Dismantling the beginning and end of the 2008 financial crisis: What are the similarities and differences between the Three Arrows crisis and Lehman Brothers?

Original title: "What are the similarities and differences between the Three Arrows crisis and Lehman Brothers?" "

Original author: yikiiiii.eth

Recently, Chinese and foreign media like to compare the liquidation of 3ac (Three Arrows Capital) to the "Lehman crisis in the currency circle", but they have not made any in-depth analysis of the similarities between the two and where they are different. discuss.

The trigger points and diffusion logic of the two financial crises are very similar. However, due to the different financial ecological positions (banking & real estate VS hedge fund & digital currency), the level of impact is not the same, and the attitude of the government in the enthusiasm for rescue and supervision is also completely different.

As can be seen,The trigger points and diffusion logic of the two financial crises are very similar. However, due to the different financial ecological positions (banking & real estate VS hedge fund & digital currency), the level of impact is not the same, and the attitude of the government in the enthusiasm for rescue and supervision is also completely different.

The following is a brief review of the 2008 Lehman crisis and a comparison with 3ac:

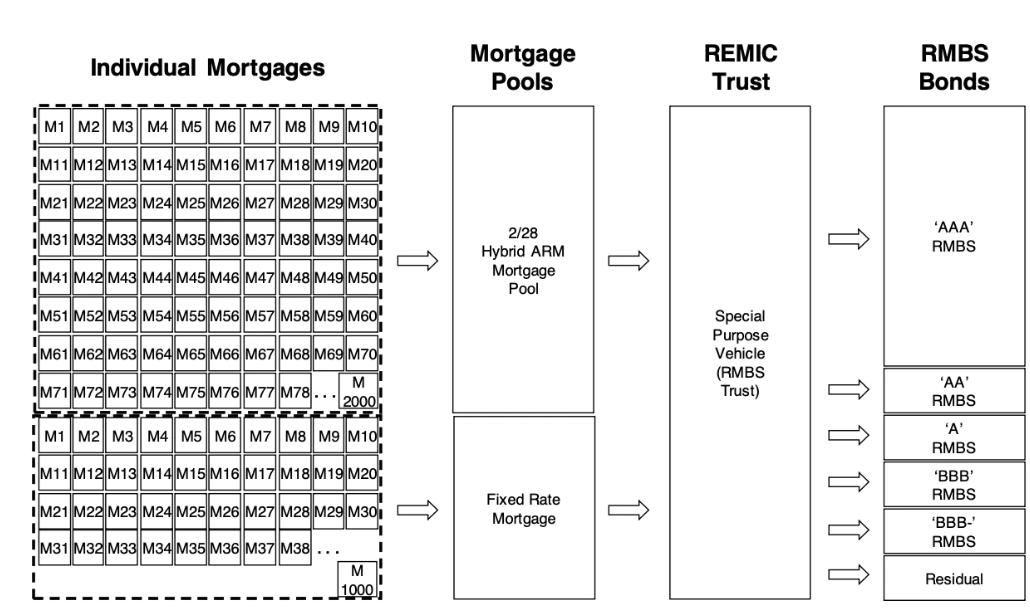

The subprime mortgage crisis in 2008 occurred when securitization banks packaged real estate mortgage loans into bonds for sale. These housing mortgage loans have different risk ratings, and we all know the story behind the thunderstorm, because many residents of these loans do not even have jobs and incomes, and are insolvent.

However, due to the packaged sale, the subprime loans as a whole realized risk diversification in a theoretical sense, and thus had a higher rating and a smooth sale. In this way, the illiquid mortgage bonds became real estate mortgage-backed securities (MBS, MBS) that could generate cash flow for the banks.

The behavior of securitization banks selling bonds here is different from the behavior of simple deposits and loans of traditional banks, which also creates high leverage risks. The reserve requirement ratio of traditional banks is regulated by the central bank, the amount of mortgages and loans is strictly regulated, and the central bank will also act as the lender of last resort. However, when a securities account bank sells securities, the price of the securities is determined by the market, which means that the mortgage rate of the bank is actually determined by the market, and there is no central bank as the lender of last resort and the government.

