Pantera Capital: Centralized financial institutions stormed, but DeFi is not dead

Original Author: Pantera Capital

Compilation of the original text: angelilu

"Cryptocurrencies have been plunging... and the chaos has spread to DeFi: Celsius, a crypto lender with assets of about $20 billion, was recently forced to suspend withdrawals. Last week, cryptocurrency exchange FTX said that after the bailout Shortly after acquiring cryptocurrency broker Voyager Digital, it is bailing out BlockFi, a struggling crypto lending platform, with a $250 million loan.”

— Jon Sindreu, The Wall Street Journal, June 30, 2022

to reportto report, the entire article is full of condemnation of the so-called DeFi failure.

DeFi - decentralized finance, has it really failed?

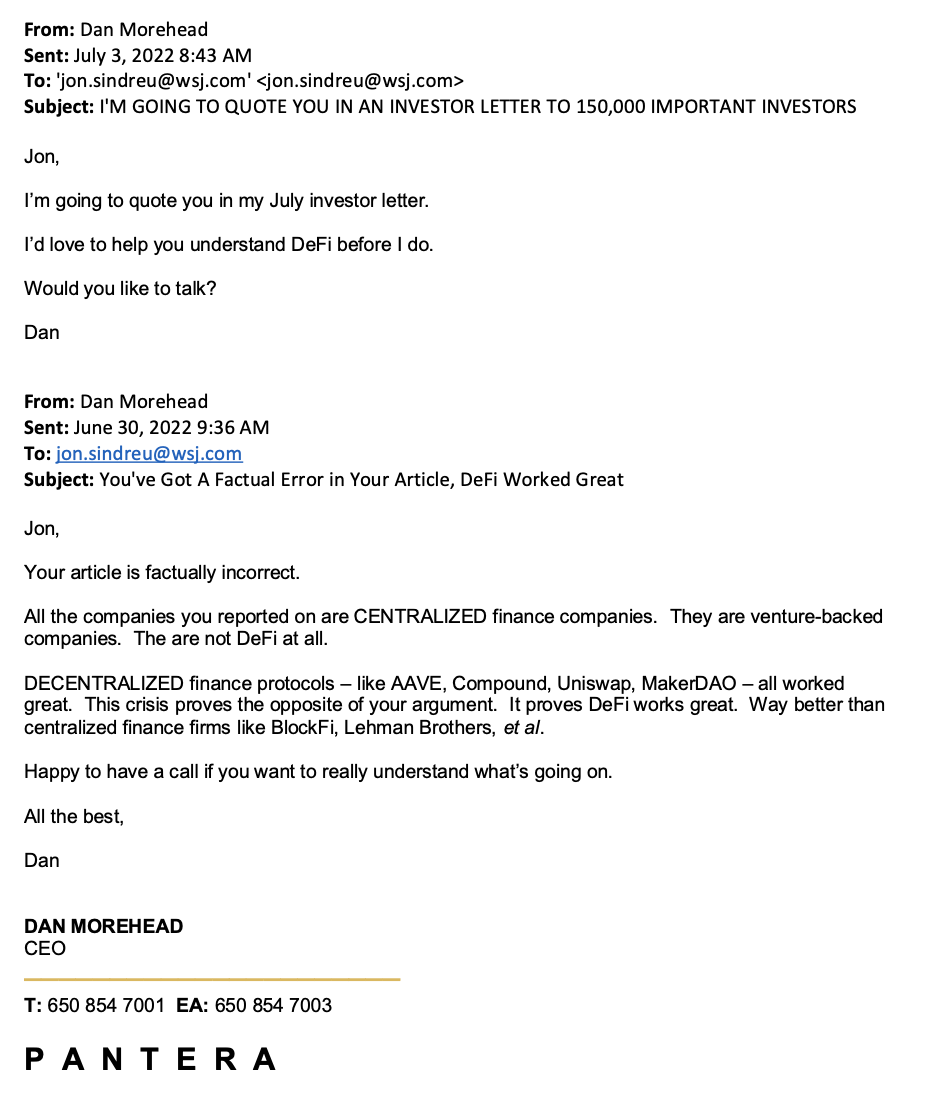

This is a huge misconception, and it didn't fail, it paid off!

