Three Arrows Capital's big defeat: ETH's No. 1 Holder is in a liquidity crisis

Produced | Odaily

Editor | Hao Fangzhou

Produced | Odaily

The encryption market is in panic, and the bad news is gradually being realized.

Luna crashed, Celsius became insolvent, stETH broke its anchor... With a series of bad news, the market kept hitting new lows without rebounding.

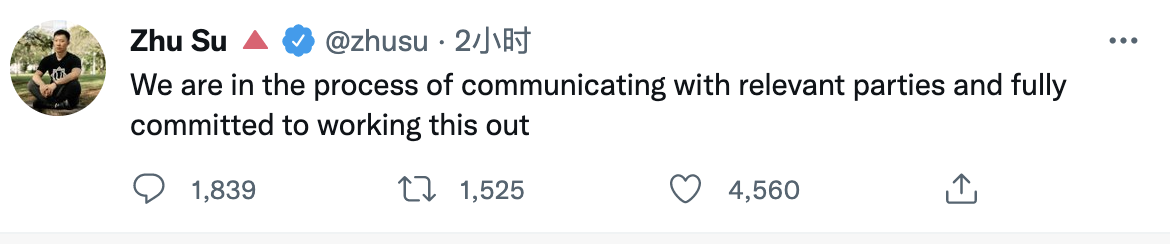

Today, a tweet by Zhu Su, the founder of Three Arrows Capital, made the encryption community fry again, "We are communicating with relevant parties and are committed to solving the problem."

This news has triggered various speculations and “reveals” about Three Arrows Capital.

In fact, in the past few days, content about Sanjian Capital’s insolvency and liquidity crisis, and therefore continuous operations, has been increasing and fermenting on Twitter. Discussions focused on:

1. It buys BTC by increasing leverage, but BTC continues to fall, which triggers a Margin call (margin call);

2. It keeps selling stETH (in exchange for ETH) to repay debts;

3. It previously participated in the investment in Luna (tens of billions of dollars have evaporated).

Although Three Arrows Capital has not responded positively to the above statement, the data on the chain (Three Arrows address was liquidated a large amount of ETH), the account profit and loss disclosed by the exchange (Three Arrows Account Huge Lossfirst level title

1. Prologue of Disaster

Why did Zhu Su post such an endless tweet? Let's cut to the chase with comments from Danny, head of trading at 8BlocksCapital.

After Zhu Su tweeted that "the problem is being solved", the Twitter user @Danny8BC stated that the $1 million in his Sanjian Capital trading account was withdrawn, and asked Sanjian Capital to return it as soon as possible.

As an investment institution that has managed tens of billions of dollars, transferring funds without the authorization of its partners inevitably arouses speculation. Could it be that the capital liquidity of Sanjian, which has always been "rich and powerful", has dried up?

In fact, there were rumors in the market before that Sanjian Capital was suspected to have operational and repayment problems due to the market crash. Since the collapse of LUNA in May, Three Arrows Capital has been operating frequently. It has successively transferred huge amounts of ETH to FTX and Bitmex, and has transferred about 162,629 ETH so far.

