The current situation of the digital stablecoin market: the market value has shrunk by 32.8 billion US dollars, and USDC is on the rise

The recent sharp drop in the price of encrypted assets in a short period of time has triggered large-scale liquidation and chain reactions. First, the CeFi lending platform Celsius suspended withdrawals and transfers due to stETH unanchored and faced user runs; and then a well-known investment institution and market maker 3AC was exposed to selling assets to repay debts. Up to now, there are still at least about 660 million US dollars in debt exposure It may constitute a breach of contract; there is also a farce caused by the community of Solend, the largest lending platform on Solana, who wants to reduce the risk of liquidation and proposes to take over a giant whale account. Under the shadow of the continued decline in the crypto market, these microcosms of liquidity crises have led to widespread concerns among investors about market liquidity risks.

What is the current liquidity in the market? PAData analyzed the recent changes in exchange capital stocks and net inflows and found that:

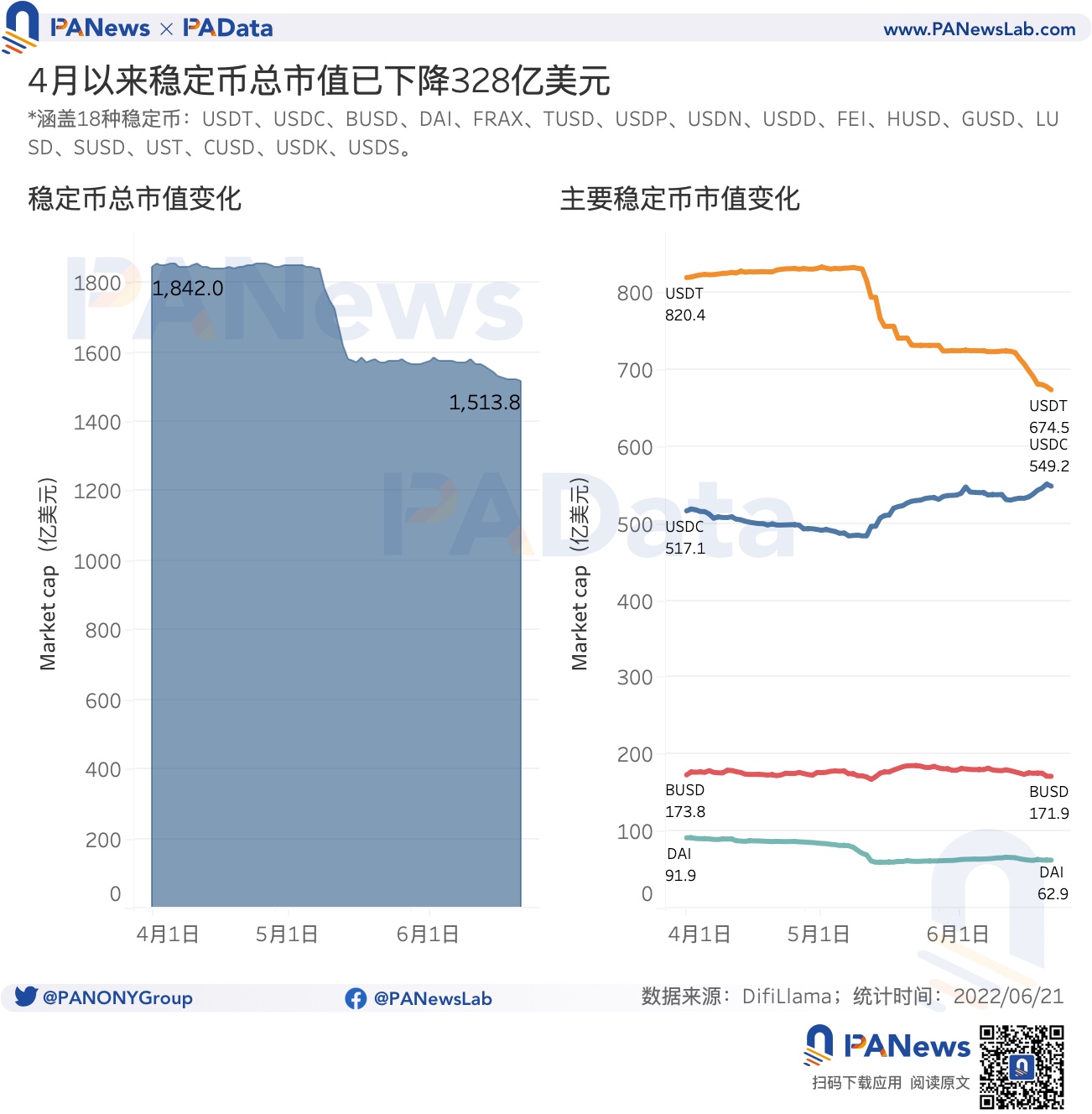

1) Since April, the market value of stablecoins has decreased by US$32.82 billion, with an overall decline of 17.82%. The market value of USDT decreased by US$14.59 billion, accounting for 44.45% of the total market value decline, while the market value of USDC increased by US$3.21 billion, or 6.21%, and the gap between the two market values further narrowed.

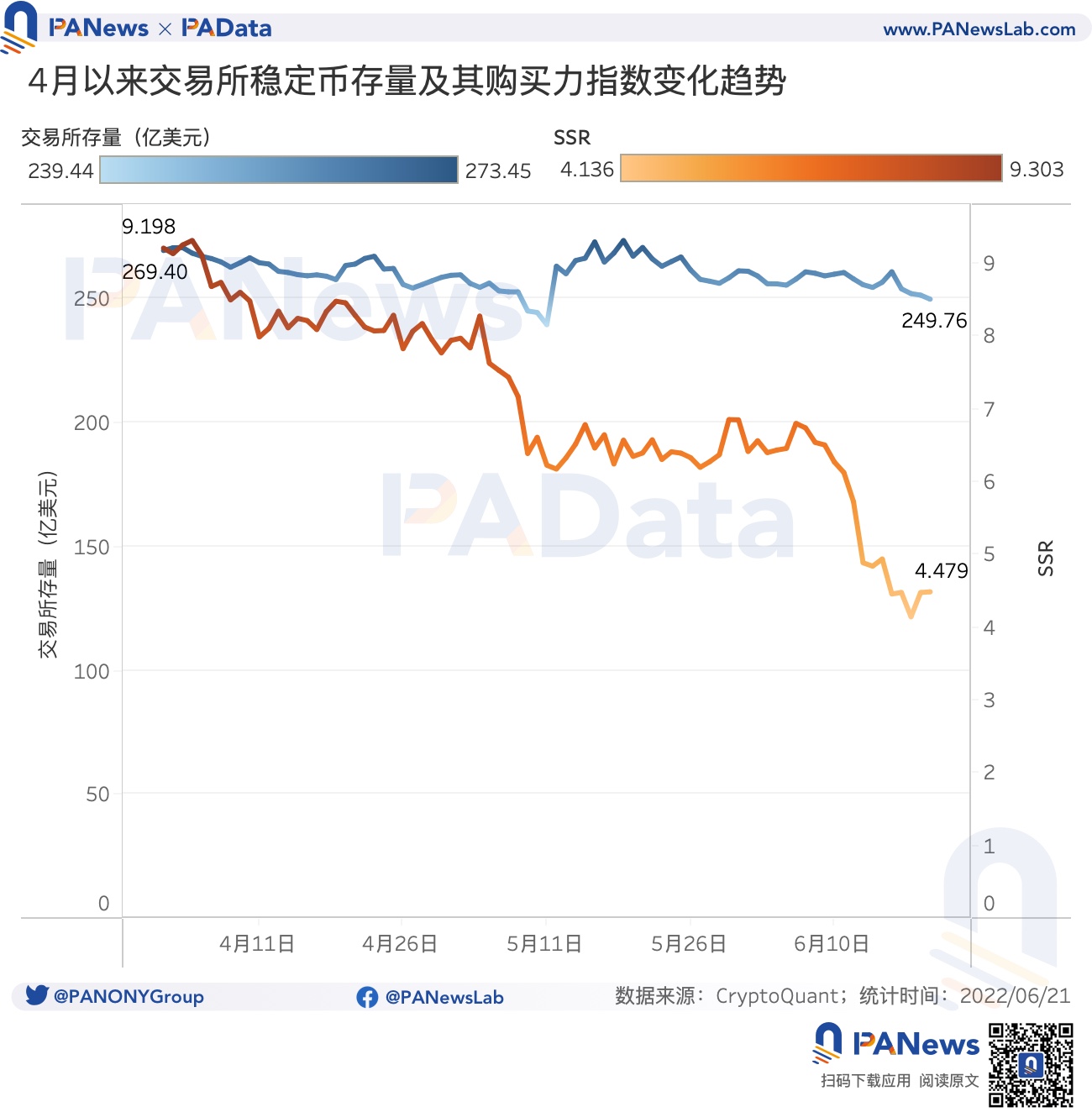

2) Since April, the stock of stablecoins on major exchanges has been basically stable, with a drop of only US$1.96 billion. However, affected by the sharp drop in the market value of Bitcoin, stablecoins have gained higher purchasing power when the stock is basically stable. Since April, the purchasing power index SSR has dropped from 9.20 to 4.48, a drop of 51.30%.

