In-depth interpretation of Ethereum data, what is the deflation ratio after the merger and upgrade?

As the second largest cryptocurrency by market capitalization, any changes to the ethereum network will be closely watched by the market.

Ethereum's next important upgrade "The Merge (merge)" is coming in September, and you can also find it inOur official website special pageIt is clear that there are still about 20 days before the upgrade is completed.

Regarding the basic concept of this upgrade, we have already introduced it in previous articles. What this article wants to do is: through a series of data to visually present, what will be the deflation situation of ETH after the merger and upgrade of Ethereum.

The inflation/deflation of Ethereum is mainly affected by two factors, one is the issuance of Ethereum, and the other is the destruction of Ethereum. The merger and upgrade of Ethereum is a complete conversion from the PoW algorithm to the PoS algorithm. Ethereum mining will soon become history, so the main factor affected is the issuance of Ethereum.

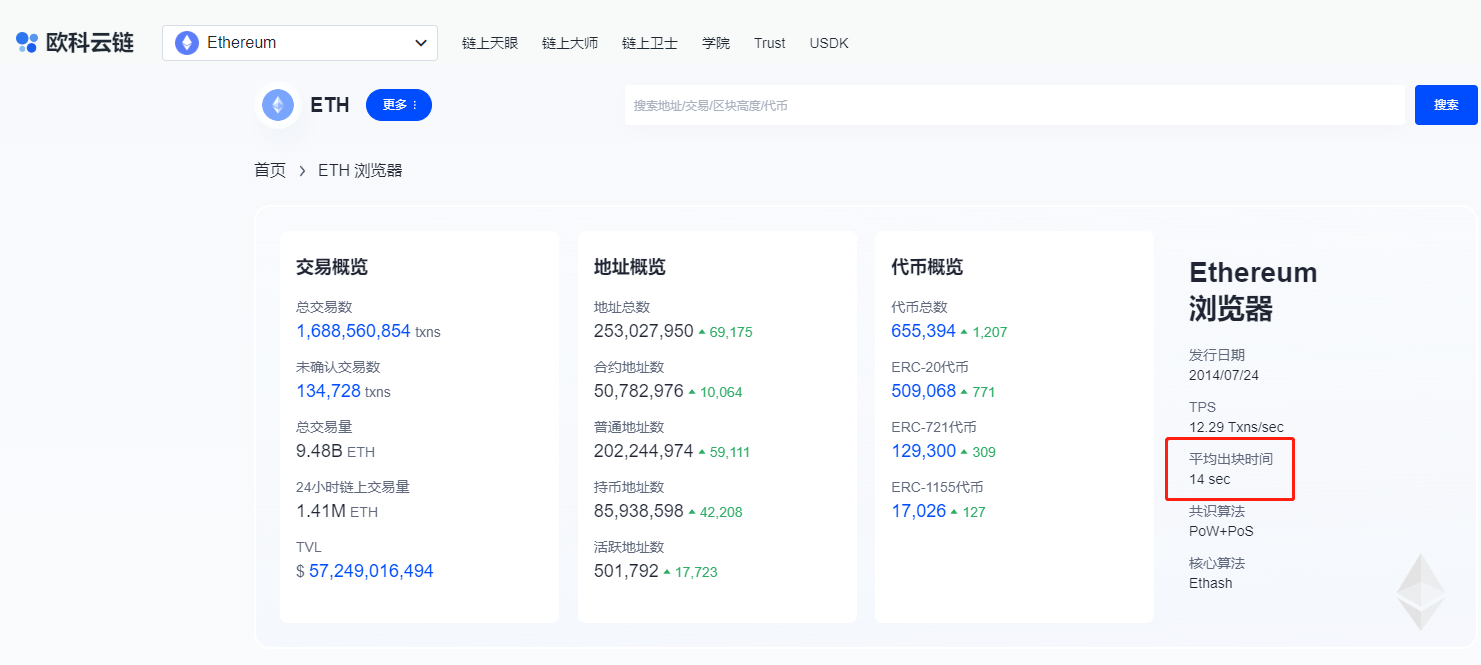

In 2019, the Ethereum mainnet underwent a Constantinople upgrade. After this upgrade, the Ethereum mining reward was set at 2 ETH per block. In addition, if miners dig out "uncle blocks", such blocks cannot be added to the main network blockchain according to the longest chain principle, but they can also get certain rewards. According to OKLink browser data, "uncle block" rewards are about every Block 0.09ETH. So the current reward/circulation per block is about 2.09ETH.

