Why did the former "bull market engine" GBTC become an "oil barrel" that caused thunderstorms in institutions?

Original Author: Morty

Original Author: Morty

The bear market is the rest of the liquidity movement.Famous investor Charlie Munger once said:

"There are three ways to bankrupt a wise man: Liquor, Ladies, and Leverage."

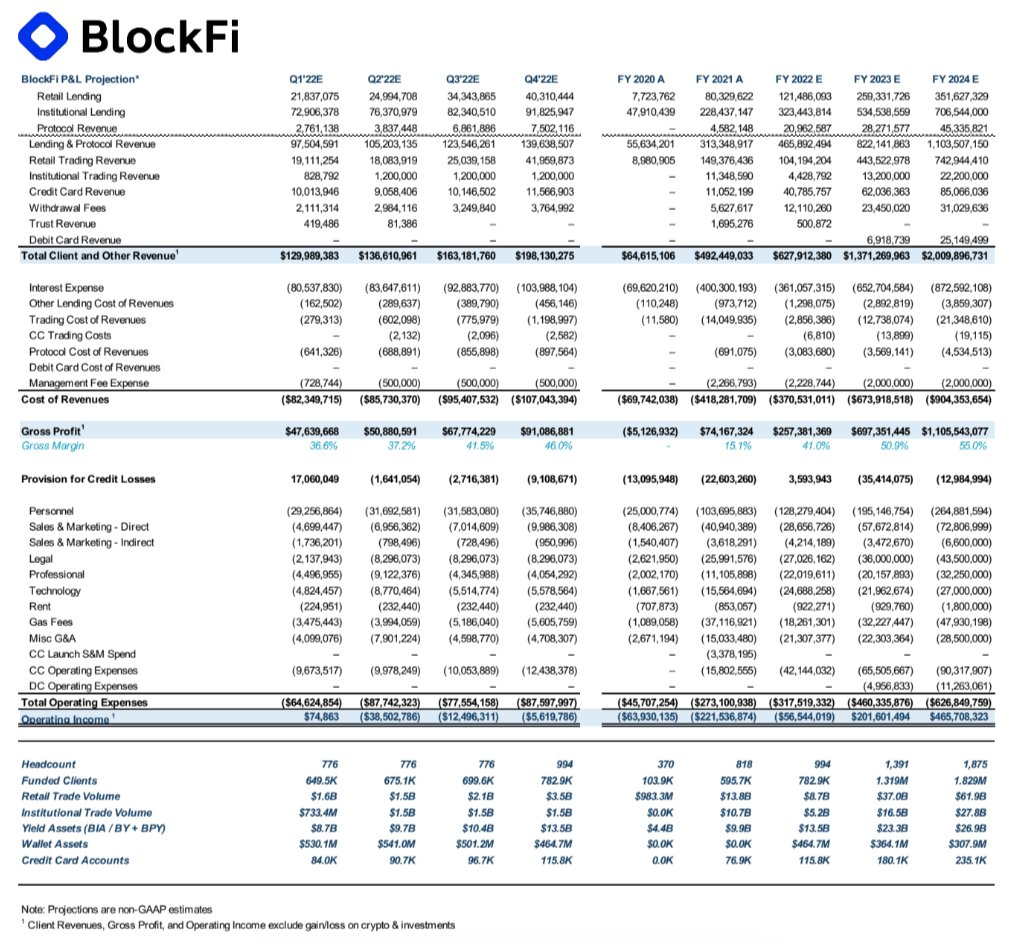

For Charlie Munger, who is used to market cycles, he has seen the power of leverage. In the crypto market, upstarts like BlockFi and Sanjian Capital have gradually ushered in their own end after the disorderly expansion of abundant liquidity in the bull market.When we look back at the "encrypted defeat", whether it is the former first-line VC Sanjian Capital, or the once valued as high as 3 billion U.S. dollars

BlockFi is stepping on the Bitcoin trust fund GBTC issued by Grayscale.

The former bull market engine has now become the "oil barrel" that has caused thunderstorms for many institutions. How did all this happen?

GBTC, the bull market arbitrage machineThe full name of GBTC is Grayscale Bitcoin Trust, launched by Grayscale.

Grayscale is a digital asset management company founded in 2013 by Digital Currency Group.

