Self-help guide for DeFi retail investors: 5 ways to develop unilateral liquidity

This article comes from SubstackThis article comes from

, the original author: Chia Jeng Yang, compiled by Odaily translator Katie Ku.

This article explores 5 ways unilateral liquidity provision (SSLP) can be set up to help retail investors reduce capital losses while providing liquidity, and areas for further research.

secondary title

Problems with current liquidity supply

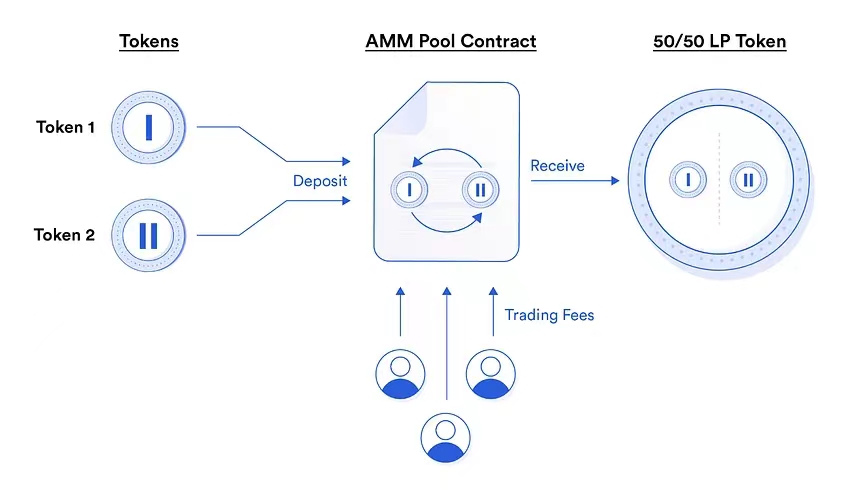

First, a quick summary - liquidity provisioning is one of the primary ways to earn crypto yields when holding a basket of tokens. Liquidity provisioning stems from the concept of an Automated Market Maker (AMM), which allows anyone to create a pool of two pairs, instantly providing liquidity to a trading pair. The pool allows others to trade between the two assets deposited, allowing traders to trade positions freely with more liquidity, and allowing depositors to earn transaction fees. Liquidity providers are typically required to deposit 50% of the value of each asset. In the frantic trading activities in the early days, liquidity supply was an important source of income.

However, as the competition for liquidity supply becomes increasingly fierce, as a liquidity provider (LP), without active and mature management, it is easy to suffer losses. The main reason for this is impermanent loss, which, due to the nature of trading pools, reduces the value of one of the two assets as traders trade the less profitable asset.

Key risks also include flaws in the design of newly developed liquidity pools, possible transaction fee rewards denominated in the platform’s native token (which could depreciate rapidly), and providing liquidity for tokens that may be “junkcoins”, May be dumped, draining liquidity and leaving worthless tokens to LPs.

The solution is twofold—proactive or structural.

From a proactive perspective, you can help create complex derivatives (or one-click strategies) and trading interfaces, help big bull traders hedge risks, and create risk-neutral (Delta-Neutral) strategies. This is a nice solution, but sometimes requires LPs to have a deep mathematical understanding of the types of risks they face, or to actively manage them. Professionals are more viable than retail investors. There are also simpler solutions like the NIL protocol, which attempt to automate much of the hedging of potential temporary losses. However, when attempting to hedge investment risk, there are some structural obstacles, including difficulties in predicting/calculating investment risk.

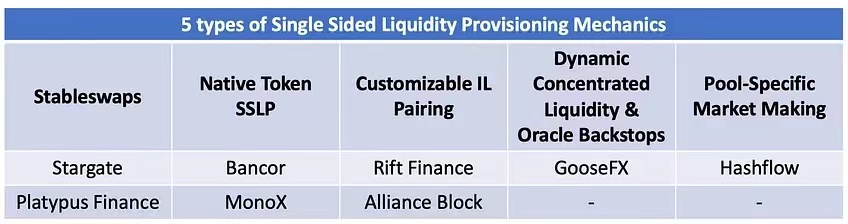

So far, the development of one-sided liquidity has been relatively slow. The following are 5 ways to develop one-sided liquidity, with the purpose of structurally reducing losses caused by temporary losses.

secondary title

Method 1: Stablecoin transactions (Stableswaps)<>USDT、ETH<>WETH、WBTC<>One of the most obvious ways to provide unilateral liquidity provision is to only provide this provision on 1:1 assets. A 1:1 asset is an asset pair whose value between the two assets should always be fixed due to the intrinsic relative value of the two assets (i.e. USDC

renBTC, etc.).

