Valuing DEXs Using Volume Shares

Aug. 2022, James

Data source:Footprint Analytics

Decentralized exchanges (DEXs) are a core Web3 infrastructure with proven uses. If people continue to participate in the blockchain economy, they will need an organization without middlemen or centralized entities to exchange corresponding tokens.

However, comparing the sustainability and potential of dozens of platforms is more challenging than the entire technology offering case. It's unclear which platforms will still be thriving a few years from now.

For example, Uniswap has become a blue-chip protocol for DeFi. But how do we compare the value of small DEX tokens like TraderJoe and Biswap?

Since the most important indicator of the health of an exchange is user engagement, this article will introduce a metric that can be used in conjunction with other metrics to evaluate DEXs: Share of Volume to Market Cap Ratio, or SOTV/MC. This indicator can be used to analyze the market performance of DEX.

What are DEXs?

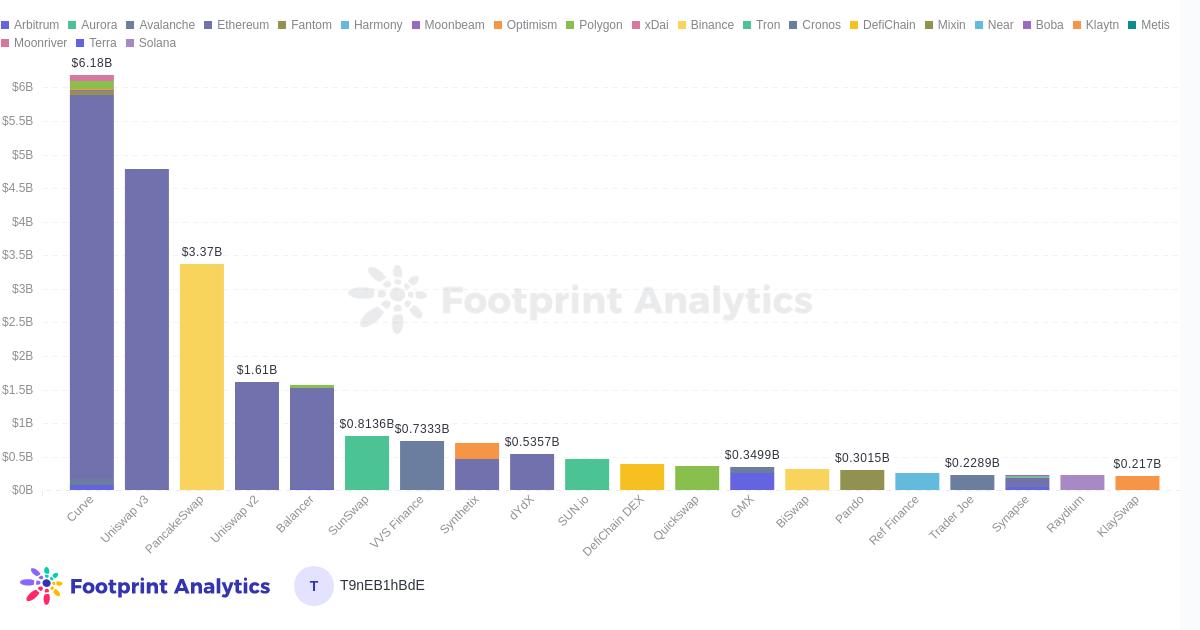

image description

Footprint Analytics - Top 20 DEXsand their TVL in Different Chains

Why is market cap important to DEX?

Market capitalization is one of the most critical metrics when analyzing cryptocurrencies. Market cap is calculated by multiplying the circulating supply of an asset by its current price. For example, if 100,000 units of a crypto asset are worth $1, then its market cap is $100,000.

Market caps tell us how big a cryptocurrency is relative to others in its industry, and they are often used as a benchmark for a crypto asset's popularity and desirability.

Companies with high market capitalizations are generally considered more valuable than those with lower market capitalizations -- but not always. By comparing the market cap of a DEX to its usage (using SOTV as a proxy), we can assess whether a protocol is overvalued or undervalued. Or, we might find a difference between the project and the user-type project, from which we can see some advantages and disadvantages of the project.

