10 things you need to know about the Ethereum merger

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

The arrival of the Ethereum merger, one of the most powerful catalysts in crypto history, is fast approaching.

text

1. After the merger, ETH L1 fees will not drop

text

2. During the 6-12 month window period after the merger, there will be no structural selling pressure from ETH issuance

text

3. The combined ETH inflation rate dropped from 4.3% to 0.22%

text

4. ETH under PoS will have better security than ETH under PoW (the cost of the attack chain is higher)

text

https://vitalik.ca/general/2020/11/06/pos2020.html

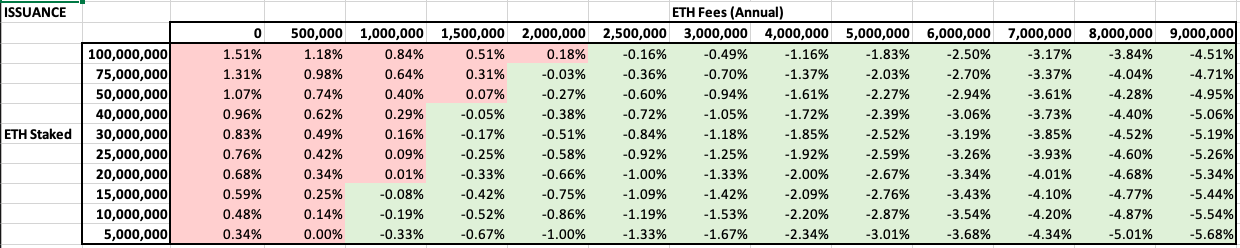

5. ETH has a deflationary monetary policy in most scenarios due to the fee burn of EIP-1559

See the ETH issuance scenario below:

text

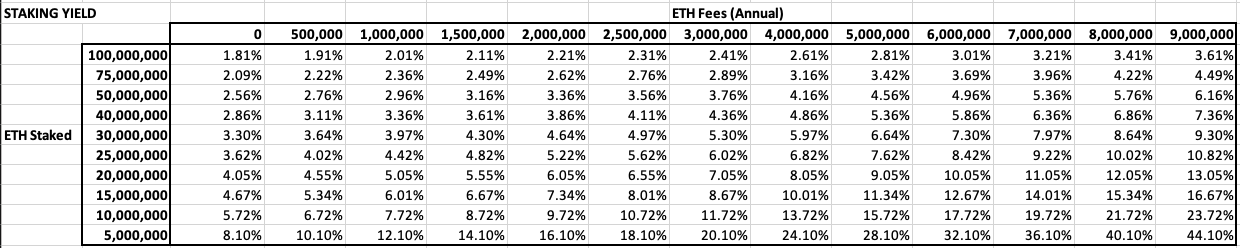

6. After the merger, the ETH pledge yield will increase by 50% (conservative estimate)

The current ETH staking yield is 4.2%. Post-merger, including transaction fees (fee tips) and MEV access to validators, staking yield jumps to over 6%

text

7. Post-merger, ETH will complement BTC’s use case as raw collateral and store of value

BTC cemented its narrative as "digital gold" - which is great.

text

8. After the merger, the Ethereum blockchain will be more sustainable than the Bitcoin blockchain

In addition to PoS being more energy efficient than PoW (using 99% less electricity), Ethereum is also less expensive.

