Ethereum official website: About mergers, you need to know these points most

secondary title

What is a merger? When will it be carried out?

In Q3 or Q4 of this year, the merger will come as expected.

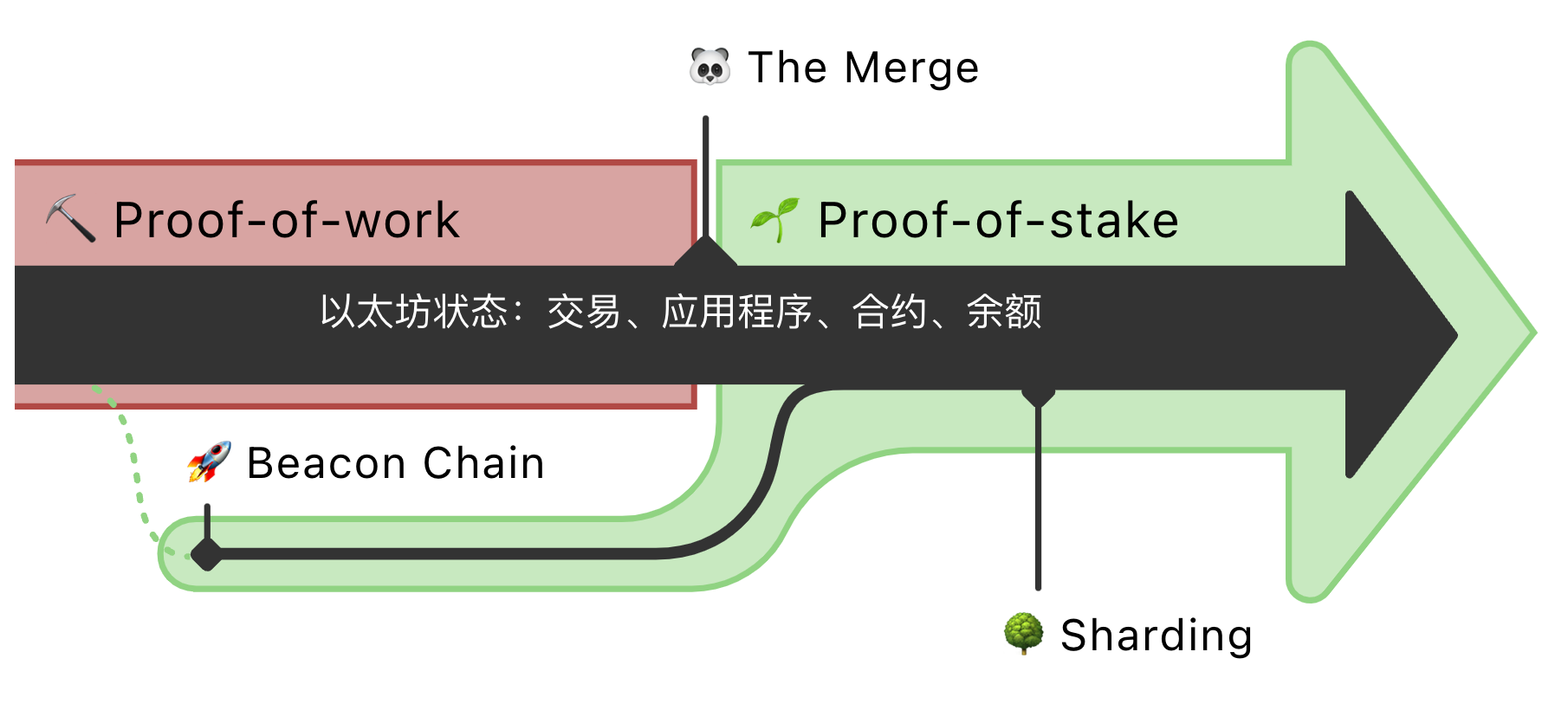

The merger represents the union of Ethereum's existing execution layer (the mainnet we use today) with its new PoS consensus layer, the Beacon Chain. This removes the need for energy-intensive mining and uses staked ETH to secure the network. An exciting step towards realizing Ethereum's vision - greater scalability, security and sustainability.

