Aave V3: Multi-chain Expansionism of the Master of Lending Kings

, republished with authorization by Odaily.

This article comes fromCRYPTO HOT, republished with authorization by Odaily.

Having experienced the summer and winter of DeFi, countless agreements have faded in the tide of the times, but the lending business can always perform forever.

content summary

content summary

1/ Aave basic business logic

2/ Aave interest rate adjustment model dismantling

3/ What is Aave Flash Loan

4/ Aave V3 - Detailed explanation of multi-chain lending logic

secondary title

Aave basic business logic

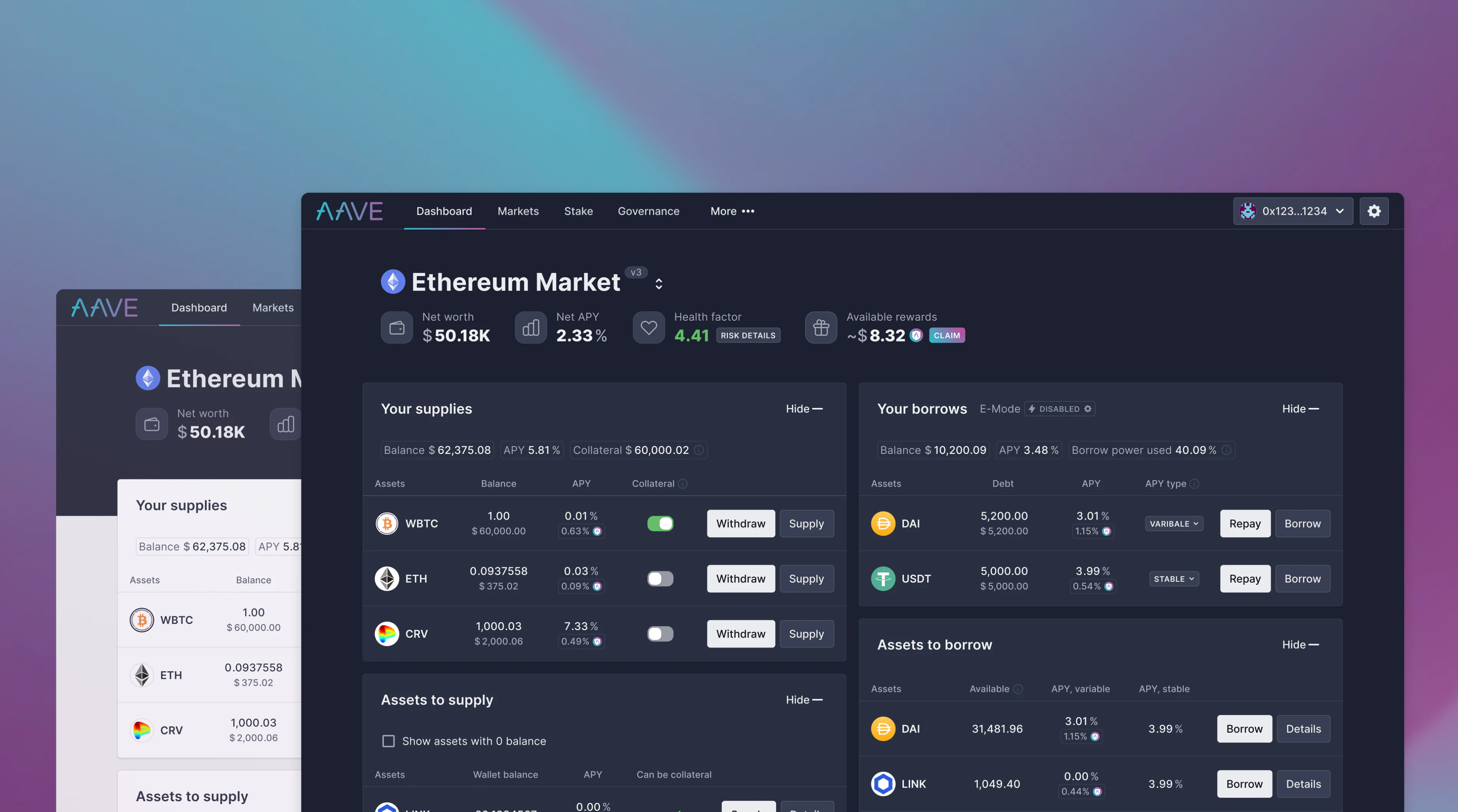

Aave uses the liquidity pool to complete the lending business. When all depositors have deposited the funds they want to lend into the liquidity pool, Aave will issue aToken in proportion to the funds (for example, if you deposit Dai, you will get aDai) to the depositors until the depositors want to withdraw the assets. The aToken will be recovered and destroyed. The advantage of aToken is that it is a general ERC20 standard token, which can be understood as an interest-bearing deposit certificate for deposits. It can support free trading or remortgage of its own assets stored in Aave.

