image description

secondary title

text

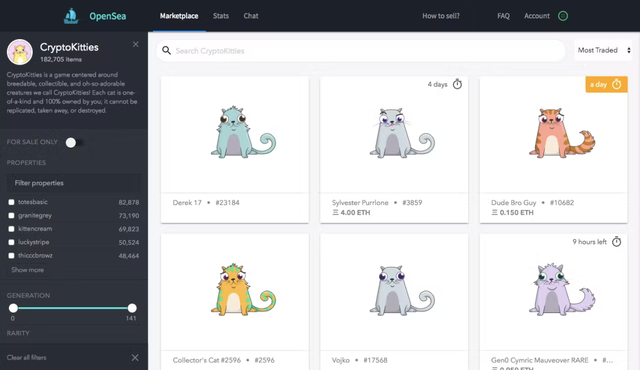

"Which idiot would buy this, there are so many and ugly, and many of them look almost exactly the same." I sighed like this when I saw cypherpunks at Opensea, and it turned out that I was the idiot who didn't buy cypherpunks.

image description

Opensea early official website

A netizen named Mr.703 received more than 730 for free when CryptoPunks was first launched, and it would be worth 600 million now. He has realized hundreds of millions of assets, and currently there are one or two hundred left in his hands.

He successfully cashed in his cognition, but I paid for my cognition.

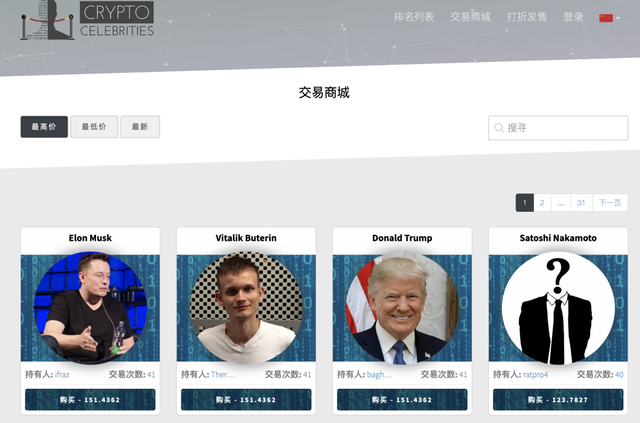

At the beginning of 2018, I saw a newsletter about Crypto Celebrities (encrypted celebrities) on Jinse Finance, and quickly asked my friend to transfer 33.6 ETH to me, and then bought the most expensive "V God" and "Satoshi Nakamoto" on the platform. Photo, this is the second NFT project I have played after CryptoKitties.

At this time, PFP is not the most popular product, and everyone prefers the "hot potato" model products with strong financial attributes.

Then CryptoCountries (encrypted countries) appeared, and I also participated in it. At that time, the market sentiment was very FOMO, and a friend spent several million to buy the most expensive country.

The number of Crypto Celebrities and CryptoCountries is only about 200. At that time, I thought that the smaller number of projects must have a lot of room for growth in the future.

Then I collected kryptowar with a total of only 100, ETHmap with only 178, and CryptoAV with less than 100. There are also some other NFT projects, the total amount of which is relatively small.

image description

Crypto Celebrities

In the end, kryptowar closed down, the encrypted country ran away, the encrypted celebrities RUG, and the encrypted cats became uninterested. Instead, the cypherpunk I was least optimistic about became well known. This taught me a deep lesson.

My investment logic has changed. To be precise, it has evolved. It has changed from a single-minded thinking to a multi-dimensional view of investment.

secondary title

The Chaos of Digital Collections in China

Since Alipay and the Dunhuang Academy of Fine Arts jointly launched the payment code skin NFT based on two AntChains, it has opened the era of digital collections in China.

The digital torch for the 2022 Hangzhou Asian Games with an original price of 39 yuan was bid as high as 3.149 million on the auction platform. The initial price of the Dunhuang Feitian NFT, which was priced at "10 Alipay points + 9 yuan 9", was fired up to 1.5 million yuan.

image description

Whale Explorer's early interface

Immediately afterwards, it also settled in Unique Art and released "The Joy of Reading". Tell the group of friends to grab the Ultraman blind box in the ibox, and you can earn about 18 times if you grab it. Domestic digital collections were still called NFT at that time, and they were still in a relatively small circle.

At that time, the works of Weiyi Art, the main artist, were not very popular. With strong endorsements, high-quality IP, and enviable traffic entrances, Whale Explorer and Huanhe quickly accumulated a large number of users, with a collection of 10,000 to 20,000 copies. It was emptied within a second.

In the days that followed, major companies saw this sweet pastry and tried to come in to get a share. Users are profit-seeking, and everyone hopes to have room for hype, so those digital Tibetan platforms with secondary markets are particularly eye-catching, seizing the dividends of the market.

When dividends come, grow wildly and strive for execution. When the dividend disappears, whoever operates more meticulously will have a stronger ability to make money.

