Uniswap integrates sudoswap, can it kick off a new prelude to NFT liquidity?

Original title: What possibilities will sudo swap * Uniswap unlock for NFT liquidity? "

, republished with authorization by Odaily.

This article comes fromCRYPTO HOT, republished with authorization by Odaily.

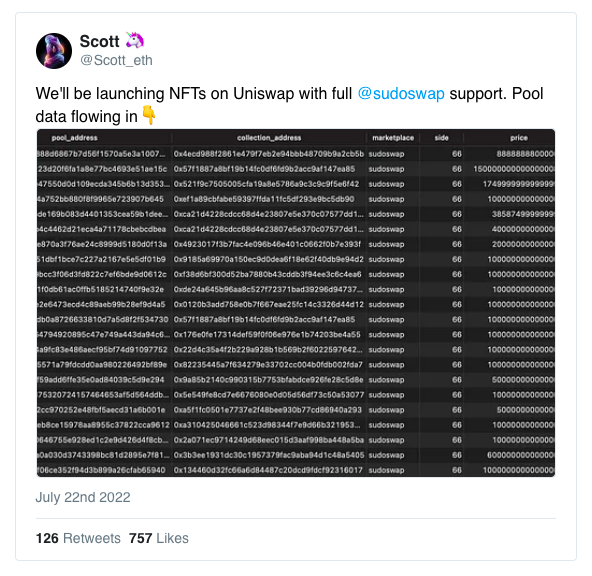

On July 23, 2022, Scott, founder of NFT aggregation platform Genie and head of Uniswap NFT products, said on Twitter that Uniswap will implement NFT transactions by integrating sudoswap.

The background to this happening is:

OpenSea monopolizes the NFT trading market, Looksrare, and x2y2's competitiveness reaches a staged bottleneck

Immediate sale at fair value has to endure large slippage, royalties and other losses

Capital inefficiency, the market lacks NFT liquidity solutions

Currently mainstream NFT exchanges such asOpenSea、X2Y2、LooksRareThey are all traded in the order book mode. The seller puts his NFT in the form of an order on the trading platform for sale, and the buyer buys according to his own choice; the buyer can also make an offer for the NFT in advance, and the seller can choose to accept it. offer. OpenSea has accumulated a large number of users and artists because of its first-mover advantage. The vampire attack in a short period of time has taken away part of the market share but still has not shaken its dominance.

We have experienced the evolution of the economic model of homogeneous tokens such as tokens, and we will know that in the early days of the industry, except for some POS public chain native tokens, most tokens did not have a staking model. DeFi Summer has liquidity mining and lending After the market, the economic system around the token began to build. However, the value of NFT in this regard has not been released. The current trading mechanism and characteristics make it difficult for its holders to capture value other than NFT itself. The corresponding problems are low capital efficiency and poor liquidity.

As the leader of DeFi Summer, Uniswap began to enter the NFT liquidity market after acquiring Genie. Let's take a look at how this integrated sudoswap can solve the NFT liquidity problem.

Over the Counter (OTC)

