Adhere to the logic of PoW: the legality and feasibility analysis of Ethereum Merge hard fork

Author: Spike, researcher at ThePrimedia

Original editor: Jerry, founder of ThePrimedia

I believe that not everything that can be counted counts, and not everything that counts can be counted.

I believe that what can be counted is not necessarily important; important things may not be counted.

— Einstein

The original intention of decentralization should not be ridiculed by the crowd, especially because it is related to the soul of the Web3 world and determines the future of encryption ecological construction.

Instead of calculating the gains and losses after switching to POS, it is better to think carefully about what happened-why are you applauding the trend of centralization?

Signs are already emerging that the idea of decentralization needs to be reemphasized with urgency and importance. After Aave and Circle responded to the U.S. Department of the Treasury’s sanctions against Tornado Cash, hundreds of celebrity addresses were “accidentally injured” by Aave, USDT’s circulation surpassed that of USDC within a week, and MakerDAO re-examined the collateral composition of DAI… Stable The consequences of currency centralization are already warning everyone that when all this happens in Ethereum, it will completely backfire on the first principle of decentralization.

If we don't stop it, then more than ten years after the advent of Bitcoin, the impossible triangle of the blockchain world will be resolved-at the cost of giving up decentralization, it will be completely reduced to a mediocre, indistinguishable Wall Street financial game. Since Bitcoin, Satoshi Nakamoto has "opened a window and revealed a ray of light" for the world"The imagination will also disappear.

Fortunately, there are still people in the crypto market who insist on decentralization: BitCoke and the mining farms it invests in officially announced that they support hard forks and token transactions, believing that these sticklers are defending the spirit of Satoshi Nakamoto’s blockchain; BitMEX launched ETHPOWZ22 derivatives products; EthereumFair is ready to defend the ideal of PoW with technology, and build a complete financial ecology belonging to ETHPOW... This is also a preparation for defending our original dream. become a dragon.

first level title

Part 1: The Legitimacy of the Resistors

The conversion of Ethereum to the PoS mechanism means abandoning the insistence on Nakamoto doctrine, which is the "mission" of the hard fork of the adherents. The Ethereum Merge hard fork can be summarized as energy saving + scalability VS security + decentralization . This is essentially a dispute over the development route of the blockchain, rather than a fork dispute in which miners coerce everyone for their own interests. The PoS mechanism will directly prompt the exit of network maintainers and miners. New staking nodes will inevitably lead to centralization of the network.

At present, the TVL of Ethereum accounts for 60% of the public chain track - the win-win situation of miners, users and Ethereum under the PoW model has achieved the prosperity of the decentralized encryption ecosystem today and left more room for expectations for the world . Thousands of people are not as good as one, just like the consensus of the EthereumFair technology community-the PoW mechanism is the best way to guard the original intention of blockchain decentralization. If you let it go, decentralization will become a castle in the air that is out of reach .

Ethereum grew up on the shoulders of Bitcoin. Don’t forget the basic elements of Ethereum’s success—PoW+smart contracts together constitute the ecological prosperity of Ethereum:

PoW is a mining mechanism. Miners compete for bookkeeping rights through hash collisions and order transactions. PoW is a guarantee for everyone to participate in Ethereum fairly.

Smart contracts are the basis of complex operations such as DeFi, NFT, and GameFi. For the first time, a public chain ecology in which multiple assets on the chain coexist.

The PoW model created by Satoshi Nakamoto is not a golden rule. The fundamentalist orientation towards technology will only bind us, but the development of Bitcoin from its launch on the mainnet to the present is the best comment on PoW. It can be understood that "Satoshi Nakamoto doctrine" has passed the test of history. In the blockchain world, decentralization, security, and scalability are the impossible triangle that has never changed. The merger of Ethereum is just evading this problem, rather than seeking a fundamental solution. After giving up PoW, the transaction The objectivity of confirmation will disappear, as will the physical connection between Ethereum and the real world.

The logic of adhering to POW is clear: in the Bitcoin PoW mode, the principle that miners finally confirm is the longest chain principle. Specifically, on Ethereum, it is the Heaviest Chain principle under the control of the Ethash algorithm. The consensus confirmation of the whole process is algorithm + mining machine computing power + block confirmation. In the PoS mode, the consensus of the pledged nodes dominates the confirmation result, and the confirmation of the true random number cannot be realized until the fifth stage of Merge. Here Previously, Ethereum would be a random walk numbers game.

