Can liquidity services survive without the business itself?

introduction:

introduction:

For investors, the quality of asset liquidity is crucial, and the Crypto world is no exception. The sudden collapse of Luna and UST, the accelerated flight of liquidity capital caused by interest rate hikes, and the discussion on liquidity are getting louder and louder.

secondary title

DeFi's need for liquidity and incentives

Why is liquidity important?

The so-called liquidity refers to the ease with which an asset can be transformed into a means of payment without affecting its value, and currency is the most liquid asset.

This is even more so in the DeFi world, where markets are driven directly by liquidity pools, which are made up of Liquidity Providers (LPs).

image description

Defillama data shows that the total lock-up volume of the DeFi protocol has dropped by about 60% from its high point

Incentives play a more important role in DeFi protocols. For an excellent protocol, risk is an external variable that cannot be intervened once the code is deployed. Therefore, protocols are forced to compete for market liquidity on the basis of rewards.

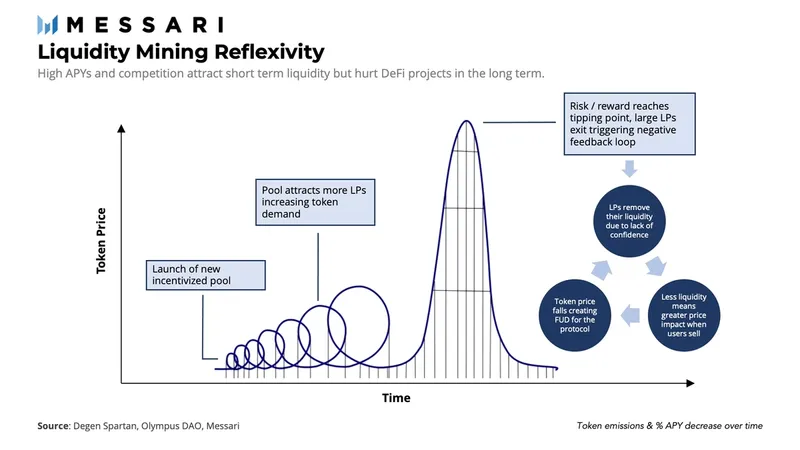

Liquidity mining has always been the preferred method for the liquidity of the DeFi protocol Bootstrap. The core is to use the high-inflation governance token emission rewards to guide the growth of the protocol. However, this short-term incentive is very expensive. The misplaced incentive mechanism between the agreement and the liquidity provider has created an extremely fragile liquidity system, especially weakening the purchasing power of the project treasury tokens. POL derivative protocol layer innovations also emerged.

In addition, capital efficiency is also a key indicator that is closely related to the project treasury, and the liquidity-as-a-service (LaaS) track that has been spawned from this has developed rapidly. By providing better liquidity depth and higher capital efficiency, it has attracted more than US$5 billion in TVL in less than a quarter of 2021 Q3.

However, as the TVL of DeFi protocols plummets, how to maintain a healthy and stable liquidity level and manage liquidity has become the subject of major project research.

How to divide liquidity?According to top-down logic, in the traditional financial market, we can divide liquidity into。

Money Liquidity, Bank Liquidity, Market Liquidity

First of all, the value basis of liquidity is credit, and the most fundamental source and motivation of liquidity comes from credit. As of now, no individual or economic entity in the market can provide enough credit to satisfy the liquidity of the entire market. Therefore, the state assumes this responsibility, and the central banks of various countries reduce transaction costs when they provide credit.

Second, the central bank regulates the market mainly through commercial banks. Central banks of various countries regulate the macroeconomy by adjusting the balance sheets of the central banks, thereby affecting the balance sheets of banks, and then transmitting to the balance sheets of micro-entities, such as individuals and enterprises, thereby affecting the entire macro market.In Crypto, we may temporarily abstract the liquidity brought about by credit and market regulation as the "joint action" of Satoshi Nakamoto and the Federal Reserve. Then finally,It is also the market liquidity that we often say in DeFi and is independent of the banking system

, mainly with the help of various financial instruments and technological innovations. Moreover, market liquidity is not continuous like the former. It is homogeneous, mutable, and expected to accelerate changes.

Obviously, the expansion of liquidity brought about by the “big water release” is manifested at the data level as a positive spiral between TVL and price, and the actual lack of macro-control led by the state has also caused a major problem for the sharp decline in the liquidity of DeFi protocols.

So, if we start from the direction of innovation, do liquidity service agreements under the background of bear market really have better liquidity and higher capital efficiency? Analyze the case through the perspective of supply relationship, profitability, trade-off and risk-reward, and maybe we will get our own answer.

Curve: vote-buying based on stablecoin business

Curve war has been talked about countless times, and the way to understand it is relatively simple. Its core is based on the liquidity demand extended from the underlying business logic of the stablecoin AMM, and to obtain more CRV emissions in the form of bribery.