OTC - sudoswap v1

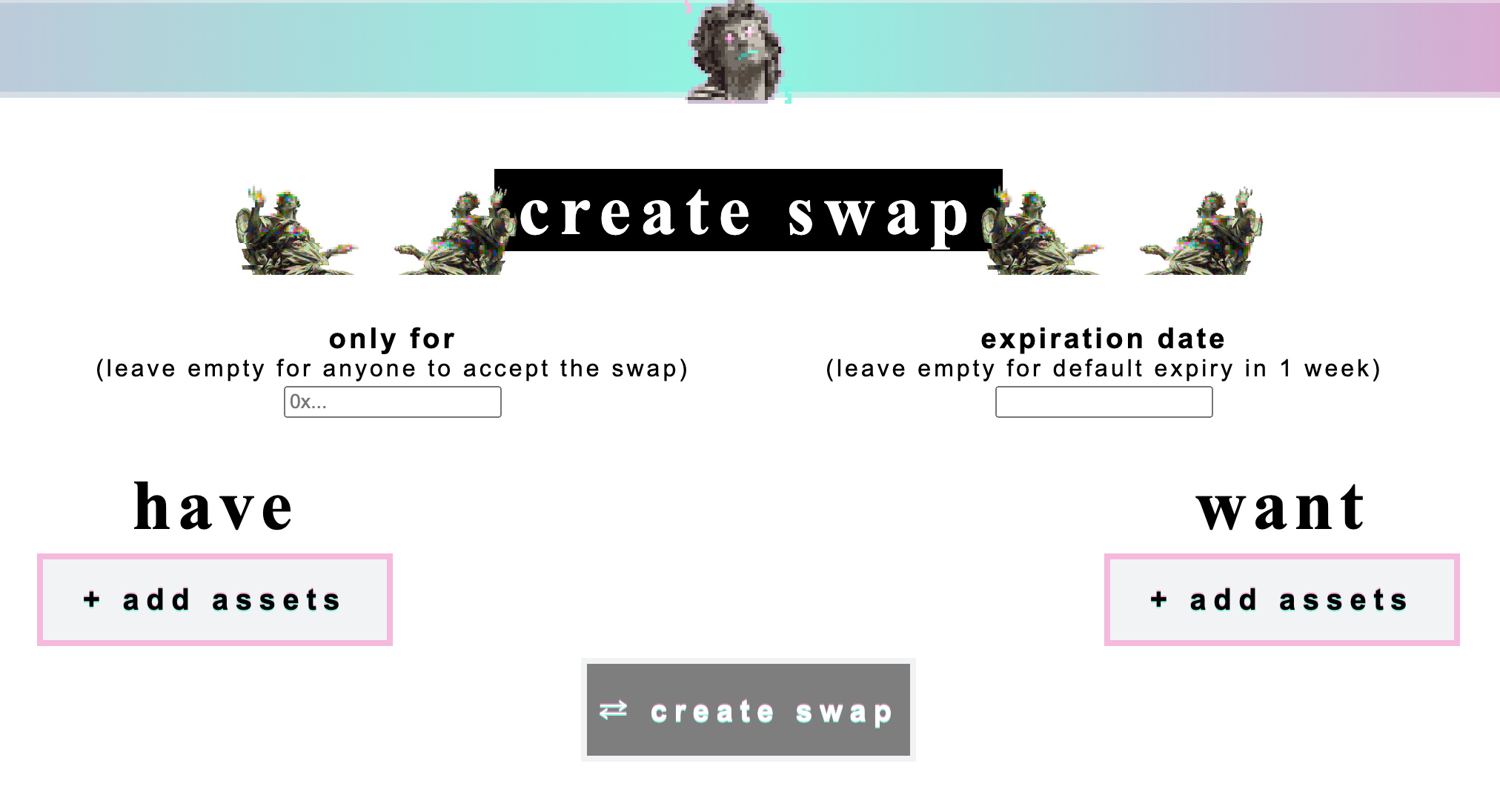

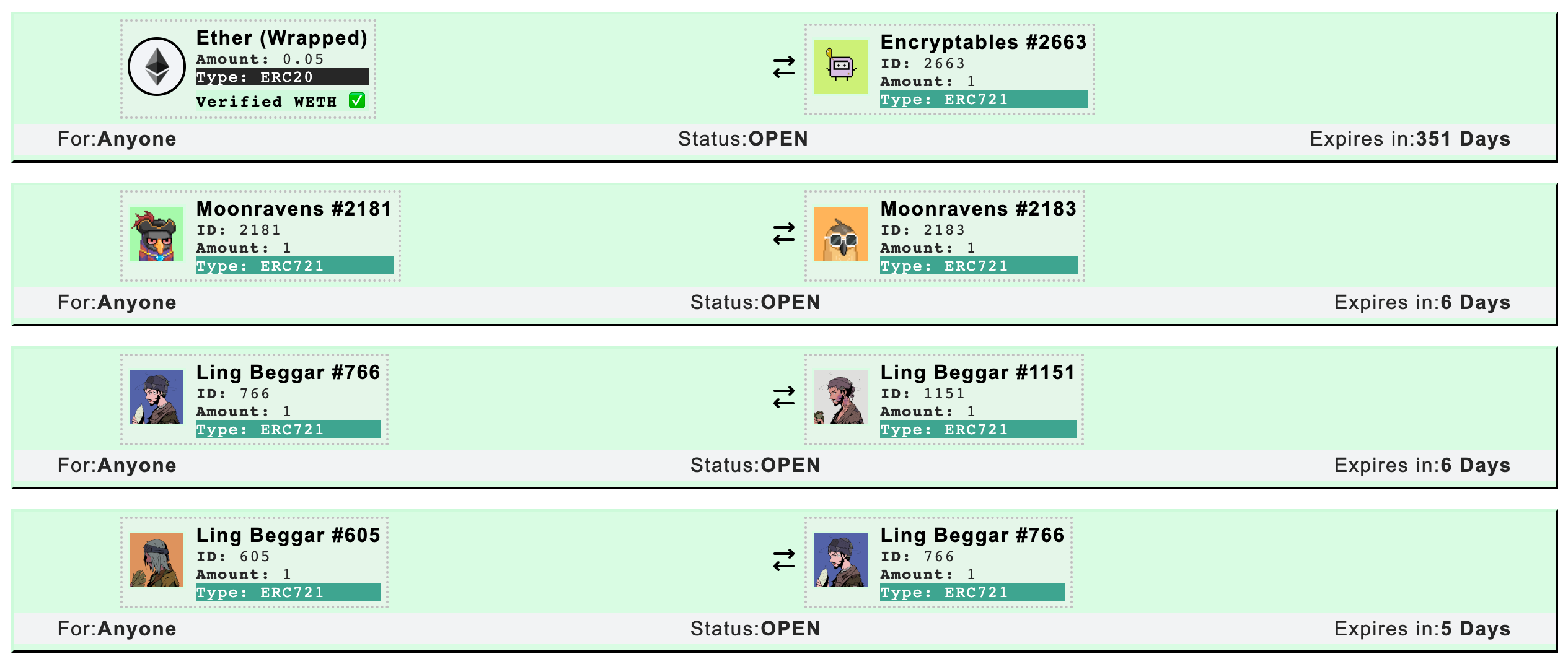

sudoswap was originally created by0xmonsPublished in April 2021Over the Counter (OTC), which has the following characteristics:

Built on the 0x protocol

Customized peer-to-peer transaction form

Support transactions of any combination of ERC20, ERC721, ERC1155 and other tokens