The 5 companies listed by the reporter in the report are all centralized, they are just old-fashioned venture capital-backed startups, not DeFi at all, and they are not on the blockchain. These businesses are just over-leveraged start-up banking entities, and in fact the failure of this type of business is so commonplace that there is nothing new about them.

Decentralized finance protocols — like Aave, Compound, Uniswap, MakerDAO — all work flawlessly 24×7. This crisis just proves that DeFi is working very well, much better than centralized financial companies such as Celsius, BlockFi, and Lehman Brothers.

First of all, I try to avoid reading this kind of report citing "tulip bubble" reporters. I haven't read anything useful in this kind of article that randomly cites cases from 400 years ago. However, it is precisely because I support blockchain so strongly that I dutifully bite the bullet and read the entire article.

Let's analyze the misconceptions contained in the article:

1. “Remember how the banking system self-destructed every few decades? Now imagine if banks only lent money to other banks, and you might think of the concept of a house of cards, ‘decentralized finance’ or "DeFi"."

You don't need to remember what the report said, it's wrong again! Celsius, BlockFi, Voyager Digital are banking entities that are not decentralized in any way.

Those startups are just banks that take short-term deposits and make long-term loans to each other and others, and they're 20-to-1 leveraged business models run by ordinary people.

On the other hand, DeFi is not an empty house of cards. Its foundation is rock solid and completely transparent. DeFi removes human subjectivity in financing decisions. Parties agreeing to transact openly and transparently on the blockchain, rather than behind the scenes by opaque, human, and potentially conflicting financial actors, is the vision we should strive for, not insist on inefficient Centralized financial system.

The author holds a misleading view of earnings in the blockchain. He ignores that DeFi is the financial backbone of the entire blockchain ecosystem, and that DeFi is being used to power all forms of transactions — retail, institutional, and even the type of green loan he claims doesn’t exist on the blockchain. Collateralized loans that secure the blockchain and incentivize liquidity to prevent slippage are just some of the ways yield is generated in cryptocurrencies today.

2. “To the delight of the critics, DeFi ended up committing the same crime as Wall Street, essentially becoming a vehicle for a new generation to engage in the rampant speculation typical of pre-2008 investment bankers.”

Oh ~ so the evils of the banking industry should have stopped in 2008? Hmm... I'm not sure the records support this. Since being redeemed by US taxpayers in 2009, banks have paid a staggering $321 billion in fines.

I remember an anti-Bitcoinist writing an article "Bitcoin is Evil". I don't understand why, Bitcoin is a piece of open source code that anyone can use. It has never done anyone a bad thing. Banks, on the other hand, have been convicted of $321 billion worth of nefarious acts. (And, that's just the kind of behavior they've been caught doing).

To put the numbers into perspective: The United Nations food aid arm, the World Food Program estimates that $6.6 billion will help avert 42 million people from starvation in 43 countries.

Banks spend 50x as much on fines as they do on world hunger, maybe this article should be Banks Are Evil.

To give another comparable data, bank fines are equivalent to the combined GDP of 84 countries. If the banks hadn't committed a crime, they could have paid all the 363 million citizens of these 84 countries for a whole year.

DeFi has never “criminally committed a crime” and the rules of engagement are codified into smart contracts. You don't need to trust a counterparty who might be incentivized to misrepresent the truth, and you don't need to rely on trust to conduct financial transactions. Code simply does what both parties agree to.

3. “Crypto lenders’ exclusive focus on other crypto projects shows that their problems are much bigger than a Lehman-style liquidity crisis.”

No... Celsius, BlockFi, Voyager are just as much centralized finance as Lehman Brothers.

4. “Digital currencies like Bitcoin are too inconvenient to deliver on the promise of eventual money concentration in a small number of banks, asset managers, and governments.”

Why would a reporter -- I like to borrow a classic line from Mark Anderson here -- "who can't have 12,000 followers" think that 300 million people are wrong? 300 million people saw the promise of blockchain. If a reactionary who completely misunderstands the fundamentals doesn't see the promise of blockchain, that's not my problem.

Still, I'm a real athlete. I tried to help this young furry boy get out of his rut.

To quote Cool Hand Luke (Paul Newman, 1967), "There are some men you just can't touch."

