Bankless: The end of the L2 token competition

Original source: Bankless

Original Author: Ben Giove

Original compilation: ETH Chinese

Original source: Bankless

Original Author: Ben Giove

Original compilation: ETH Chinese

Investing is an exercise in forecasting. Savvy investors do not base their decisions on the present, but on the future and the potential for long-term value creation.

In the cryptocurrency market, one area where traders are currently displaying short-term thinking is the L2 token. This is a huge opportunity for the prescient investor.

L2 Rollup technology on Ethereum continues to grow in user adoption, developer interest, and utility value. It represents the forefront of Web3.

These L2 tokens, and especially their valuation, have come into the spotlight recently with Optimism releasing the OP token.

OP has been met with skepticism from traders and investors throughout the cryptocurrency market.

Let’s analyze the three aspects that I know everyone is most worried about:

1. No practical value

Currently, OP is only used for Optimism's community governance (via Optimism's bicameral governance system). In this governance system, OP holders form the so-called "token house".

This House of Tokens can vote for upgrades within the Rollup ecosystem and distribution of incentives to different projects.

2. The token will not have any appreciation

Network revenue generated by Rollup Sequencers (more on this below) is not directly accrued to token holders, but is used to fund retroactive public goods.

The distribution of this value will be determined by Optimism's second branch of governance, the citizen's house, which grants identity to citizens by issuing non-transferable NFTs.

3. Low circulation and excess unlocked supply

These criticisms are valid, but they are only based on the current OP token - not its and L2 token's prospects in the future.

The disconnect between the two valuations represents an opportunity, and the OP token, and similar L2 tokens, are on the path to substantial growth in utility and high value accretion, as the future design of the L2 token will be very different from the current design.

Let's see why this happens...

In order to better understand how L2 tokens will increase in value, readers need to first understand the business model of the L2 platform.

income

You can think of Rollup technology providers as middlemen of block space: they buy L1 block space, use block space in a more efficient way, and sell it to users at a high price through L2.

secondary title

income

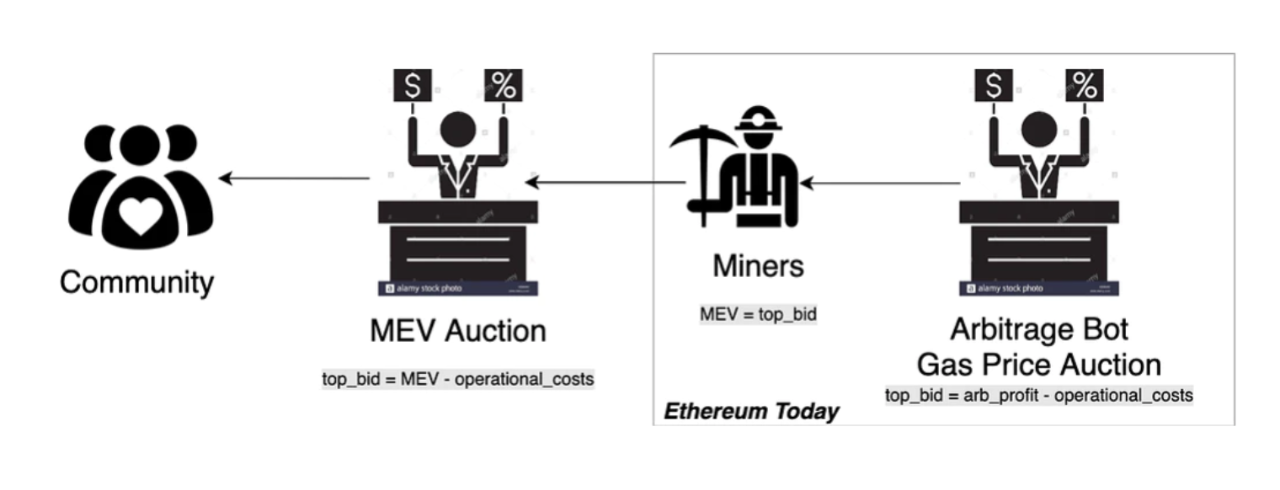

MEV is a rent-seeking method of value extraction that opportunistic block proposers (miners in PoW, validators in PoS) can do by specifically reordering transactions (David explains more about MEV here).

When sequencers perform their duties of determining the order of transactions, they can earn revenue by extracting MEV.

