a16z: Project Treasury Management Guidelines for Surviving the Bear Market

This article comes from a16zThis article comes from

, Original author: Jeff Amico & Maggie Hsu & Ed Lynch & Emily Westerhold, compiled by Odaily translator Katie Ku.

The cryptocurrency market is volatile. Prices have fluctuated wildly over the past year, only recently recovering from an active "winter".Treasury (capital library, financial library) management is the way the project party manages resources to ensure that the company can continue to operate and have sufficient operating cash on hand. This may involve short-term expenses such as paying salaries and rent, or making long-term strategic investments such as acquisitions and research and development.

Regardless of the spend, Treasury management is focused and focused on achieving the project's core business objectives.

Here, we strongly recommend the following five points in the Treasury management basic framework that teams follow.

secondary title

1. Calculate monthly cash burn

The first step is to create a realistic financial model. i.e. tracking monthly projected money inflows and outflows (e.g. "net burn"). Calculating the estimated monthly cost of a given project, the analysis should indicate the components that drive revenue and expenditure. For example, the spending side should list expenditures across key operating functions (engineering, business development, legal, etc.), as well as any expected non-operating outflows (financing costs, taxes, other one-time payments, etc.). In terms of revenue, the inflow of funds should also be divided into operating and non-operating categories. This will help determine their relative predictability over time.

DAOs differ from traditional startups in many ways, including their organizational structure and degree of decentralized control. As DAOs continue to evolve and adopt more complex operating structures, forecasting their overall financial health will be critical. This will ensure they are able to cover operating expenses, including contributions, incentive schemes, etc. It will also add transparency to the state of the DAO's operations, facilitating better decision-making.

secondary title

2. Use cash to maintain operating expenses

Once the cash burn rate is determined, the project can begin developing an overall Treasury management plan. The core objectives are: capital preservation, liquidity and income.The first priority is to cover near-term operating expenses. Optimizing the security and availability of funds is key before exploring opportunities to earn yield. This usually means that in a basic cash account (for example, a bank deposit or a money market account) or in the case of a DAO,

Sustain at least 12 months (ideally 18 months) of operating expenses in a high-quality stablecoin. This capital will earn relatively small gains but is conservatively available to repay short-term debt when it comes due.In addition to maintaining short-term cash outlays, projects should ensure currency matching of assets and liabilities.That is, if liabilities are denominated in U.S. dollars, then the corresponding current assets should also be denominated in U.S. dollars.

This is especially important for companies or DAOs that hold crypto assets but whose fees are denominated in USD. To avoid having to sell depreciating assets when the market falls, teams should ensure that they regularly convert assets into the appropriate currency to cover ongoing operating expenses. Of course, they must also ensure that any sale of assets is conducted in a manner that complies with regulatory restrictions and complies with relevant laws and taxes.

Asset diversification is fairly rare. A recent study by Chainalysis revealed that 85% of DAOs store their entire assets in a single cryptographic asset (usually the native governance token). Of those who hold stablecoins, most hold 10% or less of their reserves. While some DAOs have limited operating expenses, for those that do have substantial operations, they may be forced to sell their native tokens at a low price to cover operating expenses, or cut back on core strategic initiatives. This is not the optimal solution.Like selling native tokens in a falling market, or cutting back on strategic moves. Properly managing cash can ensure that projects can cover what could be long-term costs, which is crucial during a bear market when funding markets can be challenging. Planning ahead also allows the project to stay focused on core operating objectives and to know what is being lost and gained from working capital.

