Nine latest substantive developments of Three Arrows' debts (including a comprehensive overview of 27 creditors)

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

Author | Qin Xiaofenghttps://3acliquidation.com/Editor | Hao Fangzhouhttps://www.docdroid.net/xKIqrjq/20220709-3ac-bvi-liquidation-recognition-1st-affidavit-of-russell-crumpler-filed-pdfProduced | Odaily

On July 18, the first meeting of Sanjian creditors hosted by Teneo was formally held. On the same day, Teneo also designated the official website (

) published a legal document (restricted reading), covering creditor information, media reports and other information, a total of 1157 pages, the website is:

. Odaily synthesized the news from all parties and sorted out the nine latest developments about the debt of Three Arrows.

The handling of Sanjian's debts has just come to the prologue. Brett Harrison, president of FTX USA, posted a picture today to describe the intricate relationship among the founders, investors, creditors, and spouses of Three Arrows:Soldman Gachs1. No new liquidators will be added

The first item of this meeting is to vote on whether to apply to the British Virgin Islands (BVI) court to replace the joint liquidator with a different liquidator.

Previously, the BVI court appointed consulting firm Teneo to manage the bankruptcy of Three Arrows. The company appointed two partners, Russell Crumpler and Christopher Farmer, as joint liquidators. The result of the vote is that Teneo will continue to act as liquidator and will not hire a new liquidator. "From the conference call, they (Teneo) appear to be knowledgeable, experienced and committed to the best possible outcome for all creditors." Creditors

Tweet said.

2. Establishment of a creditors committee

The second item of the meeting was to vote on whether to set up a creditor committee, and the final result was in favor.

According to BVI regulations, a creditor committee must be composed of three to five members, and cannot be directly related to the founder/person in charge of Three Arrows. Voyager Digital, Digital Currency Group (DCG), CoinList, Blockchain.com, Matrixport were finally selected five agencies. Some of Sanjian's assets are currently illiquid and difficult to value, and the role of the creditors' committee is to work with the liquidators to discuss how best to realize the value of the assets.

3. Why were five companies including DCG elected?

Five companies, including DCG, were selected mainly because their combined debts accounted for 80% of the current claim amount.

According to court documents, Genesis, an encrypted economy provider, provided $2.36 billion in loans to Three Arrows, and is currently claiming $1.2 billion. The parent company of Genesis is DCG; in addition, Voyager Digital provided $685 million in loans, ranking second; Blockchain.com lost $270 million U.S. dollars; CoinList provided a $35 million loan.

