE: These are just my random thoughts - I'm just a dumb ape and could be completely wrong - so would love to hear your thoughts on this too!

1. Debond Protocol - Bonds as DeFi Currency Lego

postpost, explaining how they work.

This involves a whole new type of ERC token + a huge addressable market for on-chain bonds, which seems to be very important, and it is very exciting to think about the implications of this as a new "money Lego" (See Haym's great post below)。

2. Lens Protocol - Decentralized Social Media

The concept has been a hot topic over the years as we've all seen big tech companies fall prey to censorship, but Lens seems to be the first example that really caught the eye.

My friend @CurveCap recently created a Lens account (see below) after encountering the aforementioned "censorship issue" on Twitter.

herehereFollow him and create a Lens account (I plan to do so soon!) and follow him there.

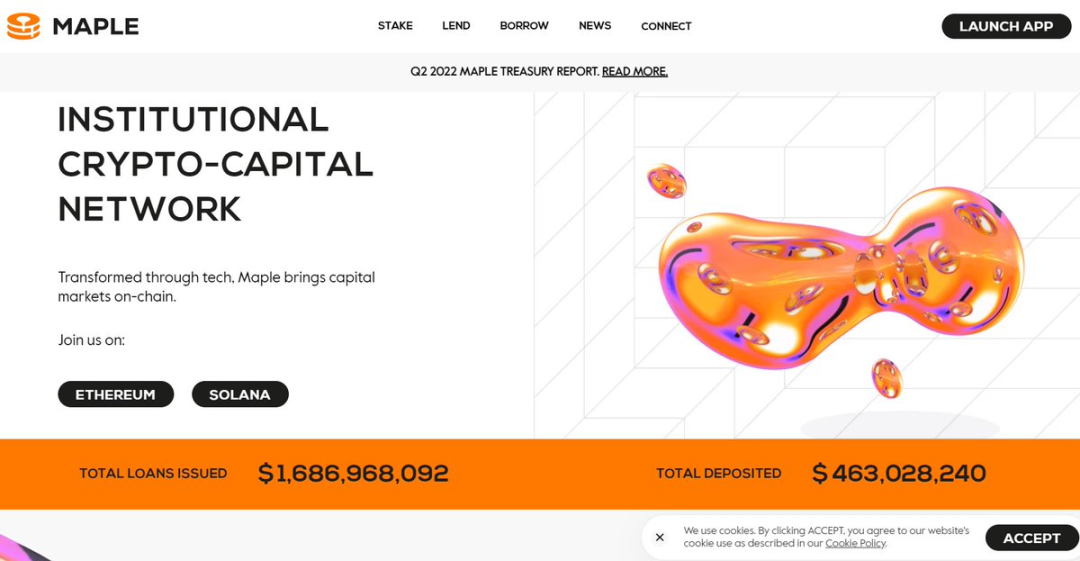

3. Maple Finance - Institutional Adoption

If you believe that DeFi apps will increasingly overtake tradfi (as I do), then Maple seems to be shining a bright light on this trend.

Maple is essentially a marketplace for undercollateralized loans to large borrowers, with a clear focus on serving a large TAM of institutional capital seeking to leverage DeFi's technological excellence.

postpost。

4. APWine Finance - Earnings Derivatives

The traditional financial market (Tradfi) has trillions of dollars in derivatives, and income derivatives are an important part of it.

https://twitter.com/iamvrushal/status/1564512259719991296

Therefore, as tradfi and DeFi become more and more integrated, such protocols should grow dramatically.

The following is from APWine Financewonderful post。

(Some other notable protocols in this space include Timeless Finance and Pendle Finance)

5. Sudoswap——Unlock NFT as a core Internet technology

Sudoswap has been getting a lot of attention lately, and rightfully so.

As an "NFT AMM", it has significantly changed the NFT sales/liquidity landscape.

https://twitter.com/will__price/status/1530323161513963521

I think this is important because I believe that NFT will start to go far beyond the realm of art and become an increasingly important "base layer technology" for DeFi and the Internet.