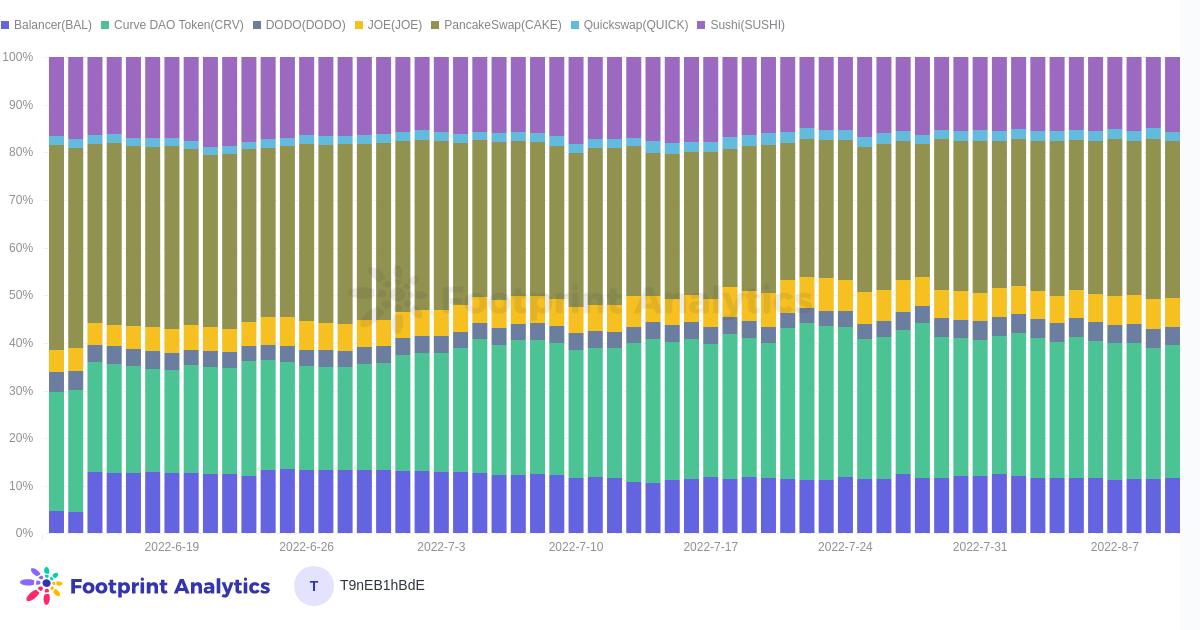

image description

Footprint Analytics -A chartshowing a basket of 7 DEXs and their share of market cap.

What is the Share of Trading Volume (SOTV) metric?

We can calculate SOTV by dividing the total daily trading volume of DEX by the total daily trading volume of all exchanges.

SOTV allows us to understand how many transactions have occurred in a particular ecosystem, and can be used as an indicator of the relative health of the ecosystem, and can also visualize the prospects of its tokens (if applicable).