image description

secondary title

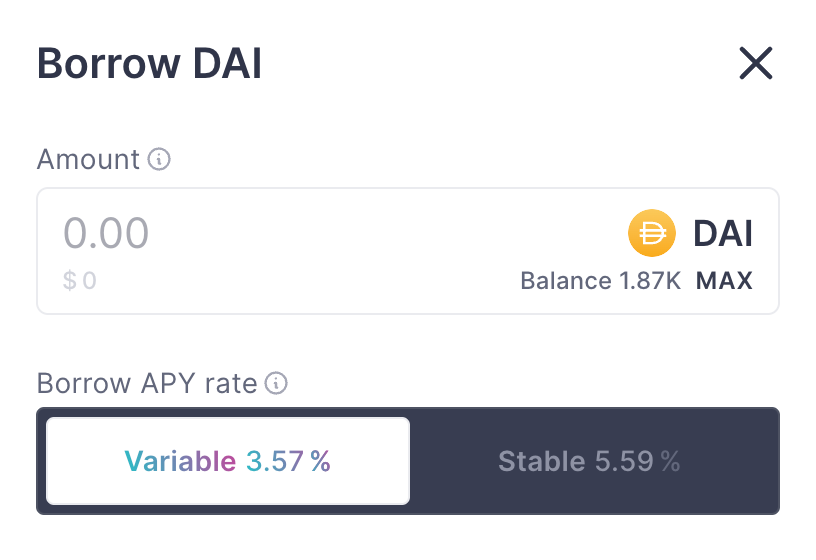

Aave Rate Adjustment Model

The interest rate is the regulator used to balance borrowing and lending, and it is generally related to the utilization rate of funds in the fund pool.

When money is plentiful: Low interest rates to encourage borrowing.

When capital is scarce: high interest rates to encourage debt repayments and additional supply.

