Overview of Web3 Company Revenue: Ethereum Becomes the Strongest Revenue Machine

Original source:

Original source:FutureMoney

TLDR; Conclusion:

(1) Total income:Web3 business models have grown a lot, the strongest of which is still "sell block space", followed by NFT trading platforms, DeFi, GameFi and infrastructure.

(2) Agreement income:Most of the income still comes from the Supply-side Revenue created by roles such as Liquidity Providers and Lenders. The profitability of the protocol itself is still less than the Protocol Revenue, and even less of it flows to Token Holders. Although users enjoy staking income and governance rights, the core economic interests are still not guaranteed.

(3) There are audit loopholes in the protocol income, which poses risks to Token Holders:first level title

secondary title

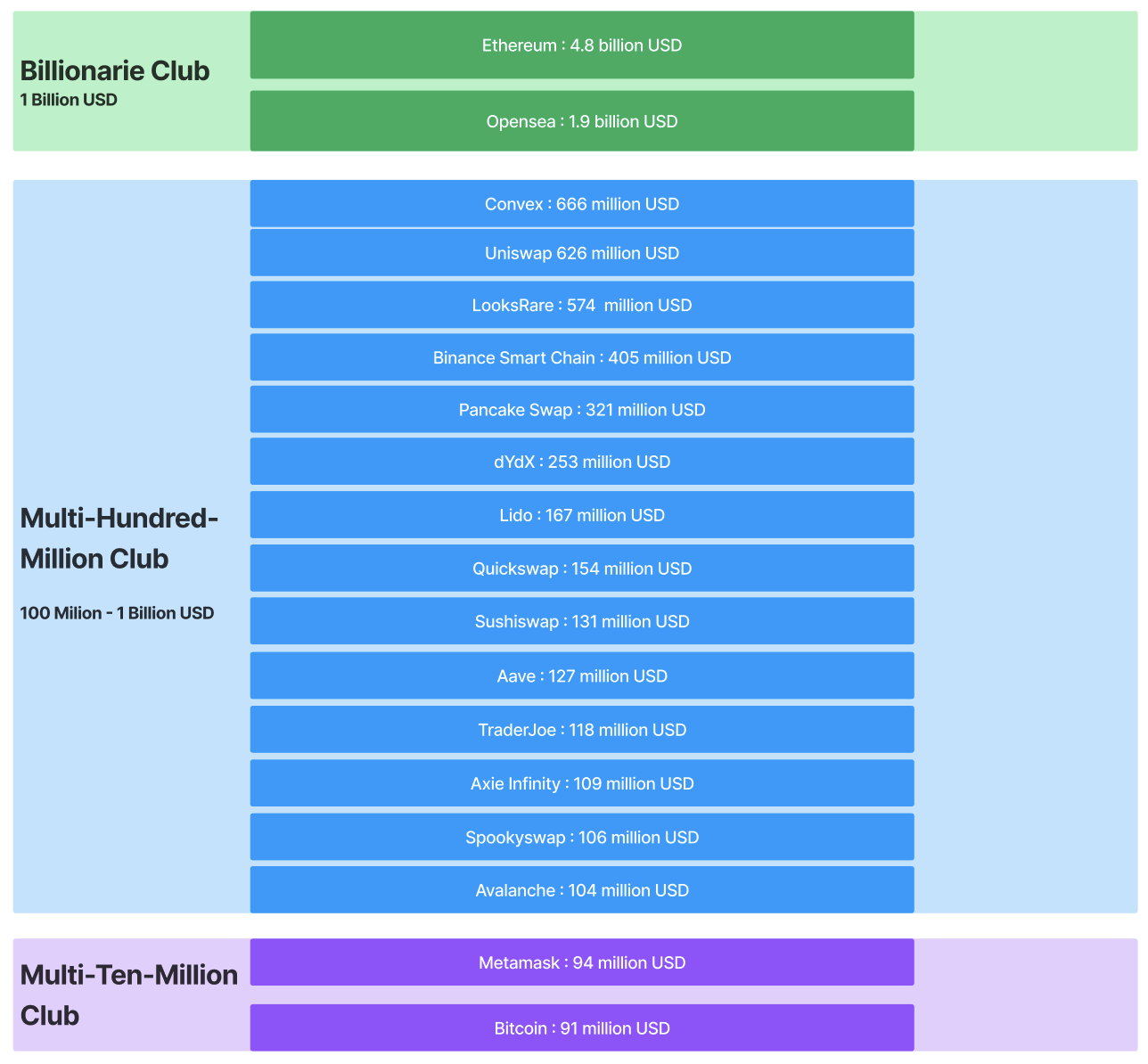

1.1 These Web3 companies (protocols) have the highest revenue

In all companies,Income is almost one of the most important metrics.image description

image description

(source:Token Terminal, the Block,curated by FutureMoney Research 2022 Q2)

Since Web3 revenues are dependent on market fluctuations,We only count gross earnings for 180 days (not linearly annualized).The top 17 companies (protocols) generated a total revenue of more than 10 billion USD.