Coupled with a Curve type of AMM design for stablecoin transactions (which can reduce but not eliminate 1:1 slippage between assets), you can essentially create a situation where LPs can reasonably expect not to encounter any temporary Losses, as they will always gain (via either token) a value equal in relative value.Protocols taking this approach include Stargate (focusing only on blue-chip assets like ETH, USDT, USDC) and Platypus Finance (using oracles to monitor and halt transactions during decoupling events).

secondary title

Method 2: Native token unilateral liquidity supply (SSLP)

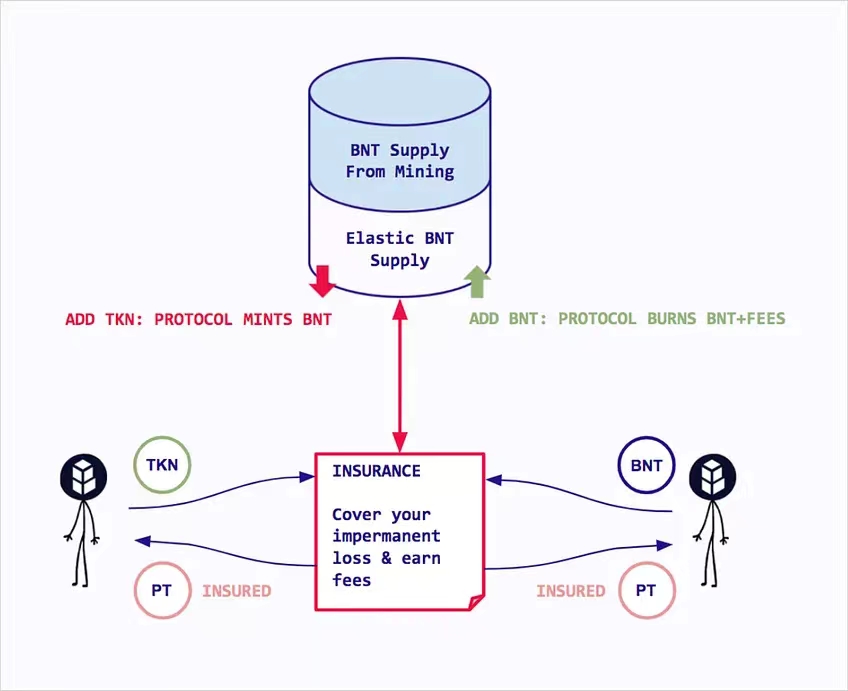

The second approach is to provide what I call native token one-sided liquidity pairings. This can be seen in protocols like Bancor and MonoX.

LPs basically make deposits in native tokens provided by the underlying platform. For Bancor, you will provide liquidity against the BNT governance token. For MonoX, you will provide liquidity against vUNIT native tokens created by MonoX. The idea is that in the event of a temporary loss, the platform can mint more native tokens at a lower rate than revenue from transaction fees.

The flaw in this model, of course, is that it creates sustained downward selling pressure despite the calculations to the contrary. Additionally, the platform essentially builds leveraged pledges on a continuous revenue stream, driving up the native token price. In the event of a generalized DeFi sell-off or a sharp drop in the price of the native token, the cost of covering temporary losses would exceed the cost of the protocol being able to mint the native token. This happened with Bancor during the DeFi sell-off of 2022, which remains suspended at press time.

Tokemak arguably has a similar design, although its model looks more sustainable. LP can be pledged on a unilateral basis into a pool paired with the native token TOKE. TOKE has a utility similar to Convex's bribe token, thus providing utility and underlying value to the token. Whether this is sustainable in the long run remains a question.

secondary title

Method 3: Customizable IL Pairing

The third method is my own customizable IL pairing. IL pairings are essentially an acknowledgment that there are some participants in the market who are willing to take on some form of price volatility, but are also willing to provide liquidity for long-term purposes.