No transaction fees and royalties

secondary title

AMM - sudoswap v69

first level title

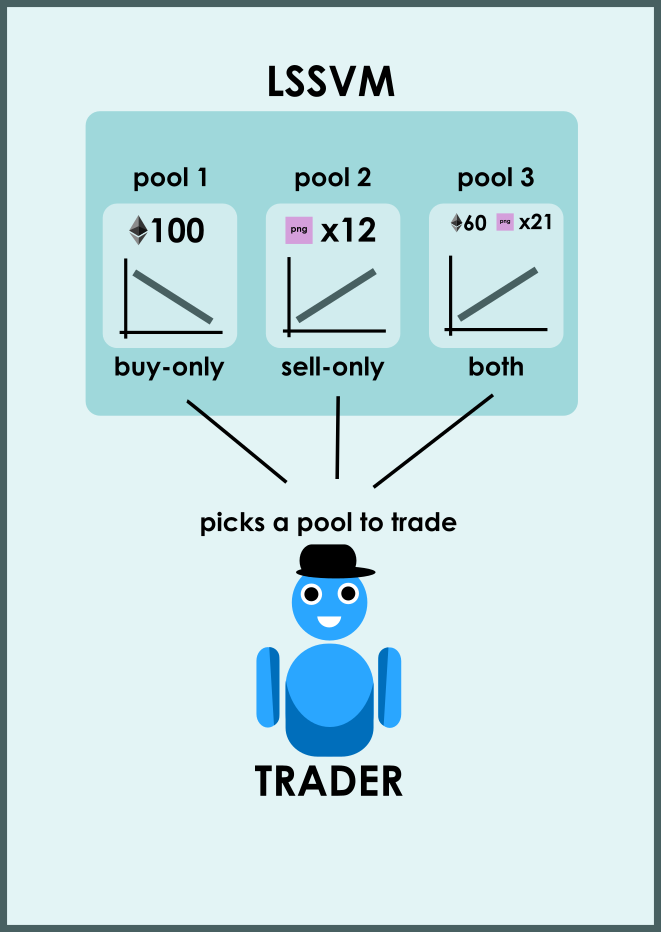

LSSVM

founder at first0xmonsDefining this set of mechanisms as LSSVM, the basic unit of the protocol, the NFT pool, is called LSSVM Pair, which can hold NFTs, tokens, or both. Then, the end user interacts with the LSSVM Router, the aggregator, to exchange across multiple pools to obtain optimal transaction results.

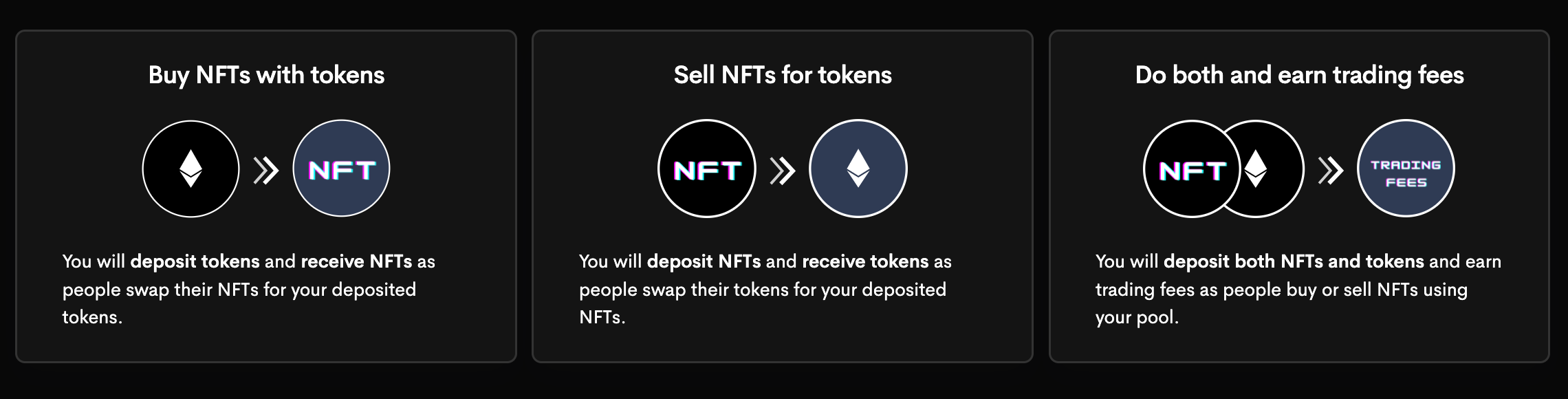

Each pool is managed by a single address, which can be divided into three categories according to the nature of the pool:

buy-only, only provide ETH to the pool, ready to provide offers to buy NFTs with their ETH

sell-only Only sell, only provide NFT to the pool, always ready to provide an offer to sell its NFT for ETH

