4D Discusses the State of Uniswap Governance: Minimizing the Paradox

Original Author: Joanna Pope, Aaron Z. Lewis, Laura Lotti

This article is from The SeeDAO.

This article is from The SeeDAO.

image description

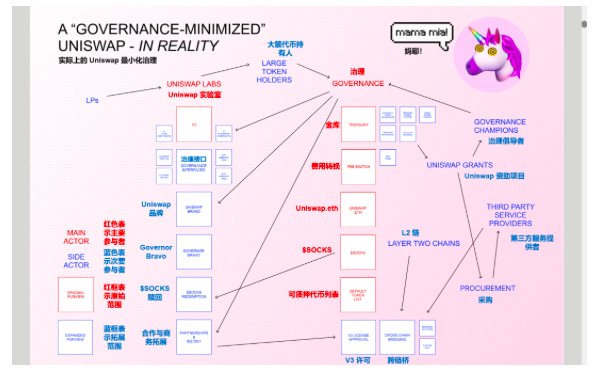

From a theoretical point of view, the governance area managed by Uniswap may be very small. But in actual operation, protocol management will involve a larger scope.

Uniswap takes a "governance-minimum" approach to maintenance and development, which is where its strength and security come from. For years, observers have praised the limits of the agreement. They believe such restrictions are elegant and consistent with the Ethereum philosophy. But for many of the governance participants we've interviewed over the past three months, minification has frustrated them by feeling that the system is sometimes too slow, too static, and unwieldy.

These growing pains are perhaps natural and unavoidable. As the complexity of the ecosystem of web3 public goods continues to expand, with new chains proliferating at an unprecedented rate, it is clear that Uniswap governance requires more formal processes. To maintain minimal governance at the protocol level, mechanisms and processes need to be in place to facilitate off-chain coordination both within the community and with external partners. At the same time, as the agreement matures, more opportunities to cooperate with service providers are also generated. Need something like"Purchasing Team"role to help evaluate these suppliers and partnership opportunities.

In order to gain a clearer picture of the latest developments in Uniswap governance and understand how to best support participants, we conducted a discussion with Uniswap stakeholders during the first two months of 2022."listening journey", they represent different interests, concerns and aspirations. Building on our previous ethnographic research efforts within the crypto community, and following up on the topic we started in our last post, we wanted to understand:

1. Who are the political players in the Uniswap community?

2. What areas of governance are they concerned about?

first level title

How to study a social organism?

DAO ethnography is an emerging field. As we chart this new field, we are also forming a new approach to research. According to Vitalik's "e-theory-um blockchain", and its emphasis on wordcel theory rather than empiricism, the protocol is not just about technology, economic mechanisms, and formal security guarantees. More importantly, it is a living social organism that evolves with its human participants and its environment. We therefore opt for a qualitative approach to mining these subjective, meaning-making practices and agents that shape protocols as social systems, with particular attention to how they apply to the emerging field of human-led protocol governance.

Drawing on the hermeneutic approach pioneered by Clifford Geertz (1973), which emphasizes the cultural context in which behavior and thought are expressed, we organized in-depth interviews with 20 stakeholders. We then encode it according to the analytical framework provided by the work of Pelt et al. (2020). This framework allows us to identify problems based on combinations of different categories.

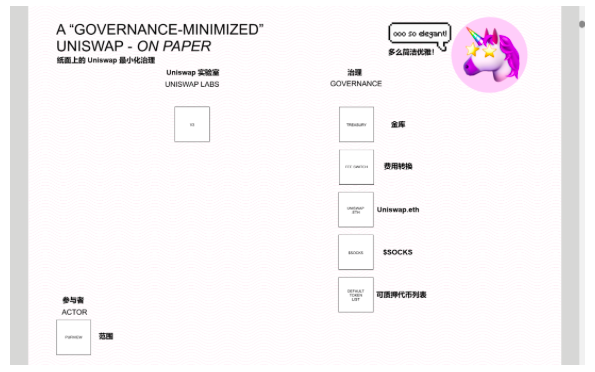

Three layers of governance:

Off-chain community:In the case of Uniswap, social dynamics and relationships take place in Uniswap's social environment (forums, Discord, Twitter, etc.) and provide information to lower layers of governance.