In December 2020, the Ethereum beacon chain was launched (Ethereum main network is called "execution layer" and the beacon chain is called "consensus layer"). By pledging 32 ETH in the dedicated contract of the main network, the Can become a verification node of the beacon chain. The verification nodes of the beacon chain obtain ETH rewards through the block transaction verification certificate. According to the performance of the verification nodes, the rewards are calculated and distributed in each "Epoch era" of the beacon chain. Here, the ETH rewards that the verification nodes can obtain will be obvious It is lower than the mining reward under the proof-of-work mechanism of the main network. According to the data of the OKLink browser, the total income of the beacon chain verification nodes in the past month has averaged 1,622 ETH, which can also be regarded as the average daily issuance of ETH on the beacon chain. quantity.

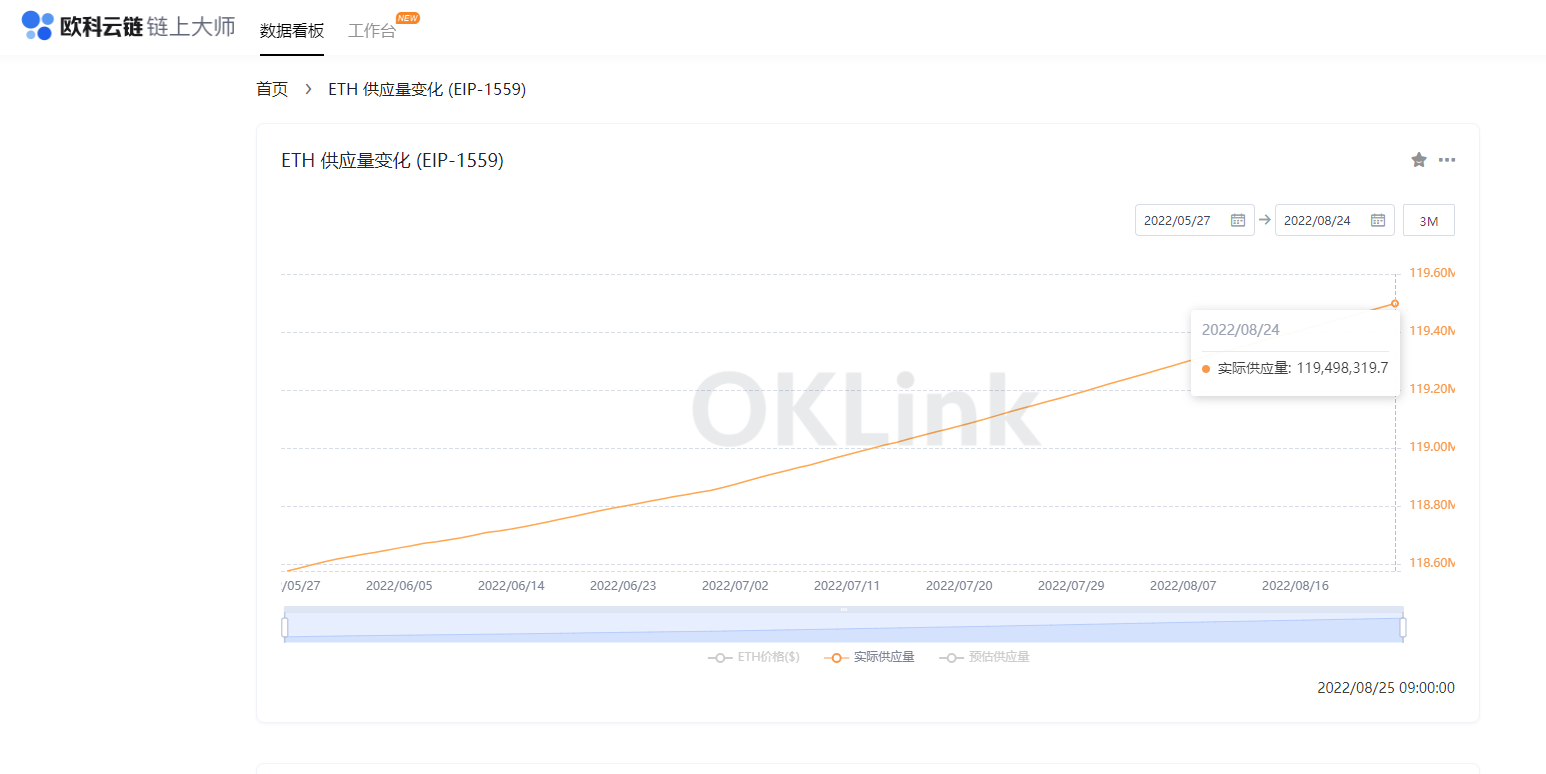

The current supply of ETH on the Ethereum mainnet is 119,498,319.7 ETH.

The issuance of the Ethereum mainnet is that the average block time is 14 seconds, and each block rewards 2.09 ETH, so the annual issuance of Ethereum is 4,707,874.26 ETH. Based on this, the current inflation rate of Ethereum is 3.9%.

The issuance of the Ethereum beacon chain is calculated on the basis of the above-mentioned average value of 1,622 ETH per day, and the annual issuance is 592,030 ETH, and the annual inflation rate can be calculated to be about 0.49%.