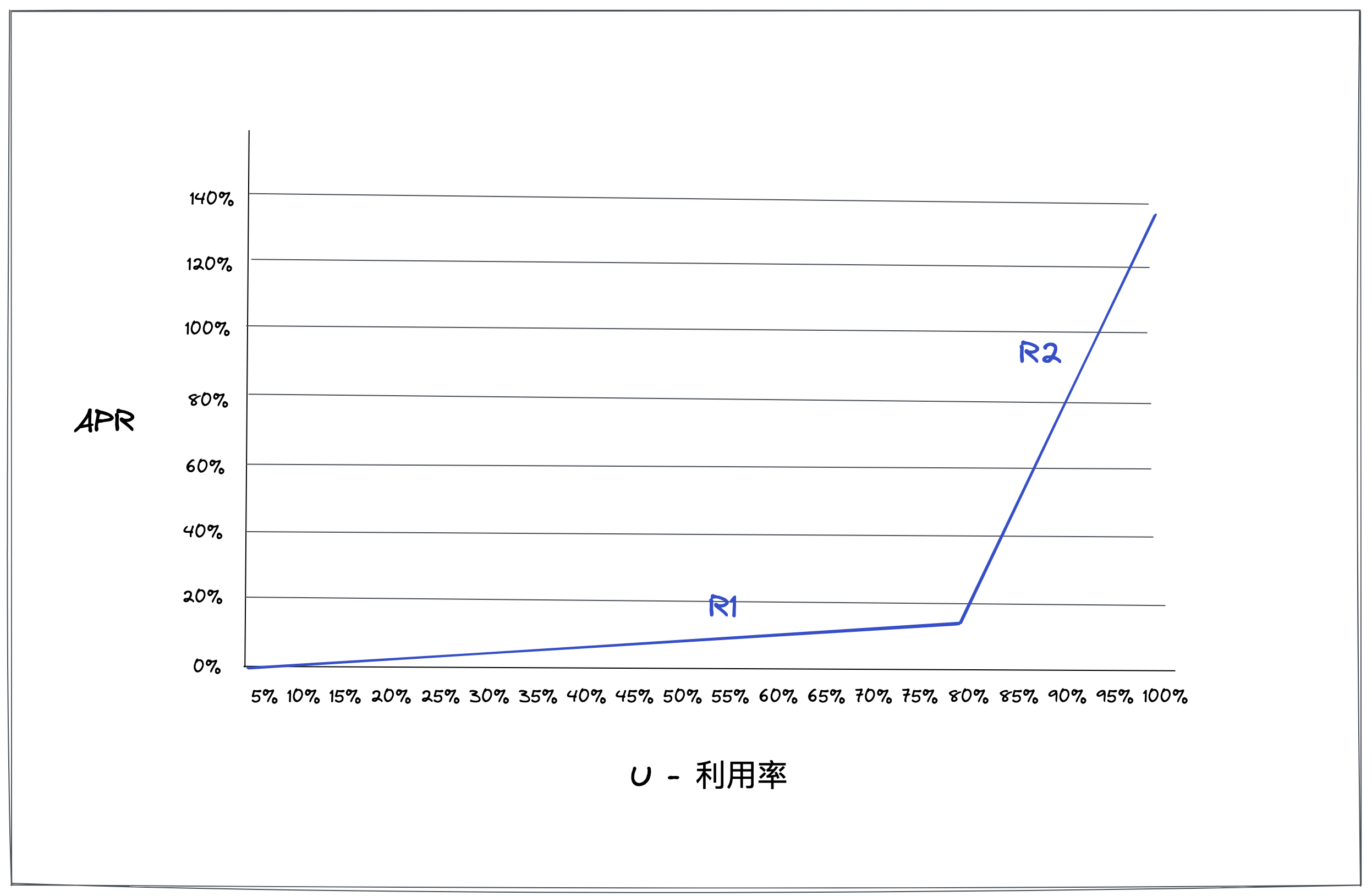

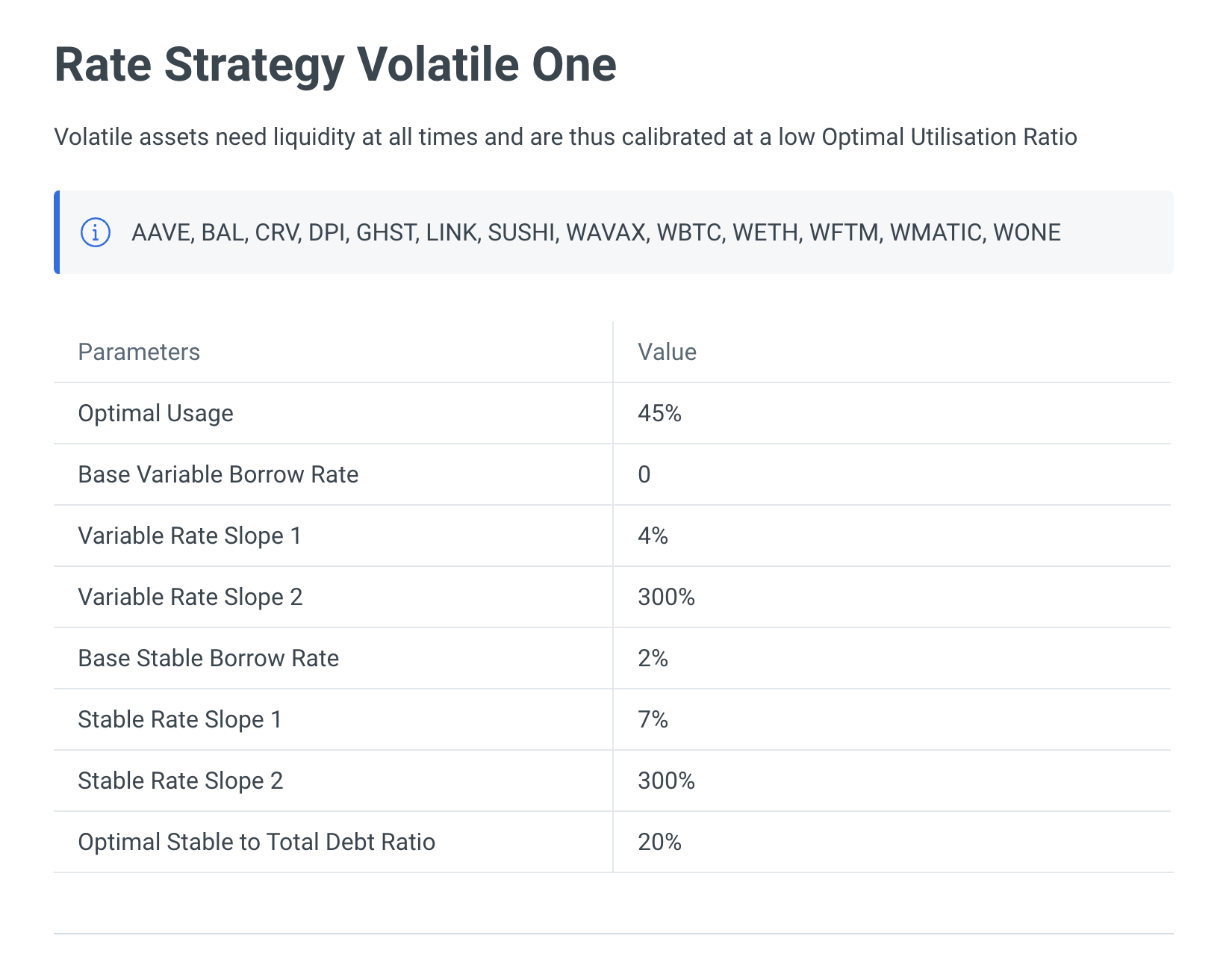

What makes it special is that Aave has a uniquely designed"Slope lending rate function", which depends on the ratio of an asset in Aave's liquidity pool being borrowed, that is, the utilization rate of the asset. Aave believes that when the utilization rate of an asset continues to increase, its capital pool is also facing liquidity risk, so it uses a high-slope interest rate function to adjust the borrowing demand based on the high utilization rate of different types of assets.

For example, let's define several variables like this, namely

U: The utilization rate of the fund pool of the token

UU: optimal utilization

R0: initial interest rate

R1: Low Slope Rate

secondary title

borrowing rate

u

When the token utilization rate U is lower than the optimal utilization rate UU, it proves that the funds are sufficient. As utilization increases from 0 to UU, the interest rate will rise linearly from R0 to R0+R1 (low slope interest rate).

U>UU: borrowing rate = R0+R1+(U-UU)/(1-UU)R2

When the token utilization rate U is higher than the optimal utilization rate UU, it proves that funds are scarce. As utilization increases from U to 100%, the interest rate rises linearly from R0+R1 to R0+R1+R2 (high-slope rate).