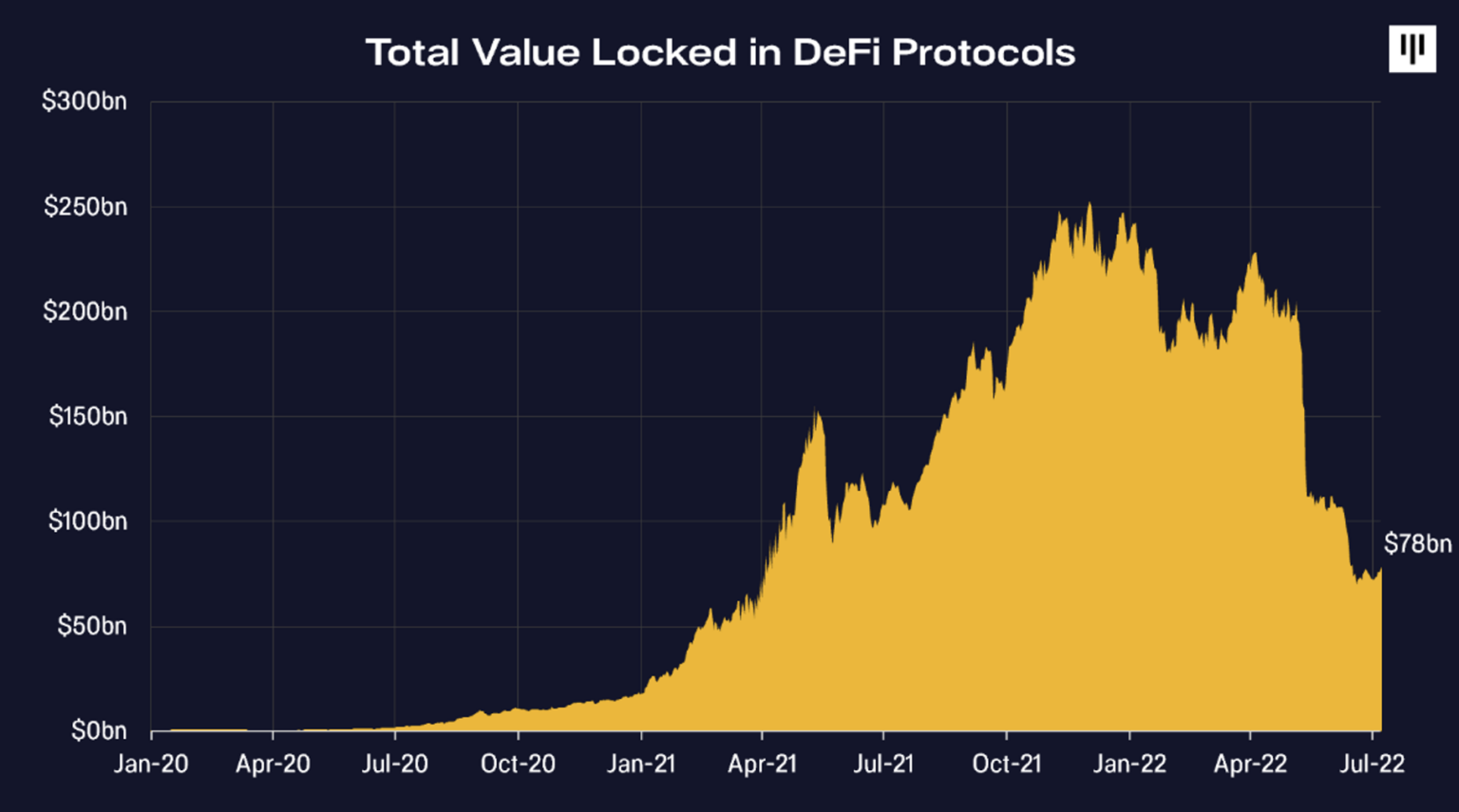

DeFi is even better

The most elegant proof of DeFi's superiority over centralized finance/banking is head-on competition. Centralized finance companies like Celsius and BlockFi do business with counterparties, and then they invest their funds in DeFi protocols, what happened?

Smart contracts force centralized financial firms to pay back DeFi protocols.

In fact, you could argue that DeFi, with its over-collateralized discipline, protects you from CeFi. Celsius was forced to take precedencerepayOver $400M in DeFi loans on Maker, Aave, and Compound to prevent their collateral from being liquidated. In DeFi, participants have no ability to violate smart contracts, "transactions are transactions" - you can't exit.

All centralized financial companies are forced by smart contracts to repay DeFi agreements. On the other hand, centralized financial companies can cheat their customers and then hide their customers.

