Dialogue with three former encrypted VC partners: the next wave of encrypted track that may explode

Original author: Yuan,Deep Tide TechFlow

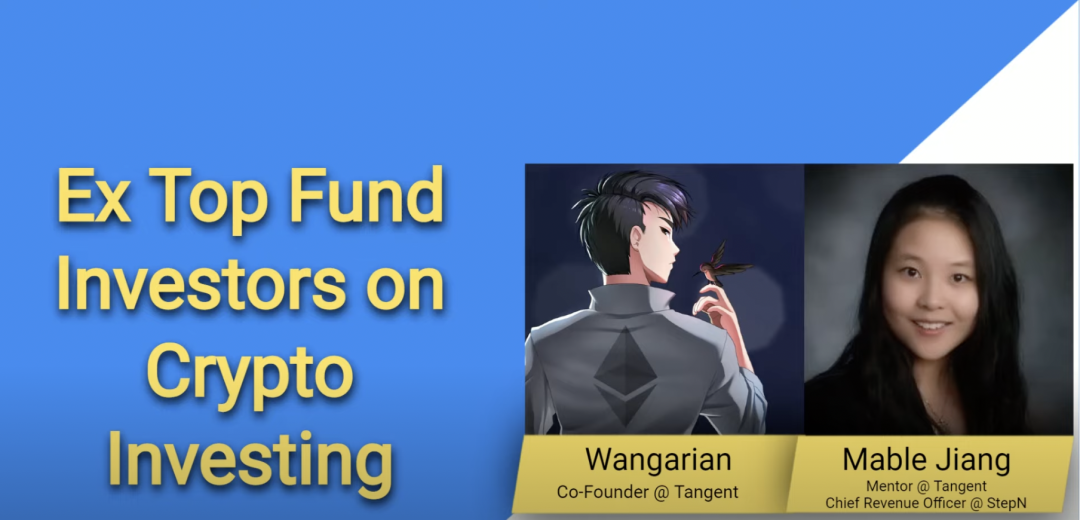

In July, former Spartan Group partner Jason Choi announced that he and former DeFiance Capital executive Wangarian co-founded Tangent, an encryption venture capital club. Mable Jiang, former partner of Multicoin Capital, also joined as an advisor.

In a recent The Blockcrunch Podcast,Three former crypto VC partners talked about the establishment of Tangent, their views on killer apps, how to evaluate excellent founders, the tracks and fields they are currently paying attention to, and their predictions for the bear market and the next cycle...

For example, in Mable's view,The next wave of encryption explosion may appear in the B2C application field, which requires a sufficiently attractive UI or front end, which can aggregate various other protocols, and the core narrative is to capture more users.first level title

Leave Crypto Fund

Darryl Wang:At the end of 2021, I found myself wanting to make more frequent cryptocurrency investments in traditional funds. I realize there are several pain points that VC or Crypto VC can't necessarily solve.

So Jason and I started to build an investment entity——Tangent—that can really solve these pain points. In order to do this, we need to sacrifice the number of bets and focus the portfolio to ensure that we can sit down and deal with every part of the company (invested in), and finally help the founders solve the burning problems of the early stage.

I see Tangent as a service or product, not a fund.My philosophy is as an entrepreneur, pitching my services to founders to see if they are interested in what I have to offer, rather than saying: I'm fun, here's my money, do you want it?When I tried to conceptualize Tangent, I thought this was the main difference between it and other VCs.

Mable Jiang:Working at Multicoin Capital has been a lot of fun, the colleagues are very smart, and even now I feel like I can learn a lot from all of them.

One of the main reasons I left Multicoin was because I wanted to work at StepN.Multicoin is actually very focused on investing in protocol level stuff, but not doing much consumer or anything B2C related.

I really like Tangent's business model. It doesn't force you to be involved in something, you just invest when you feel you can really make a difference. Basically everyone at Tangent is a founder, each with different expertise, resources, and experiences. So, we can teach students in accordance with their aptitude and really help different projects develop.

Jason Choi:first level title

The next killer app

Mable Jiang: It may not be a fully encrypted native or fully on-chain thing. Web2.5 is actually cool and can also get 10-20 million new encrypted users, StepN is like that.In 2020, I'm thinking more about fully on-chain and DeFi super apps - one project that handles everything. But I obviously realize that with all the composability factors in DeFi, that might not actually be the case.

And my current view on Super App (Super App):first level title

Tracks and areas of concern

Mable Jiang:StepN is a social entertainment product partially driven by the blockchain. Many things have nothing to do with cryptocurrency, but use the advantages of the blockchain-simple account system.

focus point:

1. Improve the utilization rate of blockchain.

2. DeFi protocols do not need to exist independently. Exchanges may still have order books as a standalone product, but basically most of the big names will do simple lending/AMMs themselves.

3. Be able to make good use of the situation and use the traffic of the App to provide DeFi products to those who have not participated in DeFi.

Darryl Wang:With Luna down, I think decentralization is needed now more than ever.

focus point:

1. Stablecoins with strong adoption. An industry is only as good as it is by product adoption.

2. Decentralized assets. In the form of making money in the game, you can basically achieve decentralization, you can create a virtual economy, and then start using it and start distributing virtual assets.