First gear:Ethereum and Opensea, Ethereum's half-year total income is 4.6 billion USD, which is far ahead in the list; Opensea's half-year total income is about 1.8 billion USD, and it is also a crazy cash cow;

Second gear:Most of them are Defi agreements, and the highest total income is Convex and Uniswap. Their half-year total income is about 600 million USD.

Third gear:secondary title

1.2 Does the business model determine the revenue ceiling?

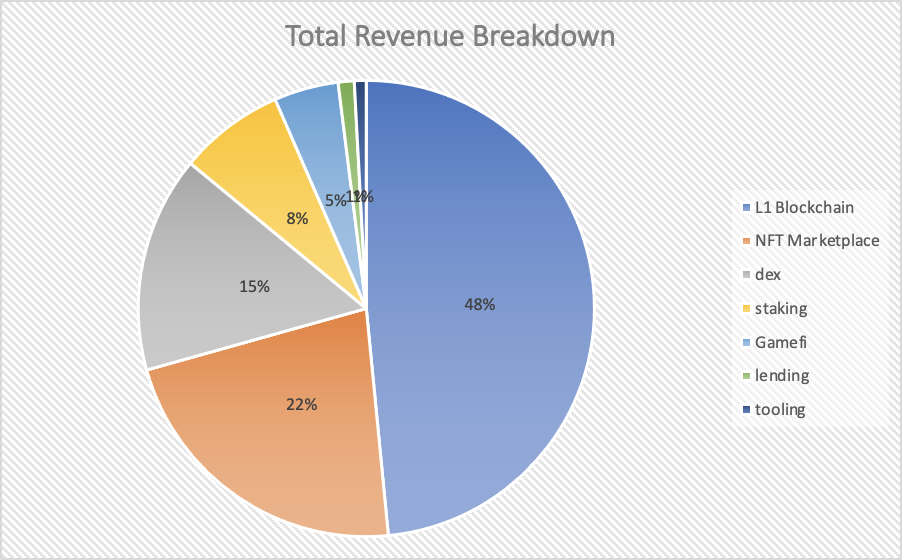

image description

As can be seen:

(Source:Token Terminal, curated by FutureMoney Research 2022 Q2)

As can be seen:

Layer1Its revenue accounts for nearly half of its total revenue, and its business model is "selling block space";

NFTTrading platform revenue accounts for 22%, and its business model is royalties;

in DefiDexThe proportion of income is 15%, and its business model is transaction fee and liquidity market-making income;

in DefiStakingThe proportion of income from this category is 8%, and its business model is the carry or spread of asset management;

GamefiThe proportion is 5%, and its business model is royalties, transfer fees, sales of NFT, etc.;

in DefiLendingThe income accounted for about 1%, and its business model is spread;

ToolingIts revenue accounts for about 1%, and its business model is service fee;

it's easy to see,The most powerful revenue machine is Ethereum, whose business model is "sell block space".Secondly,