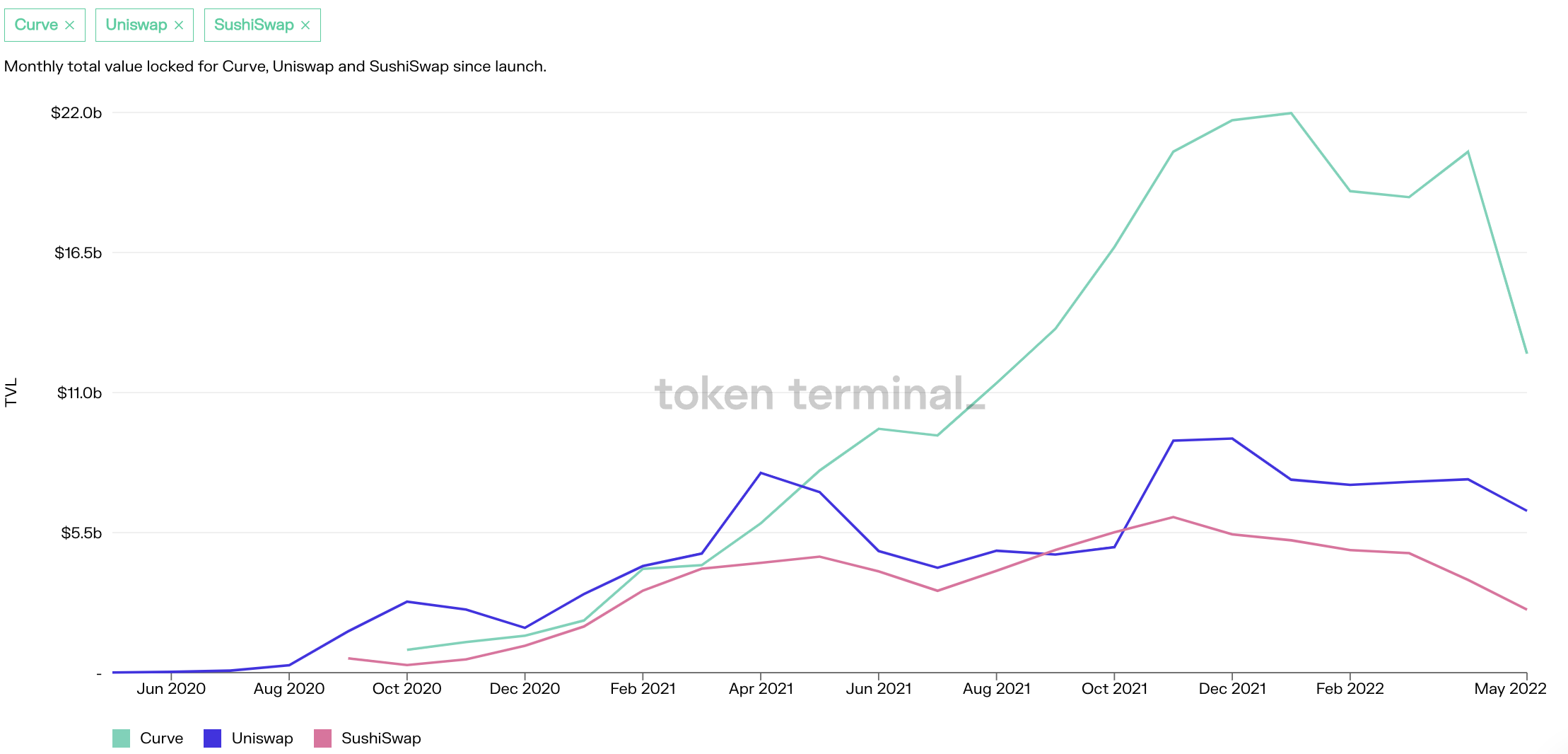

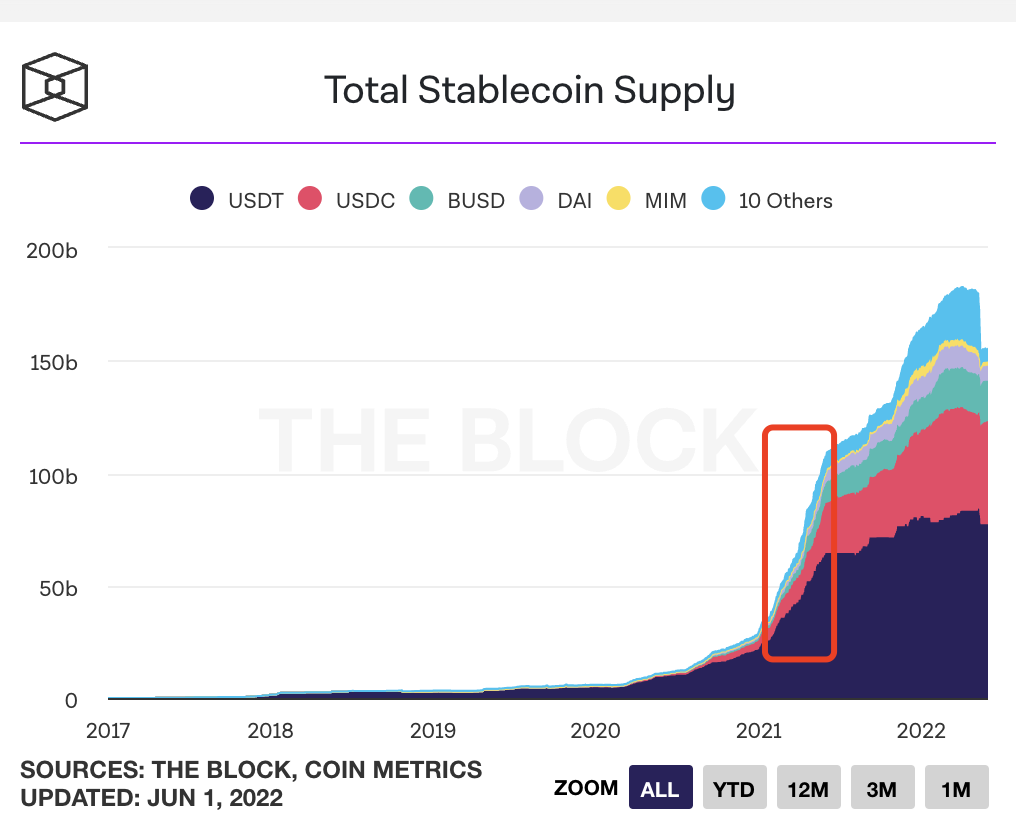

The real rise of Curve stems from the issuance of stable coins. The data shows that in May 21, Curve's TVL grew at a very high slope, and this was also a period of rapid stablecoin issuance. Curve, as the core exchange place for stablecoins, provided a huge supply of liquidity.