On the basis of communicating with POW sticklers, let's analyze the logic of V gods. In V God's view, switching to PoS mode is the only way to upgrade TPS (processing per second) - but behind it is the competition for capital (32ETH) + high efficiency to deal with Aptos/Sui in the Move ecosystem Catching up with new public chains. The first step of the ETH2.0 roadmap is launched from the Ethereum beacon chain, aiming to introduce a safer and more efficient proof-of-stake mechanism for the consensus layer of the Ethereum network, and to break away from the intense consumption of energy after integration with ETH1.0 , Towards a consensus mechanism oriented by proof of rights and interests.

Let’s take a look at the main events of the transformation of POS—on the way of Ethereum, “Ethereum 2.0” has two main upgrades: one is the consensus change from POW to POS; the other is the sharding technology for network performance expansion.

"ETH 1" is now the "execution layer", handling transactions and execution;

"ETH 2" will be the "consensus layer", dealing with proof-of-stake consensus;

After merging "ETH 1" and "ETH 2" into a single chain, there will no longer be two different Ethereum networks, the term "ETH 2" will be completely discarded, and only the overall concept of "Ethereum" will be retained ( Terminology is for naming purposes only and does not change Ethereum's goals or roadmap).

In the view of the EthereumFair research team, these two upgrades are not effective in the PoS mode. Defending PoW is not only beneficial to miners, mining pools and mining machine manufacturers, and the PoS mechanism will not be the dividing point that changes everything. The PoS mechanism has always been Being explored is not a new algorithm concept. Vitalik They will say that 32eth is more decentralized than thousands of mining machines. But compared to abandoning PoW and transforming to POS, a better solution is that Layer 1 only does what is necessary, such as consensus, allocation of bookkeeping rights, and all performance improvements can be placed in Layer 2.

"Sacrificing the security and decentralization of Layer 1 is actually completely unnecessary." This is the core idea of EthereumFair, which is in line with the official attitude of BitCoke, which strategically supports hard forks: security and stability are the cornerstones of public chain development, Efficiency is not the only goal pursued by the public chain. Many application scenarios pursue security and stability, especially large funds, such as loans, mortgages, etc. There are many solutions to improve the efficiency of POW, such as Layer2, and POS is not the best solution.

In the logic of the sticklers, the transformation of POS has a greater negative impact of division. The core competitiveness of a public chain is not a certain mining model, but its ability to operate steadily and gradually establish its own ecology. The bifurcation crisis we are facing this time will trigger a split in the community and the ecosystem on the chain. This kind of split happened once. After The DAO was attacked in 2016, the community that insisted on the immutability of the blockchain insisted on confirming that the state of the block after the attack became ETC, and insisted on rolling back to the state before the hacker attack. Be what ETH is today.

Later, the fact is that ETC is operating poorly, and ETH is ecologically prosperous. Is this (etc) a bug? This time, the sticklers need a kind of belief support for the legitimacy of the hard fork. This legitimacy is the best interpretation of the idea of decentralization. The attitude of the EthereumFair team is that the fork is definitely not a one-off decision, but a long-term construction that needs to recognize the reality. It can be assumed that the forked ETH-POW chain will encounter many problems, such as:

Lack of DeFi/NFT/GameFi ecology on the chain

Mainstream stablecoins such as USDT/USDC do not support

Lack of enough developers to update the client

Insufficient number of network status confirmations

In the face of more rampant attacks by hackers

These difficulties exist objectively, but the rationality of the fork itself should not be questioned. Abandoning PoW will cause the fairest mining mechanism envisaged by Satoshi Nakamoto to become a game of capital. In Ethereum 2.0, the minimum pledge amount of nodes is 32ETH. After switching to the POS mechanism, all nodes in ETH need to Blocks are voted on, and only a block that gets 2/3 of the locked ETH votes of the entire network is considered a valid node. In terms of mechanism design, there is a tendency to expel small and micro retail investors, and more depends on the support of giant whales. After adopting the PoS mechanism, in order to ensure network stability and improve the ability to capture token value, increasing the number of pledges is almost the only solution approach, which would further repel the degree of decentralization.