Secondly,It is the "NFT trading platform" that has a strong ability to generate income.first level title

secondary title

2.1 The value of the protocol itself: Protocol Revenue

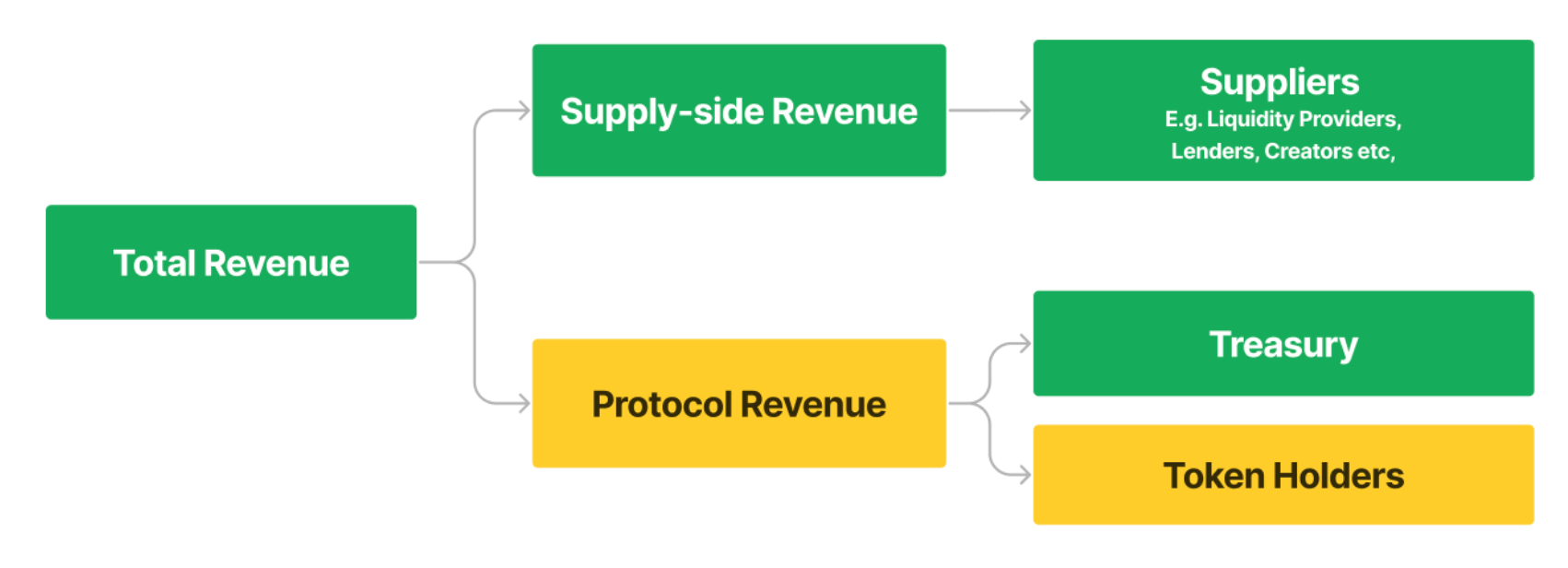

image description

(Figure 3) Distribution of total Web 3 protocol revenue (curated by FutureMoney Research)

Interpret this graph:

Total Revenue = Supply-side Revenue+Protocol Revenue

Supply-side Revenue:It refers to the income generated by Suppliers (suppliers of funds), such as all liquidity providers in Defi, all borrowers in lending, and all contributors in Staking, etc., after deducting the principal.This part of the value is created by suppliers, and the income naturally belongs to them.

Protocol Revenue:refers to the income that the agreement collects after providing services. In this part,Generally, it will be allocated to the Treasury, and the rest will be allocated to Token Holders.

According to our statistics, among the 17 companies/products/protocols with the highest total revenue,The proportion of most Protocol Revenue is extremely low.

