An article to understand how Solana's TVL was "falsified"

The recent "fake" incident of Solana TVL data has attracted attention.

Published by CoindeskThe "multiple personality" who once "falsified" 70% of Solana's TVL is looking to Aptos"The article reveals that Ian and Dylan, the developers of the Solana ecology, created dozens of DeFi protocols on Solana as 11 developers by forging their identities. Through mutual reference between the protocols, the TVL of their projects once reached 7.5 billion US dollars , while Solana's total TVL during the same period was only $10.5 billion.

Therefore, there may be a lot of "moisture" in Solana's TVL. (Of course, similar situations may exist in many other public chains)

From the perspective of statistics, DeFi protocols refer to each other to increase book TVL cannot be regarded as "falsification", but can be said to be an "evil" statistical technique - repeating statistics of certain indicators to increase the value of another indicator.

In this statistical process, changing the statistical caliber of the data can change the data, and every data is "true", but for ordinary users, the "anti-risk ability" of assets on the chain is not the same.

secondary title

uncover the forgery process

On the public chain, the statistical caliber of a DeFi agreement TVL can include lending, pledge, second pool, and the market value of the agreement currency (distinguishing between circulating and uncirculated, single currency and dual currency, and triple currency), plus the agreement treasury deposit. We will analyze the process of forging the TVL of the public chain from the perspective of the TVL statistics of the DeFi protocol.

Lending: When protocol A lends a deposit worth n to protocol B, protocol B will continue to lend n to other protocols. In this link, TVL is 2n.

Pledge: Pledge tokens with a value of n to the agreement to obtain or lend assets with a value of m. In this link, TVL is m+n.

Two pools: the protocol can reward users with a token issued by the protocol with a value of m while lending out the user deposit n. Tokens are pledged to pool 2 to obtain governance tokens with a value of y. In this process, the calculation of TVL includes the value of the user's original deposit, pledged tokens, and governance tokens. TVL is n+m+y.

Treasury: If the DeFi agreement has a treasury, the income obtained through the agreement will be included in the treasury, and this part of the income will also be counted as TVL.

Combining the above means, we can design a DeFi protocol like this: Protocol A attracts Xiaohong to deposit a deposit worth m through lending income, and then Xiaoming can lend asset n under the condition of trust and use it as a pledge in Protocol A, and then lend the value of At this time, protocol A rewards Xiaoming with protocol tokens with a value of x, but protocol A has set up a dual-currency mechanism. If you pledge protocol tokens, you can get protocol governance tokens. Pledge to the second pool of A protocol for a certain period of time to obtain governance tokens worth y.

In this process, every time Xiao Ming invests m units of assets, he will "create" a TVL of m+n+n+x+x+y. (m>n) Such a protocol has the ability to turn $1 TVL into m+n+n+x+x+y dollars.

At the same time, agreement A is an agreement that can charge transaction fees. If the transaction amount is z and the transaction fee is 0.1%, the agreement income will be 0.1%z, and the income will be included in the treasury, and the balance of the treasury will also be included in TVL.

In the last step, we need to create more than a dozen similar or identical DeFi protocols, allowing them to borrow and pledge each other, so that we have completed the process of making a public chain with a TVL of only 100 million US dollars leap to more than a billion US dollars.

Note that every data in this process is real, but it has been double-counted.

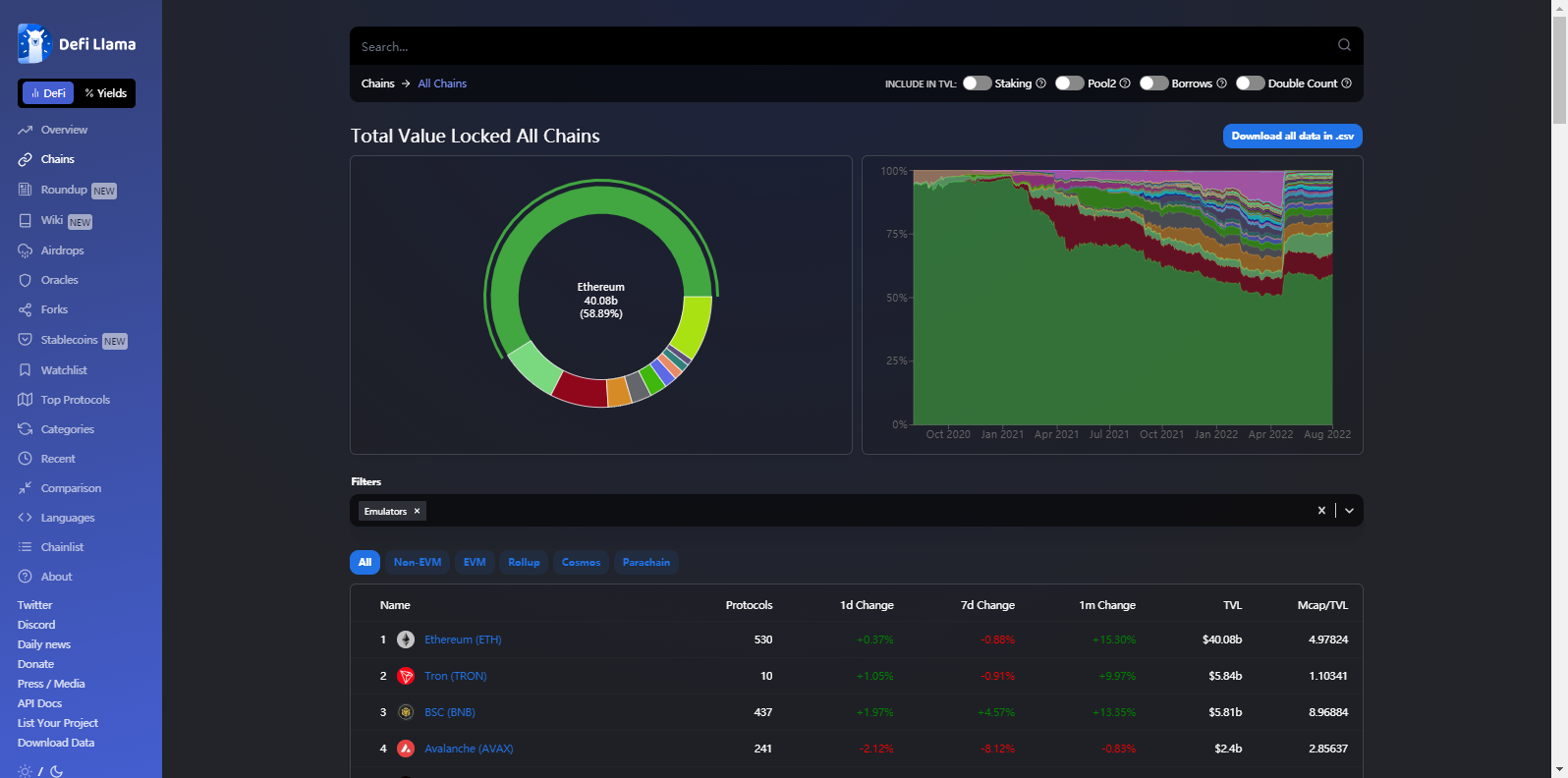

At the end of this article, I recommend a DeFi data website that supports the screening of statistical caliberDeFillama.com, hoping to help users better test the gold content of public chain TVL and make smart investment decisions.