Not only that, the Curve team has cleverly designed the veToken mechanism from the very beginning. By enhancing the internal motivation of the "organic" demand for stablecoins to achieve the matching of supply and demand, it has spawned derivative agreements led by Yearn and Convex, and Curve has also successfully become a The bottom layer of liquid assets has been launched, and the "Curve War" that itself represents an improvement in capital efficiency has been launched, so that its incentives are always aligned with the long-term success of the project.:

Profitability

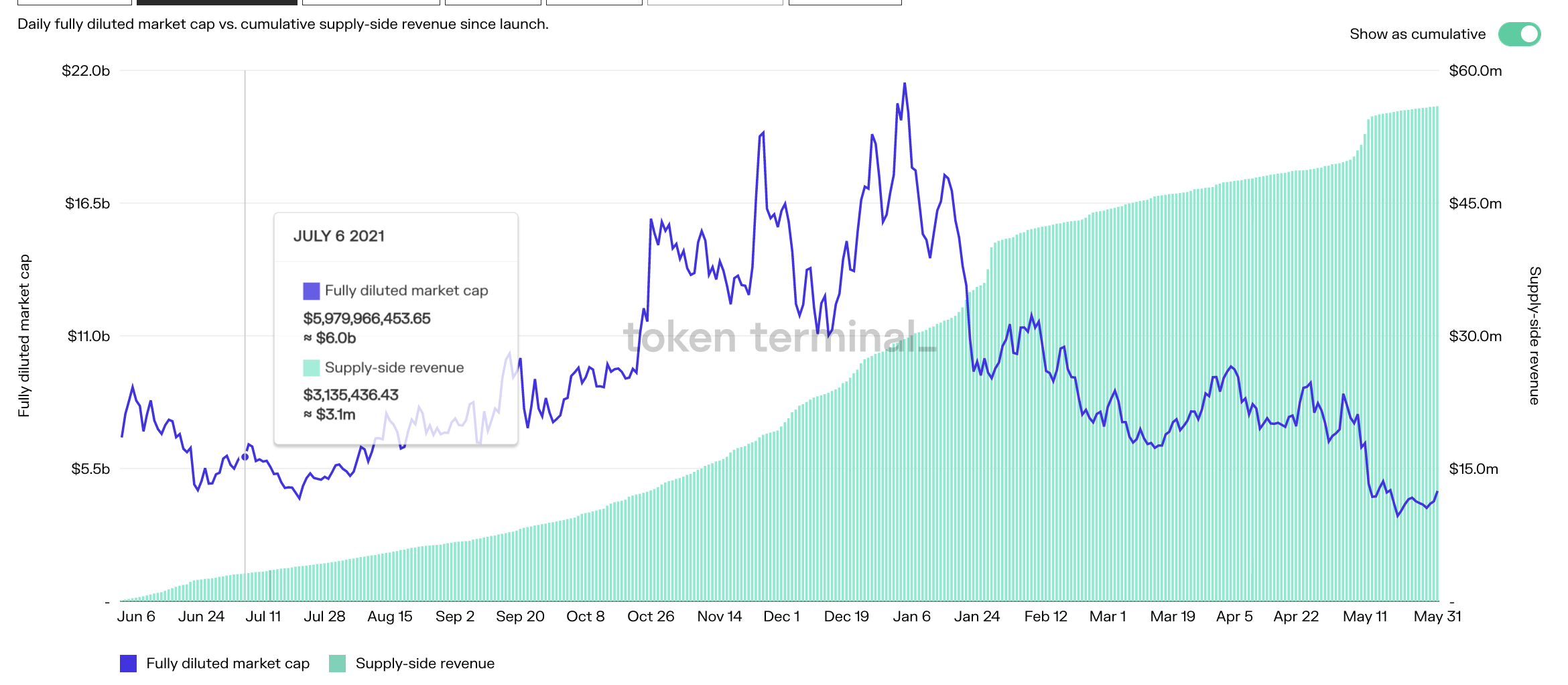

Data shows that every $1,000 of transaction volume will bring Curve $0.2 in revenue. We can clearly find that since entering 22 years, Curve's revenue growth on the supply side has gradually slowed down, and the relationship between supply and demand has lagged behind, but it is still in a healthy and profitable stage.:

risk and reward

The main risk for Curve users lies more in the dilution of governance rights, which is also determined by the mechanism. In addition, LP's "excessive right to speak" has also become one of the unfavorable factors, which has also given birth to competing agreements such as Solidly.

Based on Curve's emission model, the risk return of liquidity providers is: token emission income, service fee dividend income, and sufficient exit liquidity.

Olympus Pro: Bond and Reverse Bond Market

OlympusDAO created PCV in the form of the central bank bond market, which is similar to preferred shares of equity, subverting the reward cost of liquidity mining in a short time, and shifting the protocol burden to the more sustainable POL (protocol as a service).

In an environment with sufficient liquidity, OlympusDAO attracts liquidity by incentivizing pledge users with high inflation, which undoubtedly becomes the root cause of its rapid expansion and the root of its liquidity supply, but it also brings liquidity exit Here comes the huge problem.

From the demand side, in the first few months of the protocol's launch, the APY of staking OHM was over 10,000, creating a feedback loop for users, where people repeatedly buy and stake to get huge staking rewards. In addition, the launch of the bond market Pro not only provides OHM with a large amount of arbitrage demand, but also becomes a solid foundation for its expansion of the ecology.

