How does StarkNet's currency issuance change the L2 landscape?

TL;DR

OPR projects have an inherent MEVA dilemma. StarkNet’s PoS mechanism can limit MEV and create a higher income ceiling. It has token economic barriers and will win the battle with OPR in the long run.

In the short term, Optimism is compatible with EVM, backed by the Ethereum ecosystem, supports related development tools, has a low development threshold, and has low difficulty in project transplantation. Compared with StarkNet, it has development advantages; the market share gap between Optimism and StartNet is large, and StarkNet is difficult to catch up in the short term. In the long run, StarkNet's decentralized PoS mechanism will win the competition with Optimism's centralized MEVA mechanism.

OPR projects have an inherent MEVA dilemma. StarkNet’s PoS mechanism can limit MEV and create a higher income ceiling. It has token economic barriers and will win the battle with OPR in the long run.

StarkNet will challenge Ethereum's dominance by capturing gas settlement value and intercepting network traffic.

StarkNet will challenge Ethereum's dominance by capturing gas settlement value and intercepting network traffic.

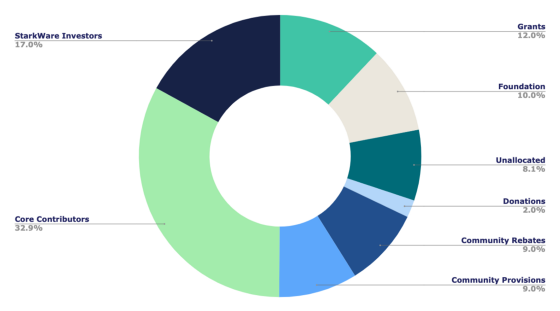

image description

Image Source:https://medium.com/starkware/part-1-starknet-sovereignty-a-decentralization-proposal-bca3e98a01ef

Image Source:

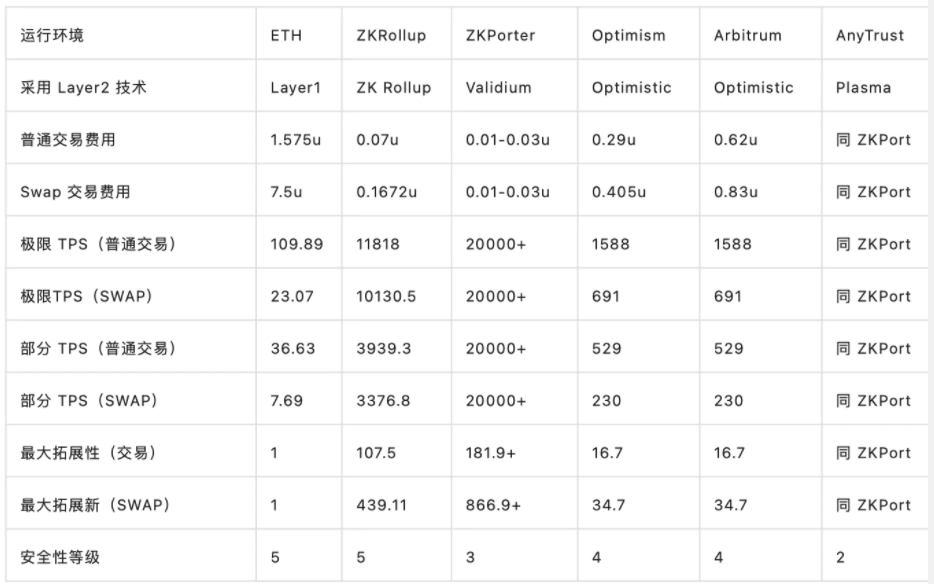

On the one hand, StarkNet can theoretically increase the TPS of Ethereum from 15 to 10,000+ on the premise of inheriting the security of Ethereum, and optimize the gas from the first digit to the last two digits. The impact of StarkNet on encrypted networks is just like that of the Internet Just as the network speed-up from 3G to 4G will lay the foundation for the subsequent explosion of the mobile Internet ecosystem, network expansion will greatly promote the development of the entire network ecosystem.