Due to its function as a trading medium, stablecoins have always been an important window to observe market liquidity. The issuance of stablecoins usually means enhanced liquidity, and vice versa. PAData has calculated the market value changes of 18 stablecoins with large market value since April this year, including USDT, USDC, BUSD, DAI, FRAX, TUSD, USDP, USDN, USDD, FEI, HUSD, GUSD, LUSD, SUSD, UST, CUSD, USDK, USDS. According to statistics, the total market value of the 18 stablecoins on April 1st was about US$184.2 billion, but from May 8th to May 14th, the total market value fell off a cliff, falling from US$183.73 billion to US$157.86 billion , decreased by $25.9 billion, or 14%, equivalent to a 2% decline each day during this period. Since then, from June 10 to June 21, the total market value has experienced the second significant decline in a short period of time, from US$157.88 billion to US$151.38 billion, and then decreased by US$6.5 billion, or about 4%. Overall, since April, the market value of stablecoins has decreased by $32.82 billion, an overall drop of 17.82%.

It is worth noting that the market value of most other stablecoins has basically shown a downward trend since April. For example, the market value of USDT, which has a large market value, dropped from $82.04 billion on April 1 to $67.45 billion on June 21. , a decrease of US$14.59 billion, accounting for 44.45% of the total decline in the total market value. The market value of BUSD and DAI also dropped slightly during the same period, decreasing by USD 190 million and USD 2.90 billion, respectively, accounting for 0.57% and 8.84% of the total market value decline. Only the market value of USDC has shown an upward trend since April, rising from US$51.71 billion to US$54.92 billion, an increase of US$3.21 billion, or 6.21%. Moreover, the current market value gap between USDC and USDT has further narrowed. The difference between the two in early April was 30.3 billion U.S. dollars, and by June 21, the difference had narrowed to 12.5 billion U.S. dollars. If USDC continues to grow, the stablecoin market may be reordered.

Although the total market value of stablecoins has changed significantly, the stock of stablecoins on major exchanges has remained basically stable. According to statistics, on April 1, the stock of stable coins on the exchange was about 26.94 billion U.S. dollars. By June 20, the stock of stable coins on the exchange was still about 24.98 billion U.S. dollars, a drop of only $1.96 billion, a drop of only was 7.28%.

However, affected by the sharp drop in the market value of BTC, stablecoins have gained higher purchasing power when the stock is basically stable. Stablecoin Purchasing Power Index (SSR) is the ratio of the market value of BTC to the market value of stablecoins. The higher the value, the less BTC a unit of stablecoin can buy, and the lower the purchasing power. Conversely, the more BTC that a unit of stablecoin can buy, the higher the purchasing power. high. According to statistics, the SSR index was still 9.20 on April 1, but the SSR index had dropped to 4.48 on June 20, a drop of 51.30%.

In addition to the market value of stablecoins, the flow of mainstream assets in exchanges is also an important dimension to observe the development of overall market liquidity. If more mainstream assets have a net inflow into the spot market, it may bring greater selling pressure to the market, which may induce asset prices to go down. If more mainstream assets have a net inflow into the futures market, it may cause violent fluctuations in asset prices. Whether it is a price decline or violent fluctuations, it may in turn trigger debt liquidation, further putting pressure on liquidity.

