OP Research: Chaos and order, watch in the severe winter of the encryption industry

Original Author: OP Research

Let me tell you a fable from The Three-Body Problem:

There is a flock of turkeys on a farm, and the farmer feeds them every day at eleven o'clock at noon. A scientist in the turkey observed this phenomenon for nearly a year without exception, so it also discovered the great law in its own universe: "Every day at eleven o'clock in the morning, there is food." The law was announced to the turkeys in the morning, but this morning when the food did not come at eleven o'clock the farmer came in and caught and killed them all.

In the field of investment, people are eager to observe the law of truth, trying to be a scientist among turkeys, and use the law of truth to predict the market, guide investment, and be invincible. However, can the market really be predicted, or is there a rule to follow once and for all? We try to compare the encrypted digital currency cycle from different dimensions, see the changes and differences between different cycles, and explore whether it is really possible to treat the encrypted investment market with empirical thinking.

1. Macroeconomic cycle

Macroeconomic cycle factors mainly include the stage and level of economic development, fiscal and monetary policies, CPI index, PMI index, black swan events, etc. Among them, the fiscal and monetary policies of various countries are regarded by investors as the weathervane of the market trend, and often directly affect the capital market; the black swan event forms the alpha factor of the market, which is a major influencing factor that investors did not expect, and has an impact on the price of risky assets. tend to be larger.

Looking at the encryption market, it has been 14 years since Bitcoin was created in 2008, and its bull-bear conversion is closely related to global fiscal and monetary policies. For example, the bull market in the encryption market in 2017 originated from the fact that the Federal Reserve originally planned to raise interest rates four times in 2016, but the actual pace of interest rate hikes slowed down. In 2016, only one round of interest rate hikes was implemented, coupled with the tax cuts introduced after Trump took office. In 2017, the prices of risk assets such as US stocks and Bitcoin continued to rise. The bull market of encrypted assets in 2021 also obviously benefited from the release of water by global central banks. Unlike previous interest rate cuts and releases, the social life and economic development environment have encountered unprecedented situations. With the outbreak of the new crown epidemic in 2020, home isolation, home office, closure of public places, city blockade, and suspension of air routes have become routine means for countries to fight the epidemic. Compared with the financial crisis in 2008, the impact of the epidemic on the real economy is more serious. Not only the international Trade exchanges have been blocked, and it has also seriously affected people's daily life and consumption. All countries have lowered their expectations for economic growth. Unemployment has surged, consumption has been sluggish, and economic recession has followed. Global pessimistic expectations have risen sharply. Under the influence of the black swan event of the new crown epidemic, countries have rarely come together in unison. Not only have they jointly fought the epidemic, but they have also introduced unprecedented positive fiscal and national currency policies to boost the economy and prevent economic recession. Lots of liquidity.

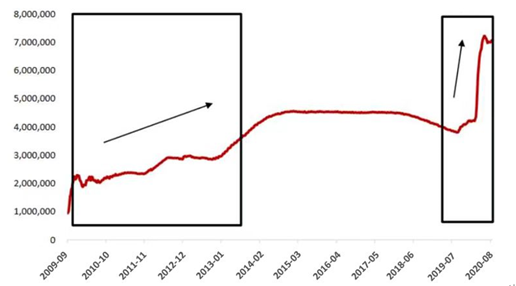

Take the closely watched Federal Reserve as an example. During the COVID-19 pandemic, the Fed’s time chain from policy formulation to implementation has been significantly shortened, and its policy strength and tool innovation have greatly exceeded those during the financial crisis. In just three months, the scale of the Fed's asset purchases has approached the total scale of the four rounds of quantitative easing policies after the financial crisis. This has lowered the market credit spread and stabilized market volatility.