The merger represents the union of Ethereum's existing execution layer (the mainnet we use today) with its new PoS consensus layer, the Beacon Chain. This removes the need for energy-intensive mining and uses staked ETH to secure the network. An exciting step towards realizing Ethereum's vision - greater scalability, security and sustainability.

Initially, the beacon chain was separate from the mainnet. The Ethereum mainnet—including all accounts, balances, smart contracts, and blockchain state—continues to be secured with PoW, while the Beacon Chain runs in parallel using PoS. The upcoming merger is when these two systems will finally come together and PoW will be permanently replaced by PoS.

text

Mainnet merge

PoW has been securing the mainnet since its inception. This is also the Ethereum we are familiar with: containing every transaction, smart contract and balance since the beginning of July 2015.

Throughout Ethereum's history, developers have worked hard to prepare for the transition from PoW to PoS. On December 1, 2020, the Beacon Chain was created and has since run in parallel as a separate blockchain from the mainnet.

The beacon chain has not yet processed mainnet transactions. Instead, it achieves consensus on its own state by agreeing on active validators and their account balances. After extensive testing, the time for more consensus on the beacon chain is fast approaching. Once merged, the Beacon Chain will become the consensus engine for all network data, including executive layer transactions and account balances.

The merger represents a formal shift to using the Beacon Chain as the block production engine. Mining will no longer be a means of producing valid blocks. PoS validators take on this role and will be responsible for validating all transactions and proposing blocks.

History is not lost. As the mainnet merges with the beacon chain, it will also incorporate Ethereum's entire transaction history. The user does not need to do anything. Your funds are safe.

estimated time

secondary title

What do I need to do?

text

text

You don't need to take any steps to protect your soon-to-be consolidated funds.

Important: As a user, holder, staker, non-node operated staker of ETH or any other digital asset on Ethereum, you don't need to do anything with your funds or wallets before merging.

Despite the abandonment of PoW, the entire history since genesis remains intact after the transition to PoS. Any funds in your wallet prior to the merge will still be available after the merge. You do not need to perform any upgrade operations.

text

Node operators and dapp developers:

Staking Node Operators and Providers

If you are a staker or node infrastructure provider running your own node setup, here are some things to be aware of:

Key action items include:

Run the consensus layer client and the execution layer client at the same time; after the merger, the third-party endpoint for obtaining execution data will not be available.

Execution and consensus layer clients are authenticated using a shared JWT so they can communicate securely.

Set up a fee receiving address to receive the transaction fees you earn.

Failure to complete the first two items above will result in your node being considered "offline" after the merge, requiring both layers to sync and validate.

Not setting a fee-receiving address will still allow your validators to behave as usual, but you will miss out on the fees and the MEV you earned in the blocks proposed by the validator.

text

text

text

text

text

Key action items include:

In addition to the execution layer client, install the consensus layer client.

Execution and consensus clients are authenticated using a shared JWT key so they can communicate with each other securely.

Failure to complete the first two items above will result in your node being considered "offline" after the merge, requiring both layers to sync and validate.

Dapp and smart contract developers

The merge is designed to have minimal impact on smart contract and dapp developers, but there are a few minor things developers need to be aware of.

The merge brought changes to consensus, which also included changes related to:

block structure

Slot/Block Timing

opcode changes

Sources of on-chain randomness

secondary title

after the merger

text

secondary title

text

Misconception: “It takes 32 ETH to stake to run a node”

Anyone is free to synchronize their own self-validating copy of Ethereum, i.e. to run a node, no ETH is required, neither before nor after the merge. "Pledge 32 ETH" is actually a requirement for block producers.

There are two types of Ethereum nodes: block producers and non-block producers.

Block producing nodes are only a small part of all nodes on Ethereum, including mining nodes under PoW and verification nodes under PoS. Such block producing nodes need to invest economic resources in exchange for block rewards.