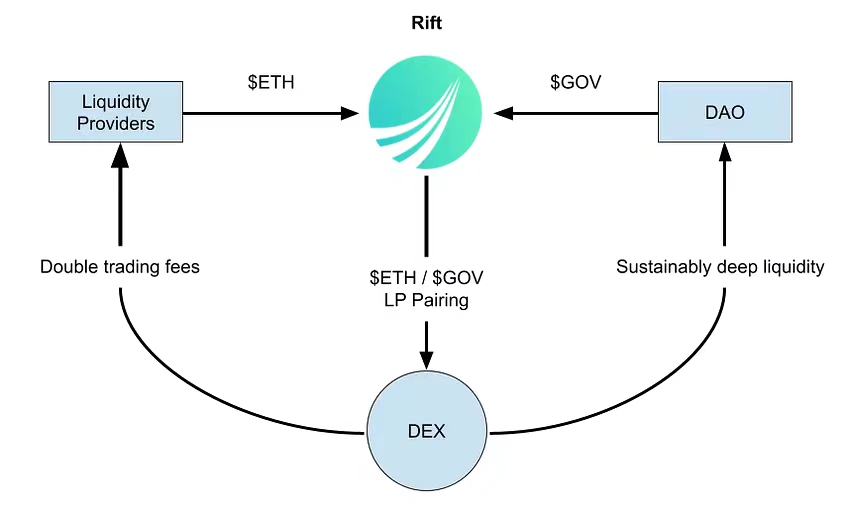

This includes many DAO liquidity management solutions such as Rift Finance. Here, the key is that the DAO is willing to provide liquidity to one side of the liquidity pair with its own native token, and is willing to absorb as much IL as possible that occurs in the entire pool. Because it's a more capital efficient way to provide liquidity to those looking to trade their DAO tokens (vs. paying a market maker, or selling their DAO tokens for ETH immediately, driving down the token price, And provide ETH and DAO tokens to trade in the pool).

What's particularly interesting is that the Rift allows the DAO to absorb any IL that might appear in the pool. The percentage of losses that DAOs absorb first can be customized (and thus IL pairings), but the default on Rift is that LPs have done primary protection of capital. Thus, LPs are protected on their primary LP count unless the value of the token pair falls by 75%.

Therefore, the three rules that define the Rift's initial jump-back configuration are as follows:

The ETH side is at least separated from the APY layer;

The DAO side reaches its upper limit at most;

The ETH side obtains any additional benefits beyond requirements (1) and (2).

I believe that unilateral liquidity management in this design mechanism will eventually become a core element second to bond instruments, interest rate swaps and other emerging instruments.

secondary title

Method 4: Stop unprofitable transactions through oracles and dynamically pooled liquidity

The whole idea of AMMs is that by allowing arbitrageurs to discover prices naturally, you can channel liquidity and thus trade.

Every trade that is used for arbitrage (looking at asset prices in other markets to see if there are arbitrage opportunities) essentially represents a loss.

Since AMMs don't exist in thin air, and an AMM can reference prices in other markets, arbitrageurs can be discouraged by only allowing LP-friendly trades to take place in the pool.

This can be achieved through two things - dynamically centralized liquidity and oracle support.