Follow this great post:

https://twitter.com/john_c_palmer/status/1485696543277690887

6. Berachain - More Efficient Chain and/or Liquidity Architecture

While I am bearish on "L1 rotation deals", it does make sense that we will see increasingly complex designs emerge to maximize their efficiency/liquidity/etc.

https://twitter.com/0x_d24/status/1566518485231947776

Berachain seems to be doing some interesting things in this regard, re: their "proof of liquidity" concept and other innovations.

postpostto break it down.

7. Jarvis Network — Everyone needs a stablecoin

If, as I believe, stablecoins are going to be used more and more by ordinary citizens in countries around the world, then Jarvis represents an attempt to serve this market as they focus on providing stablecoins for many People provide fiat currency in and out channels to use them.

For more information on @Jarvis_Network, I suggest you follow the belowtwitter account。

8. Frax Finance - Stablecoins eat the world

Likewise, I think stablecoins are the rocket fuel of DeFi, and Frax best represents the potential dominance of stablecoins as a major DeFi "element".

https://twitter.com/rektdiomedes/status/1556759881075642368

As discussed by Frax founder @samkazemian, Frax is trying to fully embrace the "trillion dollar narrative" that stablecoins represent, and their team has been building some crazy stuff lately to make it happen.

https://twitter.com/flywheelpod/status/1540806035287355392

9. Gains Network - Synthetic Assets

I have long believed that synthetic versions of non-crypto assets are one of the most natural uses of blockchain technology relative to absorbing transactions, and it also clearly has a lot of overlap with stablecoins and yield derivative phenomena.

There are many protocols that can be represented (Float, Deus Finance, GMX, etc. are entering the synthetic assets arena), but Gains has focused on synthetic assets from the beginning and has achieved great success so far.

https://twitter.com/derpaderpederp/status/1559309865687949312

10. Bond Protocol - Liquidity owned by the protocol

Developments over the past year have clearly demonstrated that a) the protocol keeps its entire treasury in its own token, and b) yield farming for hire.

That said, POL is becoming more and more standard.

https://twitter.com/DeFi_Maestro/status/1564297451929890816

Bond Protocol (a spin-off from Olympus Pro) has been focused on meeting this need and building infrastructure to help the protocol in this regard.

postpost, breaking down what they're doing.

11. Y2K Finance - Risk Derivatives > Insurance

“DeFi insurance” has been an important narrative over the past few years, but its performance has been somewhat disappointing.

In my opinion, protocols like Y2K Finance represent a superior development in this regard, towards something closer to "risky derivatives" that can be traded and combined more efficiently and will better satisfy this demand.

https://twitter.com/y2kfinance/status/1549460479470444551

Here's an article about them from Thor Hartvigsenwonderful article。

12. MakerDAO - Adoption / Decentralization / Risk Weighted Asset (RWA) Debate

The recent debate over Maker seems to perfectly sum up the decentralization vs. real world adoption debate that all DeFi must continue to have.

If anyone brings up the issue of depegging DAI, it sums up a whole very critical debate.

this is a gooddebate post(Maybe a little outdated, but there should be an updated link in the comments section).

A purer example of the RWA phenomenon might be protocols like landx finance that focus on a single RWA asset class (in this case agricultural bonds/financialization), I think we'll end up seeing hundreds Such niche-specific RWA protocols.

Bouns: Chainlink - DeFi is eating the world

Chainlink supporters have been a suffering bunch for the past year or two, but I still think Chainlink has the best chance of "world domination" among DeFi protocols :)

I think DeFi itself will "eat the world" (or at least eventually eat tradfi), and if so, it's hard not to see $LINK as an absolute behemoth of the world.

Here are the latest from @ReveloIntelDisclaimer:。

Disclaimer:

- I own $FXS, $GMX, $GNS, $LINK and a small amount of $JRT and $DEUS and may try to take a position in some of the others mentioned in the future.

Original link