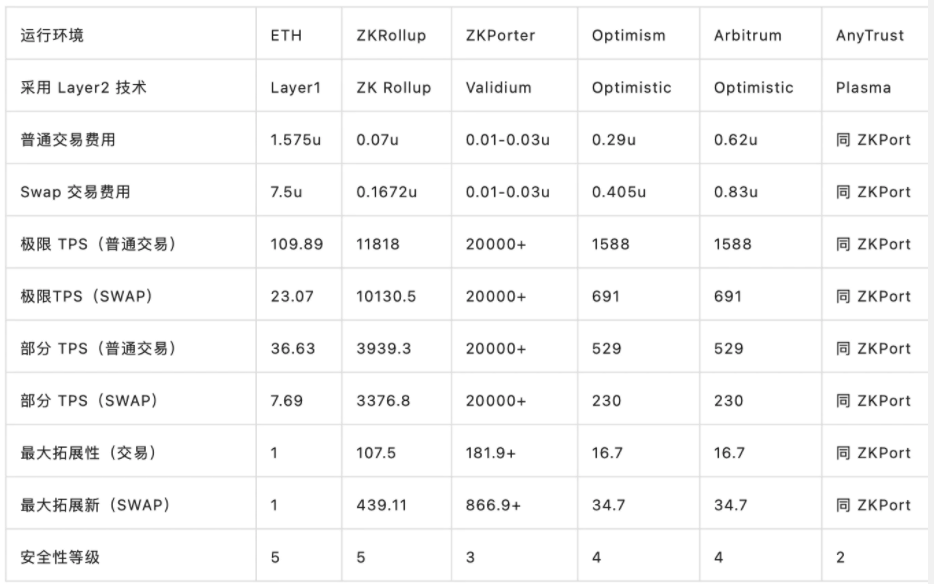

image description

Source: Xiang|W3.Hitchhiker, the premise of the above calculation is that the current ETH price is 2500 U, the block gas limit is 30,000,000, the gas fee is 30 Gwei, and the average block time is 13 seconds. The limit TPS refers to the corresponding operating environment occupying all Ethereum block space (500,000 gas is spent on proof verification), ordinary TPS means that the corresponding operating environment occupies 1/3 of all Ethereum block spaces.

On the other hand, StarkNet, as one of many L2 expansion projects, faces competition with other popular L2 projects such as Arbitrum, Optimism, and zkSync. It is not yet known whether the L2 structure will be monopolized or coexist.This article will focus on the impact of StarkNet's currency issuance on popular projects on the L2 track such as Arbitrum and Optimism, as well as the challenges to Ethereum.

Odaily will synthesize information from all parties and conduct in-depth analysis to answer the above questions.

secondary title

StarkNet is a permissionless decentralized L2 designed to allow Ethereum to scale through a cryptographic protocol called STARKs without compromising Ethereum's core principles of decentralization, transparency, inclusivity, and security. It can increase TPS and reduce gas without losing the composability and security of Ethereum.