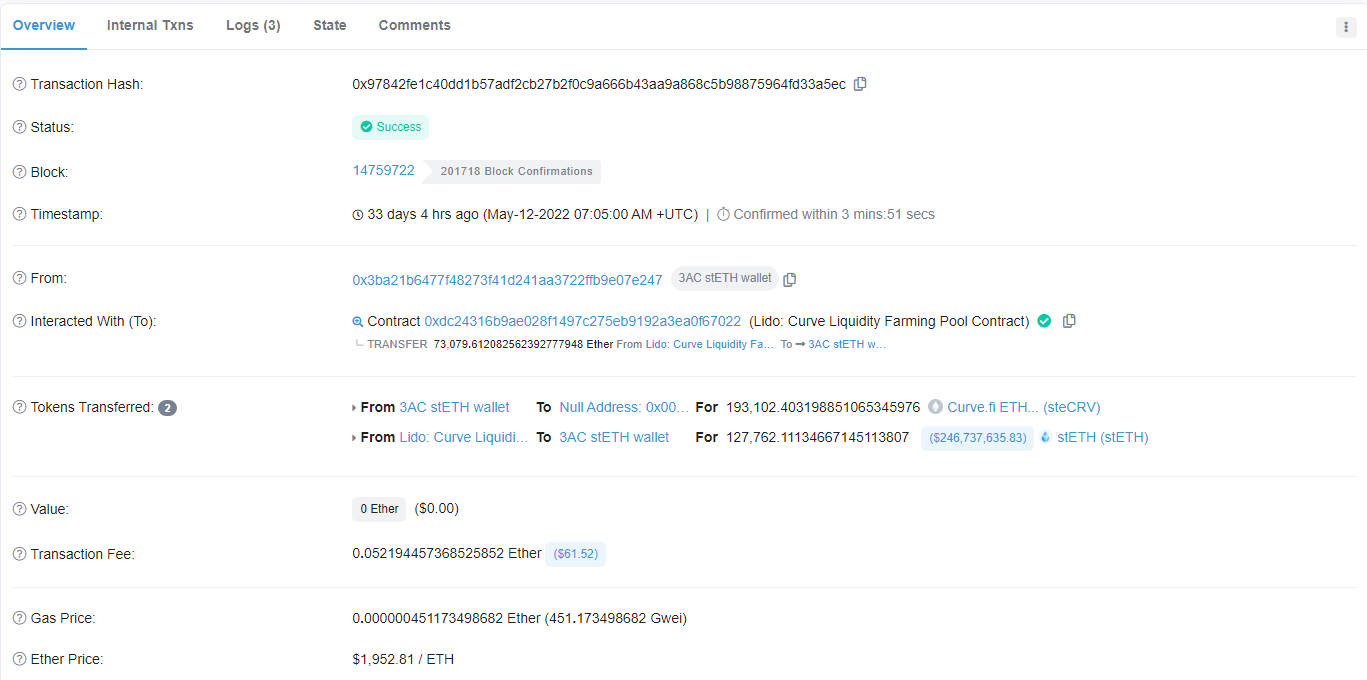

At the same time, Three Arrows Capital is still selling stETH. When stETH was "decoupled" to 0.94 ETH, Three Arrows Capital drew 127,000 stETH liquidity (valued at $246 million at the time) from Curve.

Recently, the development of the stETH unanchoring incident has intensified (see the "Why stETH is not the next UST"), revolving lending and liquidity shortages are making stETH/ETH depreciate continuously.

On-chain data shows that in addition to Celsius’s frenzied selling, Three Arrows Capital is also selling stETH through its sub-accounts and seed round investment addresses.

On June 14, the address marked by Nansen as Three Arrows Capital exchanged 38,900 stETHs for 36,718.64 ETHs through Matcha (the exchange rate is about 0.94). Afterwards, Three Arrows Capital also exchanged 17,780 stETH for 16,625 ETH, and then all of them were exchanged for nearly 20 million DAI.

According to PeckShield monitoring, between 16:30 and 17:30 Beijing time, a total of 16,254 ETHs were liquidated with the address related to Three Arrows Capital (0x716034C25D9Fb4b38c837aFe417B7f2b9af3E9AE).

In addition to stETH, Three Arrows Capital is also the largest holder of GBTC in Grayscale Bitcoin Trust (at the end of 2020, holding 5.62% of GBTC shares). During the continuous decline of the market, this part of the position has also been seriously shrunk due to decoupling, and Sanjian Capital is facing a Margin Call (margin call).

first level title

2. Sanjian’s Famous Works and “Black History”

What kind of presence does Three Arrows Capital have in the encryption market?

Founded by Zhu Su and Kyle Davies in 2012, Three Arrows Capital has been investing in the field of cryptocurrency. Its investment portfolio includes BTC, ETH, AVAX, LUNA, SOL, NEAR, MINA and other leading L1s. At its peak, it had more than 100 It is one of the most active investment institutions in the field of cryptocurrency.

Moreover, Sanjian is also the first investor to hold more than 5% of GBTC shares, with a maximum holding of 6.26% at the beginning of 2021 (the latest data is not yet available).

The reason why Sanjian Capital’s brand is famous in the market is because of the high-profile and radical speech style of the founder Zhu Su.The first time many people heard of its name was the "Ethereum Controversy" in November last year.

At that time, Zhu Su raged against Ethereum, saying that the high gas fee of Ethereum was no longer suitable for new players; developers in the Ethereum community had become rich and forgot their original intentions, and needed a bear market to cool down, or establish new real support users elsewhere Blockchain, and made it clear that he was a supporter of Ethereum, but now decided to abandon the idea of Ethereum.

As one of the biggest beneficiaries of the ecological explosion of Ethereum, Three Arrows Capital’s open boycott of Ethereum was counterattacked by members of the Ethereum community including V God. Finally, Zhu Su Furuan issued an apology, announcing the end of the matter.

In fact, Zhu Su’s difficulty in making Ethereum difficult is not aimless. There are two core reasons: one is that Three Arrows Capital bet on Ethereum and exchanged SOL for ETH before the outbreak of the Solana ecology, and the income gap between the two was huge; Three Arrows Capital invested heavily in public chain ecological projects such as Avalanche and Solana, and Zhu Su’s related tweets also supported Avalanche in a fancy way, attracting Ethereum community builders and users to migrate to the new ecology, which is more in line with its own interests.

However, just half a month after the end of the debate, Sanjian once again "rebelled". In early December, the wallet address marked as Sanjian Capital transferred more than 100,000 ETH (about 400 million U.S. dollars) from multiple trading platform addresses for several days. In response to this, Zhu Su responded on Twitter that the 100,000 ETH he bought was "insignificant" and that he would buy more ETH in the future; buy. Zhu Su's behavior of disliking Ethereum on the front foot and increasing his position on the back foot was ridiculed by the crowd on social media.