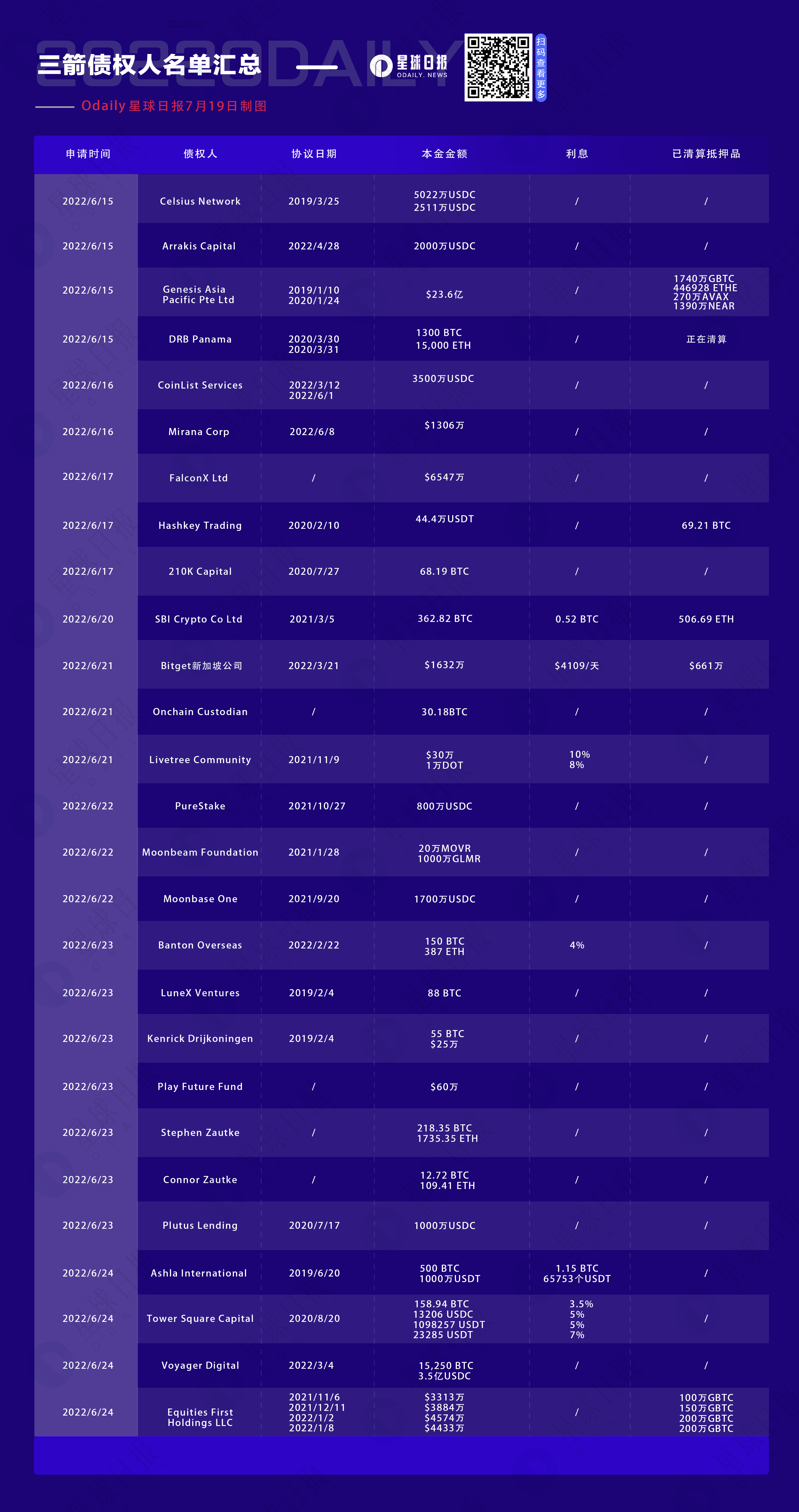

4. Claims from 32 institutions

According to the documents released by Teneo, since June 15, 2022, a total of 32 creditors have issued notices of default or claims to Sanjian, one of which initiated arbitration proceedings under the auspices of the American Arbitration Association, and the other creditor filed Section 155 of the Bankruptcy Act 2003 brought proceedings.

In addition, since Teneo created the website, a total of 27 creditor compensation applications from institutions have been received and verified, including many familiar projects and agreements. For example, DRB Panama, the parent company of the cryptocurrency exchange Deribit, provided Three Arrows with a loan of 1,300 BTC and 15,000 ETH in March 2020; MOVR and 10 million GLMR; Moonbase One provided 17 million USDC to Three Arrows in September 2021; Bitget Singapore provided US$16.32 million to Three Arrows in March this year, with a daily interest rate of US$4109 (see the end of the article for the specific list).

Claims now total $2.8 billion, a figure that is expected to rise significantly in the future given that some have yet to file claims for confidentiality reasons.

5. Unexpected Creditors

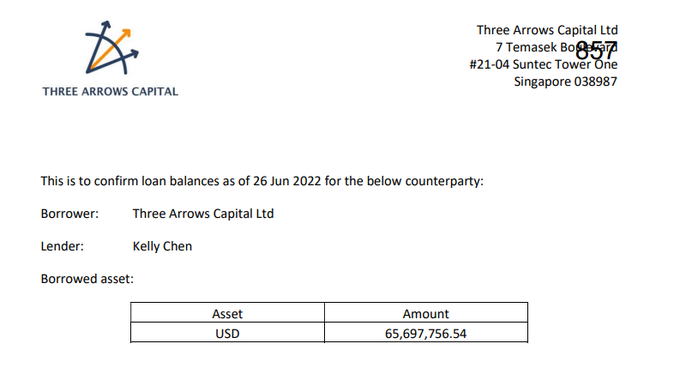

The documents show that Zhu Su, one of the founders of Three Arrows, and the wife of another founder, Kyle Davies (Chen Kaili Kelly), are also creditors. The former claims $5 million, the latter claims $66 million, and Chen Kaili Kelly also attaches Her investment in Sanjian and loan documents. As follows:

However, it was this document that many people criticized. Documents show that on June 26, Three Arrows sent a confirmation letter to Chen Kaili Kelly, indicating that Three Arrows owed him $65.69 million in debt. At this time, Sanjian had already experienced a liquidity crisis and became insolvent, and ignored the default notice issued by Voyager Digital on June 24. Under such circumstances, the effectiveness of this so-called confirmation document does not seem to be very high, and the final law is yet to be confirmed by the court.

In addition, it should be noted that the creditors announced by Teneo belong to the registration system, and as long as the submitter can provide relevant evidence, he can become a member of the creditor. The Sanjian insiders have unique conditions in this regard.

"These (Zhu Su and Kelly) claims may be considered 'quasi-equity' and subordinated to creditors, or prevent them from receiving this compensation. "Creditor Soldman Gachs explained.

(Note: "Quasi-equity" investment refers to an investment method that can be converted into equity investment in a certain period of time and under certain conditions in the future according to the agreement of both investors, filling the gap between debt and equity or grants.)6. Singapore freezes assets of Three ArrowsOn July 15, the High Court of Singapore granted "interim relief" to the joint liquidator Teneo, which means that only he can execute personal actions related to Sanjian's property, rights, obligations and responsibilities, so as to achieve the best interests of creditors. However, the liquidators did not apply for an injunction to freeze the personal assets of the founders of 3AC.

Researcher FatMan

So far, with very few exceptions, 3AC's directors have not proactively responded to the joint liquidators' requests for information and documents, and the liquidators have had to hire investigators and security teams around the world to help with the liquidation.assets

text

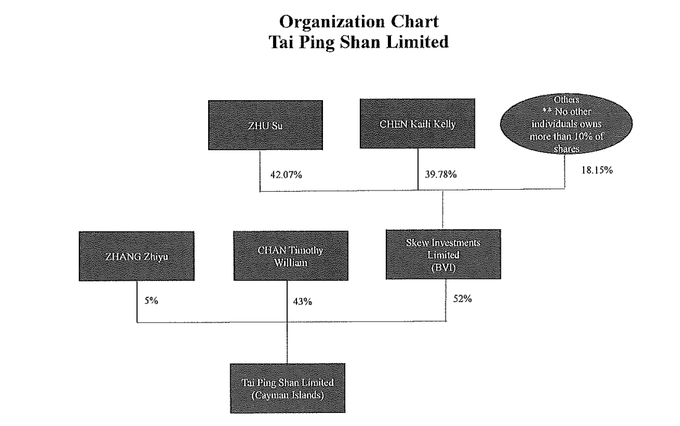

7. The mysterious TPS may be hidden

assets

According to the documents, on June 14 this year, Three Arrows transferred about $30.7 million in USDC and 900,000 USDT to Tai Ping Shan Limited, a Cayman Islands company indirectly owned by Su Zhu and Kelly Kaili Chen. , and it is unclear where the funds have since gone. The shareholding structure is as follows:

According to a Coindesk article, TPS Capital, a Singapore-registered company, is owned by Tai Ping Shan Limited and Three Lucky Charms Ltd. TPS Capital once claimed to be "the official over-the-counter trading platform of Three Arrows Capital", and then disregarded its relationship with Three Arrows, saying that I am independent from Three Arrows Capital.

However, the latest documents show that TPS Capital obtained a loan of US$20 million from Arrakis Capital in late April and defaulted in mid-June, and Sanjian was the guarantor of the TPS Capital loan. The real relationship between the two is intricate, which also increases obstacles for creditors to recover money.

8. Transferred assets may be recovered

The liquidators suggested there may have been wrongdoing while Three Arrows was in the so-called Zone of Insolvency. During this time, the company is at risk of being unable to repay its debts as they fall due, and the transfers made by Kyle Davies and Zhu Su at that time may be repossessed. In addition, creditors revealed that Sanjian Capital no longer holds any Bitcoin or Ethereum.

9. After the first meeting of creditors, what are the next steps?