Off-chain operations:Indicates governance matters that take place outside of formal on-chain voting, especially regarding the development and maintenance of the protocol and ecosystem. UGP and The Stable fall into this category. As we will see, there are not many examples of formal off-chain operations in Uniswap.

On-chain protocol:Refers to the interaction mechanisms and rules encoded in smart contracts through which the governance process works. In Uniswap's case, this layer is related to the Governor Bravo's ability to be the infrastructure for making decisions that affect protocol parameters.

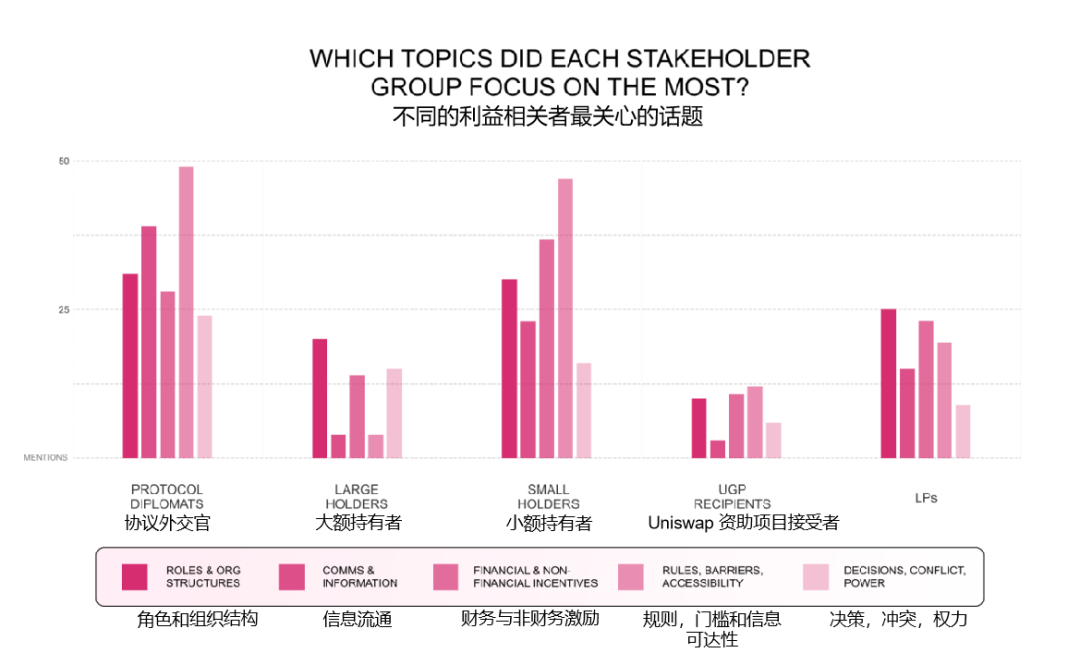

The following are the five most critical dimensions of governance in the open source software and blockchain space:

Roles and organizational structure:Organizational hierarchy and accountability of participants;

Information flow:the media channels used for communication (on-network or off-network);

Financial and non-financial incentives:Monetized and non-monetized rewards for different participants;

Rules, thresholds and information accessibility:About Participation and Membership Criteria

Decision making, conflict, power:Processes and mechanisms for decision-making;