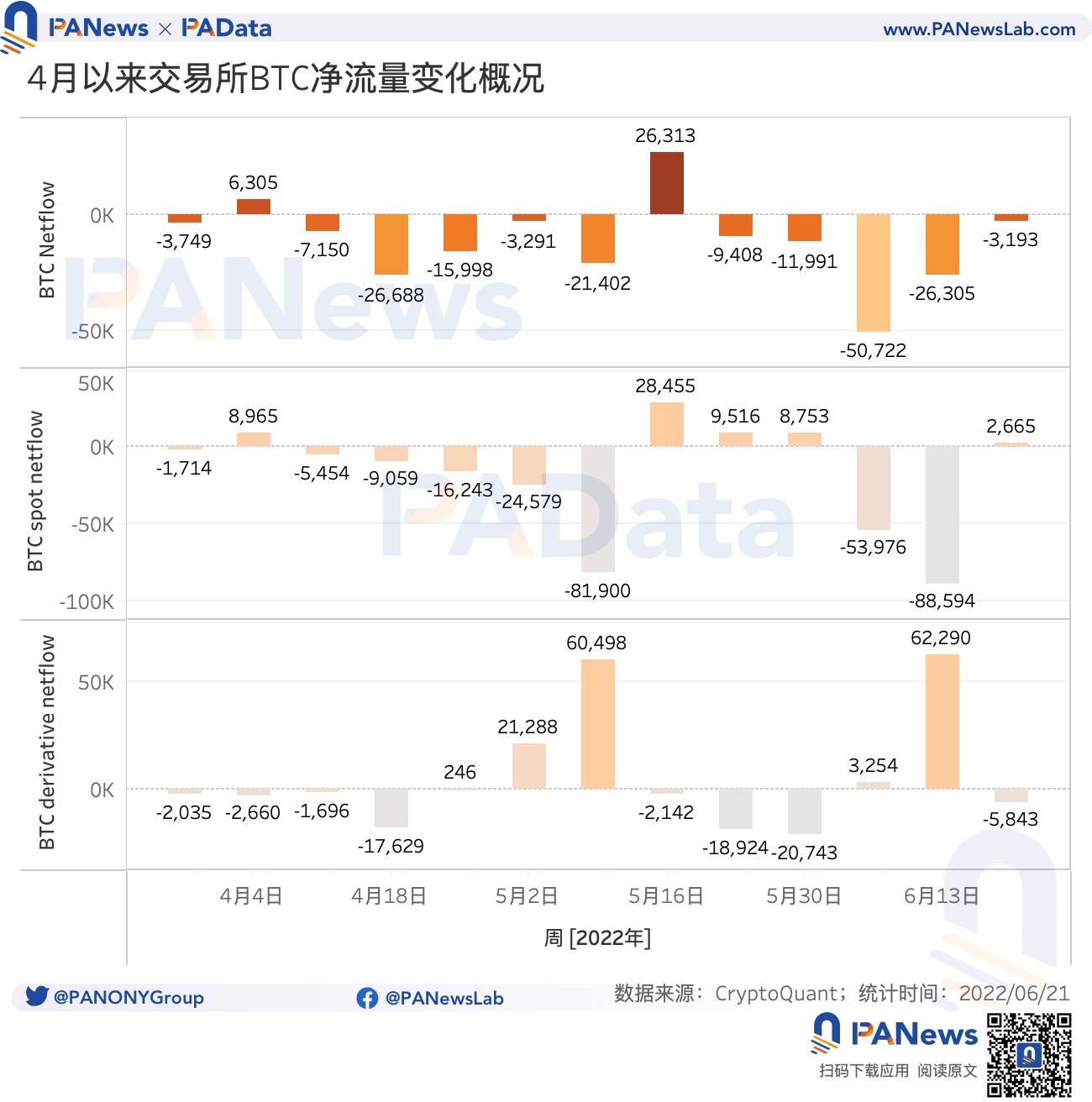

Overall, since April, there have been about 147,300 BTC net outflows from exchanges, of which about 223,200 BTC net outflows into the spot market, and about 75,900 BTC net inflows into the futures market. It can be seen that the selling pressure of BTC in the spot market has not increased, but the trading in the futures market is very active, which may make asset prices continue to fluctuate. From the perspective of a smaller market cycle, the three weeks from May 16 to June 5 were the period when the selling pressure of the BTC spot market was the largest recently, with a total of 46,700 BTC net inflows into the spot market. The two weeks from May 9th to May 15th and June 13th to June 19th were the most volatile periods in the BTC futures market recently, with a total of 122,800 BTC net inflows into the futures market.