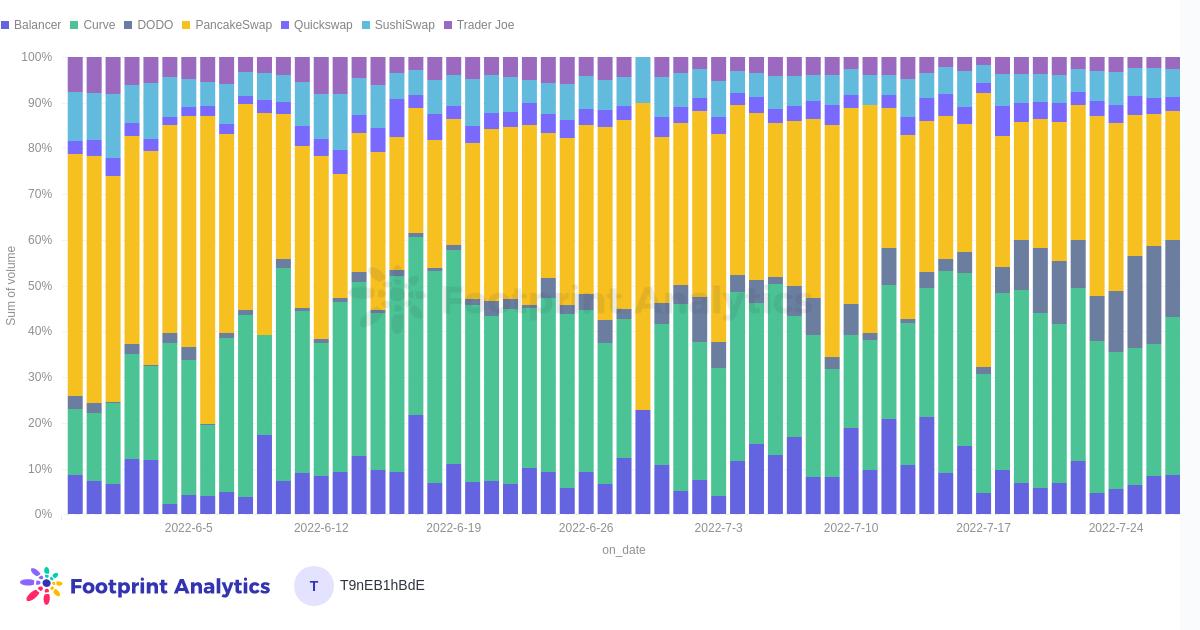

image description

Footprint Analytics -A chart showing a basket of 7 DEXs and their share of trading volume.

Finding Hypotheses Based on SOTV/MC

The SOTV/MC ratio is a contextual metric that only applies to the limited sample of agreements that you analyze simultaneously. Casting too wide a net can lead to false discoveries because there is a lot of variability between DEXs. Data output is just as important as data input.

We use the 7 major DEX platforms other than Uniswap as analysis cases because they have standard DEX functions. Because Uniswap, as the leader in the DEX market, is a leader in similar products, the data of Uniswap will cause the overall data to deviate greatly from the real market conditions. We also removed Sunswap and VVS as they belong entirely to their respective ecosystems. Another sample of a limited set of meaningful protocols are "DEXs with futures trading" - dYdX, MCDEX, Perpetual Protocol, etc.

The higher the SOTV/MC, the more overvalued the DEX's market cap relative to its trading volume.

For example, analyze the two largest DEXes in an ecosystem. DEX A has a daily volume of $600 and a market cap of $400. DEX B is only trading $400 a day, but for whatever reason, has a market cap of $600.

To calculate SOTV/MC for DEX A, you divide the share of volume 60 by the percentage of market cap 40. The result is 1.5. For DEX B, you divide 40 by 60 to get 0.6. In theory, DEX A is underestimated, but it's important to remember that this metric is only a small part of the overall data analysis.

Here are some findings from the SOTV/MC analysis of Balancer, Pancakeswap, Sushiswap, Curve, DODO, Quickswap, and TraderJoe. available hereFind the corresponding DashboardCheck.

Is the value of CRV currently underestimated?

Curve SOTV/MC:1.2

Pancakeswap SOTV/MC:0.9

Curve and Pancakeswap are the two major DEXs after Uniswap. Even though Curve has almost 6% more SOTV than Pancakeswap, CRV and CAKE are almost neck-and-neck in market cap (though CRV is rising and CAKE is falling). While their primary uses are quite different, it can be argued that Curve, which facilitates stablecoin DeFi, is more secure than Pancakeswap’s. Pancakeswap is a layer 1 DEX that lists a large number of low market cap "memecoins". However, CAKE is more versatile than CRV.

DODO is a hidden gem?

DODO SOTV/MC:4.5

As of July 27, DODO's SOTV was 17%, making it the third-largest DEX in the group. However, its market capitalization is relatively small at 3.7%. For investors who are bullish on DEXs, DODO is a protocol worth watching.

How valuable is brand building to DEX?

TraderJoe SOTV/MC:0.4

Quickswap SOTV/MC:1.3

Summarize

Summarize

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.

This article comes fromFootprint Analyticscommunity contribution

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.