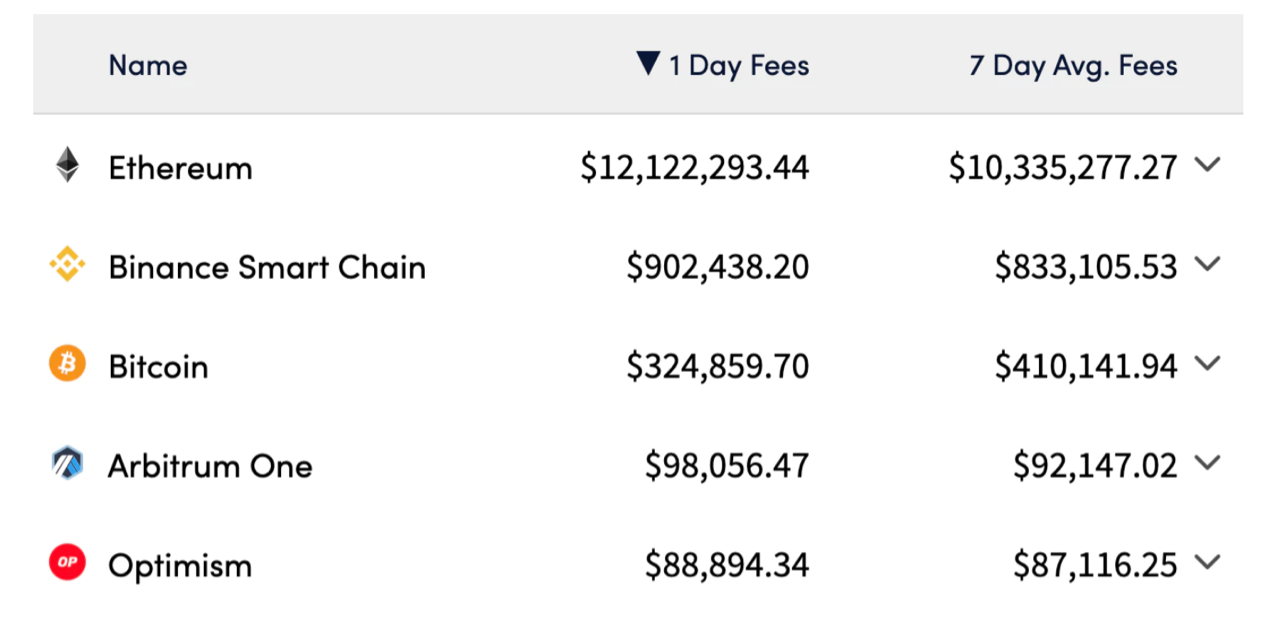

image description

L1 and L2 fee ranking, data from cryptofees.info

secondary title

overhead

In order to operate, rollup generates some overhead which will be passed on to users in the form of gas fees.

In the case of optimistic rollup, it requires fraud/error proofs, while zkRollup requires zero-knowledge proofs."Data Availability Issues"calldata overhead constitutes the so-called

Data Availability Issues

A core part of Ethereum, which refers to the expensive cost of publishing and storing data on networks such as Ethereum.