But back to MBS, why would anyone be stupid enough to buy these "junk bonds" loaned to the vagrant?

the reason isExpectations of rising real estate. As long as housing prices rise within a year or two, people who are unable to repay their debts can also use part of the house appreciation to offset their debts.

In the carnival of economic prosperity, people often fail to see the dangers that are looming large.

The vulnerability of MBS is that,Once housing prices slow down or even fall, and the consensus breaks down, it will trigger a domino-like run and death spiral.When real estate mortgage defaults begin to appear, the quality of MBS collateral will decline, and the MBS price based on market pricing will decrease, then real estate credit will decrease, and the market will further worry about repayment ability. This expected self-fulfillment and self-reinforcement led to a run, and banks were forced to sell MBS mortgage assets. Due to short-term lack of liquidity, house prices plummeted, and MBS prices fell again, thus entering a cycle of decline again.

Coincidentally, the liquidation of Sanjian Capital in 2022 also confirmed a similar logic.

Three Arrows Capital is a hedge fund investing in the primary and secondary encryption markets. At its peak, it had assets of more than US$10 billion and was one of the most active investment institutions in the cryptocurrency field. At the same time, it is also considered one of the largest borrowers,Celsius, BlockFi, Genesis, etc. are all related to Three Arrows Capital.Similar to securitized banks, this paved the way for its debt risk.

Based on public information, Sanjian’s liquidity crisis started with the decline in the crypto market, which was related to the zeroing of LUNA, the liquidation of Celsius, and the failure of BTC investment.

Misjudgment of the market, GBTC discount.Purchase BTC by increasing leverage, but BTC continues to fall, which triggers a Margin call (margin call)

It previously participated in investing in Luna (which has evaporated tens of billions of dollars).In the investment of Luna (now Lunc) project, 3AC’s investment loss of hundreds of millions of dollars reached 99.9%.

Celsius thunderstorms trigger liquidation, forcing Sanjian to repay debt as borrower, StETH was continuously sold (in exchange for ETH) to repay debts, StETH broke the anchor, and the market panicked and fell further.

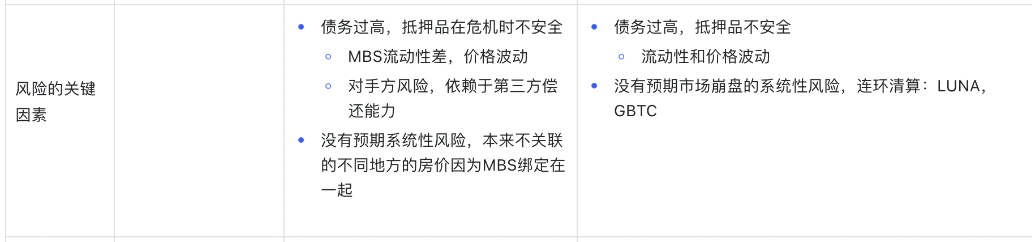

The key factors of Lehman's and Three Arrows' risks are very similar: Excessive debt, insecure collateral and misjudgment of systemic risk are the reasons why they are so vulnerable to a down market.

First, the debt is too high and the collateral is not secure.

Collaterals such as Lehman’s MBS and Three Arrows’ stETH show short-term illiquidity in liquidation and extreme cases, leading to huge price fluctuations. In addition, unlike government bonds, MBS also relies on the repayment ability of third parties and has risk exposure to third party defaults.

Second, there are insufficient expectations for systemic risks.

For example, the MBS risk assessment evaluates the correlation of real estate in different regions as low. For example, the housing prices in New York and Illinois are not synchronized, so the risk is considered to be dispersed when they are packaged together. But in fact, the act of packaging itself makes them related, and actually brings systemic risks. The same is true for Three Arrows. From LUNA to Celsius to BTC, the correlation between cryptocurrencies and the systemic risk when they plummet are more obvious.