For example, even though Voyager explicitly advertises that its customers' deposits are FDIC-insured -- and the FDIC apparently only insures failed member banks. They certainly won't bail out bank customers like Voyager for lost business.

"In the rare event that your dollar funds are harmed due to the failure of the company or our banking partners, you will be fully compensated (up to $250,000)." - Voyager website, 2019

"Your dollars are held with our banking partner, Metropolitan Commercial Bank, which is FDIC insured, so the cash you hold with Voyager is protected." — still on Voyager website, July 11, 2022

Failed centralized finance firms are silent about their customers, and unfortunately, their customers are unlikely to get their money back.

DeFi never will, customers can monitor the agreement on the blockchain and be sure that it is executed by code. Centralized finance clients have only vague websites to trust.

Why DeFi is so important (Author: CHIA JENG YANG , INVESTMENT ASSOCIATE)

Among the large leading cryptocurrency lenders (Aave, Compound, BlockFi, and Celsius) founded in 2017, DeFi protocols performed best. BlockFi was essentially bailed out by FTX, a deal that provided a $400 million line of credit and an option to buy the company at a 93% discount to the high-water mark observed in the private market. Celsius at one point managed a $24 billionassets, which is roughly equivalent to Point72, one of the most famous hedge funds founded in 2014 by Steven Cohen with 30 years of investment experience, Celsius now faces potential bankruptcy.

So how is DeFi more effective than CeFi in the current plunge?

Let's go back again to why blockchains are useful.

Blockchain provides complete transparency. Smart contracts provide automated rules for how specific financial instruments and agreements should behave, executed and governed by code, not relationships.

With blockchain visibility and transparency comes accountability. DeFi apps cannot run away with funds, deploy funds in strategies your retail investors disagree with, favor one investor over another, or undercollateralize without others knowing. With blockchain, the whole world can track your actions 24 hours a day and see your every step.

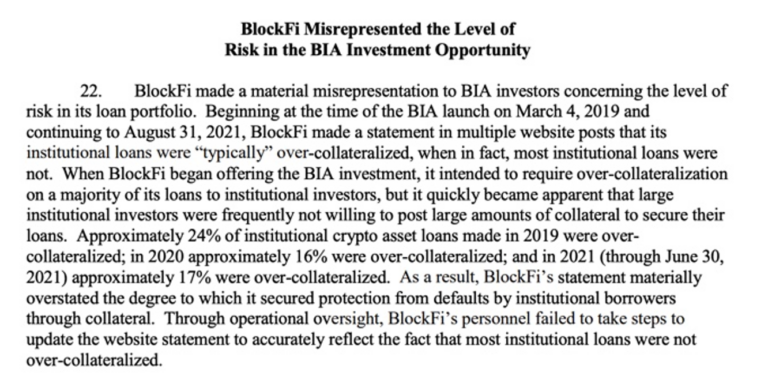

statementstatement, asserting that BlockFi misrepresented the risk level of BIA investment opportunities. A DeFi lending protocol governed by a smart contract would not allow this to happen, as the lending rules would be spelled out in the smart contract.

Data on the chainData on the chainLet's look at those wallet addresses that used leverage to buy Ethereum, facing huge liquidation pressure at $600 and $500 ETH. For any participant operating in the market, the visibility of the on-chain market is available to all, not just those in the know. This increases everyone's ability to understand what is happening in the market.

This is in contrast to the trust role of CeFi, where we rely on market rumours, to know which crypto lenders are safe to park their assets with. We have no way of knowing their balance sheet or what they are doing with your funds because CeFi has no absolute transparency.

DeFi also uses overcollateralization almost exclusively in lending, providing transparent and healthy risk management. This is similar to how banks issue mortgages on homes. The advantage of DeFi's current platform is over-collateralization. The minimum collateralization rate of most DeFi platforms is 110-150%, representing a loan-to-value ratio of 60-90%. In practice, we have seen strong DeFi protocols (MakerDAO, Compound, Aave) have higher collateralization ratios of 200-300%, representing loan-to-value ratios of 30-50%. The anonymity of DeFi means that only those with strong risk management practices will survive in the long run, and there is no wiggle room for relationship-based or gut-based underwriting/undercollateralized loans. CeFi has no such on-chain discipline to make undercollateralized loans to entities they think are good borrowers (and sometimes turn out to be not). Conversely, DeFi protocols cannot conduct such behind-the-scenes transactions without transparent smart contracts explicitly allowing it.