The launch of GBTC aims to help high-net-worth investors in the United States invest in Bitcoin within the scope permitted by local laws, just like buying a fund, but in fact Grayscale Bitcoin Trust is a castrated "like ETF fund."According to normal logic, investors can purchase GBTC shares with their own BTC in the primary issuance market, or redeem BTC through the corresponding GBTC.

But since October 28, 2014, Grayscale Bitcoin Trust has suspended its redemption mechanism.

Secondly, after GBTC is issued in the primary market, it can only be traded in the secondary market after a 6-month lock-up period.

Under the macro background of the new crown flood, the encryption market has become a piece of meat and potatoes in the eyes of institutions. Out of good expectations for future bitcoin price growth, GBTC has been at a long-term positive premium for a long period of time from 2020 to 2021. This means that if investors want to buy 1,000 GBTC shares representing 1 BTC, they need to pay a higher cost than buying 1 BTC.

So, why do investors choose to buy GBTC with a premium instead of actually holding BTC?

In the secondary market, the main holders of GBTC are qualified individual and institutional investors. Most retail investors can directly purchase GBTC through their 401(k) (U.S. retirement benefit plan) accounts without paying income tax. Therefore, as long as the GBTC premium rate is within an acceptable range for retail investors, they can profit by avoiding tax spreads.

In addition, some traditional institutions are unable to buy and hold coins due to regulatory reasons, and will also use GBTC to invest in related cryptocurrencies.There has also been speculation that Grayscale artificially drove a positive premium to attract more investors to participate. Just like the classic bridge in the movie "The Wolf of Wall Street",

If we want consumers to buy a pen in our hands, creating demand is the best way, and positive premium is "demand", that is, investors' pursuit of profit.Positive premium will be a stable means of arbitrage for crypto institutions——

Buy BTC, deposit it in Grayscale, and dump it to retail investors and institutions in the secondary market at a higher price after the GBTC unlocking period ends.

And this is also one of the main driving forces for the rise of BTC in the second half of 2020. As the spot available for purchase in the market continues to decrease, the price of BTC will naturally rise, and American investors will be more motivated to invest in GBTC, which is why GBTC has maintained a positive premium for a long time.

GBTC and its unjust institutionsGBTC arbitrage,

BlockFi and Three Arrows Capital are all too familiar.

According to the SEC Form 13F documents previously disclosed by Grayscale, only two institutions, BlockFi and Three Arrows Capital, accounted for 11% of GBTC holdings at one point (institutional holdings accounted for no more than 20% of the total circulation).This is one of the leverages of the upstarts—

Use the user's BTC for arbitrage, and lock the BTC into Grayscale, a Pixiu that can only enter but cannot enter.

For example, BlockFi previously absorbed BTC from investors at an interest rate of 5%. According to the normal business model, it needs to borrow at a higher interest rate, but the real demand for lending Bitcoin is not large, and the utilization rate of funds is very low.Therefore, BlockFi chose a seemingly safe "arbitrage path" to convert BTC into GBTC,

Sacrifice liquidity to gain arbitrage opportunities.

Relying on this method, BlockFi once became the largest holding institution of GBTC before, and was later surpassed by another enemy institution, that is, Three Arrows Capital (3AC).

According to public information, at the end of 2020, 3AC held 6.1% of the GBTC share, and has been the largest holding since then. At that time, BTC was trading at $27,000, with a $GBTC premium of 20%, and 3AC held more than $1 billion.The news of "GBTC's largest holding institution" made 3AC quickly become a star in the industry. Of course, more people's questions are,

Why is 3AC so rich, how did these BTC come from?Now all the answers have surfaced——

borrowed.Shenchao TechFlow learned that,

3AC has borrowed BTC without collateral at an ultra-low interest rate for a long time and converted it into GBTC, and then mortgaged it to Genesis, a lending platform that also belongs to DCG, to obtain liquidity.

In the bull market cycle, all this is beautiful, BTC continues to rise, and GBTC has a premium.

The good times didn't last long. After the launch of three Bitcoin ETFs in Canada, the demand for GBTC decreased, so that the premium of GBTC disappeared quickly and a negative premium appeared in March 2021.Not only 3AC panicked, but Grayscale also panicked.

In April 2021, Grayscale announced plans to transform GBTC into an ETF.