image description

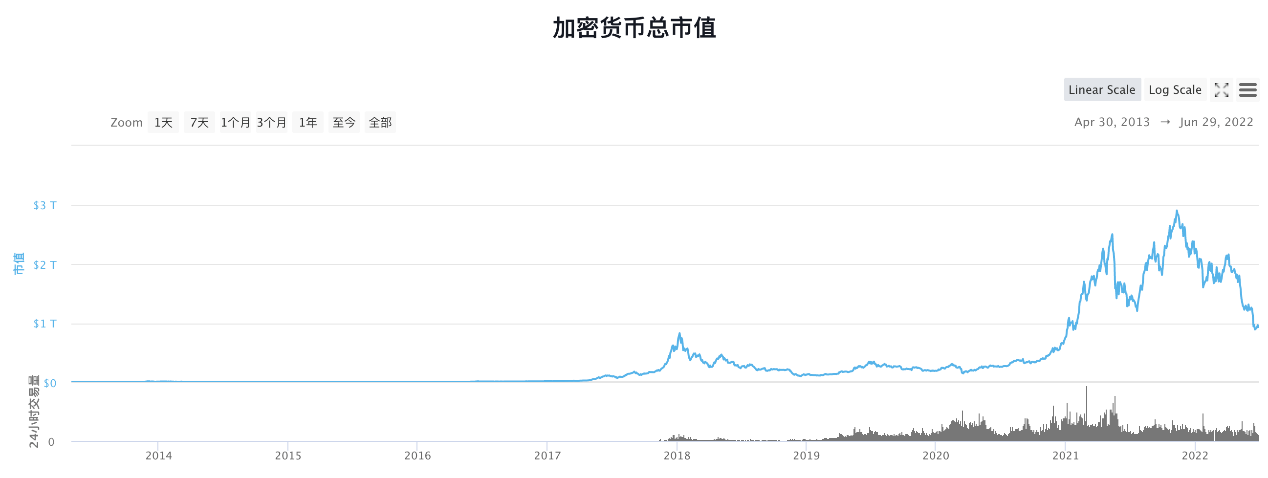

image description

image description

Source:https://coinmarketcap.com/zh/charts/

Although each round of bull market is inseparable from loose fiscal and monetary policies, sufficient liquidity support and a loose market environment, the background of the implementation of various policies by central banks in each cycle, the motivation for policy implementation, and the overall economic environment are all important factors. Therefore, the specific details of policy formulation and implementation (such as the scale of quantitative easing, duration, and interest rate levels) will also be different, so the impact on the encryption market cannot be generalized. Coupled with the frequent occurrence of black swan events in recent years, it will also have an impact on various economic policies. Therefore, the analysis of macro-fundamentals should seek truth from facts, and we should not draw general conclusions based solely on experience, but need to make detailed observations before making judgments on the subsequent development of the market.