The supply-side revenue of Defi projects mostly accounts for the total revenue90%above. What's more, like Uniswap, although the cumulative total transaction volume has reached 1 trillion US dollars and the total revenue has reached 600 million US dollars (half a year), but there is no Protocol Revenue.

secondary title

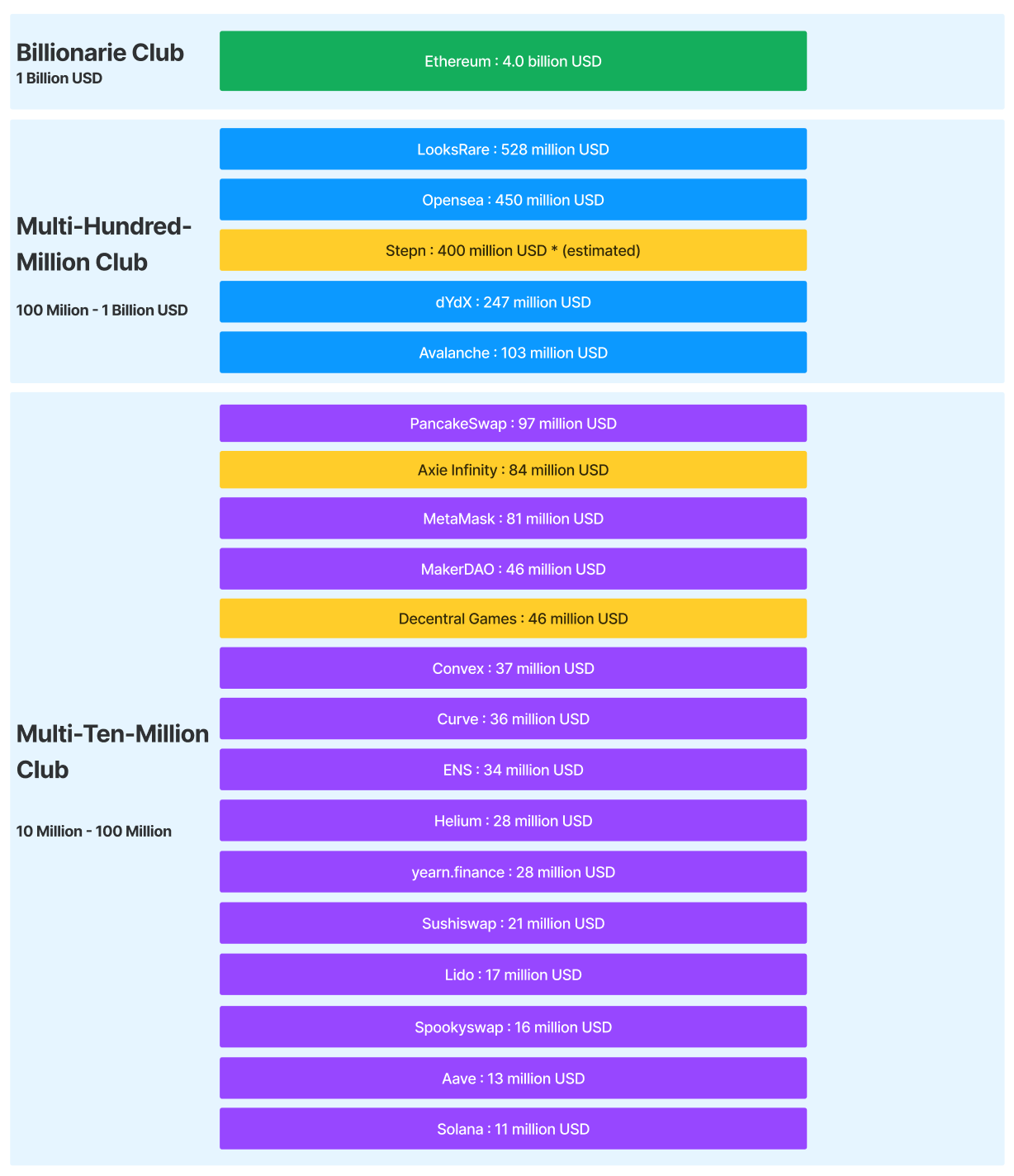

image description

image description

(Source:Token Terminal, the Block, curated by FutureMoney Research)

We can see that,If Protocol Revenue is used to measure the profitability of the protocol, the leaderboard is completely different from that measured by Total Revenue.In the list, the proportion of Defi plummeted, while the L1 public chain, NFT trading platform, and Gamefi projects remained unchanged.