image description

secondary title

Complex Participation and Multiple Levels of Perspective

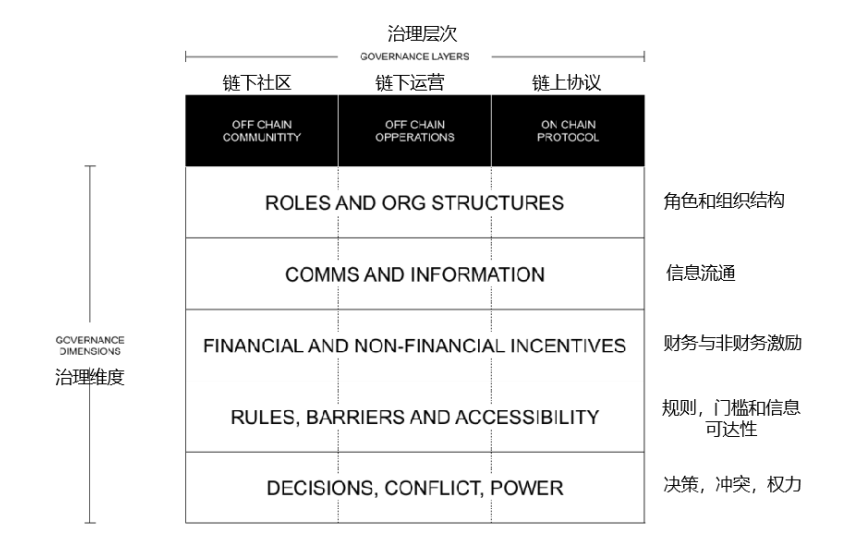

When we started our research, we expected to find that there was a relatively clear separation of roles between stakeholders based on the size of their token holdings. This follows from Uniswap's governance narrative, namely: a small"whale"to dominate the product decision-making process, and at their opposite is a large number of disenfranchised small holders.

However, we have found that this distinction is incorrect. Their identities can be very tangled, with several respondents fitting into more than one category and shifting into different roles depending on the specific context in which they interact with Uniswap.

About a quarter of the users surveyed actively participated in Uniswap's governance, either participating in discussions as contributors in forums and discord, or making proposals, or both. We call these actors:"protocol diplomat"。

Governance was conspicuously absent from large or specialized LPs in our analysis. Given that LPs are not deeply involved in the project, they are somewhat completely excluded from the governance process. This is not surprising.

The picture above is a statistic of stakeholder views during our interviews. Some respondents identified themselves as falling into more than one category.

Different types of stakeholders also have different perspectives on governance. Protocol diplomats and small holders pay more attention to issues related to rules, barriers and accessibility, while large holders and LPs mainly focus on roles and organizational structures.

image description

secondary title

Different Dimensions of Attention

We examine the role of the community in protocol governance and the rise of interest representation/lobbying around web3 public goods by listening to their voices. We observed that while the amount of governance activity was low, the L2 scaling solution sparked some healthy activity on the forums, we speculated that these web3 issues around the ecosystem could be the catalyst for community activity.

first level title

secondary title

The governance process itself is an obstacle

While ecosystem-level issues are certainly a concern (especially for protocol diplomats), the governance process, and compensation to contributors (especially delegates), is a major obstacle preventing these issues from being addressed. Nowhere is this more evident than in the licensing process. To support the community in handling additional licensing requests, Uniswap Labs has open-sourced deployment scripts and documentation outlining how to deploy V3 to other chains; they also recently proposed a template to speed up the licensing process. While these efforts are laudable, to achieve"Multi-chain Uniswap"slowness and power imbalances in the governance process must first be addressed.

"Governance is moving so slowly. There is simply too much coordination to do. "

"We ended up deciding to stop applying for authorization because we didn't want to go through all this effort just to get the ballot done. "

image description

The Selene vomer, or Lookdown, is an extremely narrow-bodied fish. From the front angle, it appears to be a very small fish. But viewed from the side at another angle, it appears much larger.

Another classic example of this paradox in Uniswap governance is the issue of fee switching, which has been endlessly discussed but never acted upon. Fee switching is often thought of as a single problem, with just one switch. In fact, as some interviewees pointed out, each individual pool could theoretically spin off its own DAO and make its own governance decisions: the associated fee structure. Fee conversion is not a single issue.

"exist

exist"governance"There are many different interest groups within, and it is difficult to make a difference if the community is viewed as a single unit. For example, Uniswap could try different experiments on different L2s. The size and scale of the Uniswap governance portal makes it difficult to experiment and move quickly.

"We explored the governance of each pool to determine fee levels. One problem is that the problem is compounded when the liquidity of the trading pool is more concentrated. This could affect how much power/fees are distributed, causing bias... each pool having its own DAO is a cool idea. "

Uniswap Labs made proposals to simplify the governance process, and Other Internet agreed with them after proposing some modifications. These changes may help simplify governance"interface"secondary title