2. Entry of traditional institutions, more long-term holders

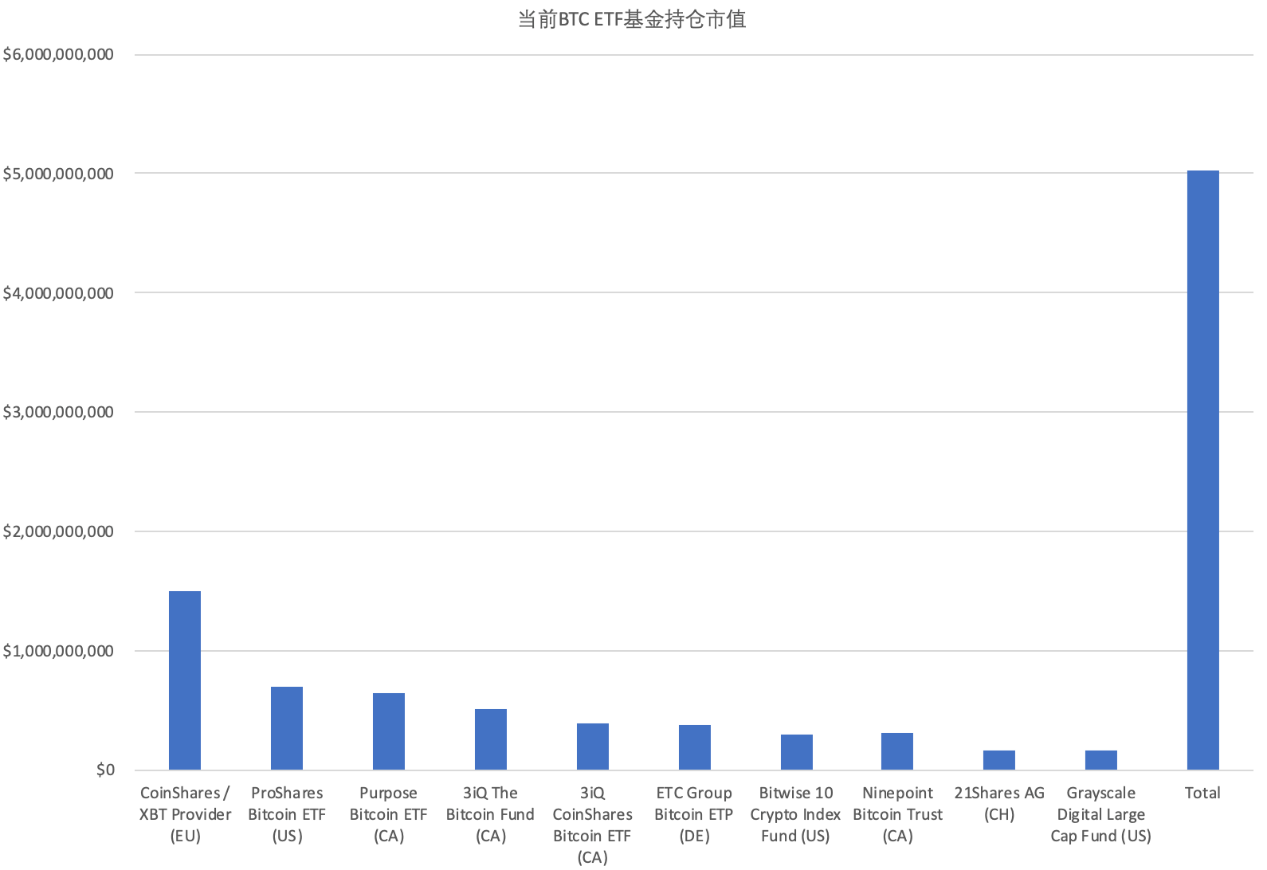

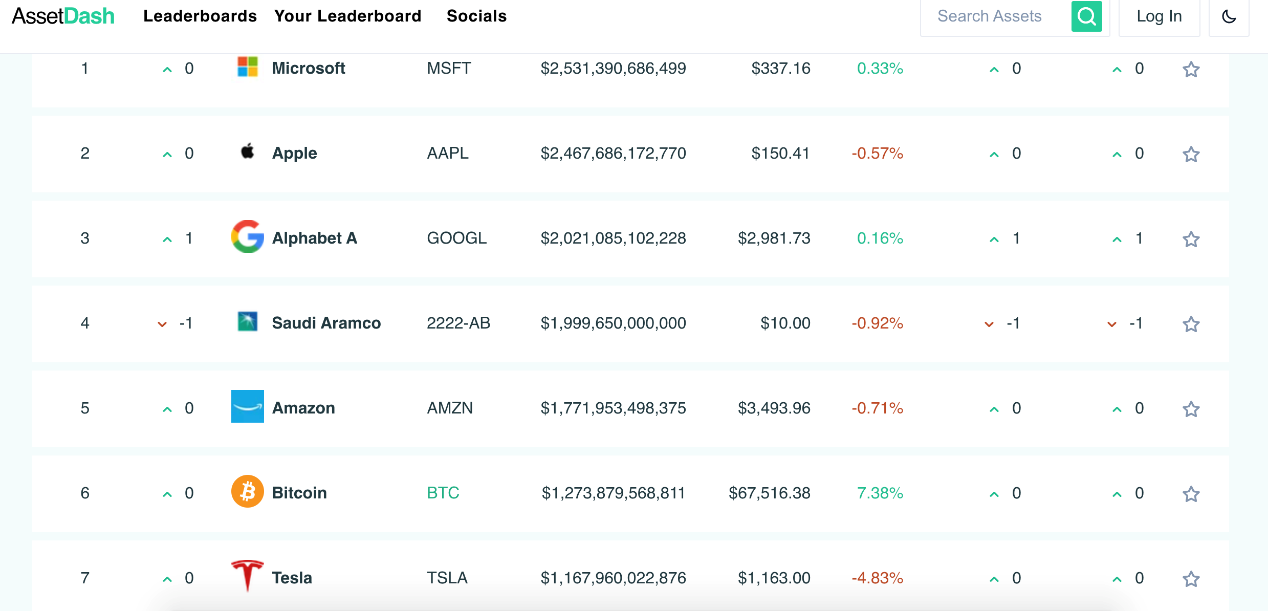

Unlike the 2017 bull run, 2018 tried and failed with a BTC ETF. The bull market that started in 2021 is obviously driven by the entry of traditional institutions. These institutions, such as JP Morgan Chase, Standard Chartered Bank, Citigroup, Deutsche Bank, DBS Bank Group, Fidelity Securities, etc., have a large amount of funds, decisive decisions, and almost all long-term holdings, making BTC's huge and continuous increase. Of course, there are also various well-known companies that, with the endorsement of major traditional institutions, have also participated in using Bitcoin as an asset allocation. The most famous of these is Elon Musk's Tesla. Musk once used two Twitters to cause a nearly 20% rise and fall of BTC in a single day, and was dubbed the title of "King of Orders" in the currency circle. In addition, BTC ETF and Grayscale Fund are the biggest boosters in this round of bull market. Various BTC and ETH ETFs (Figure 2.1) have given traditional financial market funds the opportunity to participate in the encryption market. The adoption of BITO, the largest BTC ETF in the United States, has brought billions of dollars of incremental capital to the encryption market. Grayscale Fund, as the largest cryptocurrency trust and compliance business benchmark in the United States, has truly opened the channel for traditional funds to enter the market and brought tens of billions of buying to BTC (Figure 2.2). Since there is a 6-month lock-up period after the customer purchases Grayscale’s GBTC, and even after the lock-up period, the customer still cannot redeem it and can only withdraw through the off-market secondary market, which makes most GBTC buyers long-term holder. Even El Salvador defined Bitcoin as a legal tender and bought 150 million US dollars of BTC successively. With the participation of many institutions, enterprises and even countries, retail investors have the confidence to further participate. It can be seen that this round of bull market is almost jointly promoted by major investment institutions, emerging companies and sovereign countries seeking change.

image description

image description

Source:https://www.coinglass.com/zh/BitcoinTreasuries

image description

Source: https://www.coinglass.com/zh/Grayscale

3. Narrative changes, sources of bubbles

Narrative changes are often one of the powerful driving forces of a bull market: After Bitcoin broke through the foreign exchange controls of centralized countries and organizations, the birth of Ethereum also laid the foundation for the ICO boom in the encryption industry. The emergence of the ICO market was essentially an impact and subversion of the existing securities market structure and system, which also directly or indirectly led to the magnificent bull market in the encryption industry in 2017. Different from the bull market in 2017, the concept of decentralized finance (DeFi) was