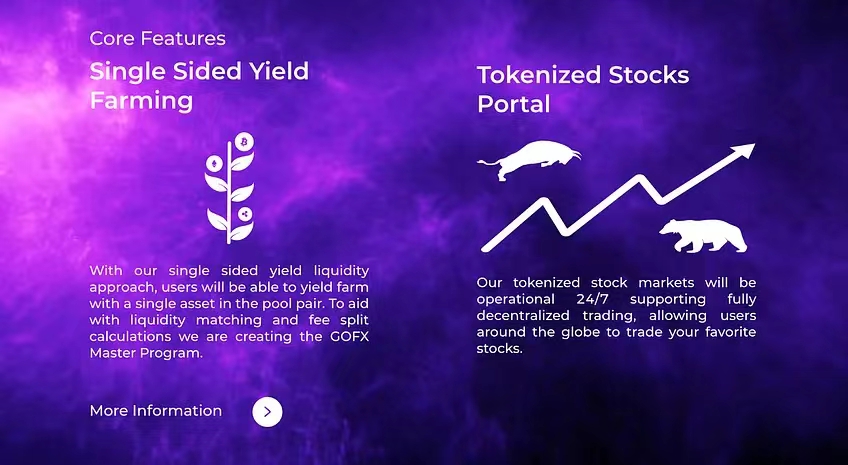

GooseFX has an interesting model where LPs benefit from dynamically pooled liquidity provisioning to reduce arbitrage happening on their AMMs (since liquidity will be dynamically pooled around a price set by the oracle, which should be market prices in other parts of the market). Additionally, there exists an oracle-backed solution where the oracle will charge traders in the AMM the worst of the market price (judged by the oracle based on prices in other markets) and the price within the AMM. This ensures that there is no situation where LPs provide liquidity at prices that allow them to take advantage. Relying on oracle systems has some limitations, such as front-running and centralization risks, but over time these issues should be resolved.

secondary title

Method 5: Market making for a specific pool

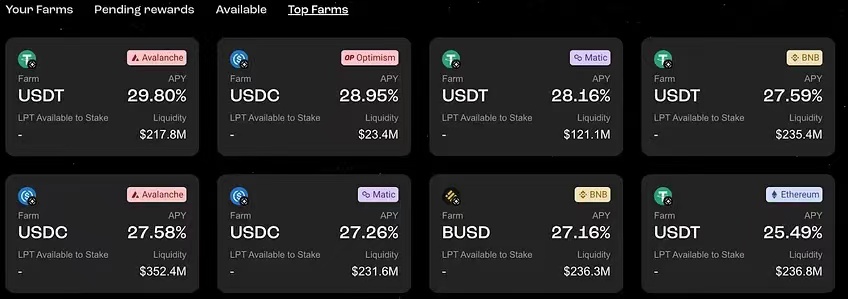

Hashflow employs an interesting one-sided liquidity model that allows users to lend to pools that are issued as capital to market makers, thereby creating liquidity for the pools that users loan into.

This is a bit controversial in my opinion, because if you issue capital to a market maker, then it's only a mostly unsecured lending market, or conversely, not an "automatic" market maker. Traditional lending protocols also provide loans to market makers who generate yield by providing liquidity to CeFi and DeFi mechanisms. In theory, this makes the company's risk profile indistinguishable from that of unlicensed lenders such as Clearpool that end up lending to market makers.

Hashflow's model should be a potential replication model we can look forward to if we fundamentally optimize the safer structure of liquidity provision.

secondary title

What unilateral liquidity supply issues I haven't considered yet?

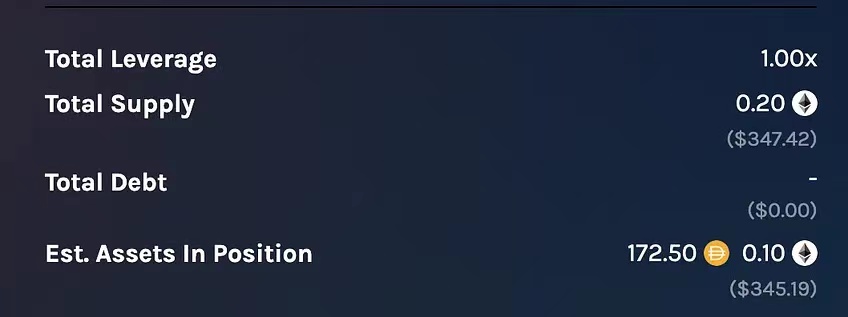

LP supply and trade at Thorchain deposit points. Note the difference between total supply and existing assets.

secondary title

Areas of further research/other ideas<>If we think about what IL is, it's essentially shorting volatility. Low/no volatility pairs (i.e. USDC

Token pairs of stablecoins such as USDT) will not be affected by IL.

The entire loss of the liquidity provider is also a net position (that is, the loss will only be incurred when the temporary loss of the asset value in the pool exceeds the transaction fee charged by the LP to the pool). This means that IL is also time-based. After a period of high volatility, exiting a liquidity pool could mean the formation of an IL, rather than at some point in the future.

secondary title

Summarize

Summarize

The maturation of unilateral liquidity provision heralds a new, safer era for DeFi, especially for retail investors. What I'm particularly excited about is that DeFi will mature in a safer way while creating the infrastructure that will unlock more financial tools.