August NFT hot spot: CC0 policy and the rise of Sudoswap

Although the entire cryptocurrency market rebounded from the previous trough in August under the influence of Ethereum Merge and the improvement of economic indicators such as the US CPI and unemployment rate, the entire NFT market is still developing in a worse direction. As more liquidity was taken away from the NFT market, even the floor prices of traditional blue-chip projects such as Boring Monkey and Moonbird have experienced a large drop. However, the situation of Moonbird may be a little special, because the founder Kevin Rose announced that the project was transformed into CC0.

If you don't know the CC0 policy very well, you can refer to this thread:https://twitter.com/omrlxs/status/1561080640744951808

image description

Moonbird project secondary market trend

Although everything is just unofficial speculation, the cruel reality is that today's NFT industry is in great need of fresh blood from web2. The CC0 policy is not only the best way to incubate derivative projects and second-generation projects, but also build a bridge between the NFT/web3 and web2 worlds. And this coincides with Kevin Rose's idea of building Highrise, a web3 social ecological kingdom. In order to achieve this goal, sacrificing exclusive IP patent rights becomes very necessary.

For more information about the Highrise project and potential future roadmaps, please refer to this thread:https://twitter.com/mikewunyc/status/1559544783684751360

So will other NFT project parties follow the trend of this CC0 policy? We don't know yet. But the core concern here should be: Is there a better platform to help CC0 projects and their derivative projects and secondary creations to generate enough cash flow income to support their continuous long-term operation?

The answer is very coincidental, and it happens to be another hot event in August: the rise of Sudoswap/SudoAMM.For an introduction to the background and mechanism of the SudoAMM project, please refer to this thread:https://twitter.com/corleonescrypto/status/1559206562685747202?s=20&t=udYD6SFHdzibrBxeUnVQiQ

Simply put, SudoAMM introduces the traditional automatic market maker mechanism into NFT, which allows users to trade and exchange NFT through the liquidity pool. Users can also buy and sell NFT by providing liquidity to the pool to obtain income, and the price is set along the bonding curve. Therefore, this mechanism enables SudoAMM to provide more instant transaction liquidity than traditional centralized trading markets such as Opensea, and there is no review risk. CC0 or derivatives projects usually bear the huge risks brought about by strict scrutiny from the centralized trading market, making a decentralized trading market like Sudoswap an option.

Because NFT project parties usually reserve a certain proportion of NFT, they can create liquidity by creating a Sudo transaction pool and injecting NFT and additional ETH. In the end, Sudoswap may become an optional trading market for CC0 projects or ordinary projects to create and maintain liquidity. This behavior may help project parties save market-making expenses in the centralized trading market, and can create liquidity pools to Generate potential additional fee income. Especially in a bear market, liquidity has become a major factor in determining whether players are willing to hold a project for a long time, and largely determines the performance of the project in the secondary market.

Unfortunately, at present, this idea can only stay at the theoretical level. Because this directly exposes the market-making behavior of the project party to the sun. Although the regulation of NFT secondary market transactions has not yet been perfected, based on previous cases such as the Opensea trader Ratcang being sentenced and other cases, the improvement of the regulatory system will come sooner or later. Therefore, whether the project party can build its own trading pool in this way remains to be verified.