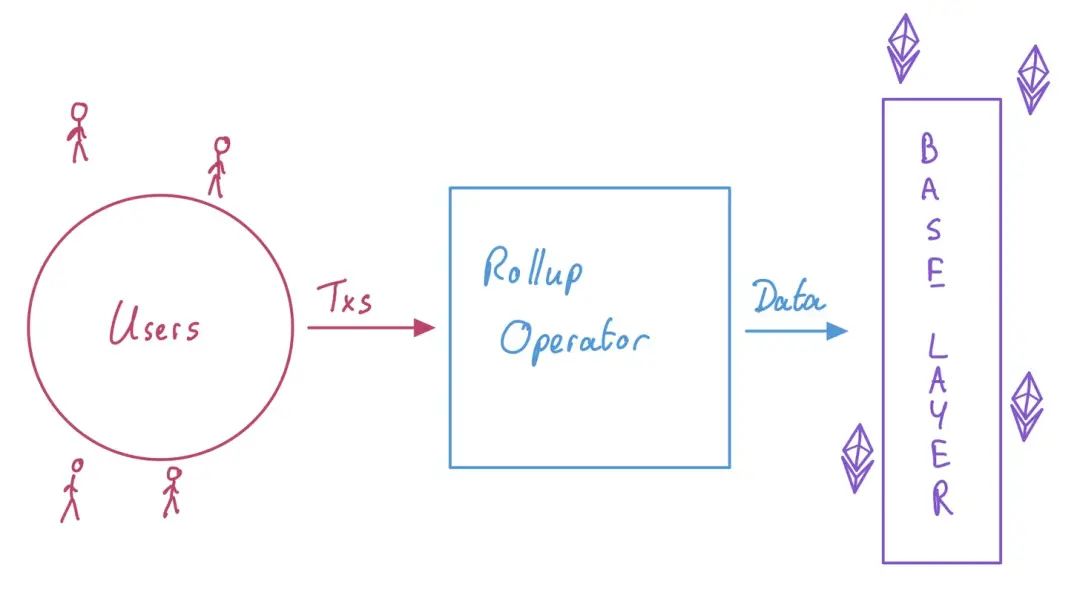

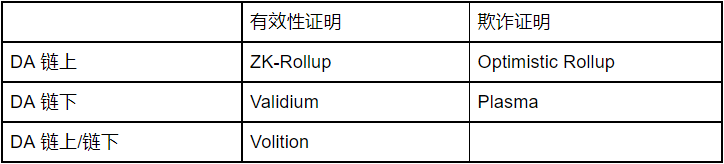

image description

image description

Image Source:https://mp.weixin.qq.com/s/GmHoX2iBBa-_TDC8_dH88g

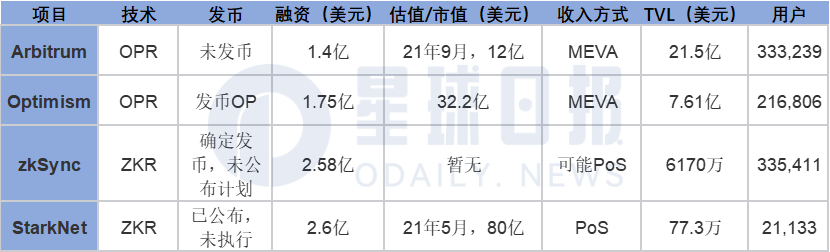

The most popular projects of Optimistic Rollup include Optimism and Arbitrum, and the most popular projects of Zero Knowledge Rollup include StarkNet and zkSync. Optimism, Arbitrum, StarkNet, and zkSync are also known as the four kings of L2.