Remarks: We marked some of the above items in yellow

Stepn is not included by mainstream websites, but it does have a lot of income. We made estimates based on public information

Axie Infinity's revenue has fluctuated too much and has fallen below 10% of its peak

Decentral Games is only included by Token Terminal, but not by other websites, and the data may be inaccurate

secondary title

image description

(Figure 5) Meme about UNI (curated by FutureMoney Research)

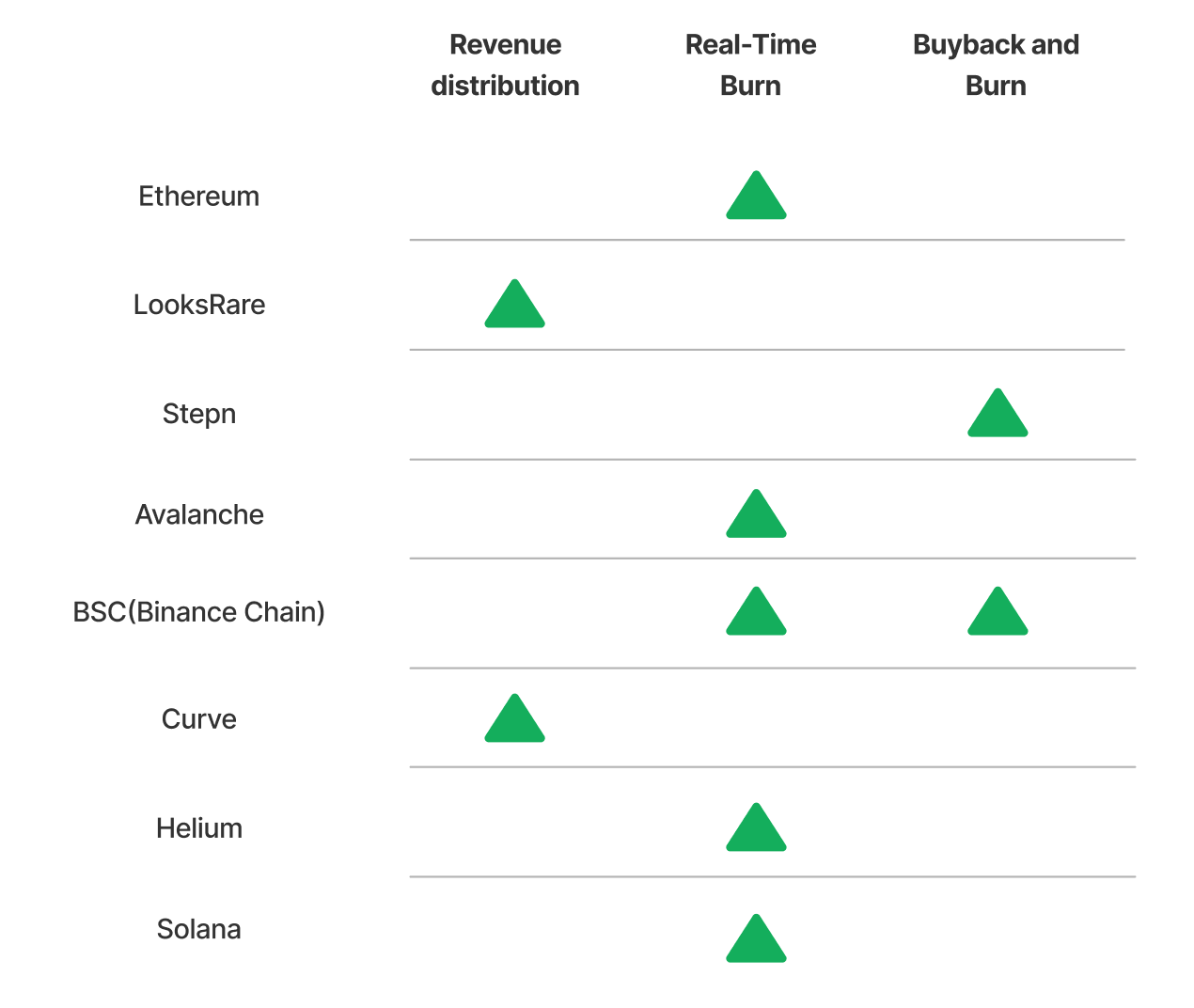

Protocol Revenue can be generated in the following three ways,Pass the value to Token Holders:

Direct Distribution (Revenue Distribution):Direct distribution of money, due to compliance issues, is relatively rare

Real-Time Burn:Common in L1 blockchain, automatically implemented in the contract

Buyback and Burn:Relatively centralized, the project party leads the repurchase and destruction

In the above protocol with Protocol Revenue, we have made adjustments (hereby note: we have added BSC, whose documents disclose detailed real-time destruction and repurchase plans, but are not included in Token Terminal),image description

(Figure 6) Agreement with profit sharing or repurchase (curated by FutureMoney Research)

From the category point of view,The most mainstream way is Real-time-burn;Among them, Ethereum burned the most, with a total of nearly 2.38 million ETH burned; followed by BSC, which repurchased and burned a total of 37 million BSC.Except for these 8 protocols, none of the remaining 12 protocols in the top 20 by Protocol Revenue gave any value back to Token Holders.

first level title

secondary title

3.1 Some income, no risk accrual

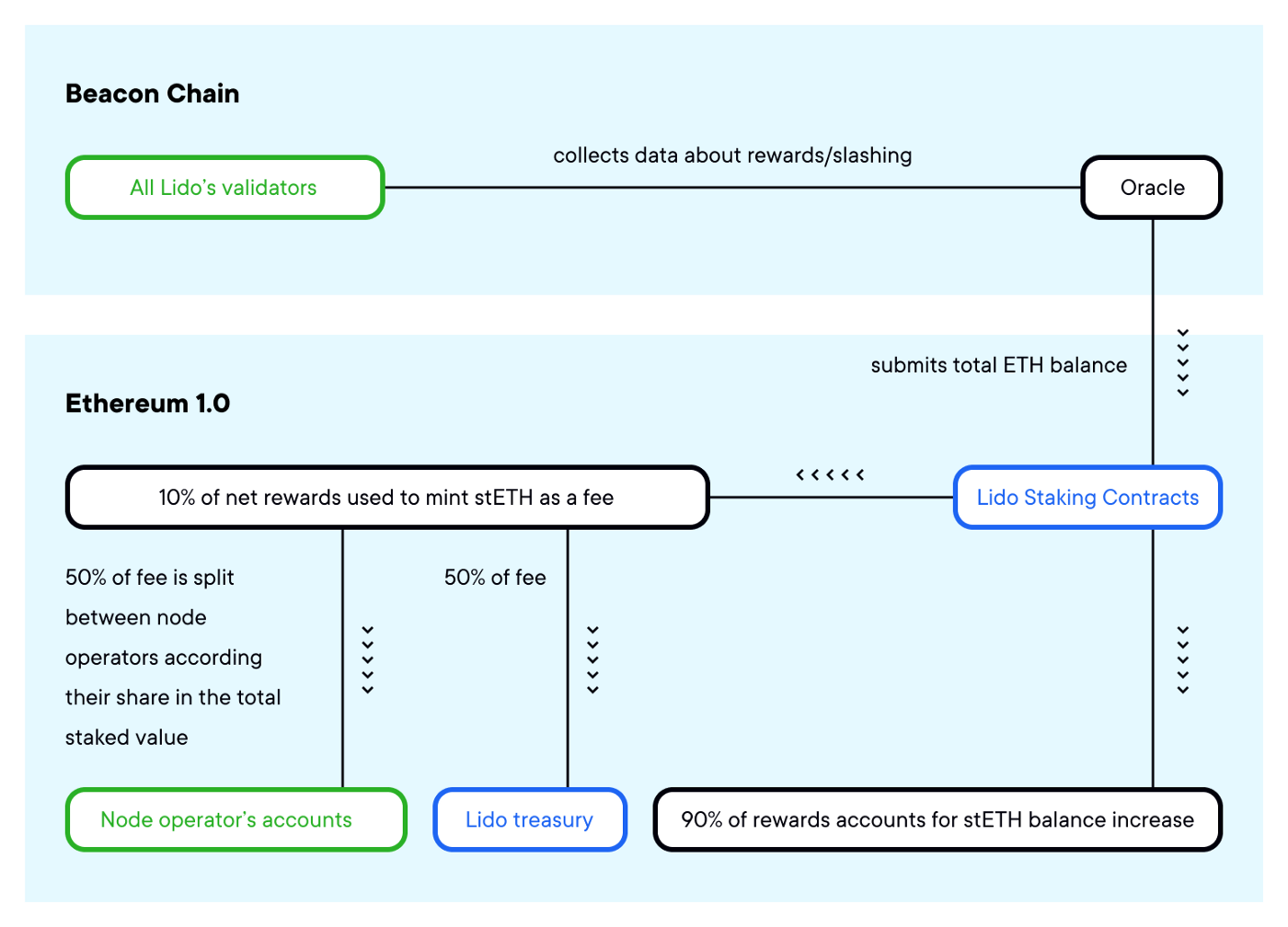

In order to attract users, many staking platforms describe their core functions as providing "high yield" or "high liquidity". IWe must understand that the core competitiveness of this kind of business is not technology, but how to use financial leverage skillfully.

image description

(Figure 7) Lido protocol schema (source: Lido, curated by FutureMoney Research)

Of course, there is no free lunch in the world. Lido holds a large amount of locked ETH, but issued liquid stETH and promised 1:1 exchange, so it is necessary to prepare a large amount of funds to deal with the risk of stETH withdrawal. Usually this kind of business performs very well in the credit expansion cycle, but the profit will decline in the credit contraction cycle, and it faces great risks.secondary title

3.2 Some income, the essence is Token Sale, very unstable

According to the definition of Web3 Index, revenue can be divided into internal and external, which we extend as follows:

External income (Explicit Revenue):The payment made by the user for the use of the service, the utility attribute;

Internal income (Implicit Revenue):In order to obtain the payment made by the agreement Token, the user has the attribute of speculative arbitrage.

