Eight-year sell-off is coming to an end, how much money did Ripple's ex-CTO cash out?

In recent years, Ripple (XRP), whose presence has become less and less, is about to usher in a "big event".

Jed BalanceThe latest data shows that there are only 17,945,934 XRP left in Ripple’s first chief technology officer, Jed McCaleb’s wallet, which is equivalent to about $5.56 million based on the secondary market price of $0.31, and calculated based on the average daily selling speed in recent months , Jed will probably clear its positions in the next few days, which also means that its eight-year XRP sell-off is about to come to an end.

A member of Ripple's core founding team when it launched in 2012, Jed shared a share of approximately 20 billion XRP in the initial distribution of XRP with Chris Larsen and Arthur Britto. In 2014, due to a conflict of ideas, Jed chose to leave (and subsequently founded Stellar) and took with him his share of XRP, totaling approximately 9 billion XRP.

In order to limit the impact of Jed's selling on the XRP secondary market, the Ripple team had signed a selling restriction agreement with Jed at that time. Agreement constraints, Jed cannot sell more than $10,000 of XRP per week in the first year, and in the next three years, it will be relaxed to no more than $20,000 of XRP per week. After that, the content of the agreement has been adjusted to a certain extent, from The specific amount of constraints has become a constraint on the number of tokens, that is, it is required that Jed can only sell a maximum of 1 billion XRP during 2018-2019, and after 2020, it will be relaxed to a maximum of 2 billion XRP.

It is precisely because of the existence of the restriction agreement that Jed's sell-off will last for eight years, so how much money did Jed cash out with these 9 billion XRP?

Regrettably, perhaps due to the gradual decline in the market position of XRP, most of the statistics on the cash-out value of Jed in the currently available data sources at home and abroad have stopped before 2020, and Jed Balance has continued to exist. However, the data source only counts the number of XRP, and does not combine the real-time price to calculate the corresponding value. So if we want to get the answer of the total value of cash out, we still need to make an estimate by ourselves.

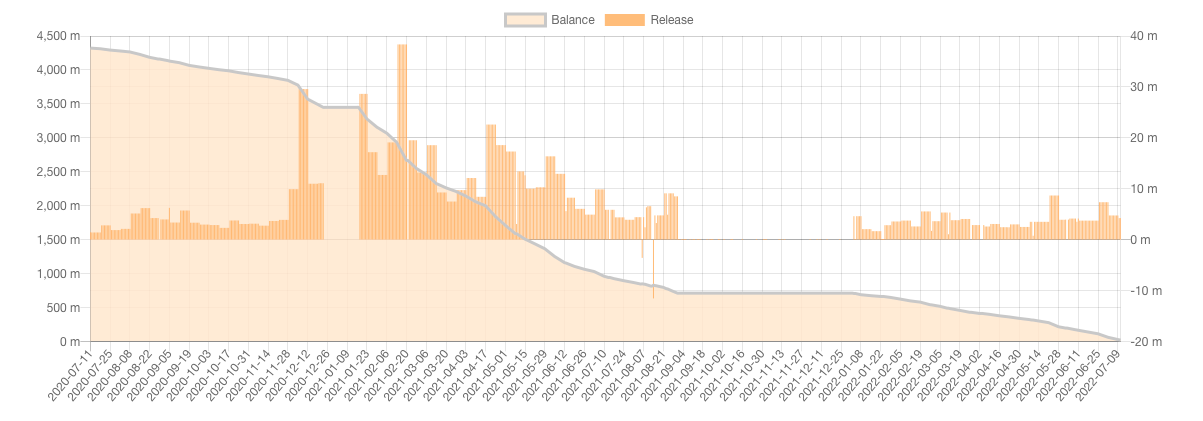

Combined with the above figure, we can divide the Jed sell-off into three stages: before 2021, from January 2021 to September 2021, and from January 2022 to the present.

The first is the first stage. Fortunately, Whale Alert once did a Jed historical sell-off at the end of 2020.statistics(You can read the original text for the specific algorithm, so I won’t go into details here),The result is that Jed has cashed out $546 million through the sell-off at this stage。

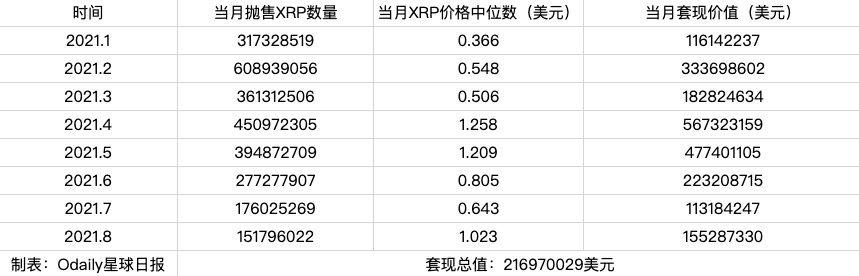

Followed by the second stage, this is also the period when Jed sold the most. We calculated the specific sales volume of Jed on a monthly basis, and combined with the median price of XRP in the current month to estimate its overall cash-out value.The result obtained is that the total cash out of Jed at this stage is about 2.1697 billion US dollars, the specific calculation process is as follows:

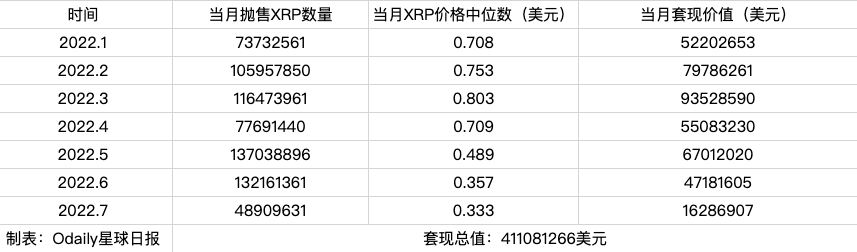

The last stage is the third stage, which continues the calculation method of the previous stage,The result is that Jed has cashed out a total of about 411 million US dollars at this stage, the specific calculation process is as follows:

546 million, 2.1697 billion, 411 million, leaving aside the last remaining 17945934 XRP in the wallet,In the past eight years of sell-offs, Jed has a combined cash value of approximately $3,126.7 million.It should be noted that this data is derived from the estimation model we set (number sold in the current month * median price in the current month), and there may be some discrepancies with the actual data, but the deviation should not be too large.

Some friends may ask at this time, with the end of Jed's "smashing the market", is it possible to "charge" XRP? Regarding this operation, I personally strongly do not recommend it, for three specific reasons:

First of all, purely from the perspective of the secondary market, Jed’s continuous selling has been one of the important selling pressures of XRP for a long time, so the end of the selling can indeed weaken the selling pressure of XRP to a certain extent, but compared to XRP’s daily With an average trading volume of hundreds of millions of dollars, Jed's average daily selling volume in recent months has only been in the millions of dollars, so how much this "certain degree" is worth considering.

Secondly, the current cryptocurrency market as a whole has not yet stabilized, the cloud of interest rate hikes and balance sheet shrinkage is still there, and the trauma caused by the liquidity crisis has not yet fully recovered. No one can say for sure what the market will do next.

Last but not least, in the past few years of development and competition, the narrative of XRP and the concept of "cross-border payment" it represents is constantly weakening. With the advent of the Web3 era, we will continue to falsify some old concepts while proving some new concepts. Judging from the current development trend, Ripple is gradually sliding towards the latter.