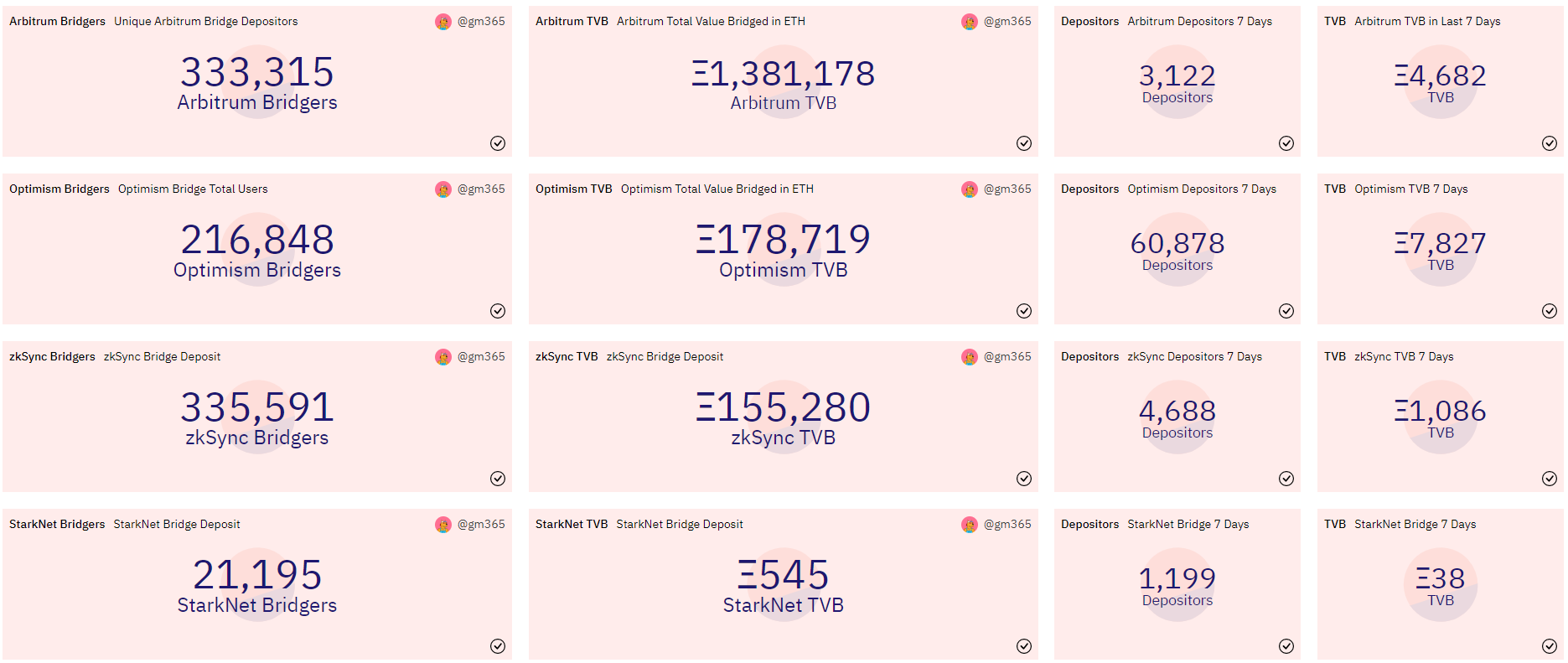

image descriptionhttps://l2beat.com/(Inconsistent with some data sources of Arbitrum below); User data source: https://dune.com/gm365/L2; Optimism valuation source: Messari, other information comes from Google

secondary title

2. Impact on Arbitrum

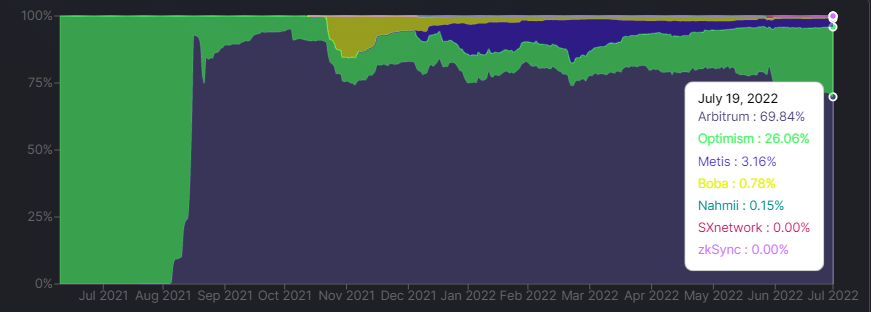

OPR’s Optimism announced the token plan on May 31, and implemented the token airdrop on June 1. ZKR’s StarkNet announced the token plan on July 13. As the two major competitors in the L2 track have launched token plans , Arbitrum may speed up its tokenization process.

image description

Data Sources:https://defillama.com/chains/Rollup

image description

Data Sources:https://defillama.com/chains/Rollup

Data Sources:

image description

source:https://dune.com/maxlion/l2-overview

source:

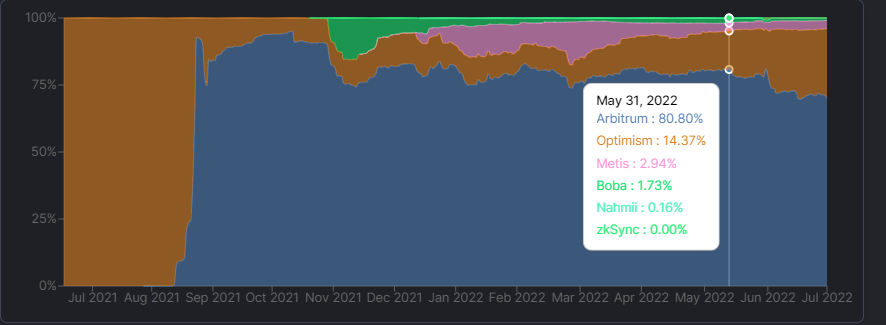

This chart shows the growth in users and funds over the 50-day period of the Optimism airdrop token event by comparing Arbitrum and Optimism’s users vs. TVB (Total Bridging Value) data.

The chart in the upper left corner shows the number of Arbitrum users in the last 50 days, and the number of Arbitrum users in the last 50 days reached 67,776; the icon in the lower left corner shows the number of Optimism users in the last 50 days, and the number of Optimism users in the last 50 days reached 75,497. Optimism outnumbered Arbitrum by 11.4% over the same period.

The icon in the upper right corner shows the TVB of Arbitrum in the last 50 days, and the assets bridged to Arbitrum in the past 50 days reached 55,929 ETH; the chart in the lower right corner shows the TVB of Optimism in the last 50 days, and the assets bridged to Optimism in the past 50 days reached 62,209 ETH. Optimism led Arbitrum by 11.2% over the same period.We can find that within 50 days after Optimism launched the OP token and airdropped it, the number of Optimism users and TVB both surpassed Arbitrum, and we can know that there is a positive correlation between the ecological development of Optimism and the token launch plan.

The initiative of Optimism to issue tokens and execute airdrops has promoted the development of the ecology and led the competition with rival Arbitrum for a while.