Hesitation in the face of regulatory pressure

Time for the elephant in the room: SEC regulation. Some people worry that Uniswap may be fined or shut down by the SEC. Since the Wall Street Journal and other media reported in September 2021 that Uniswap was facing scrutiny from the SEC, governance participants have been cautious. Opponents argue that the agreement is an unregistered stock exchange. Proponents argue that it is technically impossible for Uniswap to be shut down because there is no single entity responsible for ongoing operations. As Coin Center puts it: “Calling these tools “a DEX” and referring to “DEX” as a class of things that exist in the world (rather than actions) does the tech industry a disservice: it wrongly Depicts software tools as individuals or businesses with agency and legal obligations. Companies and individuals—legal or natural persons—explicitly have agency and obligations; software tools do not. Companies and individuals can be held accountable for their actions, while software tools cannot ’ ” Still, no one knows what the next few months and years will bring, and that’s part of the problem. Being the largest and most successful DEX means that policy makers can use you as a leader. The threat of regulatory scrutiny was felt especially strongly by deal diplomats, making them reluctant to develop proposals. As someone observed:

“Due to regulatory reasons, Uniswap’s risk aversion is very high. Other projects can do more to diversify and accumulate meta-governance power.”

Our investigation also identified some workflows and projects being held up due to regulatory risk. One interviewee said:

“There are a lot of proposals that I would like to get out. One or two we actually wrote, iterated, iterated, and it didn’t get published. The main reason was legal. Know how to fix it. They get easier over time."

While we don't know the content of these proposals, we can definitely feel that looming regulatory risk is slowing Uniswap down.

“Frankly speaking, Uniswap is the worst project we have participated in. Because the project lacks agility, and this is partly due to regulation. We want to do some cutting-edge innovation in the direction that DAO is interested in. But Doing something like this for Uniswap would be much more demanding and I have to figure out, is it worth it?"

secondary title

Inequality of power:

Indifferent Voters and Weary Clients

The severely unequal distribution of voting rights has left many small token holders lying flat and doing salty fish. They feel no reason to participate in governance because their votes don't matter. They really are not wrong. Whales holding coins can show up at the last moment and change the voting situation. Smaller token holders have a harder time pushing proposals through.

"I felt like I was just a helpless little fish with no influence at all. It's really hard to quantify. I find it exhausting to be involved in governance because […] [a large VC firm] owns everything and can control voting to get whatever outcome they want. Whatever they do, it happens. Concentration of control exists in any organization, and so does a listed company. I do not vote on stocks I own. "

Some believe that Uniswap is an entirely new superstructure—a free, unstoppable, permissionless protocol—full of limitless possibilities and potential for innovation. This is a new organizational design where none of the old rules apply. There are also some people who see the shadow of the old order and believe that Uniswap's governance is moving closer to the past corporate governance model.

"I've always wanted to see where the power is - the power is in the hands of a very small number of people; almost 10 whale participants hold a lot of governance tokens, and everyone else has zero tokens compared to them. "

However, some community members feel that this power asymmetry is not a big problem. They feel that participation in governance decision-making deals with too many risk issues, and that there is no reason to try to maximize participation in governance if ordinary people do not have sufficient information or expertise to make good decisions.

"I don't think the number of voters is a metric that has to be improved. A lot of people are asking: how do we get more people to vote? I don't know why this is a thing to look forward to. Governance is a highly specialized Things. In reality, is getting more people to vote a worthwhile pursuit? Most people will make decisions without information. It’s more important to get tokens into the hands of people who care about it, They have a higher degree of credibility in terms of knowledge and experience.....for many it is not practical to form their own opinion and vote. Therefore, the best solution is to have them delegate, or have them Vote according to the opinion of your favorite representative."

A more complex delegation process could help alleviate some of the power asymmetries in the Uniswap governance ecosystem. But for now, delegation seems to be an underutilized governance tool that has not been fully integrated into Uniswap's culture. on the Governance Forum"Authorization Proposal"The thread is relatively inactive, with only 10 posts in the last year. a16z’s token delegation program may be the right direction, as it opens up a formal channel through which more engaged community members can gain more voting power. More licensing opportunities and processes can keep active contributors interested in taking on bigger roles. However, with more voting delegation comes greater responsibility. Participating in governance requires significant time, expertise and social capital. Currently, there are not enough organizational structures or tools in place to make this process straightforward. The work is largely unpaid and unfunded. Some governance contributors point to a lack of incentives for delegation:

"Why should I entrust others when I can be an LP? I hold these governance tokens because I like Uniswap. I think this agreement will be valuable in the future, and they will do some great things. But none of these can convince me Governance tokens are delegated to others”

"If you can give enough monetary incentives to reps, maybe the way will go. That's why people like me don't get more involved -- there's no motivating factor. I have a lot of voting rights, so what? Important, controversial issues motivate me. I don't know of anything that has felt super controversial or important over the past few months. If there was enough incentive for me to spend 15 minutes writing an article, I might just do it. "

One respondent suggested introducing a political party-like"Yuan stands for", to incentivize delegate participation and introduce a more inclusive approach to governance.