However, the data shows that the price of OHM has dropped from nearly US$1,500 at ATH to less than US$20 today. The excessive liquidity supply has caused the price of OHM to plummet, so that most project parties who purchased bonds through Olympus Pro lost money, forming a negative cycle. In this regard, the government launched reverse bonds to provide another way to exit, thereby reducing the continuous decay of secondary liquidity.:

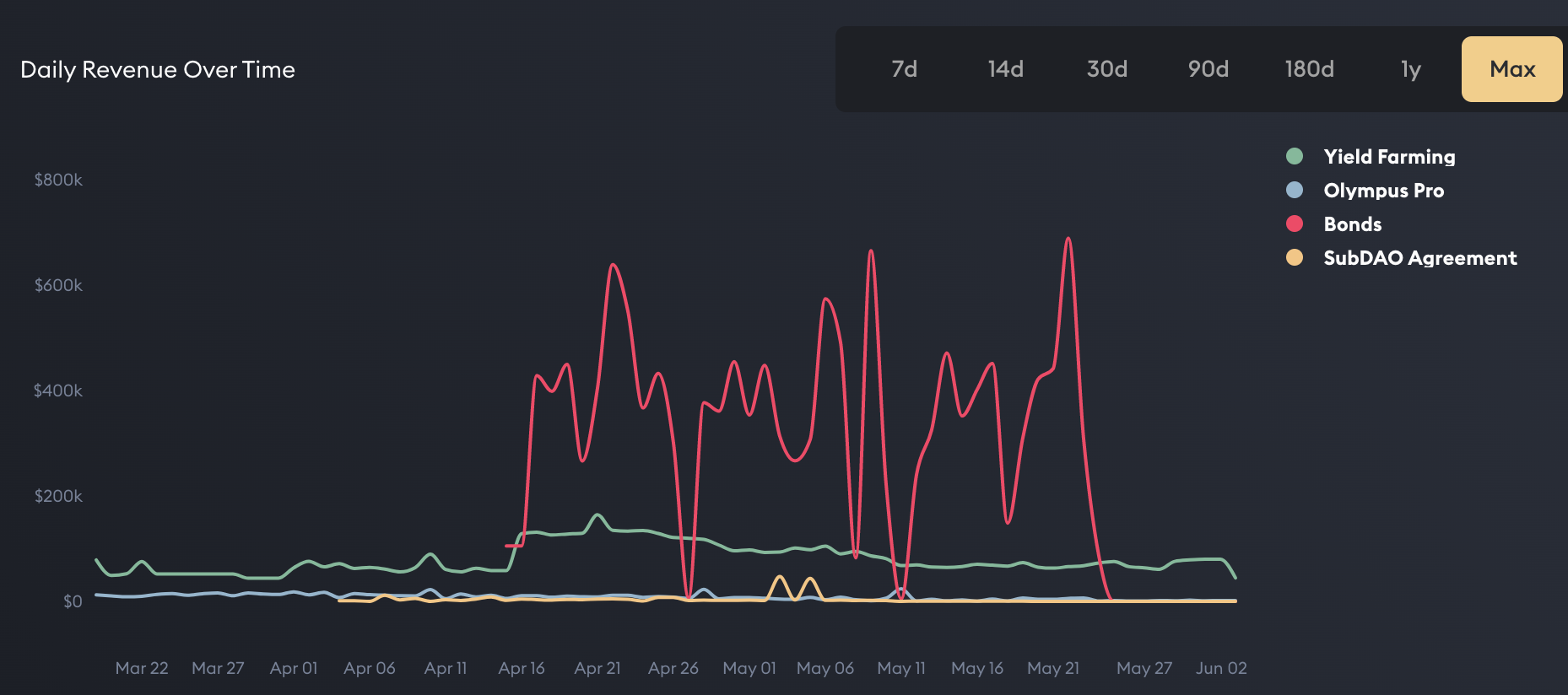

Profitability

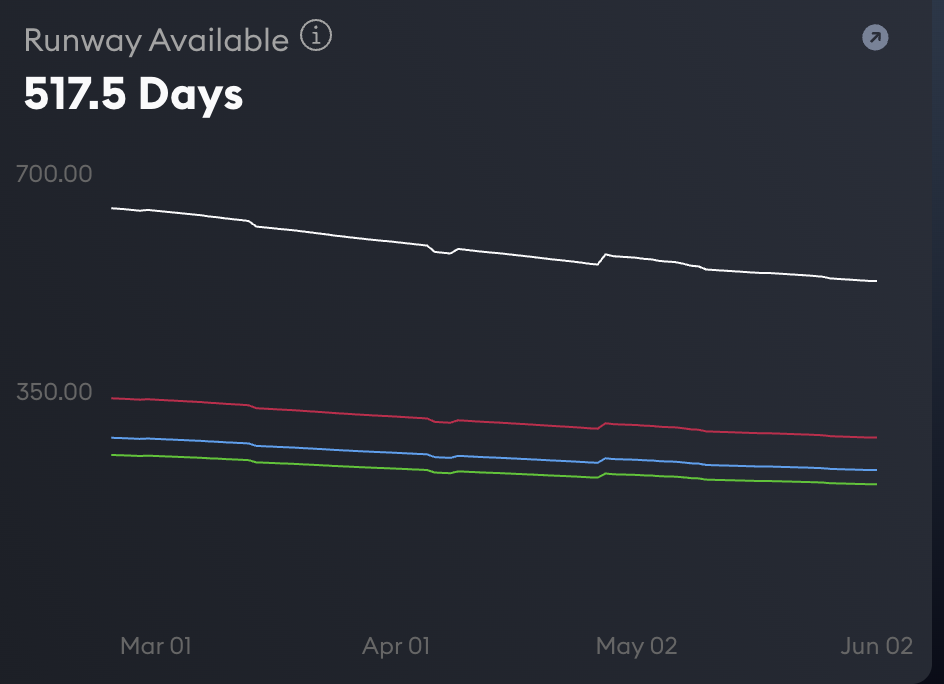

Thanks to the mechanism design of PCV, OlympusDAO's income sources mainly come from bond income, treasury PCV mining income and transaction fee income, and has more than 500 days of Runway. Therefore, from the perspective of profitability, the profitability of OlympusDAO is still healthy.:

Risk and Risk Reward

With the withdrawal of liquidity, the price of OHM has fallen to its risk-free value (Risk-free value), which means that the current liquidity value of the treasury is sufficient to fully support the exit of all circulating OHM. In addition, the introduction of reverse bonds also adds flexibility to its business mechanism to fully utilize PCV. However, when liquidity is tight, OHM does not have natural organic demand growth other than arbitrage at this time, and the risk return is extremely low.