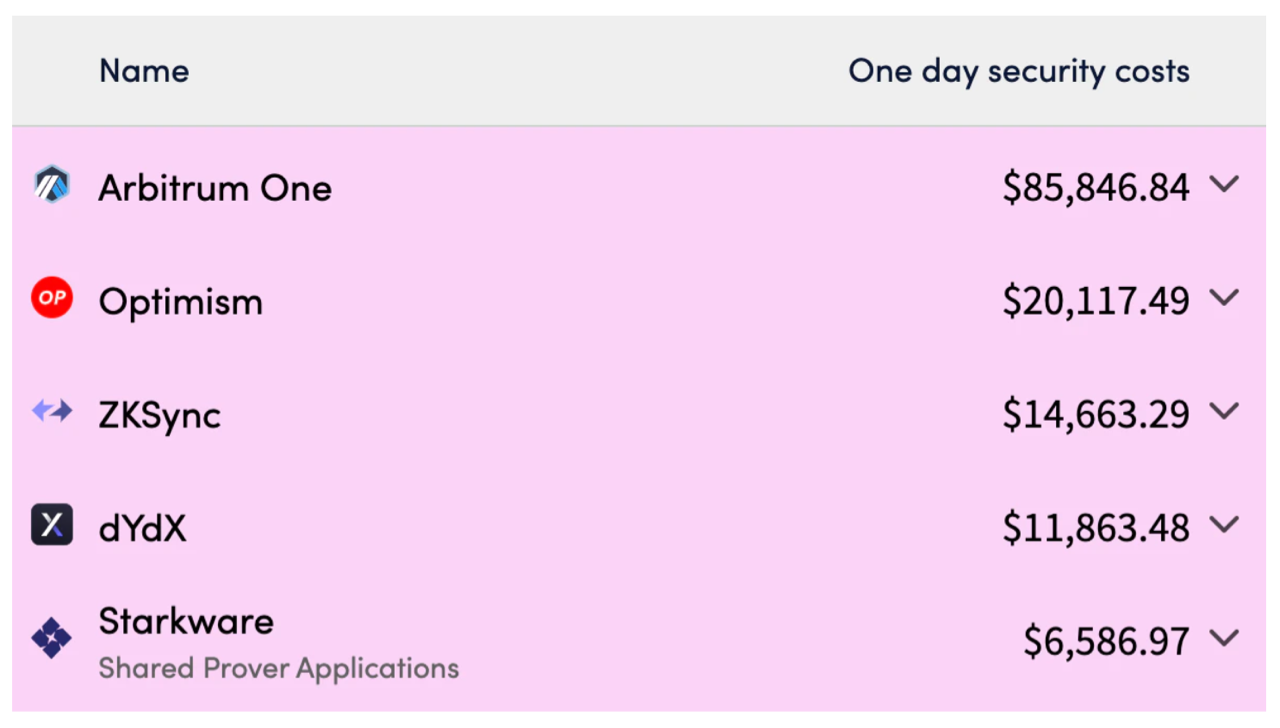

image description

There are a number of solutions in the pipeline to deal with the L2 overhead problem.

The first solution is Calldata compression, which reduces the size of data sent from L2 to L1. While rollup itself can take advantage of data compression techniques, the upcoming EIP-4488 proposed by Vitalik aims to help with this as well.

Other options include danksharding and proto-danksharding, which can increase the amount of data stored on Ethereum or Celestia (a dedicated data availability layer solution).

secondary title

profit

This is what Optimism accomplishes by implementing a "fee scaling factor", a dynamic additional fee charged to users for each transaction.

MEV

Optimism's goal is to generate a 10% profit for the sequencer. This profit represents a potential source of value for the L2 token and its holders.

(Translator's Note: "Fee Scalar" is a dynamic cost that Optimism rollup charges its users. Currently, the cost scaling factor on Optimism is set at 1.24 times.)

secondary title

Another revenue stream for Rollup is MEV. It has gradually become a key differentiator between L2 projects, and the way each L2 platform handles MEV has a significant impact on the future appreciation of its native token.

To better understand this concept, let's explore the differences in how Optimism and Arbitrum handle MEV.

