A Sober Assessment of Coinbase’s Mid- to Long-Term Prospects

This article comes fromsubstackOdaily Translator |

Odaily Translator |

In April 2021, before Coinbase went public, CEO Brian Armstrong demonstrated the following PPT to investors:

In April 2021, before Coinbase went public, CEO Brian Armstrong demonstrated the following PPT to investors:

When thinking about Coinbase's medium to long-term prospects, we must ask two questions:

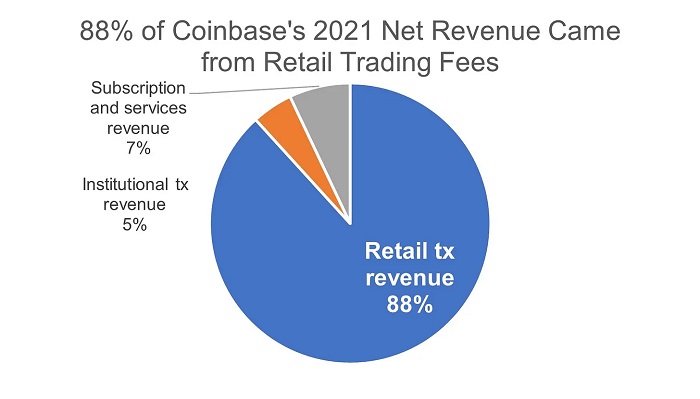

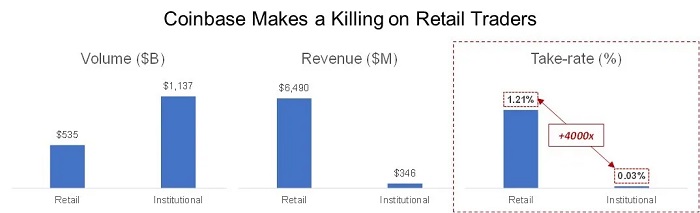

Breaking down the 2021 performance further, Coinbase facilitated $1.7 trillion in trading volume in 2021, 68% of which came from institutions and 32% from retail. While institutional trading volume was more than double that of retail trading volume, Coinbase saw an 18-fold increase in retail revenue. Why? It's simple: retail trading is more profitable than institutional trading. Coinbase's 2021 retail transaction's blended rate of return reaches 1.21%, while the institutional transaction's blended rate of return is only 0.03%, a difference of about 4,000 times (as shown in the figure below).

Breaking down the 2021 performance further, Coinbase facilitated $1.7 trillion in trading volume in 2021, 68% of which came from institutions and 32% from retail. While institutional trading volume was more than double that of retail trading volume, Coinbase saw an 18-fold increase in retail revenue. Why? It's simple: retail trading is more profitable than institutional trading. Coinbase's 2021 retail transaction's blended rate of return reaches 1.21%, while the institutional transaction's blended rate of return is only 0.03%, a difference of about 4,000 times (as shown in the figure below).

When thinking about Coinbase's medium to long-term prospects, we must ask two questions:

1. Is Coinbase’s retail trading revenue stream sustainable?

2. Can Coinbase’s other revenue streams grow to a larger scale?

Coinbase’s Retail Trade Revenue Is Unsustainable

Coinbase’s Retail Trade Revenue Is Unsustainable

More importantly, Coinbase also needs to face three other challenges:

More importantly, Coinbase also needs to face three other challenges:

1. Challenges from centralized exchanges:Coinbase has two biggest competitors, Binance and FTX, the former offers more than 600 cryptocurrencies, subsidiary Binance US offers "more than 100" cryptocurrencies; FTX offers more than 300 cryptocurrencies, and subsidiary FTX US offers "more than 20" cryptocurrencies Cryptocurrencies”. In contrast, Coinbase has certain disadvantages. According to the shareholder letter in the first quarter of 2022, Coinbase currently supports 212 asset custody and 166 asset transactions, perhaps its advantages are limited to the US market;

2. Challenges from traditional financial institutions:Once the regulatory status of cryptocurrencies is clarified in the next few years, traditional financial giants such as Goldman Sachs and JPMorgan Chase will undoubtedly enter this field, and the competitive pressure on Coinbase is bound to increase further;

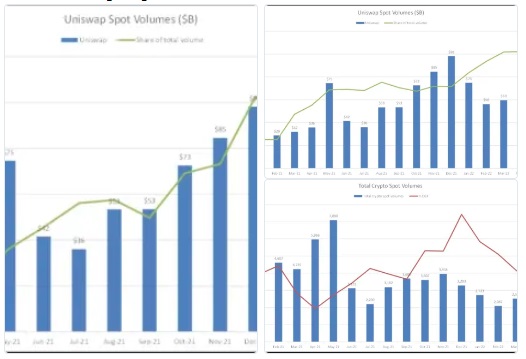

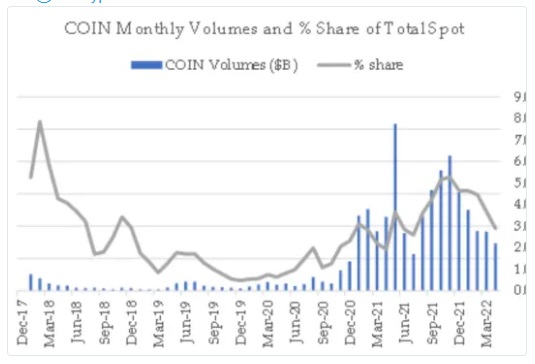

3. Challenges from decentralized exchanges:Decentralized exchange Uniswap has over 1,000 tokens available on its platform with a transaction fee of only 0.3%. DEXs have been grabbing crypto trading market share, and this trend is likely to continue (as shown in the chart below).