Tokemak: Liquidity Leasing

Different from Curve, Tokemak reconstructs the supply and demand relationship of retail users by introducing the role of a third-party liquidity guide (LD), and its service is called "liquidity leasing".

If Olympus Pro is akin to preferred stock that looks like debt but works like equity (i.e. growing PCV), Tokemak is closer to a traditional bond with the protocol renting liquidity in exchange for Tokemak transaction fees.

Tokemak's business model is designed as a distributed market maker, splitting the scarce resources controlled by traditional market makers: capital, market knowledge and technology. Specifically, the Tokemak protocol acts as a technical component whose capital and market expertise comes from third parties, namely LPs, LDs and pricers.

To put it simply, Tokemak decides which assets to support, that is, which Token Reactors there are. LPs earn income by providing capital to Reactors. LD manages the funds in Reactors and earns income through market making. The huge amount of TOKE emissions of the agreement is responsible for the economic incentives of the three to ensure that the agreement operates in the designed way. All settlements are denominated in TOKE, and its value support and role in the agreement are stronger than other projects. The income from the market-making behavior that actually generates revenue is all owned by Tokemak, including transaction fees and other token incentives that may exist.

However, Tokemak still has its own defects. The agreement does not pay it in the form of basic tokens invested by LPs. All fees are held and redistributed by LPs owned by the agreement. Tokemak also cannot eliminate the impermanent loss of LP, but transfers this risk to LD, and LP only has a single asset exposure. This method makes the boundary between LP and LD more blurred and so on.

On the demand side, the more tokens pledged, the higher the LP's rate of return will be based on Reactor's dynamic rate of return adjustment, which will continue to attract more LP deposits. In addition, Tokemak has also set up a bribery mechanism to drive demand. However, Tokemak's own business does not have continuous organic demand, so only by continuously expanding its business line can it truly maximize its utility as a liquidity layer tool. For example, cooperating with many DEXs, aiming to become the dominant trading pair in this market; or targeting DAOs and making proposals to promote capital diversification, etc.

The data shows that the price of TOKE has also dropped by more than 90% in the past 3 months. The direct reason is that the team is not confident in the business logic: the team has reduced the TOKE rewards of a single equity pool, which makes holding TOKE Very less attractive. At the same time, Tokemak canceled the mining rewards of TOKE-ETH LP on Uniswap, causing the trading pair with more than 100 million US dollars to begin to bear huge selling pressure.:

Profitability

According to Token Terminal data, after the protocol revenue peaked in March, with the negative spiral of TVL and TOKE prices, Tokemak’s protocol revenue dropped sharply to less than 5% of the peak value.:

Risk and Risk Reward

Tokemak is originally a product with low capital efficiency. The root cause is that its business is built on other products such as DEX, which is more like a liquidity symbiotic and synergistic relationship. Therefore, when liquidity is tight, when the team is no longer confident in expanding its business lines and reducing emission incentives, users should withdraw decisively.

Ondo Finance x Fei Protocol: Structured Product Vault-Based LaaS

Ondo Finance splits asset pools and LP assets into multiple investment classes by offering users a choice between token price downside protection and enhanced returns: stable assets earning fixed income and volatility with variable but higher APY assets. The income from current assets will be given priority and there will be no impermanent loss, and all remaining income will be owned by contributors to volatile assets.

Unlike Tokemak, Ondo incentivizes liquidity providers by building fixed income positions with lower-risk and understandable exposures, while providing sophisticated crypto-asset investors with new forms of leveraged exposure Hold long-term positions.

Based on its own structured vault, Ondo Finance and Fei Protocol have jointly launched a LaaS service specifically for B-end users, that is, depositing the project's native tokens into the Ondo liquidity vault within a specific period of time, and conducting transactions with the newly minted FEI pair. This token pair is then sent to an AMM, such as Uniswap, which provides liquidity.

Fei x Ondo's design is attractive for projects that want to generate on-demand liquidity without the upfront cost of acquiring liquidity on the other side. Fei charges a small fixed fee when the vault expires for providing the other half of the liquidity position. Since projects themselves act as liquidity providers, they are entitled to transaction fees, but also face potential impermanent losses. At the end of the term, Ondo returns the provided token liquidity minus transaction fees (positive number) and IL (negative number). This strategy provides a new way for the protocol to provide liquidity in a short period of time and at extremely low cost.:

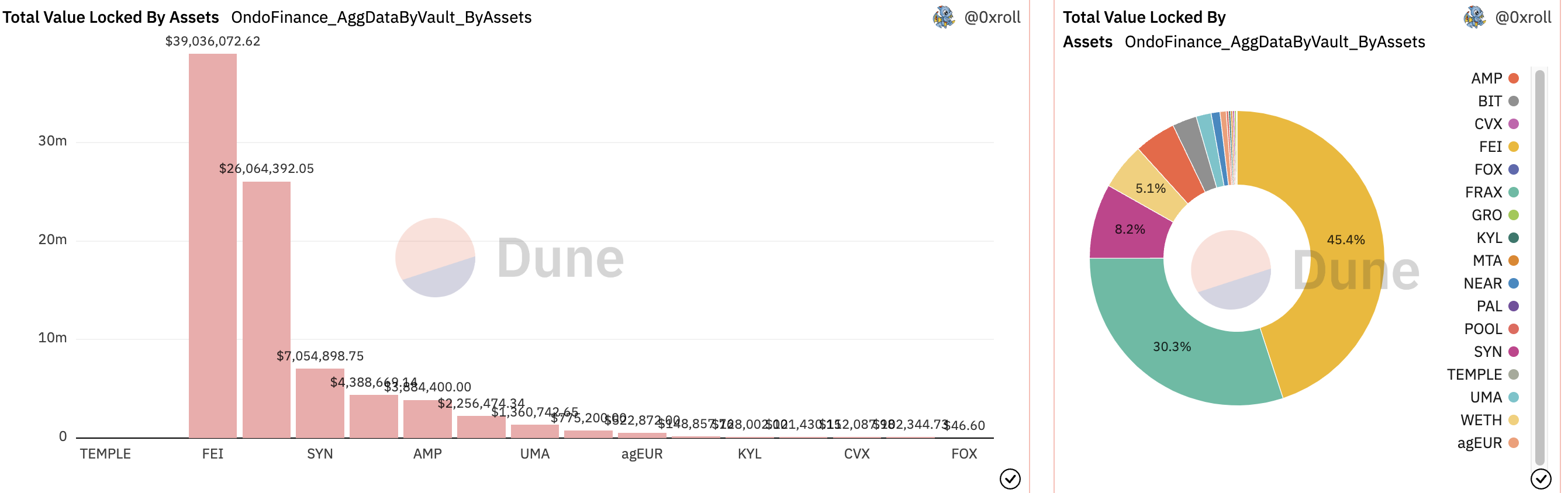

Profitability

Unknown, since Ondo has just announced a financing of tens of millions of dollars, and the business and tokens are still fully launched, the profitability is unknown. However, the data shows that Ondo currently has a TVL of about US$100m, of which more than 40% are FEI, 30% are FRAX, and the rest are mostly long-tail assets.:

risk and reward

Fei x Ondo's model is similar to that of commercial paper. It is a very short-term form of debt financing. It usually charges slightly higher interest than bonds, but provides greater flexibility for borrowers. It is essentially an intermediary provided by investment banks and Fund matching services are essentially the same as Tokemak's lack of organic demand. Currently, Ondo is mainly subject to smart contract risks as tokens are not yet in circulation.

UMA: Using Range Token and KPI Options to Drive Capital Efficiency as a Liquidity Source

The oracle protocol UMA launched Range tokens last year that function similarly to convertible bonds to allow DAOs to borrow funds without the risk of liquidation while diversifying funds.

The nice thing about raising funds with Range tokens is that governance tokens are only sold in the future. When the value of the governance token is higher than the sale financing amount, capital efficiency is improved. Governance tokens can also be used to open risk-free collateralized debt positions using Range tokens and use the funds raised to fund treasury purchases or expenditures, such as buying Olympus Pro bonds or purchasing liquidity services on Tokemak.

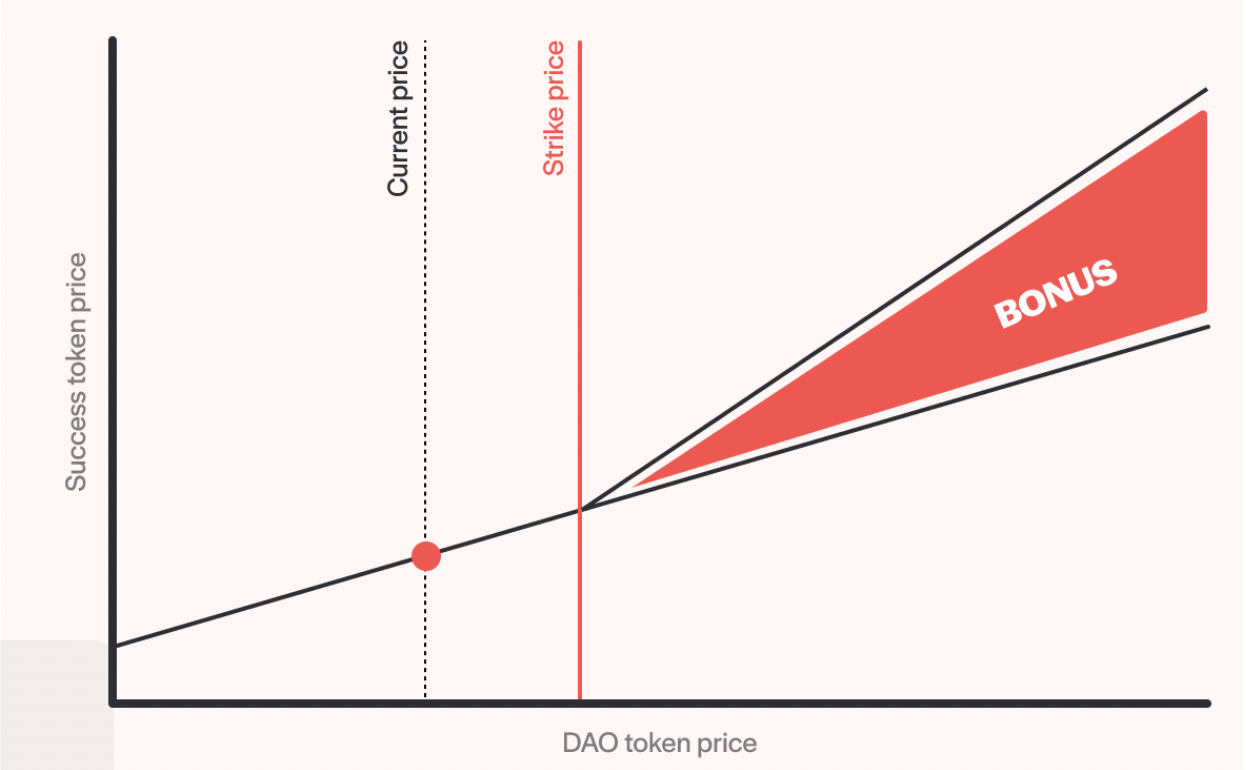

In addition, UMA has introduced Success Tokens: a way to raise funds for DAOs without an upfront token discount. Instead, DAOs offer investors a call option to manage tokens. Call options may bring investors more DAO token rewards, but only if the token price rises, which also means that investors can only get their own token rewards when DAO performs well.