According to the successful competition experience of Optimism against Arbitrum, we can try to make the following reasoning:

Premise 1: The act of issuing tokens and performing airdrops can drive ecological development and win competition for a period of time.

Premise 2: StarkNet is a competitor of Arbitrum.

Premise 3: StarkNet is about to issue tokens and perform airdrops.

We may foresee that as StarkNet issues tokens and implements the airdrop plan, the number of StarkNet users, developers, TVL/TVB, and applications will usher in a period of growth, thereby grabbing the L2 market share and increasing the competitive pressure of Arbitrum to accelerate Its currency issuance process.

secondary title

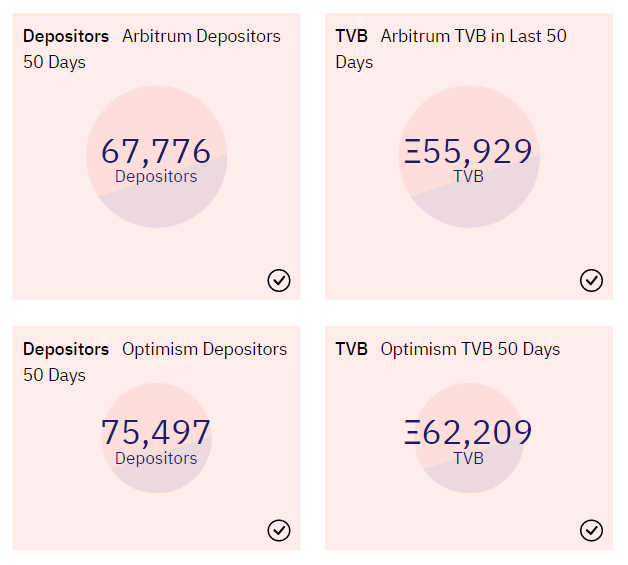

3. Impact on Optimism

StarkNet's coin issuance and airdrops have limited impact on Optimism's ecology. Optimism is backed by the EVM ecology and the existing DeFi market share, and it is difficult for StarkNet to shake the status of Optimism in the short term.

image description

Data Sources:https://dune.com/gm365/L2

Data Sources:

The following will analyze in depth the MEVA dilemma faced by OPR and StarkNet’s PoS innovation.