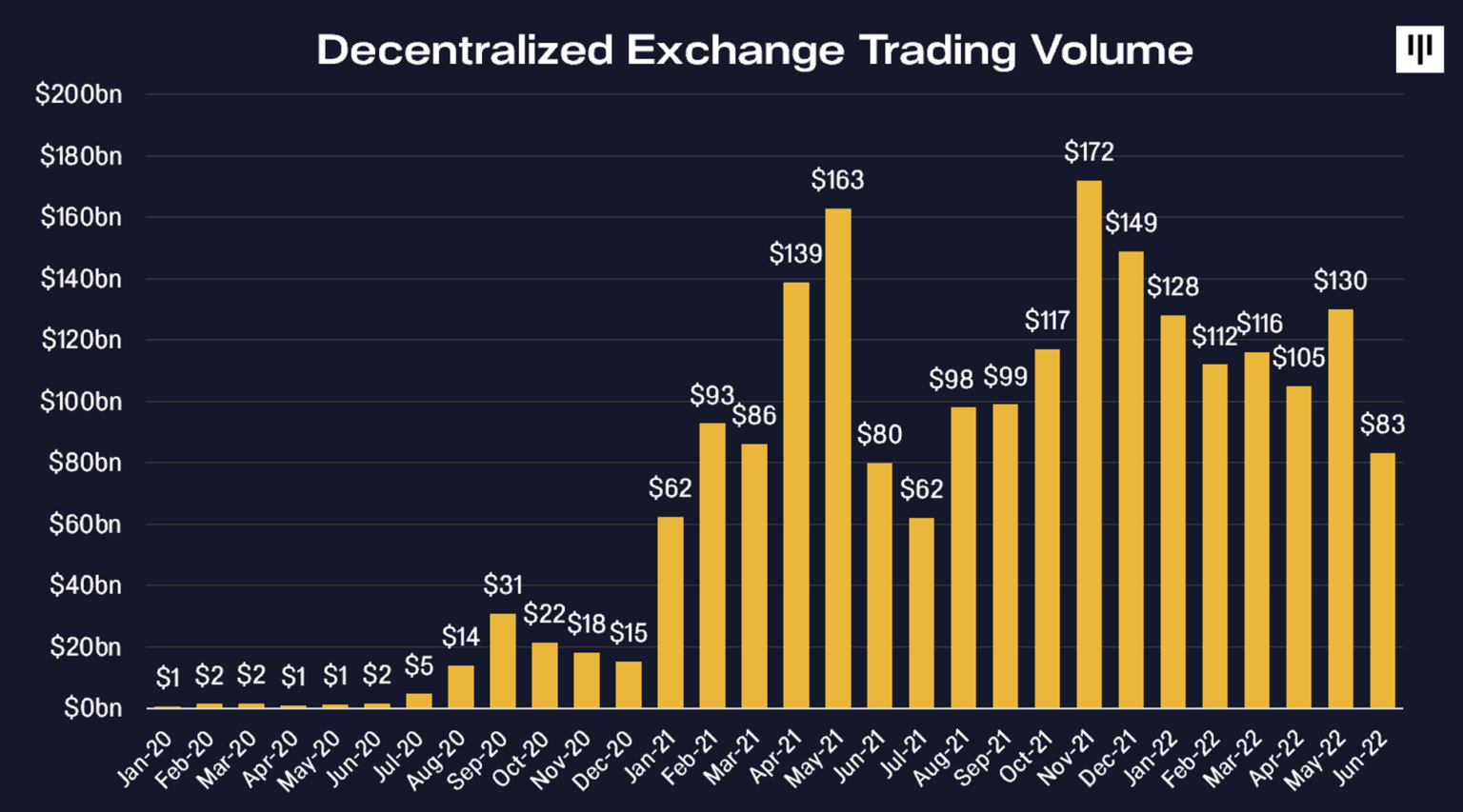

Participants in DeFi can also conduct their business in the same way before, during and after the crash without suspending withdrawals or requiring emergency funds. For example, during the LUNA crash, DEXs continued to operate normally, while some CEXs were forced to stop withdrawals, which obviously harmed the interests of users, so users suffered losses.

Original link