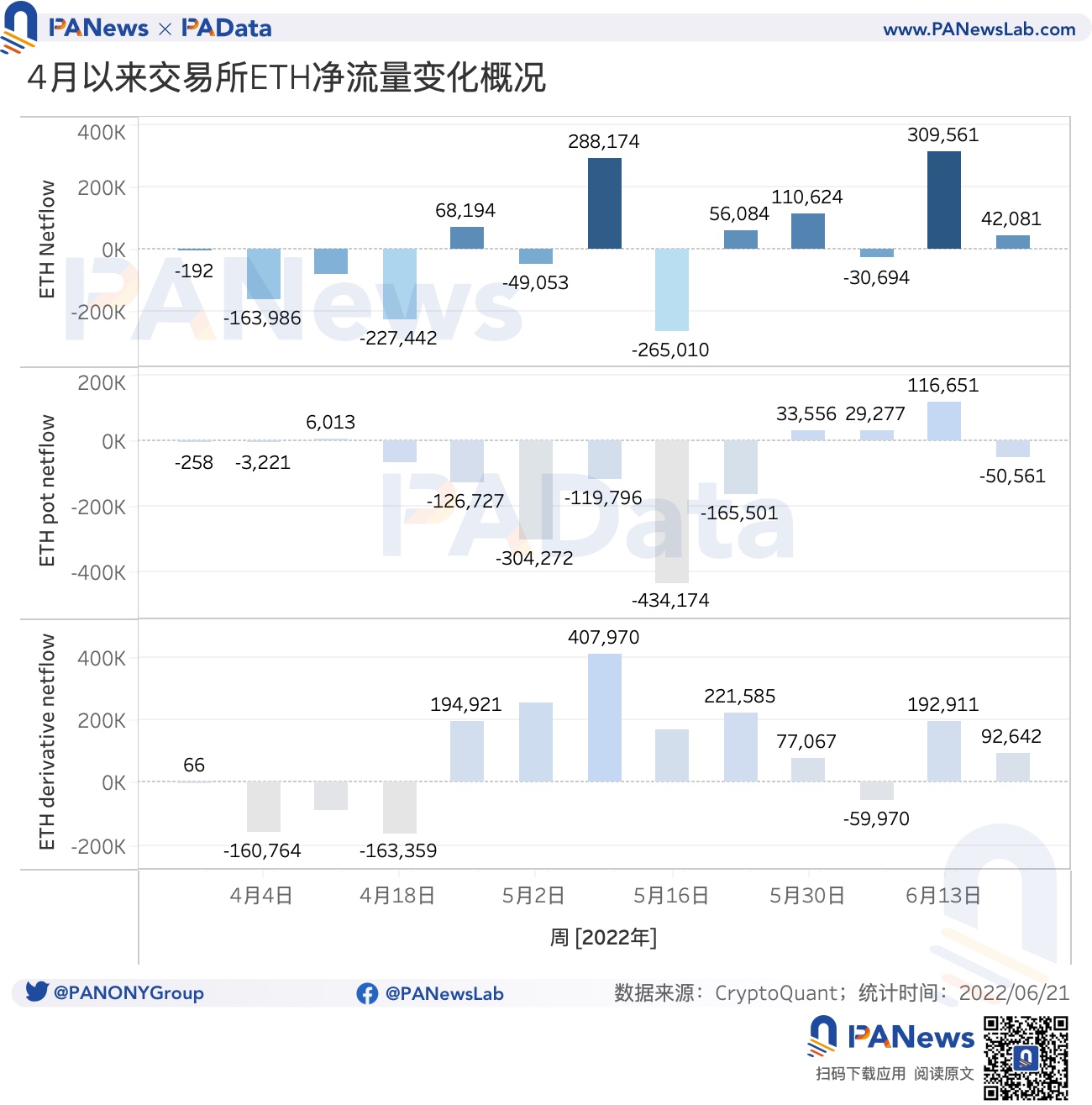

Since April, there have been about 56,000 ETH net inflows into exchanges, of which about 1,083,000 ETHs have net outflows into the spot market, and about 1,139,100 ETHs have net inflows into the futures market. It can be seen that similar to the overall situation of BTC, ETH also has little selling pressure in the spot market, but the trading in the futures market is very active, which may make asset prices continue to fluctuate. From the perspective of a smaller market cycle, the three weeks from May 30 to June 19 were the period when the selling pressure of the ETH spot market was the largest recently, with a total of 179,500 ETH net inflows into the spot market. In the 9 weeks from April 25 to June 21, the net inflow of the futures market was positive for a total of 8 weeks, with a total of about 1.6115 million ETH net inflows into the futures market.