Uniswap's "Value Question": How to empower UNI?

Original title: "A brief roadmap for UNI holders to take control of the Uniswap protocol"

Original compilation: Frank

Original compilation: Frank

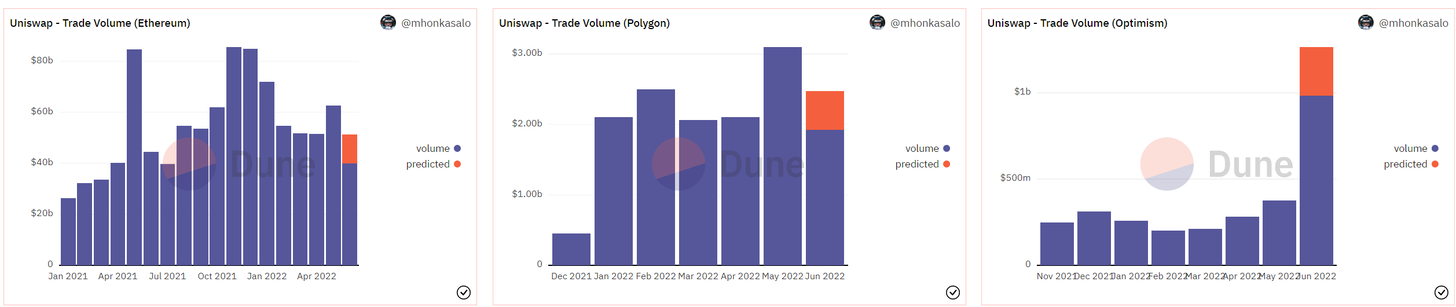

Uniswap is the leading decentralized exchange, with more thanmarket shareFluctuates between 65% - 75% and has had success on networks like Optimism and Polygon.

As of now, Uniswap is most likely to become the "order book of the world" (order book of the world) and the most important DeFi infrastructure component.

But on the downside, there is a fair amount of negative sentiment towards Uniswap's recent progress - due to the lack of value capture capabilities and the activity of Uniswap Labs (such as its VC arm),The UNI token economy is considered bad and does not necessarily deliver value to token holders.

In general, the UNI community should eliminate its dependence on Uniswap Labs - Uniswap Labs should eventually become one of the (probably the most important) teams working on behalf of Uniswap, and the Uniswap community should start to maximize its own value in the short term journey of.

Note that due to regulatory reasons, Uniswap Labs may choose to support "community (partially) responsible projects".

So far, the community's governance of Uniswap's huge funds (approximately $1.6 billion in UNI) has not produced much value, includingMany initiatives and grants, arguably of no value to Uniswap.

A rough roadmap is outlined below, intended to illustrate what a better community-led effort should look like. Specifically, it can be divided into 4 steps, of which the first 2 steps are small steps for token holders to become more active in the protocol:

Experimental precipitation part of the cost;

Recognized (UNI) delegation platform;

Formation of new teams outside of Uniswap Labs;

first level title

Expenses for experimental deposits

Uniswap has a fee switch that can charge LP fees of 10%-25% on a given liquidity pool.

A common misconception is that startups should not distribute profits but reinvest them --However, Uniswap currently does not draw profits at all, but provides exchange services for free.However, Uniswap does not necessarily distribute profits after charging fees, and this part of funds can be collected in the treasury.

But there is a problem, that isWill reducing LP profits cause Uniswap to become less competitive with other DEXs?

Overall, a data-driven research report should follow (we'd be happy to take on this task):

(Experimental precipitation part of the fee) What is the impact on LP, and will charging a fee of 10% for example have an adverse impact on Uniswap liquidity?

first level title

Create a recognized commissioning platform

MakerDAO pays its delegates an annual salary, which is a great idea and can be replicated cheaply with UNI incentives.

Recognized commissioning platforms are a good idea becauseToken holders can elect capable individuals to drive the DAO's vision and strategy.They will be responsible for representing the wishes of the token holders and will be aligned with this as their incentives are tied to the success of the DAO.

first level title

Forming a new team outside of Uniswap Labs

MakerDAO has core units that work for MKR holders. These core units require a budget and have a certain scope of work, including protocol engineering, real world assets (Real World Finance), data insights, etc.

UNI holders will go through a standardized process to vote on onboarding the development team and budget approval, and development team requirements are drawn from the development roadmap.

first level title

Create a development roadmap

This is actually about:

Develop a project development roadmap (and vision) that UNI holders can understand;

Cooperate with Uniswap Labs to avoid duplication of work and achieve strategic synergy;

one fromHasuflThe list of easier goals that can be achieved in the short term (may not all apply to Uniswap):

Front-running protection;

Revert protection;

More order types (eg TWAPs);

Solver/market-maker competition for user fills;

Account abstraction;

Order payment process (Payment-for-order-flow);

In addition, Uniswap has some larger and interesting opportunities, such as perpetual trading and synthetic stock trading-the goal is to exit the "internal DeFi casino" (internal DeFi casino).

first level title

follow-up

If these ideas are interesting, we will have more discussions with token holders and bring ideas to the Uniswap community to share withlaurikainen.ethvote together, in addition to recognizedMakerDAO Delegation PlatformIt was also officially launched today.

Original link