born and became the initial engine of the big bull market in 2020-2021 (Figure 3.1 TVL on the chain), because DeFi provides a new way for funds to be leveraged The way - on-chain lending. This allows users, especially traditional institutions, to further increase leverage on the chain after obtaining financing, which is also confirmed by 3AC's liquidation incident. After DeFi, GameFi is nothing more than a shell-changing model of DeFi, and its essence is DeFi with game attributes added. But the difference is that with the rise of GameFi, along with the popularity of NFT, NFT series such as Crypto Punks, NBA Top Shot, and BAYC have pushed NFT to the apex step by step, and quickly became popular on the entire network, completing the emergence of NFT. In this way, NFT took the baton from GameFiI and became the hottest concept in the capital market and a new financing method. The fundraising of NFT is independent of traditional private placement and IEO/IDO. The key lies in the particularity of NFT's own attributes (for details, please refer to our article: "NFT, a paradigm shift in the form of fundraising").

High leverage and narratives are the bubble-making machines that push up the market value of encrypted assets, and they are also the catalysts that accelerate their decline: Since the explosion of DeFi, the use of leverage has become the norm for funds in the circle, such as the recent thunderstorm incident on the encrypted lending platform Celsius , because users ran deposits on a large scale under market panic, the problem of serious insufficient liquidity was highlighted. The deeper reason was that there were long-term serious problems in the project operation mechanism and risk control strategy, which led to this thunderstorm. Another example is the liquidation incident of 3AC. On the basis of financing, 3AC added leverage on the chain. At the same time, it was not clear enough about the leverage multiples and liquidation points on the chain. Therefore, after consecutive major accidents such as UST and stETH unanchored, it was rejected by users. They watched the liquidation. As more and more CeFi/DeFi projects in the encryption industry run out or experience thunderstorms, the problems concealed by the rapid growth of the industry in the past two years finally broke out in the bear market. In addition, numerous expensive NFTs and NFT issuances have repeatedly absorbed and destroyed countless ETH while pushing up the market value of the NFT sector, which has increased the risk while growing the bubble. Because although the market value of many projects has increased, the real silver in the market is decreasing, so once the tide ebbs and the bubble begins to subside, there will inevitably be a spiraling crash like a DeFi run. Especially after NFT, although everyone tried hard to find opportunities in the concept of Web3.0 and DAO model, they did not break away from the concept of DeFi and NFT, so as the narrative dried up, the decline of the market can be said to be "just around the corner" .