To sum up, the total annual issuance rate of Ethereum’s current main network and beacon chain is 3.9%+0.49%=4.39%, of which about 88.84% are issued on the main network, and the remaining 11.16% are issued on the beacon chain.

After the merger and upgrade, the issuance of the main network/execution layer will be zero, while the issuance of the beacon chain/consensus layer will continue, that is to say, nearly 90% of the issuance will disappear, and the foundation of Ethereum deflation will be established.

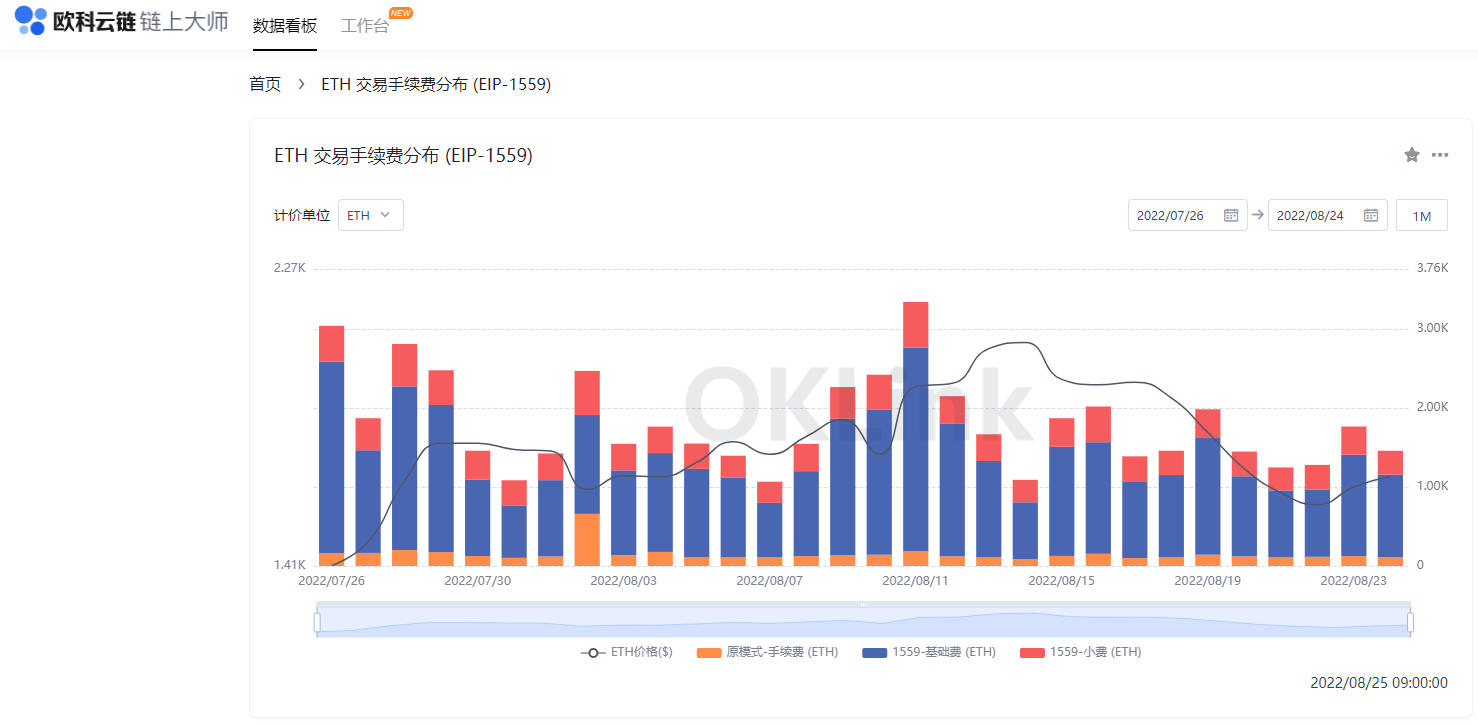

In August 2021, the Ethereum destruction mechanism was launched with the upgrade of London, and has continued until now. This plan is also known as EIP-1559. It is an improvement proposal put forward by the Ethereum community to solve the Ethereum congestion problem. Every transaction Users need to pay a fixed base fee. If they need to speed up transaction confirmation, they can pay a tip to the miner. The tip belongs to the miner, and the base fee will be completely destroyed.

The average daily base fee of Ethereum in the past year accounted for 70%, and a total of 2,511,002.527 ETH was destroyed, accounting for 2.1% of the total circulation. Assuming that the average annual destruction of 2.1% is maintained after the merger of Ethereum, the inflation rate of Ethereum will be 0.49 %-2.1%=-1.61%, Ethereum will enter the era of real deflation.

Note: The above charts and presented data can be found through the browser page of oklink.com, and the charts can provide data downloads. Some of the unmapped data in this article are calculated from the downloaded data.