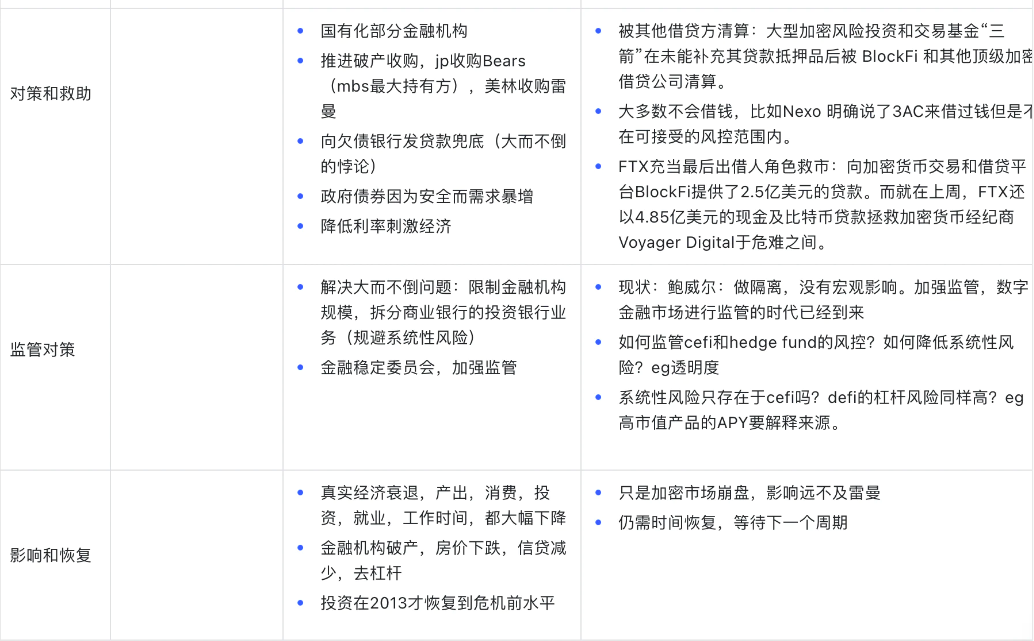

However, due to the excessive financial systemic risks caused by the subprime mortgage crisis, the US government finally came forward to become the last mediator and the bottom line. Including: promoting bankruptcy reorganization and acquisition, nationalizing some bankrupt financial institutions, issuing loans to bankrupt banks, lowering interest rates to stimulate the economy, etc.

However, there is no government backstop in the currency circle.

In the traditional financial world, the government promotes acquisitions, but after the thunderstorm of the Three Arrows, it triggered mutual liquidation among large institutions. When Sanjian borrows money from other institutions, there is a high probability that it will be rejected because the loan from a bankrupt institution is far beyond the scope of the institution's risk control. Only more powerful exchanges such as FTX are trying to play the role of the central bank to rescue the market, but compared with the US government's vigorous intervention in 2008, it can also be felt that its own power is really weak.

History keeps repeating itself, and the new regulatory regulations of the US government after 2008 may be a reference for the future of the encryption market.

After 2008, the US government vigorously strengthened financial supervision. In order to reduce systemic financial risks, regulations were introduced to limit the size of financial institutions and split commercial banks and investment banks.

In contrast,The turmoil in the currency circle is far less than the risk of the 2008 financial crisis. Although it will attract a certain amount of attention from the regulators, the government will not step down to rescue the market.On June 22, Federal Reserve Chairman Powell said that cryptocurrencies need better regulation, but so far, the sharp decline in cryptocurrencies has not had a significant macro impact.

If the regulation of the encryption market becomes stricter in the future, and the lending and leverage ratio are controlled, then requiring cefi to increase transparency and report the use of funds, and requiring high market capitalization defi to explain the source of bond issuance and apy may all be measures that can be imagined at present.

Finally, after 2008, the U.S. and even the world economy fell into a real recession, credit decreased, consumption, employment, and output all decreased significantly, and investment did not return to the pre-crisis level until 2013.

What awaits the crypto world?