How to survive the long bear market?

Original author:0xRusowsky

Compilation of the original text: The Way of DeFi

Related Reading:

Compilation of the original text: The Way of DeFi

secondary title

Related Reading:

How Crypto OG Sees the Bear Market: We Just Entered Phase 2 of the Bear Market

To get through the difficult times we will have to face in the coming months, we need to prepare and build mentally using a three-stage approach.

Do you spend a lot of time every day looking for talents and eager to understand all kinds of information in the currency circle? You think you can get a good feedback like hope to find the next alpha and build an edge. But in my opinion, you are wasting your time looking at diagrams, gimmicks, pictures of beautiful women and engaging in ridiculous discussions. Not only is this behavior a waste of your time, but it's detrimental to your well-being and long-term goals.

In a bull market that only goes up but not down, all kinds of negative effects are hidden behind the prosperity of astronomical returns, and encrypted Twitter is also full of copper smells everywhere.

But when the bear market actually hits, everything changes and people get angry and frustrated. The currency in your hand has fallen miserably, but you still insist on the old model of "winning" by dopamine in the bull market, and the result is that your book wealth is constantly shrinking.

In case you don’t realize it, you’re already trapped by a powerful social media algorithm, the regret of missed gains, and the pain of losses. You used to be addicted to the fantasy of "one coin, one villa", and now the bubble has burst. You try to emulate the same behavior in a bull market, but the environment has long since changed, and this time, various operations will only accelerate the shrinkage of your portfolio.

So, what should you do to maintain your mental health during this long bear market?

Stage One: Self-Acceptance

Should you leave the currency circle?

First, you need to figure out whether you should be a resident of the currency circle.

If your theories and ethos don't align with the field, then you better admit that you're only here for the quick bucks and act accordingly.

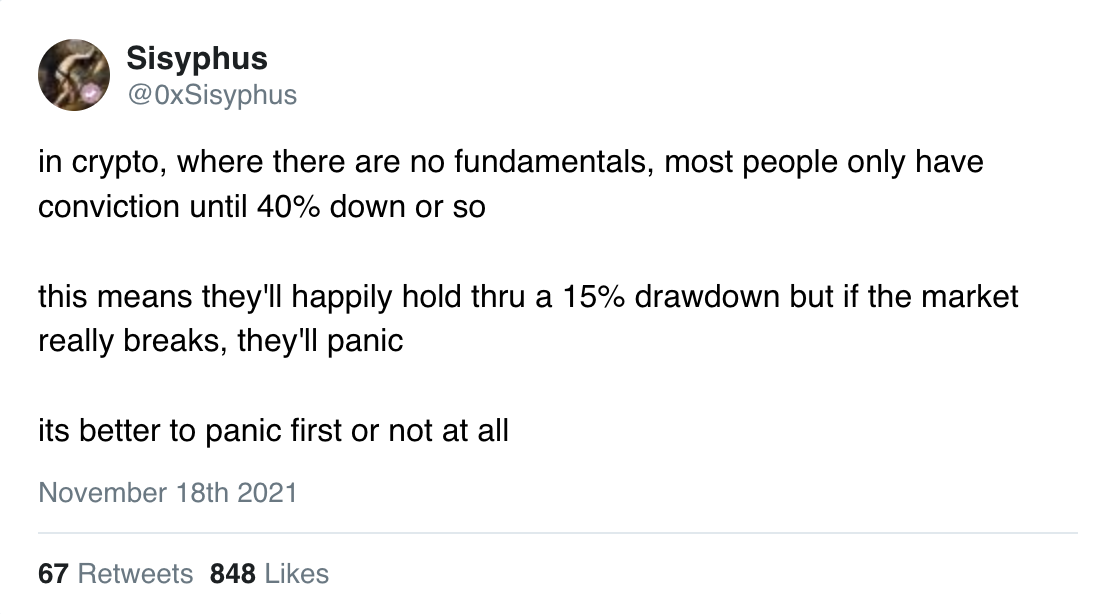

In cryptocurrencies without fundamentals, most people's beliefs will only collapse when they fall by 40% or more.