image description

Low slope rate R1 and high slope rate R2

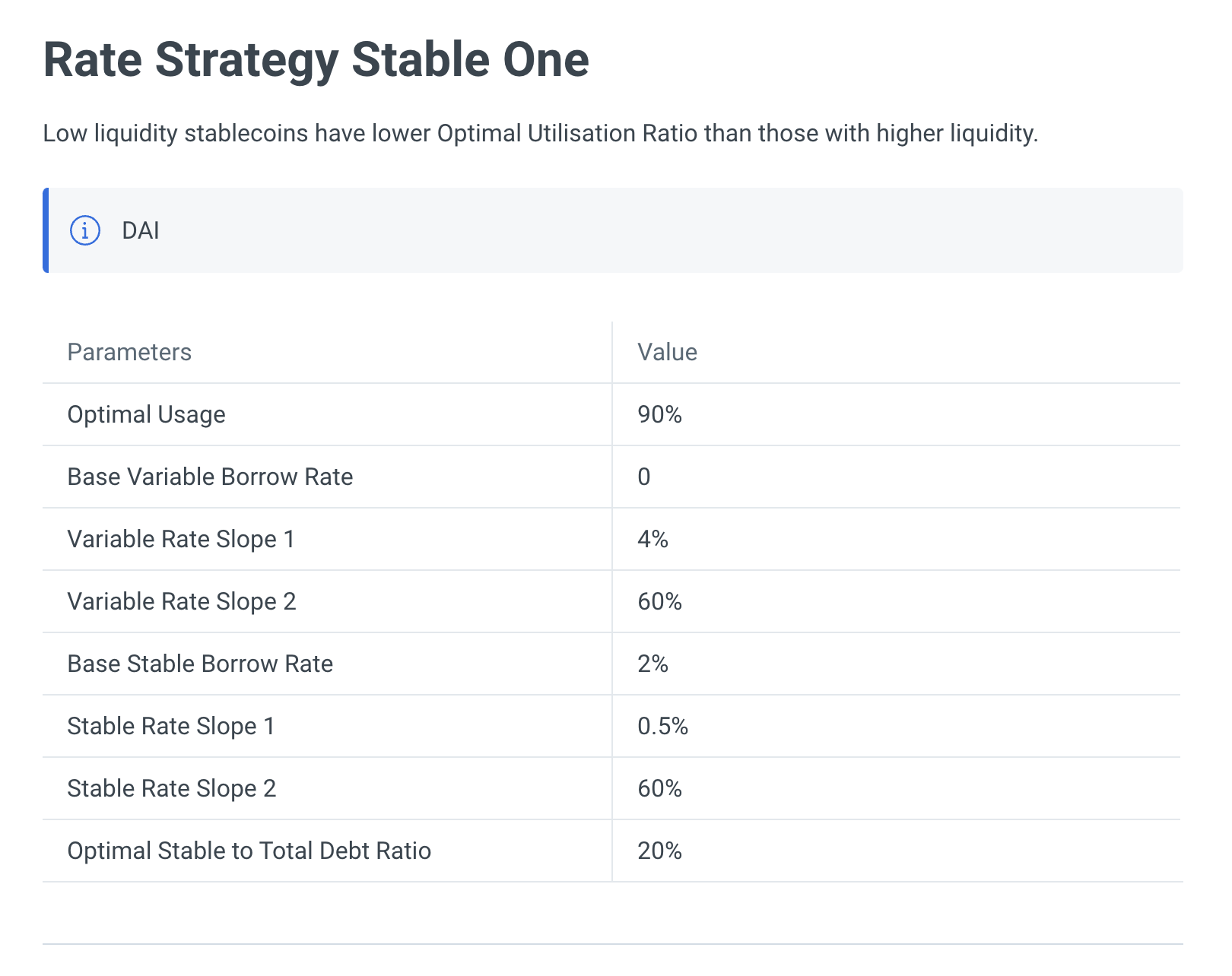

According to the risk characteristics of an asset, Aave will give different optimal utilization rates UU, R0, R1 and R2 for different tokens. For example, highly volatile tokens or tokens that are less liquid require more liquidity, so excessive utilization should be avoided as much as possible. Therefore, the optimal interest rate UU cannot be set too high, usually set at 45%-60%, and R2 is often very high, such as 300%. The corresponding stable currency price fluctuates little and has good liquidity, so the UU is relatively set higher, and the R2 is relatively small, such as 60%.

image description

image description

secondary title

deposit rate

Usually the deposit rate is related to the current borrowing rate. Aave will collect a part of the borrowing rate as a reserve asset, and the remaining part will be distributed to atoken as the income of depositors.

first level title

Aave Flash Loan - DeFi Sword of Damocles

flash loanflash loan" agreement. This highly controversial innovation also paved the way for many major events in the DeFi world.

To understand what is a flash loan, you first need to popularize a concept called:atomicity. Generally speaking, if the actions of a transaction process are coherent, indivisible and irreducible, it is atomic. Simply put: either all actions within the transaction are executed, or nothing happens. There are no intermediate states.

Flash loans leverage atomicity, allowing users to borrow money without submitting collateral. So how to solve the problem of borrowers defaulting on repayment? First of all, flash loan is strictly speaking a transaction involving multiple consecutive actions. For example, after borrowing funds in Flash Loan, the simplest method is to buy assets with a price difference on Platform A and sell them on Platform B, and finally return the borrowed funds to leave arbitrage profits. In this way, the simplest Flash Loan arbitrage at no cost is completed. Yes, of course you need to pay a fee of 0.09% of the borrowed amount here. All transactions must be completed within a block. If the loan is not returned within a block, all transactions will be rolled back as if nothing happened. For example, if the arbitrage failed in the example just now and the loan cannot be repaid in the end, then all you lose is the handling fee. But in the same situation, if you use your own funds to arbitrage, you may suffer a loss of principal once the arbitrage fails. Therefore, the emergence of flash loans has greatly improved the efficiency of arbitrage, lowered the capital threshold for arbitrage, and at the same time provided a certain amount of fee income for the lending market.