Jason Choi:Stablecoins are really interesting. On the one hand, it can be said that Terra collapsed because there was no supervision, while USDC is technically regulated; on the other hand, when the market value of USDC reaches one trillion U.S. dollars and penetrates the entire encryption market, if the regulatory authorities suddenly want to ban such products, then basically all DeFi will be banned.

first level title

Crypto Vertical

Jason Choi:Back in DeFi Summer, I saw projects start to verticalize. For example, 1inch, as an aggregator, built their own AMM—Mooniswap, but no one really uses it, and we haven’t really seen a successful example of vertical integration. For me it's the same as"Composability is one of the best things about cryptocurrencies"arguments are contradictory.

The founders were almost always motivated by verticalizing and building their own layers of the application stack, rather than spilling value to others, and they started building their own neobanks, largely in isolation, like reinventing Web2.

Smart Contract Wallet

Smart Contract Wallet

Jason Choi:Argent is a smart contract wallet based on StarkNet. It recently launched a wallet recovery solution that does not consume Gas and does not require mnemonic words, allowing users to access Dapps in the application itself. Metamask is probably the most valuable offering of all cryptocurrencies today. Almost everyone uses Metamask.

Darryl Wang:I think people have not started to use smart contract wallets more because: users are still accustomed to using computers instead of mobile phones for Web3-related activities, and now there is a need for a secure mobile phone product that allows users to use it with confidence. situation. As the number of new protocols increases, developers will focus more on security and focus on connecting Web 2 players to Web 3. In the next cycle, we will see more solutions that really help increase adoption.

Mable Jiang:Mass adoption of the Web3 account login system is actually very important.I am very optimistic about smart contract wallets. I even think that the fact that the order book on the chain has not risen in this cycle is actually because the threshold for traditional users is still too high, so it is the key that smart wallets can lower the barriers to entry.

Smart contract wallets in the next cycle will be very interesting. Private key management solutions like Torus may also have a place. Since most of the smart contract wallets in this round are built on Ethereum, Gas fees are too expensive, so people have gradually begun to forget about smart contract wallets.But if you want to help users access blockchain wallets in a non-custodial and simple way, smart contract wallets are almost the only option.

On-chain identity credentials also deserve attention. Not only Project Galaxy, but many other projects are working around this as well.

first level title

GameFi & NFTFi

Jason Choi:I am bullish on identity solutions and games that can attract players from outside the circle, and I am also interested in NFTFi. Darryl and I are big fans of Sudoswap, which is an AMM specially built for NFT. Compared with existing NFT exchanges, this is a superior design.

first level title

How to choose a founder

Jason Choi:In terms of filtering founders, first, while we do have an application form,But we prefer founders with endorsements.When someone we've worked with or an investor we've co-invested in recommends a deal to us, it's usually a very positive sign and we'll put it at the top of the list.

Second, we actually have a differently weighted scoring system that weights founders on several metrics. We have backtested with many transactions done in Defiance and Spartan.

Darryl Wang:I value two points most:

1. Whether the founder has the unique ability to solve the problem of the team.

2. Valuation investment, as a fund, the margin of safety is our top priority.

Mable Jiang:I am willing to support those founders who are willing to continue to work very hard, and at the same time know how to let the public clearly see what the project party is doing through publicity.

Solana is a good example,first level title

Thoughts on a Bear Market

Darryl Wang:The next few months will be a very challenging time. Ethereum has caught many institutional funds by surprise from 4000 to 1000 in the past few months. Either the funds have withdrawn sharply or they have withdrawn from the market. In the subsequent Ethereum merger narrative, many funds were also put on hold, waiting for a larger macroeconomic recession before building positions.

First, I think when attention starts to come back, it will drive crypto-focused capital inflows from the rest of the world, and second, it's looking at the inflation numbers and looking at the GDP numbers to see if the world is going to be in recession or if we can't get the Fed soft landing. I'm not a cryptocurrency expert, so my views may not really be the same as those of the audience.

Mable Jiang:It’s important to note that everyone is talking about the Ethereum merger, which is probably the only really hot topic these days, the Ethereum merger and the market hikes, and the new money is not pouring in.

Consider over-the-counter (OTC) trading and see if more active SAFT sell orders start to appear.If that happens, I think it might be a good starting point to start thinking about the next cycle.

Prudently consider the valuation, it can be a good measure of the popularity of a project.

Jason Choi:first level title

Forecast for the next cycle

Jason Choi:In 2019 I tried to predict that the TVL of DeFi would be $1 billion, but the top in the past few years seems to be about 180 billion. So if I had to make another prediction, over the next five years, across all applications, there will be a trillion dollars in TVL.

Darryl Wang:I think the market cap or FDV of GameFi related projects will reach 100 billion.

Mable Jiang:Three thoughts:

In the next cycle, some social entertainment applications may attract about 50 million users, who will interact with the blockchain and interact through Web3 accounts.

Founders may care more about UI and UX, because a good UI and UX can harvest a large number of users.

The next big bang will happen in anything B2C, and a lot of opportunity will be in Asia, but it's a long way off. Looking back at the Web 2 wave, although many innovations always took place in North America, especially the United States at the beginning, few things at the application layer came out.Asian founders are actually very good, they are very good at thinking about operating models and other factors.