secondary title

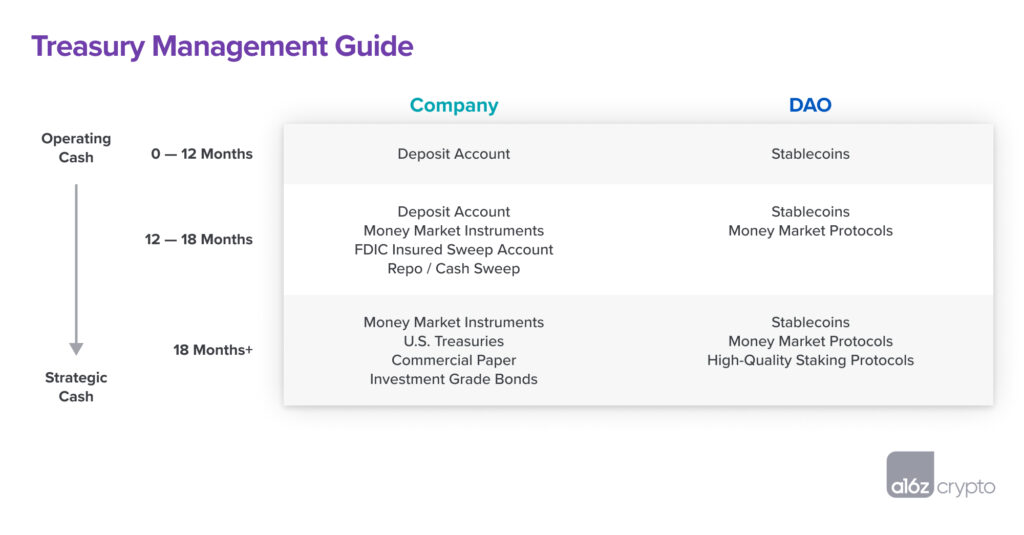

3. Develop a plan for additional fundingFor companies that hold cash beyond their 12-18 month operating budget, there is more initiative to explore opportunities to increase earnings,Should be adjusted according to the liquidity needs of the project. The chart below provides a high-level view of each product and when it is appropriate to include it for reference.

Generally speaking, as projects move from operating cash (used to meet day-to-day needs) to strategic cash (used to pursue growth and other opportunities), products that offer higher yields are more appropriate.

Each product has different risks, yields and liquidity. Before they can be allocated, a basic plan needs to be developed.

We often share an investment plan template with traditional portfolio companies. While some of these considerations may not apply to early-stage companies, DAOs, and other projects, they are instructive in understanding how companies with larger balance sheets think about cash management.

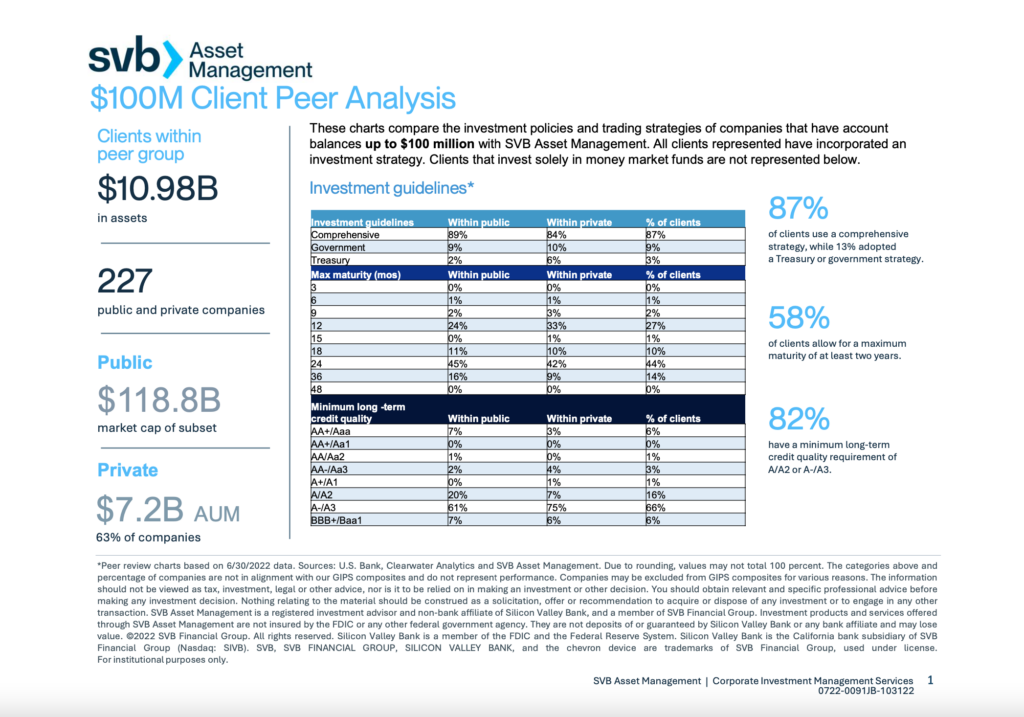

Typically, traditional companies invest excess cash in safe assets. These products include money market instruments and investment grade fixed income securities (rated 3B or higher). Within a given portfolio, these companies typically diversify assets across different maturities, credit quality, industries and issuers. Below is SVB's allocation to mid- to late-stage companies with $100 million or less in assets.