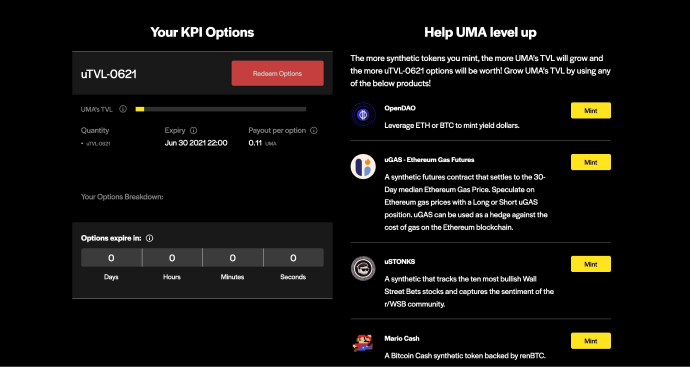

In addition to the Success token, UMA has also formulated a performance-tracking financial derivative - KPI options, which allow the agreement to motivate the progress of specific KPI goals and pay more rewards based on the completion of the indicators.

KPI options provide an alternative to liquidity incentives, trying to combine LP incentives with agreement incentives to prevent excessive selling pressure and increase the depth of liquidity. However, because Crypto is in a period of rapid expansion, the irreconcilable conflict between LP, DAO and external investors makes the actual organic demand of KPI Option extremely low.:

Profitability

unknown.:

risk and reward

The performance-linked approach has successfully incentivized better liquidity depth, but remains capital inefficient. Instead, KPI options should incentivize the adoption of LaaS services such as Curve War, Olympus Pro, and Tokemak. This would add another economic incentive to encourage strategies to channel more sustainable liquidity into state coffers.

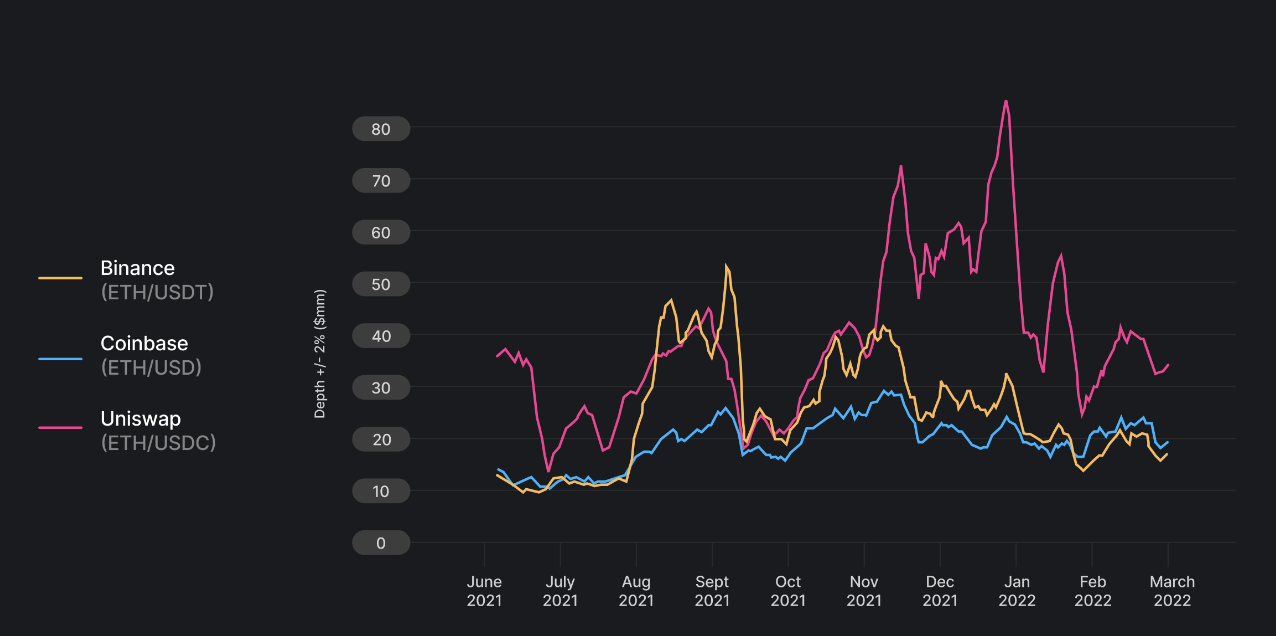

When it comes to the LP management of Uniswap V3, whether it is Visor Finance, which was once prosperous, or Arrakis Finance (ex Gelato Protocol), which is currently the largest LP, most people may think that this is a track that has been falsified. Indeed, under the V3 version where the benefits are infinitely magnified, the risk of LPs is also magnified, and it follows that the benefits of most V3 management strategies are far lower than those of V2.