secondary title

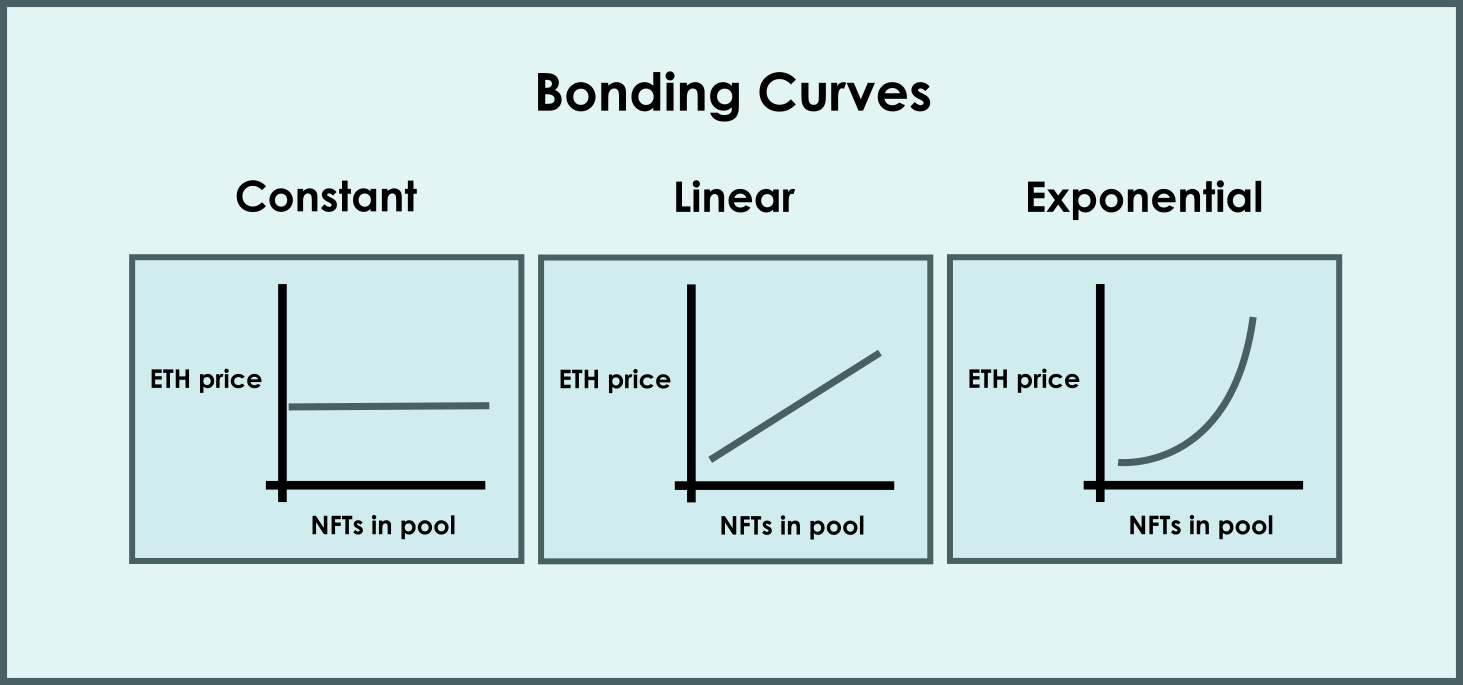

Quote - Bonding Curve

To determine pricing, each NFT pool is associated with a specific bonding curve type and parameters set by the LP (Liquidity Provider). There are currently three options:

Fixed Curve ConstantCurve

Linear Curve LinearCurve

Exponential Curve ExponentialCurve

The linear and exponential curves are controlled by a variable delta as a parameter, the delta is set by the LP that created the pool.