Therefore, the "Ethereum 2.0" plan that is on the cusp this time seems to be an upgraded version of Ethereum, but it is actually a brand new project. Most conventional forks require computing power to make choices, and the protagonist is the miner system. The focus of this POS fork is not a battle for computing power, but a game between capital and capital. At present, in the PoW state, Bitcoin has a total of 14,516 nodes worldwide, of which the number of full nodes is 13,097, accounting for more than 90%, while Ethereum has a total of 4,896 nodes worldwide. After switching to PoS, the number of pledges on the entire network will increase significantly , but the degree of decentralization cannot be guaranteed.

In this game about the future, miners are faced with a life-or-death choice: the first choice is to sell the mining machine and use the sold ETH to participate in the Staking mechanism of POS and become one of the vast nodes; the second choice is to directly Switch the mining machine to the ETC network, in other words, ETH2.0 will prompt the mining industry worth 19 billion US dollars to find a new gold rush; the third option is to hard fork ETH-POW, retain the original PoW model, and choose to rebuild the PoW ecology ——In a sense, this is the most difficult road, but it is the avenue that is most in line with the spirit of decentralization.

This most difficult path has already received an ecological response. For example, in addition to supporting hard fork token transactions, the exchange Bitcoke will also fully support Bitcoke’s major shareholder’s $100 million ETH head mine. Bitcoke's strategic layout of investment in mining farms - DeFi development vision with the goal of asset tokenization and free pledge, lending, trading, etc. in the global market, at this moment of the hard fork of Ethereum Merge, has become the core of the adherents backing.

first level title

Medium Part: The Controversy of the Route of Redemption

After reaching a consensus on the legality of the hard fork, how to carry out the fork has become the core focus of the debate.

Action-first faction: Focusing on BitCoke and other exchanges, strategically support hard forks and build an offensive and defensive alliance between mining machine manufacturers, miners and the market, rebuild the ETHPOW ecological reality, and leave room for discussion on secondary liquidity;

Ecological Construction School: Based on technical communities such as EthereumFair, we hope to build a complete set of ETH-POW ecology including stable currency and DeFi application support as much as possible, and continue the current ecological scene;

Waiting for peach picking pie: ETC hopes to attract ETH computing power to itself as much as possible, and Conflux initiated a community proposal to change its own PoW mining algorithm to Ethash to facilitate miners to switch.

BitCoke launched its official plan. The details of the plan are as follows: BitCoke supports all Ethereum hard fork tokens and related airdrops. BitCoke will launch hard fork token contracts. BitCoke believes that hard fork tokens are seriously undervalued and predicts hard fork The token may stand at $1,000; Sun Yuchen also said that his USDD will support the forked ETHPOW chain to solve the problem of stablecoin access to gold on the chain, but Guo Hongcai’s perspective is completely focused on the miners themselves. Many, at this time they have to stand up and defend their interests...

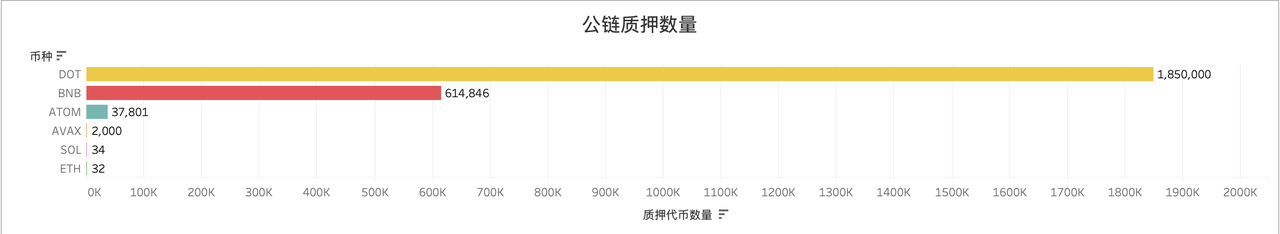

image description

Image source:https://ethereumpow.org/

Therefore, there will be more ecological forces in the market to make better choices and development directions in the game. Capital is the first to pour in, and V God also encourages miners to transfer, which can not only protect the interests of miners, but also minimize the damage to the Ethereum ecology. But the potential harm of influx of ETC mining has attracted the attention of the market.