Not only that, but data on crypto spot trading volumes suggests that Coinbase’s market share has also been trending lower in 2022 (as shown in the chart below).

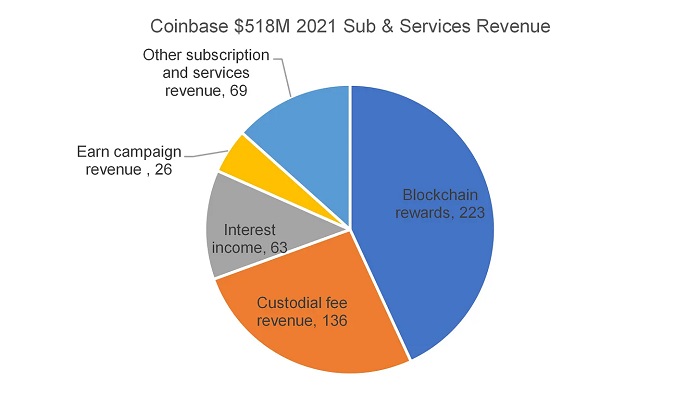

Coinbase's revenue streams are wildly uneven

Coinbase's revenue streams are wildly uneven

Coinbase’s revenue streams are so “biased” that it’s almost impossible to replace its core retail trading business with other revenues.

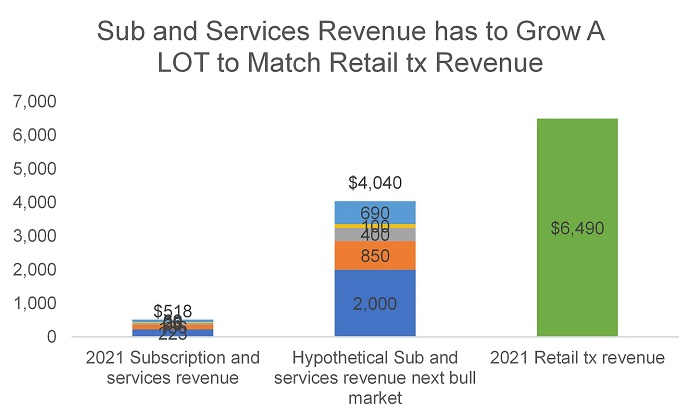

Next, let's estimate the future prospects of these income streams according to the most optimistic scenario-

Next, let's estimate the future prospects of these income streams according to the most optimistic scenario-

1. Blockchain reward income:This revenue stream is the staking rewards Coinbase receives from running validators (primarily Ethereum). Assuming that in the next cycle, Ethereum can reach the upper limit of 1 trillion US dollars and generate a 5% pledge rate of return with a 30% pledge rate, which is equivalent to an addressable market value of 15 billion US dollars pledged every year. If Coinbase can maintain the current 14 % of the network market share, it is equivalent to about $2 billion in block reward revenue.

2. Custody fee income:Coinbase charges its customers a fee for custody of crypto assets. In 2021, Coinbase managed $234 billion in cryptoassets and earned $136 million in custody fee revenue, implying a term custody fee rate of approximately 0.06%. Assuming that the total crypto market capitalization reaches $10 trillion in the next cycle, and Coinbase maintains its current market share of custody assets, its custody revenue will increase by 6.25 times to $850 million.

3. Interest income:Coinbase will get a share of the interest income earned by hosting customers’ fiat funds through the platform. Assuming this income item grows with the growth of custody fee income, it can obtain approximately $400 million in income.

4. Commission to earn activity income:For customers who participate in educational content on specific blockchain protocols, Coinbase will take a commission from the cryptocurrency they earn, which is expected to generate approximately $100 million in revenue in the next cycle.

5. Other subscription and service income:This income mainly comes from the encrypted infrastructure platform Coinbase Cloud. Assuming that this source of income can grow 10 times in the next cycle, Coinbase is expected to earn US$690 million in income.

Coinbase currently has three other thorny issues:

Other Coinbase Questions

Coinbase currently has three other thorny issues:

1. The staff is too bloated.Currently, Coinbase has more than 6,000 full-time employees, second only to Binance, which has more than 8,000 employees (but Coinbase's spot trading volume is only about 10% of Binance's), and much higher than FTX, which has about 600 employees.

2. No derivatives business. At this stage, FTX is working hard to push the U.S. Commodity Futures Trading Commission to clarify regulatory measures for encrypted derivatives business. As long as clear regulation is given, Coinbase should enter this field, but it is bound to lag behind Binance and FTX, which dominate the current market.

3. The NFT market with huge investment has completely failed.A sober analysis of Coinbase's business suggests that the company faces a highly uncertain and unfavorable fundamental path over the next three to five years, making it unlikely to succeed again anytime soon, and possibly never.

epilogue

Overall, it is almost certain that Coinbase's core retail trading business is very lucrative but not sustainable, and that in the long run, this revenue stream will likely taper off and eventually go to zero. On the other hand, Coinbase's subscription and services business is unlikely to displace retail transaction revenue anytime soon. To make matters worse, Coinbase's attempts to expand beyond retail trading haven't worked out well, most notably with its NFT marketplace.

A sober analysis of Coinbase's business suggests that the company faces a highly uncertain and unfavorable fundamental path over the next three to five years, making it unlikely to succeed again anytime soon, and possibly never.

Of course, I hope these analyzes are wrong, and I hope that Coinbase can regroup in the future, open up new revenue streams in the encryption market, and be successful. Frankly, as CEO of Coinbase, Brian Armstrong is a visionary, and has been actively advancing the crypto industry and firmly believes that the higher purpose of cryptocurrency is to create a better system. We should be rooting for people like Brian Armstrong to be successful, but at the same time, we shouldn't be blind to the problems Coinbase is facing.