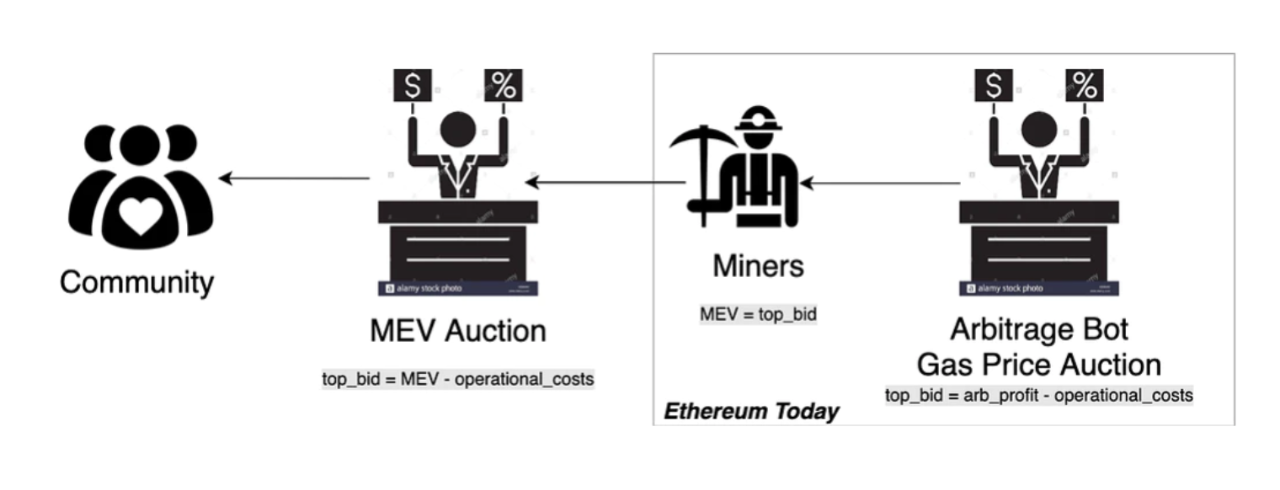

Optimism is taking what it calls an "offensive" approach to MEV. Rooted in the idea that MEV is the foundation of the blockchain and that trying to eradicate it would be futile, Optimism will eventually incorporate what is known as the MEV Auction (MEVA).

MEVA attempts to split and redirect the revenue generated by MEVs by auctioning off the rights to withdraw MEVs to the highest bidder.

Optimism intends to distribute the proceeds earned by MEVA to eligible public goods through retroactive public goods funding.

By doing so, the L2 Platform believes it will be able to create a self-sustaining ecosystem that will deliver more value to all stakeholders in the long run.

In order to reduce MEV, the Arbitrum network will implement fair ordering, or fair ordering, where all transactions in a batch are processed according to the order they were received.

In this process, Arbitrum intends to reduce the extracted MEV, thereby reducing the cost of Rollup and making it more attractive to users and builders.

The debate over how each L2 platform should handle MEV is subtle and complex, and well beyond the scope of this article. But if we're talking about investment strategy, then here's where to talk about its impact on the appreciation of the L2 token.

first level title

What does MEV mean for your L2 investment strategy?

Offensive MEV provides L2 with a revenue stream that directly adds value to its native token.

While Optimism’s MEV proceeds will initially be fully funded for public goods, some or all of these MEV proceeds can eventually be distributed to token holders through traditional unilateral staking pools, or through decentralized orderers. There are (discussed further later).

In terms of funding public goods, MEV may help its tokens add more value indirectly by improving the general health and long-term sustainability of the L2 platform ecosystem.

Users may be more inclined to transact on networks where MEV is less rampant, strengthening network adoption and its network effects.

While it remains to be seen which approach will lead to longer-term adoption, it is clear that MEV can be used to accrete the value of the L2 token.

L2 platforms that embrace MEV will add value to their native assets more easily than other platforms that do not.

first level title

Decentralized Sequencer

Although L2 tokens can be used to decentralize various protocol functions. However, the most obvious way that transaction fees and MEV value can be captured (while also enhancing its utility) is a decentralized orderer.

Currently, the sequencers on many excellent Rollups are centralized and run by a single entity. For example, Offchain Labs and Optimism PBC are the sole operators of Arbitrum and Optimism's sequencers, respectively.

Since each platform is nascent, these systems are placed there like guardrails.

In future developments, it is important that these sequencers are eventually decentralized for maximum censorship resistance.

Sequencers on L2 platforms like Arbitrum and Optimism are able to do this with their native tokens. There are currently several designs of decentralized sequencers that could take shape.

For example, the sequencer can be selected through the PoS methodology.

Here's how the methodology works: similar to PoS on L1, a potential sequencer stakes a Rollup project's native token for the right to hold that role.

In the case of Rollups with aggressive MEV strategies like Optimism, this mechanism can be implemented in conjunction with the MEV auction mechanism:

The staking mechanism can provide a source of utility value — and therefore demand — for L2 tokens. In order to join the system and earn the aforementioned cash flow, potential sequencers need to purchase tokens on the open market.

Although the details are yet to be finalized, zkSync has confirmed that its token will be used for this purpose.

first level title

clear path

The L2 Token has a definite development path in terms of its usage and token appreciation.

Rollups generate profits from transaction fees and MEV, which can be used as a way to directly add value to the native token, or indirectly by reinvesting in areas such as public goods.

It can capture this value by being used for decentralized orderers or other protocol functions (eg through PoS systems). This further creates utility value and demand for the L2 token."If these token economies look similar, it's because they both mirror the ETH token economy itself."After the merger, ETH will be used within the PoS system, which allows stakers to earn cash flow in the form of insurance, gas fees, and MEV.

While L2 tokens are unlikely to be net deflationary or have the same monetary premium as ETH, they will still trade at

Make transactions as they represent the broadest means of reaching out to their respective ecosystems.