According to a friend close to me, “When Weiyi Art was hot before, the daily transaction volume was 300 million. Calculated according to the transaction fee of 7.5%, the single-day profit was 20 million. If it were not for the payment channel limit, there would be a breakthrough. When iBOX was crazy , with a single-day transaction volume of more than 1 billion, and a single-day profit of more than 30 million."

But as the market boomed, the bubble grew bigger and bigger, and many problems gradually emerged.

More than 1,000 digital collection platforms have appeared, and the major digital collections are dazzling. The digital collections of "Dunhuang" and "Zhang Daqian" that can be seen everywhere have become synonymous with "bad streets" in the eyes of users.

Many IP authorization chains are not complete, so they are listed on the platform. Some platforms are more wild, without relevant authorization, and directly uploaded to pirated versions; more and more entrants launch new platforms with impure purposes, leading to incidents of platforms running away It is not uncommon; there are more and more platforms, more and more collections, but the number of people entering the venue has not increased.

The method of selling thousands of copies of a picture is indeed convenient for users to operate, and has played a certain role in the initial market cultivation, but this method is not the future of data storage, but a game with a capital disk, which is better than the original postage currency Cards are even crazier.

When it was hot, a random picture sold 2,000 copies. When the circulation was good, the price per copy could reach 50,000, and the market value of a single picture reached 100 million, which is already comparable to some listed companies.

We know that the domestic Greenland Group bought a monkey. As the holder of BAYC#8302, he can use it commercially around the world without the permission of Yuga Labs, the parent company of bayc.

However, domestic digital collections lack the spirit of web3.0, and almost all platforms have similar copyright statements, "Unless the written consent of the copyright owner is obtained, digital collections shall not be used for any commercial purposes." The digital collections you buy Ownership does not belong to the buyer, which is very different from the ownership of overseas NFT.

The purpose of the big IP side is to earn a licensing fee, and after licensing to a third party or platform, they will directly sell digital collections for a fee. Some other brands enter this field only for marketing publicity, pulling their own stocks.

secondary title

From Rarible to Opensea

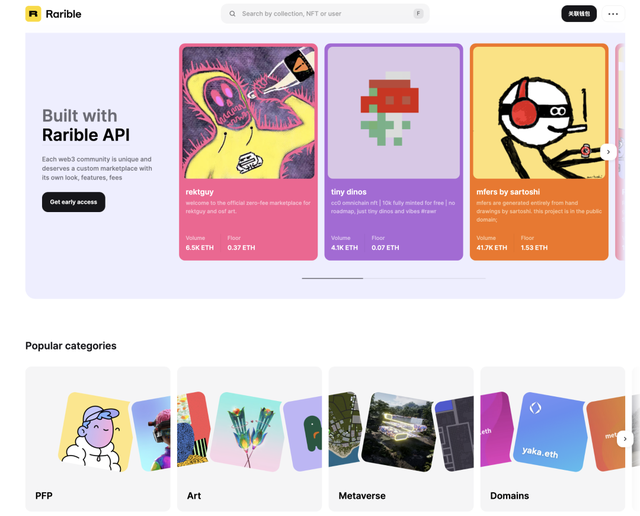

image description

Rarible page

In 2021, Beeple's digital art will fetch a sky-high price of 450 million. I started ALL IN to encrypt art creation. I still chose Rarible as the sales platform and launched Dream Chaser"NFT series works. Why didn't I choose Opensea? Because it feels that its interface is too low, and the items on it are relatively earthy, without an artistic atmosphere.

Although Rarible has outperformed OpenSea in the past, OpenSea has risen rapidly with its simple and elegant official website, good user experience, convenient and fast distribution functions, and powerful filtering and cataloging systems.

Everyone knows what happened next. Opensea has gradually become popular, with more and more transactions and more and more users, becoming the well-deserved NO.1 in the world. I think the most important thing is the "collection" function of Opensea. OpenSea aggregates and provides a wide range of different assets, such as familiar Punks and Axies, and even platforms such as superrare and Rarible have made collections.

Of course, there are also more and more original series that have been launched on the platform. Copy products that have been recognized by the market, so that there is no need to bear the cost of trial and error. Some innovative and artistic series are more popular among collectors.

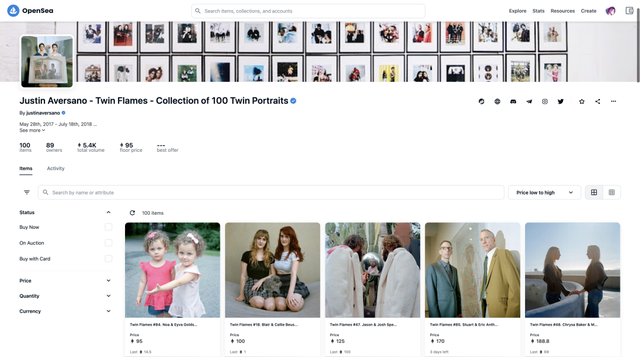

The popular photography series Twin Flames, created by 28-year-old artist Justin Aversano, is a collection of 100 photographs of twins. One of the works was auctioned at Christie's and sold for $1.1 million.