EthereumFair researcher said, “When a large number of miners pour into ETC mining, it is good for ETC in the short term, but the secondary market must have enough liquidity to bear the pressure. This makes ETC more difficult to mine." The most important problem is that the capacity of ETC is too limited to bear so much computing power. Although the ETH graphics card mining machine is not as power-hungry as the Bitcoin mining machine, and the shutdown currency price is not as high as BTC, but the competition for forced hard mining of ETC is too fierce. Therefore, the influx of a large number of miners will form involution, and the payback cycle will become longer.

first level title

Final chapter: future ecological buidler

In the development history of Ethereum, this is the second global crisis. The last time it proved the weakness of ETC, but it left behind a faint fluorescence that adhered to the concept of decentralization. This ray of light is not enough to become a prairie fire. But the hard fork is given enough legitimacy.

POW is the only blockchain system that has been verified to be completely decentralized and stable so far. All POS public chain systems have experienced security or inaccessibility issues, essentially because the POS system relies on centralized nodes. The fundamental difference between ETH and other public chains is POW, and only POW cannot be achieved by other public chains. The conversion of ETH to POS is a self-defeating martial art, and will lose its biggest advantage-reduced to a starting line with other second-tier public chains. Everyone's mechanism, speed, rate, security, etc. are the same. Why choose the Ethereum POS chain? Is it because of feelings? This is the basis for the value judgment of the exchange BitCoke and the mining farms it invests in to support the hard fork of Ethereum.

image description

Image source:https://wenmerge.com/

ETHPOW is destined to have more than one, and the tension between users, miners and ecology will dominate the future direction of forks, and ecological construction will become a long-term battle field after a short-term carnival. This is the best era, we can fall into a carnival, and ordinary users will get airdrops of each forked chain; this is the worst era, we will witness the cruel and bloody ecological competition, and finally decide the POW ecology king. ETC is a mediocre generation that cannot be supported by mud, and it is difficult to undertake the historical mission of the new fork chain. New PoW chains such as EthereumFair will have the opportunity to break out into a new world-of course, it will take time for which chain will win in the end test.

The future must belong to buidler who has been focusing on ecological construction for a long time. In public chain competition, ecology is the foundation of everything. Users do not assume the responsibility for the survival of the public chain. Better experience and economic returns are always the most primitive motivation for other users. Only by building a better ETHPOW ecology can the PoW chain after the fork be guaranteed. Built to last, not a flash in the pan, falling into nothingness. Next, we will introduce the development concept, technical strength, ecological construction and progress of the Ethereum fork chain EthereumFair, which continues the PoW mining method, based on the research and interview with the EthereumFair technology development team.

The development of the public chain requires the support of supporting infrastructure. From the perspective of users, a public chain with complete functions and usable functions is attractive enough. In the words of the EthereumFair technology development team, ""ETH forking POW is fair, and it will not be a certain investment institution that has a great interest in the early stage. I hope that the funds and friends who supported EthereumFair in the early days will come to support the EthereumFair technology community. The leading ETH fork chain. The Ethereum Foundation is moving to the POS fork, and we will keep the original chain.”

The Ethereum fork chain EthereumFair is forked by the EthereumFair (ClassZZ) technical community. Its ClassZZ public chain PoW technology has been successfully operated for 3 years. The current technology research and development team includes mathematics experts, chip experts and developers who have been in the industry for more than six years. In terms of action, the current EthereumFair development team has implemented a list of functions as follows:

Complete the research and development of the cross-chain support function of the ETHPOW chain,

Test network, browser and other infrastructure,

Financial facilities such as DeFi and stable coins have been prepared.

It can be seen that for this fork, the EthereumFair community will support the POW mining mode of Ethereum to maximize the continuation of the ecology on the chain. Ecology is the foundation of public chain competition, and only by attracting enough miners to participate can we build sufficient network security for a high-performance network and avoid repeating the mistakes of ETC.

The EthereumFair team set the mining difficulty coefficient from scratch. The minimum requirement is a personal laptop to participate in it. It is also beneficial to ordinary users rather than large miners and mining pools. After solving the security problem on the chain, more participants need to build together. The chain after the fork should not be an exclusive ETC-style self-entertainment, but an open chain of many chains.

In terms of development, the EthereumFair community is currently focusing on the implementation of the test network, focusing on difficulty control and block reward adjustments, and strives to provide the same mining program as Ethereum, which is convenient for all users to download by themselves, and will provide block browsing Infrastructure such as servers can be tested as early as August.

EthereumFair also intends to absorb fresh blood from foreign mining pools and large miners to supplement the existing public chain. After the state of the public chain is stable, it will conduct in-depth docking with mining machine manufacturers. For example, mining machine manufacturers have started negotiations on custom mining machines. The latest news is that for the hard fork of Ethereum, the exchange BitCoke and its top ETH mining farm, which invested 100 million US dollars for important shareholders, will also fully support it.