The tweet content and frequency of the two founders of 3AC are basically a barometer of 3AC. From June to July 2021, they all quieted down on Twitter, started talking about TradFi, talking about safe-haven bets, and even had a Time rarely mentions cryptocurrencies.Until a wave of counterfeit currency market led by the new public chain made 3AC's book assets take off,

The two founders also came back to life on Twitter.

Secondly, 3AC is oriented to institutional lending, and there is not much immediate and scattered redemption pressure, but BlockFi raises BTC from public investors, and there is more redemption pressure, so BlockFi has to continue to sell GBTC at a negative premium, and in the first quarter of 2021 , selling and reducing holdings all the way.Even with the two-year crypto bull market in 2020 and 2021, BlockFi lost more than $63.9 million and $221.5 million respectively. According to a practitioner of an crypto lending institution,

BlockFi lost nearly $700 million on GBTC.3AC has no short-term redemption pressure of BTC,

However, there is a risk of liquidation in the pledged GBTC, and the risk will be transmitted to DCG simultaneously.On June 18, the Bloomberg terminal once emptied 3AC’s GBTC position to 0. The reason given by Bloomberg is that since January 4, 21,

3AC did not file 13G/A, they could not find any data confirming that the three arrows still held $GBTC and removed it as stale.Less than a day later, the data was restored, and Bloomberg said,

"Until we confirm that they no longer own the position, which may require looking at the 13G/A filing."

At present, it can be confirmed that at the beginning of June, 3AC still held a large number of GBTC positions, and hoped that GBTC could save 3AC.According to The Block, starting from June 7, TPS Capital, an over-the-counter trading company under 3AC, has been promoting GBTC arbitrage products on a large scale.

Allows TPS Capital to lock up bitcoins for 12 months and return them at maturity, and receive a promissory note in exchange for bitcoins with a 20% management fee.An encryption agency told Shenchao TechFlow that 3AC had contacted them around June 8 to promote arbitrage products,

It is said that a 40% profit can be obtained within 40 days through GBTC arbitrage, and the minimum investment amount is 5 million US dollars.

In theory, there is still room for arbitrage in GBTC with a severe negative premium.

DCG is actively applying to the US SEC to convert GBTC into a Bitcoin ETF.

Once successful, the ETF will track the price of Bitcoin more effectively, eliminating discounts and premiums, which means that the current negative premium of more than 35% will disappear, leaving room for arbitrage.

At the same time, DCG promised to reduce GBTC management fees, and GBTC's trading venue will be upgraded from OTCQX to NYSE Arca with higher liquidity.

As the largest holding institution of GBTC, what Zhu Su has been looking forward to is that GBTC will be recognized as soon as possible and upgraded from a trust to an ETF, so that the value of its holdings will quickly jump by more than 40%.In October 2021, Grayscale submitted an application to the US SEC to convert GBTC into a Bitcoin spot ETF,

The deadline for the SEC to approve or reject the application is July 6, so 3AC told a large number of institutions that they can obtain more than 40% of the profits in just 40 days, essentially betting that the SEC will approve the application.

But for this arbitrage product, Bloomberg ETF analyst James Seyffart said:“In traditional finance, they call this operation structured notes, but anyway, they take ownership of your bitcoin and also make money with your BTC. They get your BTC and in either case (Whether GBTC is converted into an ETF) takes returns from investors.。”

Even if Sanjian/TPS were solvent, it would be an absolutely terrible deal for any investor

It is reported that 3AC did not rely on this product to obtain too much external funds, waiting for 3AC or a tragic liquidation.On June 18, Genesis CEO Michael Moro tweeted,The firm has liquidated the collateral of a "large counterparty" after it failed to meet margin calls

, adding that any potential residual losses will be actively recovered by all possible means, the potential losses are limited and the company has rid itself of the risk.Although Moro did not directly name 3AC, but combined with the current market dynamics and Bloomberg’s deliberate clearing of 3AC’s GBTC holding data on this day, therefore,

The market believes that there is a high probability that the large counterparty is Sanjian Capital.

Success or failure is arbitrage, and the stars who dance arbitrage on leverage eventually fall due to leverage.As Zweig puts it,Maybe it was because I was too young at that time, and I didn't know that all the gifts given by fate had already marked the price secretly.

Under the liquidity crisis, no one can survive alone. The institutional bull market driven by the purchase of BTC by institutions has finally disappeared due to the liquidation of institutional leveraged assets.