text

https://twitter.com/ryanberckmans/status/1386505715938775044

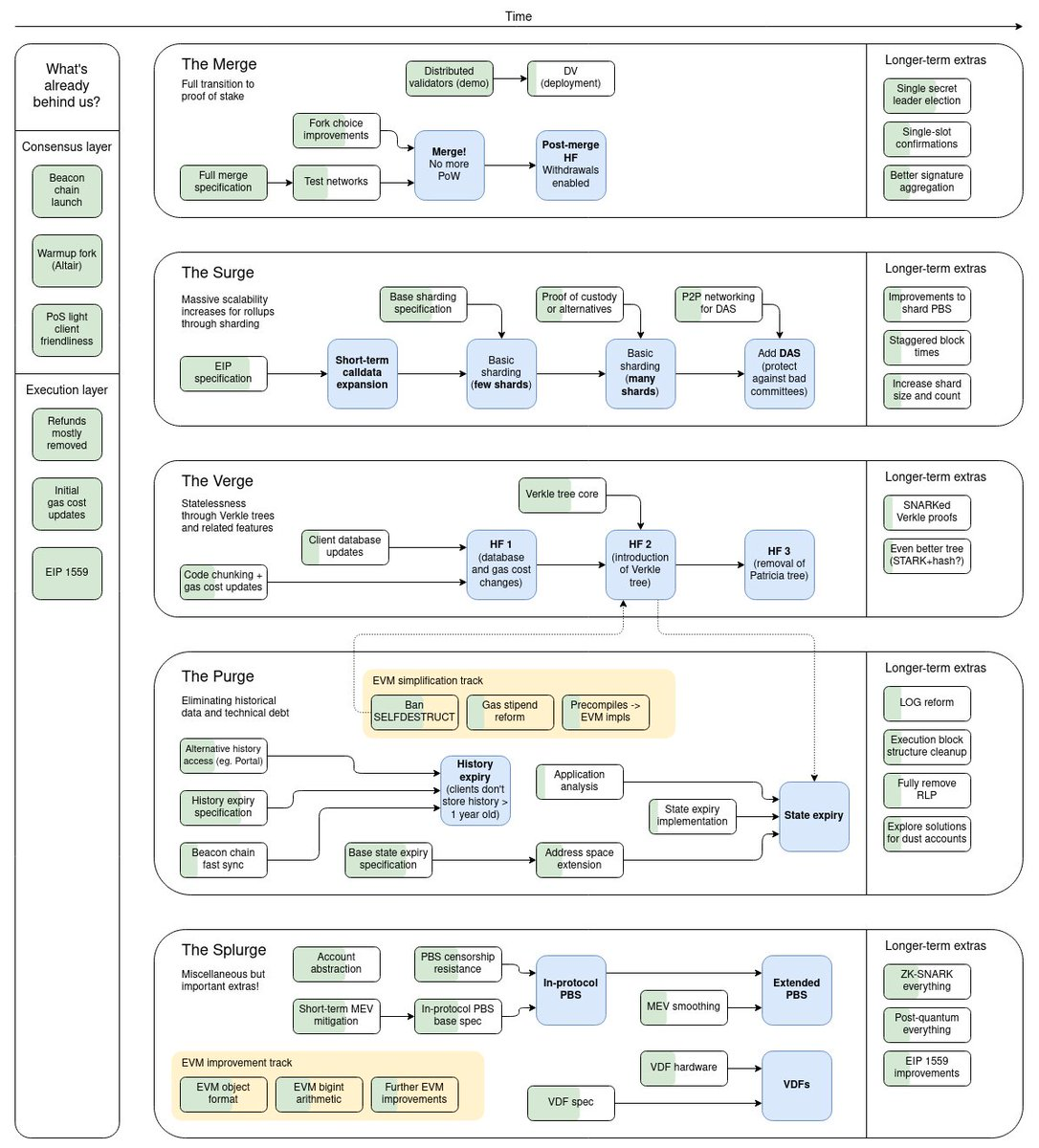

9. ETH expansion is coming!

Merge swaps ETH's consensus engine for PoS to improve security. A secure L1 is conducive to the development of L2 Rollup.

text

10. After the merger, Ethereum’s upgrade journey will not end

Although the technical specifications of L1 Ethereum will be greatly rigid after the merger, the technology needs to continue to develop.

Data sharding, light clients, staking withdrawals, state management, and more - coming soon. In the words of God V:

https://twitter.com/VitalikButerin/status/1466411377107558402

I repeat: The Ethereum merger is one of the most impressive engineering feats in blockchain history.

Original link