"first level title"。

secondary title

Slow Operational Decentralization

In the initial announcement of the UNI token, the governance layer was given a stake in the community treasury"direct ownership". In early 2021, the Uniswap Grants Program (UGP) was established to facilitate funding for proposals related to ecosystem development. While the community can still vote on treasury-related matters, UGP essentially monopolizes treasury payments. The six-person committee makes decisions about how millions of dollars are distributed. Of course, controversial proposals still need to be decided through the governance mechanism. But in an ideal world, the UGP committee would be just one of many funding agencies in the Uniswap ecosystem. Other Internet and The Stable (a grant committee with the purpose of rewarding community contributors) are two early examples of this decentralized process, as they are both working groups under the Uniswap governing body that have the ability to distribute grants. But it's not hard to imagine that there are many other funding agencies, each with its own theme or focus area. They may even compete with each other, spurring more innovation in the ecosystem. As observed by users who hold two large tokens and participate in governance:

"Better decentralization will require funding more truly independent entities. These entities can do different things, or even do similar things, because this is the real source of resilience in the system. I would love to have 5 UGPs funding different things. Not just Uniswap labs doing development, funding. Funding is still a pretty good way to get there.”

"Outside of scaling, you can consider funding programs as an example of satellite teams. You can compare this to MKR, which spins out the core operations team into smaller units. IMO does the best job of governing a complex protocol. "

secondary title

Governance Expansion and Security Risks

Although Uniswap's governance was initially minimal by design, its scope has slowly expanded as issues with multi-chain deployments have arisen. As we have observed in previous reports, governance mechanisms are being asked to make an increasing number of decisions that have the potential to threaten the security of the network. For example, in a January 2022 blog post about multi-chain Uniswap, the Uniswap Labs team wrote:"When evaluating Uniswap v3 deployments, we encourage the community to pay close attention to the security and trust assumptions of the cross-chain bridges being used to pass governance to the chain."This widening of the scope of governance introduces new risks and is consistent with the spirit of minimization initially emphasized by Hayden Adams and by Vitalik last year"Non-governance"pattern (i.e., governance has control over fewer and fewer functions over time).

In addition to the governance discussed above"depth maximization"(Seemingly simple governance proposals would implicate the need for governance structures and processes, requiring additional governance decisions.) Uniswap governance is also vulnerable to scope expansion because its function is so unclear. The scope of governance is forever expanding.

As governance expansion is inevitable, there needs to be clear processes in place to handle these expanding areas of responsibility and avoid risks. Any governance system, whether its purpose is minimization or maximization, requires auditing, active maintenance, and ongoing, targeted intervention to keep the governance system functioning properly. Minimal governance at the protocol level does not necessarily imply a minimal approach at the community and ecosystem level. The scope of governance, both on-chain and off-chain, is a process that must be constantly negotiated as the world around Uniswap changes.

We shouldn't forget that minimization is a means—not an end goal. Minimization should not be minimized for the sake of minimization. This ultimate goal is not necessarily speed and efficiency, but security. This, in the words of Hayden Adams, is threatened by "new assumptions of risk and trust that do not exist in immutable automated systems". The protocol currently uses a minimum threshold of people voting to pass as a safety measure. The logic behind this design is that if the bar is high enough, no controversial proposal will ever make it through the governance process. but this"aristocratic safety"secondary title

Lack of accountability in partnerships

Security risks aside, governance to facilitate Uniswap’s interaction with other protocols means that negotiated deals currently lack the possibility of execution.