Other than a consumer-grade computer with 1-2 TB of storage available and an internet connection, the other nodes on the network (i.e. most nodes) don't need to contribute any economic resources. These nodes do not produce blocks, but they still play a key role in protecting the network—monitoring new blocks and verifying the validity of new blocks according to network consensus rules, and supervising all block producers to take responsibility. If the block is valid, these nodes are responsible for broadcasting the valid information to the network. If the block is invalid for any reason, the node software will ignore it and stop broadcasting.

Under either consensus mechanism (PoW or PoS), anyone can run a non-block producing node. If able, Ethereum officials strongly recommend that all users run a node, as this is very valuable to the decentralization of Ethereum, and can bring additional benefits to any individual who runs a non-block producing node-such as improved security, Privacy and censorship resistance.

Misconception: "The merger will lower the gas fee"

Merging is a change in the consensus mechanism, not an expansion of network capacity, and will not reduce Gas costs.

Gas fees are a product of network demand relative to network capacity. The merged Ethereum no longer uses the PoW consensus, and the transition to the PoS consensus will not significantly change any parameters that directly affect network capacity or throughput.

According to the roadmap centered on Rollup expansion technology, Ethereum advocates to focus on expanding user activities in the Layer 2 network, while making the Layer 1 main network a secure decentralized settlement layer. Layer2 optimizes the storage of aggregated data to help reduce aggregated transactions exponentially. The transition to PoS consensus is a key prerequisite for this to happen.

Myth: "Merger transactions will be significantly faster"

Although there are some minor changes, the transaction speed of Layer 1 will remain basically the same.

The "speed" of a transaction can be measured in several ways, including the time it takes for a transaction to be included in a block and the time it takes for it to be confirmed. These two changes have changed slightly after the merge, but not in a way that users will notice.

In terms of block generation speed, historically, under the PoW mechanism, a new block is generated approximately every 13.3 seconds. On the beacon chain, slots (12-second time slots) appear exactly every 12 seconds, and each slot is an opportunity for the verifier to produce a block. Blocks are produced in most slots, but not necessarily all (i.e. validators are offline). The block generation frequency under the PoS mechanism will be about 10% higher than that of PoW. "It's a fairly insignificant change that users are unlikely to notice."

When it comes to confirming transactions, PoS consensus introduces a concept of transaction finality that did not exist before. Under PoW consensus, the ability to reverse blocks increases exponentially with each block mined to confirm transactions, but it never quite reaches zero. Under the PoS consensus, the confirmed block is bundled into the verifier's epoch (voting period, 6.4 minutes time span, including 32 opportunities for block generation or 32 slots). When an epoch ends, validators vote to decide whether they think the epoch is "fair". If the validator agrees to justify the epoch, it will complete the confirmation in the next epoch. Reversing a finalized transaction is not economically feasible as it would require acquiring and burning more than 1/3 of the staked ETH.

Under the PoW consensus, the operation of many Dapps requires a large number of blocks to confirm transactions, and the time it takes for these confirmations is equivalent to the final confirmation time under the PoS consensus. Therefore, confirmation work can provide additional security guarantees, but will not significantly speed up transactions.

Misconception: "Staked ETH can be withdrawn as soon as the merge is complete"

This merge upgrade has not yet enabled withdrawals for pledged ETH, and the Shanghai upgrade of Ethereum will enable withdrawals.

Staked ETH, staking rewards to date, and newly issued ETH after the merger will remain locked on the Beacon Chain and cannot be withdrawn. The Shanghai upgrade plans a withdrawal function, which is the next major upgrade after the merger of Ethereum. This means that the newly issued ETH, although accumulated on the Beacon Chain, will remain locked and immobile for at least 6-12 months after the merger.

Misunderstanding: "Before the Shanghai upgrade, validators could not obtain liquid ETH rewards"

Tips and MEV will be credited to the mainnet account controlled by the validator and available immediately.

What needs to be known is that the ETH issued by the consensus layer is a reward for validators who contribute to the consensus, and the beacon chain represents the newly issued ETH. Validators have a unique address to save their pledged ETH and pledge rewards, and this part of ETH will be locked until the "Shanghai upgrade".