1/ linear curve

Linear curves perform addition operations to update prices. If the pool sells an NFT and receives ETH, the next price it quotes to sell an NFT will automatically be adjusted upwards by a delta amount of ETH. Conversely, if the pool buys an NFT and sells ETH, its next offer to buy an NFT will automatically be adjusted downward by a delta amount of ETH.

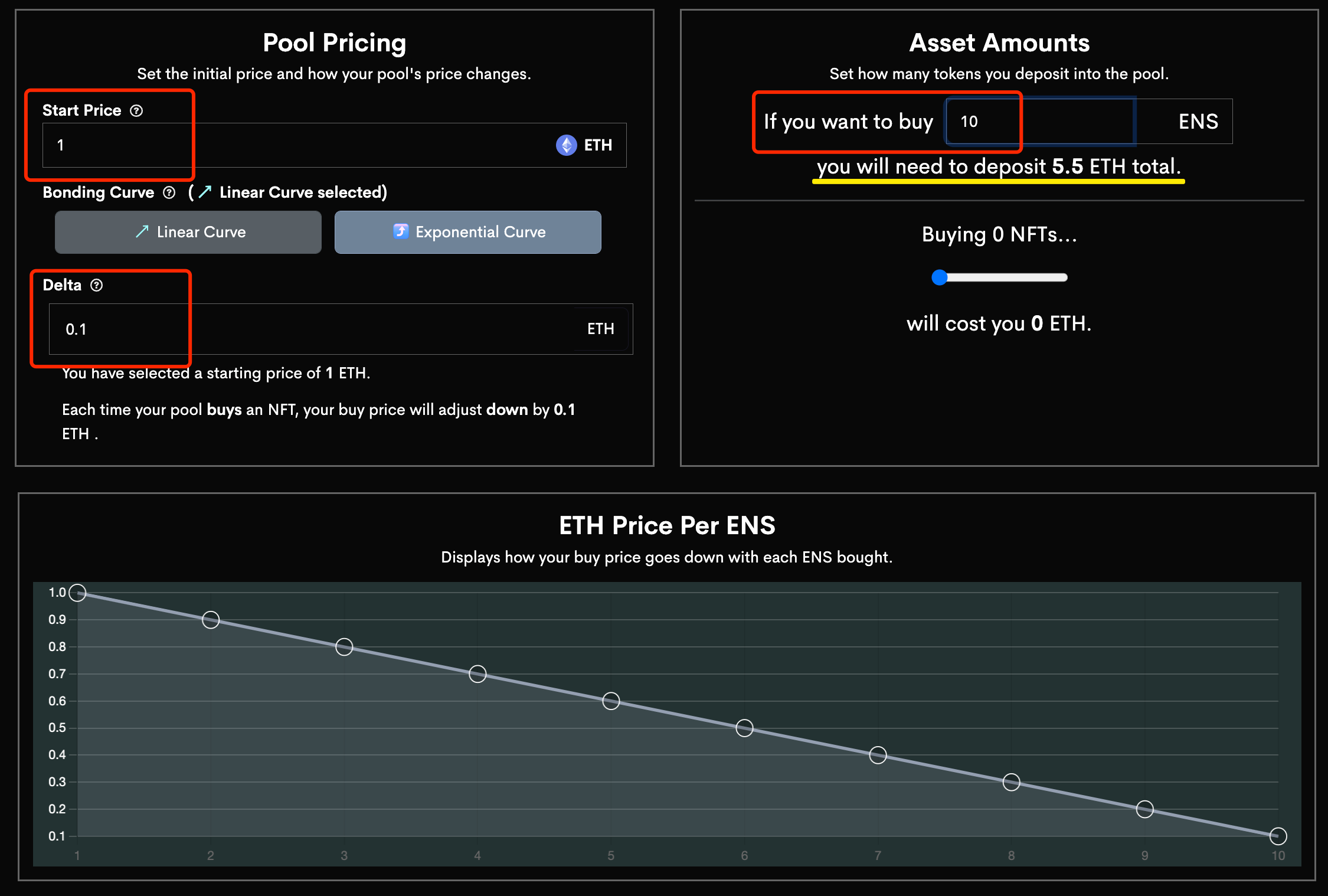

For example, the example in the figure below is:

Select buy-only pool

Linear Curve

The initial price is set to 1 ETH

delta is set to 0.1 ETH

When the pool successfully purchases an NFT with 1 ETH, the next purchase price will be decremented by delta=0.1: 0.9, 0.8, 0.7, 0.6….