Twitter is very important overseas. Pranksy, an NFT big V with 425,000 fans, earned hundreds of millions of dollars last year. The quality of fans in this industry is particularly high.

Justin Aversano has 79,000 followers on Twitter. Among the 517 tweets I followed, 102 people followed him. These include Coinbase NFT, Cozomo de' Medici, PROOF, Bored Ape Yacht Club, OpenSea, FEWOCiOUS and many other well-known institutions and influential figures.

One day I found out that he also followed me. After I got to know him, I found out that he is actually the fiance of Buffett’s granddaughter Nicole. It may be that I have a cooperative relationship with Nicole, and Justin also noticed my existence.

image description

Twin Flames

When I saw someone using this twin photography series as their avatar on social platforms, I felt that this person was very rich, because it was worth several million at its peak.

Twin Flames belongs to the "collection" accurately, not the category of PFP. PFP is more of some cartoon avatars or 3D avatars. "Collection" contains PFP, and this concept is relatively easy to understand.

More and more companies and artists have released "collections" on Opensea, among which many star projects have been born.

secondary title

Will PFP be the future of domestic digital collections?

If my bag is a small CK, I will be more envious of the sisters who carry Hermes, Louis Vuitton, and Chanel. Owning them is a symbol of noble status.

If you have a Chanel bag, and yours is the most expensive limited edition, then you will not only get envious eyes from the bag-loving crowd, but also have a certain status among the Chanel bag crowd. Owning an expensive bag is to show his purchasing power to others. The brand and model of the bag are equivalent to a symbol of social status.

image description

BAYC promotional video

When it comes to NFT, people think of Boring Ape and Cryptopunk, but when people talk about digital collections, there is no representative series of works. Every practitioner has a dream of a boring ape, and I also want to create an influential PFP series in the future.

One of the factors that made Boring Ape so popular was the adoption of the CC0 protocol, which was considered a pioneering work at the time. You must know that the copyright of cypherpunk was still firmly in the hands of the parent company Larva labs. Owners of Boring Apes are very free to commercialize any apes they currently own, turning them into brand new IP. People are excited about its CC0 narrative and the possibility of derivatives etc.

What is the CC0 agreement? That is, by declaring CC0 for a specific work, the author or creator waives all his copyright and neighboring rights in the work to the maximum extent permitted by law, and contributes the work to the public domain. Take the mfer series as an example, they have their own mfer, but no one owns the IP.

If domestic digital collections can learn from overseas NFT's attitude towards copyright and actively adopt the CC0 protocol, I believe it will definitely promote the development of the entire industry.

Maslow's hierarchy of needs theory includes a five-level model of human prelude, which is usually described as a hierarchy in a pyramid, from bottom to top are physiological needs, safety needs, social needs, esteem needs, and self-actualization needs.

The emergence of PFP perfectly meets the social needs and respect needs of today's society. As more and more people decide to hold the corresponding PFP series, the PFP in his hand may become more and more valuable.

PFP is not very popular in China at present, and it is normal for a picture to sell thousands of copies.

Generally speaking, NFT players mainly have three purposes, namely collection, investment and speculation. Some users are for collection and appreciation of art; there are also some NFT funds and investors overseas, mainly investing in blue-chip projects for the diversification of asset allocation; of course, most people are attracted by the sudden wealth effect, more for Make money by speculating.

Domestic platforms with secondary markets sell tens of thousands of copies of a picture, which will increase the financial attributes, and for most people, the meaning of collection will not be very great.

When 10,000 PFPs are used as social capital, differentiation and dissemination are the most important parts. Therefore, the current popular gameplay of domestic digital collections cannot pass the level of differentiation. For example, I bought a painting on Whale Explorer, and 10,000 people hold this painting at the same time. This painting is not unique to the holder, so the collection attribute is greatly reduced.

Over time, NFT in the understanding of overseas users has changed from artwork to social capital. History is informative, and people's understanding of digital collections will gradually change from speculation to social capital.

Although there are overwhelming reports about digital collections, I think the entire digital collection industry is still very small, so there are no popular phenomenon-level series of works.

At present, more post-00 students are playing, and now a lot of funds have not entered the game. Institutions, celebrities, traditional collection tycoons, and even most NFT players have not entered the game. But this is also where the opportunity lies. If the industry is not cut across the board, there will be huge space in the future.

However, PFP is the easiest way to allow traditional funds to enter the market. PFP plus CC0 agreement may be more likely to be favored by investors, enterprises, and institutions.

At the beginning of the PFP series, thousands of NFTs are often generated at one time. All NFTs use a fixed set of data to be combined through an algorithm. The overall number is limited, but each is different. In this way, the scale of such PFP projects will become larger, instead of existing as one-off digital art like other NFT types.

The number of NFTs of many artists is relatively rare, and the price is relatively high, making it difficult to form a group community effect. Because of the way the PFP series came about, they sparked a loyal group of buyers.

In the future, will the domestic digital collection industry usher in a bright moment because of PFP? Just give time to test it.