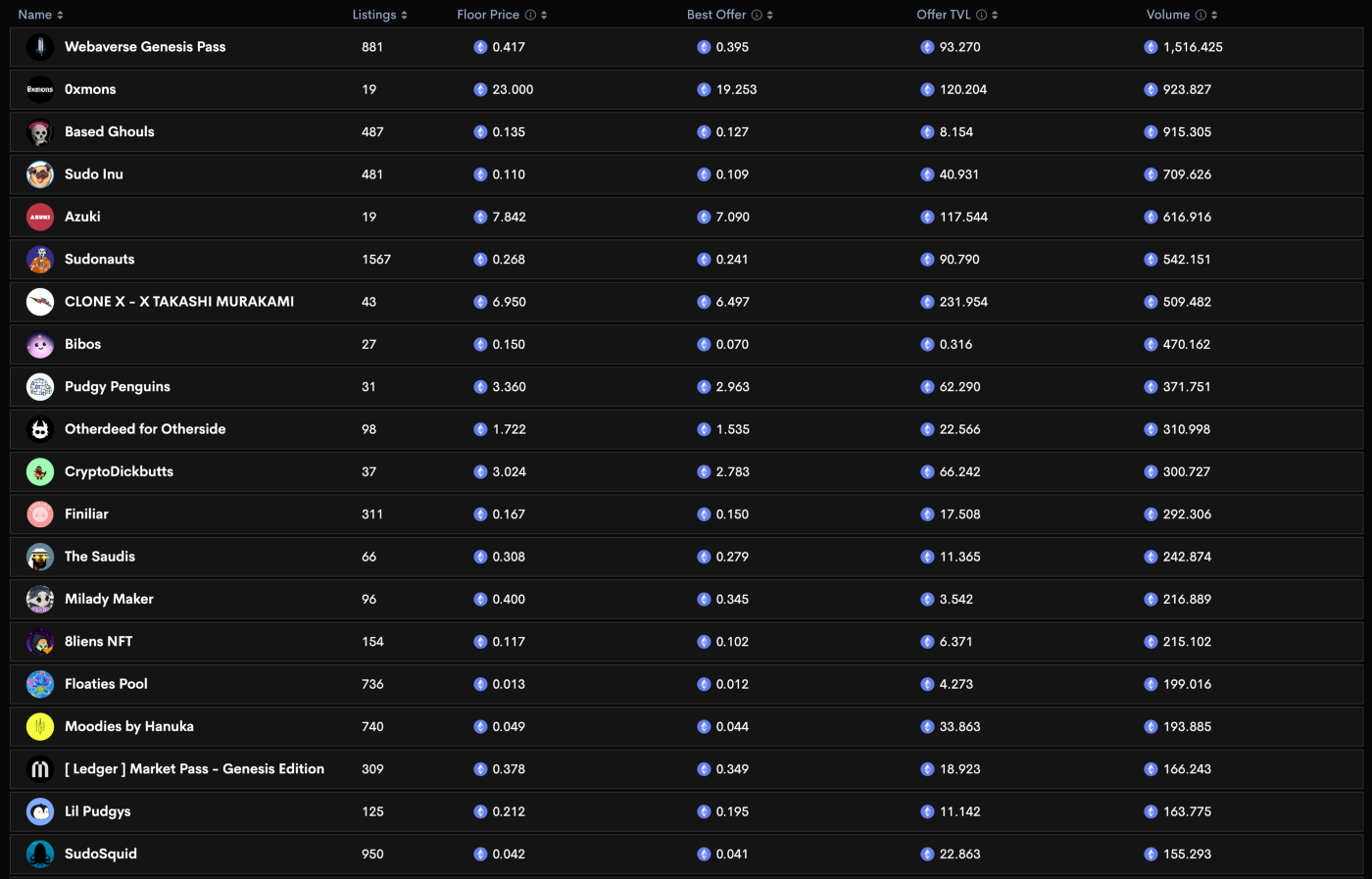

image description

Sudoswap Total Trading Volume Ranking

In addition, pricing disputes for different rarities and characteristics are also a pressing issue. Through the review of the calling method of the contract address on Ethereum, it can be found that the operation of exchanging ETH for NFT is 0x11132000, and the corresponding contract method swapETHorSpecificNFTs requires 4 parameters:

swapList: the list of tokens to be traded and the NFT IDs to be purchased

Recipient: The address that will receive unspent ETH input

nftRecipient: the address to receive NFT output

deadline: timestamp, the order will not be executed if the timeout expires

It can be seen that the concept of rarity no longer exists in pricing and trading scenarios. This will cause Sudoswap to only focus on providing liquidity to floor NFTs, while ignoring the liquidity requirements under different pricing standards required by NFTs of different rarities and characteristics. So for those NFT projects that need to emphasize rarity and feature diversity, is there currently an alternative solution to improve liquidity? In fact, as early as May 2021, the DRepublic team proposed a protocol solution called EIP-3664 (also known as the NFT attribute extension protocol). According to the article of Foresight News, there is no need to modify the existing ERC-721 protocol and ERC-1155 protocol in this scheme. It supports directly attaching attributes to NFT in the callback function of IERC721Receiver or IERC1155Receiver of the NFT mint method, or through The method of overriding the mint contract is customized to realize the way of attaching attributes to NFT. An NFT can attach any number of attributes infinitely. NFT attributes are tokenized.

Now well-known NFT fragmentation protocols such as NFTX, etc., only increase liquidity by converting NFT into FT. However, this method sacrifices the nonfungible characteristics of NFT itself, which is far from satisfying the requirements for rarity and NFT projects that demand diversity of features. However, if different types of tokens are issued for NFTs with different rarities in the same project, the integrity of the project will be further lost, and it will also not be able to play a role in making value judgments on the different characteristics of the same NFT.

The difference of EIP-3664 is that the update, transfer and evolution of attributes can be realized by extending the basic EIP-3664 protocol. At present, EIP-3664 has realized six core attribute operations: upgradeable and modifiable , can be added, removed, split, and combined. That is to say, EIP-3664 provides NFT with a detachable and composable feature, allowing all NFTs to be assembled freely. The initial version released by Genesis is a combination of multiple different parts, similar to a Lego set, and each part can still be sold as a complete NFT asset in the secondary market after being split.

If EIP-3664 can solve the liquidity dilemma, then the value of the rare characteristic attribute itself will be very high, thus further enhancing the value of the IP itself. For the CC0 project, is it possible for the project party to retain the ownership of these rare feature attributes, and only open the attributes of common rarity for ecological construction? This may be a future development trend. Maybe in the near future, we will be able to conduct individual feature attribute transactions on SudoSwap, then the liquidity of NFT will be greatly improved. And this may also attract more NFT projects that require extremely high rarity and feature diversity, such as game props, old pfp blue-chip projects, generated artwork, etc., which will also help to improve the problem of poor gold content in Sudoswap's existing projects. After all Only by attracting more leading project parties can we truly establish a greater voice in the industry.

Reference list:

“Sudoswap.” Sudoswap, https://sudoswap.xyz/#/.

Fourteen Jun. "One article clarifies - the AMM mechanism of SudoSwap, a rookie in the NFT market - innovation challenges and limitations." WeChat Public Platform, 21 Aug. 2022,https://mp.weixin.qq.com/s/S9oRPtLEp1IHJ76BHOJGDQ.

Black Mario. "Composable NFTs? Check out the EIP-3664 standard." Foresight News, 12 Aug. 2022,https://www.foresightnews.pro/article/detail/11502.

For more information, please follow SATCE official website and our Twitter account: