Three Arrows Capital's defeat: the impact on the encryption market is coming to an end

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

Related Reading:

Editor | Hao FangzhouZhu SuProduced | Odaily

secondary title

Related Reading:

"Three Arrows Capital's Big Defeat: ETH's No. 1 Holder Is in a Liquidity Crisis"

On July 12, the founder of Three Arrows Capital, who had been silent for nearly a month

Tweeted again: "Unfortunately, our sincerity in cooperating with the liquidators has been misguided. Hope they (liquidators) honor their good faith in StarkWare Token Warrants."

In the tweet (user comments have been restricted), Zhu Su also attached two screenshots of emails, showing that he wanted to liquidate according to the process, but the creditor and liquidator Russell pretended to provide help and negotiated a liquidation plan, but actually obtained internal information. And submit the materials in the coordination process to the court, which hinders the liquidation process.https://3acliquidation.com/The lawyer for Three Arrows Capital also stated that the creditors failed to honor their commitment to acquire StarkWare's equity, resulting in losses to the company and a series of adverse effects.

Zhu Su's "appearance" can be said to be a response to the recent rumors of complete loss of contact.

But apart from this self-explanatory tweet from the liquidator, there was no new response from Three Arrows, and neither founder attended a July 12 court hearing in New York.

In the end, the U.S. court froze Sanjian’s remaining assets in the U.S. and designated Teneo as the bankruptcy liquidator to enjoy the right to dispose of related assets. The latest news is that the first meeting of creditors of the Three Arrows, hosted by Teneo, will be held on July 18. The specific agenda is unclear, but the follow-up progress will be posted on the designated official website (

) announcement.

Luna's plunge accelerated the bear market, and then several CeFi institutions fell down one after another like dominoes, which is embarrassing. However, for more than a month, Celsius has continued to repay more than 800 million US dollars in various DeFi agreements, and has successively redeemed collateral. BlockFi has also received multiple rounds of loans and confirmed that it will be acquired by FTX. Some other small and medium-sized institutions have also made progress... Only the "initiator" made three arrows, and related gossips emerged one after another, making up a suspenseful drama.As a top fund that managed tens of billions of dollars in assets in the past, what is the scale of Sanjian's liabilities, who are the creditors, and how many assets are still on the account? Can creditors sue Sanjian, can they get back part of their debts? What are the difficulties in the game between the two sides? Is the impact of the Three Arrows debt crisis on the crypto financial market drawing to a close? Based on information from all parties, Odaily will try to answer the above questions.。

secondary title

(1) Sanjian and his creditors

“We are communicating with relevant parties and are committed to solving the problem.” On June 15, Zhu Su, the founder of Three Arrows Capital, disappeared after leaving this tweet. At that time, Sanjian was rumored to be in a liquidity crisis and became insolvent, causing panic in the market. Zhu Su’s tweet undoubtedly verified some speculations.

The root cause of the defeat is that Sanjian misjudged the situation and continued to buy more encrypted assets such as Bitcoin through revolving mortgage loans and increased leverage. As the market went down, huge margins and collaterals were liquidated one after another, and the previous investment in LUNA also lost money Hundreds of millions of dollars directly led to the drying up of liquidity, which in turn triggered a spiral decline in the market, with Bitcoin falling below $18,000 at the lowest. Odaily once wrote an article analyzing the defeat of the Three Arrows, recommended reading

"Three Arrows Capital's Big Defeat: ETH's No. 1 Holder Is in a Liquidity Crisis"

Regarding the specific scale of Sanjian’s debt, the market does not have a clear understanding. In particular, some creditors are afraid of causing users to panic and run, and they dare not take the initiative to disclose what they know, and even want to clarify their relationship with Sanjian.

In the past month, as the market sentiment stabilized and a series of incidents were gradually resolved, the creditors of the Three Arrows also surfaced one after another: Voyager Digital, BlockFi, Deribit, Blockchain.com, Genesis, DeFiance Capital, TrueFi and several three arrows. The DeFi protocol of Arrow Investment.

The one with the highest debt is the crypto brokerage Voyager Digital. The company lent 15,250 bitcoins and 350 million USDC unsecured loans to Three Arrows. If BTC is calculated at 20,000 US dollars, the total value is about 655 million US dollars. On the day the news came out, Voyager Digital’s stock price plummeted more than 60%, and its cumulative decline has reached 86% so far.

Voyager Digital lowered the daily withdrawal limit from $25,000 to $10,000 and limited the number of daily withdrawals as cash flows dried up; on the other hand, it sought short-term debt support from Alameda and received $200 million and $15,000 BTC revolving credit line, but still failed to save the collapsing building. On July 6, Voyager Digital announced the suspension of all customer transactions, deposits and withdrawals, and loyalty rewards, and officially launched the bankruptcy reorganization process and filed for bankruptcy protection. It plans to repay users through Sanjian repayment, distribution of new stocks and remaining platform tokens assets.

But how much cryptocurrency customers will eventually get back is still unknown.

Voyager Digital's experience from the most promising encryption economy business in North America in the past to bankruptcy and liquidation is not very embarrassing. Another encrypted lending platform, BlockFi, is also facing the situation of being acquired at a low price due to the debt of the Three Arrows.

According to the leaked recording of the Morgan Creek investor conference call, BlockFi had provided about $1 billion in loans to Three Arrows. The collateral was two-thirds of Bitcoin and one-third of GBTC, and the overcollateralization rate was 30%; As the price of BTC went down, BlockFi liquidated the collateral of Sanjian, and the specific loss is unknown. After Sanjian went bankrupt, BlockFi was also actively seeking external financing, but the latest valuation given by several parties is far lower than BlockFi's $5 billion valuation last year. In the end, BlockFi chose FTX US ($240 million acquisition option + $400 million revolving credit line), and plans to complete the acquisition in the fall of 2023.

The creditors of Sanjian, as well as several trading platforms and encrypted market makers. Among them, Blockchain.com, a cryptocurrency trading platform, faced a loss of US$270 million for providing loans to Three Arrows Capital. The company announced that its liquidity was sufficient and customers were not affected.3AnonCompany Genesis, a cryptocurrency market maker and lending company, also lost hundreds of millions of dollars, but its parent company Digital Currency Group (DCG) has strong financial resources and assumed some debts to ensure its continued operations.

Deribit, an encrypted derivatives platform, made it clear that Sanjian, as a shareholder of its parent company, does have liabilities on a small number of accounts in the company, but this will not affect its operations. Deribit is financially healthy and willing to bear losses.

The reason for the loss of trading institutions is that when the market fell below the liquidation line when the market went down, these institutions did not immediately liquidate the margin of Sanjian, but gave them time to cover their positions (a common practice in the industry), but in the end Sanjian skipped the ticket, resulting in a loss .FatManIn addition, Sanjian was also exposed to misappropriating client funds. 8 BlocksCapita trading director Danny said that when using a Sanjian trading account for transactions, Sanjian took about 1 million from the account.3AnonCompany It was revealed that Sanjian has launched a structured credit product with a yield of 10%-15% since its establishment in 2018. “Lenders include small trading platforms, individuals and companies. Clients’ money is treated as if they were using their own money.” Some Sanjian investment projects will also return the investment funds to Sanjian for financial management, including Kyber Network, encrypted savings application Finblox, etc., but the whereabouts of these funds are currently unknown.

Other creditors of Three Arrows include: TrueFi, an institutional lending platform, with 2 million US dollars, originally planned to repay in August; DeFiance Capital, a Web3 venture capital company, whose specific debt is unknown; TPS Capital, the over-the-counter (OTC) department of Three Arrows Capital, also issued a document Said to be one of the creditors of Three Arrows Capital.

According to Terra researchers

According to the statement, the total debt of Sanjian is about 2 billion U.S. dollars, the existing assets are about 400 million U.S. dollars, and the liabilities are 1.6 billion U.S. dollars; anonymous sources

According to a post on Twitter, Sanjian currently has outstanding debts totaling more than US$2 billion, but only 200 million in current assets (due to poor liquidity, it is difficult to assess the actual repayable figure).secondary title

(2) Multiple lawsuits VS bankruptcy protection

On June 24, Voyager Digital issued a default notice to Three Arrows Capital, but did not receive any feedback, which also cast a shadow on the minds of creditors. Although many creditors have tried to liquidate Sanjian's assets in the first place, they still failed to make up for the losses in time.As the debt gap of Sanjian became bigger and bigger, the creditors couldn't sit still, and began to sue in many places, trying to obtain priority compensation. DeFiance Capital stated that it is considering taking legal action against Sanjian Capital, or taking the form of arbitration, litigation or bankruptcy procedure amendments, requiring Sanjian Capital to repay as a debtor.(Note: Sanjian is headquartered in Singapore, but incorporated in the British Virgin Islands, and is sued under the principle of territorial jurisdiction.)

On July 1, the BVI court ordered the liquidation of all the assets of Three Arrows on Monday and appointed global consulting firm Teneo Restructuring to manage 3AC's bankruptcy matters-Teneo mainly focuses on protecting the assets of the liquidated company and determining who its creditors are. Teneo subsequently appointed two partners, Russell Crumpler and Christopher Farmer, as joint liquidators, and established a website through which creditors can file claims against Three Arrows, and related matters will also be synchronized on the website.

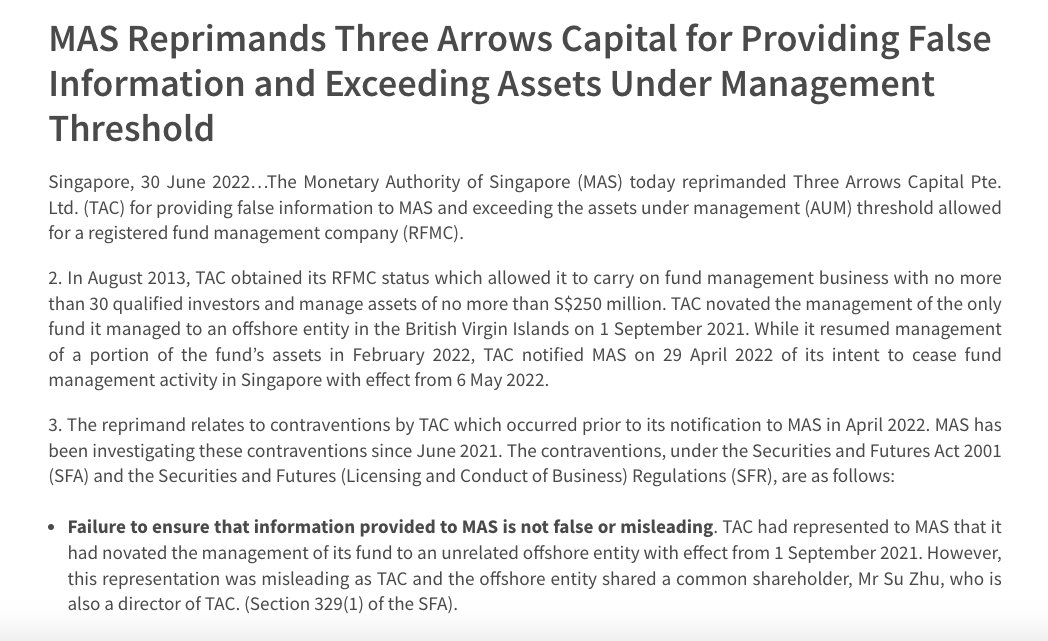

At the same time, the location of Sanjian headquartersChristopherMonetary Authority of Singapore (MAS)

It has also been issued a warning and its violations will be investigated. The official announcement stated that Sanjian Capital provided false information, and its assets under management (AUM) exceeded the limit of registered fund management companies. Specifically, Sanjian has transferred the management of its fund to an unrelated offshore entity since September 1, 2021, without notifying the HKMA of changes in directors and shareholding; in addition, Sanjian has long violated the AUM threshold , exceeding its allowed RFMC AUM of S$250 million. "MAS is assessing whether it is a further breach of MAS regulations."

image description

MAS announcement

Sanjian has also taken countermeasures. To avoid jail time, Zhu Su teamed up with Advocatus Law LLP, a law firm in Singapore specializing in white-collar crime cases, led by one of the firm's founders.As the chief lawyer, he is responsible for the debt prosecution of Three Arrows. Christopher, who took office but has a lot of experience, applied for bankruptcy in the New York court according to Chapter 15 of the US Bankruptcy Law (Chapter 15) in order to protect Sanjian's assets in the United States.:

It should be emphasized that there are usually the following types of bankruptcy liquidation in the United States: Chapter 7, direct liquidation bankruptcy, the company will immediately enter the liquidation process; Chapter 11, the company can negotiate with creditors on reorganization; and Chapter 15 filed by Sanjian It is usually a secondary bankruptcy procedure against a foreign individual or entity. Ruixing Coffee has used this trick before-the main process of bankruptcy is carried out in the home country of the foreign company (Singapore, the headquarters of Sanjian). Before the liquidation is completed, Sanjian Arrow's assets in the United States cannot be acquired by other creditors.

For this reason, the New York court held an emergency hearing for creditors. Neither of the two founders attended. In the end, the court granted provisional relief to the creditors to prevent Sanjian from transferring and disposing of assets in the United States, and appointed Teneo as the bankruptcy liquidator Have the right to dispose of relevant assets (Note: According to the "temporary relief", foreign representatives have the right to issue a subpoena to the founder of Sanjian, requiring him to produce documents and testimony).

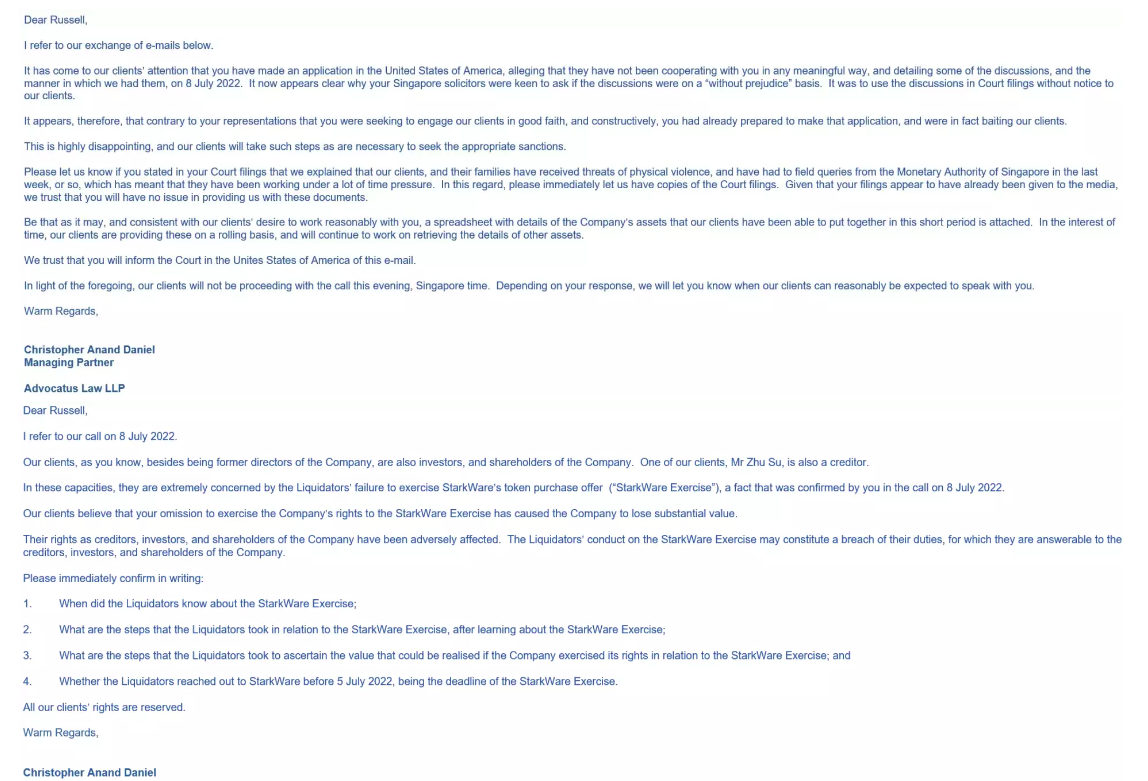

In response to the creditor's claim of "unaccounted for", Zhu Su fought back and posted two photos of his attorney and debt liquidator (Teneo)