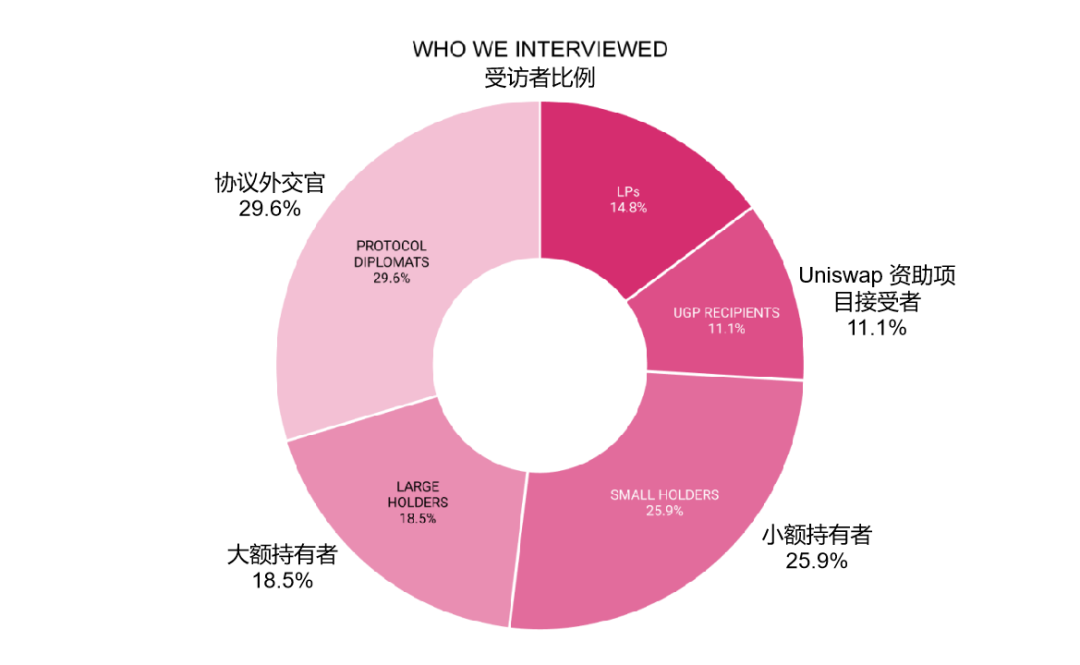

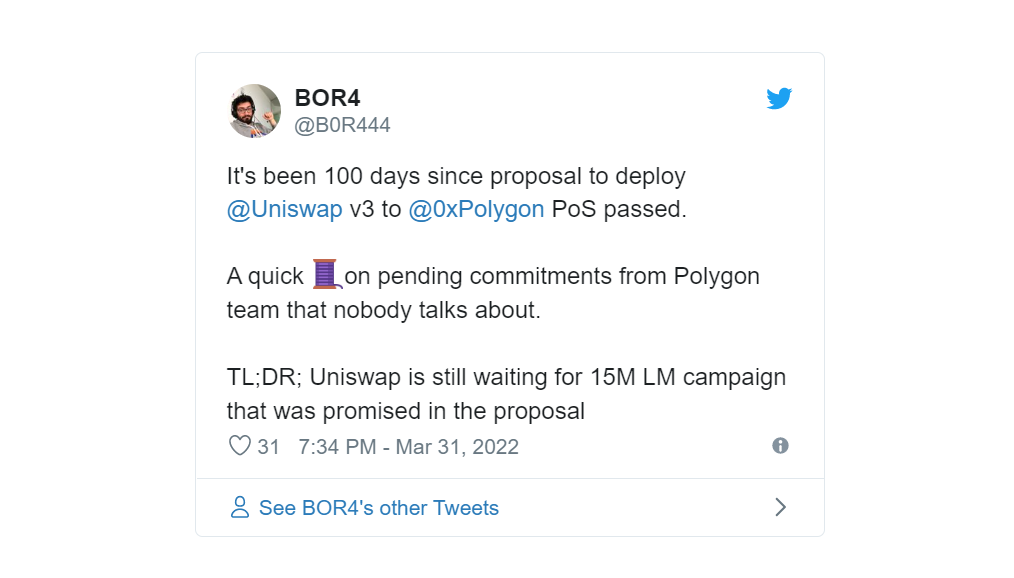

Uniswap’s governance process is indeed time-consuming through its technically minimal on-chain governance. Because Governor Bravo — and the DAO's legal nature — provide no formal accountability or enforcement mechanisms for these proposals. This means that in Uniswap governance, the proposal is passed on the chain, as if a"Binding force"image description

Twitter: Proposal to deploy @Uniswap v3 to @0xPolygon has passed 100 days. Why is no one discussing the unfulfilled promises of the Polygon team, it's time to fix this. Too long to wait: Uniswap is still waiting for the $15M liquidity mining promised in the proposal

There are also issues with malfunctions and blind spots in the v3 delegated exemption process generated through governance. While granting waivers includes adding the project name to a text record stored at v3-core-license-grants.uniswap.eth under a commercially sourced license, there is no on-chain or legal path to enforce additional usage through governance proposals Financial and non-financial commitments made at the time of funding.