While we've seen some corporate treasuries take on additional risk in recent years, a more conservative approach is usually still wise. This is especially true in the current interest rate environment, where yields on many traditional credit and banking products are starting to pick up. A portfolio built around these types of assets may be a good fit for many companies.In the long run, investing in high-quality protocols such as Lido is a good choice. However, as with traditional products, it is important to consider the risk, return and liquidity profile of these options before deploying them. It is also important to assess any technical or operational risks that may arise when interacting with on-chain assets or protocols to ensure projects do not expose assets to risk of loss.

secondary title

4. Strengthen operational capabilities

Once you decide on a strategy, it's time to implement it. For companies with a more traditional Treasury management plan, there will be a need to source banking partners and investment advisors and put in place internal processes to ensure proper custody, reporting, valuation, controls, tax and audit requirements are met.

The project does not need to be "all inclusive". Banking partners can help provide investment vehicles that align with the company's investment policy strategy. Banking partners can also recommend more sophisticated investment advisors to help maximize returns within specific risk parameters. For procedures related to investment and income accounting, be sure to consult an accounting firm or auditor.

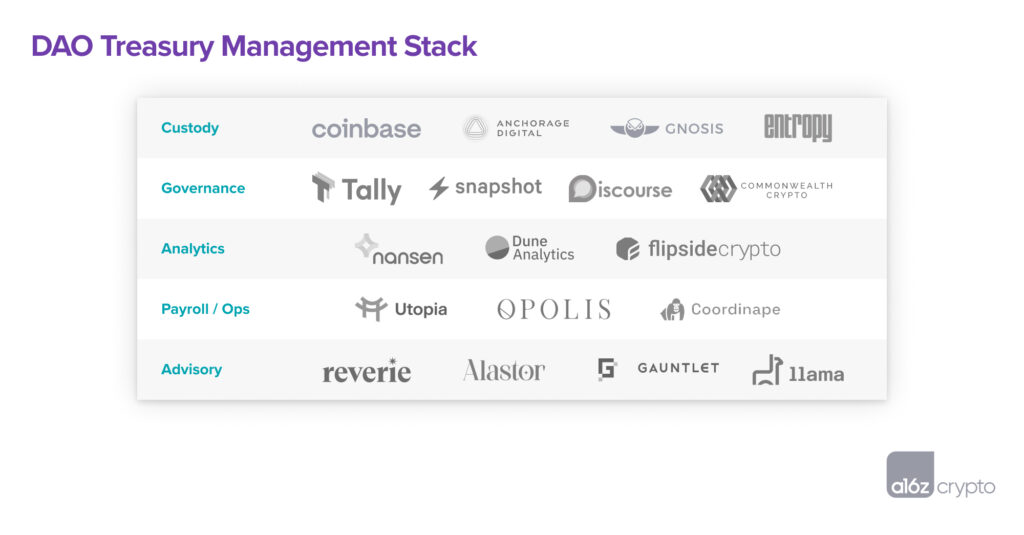

For DAOs or companies holding cryptocurrencies, the diagram below outlines some operational priorities:

A secure wallet setup is necessary to ensure assets are always safely escrowed. This is especially important when assets are deployed to other protocols or otherwise move on-chain. Choices range from traditional custodians like Anchorage or Coinbase, to decentralized or multisig options like Entropy or Gnosis.

In addition to custody, DAOs typically require some form of governance approval from token holders before executing a treasury management strategy. Snapshot and Tally tools are available for voting, while Discourse and Commonwealth forums help facilitate community discussions.

Finally, you can consult the relevant companies. These firms include traditional advisors such as Silicon Valley Bank, as well as local crypto firms such as Reverie, Alastor, Gauntlet, and Llama. The team should also ensure regulatory analysis of various strategies and engage external consultants as appropriate.

secondary title

secondary title

Summarize

Summarize

Treasury management is integral to the long-term success of any project. To maximize the chances of success, both cash management and long-term capital allocation should be clearly defined and properly executed.In current economic conditions, it is important to think critically about potential additional business expenses that may arise outside of the normal course of operations.Once a project has a conservative estimate of the capital required to maintain operations, it should set aside an available cash balance equal to at least 12 months (preferably 18 months) of net cash outflows. Any remaining cash reserves can then be allocated according to policy.