According to the first email, Zhu Su "disappeared" because of "threats of physical violence" against her and her family, and "has been under a lot of pressure" when facing MAS inquiries, but the debt liquidator did not take This fact was reported to the court;https://3acliquidation.com/)。

The second email reveals that the liquidator did not enforce the agreed StarkWare token warrant treaty, which “caused [3AC] to lose considerable value.” Three Arrows participated in StarkWare's US$75 million Series B financing in March 2021. The warrant expired on July 5. Since the liquidator failed to honor the StarkWare Token acquisition offer, Starkware Token is now gone.

image description

Two emails posted by Zhu Su

What is right and what is wrong, the two sides hold their own opinions, and there is no conclusion at present. The latest news is that the first meeting of Three Arrows Capital creditors will be held on July 18. The meeting will be hosted by Teneo. The specific agenda of the meeting is not clear, but the latest news will be synchronized on the dedicated website (

secondary title

(3) Where are the difficulties in liquidation?

Although the creditors have won the support of the courts in various places, the bankruptcy liquidation of Sanjian is destined to fail to satisfy the creditors.

Different from the bankruptcy liquidation in the traditional financial world, encrypted finance has its special features, mainly in the recovery of assets on the chain.

Without the cooperation of the founder, the liquidator cannot fully understand all the encrypted assets of Three Arrows, and some transferable tokens remaining in its on-chain wallet cannot be seized, and even the founder or other parties may transfer them secretly. At present, the NFT of Starry Night, an NFT fund under Three Arrows, has been transferred to a new wallet for unknown reasons.

For creditors, the few assets that can be seized include:The second is exchange or custody account assets. According to the rights granted by the U.S. bankruptcy court, creditors can issue subpoenas to encrypted trading platforms in the U.S. to request cooperation in liquidation. However, considering that BitMex, Blockchain.com, FTX and other institutions have liquidated most of the collateral of Sanjian, the scale of the remaining assets may not be very large, and the impact on the market will be relatively small.

The third is to invest in equity/Token. Three Arrows has invested in dozens of start-up companies before, and there are still some Tokens that have not been unlocked in the contract, and there are also some project equity that have not been issued. These can be used as liquidation assets, but the liquidity is not high. In addition, some investment institutions (such as TPS Capital) issued a document to clarify the relationship with Sanjian, which also increased the difficulty of creditors' recovery.

In addition to encrypted assets, the physical assets of Sanjian and Zhu Su cannot be ignored.Registration records in SingaporeIt shows that Three Arrows Capital controls 5 high-end properties, including three GCBs (Singapore High-quality Bungalows), a shophouse and a townhouse. Other assets include a group of high-end cars and a yacht (Note: GCB is the most Top private residential real estate category, only about 2,800 in the whole of Singapore).

image description

Among them, the real estate worth 48.8 million U.S. dollars under the name of Zhu Su's daughter is held by a trust fund. There is a new house under construction (worth 28.5 million U.S. dollars) under the name of his wife. The yacht was purchased last year and is worth 50 million U.S. dollars. down payment.

Researcher FatMan

According to the tweet, a source confirmed that Zhu Su is urgently trying to sell the mansion under his daughter’s name. He requested that the funds be transferred to a bank account in Dubai and did not intend to use the proceeds of the sale to repay creditors.

Other physical assets under Zhu Su’s name are currently unknown, and creditors need to initiate investigations in courts around the world

. At present, Teneo has transferred to East Asia and applied to the Singapore High Court for interim relief, allowing Teneo to manage the assets of Sanjian in Singapore, and summoned the co-founders Zhu Su and Kyle Davies. If the court approves, the assets of Sanjian and Zhu Su in Singapore will be frozen and cannot be transferred.