A key question to consider is: Does the lack of automated accountability mechanisms mean that on-chain partnerships are poorly designed — or that off-chain accountability solutions are inevitable? To what extent can these trading mechanisms be fully automated?

first level title

Conclusion: Grow Protocols Like Gardeners Grow Plants

The Uniswap protocol was praised by many respondents for its elegance and minimal governance. But we have seen that the problem of human coordination cannot be eliminated. Because there was no process at the beginning of Uniswap's evolution towards gradual decentralization, governance efforts have become unsustainable in the eyes of many. It’s as if the airdrop turns all the value Uniswap generates for users into new costs for coordinating the operational functions that were managed by Uniswap Labs prior to the release of UNI.

Our interviews revealed that new redistributive mechanisms need to be established to balance the additional effort required from the community, and several stakeholders have proposed ideas in this regard. A large stakeholder suggested creating incentives for high-quality proposals,"As a separate effort from proposal/protocol update maintenance". A small holder, community contributor suggested setting up"principal bonus", as some kind of LP token related to the personal entrusted amount. Another forum contributor suggested"Small giveaways to all those involved in governance"idea. A protocol diplomat suggests that token design requires"More like gardening than building", and propose ideas about token distribution accordingly:

“There’s an idea that community building is more like gardening than architecture, and I think token design might be the same. Some ideas around token distribution, maybe there’s a way to somehow reward governance based on the success of a proposal Proposals or voters have a budget of 1 million every six months, and UNI tokens are issued to final voters and proposers to encourage more people to propose proposals.”

For a garden to thrive and bear fruit, it needs the right climate, soil composition and cultivation techniques. Likewise, for a community to grow organically, there needs to be processes and roles in place to facilitate decentralized contributions and decision-making around these big questions. According to our survey, there are some core infrastructure areas that are critical for the ecosystem around Uniswap to thrive.

1. inFormalize off-chain processes and mechanisms in the governance process that cannot be fully automated. In cases where a proposal does not involve a protocol change or token transfer, consensus can be achieved through off-chain means.The Uniswap Labs team has proposed a simplification of the governance process, but it has not yet been implemented, which is an excellent irony to the current governance deadlock. While this is an important first step towards making the decision-making process more flexible and less burdensome, more effort is needed to create credibly neutral processes to address key areas such as partnerships and off-chain operations (i.e. establishing work group or child DAO), rather than on a case-by-case basis. To address the design of these processes, and to address some of these pressing issues, we have established working groups in areas such as licensing and partnerships and fiscal diversification.

2. Establish many power centers independent of the core team.Delegated representation is a means of governance that is currently underutilized, but can be very helpful in bringing representatives of different interests into discussions to participate in decision-making. Becoming a representative not only depends on the number of governance tokens held by this person, but also depends on his analysis and interpersonal skills. If not born with these abilities, he will need to learn them by practice. This is work that takes time and effort and should be rewarded accordingly. Only a few delegates actively participated in discussions in the forum, and those who responded were in some cases also coincident diplomats of the agreement. This is no coincidence. They have the skills, intrinsic motivation, and ecosystem interests to make informed decisions for the benefit of the protocol. However, for a truly thriving web3 ecosystem with positive externalities to the real world, there needs to be more diverse, multi-layered representation of interests, including protocol contributors, DAO workers, LPs, and perhaps Uniswap-connected local community. Other Internet is partnering with Orca Protocol to organize a Governance Summit where rising protocol politicians will be paired with real-world governance experts to learn and network to tackle these tough organizational issues. Another central piece of the polycentric puzzle may be establishing a"Purchasing Team” to present Uniswap DAO requirements to the web3 community. With the possibility of collaboration and governance expanding, it may be useful to have a team dedicated to obtaining resources for the maintenance and development of the protocol, especially in Uniswap’s decentralized These initial stages of globalization operations. Other Internet is well positioned to help fill this role.