In the following months, Sanjian Capital did fulfill its promise and continued to increase its position in ETH, as if it had "infinite bullets", and gradually became one of the largest currency holding institutions on Ethereum. At that time, the market was still curious about where the money for Sanjian to increase its position came from. Thinking about it now, it was probably a revolving mortgage loan that put leverage on itself, which also paved the way for today's rout.

The core reason for the collapse of Sanjian Capital is that Zhu Su misjudged the market and was overly optimistic about the trend of encrypted finance and Bitcoin, so that he made mistakes in his decision-making and continued to increase leverage. , was liquidated.

In an interview with the UpOnly podcast last year, Zhu Su said that if the market value of bitcoin reached the level of gold, the price of bitcoin could reach as high as $2.5 million per coin. At the beginning of this year, Zhu Su tweeted, "I will only make one prediction for 2022, that is, at least 10 nation-states will make BTC a legal tender." In addition, Zhu Su also proposed the concept of "super cycle", He believes that the crypto market will gradually rise in this market cycle, avoiding a prolonged bear market.

However, this year, as the central banks of various countries raise interest rates and curb inflation, the global financial market has continued to decline in the past few months, and encrypted finance has been difficult to survive alone. Bitcoin continued to fall and hit a 19-month low. Zhu Su's "super cycle" has also become made a joke. In a tweet at the end of May, Zhu Su wrote: "Sadly, the super cycle price theory is wrong, but cryptocurrencies will still thrive and change the world every day."

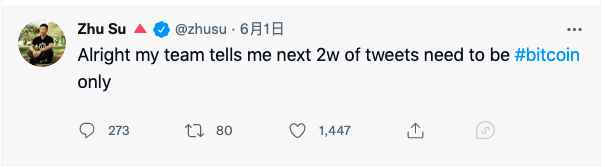

Since June this year, Zhu Su, who has always been high-profile, has become "silent" and has begun to reduce his comments on currencies other than Bitcoin; even when Bitcoin is involved, he lists favorable data to recharge the market's faith. In a tweet, he wrote "My team told me that the next 20,000 tweets should only be Bitcoin." Moreover, he also deleted ETH, AVAX, LUNA, SOL, NEAR, MINA and other words from his Twitter profile.

Of course, in addition to decision-making mistakes, Sanjian also seems to lack some "luck", catching up with the biggest crash and defeat in the history of encryption-Terra & UST Thunderstorm. In February of this year, Terraform Labs established LFG to support UST pegging and successfully raised one billion US dollars, led by Jump Capital and Three Arrows Capital; with the thunderstorm of UST and the plunge of Terra, LFG’s loss rate exceeded 90%, and Sanjian also lost heavy.

This thunderstorm undoubtedly greatly weakened Sanjian Capital's ability to resist risks, and it was completely exposed to the risk of the overall downward trend of the market.

3. The possibility of a death spiral

Coincidentally, when the encryption market is booming, the institutions' high-profile heavy positions and loud singing are undoubtedly the "reassurance" of all investors. However, in today's falling market, the former bull market promoters have become black swans queuing up. with the number plate to be cleared. What's even more frightening is that in the transparent financial system on the chain, the numbers on these number plates are clearly seen by everyone.

In the face of various speculations in the market, Sanjian Capital has not given an official reply so far. Under the panic of liquidation and debt, will Three Arrows Capital face a death spiral? Will the market fall further? In the absence of accurate data and information support, some KOLs also gave some judgments.

degentrading considers Three Arrows Capital to be one of the lender's largest borrowers/clients globally. Celsius, BlockFi, Genesis, etc. are all related to Three Arrows Capital, and their incident will transfer economic risk to their lenders. For example, Sanjian holds a large number of loan positions through CeFi institutions such as Celsius. Once it encounters a complete liquidation, in addition to bringing greater selling pressure, it may also trigger a more terrifying chain reaction, because its loan positions and mortgage assets The loss gap between them will be forced to be borne by these CeFi institutions, and the current situation of institutions such as Celsius is also difficult to protect itself...

And encryption KOL Jiang Zhuoer believes that Sanjian will die, but the market has basically bottomed out, and market panic will gradually pick up.

Regardless of the outcome of the Three Arrows, it is a fact that the market is in panic. As of press time, ETH fell below 1100 USDT and is now at 1024.01 USDT, a 16% drop in 24 hours.

Today, when the market sentiment is sluggish, no one can accurately predict the next market trend of the market. This is the first big bear market after the large-scale entry of institutions, but it is not the first time that Bitcoin, Ethereum and even the encryption market are facing difficulties. crisis.

We are convinced that the market will always bottom out and rebound. This decline may not be worth mentioning in the long history of the future, but as ordinary investors, don’t easily judge short-term and heavy positions to buy bottoms. The encryption market is never short of opportunities, but we There is always a shortage of bullets in the hand.