image description

Flash Loans and the Sword of Damocles

Aave V3 - Multi-chain Lending Portal

secondary title

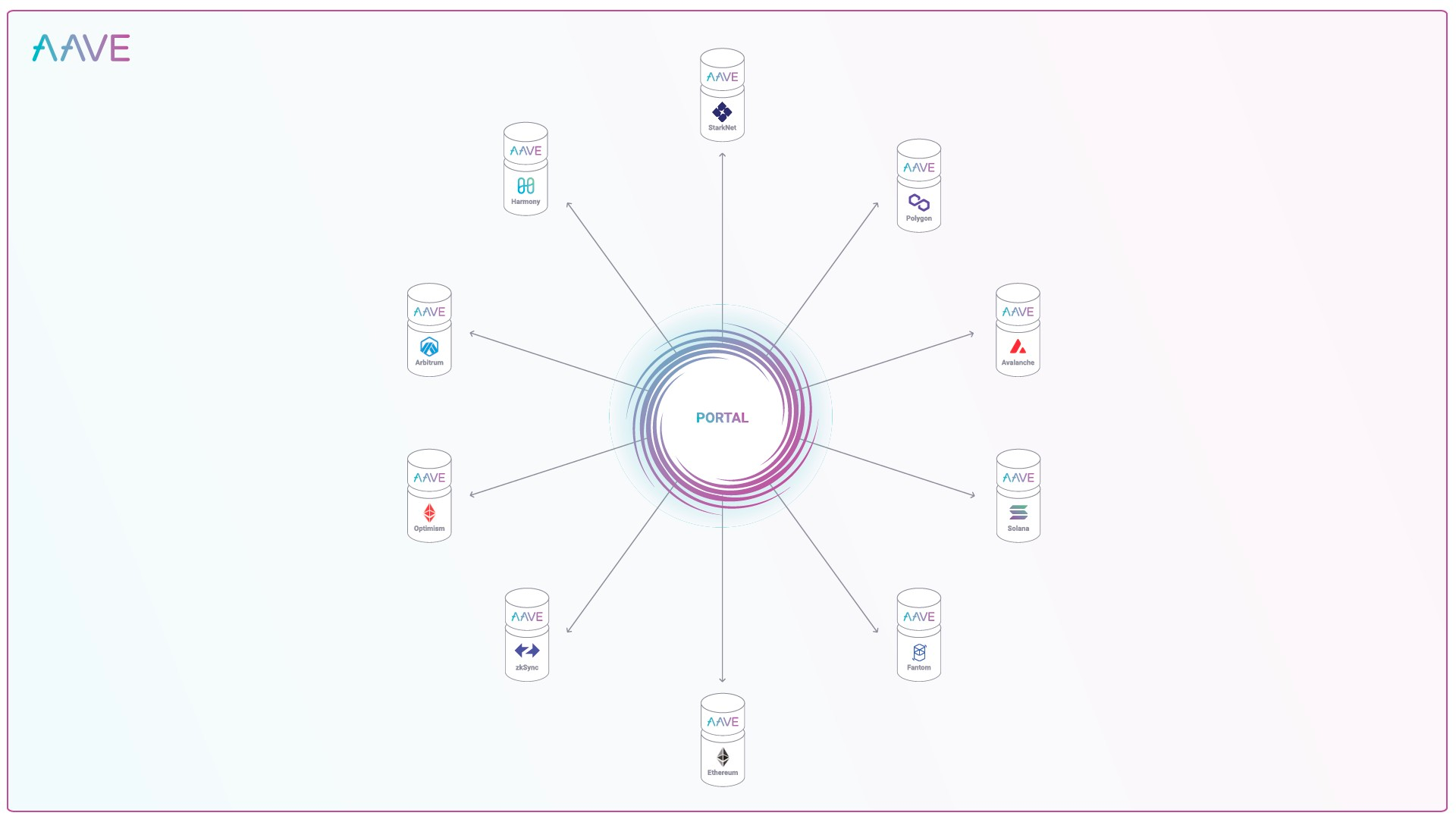

1 portal

Known as the most anticipated feature of Aave, the portal function needs to be voted by Aave governance to select a "white list" cross-chain bridge protocol, which will be used to facilitate cross-chain lending and allow assets to seamlessly move between Aave V3 markets through different networks flow. That is, through the whitelist cross-chain bridge protocol, Aave's "aTokens" are minted on one chain and destroyed on the other chain. Simply put, the portal function will support you to deposit ETH on Arbitrum for collateral, and then borrow on Polygon. The emergence of cross-chain lending has raised the lending business of the entire agreement to a higher level. The situation of multi-chain sharing liquidity may quickly spread to all blockchains for the lending track that relies more on TVL.