image description

image description

Source: https://defillama.com

image description

Source:https://images.bitpush.news/cn/20211109/163641542751445079.png

4. The empiricism trap

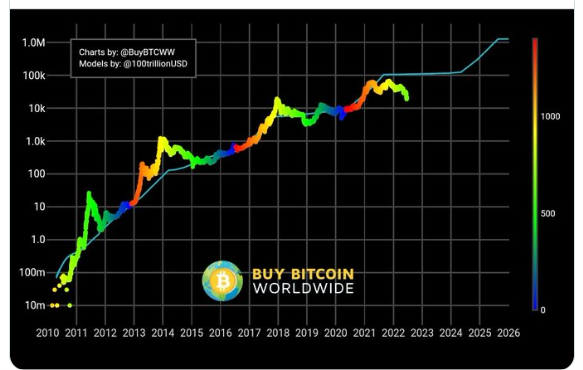

At the beginning of this article, the story of the turkey scientist described in Liu Cixin's novel "The Three-Body Problem" is called the "farmer hypothesis". This hypothesis comes from the philosopher Hume's views on causality. Hume subverted the objective necessity of causality, and believed that causality is often nothing more than: the constant convergence of two things + subjective psychological association. And in the 14-year history of the encryption industry, we may ourselves be the turkeys on the farm: "the four-year bull-bear cycle", "every time the output is halved to usher in a big bull market", but in this cycle , more and more empirical laws have been broken: the S2F model advocated by planB (the high stock-to-flow ratio model S2F refers to the model obtained by dividing the total assets in reserves by the total assets produced each year, mainly used to highlight The relationship between scarcity and market prices is mainly used for popular metals such as gold and silver. Proposed by PlanB in 2019, he believes that this can eliminate price fluctuations caused by accidental events. Inferred from the S2F model, the value of Bitcoin Will reach a staggering $288,000 in 2024.) Has been proven distorted, and even Ethereum founder Vitalik Buterin criticized the Bitcoin S2F model (Stock-to-flow) on Twitter for giving people a wrong A sense of certainty, thinking that "predetermined numbers will increase people's harmful feelings, and those who follow blindly should be ridiculed." Coincidentally, in the latest round of decline, Bitcoin has recently quietly fallen below the peak of the last round of bull market, breaking the historical law that the bottom of each bear market is higher than the top of the previous round of bull market.

image description

image description

Source: https://twitter.com/VitalikButerin/status/1539167095312850944

5. Reflections and principles

The encryption market naturally has financial attributes. Constantly looking for new narratives is an important way to attract funds and talents to continue to enter the market. Only when funds and talents continuously enter this market can new narratives be realized. It is undeniable that in this process, the influx of funds, the marketing hype of various project teams, and the boost of FOMO sentiment of users will cause huge bubbles in encrypted assets. Although the bubble means bad growth far exceeding its own value, it is also the spark that ignites the enthusiasm of the industry and promotes the development of the industry. In the last cycle, as long as there is a white paper and a team of several people, it can run smoothly in the encryption time by telling a passable story. In this cycle, compared with the previous cycle, there are more landing applications. The model is also more mature than before, and the fundamentals are better, so the bubble in this round of bull market is not completely "water without a source". However, as investors in the encryption market, we must remain as absolutely rational as possible. We must always maintain a skeptical attitude, be vigilant against bubbles while embracing them, and control risks while gaining benefits in bubbles—this is the most important thing.

At the same time, as a "rational person", we must avoid falling into the trap of empiricism. It has only been 14 years since the creation of encrypted assets. Compared with other assets, the history is very short. Therefore, the "laws" observed in this process are not necessarily the real "truths", which may be caused by various factors. Coincidence, or longer time verification is needed to verify the observed phenomenon. The past does not represent the future, and the law does not represent the truth. No one knows which will come first, tomorrow or accidents. Therefore, adhering to technological development as the basis and adhering to the concept of value investment is the fundamental way of industry development and the core essence of investment.

Although purely one-sided empiricism is not advisable, we can still reflect from history. The market is currently in a bear market. By summarizing and learning these principles, we can deal with it more calmly when the bull market comes. These conclusions include:

(1) Always be in awe of the market, because black swan events are unpredictable, and don't fall into the trap of empiricism;

(2) Embrace and be wary of bubbles. Bubbles are the spark that ignites the market. You can gain benefits in the bubbles, but you must also remain suspicious of the bubbles;

(3) The core of industry development is continuous innovation, to achieve underlying technological progress, and ultimately return to value investment;

(4) Technology and macro-economy have their own laws and cycles of development, keep pace with the trend, and continuously improve productivity is the foundation;

(5) The fundamentals of the market are improving, and the bear market is the touchstone for testing applications and projects. Therefore, only by remaining optimistic can we win the future.