In addition, well-known funds and ecological partners will cooperate with the EthereumFair technical community to promote the ETH fork chain. For example, EthereumFair's L2 public chain ecological research and development team will also enter the current fork synchronously, and bitkeep, swftc and tokenpocket will provide in-depth support for wallets, presenting the current Ethereum infrastructure and dex as the earliest tools provided to developers and users.

As the first successful fork project of Ethereum, ETF pays tribute to all blockchain networks that support the PoW consensus mechanism. The address 0x00000000219ab540356cbb839cbe05303d7705fa currently has a pledge amount of 13,185,717 ETH, and the Token in st-eth will be distributed according to the public key (September 6 Send transactions before) to BTC token holders (55%), DOGE token holders (15% each); then distribute according to address (no need to send transactions) to ETC, CZZ token holders (15% each) %).

secondary title

Support or neutral mainstream exchanges

BitCoke and the top mining farms it invested in officially announced support for the Ethereum hard fork, and have officially announced three plans for the Ethereum hard fork: 1. BitCoke supports all Ethereum hard fork tokens and related airdrops; 2. BitCoke will launch the hard-fork token contract; 3. BitCoke: The hard-fork token is seriously undervalued, or it may reach $1,000.

OKX announced that it will actively monitor and support the merger of Ethereum. When the network upgrade takes effect, there may be a potential hard fork of Ethereum. If there is enough demand, the platform will evaluate and list new forked tokens.

F2pool said that the ether miners are the unsung heroes of the ether ecosystem. Whether the miners support the ether fork is no longer important. It will be decided by the miner community and continue to provide mining pool services for ETH PoW.

TRON Poloniex announced on August 4 that it will support the ETH 2.0 upgrade and potential fork, and will launch two potential fork futures tokens and related trading markets on August 8. If Ethereum is successfully forked this time, some ETHW will be donated to the ETHW (Ethereum PoW fork chain) community and developers to help build the Ethereum ecosystem.

Gate.io released an announcement to support the ETH pre-fork and open the fork currency "candy" in advance. If the hard fork is successful, ETHS will be automatically converted to the upgraded ETH at a ratio of 1:1, and ETHS will withdraw from the trading market.

MEXC will support the upgrade and potential hard fork of Ethereum. After the upgrade is completed, all ETH holders on MEXC will obtain the forked assets at a ratio of 1:1.

The Deribit Derivatives Exchange issued a policy announcement on the Ethereum merger hard fork, saying that the Deribit settlement of all instruments will be carried out on the chain supported by the ETH Foundation (ie POS or ETH2). If the value of the forked tokens is greater than 0.25% of ETH POS and the new chain is stable and running normally, Deribit will provide these forked tokens to users, but if there are new tokens, it will not be considered as a deposit.

BitMEX will launch the ETHPoW futures contract ETHPOWZ22 on August 9, with USDT (ERC-20) as the margin and a maximum leverage of 2 times.

Huobi issued a document "Explanation on Supporting ETH Potential Forks and Processing Solutions", expressing an objective and neutral attitude towards split assets (including but not limited to ETH) created through hard forks. As long as the forked assets meet the security requirements, they will be Support users to hold assets and provide trading services as soon as possible according to the rules. Huobi will support the distribution of assets on the ETH fork chain (including but not limited to mainnet coins) that meet the following conditions: 1. Notify Huobi in advance before the fork and get a clear reply; 2. By default, it has strict two-way anti-duplication 3. The new chain will not be overwritten or eliminated by the original chain; 4. The transaction has a different format so that all wallets (including lightweight clients) Both end) need to be upgraded to support the new chain; 5. The official client software should be released before the hard fork is activated, and the client software must undergo public testing and evaluation.

Moreover, in order to further consolidate the ecology on the chain, the focus of this fork is that the ETHPOW chain has added cross-chain functions, not internal chains, but POW+ external chains, which can support forked chains leading to any other chains. This underlying technology It can ensure the stable financial activities of the public chain in the early stage and avoid the death spiral caused by excessive speculation. Because the hard fork of the sticklers has gained legal spiritual support, and the strategic deployment is also clear and clear - what really determines the success or failure of the fork is whether the ETHPOW ecological construction can achieve results. Lose PoW, lose miners; no ecology, no future.