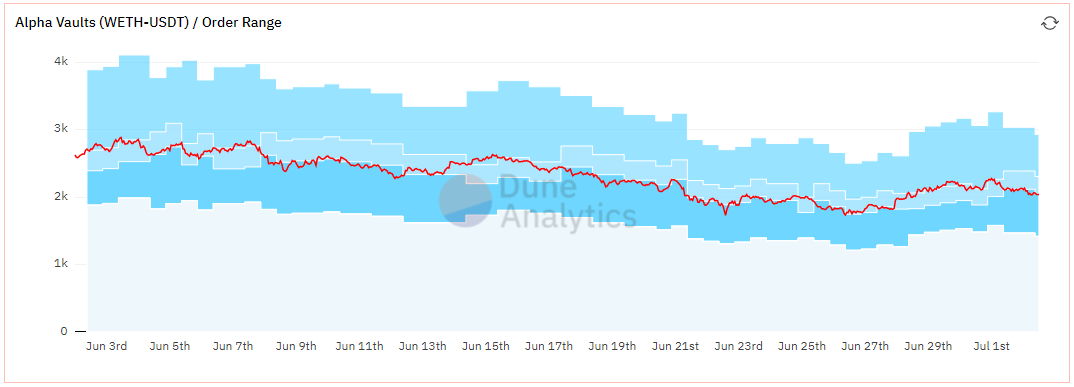

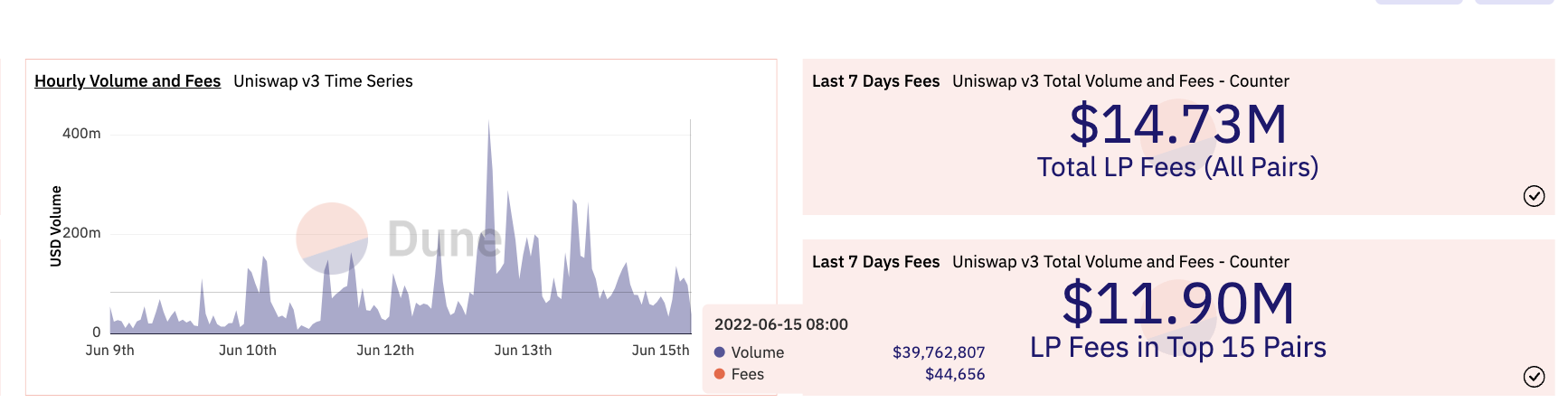

image description

Charm Alpha Vault: The darker light blue part is the basic fluidity, and the softer light blue part is the single-sided fluidity

However, repeated failures have not slowed the adoption of V3. Instead, users have become more dependent on the more flexible V3, which has become an organic transaction demand. The depth of liquidity of V3 has also gradually emerged, and its LP management has also become professionalized, from the simplest use of backtesting range to reduce impermanent losses or use active rebalancing to adjust positions, and now can be freely executed by smart contracts. LP strategy and more. In addition, V3 also gives high leverage to LPs with only a small amount of capital. While high leverage magnifies capital to earn high returns, LPs will also face more severe risk management challenges. Whether they can manage high risks under high leverage and bring deeper liquidity and organic demand will be the key to future competition core.:

Profitability

unknown. Past experience has shown that overall benefit expectations for V3 have been mixed. For a long time, the transaction cost of UNI-V3 has been closely related to the big market, and based on the fact that Arrakis currently holds nearly 25% of the V3 LP position, the income of V3 LP management (except for impermanent losses) is quite considerable.:

risk and reward

At present, it is difficult for V3 management to have an objective profit maximization point, and different strategies will lead to different results. Some strategies will focus on maximizing the short-term fee income, while others will rely on the medium and long-term infinite grid to passively follow the maximization of income. In any case, having the skills to control risks and losses will always win in the game of maximizing income.

Around organic demand, the development of LaaS is still on the way

Today, there are actually many mechanisms and product business lines around liquidity, but there are very few organic demands that are truly generated by transactions. Liquidity is very precious in today's market environment, how to provide better and more stable liquidity services will be the real challenge after the bubble fades.

Liquidity services based on its own market maker mechanism are more organic, as is Curve, and so is Uniswap. Then, the definition of LaaS is no longer limited to the cold start and other methods provided for B-end users, but broadened to all Crypto users based on liquidity itself and its derivative services. In this way, it becomes quite common for single-existing derivative agreements to have a short life cycle and become less and less attractive.

disclaimer

"DODO Research Institute" led by the dean "Dr.DODO" led a group of DODO researchers to dive into the Web 3.0 world, doing reliable and in-depth research, aiming at decoding the encrypted world, outputting clear opinions, and discovering the future value of the encrypted world. "DODO" is a decentralized trading platform driven by the Proactive Market Maker (PMM) algorithm, which aims to provide efficient on-chain liquidity for Web3 assets, allowing everyone to issue and trade easily.

Copyright Notice

Without the authorization of DODO Research Institute, no one may use without authorization (including but not limited to copy, disseminate, display, mirror, upload, download, reprint, excerpt, etc.) or allow others to use the above intellectual property rights. If the work has been authorized to be used, it shall be used within the scope of authorization, and the source of the author shall be indicated. Otherwise, its legal responsibility will be investigated according to law.

about Us

"DODO Research Institute" led by the dean "Dr.DODO" led a group of DODO researchers to dive into the Web 3.0 world, doing reliable and in-depth research, aiming at decoding the encrypted world, outputting clear opinions, and discovering the future value of the encrypted world. "DODO" is a decentralized trading platform driven by the Proactive Market Maker (PMM) algorithm, which aims to provide efficient on-chain liquidity for Web3 assets, allowing everyone to issue and trade easily.

More information

Official Website: https://dodoex.io/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Discord: https://discord.gg/tyKReUK

Twitter: https://twitter.com/DodoResearch

Notion: https://dodotopia.notion.site/Dr-DODO-is-Researching-6c18bbca8ea0465ab94a61ff5d2d7682

Mirror:https://mirror.xyz/0x70562F91075eea0f87728733b4bbe00F7e779788