The ETH on the execution layer (the current Ethereum mainnet) is calculated separately from the consensus layer. When a user executes a transaction on the Ethereum mainnet, gas fees must be paid in ETH, including tips for validators. This ETH is already in the execution layer and is not newly issued by the beacon chain protocol, so it can be provided to the verifier immediately (note that the verifier must provide the correct address to the Fee Recipient client software).

Myth: "Stakers can withdraw immediately after withdrawals are enabled"

For security reasons, the rate at which validators exit will be limited.

After the withdrawal is enabled in "Shanghai Upgrade", all validators will be encouraged to withdraw their pledged balance above 32 ETH, because these funds will not increase the income, otherwise they will be locked. The APR (determined by the total amount of staked ETH) incentives may cause validators to withdraw to recover their entire balance; validators may also re-stake their rewards to earn more.

One important caveat here - full validator exits are rate limited by the protocol, only 6 validators can exit per epoch (i.e. 6.4 minutes to exit, so 1350 validators per day can exit, or Say, with a pledge of more than 10 million ETH, only about 43,200 ETH can be withdrawn every day).

Why rate limit? First, the rate limit is adjusted according to the total amount of ETH pledged to prevent large outflows of funds. Additionally, it prevents would-be attackers from using their stake to conduct a "slash attack" - withdrawing their entire stake balance at the same time the protocol enforces the slash.

It can be seen that Ethereum deliberately sets APR as a dynamic adjustment mode, which allows stakeholders to decide how much they are willing to pay to protect the network according to the market. With withdrawals enabled, if the rate is too low, validators will exit at the protocol-limited rate, which will result in an increase in the APR of all remaining validators, at which point new stakers will be attracted, or exited stakers will return.

Myth: “Staking APR expected to triple after merger”

According to the latest estimates, post-Ethereum mergers would see staking APR growth of closer to 50%, not 200%.

The APR of the stakers will indeed increase after the merger, but to understand the specific increase by how much, it is necessary to understand where the APR increase comes from.

The growth does not come from an increase in ETH issuance. On the contrary, after the merger of Ethereum, ETH issuance will decrease by about 90%. The growth actually comes from a redistribution of network transaction fees, which will start going to validators instead of miners in the past.

Network fees are a separate source of income when validators produce blocks. As you can imagine, the amount of fees received by validators is proportional to the activity of the network at the time of their block creation. The more fees paid by users active on the network, the more fees validators receive.

Judging by recent activity on the Ethereum blockchain, approximately 10% of all gas fees paid are currently paid to miners in tips, with the rest being burned. Forecast figures are much higher than this percentage and were calculated when network usage was at an all-time high. Extrapolating the 10% figure to an average of recent network activity, the projected APR for staking increases to ~7%, ~50% higher than the base issuance APR (as of June 2022).

Misconception: "Merger Will Cause Ethereum Network Downtime"

The merge upgrade aims to transition to Proof-of-Stake (PoS) consensus with zero downtime.

Ethereum developers have put in a lot of work to ensure that the transition to PoS consensus does not disrupt the network or harm users.

Like changing the engines of a rocket ship mid-flight, Ethereum merges are designed to be performed without pausing any operations during the switchover. Mergers will be triggered by Terminal Total Difficulty (TTD), which is a cumulative measure of the total hashrate building the chain. When the time comes and this criterion is met, blocks will transition from a block built using PoW consensus to a block built with PoS consensus.

secondary title

text

text

text

To reduce confusion, the community has updated these terms:

"Eth1" is now the "execution layer", which handles transactions and execution.

"Eth2" is now the "Consensus Layer" which handles PoS consensus.

secondary title

text

text

text

text

text

text

text

text

text

Given the rise and success of L2 in scaling transaction execution, the sharding initiative has turned to finding the best way to distribute the burden of storing compressed call data from rollup contracts, enabling exponential growth in network capacity. This is not possible without transitioning to PoS first.