This means that when their coins drop by 15%, they will still be happy to hold them, but if the market does crash, they will panic.

Feeling scared is a good thing.

This tweet from @0xsisyphus perfectly reflects that. The more genuine you are with yourself, the better. Don't hold assets that make you uncomfortable or intimidating. Stay here if you have to. If you finally choose to surrender, I think you should do so as soon as possible, there is no shame in selling something you feel you no longer hold.

Are you happy with your current portfolio?

You might still want to stay in the crypto space, but you shouldn't do it at all costs. Sell your worthless tokens and stop letting them affect your mood. Evaluate your portfolio and get rid of assets that don't align with your theory or make you uncomfortable. That could mean holding a percentage of stablecoins and blue-chip crypto assets like bitcoin and ethereum. Even if the coins in your hand have fallen miserably, we are still likely to shed more blood, so it is never too late to redistribute the positions in your hands. I want to stress again, the key is to be true to how you feel. The portfolios you hold should give you a good night's sleep while you prepare them to go to zero.

Phase Two: Slowing Down

Always Be Cautious About Encrypted Twitter

Crypto Twitter is always noisy and frenetic. It's a competition of egos, most accounts are either a bunch of rich brats, or narcissists looking for influence and pretending to be prophets, and of course angry ones who like to bash everything.@darrenlautf(the daily apeInstead of spending endless hours scrolling through encrypted Twitter, take a step back and choose to calm down. Bull markets are not booming like they would have you believe, and at the same time, bear markets are not the end of the world. You need to admit that most crypto influencers often contradict themselves, they like to pretend they know what they are talking about, but most people are not that smart, don't be fooled.@nosleepjon。

Learn to limit the amount of time you spend watching crypto tweets, but stay engaged with the field

If you are addicted to encrypted tweets, I encourage you to do some practice to make yourself less of this content. Make sure to go 1-2 days a week off Twitter. It would be even better if you could go a step further and not read encrypted tweets at all.

It's also important to organize your information, which will help you spend less time browsing through noise. An easy alternative to look at some premium content planners such as

)or@jasonyanowitzThis can be counter-intuitive because if you want to be ultimately successful, you need to stay in the field. But trust me, if you burn out, or end up depressed, you'll leave.Are you missing anything in a bear market?What you need to know is that the bottom of the cryptocurrency is not reached by pins, and we will definitely go through the process of bottoming for a long time. Investors are currently leaving the market, and they are generally risk-averse. Sentiment needs to shift and new money needs to flood the market before the next bull run arrives. We still need a lot of time to finally achieve this goal.

i encourage you to read

of this topic (

How Crypto OG Sees the Bear Market: We Just Entered Phase 2 of the Bear Market

), to understand what a bear market looks like.

As you can see, the builders will continue to build, but you won't miss out on any life-changing opportunities by reducing your viewing of crypto-tweeting events. Things are moving a lot slower than you think, and if you're still there, you can spot opportunities, don't worry. Don't think that you will be able to accurately copy to the bottom of the bear market, you must get rid of this kind of thinking. The best time to invest is when you see the wind turning in the market.

Phase Three: Preparing for the Future

build your own strengths

The best way to prepare for a bull market is to build your edge, here are some things you need to prepare for in a bear market:

For programmers:

Learn solidity or vyper to develop smart contracts

Use python and JS to build on-chain robots and get involved in MEV (miners can extract value)

Learn GraphQL to build subgraphs

Create on-chain analytics using tools like Dune Analytics

For creators:

Use your skills to join a DAO (marketing, content, community management, etc.)

Start writing and sharing content to build a long-term online content channel

For everyone who wants to stay in the currency circle:

Review the fundamentals and value of existing projects, looking for undervalued ones

Conduct research on emerging projects to try to discover future narratives

Get active in communities that relate to you and build your network

Trying to build passive income streams other than cryptocurrencies (to have more drive)

Save money on a monthly basis and start regular investment at an attractive valuation level for you

learn from past experience

Reflect on the last cycle, listing the following:

Well done: you should try to repeat them

Could be improved: Try to decide how you can further improve these areas in the future