2/ Exponential curve

Exponential curves operate in the same logic as linear curves, but the increment and decrement of delta will be calculated in %. For example, the following picture:

Select sell-only pool

Exponential Curve

The initial price is set to 1 ETH

delta is set to 10%

secondary title

question

1/ The pool is too fragmented

This is the first problem that may arise, especially when users and liquidity are relatively small, because each LP manages at least one pool, so the same NFT series can have many different pools. It somewhat decentralizes liquidity which is already not good enough, worst case only 1 NFT per LSSVM pool, which basically relegates to an on-chain order book. Here, some NFT whales or teams may be needed to manage several large LSSVM pools and become the main early market makers. Just like Uniswap has also been exposed that the liquidity of mainstream assets such as ETH and USDT is still mostly provided by whales and professional market makers.

2/ The rarity distinction and pricing issues are still not resolved

secondary title

Is it necessary for NFT to solve the liquidity problem?

At present, there have been many attempts on the issue of NFT liquidity in the market. The problem faced by most protocols is that they cannot distinguish and price the important factor of rarity. Rarity can be said to be the most prominent indicator of the non-homogeneous characteristics of NFT , This has a lot to do with the current NFT product environment. At present, the products in the NFT market are mainly works of art. Whether it is PFP avatars or generated art creations, works of art inherently pay more attention to rarity and particularity, just like The value of Mona Lisa in everyone's heart is different.

So we want to figure out whether it is necessary for NFT to solve the problem of liquidity. First, let’s split the roles and needs of the market:

1/ artwork

From the concept of collection, artwork should be priced independently on each item, and it is not suitable to be traded in a liquidity pool, and its own value is not mainly reflected in liquidity, you Have you ever seen any artist package his works and sell them wholesale? Just like every painting of Van Gogh represents a different meaning and value. Therefore, starting from this demand, artworks should exist in the form of low liquidity.

2/ General-purpose substances or props

The market in this field has not been fully excavated and discovered at present. Starting from the concept of Metaverse, all items and props in Metaverse should be cast in the form of NFT. The simplest example is similar to game props. Game props require NFT non-homogeneity The characteristics of specialization, but the demand for rarity is not high. Usually, the dimensions that can be priced are relatively certain. For example, props can be distinguished by dimensions such as bronze, silver, and gold, and by pricing for each dimension, items and props of each category can be priced in batches.It also shows that "non-homogeneity" is not completely equal to "rarity". Its deeper characteristics are independent ownership and irreplaceability, and irreplaceability cannot be fully reflected by rarity.

3/ The current NFT artwork "hype"

It can be said that most of the current NFT art market is dominated by PFP avatars. This type of NFT is still positioned as a kind of art in essence, but its market performance is gradually approaching between 1/work of art and 2/universal material. According to statistics , The floor transaction volume and amount of the PFP market are much higher than the transaction data of high rarity. For those NFTs with high rarity, the number of transactions will decrease significantly as the rarity increases. In other words, the mentality of this "hype" is that investing in the floor price is investing in the entire series, which is moving towards the characteristics of general-purpose materials.

In the end, we came to the conclusion that NFT needs to adapt corresponding liquidity solutions according to different demand scenarios. The existing OpenSea-based trading solutions are still applicable to NFT transactions in the form of pure artworks, and the closer to general-purpose material The NFT type of NFT needs a liquidity solution similar to a liquidity pool.

official document

references

About us

Original link