secondary title

4. OPR’s MEVA Dilemma

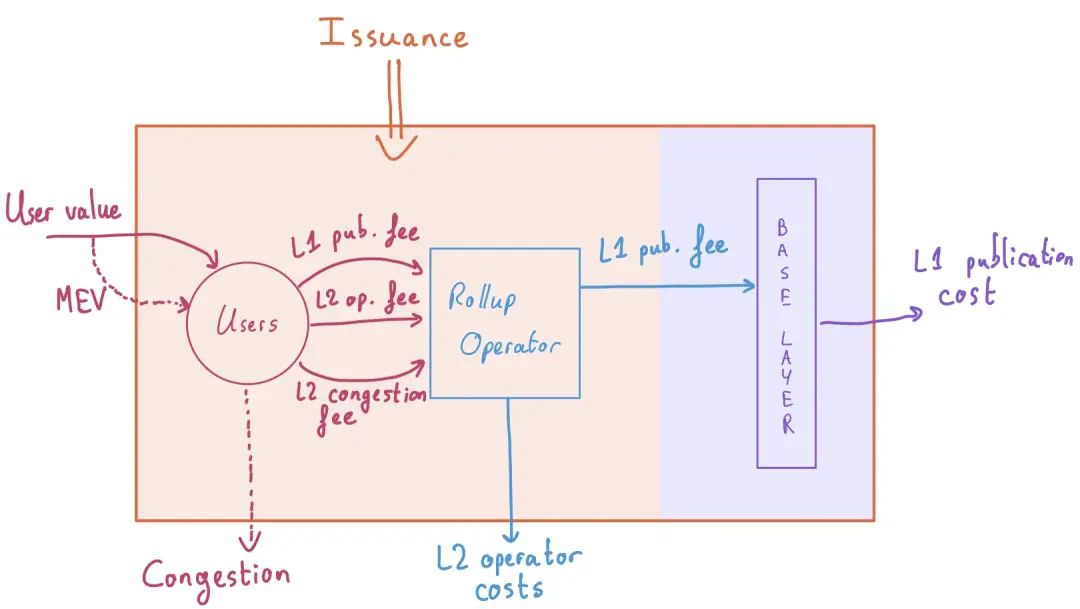

image description

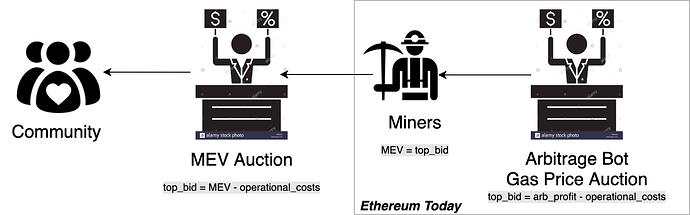

Similar to the situation of L1, on L2, the L2 sorter is similar to the miners/nodes on L1, and has the power to sort transactions. The sorter can choose to prioritize transactions with higher gas prices to obtain additional profits. The additional profits It is called MEV (Maximal/Miner Extractable Value, maximum extractable value). The act of auctioning the ranking right is called MEVA (Maximal/Minter Extractable Value Auction).

image description

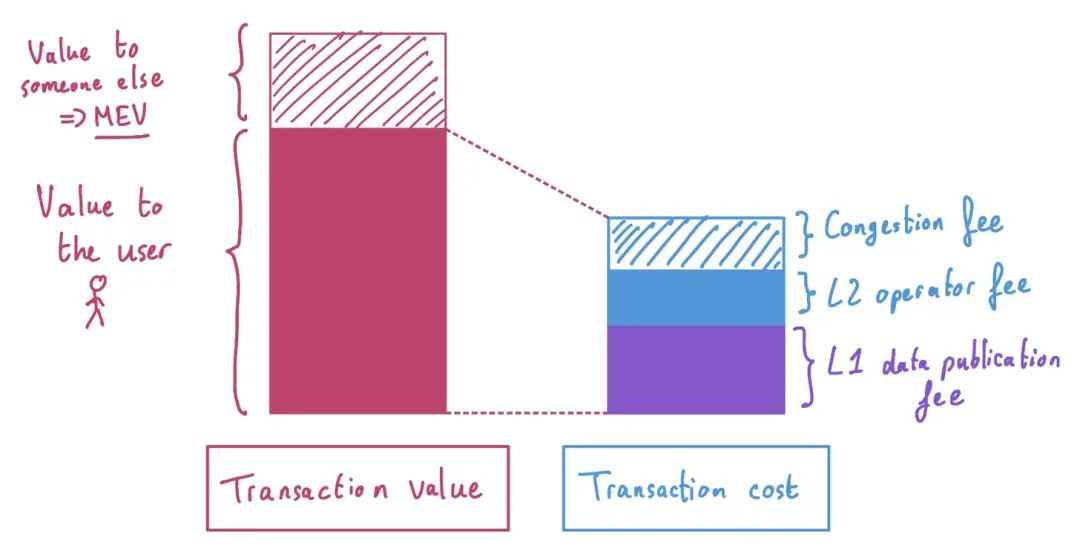

Image source: barnabe.substack.com

image description

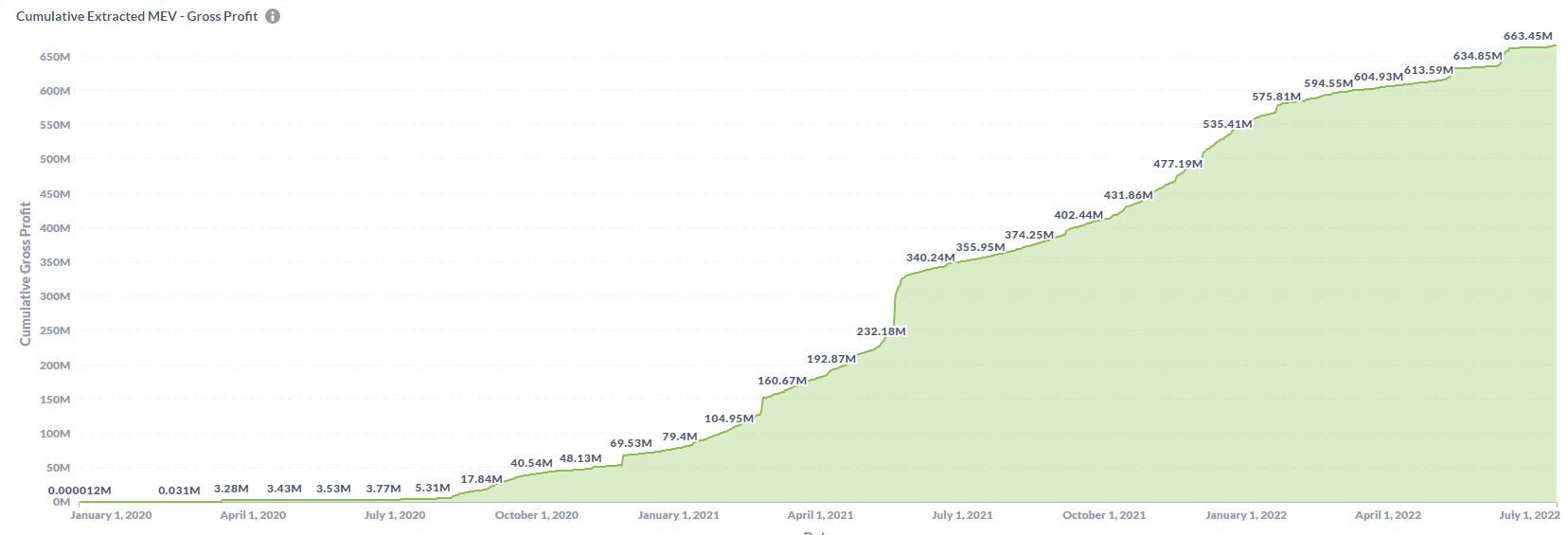

Image Source:https://explore.flashbots.net/

Image Source:

The dangers of MEVA

As mentioned above, the existence of MEV can theoretically push up the user's cost infinitely until it reaches the highest price that the user is willing to pay for the transaction, which will hurt the user's application experience. On the other hand, the additional arbitrage transaction initiated will also occupy the chain. TPS increases the network burden and causes network congestion. Both Arbitrum and Optimism use MEVA as a source of income through a centralized operation sequencer (analogous to L1 nodes), which will also exacerbate the risk of centralized operations.

MEVA's Dilemma

From the perspective of token supply, if the supply of OPR tokens is fixed and the gas on the chain is settled with OPR tokens, this will continue to consume OPR tokens and increase the price of gas. L2 will lose its meaning, and users and funds will get away. If the supply is circulated, it is necessary to design a token casting mechanism, introduce PoW or PoS, and promote the decentralized operation of the sorter, but this contradicts the reality of OPR's centralized sorter. Both Optimism and Arbitrum use MEV as their main source of income. After forming financial dependence, they need to continue to ensure the centralization of the sorter to obtain MEV benefits.In short, the MEV dilemma for OPR projects like Arbitrum and Optimism is:

The PoS mechanism established on L2 mentioned in the StarkNet token proposal will solve the MEVA problem existing in the OPR project.

secondary title

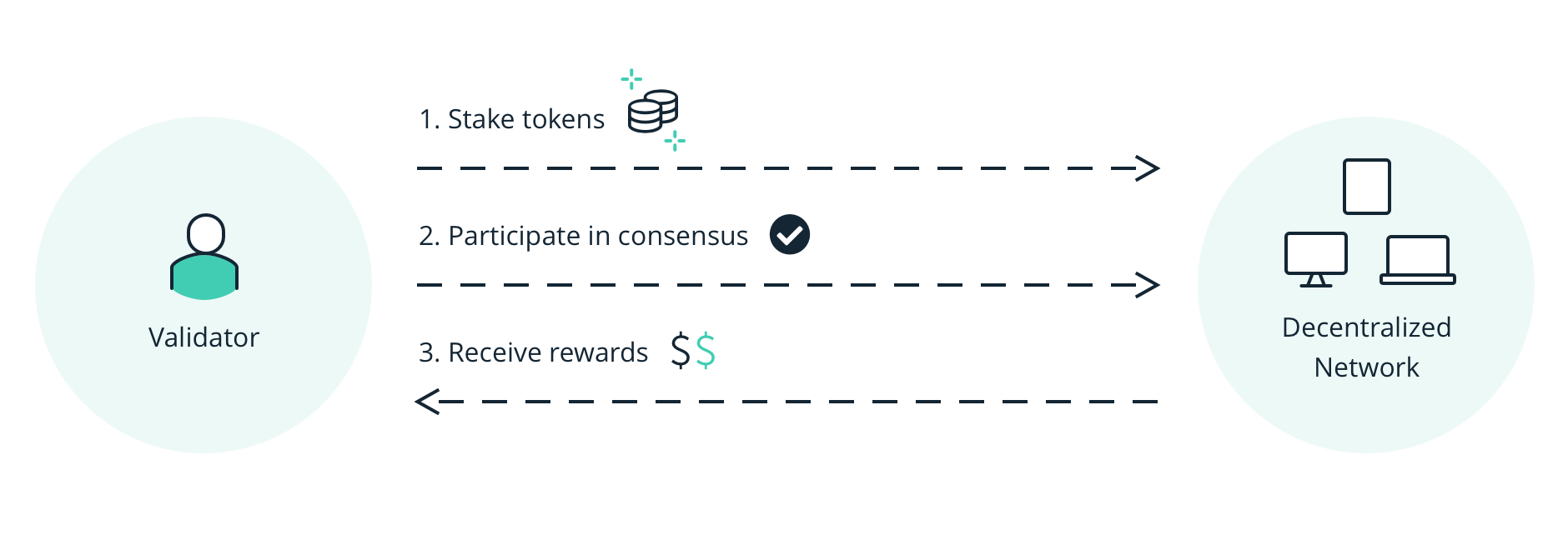

image description

Image Source:https://www.ledger.com/academy/blockchain/what-is-proof-of-stake

Image Source:

limit MEV

StarkNet's PoS mechanism can limit MEV through pledge and consensus rules.

In the past, there were two ways of thinking about the operation of the L2 sorter:

Centralized sorter, centralized sorter operators like Optimism and Arbitrum obtain all MEV through auctions, but they can "consciously" promise to invest revenue in ecological construction to give back to users and developers;

Decentralized sorters or nodes, MEV profits to speculators and miners, like L1 in Solana and Ethereum.

Both of these have experienced gas surges and network congestion due to this.

StarkNet's method is to promote the decentralized operation of sorting. Developers can apply to become sorter operators. Users who own StarkNet tokens can become pledgers by pledging tokens. The sorting function is rewarded, which can limit disordered MEVs to a certain extent, achieve relatively fair transaction sorting, and limit the terrifying gas surge and unnecessary network congestion.

more income

In the long run, StarkNet, which has established a PoS mechanism, will achieve a higher income ceiling than the OPR project.

The protocol income of Arbitrum and Optimism is obtained through MEVA. The maximum value is the sum of potential transaction profits on the network, and the profit is affected by DeFi applications on the network. The tokens issued by Optimistic Rollup only have governance rights and dividend rights for MEV income.

Moreover, StarkNet belongs to ZKR, and the theoretical upper limit of TPS and gas optimization is much higher than that of OPR. The performance optimization of OPR is limited. At present, it can only operate DeFi and other relatively low TPS and high unit revenue scenarios. However, StarkNet is more likely to generate application innovation and promote the explosion of more application categories. In addition, the gas on StarkNet is paid by StarkNet tokens, so it can be deduced that StarkNet’s income ceiling is higher than OPR.

Source: Xiang|W3.Hitchhiker, the premise of the above calculation is that the current ETH price is 2500 U, the block gas limit is 30,000,000, the gas fee is 30 Gwei, and the average block time is 13 seconds. The limit TPS refers to the corresponding operating environment occupying all Ethereum block space (500,000 gas is spent on proof verification), ordinary TPS means that the corresponding operating environment occupies 1/3 of all Ethereum block spaces.

As the first L2 project to establish a PoS mechanism, StarkNet broke the long-standing MEVA dilemma in L2 Rollup. The consensus participation mechanism of PoS can limit MEV, reduce user payment costs, improve platform experience, alleviate network congestion, and obtain a higher upper income limit. Its token economy is far more benign and healthy than Optimistc Rollup projects. In the long run, it will make StarkNet in Gain a greater advantage in the competition of L2. StarkNet's token plan will be an important node in the history of L2 development.

secondary title

image description

Image Source:https://ethereum.org/en/

Image Source:

StarkNet tokens and ETH will compete for the settlement value of gas.

image description

Image source: barnabe.substack.com

Although StarkNet, as the L2 of Ethereum, needs to use ETH to pay the packaging and publishing fees for publishing the summary information on the Ethereum mainnet. But the gas on the StarkNet network is paid by StarkNet tokens, which diverts the gas revenue on Ethereum.

On the one hand, with the continuous optimization of TPS and gas on StarkNet, a wealth of ecological applications will emerge on StarkNet, resulting in a large amount of gas usage. On the other hand, the Ethereum mainnet project is continuously ported to StarkNet and other L2 networks with higher TPS and lower gas, which will reduce the use of Ethereum gas and ETH tokens. This ebbs and flows, StarkNet tokens get more gas settlement value than ETH.

image description

Image Source:https://ethereum.org/en/layer-2/

secondary title

epilogue

epilogue