The portal function has reached a deployable state with the launch of V3 in March, but users are still unable to use it. The main reason is that the integration of the whitelist cross-chain bridge has not been completed yet, although it has been announced in MarchGovernance framework of portal cross-chain bridgesecondary title

2 Isolate the market

Aave is facing increasing pressure from lending platforms such as Euler, Kashi, and Rari to better cater to long-tail or exotic assets with permissionless lending pools. Therefore, Aave V3 introduces an "isolated market", which allows Aave to list new collateral more quickly through governance, but new collateral (isolated assets) can only be used as a single collateral for lending, that is, users can only use the asset as Collateral, providing other assets to the protocol can still earn deposit income, but these assets cannot be used as collateral. At the same time, the upper limit of its loan amount is strictly controlled by DAO and can only borrow stablecoins approved by Aave through governance.

For example, Chad provides TOKEN2 as collateral. TOKEN2 is a segregated asset with a maximum debt limit of $10 million, and USDT, DAI, and USDC are borrowable assets that have passed governance permission. After providing TOKEN2 as collateral, Chad will be able to borrow up to $10 million in USDT, DAI, and USDC. Even if Chad provides another asset, such as ETH, WBTC, the system will not allow Chad to borrow against these assets due to the existence of the isolation mode. But Chad will still earn from the ETH and WBTC provided. On the other hand, after Chad disables TOKEN2 as collateral, he can exit the isolation mode, and Chad can still continue to use other assets as collateral for lending.

Isolating the market is a measure for Aave to enhance market competitiveness while taking security into account. More and more platforms are beginning to support the lending business of long-tail assets. These assets are more volatile and uncertain, but the market demand is still strong. The volatility and security of mainstream assets are more reliable, but the market space is relatively limited. Isolating the market can gradually meet the development needs of the market while isolating risks.

secondary title

3 Efficient Mode (eMode)

first level title

GHO - Aave Stablecoin Strategy

Aave published an opinion post on the release of the decentralized stablecoin GHO on the Governance Forum on July 7, 2022. First, Aave put forward his own views on the stablecoin market and why he should issue a decentralized stablecoin?

Aave believes that in the past few years, the stablecoin market has reached the core of the Crypto field, and nowhas a market cap of around $150B, Stablecoins provide a fast, efficient, borderless and stable way to transfer value on the blockchain. At the same time, the important thing about decentralized stablecoins is to provide a kind of transparency and anti-censorship characteristics. One point is especially important in the decentralized world. It is foreseeable that the future Web3.0 world will definitely have its own decentralized value measurement unit. Therefore, many leading protocols and blockchains currently issue stable coins. underlying motivation.

The following is a detailed explanation of the mechanism of the GHO stablecoin:

1 Overcollateralized

secondary title

2 All revenue goes to the treasury

secondary title

3 Facilitators

secondary title

4 AAVE Governance controls interest rates

secondary title

5 skAAVE discount

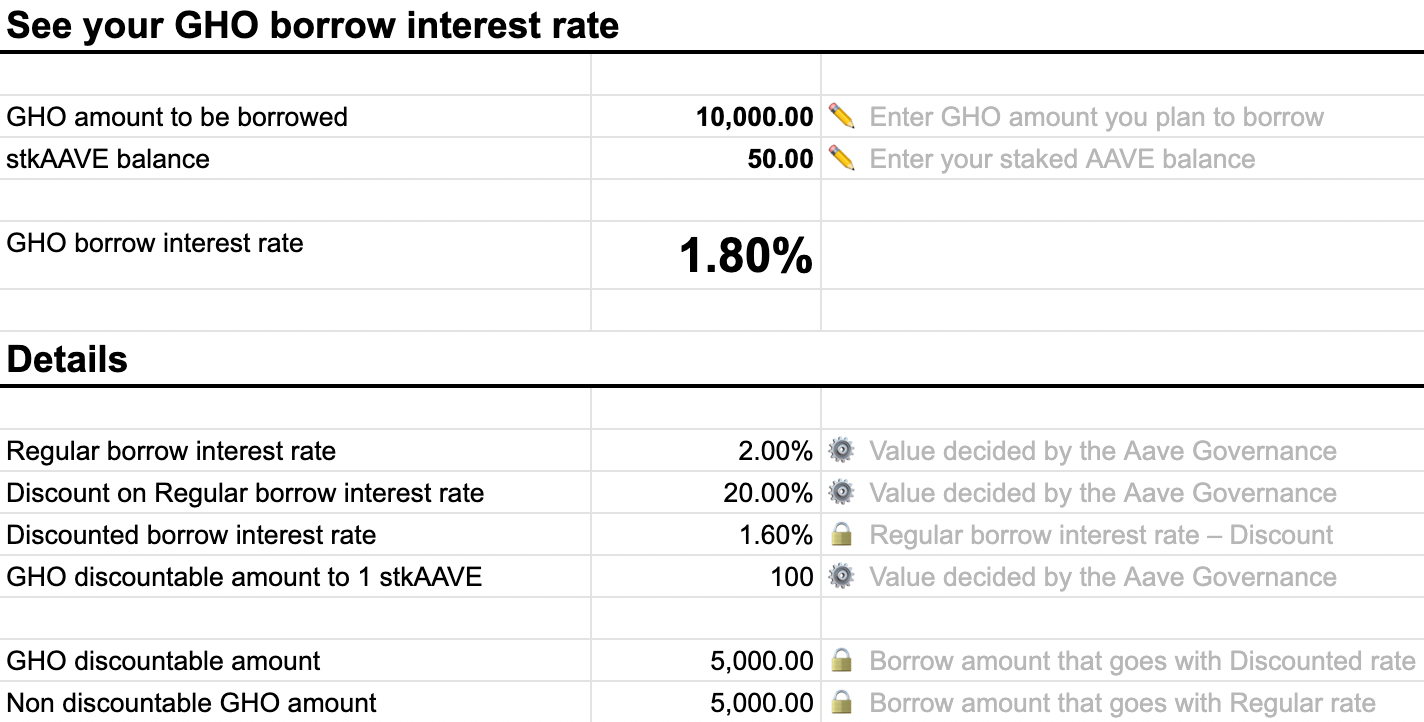

The initial discount policy allows security module participants (stkAAVE holders) to receive a discount on the GHO borrowing rate. The official currently gives the final loan rate algorithm for borrowing 10,000 GHO when 50 stkAAVE is pledged. where Aave Governance will control

conventional borrowing rate

Universal discount on regular rate (0%-100%)

1 sktAAVE corresponds to the amount of GHO discount that can be enjoyed

Disassemble according to the data in the table below:

The user plans to borrow 10,000GHO and pledge 50 sktAAVE. The regular borrowing rate is 2%, and the general discount is 20%. 1 sktAAVE can enjoy a borrowing discount of 100GHO.

Users will get 50*100=5,000GHO loan discount amount, and another 5,000GHO will be borrowed at the regular interest rate

The borrowing rate after general discount is 2%*(1-20%)=1.6%

image description

from

fromGHO's Forum ProposalFrom the point of view, GHO’s mortgage model is similar to MakerDAO’s DAI, and both use an over-collateralized model macroscopically. But there are many differences in details:

Aave DAO control rights, high income, almost full empowerment

The entry of facilitators makes GHO a credit stablecoin (not fully collateralized) in some cases

Combining the eMode high-efficiency mode of V3 is equivalent to building a natural low-slip point exchange path for GHO

Combined with the portal function of V3, GHO can be transferred on multiple chains without going through an additional cross-chain bridge

It is worth noting that the compatibility between GHO and Aave V3 is very high. It can be said that almost any new function can provide corresponding convenience for the stable currency GHO, provided that GHO grows into a stable currency with a high market value. Then as people mint GHO through the Aave protocol and any other facilitators, the Aave DAO will get a lot of income in the form of charging full fees. After going through the process of bull market and bear market transition, the market has verified that those agreements with abundant treasury reserves can often survive better in a downturn environment.

There are also many negative voices in the corresponding market:

Does the entry of facilitators create a global undercollateralization risk

The rationality and feasibility of controlling the interest rate by Aave DAO

Judging from the content of the current proposal, the promoter has the ability to generate GHO without trust within a certain amount range. The potential threat may be that although normal users are over-collateralized on the surface, the specific rules for the promoter to enter are How about, does not need to trust mean to have unsecured casting GHO, this link is aimed at whether the promoter has more detailed risk control management. On the other hand, since all borrowing rates are collected by the treasury of Aave DAO, holders of Aave naturally hope that the interest rate will be maintained at a high level. Will this potential governance tendency reduce the market’s driving force for borrowing? This leads to capital inefficiency.

On the whole, Aave's stablecoin layout seems to symbolize the cross-rolling of leading protocols entering the multi-chain market. It is designed to give full play to its own market advantages. At the same time, it pays more attention to the empowerment and governance of Aave DAO. Full. But on the other hand, the specific implementation details are still not implemented, and there are many unknown details in the current document. Moreover, the portal function of V3 has not really been put into use yet. This plan first requires Aave V3 to reach a fully mature state. There is a long way to go, and it may take longer than we imagined.

Original link