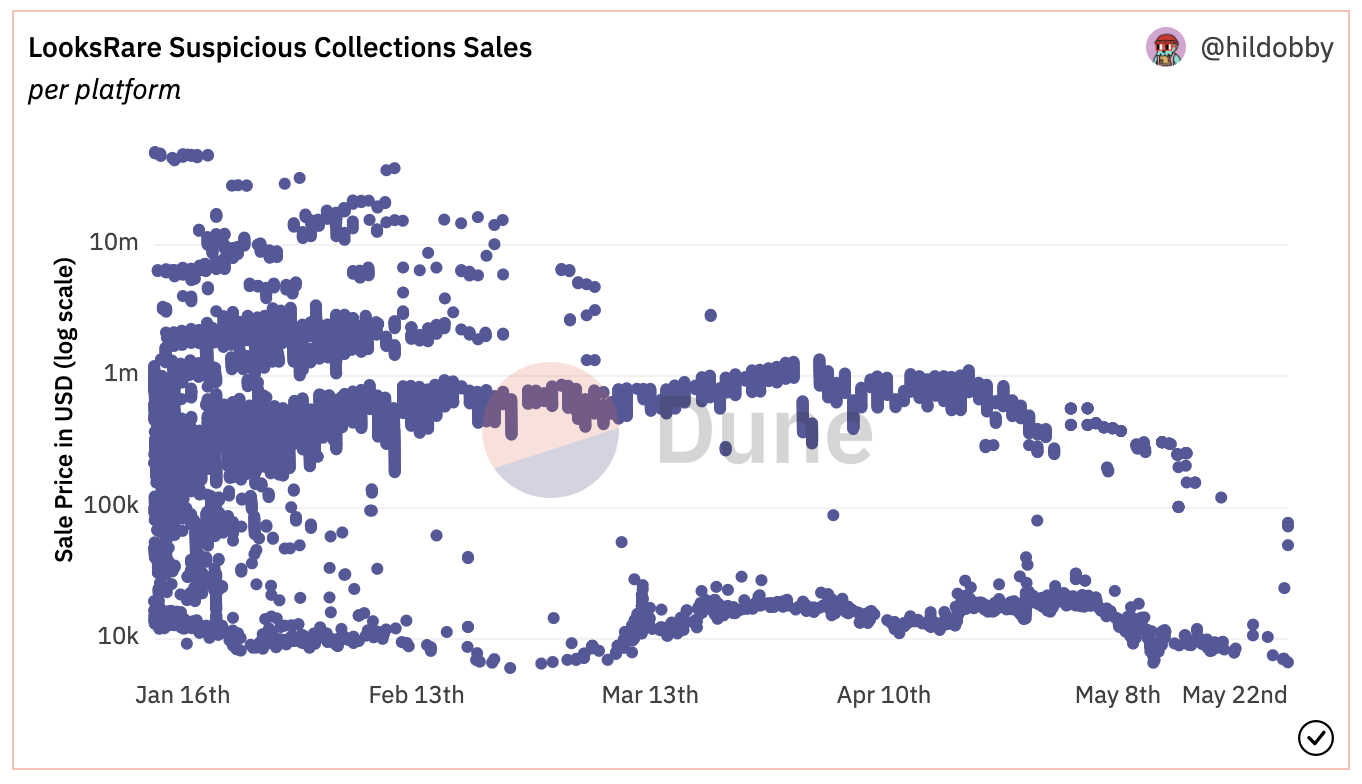

This part of Implicit Revenue is common in x-2-earn and Web3 infra. It is similar to Supply-side Revenue in Defi, but closer to Token Sale,image description

image description

(source: hildobby,created by FutureMoney Research)

Take LooksRare as an example,Washtraders are the largest Implicit Revenue Generator on the platform.They paid a large amount of transaction fees (ETH) to the platform to get LOOKS and sold them, using this arbitrage trading method to continue to make profits.This is more like a Token Sale-driven financing income, rather than business-driven income.

In addition, although LooksRare distributes the Protocol Revenue to the pledgers of the LOOKS token, all the revenue from this part of ETH is automatically sold into LOOKS, and the pledgers are paid in LOOKS. This is also similar to a defaulttoken sale。

Ultimately within this economy, LooksRareGenerated incredible profits ($580 million in 180 days), but other participants—whether it is Washtrader or Token Holders—finally paid ETH but got a bunch of LOOKS tokens.secondary title

3.3 Some income is never disclosed, such as the income from additional issuance in the dual currency system

In Gamefi2.0, there are many dual currency modes:

Governance Token:Rewards to VC/investors, with upper limit, and with repurchase and destruction;

Utility Token:Rewards are given to game players with no upper limit and no repurchase. The purpose is to maintain the stability of the game economic system and not be affected by investors.image description

image description

(source: hildobby,curated by FutureMoney Research)

An easy mistake for on-chain analysts to make when we areWhen the "inbound/outbound" data is cheering, in fact, Utility Tokens have been issuing more.The project party may repeatedly trade this part of Utility Token through multiple addresses to make huge profits without disclosing it to the community. Because according to the white paper, they only need to disclose the release rules of Governance Token.

Although Governance Token is deflation and accumulating value, the additional issuance of Utility Tokens makes profits, so that the project side continues to take away the value of the game economy, which is similar to the entire project in rug pull, which is unfavorable to investors.Four. Conclusion

Four. Conclusion

By 2022, we can see that Web3 companies already have a business model and the ability to generate huge revenue.

How to find a way to distribute income that is more valuable to the community, or even society, is a difficult task. Some agreements keep the income for themselves, some agreements keep it in the treasury and choose to wait and see, and some choose to give the income back to the community. Of course, there are also projects that choose to avoid disclosure, cover up their interests in various ways, and make Token Holder take huge risks.

We hope to see more Web3-focused auditing, financial, and regulatory functions emerging to complement the industry.Original link